Professional Documents

Culture Documents

Standard and Poor's: Key Considerations For Rating An Independent Scotland

Uploaded by

Patrick McPartlinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standard and Poor's: Key Considerations For Rating An Independent Scotland

Uploaded by

Patrick McPartlinCopyright:

Available Formats

Key Considerations For Rating An Independent Scotland

Primary Credit Analyst: Frank Gill, London (44) 20-7176-7129; frank.gill@standardandpoors.com Secondary Contact: Moritz Kraemer, Frankfurt (49) 69-33-999-249; moritz.kraemer@standardandpoors.com

Table Of Contents

Economic Structure And Growth Prospects: A Rich, Diversified Country External Liquidity And International Investment Position: An Open Economy Monetary Flexibility: The Challenges Of An Independent Regime Fiscal Performance And Flexibility: Sensitive To Oil Revenues, But Free To Set Tax Rates

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 27, 2014 1

1264946 | 301015591

Key Considerations For Rating An Independent Scotland

Scotland's electorate will go to the polls to vote in a referendum on independence on Sept. 18, 2014. If the "yes" vote wins, the new government of Scotland and the remaining U.K. will enter negotiations on issues such as the allocation of liabilities and assets and the monetary regime, among others. Standard & Poor's Ratings Services is often asked how we would rate a newly independent sovereign Scotland. Our views on the capacity of any sovereign state to pay its commercial debt on time and in full reflect five key factors detailed in our criteria, "Sovereign Government Rating Methodology And Assumptions," published June 24, 2013, on RatingsDirect. These factors are: institutional and government effectiveness, economic structure and growth prospects, external liquidity and international investment, fiscal performance and flexibility, and monetary flexibility. Standard & Poor's credit ratings are determined by rating committees. The views expressed herein have not been determined by a rating committee and do not constitute a rating or an indication of any potential Standard & Poor's rating on an independent sovereign Scotland. Standard & Poor's takes no position in the debate on the pros and cons of Scottish independence. Although we recognize that the debate is still in its early stages, we can draw a few broad conclusions about the creditworthiness of an independent Scotland: The macroeconomic profile of the wealthy and open Scottish economy conforms with the typical profile of sovereigns rated in investment-grade categories (i.e., 'BBB-' or higher). A successful agreement on Scotland's membership of a monetary union negotiated with either the U.K. or the eurozone (European Economic and Monetary Union) would provide considerable support for the rating on a sovereign Scotland. Alternatively, a decision by a sovereign Scotland to issue its own new and untested currency or to unilaterally adopt the currency of another sovereign--without gaining access to that currency's lender of last resort--could pose some initial risks to external financing, in our opinion. Specifically, we think Scotland would be hard-pressed, under a new currency regime, to quickly replicate the deep capital markets it enjoys today as part of the larger U.K. Nevertheless, with a GDP (including North Sea oil output) only slightly below that of New Zealand, a developed economy and developed financial system, there is no fundamental reason why Scotland could not successfully float a currency. The composition of Scotland's external balance sheet is as yet hypothetical, but our initial observation is that the Scottish financial sector is unusually large, with total assets estimated at 12.5x GDP. We would therefore likely view the financial sector as a significant contingent risk to the state. At the same time, a large part of this activity could be re-domiciled to the U.K. Peer Comparison For An Independent Scotland

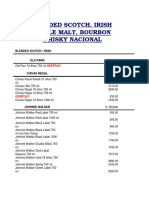

2014 estimated data Total domestic banking assets/GDP (%) 5.2

Rating Ireland BBB+

Per capita GDP (US$) 48,053

GG debt/GDP (%) 133

Current account receipts/GDP (%) 149

Estimated current account GDP (%) 1.5

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 27, 2014 2

1264946 | 301015591

Key Considerations For Rating An Independent Scotland

Peer Comparison For An Independent Scotland (cont.)

Scotland (Geographical)* Germany U.K. Scotland (Population) New Zealand Slovenia Chile N.R. AAA AAA N.R. AAAAA47,369 43,855 41,006 39,913 39,840 22,733 17,826 77 79 94 92 36 73 8 45 63 43 42 33 87 37 (1.1) 6.3 (3.0) (4.6) (5.1) 6.7 (4.3) 12.5 2.8 4.6 12.5 1.6 1.3 1.1

*North Sea oil distributed according to geography. North Sea oil distributed according to population. GG debt--General government debt. N.R.--Not rated.

