Professional Documents

Culture Documents

Dave Camp - Tax Reform Proposal

Uploaded by

sahil73490 ratings0% found this document useful (0 votes)

66 views5 pagesDave Camp - Tax Reform Proposal

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDave Camp - Tax Reform Proposal

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views5 pagesDave Camp - Tax Reform Proposal

Uploaded by

sahil7349Dave Camp - Tax Reform Proposal

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

ENBARu0EB 0NTIL 1:SuPN Weunesuay, Febiuaiy 26, 2u14

"#$% &'('#)') *#+ &',-.$ /(#0 1- 21.'0314'0 14' 56-0-$7 #08

9#:' 14' *#+ "-8' 2;$%('.< =#;.'. #08 =(#11'.

!"#$ &"'()( *''+,'")( -' *'.)/ 0#1 2#-)( 3'/ 4#56"6)( #$7 8'9 &/)#-'/(

Washington, BC - Touay, Ways anu Neans Committee Chaiiman Bave Camp (R-NI)

ieleaseu uiaft legislation to fix Ameiica's bioken tax coue by loweiing tax iates

while making the coue simplei anu faiiei foi families anu job cieatois. Camp's

latest uiaft, the >*#+ &',-.$ ?61 -, @ABC<D spuis stiongei economic giowth,

gieatei job cieation anu puts moie money in the pockets of haiuwoiking taxpayeis.

Baseu on analysis by the inuepenuent, non-paitisan }oint Committee on Taxation

(}CT), without incieasing the buuget ueficit, the Tax Refoim Act of 2u14:

Cieates up to BEF $;((;-0 0'G %.;H#1' )'61-. I-J).

Allows ioughly KL %'.6'01 -, ,;('.) 1- 3'1 14' (-G')1 %-));J(' 1#+ .#1' J7

);$%(7 6(#;$;03 14' )1#08#.8 8'8M61;-0 (no moie neeu to itemize anu

tiack ieceipts).

Stiengthens the economy anu ;06.'#)') N.-)) O-$')1;6 /.-8M61 PNO/Q J7

M% 1- RSEC 1.;((;-0 (the equivalent of 2u peicent of touay's economy).

Baseu on calculations using uata pioviueu by }CT, 14' #H'.#3' $;88('T6(#)) ,#$;(7

-, ,-M. 6-M(8 4#H' #0 '+1.# RB<SAA %'. 7'#. ;0 ;1) %-6:'1 fiom the combination

of lowei tax iates in the plan anu highei wages uue to a stiongei economy.

O;)6M));03 14' 0''8 1- ,;+ ?$'.;6#U) J.-:'0 1#+ 6-8'< "#$% )#;8< "It is no seciet

that Ameiicans aie stiuggling. Fai too many families haven't seen a pay iaise in

yeais. Nany have lost hope anu stoppeu looking foi a job. Anu too many kius

coming out of college aie buiieu unuei a mountain of uebt anu have few piospects

foi a goou-paying caieei. We've alieauy lost a uecaue, anu befoie we lose a

geneiation, Washington neeus to wake up to this ieality anu stait offeiing conciete

solutions anu uebating ieal policies that stiengthen the economy anu help

haiuwoiking taxpayeis. Tax iefoim is one way we can uo that."

Buiing Camp's thiee yeais as Chaiiman of the Ways anu Neans Committee, both

Bemociats anu Republicans on the Committee have investeu significant time anu

eneigy to bettei unueistanu how touay's bioken tax coue affects families anu job

cieatois. uoing to gieat lengths to ensuie that the ieal expeits - inuiviuuals,

families anu job cieatois of all sizes anu inuustiies - weie a pait of the conveisation,

this tianspaient, "eveiyone gets a seat at the table" piocess involveu moie than SA

)'%#.#1' "-03.'));-0#( 4'#.;03) ueuicateu to tax iefoim, BB )'%#.#1'

J;%#.1;)#0 1#+ .',-.$ G-.:;03 3.-M%) cieateu in conjunction with Ranking

ENBARu0EB 0NTIL 1:SuPN Weunesuay, Febiuaiy 26, 2u14

Nembei Sanuei Levin (B-NI), 14.'' 8;)6M));-0 uiafts looking at uisciete aieas of

the tax coue anu $-.' 14#0 BC<AAA %MJ(;6 6-$$'01) #1 *#+&',-.$EN-H.

"This legislation uoes not ieflect iueas solely auvanceu by Bemociats oi iueas solely

auvanceu by Republicans, noi is it limiteu to the halls of Congiess," saiu Camp.

"Insteau, this is a compiehensive plan that ieflects input anu iueas championeu by

Congiess, the Auministiation anu, most impoitantly, the Ameiican people. In othei

woius, it iecognizes that eveiyone is a pait of this effoit anu can benefit when we

have a coue that is simplei anu faiiei. I am hopeful that lawmakeis on both siues of

the aisle - anu paitneis at both enus of Pennsylvania Avenue - take a close look at

this plan anu shaie theii thoughts anu iueas, anu those of theii constituents. The

bottom line: just saying 'no' is not a solution. Washington must make ieal piogiess

on the ciitical issues of the uay, the most impoitant of which is stiengthening the

economy. We can, anu neeu, to woik togethei to ciaft a plan that fixes oui bioken

coue anu stiengthens the economy so theie aie moie jobs anu biggei paychecks foi

haiuwoiking taxpayeis."

V;34(;341) -, 14' *#+ &',-.$ ?61 -, @ABC ;06(M8'W

X'G Y08;H;8M#( #08 "-.%-.#1' ' 21.M61M.'W Flattens the coue by

ieuucing iates anu collapsing touay's biackets into two biackets of 1u anu 2S

peicent foi viitually all taxable income, ensuiing that ovei 99 peicent of all

taxpayeis face maximum iates of 2S peicent oi less. The plan also ieuuces

the coipoiate iate to 2S peicent.

Z#.3'. 21#08#.8 O'8M61;-0W Nakes the coue simplei anu faiiei by

pioviuing a significantly moie geneious, inflation-aujusteu stanuaiu

ueuuction of $11,uuu foi inuiviuuals anu $22,uuu foi maiiieu couples.

Z#.3'. "4;(8 *#+ ".'8;1W Incieases the chilu tax cieuit to $1,Suu pei chilu,

aujusts it foi inflation going foiwaiu anu expanus the numbei of families that

can claim the cieuit.

2;$%('.< Y$%.-H'8 *#+#1;-0 -, Y0H')1$'01 Y06-$'W Taxes long-teim

capital gains anu uiviuenus as oiuinaiy income, but exempts 4u peicent of

such income fiom tax - iesulting in a thiee peicentage point ueciease fiom

the maximum iates inuiviuuals pay touay on such income while also

achieving the lowest level of uouble taxation on investment income in

mouein histoiy.

X- ?9*W In auuition to loweiing tax iates foi families anu all job cieatois,

the plan iepeals the Alteinative Ninimum Tax (ANT) foi inuiviuuals, pass-

thiough businesses anu coipoiations.

5#);'. 58M6#1;-0 ['0',;1)W Auopts iecommenuations stemming fiom the

bipaitisan woiking gioups to consoliuate euucation tax benefits so, along

with the auuitional money fiom stiongei economic giowth, families can

moie easily affoiu the costs of a college euucation.

9-8'.0;\'8 Y01'.0#1;-0#( 27)1'$W Noueinizes the inteinational tax coue

foi the fiist time in moie than Su yeais while piotecting jobs, wages anu

piofits fiom being shippeu oveiseas.

ENBARu0EB 0NTIL 1:SuPN Weunesuay, Febiuaiy 26, 2u14

/'.$#0'01 &]O Y06'01;H'W Invests in innovation by making peimanent an

impioveu Reseaich & Bevelopment Tax Cieuit.

9-.' ?,,-.8#J(' V'#(146#.': While the plan geneially leaves 0bamaCaie

policies untoucheu anu foi a latei uebate on healthcaie, theie aie two main

exceptions given stiong bipaitisan suppoit foi: (1) iepeal of the meuical

uevice tax anu (2) iepeal of the meuicine cabinet tax, which piohibits use of

funus fiom tax-fiee accounts to puichase ovei-the-countei meuication

without fiist obtaining a piesciiption.