Economic Structure And Growth Prospects: A Rich, Diversified Country

The Scottish economy is rich and relatively diversified, with 2014 per capita GDP estimated to be US$47,369 (based on the Scottish government's estimates, which include Scotland's geographic share of North Sea output, abbreviated as Scotland (Geographical) in the table above). Scottish wealth levels are comparable to that of the U.K. ('AAA'), Germany ('AAA'), Ireland ('BBB+'), and New Zealand ('AA-'). Even excluding North Sea output and calculating per capita GDP only by looking at onshore income, Scotland would qualify for our highest economic assessment. Higher GDP per capita, in our view, gives a country a broader potential tax and funding base to draw from, which supports creditworthiness. We view Scotland's trend growth as closely matching that of the U.K. While North Sea output (again on a geographical, rather than population-derived basis) accounts for 16% of Scottish GDP (calculated using data from the Scottish government's experimental national accounts project), this does not, under our methodology, lead us to conclude that the economy is excessively concentrated. We typically only adjust for excess economic concentration should a single sector exceed one-fifth of a country's GDP. Nevertheless, Scotland's economic performance would be subject to several potential adjustment risks during its early years as an independent state. First, at 8% of GDP, and employing 7% of the workforce, Scotland's financial sector is large and closely integrated into the U.K. Re-domiciling of these international banks to the remaining U.K. could exert a drag on the size of Scottish GDP, though less so on gross national product, which excludes income from foreign-owned companies. Second, Scotland also has a natural dependency on merchandise and business services trade with the rest of the U.K., the destination for an estimated 49% of Scottish exports; independence may lead to a partial reversal of that integration, with economic consequences. Third, the public sector is sizable, accounting for nearly one-quarter of the total workforce. This is considerably higher than the U.K. average. In our opinion, shifting post-independence to a lower public sector employment rate could weigh on Scotland's initial growth performance. Fourth, at 16% of GDP the oil sector is also large. Indeed, a secular decline in oil production in the North Sea has been a significant factor in the U.K.'s below-par growth and productivity performance since 2008 and would be proportionally a larger drag on Scotland's future GDP performance unless the decline in volume energy output could be reversed. However, redressing the long-term decline in oil production might also carry fiscal implications if it

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 27, 2014 3

1264946 | 301015591

Key Considerations For Rating An Independent Scotland

involved lowering taxes on the energy sector.

External Liquidity And International Investment Position: An Open Economy

The Scottish economy is relatively open, with exports of goods and services for 2012 contributing an estimated 45% of GDP (based on estimates from the Scottish government's national accounts project of current market value GDP, including North Sea oil). Based on experimental national accounts data published by the Scottish government, the amount of Scotland's exports as a share of GDP somewhat exceeds New Zealand's but is considerably less than Ireland's. Under our methodology for determining sovereign ratings, we measure debt servicing capacity as a percentage of current account receipts; therefore, this relative openness would likely benefit our external assessment of Scotland. Estimates provided by the Scottish government suggest an average trade deficit of around 1% of GDP between Scotland and the rest of the world, once North Sea energy and financial sector exports are included, although U.K. government data actually imply a slight surplus. Overall, then, from a balance of payments perspective, there is little evidence that Scotland depends on the rest of the world to finance a large share of its annual GDP. In other words, net external financing on an annual basis appears to be relatively low--again, based on the critical assumption that foreign currency receipts from all oil exports and financial sector activity accrue to the Scottish economy. However, were Scottish commercial banks to leave Scotland, its services exports would decline to a considerable degree. This could reveal an underlying dependency of the Scottish economy on net external financing flows--though without better data, it is difficult to say so with any certainty. While Scotland's net external financing needs seem relatively modest, gross external financing requirements appear substantial. This would indeed imply vulnerability of the open and highly intermediated Scottish economy to the external environment, so caution is warranted, in our view. We do not have access to data on Scotland's net international investment position with the rest of the world--a key input into our rating on a sovereign--so we cannot reach any sweeping conclusions about an independent Scotland's external vulnerabilities. One thing, however, appears clear to us: the financial sector is large and makes up a significant proportion of Scotland's GDP. Scottish banks borrow from abroad to finance their operations both in Scotland and overseas. The assets of Scotland's banks and building societies--including Royal Bank of Scotland, Bank of Scotland (part of the Lloyds banking group), and Clydesdale--account for about 12.5x Scotland's mainland GDP versus an estimated 5.2x in Ireland, 4.6x in the U.K., and an average of 3.5x GDP across the EU. The capacity to finance banking operations via borrowing from nonresidents could become more challenging should Scotland be unable to retain its current monetary arrangement with the U.K, and hence lose access to financing from its lender of last resort, the Bank of England.

Monetary Flexibility: The Challenges Of An Independent Regime

As stated above, the framework for Scotland's monetary regime will be a key consideration in assessing its creditworthiness, according to our published criteria. If Scotland were not to join a monetary union then Scottish financial institutions would not have access to lending facilities from a major central bank such as the European Central Bank (ECB) or the Bank of England in a crisis. Under our methodology, we would likely assume initially that any newly launched Scottish currency would not be used in financial transactions outside Scottish borders. A unilateral

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 27, 2014 4

1264946 | 301015591

Key Considerations For Rating An Independent Scotland

assumption of a global reserve currency such as the British pound sterling or the euro would not address the absence of access to liquidity support from the Bank of England or the ECB, unless a treaty arrangement along the lines of that between Lichtenstein and Switzerland could be reached. In our view, this would leave investors more reluctant to lend to Scotland's banks in a new currency that may not benefit initially from deep capital markets. Consequently, we would likely view a new independent monetary regime for Scotland as a constraint, relative to the U.K.'s monetary flexibility--primarily because active trading in the currency would, at least initially, be unlikely. Our 'AAA' rating on the U.K. is supported by the country's power to issue a global reserve currency and the depth of its local capital markets, denominated in this currency.

Fiscal Performance And Flexibility: Sensitive To Oil Revenues, But Free To Set Tax Rates

Based on data released by the Scottish government, we understand that Scotland's budgetary deficit had narrowed to about 5% of GDP (data for the fiscal year to March 31, 2012) from a peak of 10.4% of GDP in the fiscal year to March 31, 2010. The pace of consolidation appears to have been slightly more rapid than that in the U.K. as a whole. However, Scotland's higher dependency on oil and gas revenues could limit its fiscal flexibility in the absence of a fund set up to preserve these, similar to Norway's Fiscal Stabilization Fund. A new Scottish state would presumably begin life with a high stock of government debt and revenues highly sensitive to the price of oil. That said, an independent Scotland with fiscal sovereignty would benefit from the ability to set corporate tax rates and other policies to attract foreign investment inflows. In fact, Scotland already has considerable fiscal independence. At present, about 60% of the total spending allocation for Scotland is already devolved from the U.K. treasury to the Scottish government and local authorities, while only 7% of the tax receipts of Scotland's regional government are raised by Edinburgh. Our understanding is that under the Scotland Act, 2012, this ratio is set to rise to 16%. Scotland's share of public spending, at 9.3%, is above its share of the U.K. population at 8.4%, with the biggest outlays in social protection, transport, health, and housing. In terms of its share of the U.K.'s outstanding debt, how much an independent Scotland would assume would depend on negotiations between the two parties. On a per capita basis, its share of general government debt would amount to 116 billion for fiscal year 2012, or 8.4% of the total. Assuming that North Sea oil was allocated on a geographical basis, the ratio of Scottish debt to GDP would be about 77%. If the oil were allocated on a population basis, the figure would rise to 92% of GDP. This measure excludes future U.K. liabilities, such as payments of public sector pensions in Scotland, private finance initiatives, and the decommissioning of nuclear power stations. Compared with peers--excluding Chile and New Zealand, which have considerably less leveraged public sectors--these figures are roughly in line with high European averages (see table 1). In brief, we would expect Scotland to benefit from all the attributes of an investment-grade sovereign credit characterized by its wealthy economy (roughly the size of New Zealand's), high-quality human capital, flexible product and labor markets, and transparent institutions. Nevertheless, the newly formed sovereign state would begin life with comparatively high levels of public debt, sensitivity to oil prices, and, depending on the nature of arrangements with the EU or U.K., potentially limited monetary flexibility. At the same time, Scotland's external position in terms of

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 27, 2014 5

1264946 | 301015591

Key Considerations For Rating An Independent Scotland

liquidity and investment could be subject to volatility should banks leave. On the other hand, if this were to happen, it could bring benefits in terms of reducing the size of the Scottish economy's external balance sheet, normalizing the size of its financial sector, and reducing contingent liabilities for the state. In short, the challenge for Scotland to go it alone would be significant, but not unsurpassable.