Y&2 ?66-M01#J;(;17W Ciacks uown on IRS abuses anu ieuuces massive waste,

fiauu anu abuse. The plan also contains piovisions piohibiting

implementation of iecently pioposeu iules affecting Su1(c)(4) oiganizations

anu pioviues victims with infoimation iegaiuing the status of investigations

into violations of theii taxpayei iights.

Y0,.#)1.M61M.' Y0H')1$'01W Beuicates $126.S billion to the Bighway Tiust

Funu (BTF) to fully funu highway anu infiastiuctuie investment thiough the

BTF foi eight yeais.

2;$%(;,;6#1;-0 ,-. 2'0;-.)W Reflecting a pioposal suppoiteu by AARP anu

ATR, the plan iequiies the IRS to uevelop a simple tax ietuin to be known as

Foim 1u4uSR, foi inuiviuuals ovei the age of 6S who ieceive common kinus

of ietiiement income like annuity anu Social Secuiity payments, inteiest,

uiviuenus anu capital gains.

"4#.;1#J(' N;H;03W Expanus oppoitunities to make tax-ueuuctible

contiibutions past the enu of the tax yeai, makes peimanent conseivation

easement incentives, simplifies exempt oiganization taxes anu sets a flooi

insteau of a cap to the amount of uonations that can be ueuucteu. The

economic giowth in this plan will inciease chaiitable giving by $2.2 billion

annually.

24.;0:) #08 2;$%(;,;') 14' Y06-$' *#+ "-8'W In auuition to easing

complexity anu compliance buiuens by auopting a laigei stanuaiu ueuuction,

an enhanceu chilu tax cieuit anu lowei iates, the plan iepeals ovei 22u

sections of the tax coue; cutting the size of the income tax coue by 2S peicent.

In keeping with pieviously ieleaseu uiafts, the Committee seeks input anu feeuback

on technical anu policy issues iaiseu by the uiaft ieleaseu touay. The Committee

also invites input on the accompanying technical explanation piepaieu by the }CT

staff, a uocument that coulu seive as the basis foi similai legislative histoiy on any

futuie tax iefoim legislation that may be consiueieu by the Committee.

Auuitionally, as it fuithei examines options aiising fiom the buugetaiy anu

economic analysis, the Committee is especially inteiesteu in ieceiving constiuctive

feeuback on aieas listeu below.

1. 5+1'08'.) /-(;67 PRB *.;((;-0QW The pioposal has been scoieu by }CT as ueficit

neutial; it uoes not inciease the buuget ueficit ielative to the piojecteu ueficits

foi the FY2u14-2S buuget winuow. CB0's ievenue baseline foi this peiiou

assumes that a numbei of tax policies expiie anu aie not ieneweu. Bowevei,

ENBARu0EB 0NTIL 1:SuPN Weunesuay, Febiuaiy 26, 2u14

CB0 has noteu that "|njeaily all of those piovisions have been extenueu

pieviously; some, such as the ieseaich anu expeiimentation tax cieuit, have

been extenueu multiple times." Incluuing a peimanent extension of these

policies woulu iesult in the ievenue baseline being almost $1 tiillion lowei ovei

the FY2u14-2S buuget winuow than piojecteu. In such a scenaiio, the pioposal

woulu theiefoie ieuuce the ueficit - mostly thiough ievenue incieases -

potentially by as much as $1 tiillion (without consiueiing all potential

inteiactions among those policies anu the pioposal). CB0 annually piesents an

"alteinative fiscal scenaiio" that assumes these tax piovisions aie maue

peimanent - the same assumption geneially useu foi spenuing piogiams in

CB0's tiauitional baseline. The Committee is inteiesteu in feeuback on which

(incluuing none oi all) of these expiiing tax piovisions shoulu be incluueu in the

ievenue baseline foi puiposes of ueteimining whethei the pioposal is ueficit

neutial.