Under Standard & Poor's policies, only a Rating Committee can determine a Credit Rating Action (including a Credit Rating change, affirmation or withdrawal, Rating Outlook change, or CreditWatch action). This commentary and its subject matter have not been the subject of Rating Committee action and should not be interpreted as a change to, or affirmation of, a Credit Rating or Rating Outlook.

Additional Contact: SovereignEurope; SovereignEurope@standardandpoors.com

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 27, 2014 6

1264946 | 301015591

Copyright 2014 Standard & Poor's Financial Services LLC, a part of McGraw Hill Financial. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

FEBRUARY 27, 2014 7

1264946 | 301015591

You might also like

- 'Working Together' NewsletterDocument8 pages'Working Together' NewsletterPatrick McPartlinNo ratings yet

- Hamilton School - Statement of ConcernsDocument21 pagesHamilton School - Statement of ConcernsPatrick McPartlinNo ratings yet

- NIESR Press Release - Feb Review Research ScotlandDocument4 pagesNIESR Press Release - Feb Review Research ScotlandPatrick McPartlinNo ratings yet

- AAIB Special Bulletin, Clutha Helicopter CrashDocument0 pagesAAIB Special Bulletin, Clutha Helicopter CrashPatrick McPartlinNo ratings yet

- Guide To The New EU DirectiveDocument2 pagesGuide To The New EU DirectivePatrick McPartlinNo ratings yet

- Scots Party Combined Medical Research and MountaineeringDocument1 pageScots Party Combined Medical Research and MountaineeringPatrick McPartlinNo ratings yet

- Scotland's Top 500 CompaniesDocument10 pagesScotland's Top 500 CompaniesPatrick McPartlin62% (13)

- STTS 22 02 14 002 STTSDocument1 pageSTTS 22 02 14 002 STTSPatrick McPartlinNo ratings yet

- UK Debt and The Scotland Independence ReferendumDocument5 pagesUK Debt and The Scotland Independence ReferendumPatrick McPartlinNo ratings yet

- AAIB Special Bulletin, Clutha Helicopter CrashDocument0 pagesAAIB Special Bulletin, Clutha Helicopter CrashPatrick McPartlinNo ratings yet

- AFCAS Report On Forces Morale 2008-2012Document1 pageAFCAS Report On Forces Morale 2008-2012Patrick McPartlinNo ratings yet

- Highest Number of Affordable TownsDocument5 pagesHighest Number of Affordable TownsPatrick McPartlinNo ratings yet

- Basing - Letter From David Cameron To Alex SalmondDocument3 pagesBasing - Letter From David Cameron To Alex SalmondPatrick McPartlinNo ratings yet

- Borders General Hospital Inspection Report (August 2012)Document21 pagesBorders General Hospital Inspection Report (August 2012)Patrick McPartlinNo ratings yet

- Molson Coors ReportDocument11 pagesMolson Coors ReportPatrick McPartlinNo ratings yet

- Witness Statement of Alex SalmondDocument11 pagesWitness Statement of Alex SalmondPatrick McPartlinNo ratings yet

- All MSPsDocument3 pagesAll MSPsPatrick McPartlinNo ratings yet

- Joesph Rowntree Foundation ReportDocument52 pagesJoesph Rowntree Foundation ReportPatrick McPartlinNo ratings yet

- Fuel For Thought: The What, Why and How of Motoring TaxationDocument120 pagesFuel For Thought: The What, Why and How of Motoring TaxationPatrick McPartlinNo ratings yet

- RBS Group PLCDocument23 pagesRBS Group PLCPatrick McPartlinNo ratings yet

- Key Findings EnglishDocument6 pagesKey Findings EnglishPatrick McPartlinNo ratings yet

- WWF Living Planet Report 2012Document85 pagesWWF Living Planet Report 2012John MalcolmNo ratings yet

- Housing Affordability Continues To Improve For Scotland's Key WorkersDocument4 pagesHousing Affordability Continues To Improve For Scotland's Key WorkersPatrick McPartlinNo ratings yet

- RCN Briefing Note - 1 May Health Board FinancesDocument3 pagesRCN Briefing Note - 1 May Health Board FinancesPatrick McPartlinNo ratings yet

- Scottish Share of UK DebtDocument14 pagesScottish Share of UK DebtPatrick McPartlinNo ratings yet

- Pension Deficits 2012 ScotlandDocument3 pagesPension Deficits 2012 ScotlandPatrick McPartlinNo ratings yet

- Pension Deficits 2012 UKDocument24 pagesPension Deficits 2012 UKPatrick McPartlinNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Whisky Bourbon PDFDocument16 pagesWhisky Bourbon PDFpolohksNo ratings yet

- Reportr Semana 45 Claudia Selene Barrios Parques PolancoDocument4 pagesReportr Semana 45 Claudia Selene Barrios Parques PolancoClaudiaNo ratings yet

- TastToe Pricelist 22062011Document52 pagesTastToe Pricelist 22062011Talleyrand76No ratings yet

- Base de DatosDocument12 pagesBase de DatosauraespaillatNo ratings yet

- Sport Tourism - Scale of Opportunity From Hosting A Mega EventDocument11 pagesSport Tourism - Scale of Opportunity From Hosting A Mega EventPETROSPAPAFILISNo ratings yet

- WhiskiesDocument3 pagesWhiskiesblessvalley100% (3)

- Whisky TrailDocument2 pagesWhisky TrailDzajo5No ratings yet

- Price List - 01 07 2023 - Price List of Foreign Made Items W.E.F 01 07 2023Document25 pagesPrice List - 01 07 2023 - Price List of Foreign Made Items W.E.F 01 07 2023Kathir AmuthanNo ratings yet

- Ron Vodka Whisky Liq3 313 Id 2CDocument6 pagesRon Vodka Whisky Liq3 313 Id 2CAeplusca Rikchariy LlaqtaNo ratings yet

- Whisky List (PDFDrive) PDFDocument102 pagesWhisky List (PDFDrive) PDFSergio MichelNo ratings yet

- Whisky Price in Kolkata, West Bengal: Sr. No. Whisky Name Measure (Packing) Rate (Price)Document7 pagesWhisky Price in Kolkata, West Bengal: Sr. No. Whisky Name Measure (Packing) Rate (Price)Yash Anand0% (2)

- Telangana (TS) Liquor Price List 2023-24 PDF Download - PDF ListDocument36 pagesTelangana (TS) Liquor Price List 2023-24 PDF Download - PDF ListManvith ZerardNo ratings yet

- Description Packing Price List Unit Vol CTN Bottle: Japanese WhiskyDocument4 pagesDescription Packing Price List Unit Vol CTN Bottle: Japanese WhiskyErina SweetNo ratings yet

- Himachal Prades NewDocument6 pagesHimachal Prades NewManali TripNo ratings yet

- Scotch Malt Whisky Map of ScotlandDocument2 pagesScotch Malt Whisky Map of ScotlandAnthony Webb100% (1)

- Royal Bank of ScotlandDocument5 pagesRoyal Bank of ScotlandbaajpurNo ratings yet

- Business Plan 2013Document44 pagesBusiness Plan 2013Sebastían Alejandro Pérez DuqueNo ratings yet

- Oferta Bauturi AlcooliceDocument57 pagesOferta Bauturi AlcooliceVlad BabiciNo ratings yet

- Highland Distillery GuideDocument23 pagesHighland Distillery GuideNino Armstrong MarchettiNo ratings yet

- Rum Price in Chandigarh Bottle 750 ML HALF 375 ML Quarter 180 MLDocument7 pagesRum Price in Chandigarh Bottle 750 ML HALF 375 ML Quarter 180 MLNikhil MahajanNo ratings yet

- Malt Maniacs MonitorDocument286 pagesMalt Maniacs MonitorsumplerNo ratings yet

- Stockvaluation 31032022Document17 pagesStockvaluation 31032022Fca Hari BahetiNo ratings yet

- Particulars Inwards Opening Balance: 1-May-2022 To 20-May-2022Document24 pagesParticulars Inwards Opening Balance: 1-May-2022 To 20-May-2022kush mishraNo ratings yet

- Wine Rate in AssamDocument6 pagesWine Rate in AssamJeet Gogoi50% (10)

- Hirschenbrunner Spirits - Preisübersicht 1. Quartal 2022 / No 1Document38 pagesHirschenbrunner Spirits - Preisübersicht 1. Quartal 2022 / No 1Lakis LokosNo ratings yet

- Inventario 29-03-19Document2 pagesInventario 29-03-19auraespaillatNo ratings yet

- Lowland Distillery GuideDocument9 pagesLowland Distillery GuideNino Armstrong MarchettiNo ratings yet

- AE Price List - OCT 2023Document31 pagesAE Price List - OCT 2023Karen LowNo ratings yet

- Scotch WhiskyDocument19 pagesScotch Whiskywhisky-exchangeNo ratings yet