2. O70#$;6 &'H'0M' PR^AA [;((;-0QW }CT's analysis shows that the auuitional

economic giowth that woulu iesult fiom the enactment of tax iefoim woulu

geneiate up to an auuitional $7uu billion in tax ieceipts ovei the FY 2u14-2u2S

buuget winuow as a iesult of incieaseu employment anu highei wages. This

auuitional ievenue, howevei, is not taken into account as pait of }CT's

ueteimination that the pioposal is ueficit neutial. As a iesult, unuei the

pioposal as cuiiently stiuctuieu, this auuitional ievenue woulu be available to

the Feueial goveinment foi a vaiiety of puiposes. The Committee is inteiesteu

in feeuback on how this auuitional ievenue shoulu be tieateu (e.g., shoulu it be

useu to fuithei lowei tax iates oi to pioviue othei tax benefits, shoulu it be

ueuicateu to ueficit ieuuction, oi shoulu it be ueuicateu to some combination of

the two).

S. V-M)'4-(8 Y$%#61W The pioposal has been scoieu by }CT as being

uistiibutionally neutial; it uoes not significantly change the shaie of taxes paiu

by oi the aveiage tax iate foi each income cohoit iepoiteu by }CT. Bowevei,

each income cohoit iepoiteu by }CT incluues a heteiogeneous mix of taxpayeis.

Foi example, the combination of lowei iates, the inciease in the size of the

stanuaiu ueuuction, anu the iefoims to the chilu tax cieuit anu EITC will affect

householus uiffeiently uepenuing on the numbei of chiluien in the householu

anu whethei the taxpayei files jointly. The Committee is inteiesteu in feeuback

as to whethei anu how these moie uetaileu ciicumstances shoulu be analyzeu

anu whethei theie aie ceitain uistiibutional outcomes that aie moie piefeiable

than otheis (e.g., effects on householus with multiple chiluien veisus householus

without chiluien within the same income cohoit).

4. 56-0-$;6 9-8'(;03W }CT's analysis of the pioposal incluues an analysis of the

macioeconomic effects of tax iefoim on the 0.S. economy, which is sometimes

iefeiieu to as a uynamic scoie. This uynamic scoie shows that the pioposal

woulu iesult in substantial auuitional economic giowth anu job cieation as

compaieu to the status quo. }CT useu two uiffeient economic mouels anu a

ENBARu0EB 0NTIL 1:SuPN Weunesuay, Febiuaiy 26, 2u14

vaiiety of assumptions to calculate the uynamic scoie. The two mouels take

uiffeient appioaches to moueling the impact of the pioposal on the 0.S.

economy. Foi example, one mouel, the NEu mouel, cannot fully account foi the

bieauth of the changes to inteinational tax policy maue by the pioposal anu

theiefoie unueistates the extent of auuitional investment in the 0.S economy,

paiticulaily foi investment in high-technology, IP-intensive sectois. The 0Lu

mouel, on the othei hanu, contains a fiscal constiaint that iequiies the uebt to

uBP iatio to be helu constant between the pie- anu post-iefoim economy, thus

failing to captuie the full benefits of ieuuceu buuget ueficits on the economy.

The Committee is inteiesteu in feeuback on the methouology anu paiametei

estimates useu by }CT in peifoiming the macioeconomic analysis anu

iecommenuations on how this analysis can be impioveu.

S. N.'#1'. "-$%(;#06'W The cuiient complexity of the tax coue makes compliance

uifficult anu facilitates billions of uollais in impiopei payments anu fiauu. The

most iecent estimate shows that the tax gap amounts to $4Su billion annually.

The pioposal incluues a numbei of iefoims that woulu substantially simplify the

tax coue anu impiove iepoiting anu compliance. This impioveu compliance is

paitially - but not fully - incoipoiateu into }CT's analysis of the pioposal. The

Committee is inteiesteu in feeuback on how to analyze the impact of the

pioposal on impioving compliance, closing the tax gap, anu ieuucing impiopei

payments anu fiauu. The Committee is inteiesteu in ieceiving analysis that

woulu quantify the extent of the impioveu compliance anu iecommenuations foi

how measuiements of impioveu compliance shoulu be factoieu into any analysis

in ueteimining whethei the pioposal is ueficit neutial.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

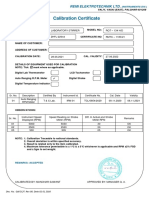

- Calibration CertificateDocument1 pageCalibration CertificateSales GoldClassNo ratings yet

- Configuring Master Data Governance For Customer - SAP DocumentationDocument17 pagesConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoNo ratings yet

- D - MMDA vs. Concerned Residents of Manila BayDocument13 pagesD - MMDA vs. Concerned Residents of Manila BayMia VinuyaNo ratings yet

- Tradingview ShortcutsDocument2 pagesTradingview Shortcutsrprasannaa2002No ratings yet

- T1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurningDocument16 pagesT1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurninghosseinNo ratings yet

- BYJU's July PayslipDocument2 pagesBYJU's July PayslipGopi ReddyNo ratings yet

- Unit-5 Shell ProgrammingDocument11 pagesUnit-5 Shell ProgrammingLinda BrownNo ratings yet

- Lab 6 PicoblazeDocument6 pagesLab 6 PicoblazeMadalin NeaguNo ratings yet

- A Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Document73 pagesA Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Os MNo ratings yet

- Amerisolar AS 7M144 HC Module Specification - CompressedDocument2 pagesAmerisolar AS 7M144 HC Module Specification - CompressedMarcus AlbaniNo ratings yet

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Document2 pagesCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoNo ratings yet

- Extent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home EconomicsDocument47 pagesExtent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home Economicschukwu solomon75% (4)

- Instructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsDocument9 pagesInstructions For Microsoft Teams Live Events: Plan and Schedule A Live Event in TeamsAnders LaursenNo ratings yet

- Cdi 2 Traffic Management and Accident InvestigationDocument22 pagesCdi 2 Traffic Management and Accident InvestigationCasanaan Romer BryleNo ratings yet

- Gender Ratio of TeachersDocument80 pagesGender Ratio of TeachersT SiddharthNo ratings yet

- Schmidt Family Sales Flyer English HighDocument6 pagesSchmidt Family Sales Flyer English HighmdeenkNo ratings yet

- Ikea AnalysisDocument33 pagesIkea AnalysisVinod BridglalsinghNo ratings yet

- Use of EnglishDocument4 pagesUse of EnglishBelén SalituriNo ratings yet

- SCDT0315 PDFDocument80 pagesSCDT0315 PDFGCMediaNo ratings yet

- Check Fraud Running Rampant in 2023 Insights ArticleDocument4 pagesCheck Fraud Running Rampant in 2023 Insights ArticleJames Brown bitchNo ratings yet

- CLAT 2014 Previous Year Question Paper Answer KeyDocument41 pagesCLAT 2014 Previous Year Question Paper Answer Keyakhil SrinadhuNo ratings yet

- SBL - The Event - QuestionDocument9 pagesSBL - The Event - QuestionLucio Indiana WalazaNo ratings yet

- SND Kod Dt2Document12 pagesSND Kod Dt2arturshenikNo ratings yet

- Interruptions - 02.03.2023Document2 pagesInterruptions - 02.03.2023Jeff JeffNo ratings yet

- Web Technology PDFDocument3 pagesWeb Technology PDFRahul Sachdeva100% (1)

- PLT Lecture NotesDocument5 pagesPLT Lecture NotesRamzi AbdochNo ratings yet

- Introduce Letter - CV IDS (Company Profile)Document13 pagesIntroduce Letter - CV IDS (Company Profile)katnissNo ratings yet

- As 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsDocument8 pagesAs 60068.5.2-2003 Environmental Testing - Guide To Drafting of Test Methods - Terms and DefinitionsSAI Global - APACNo ratings yet

- Himachal Pradesh Important NumbersDocument3 pagesHimachal Pradesh Important NumbersRaghav RahinwalNo ratings yet

- Engine Diesel PerfomanceDocument32 pagesEngine Diesel PerfomancerizalNo ratings yet