Professional Documents

Culture Documents

AMEND SEC 27 (C), RA No. 10026

Uploaded by

Bing MendozaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AMEND SEC 27 (C), RA No. 10026

Uploaded by

Bing MendozaCopyright:

Available Formats

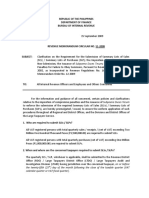

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

March 22, 2010

REVENUE MEMORANDUM CIRCULAR NO. 28-2010

SubjecT : Circularizing the full text of Republic Act No. 10026 entitled AN ACT

GRANTING INCOME TAX EXEMPTION TO LOCAL WATER DISTRICTS BY

AMENDING SECTION 27 (C) OF THE NATIONAL INTERNAL REVENUE

CODE (NIRC) OF 1997, AS AMENDED, AND ADDING SECTION 289-A TO

THE CODE, FOR THE PURPOSE.

To : All Internal Revenue Officials, Employees and Others Concerned

For the information and guidance of all internal revenue officers, employees and other

concerned, attached is the full text of Republic Act No. 10026 issued by the President of the

Republic of the Philippines on March 11, 2010.

REPUBLIC ACT NO. 10026

AN ACT GRANTING INCOME TAX EXEMPTION TO LOCAL WATER DISTRICTS BY

AMENDING SECTION 27 (C) OF THE NATIONAL INTERNAL REVENUE CODE (NIRC) OF 1997, AS

AMENDED, AND ADDING SECTION 299-A TO THE CODEM, FOR THE PURPOSE.

Be it enacted by the Senate and House of Representatives of the Philippines in

Congress assembled:

Section 1. Section 27 (C) of the National Internal Revenue Code (NIRC) of 1997,

as amended by Republic Act No. 9337, is hereby further amended to read as follows:

Sec. 27 Rates of Income Tax on Domestic Corporations.

x x x

(C) Government owned or Controlled Corporations, Agencies or

Instrumentalities. The provisions of existing special or general laws to the

contrary notwithstanding, all corporations, agencies, or instrumentalities owned

or controlled by the Government, except the Government Service and Insurance

System (GSIS), the Social Security System (SSS), the Philippine Health Insurance

Corporation (PHIC), the local water districts (LWD) and the Philippine Charity

Sweepstakes Office (PCSO), shall pay such rate of tax upon their taxable income

as are imposed by this Section upon corporations or associations engaged in a

similar business, industry, or activity.

x x x

Section 2. A new section, designated as Section 289-A under Chapter II, Title XI,

of the same Code is inserted to read as follows:

Sec. 289-A. Support for Local Water Districts, - The amount that would

have been paid as income tax and saved by the local water district by virtue of its

exemption to the income taxes shall be used by the local water district

concerned for capital equipment expenditure in order to expand water services

coverage and improve water quality in order to provide safe and clean water in

the provinces, cities, and municipalities: Provided, That, the water district shall

adopt internal control reforms that would bring about their economic and

financial viability: Provided, further, That the water district shall not increase by

more than twenty percent (20%) a year its appropriation for personal services, as

well as for travel, transportation or representation expenses and purchase of

motor vehicles.

All unpaid taxes or any portion thereof due from a local water district for

the period starting August 13, 1996 until the effectivity date of this Act are

hereby condoned by the Government subject to the following conditions: (1)

that the Bureau of Internal Revenue, after careful review of the financial

statements of a water district applying for condonation of taxes due, establishes

its financial incapacity, after providing for its maintenance and operating

expenses, debt servicing and reserved fund, to meet such obligations for the

period stated herein; and (2) that the water district availing of such condonation

shall submit to Congress of the Philippines a program of internal reforms, duly

certified by the local water utilities administration, that would bring about its

economic and financial viability.

All water districts, through the Local Water Utilities Administration, shall

furnish the Committee on Ways and Means of the Senate and House of

Representatives, respectively, on an annual basis, with statistical data and

financial statements regarding their operations and other information as may be

required, for purposes of monitoring compliance with the provisions of this Act

and reviewing the rationalization for tax exemption privileges.

Section 3. Implementing Rules and Regulations. The Secretary of Finance shall,

upon the recommendation of the Commissioner of Internal Revenue, and upon

consultation with the appropriate government agencies, promulgate the necessary rules

and regulations for the effective implementarion of this Act.

Section 4. Separability Clause. If any provision of this Act is declared invalid or

unconstitutional, other provisions hereof which are not affected thereby shall continue

to be in full force and effect.

Section 5. Repealing Clause. Any law, presidential decree or issuance,

executive order, letter of instruction, administrative order, rule or regulation contrary to

or inconsistent with any provision of this Act is hereby repealed or modified accordingly.

Section 6. Effectivity Clause. This Act shall take effect fifteen (15) days after its

publication in the Official Gazette or in at least two (2) newspapers of general

circulation, whichever date comes earlier.

Approved,

(sgd.) JUAN PONCE ENRILE (sgd.) PROSPERO C. NOGRALES

President of the Senate Speaker of the House

Of Representatives

This Act which is a consolidation of House Bill No. 5210 and Senate Bill No. 3392

was finally passed by the House of Representatives and the Senate on December 15,

2009 and December 8, 2009, respectively.

(sgd.) EMMA LIRIO-REYES (sgd.) MARILYN B. BARUA-YAP

Secretary of the Senate Secretary General

House of Representative

Approved:

GLORIA MACAPAGAL-ARROYO

President of the Philippines

All revenue officials and employees are enjoined to give this Circular as wide a publicity

as possible.

(Original Signed)

JOEL L. TAN-TORRES

Commissioner of Internal Revenue

A

You might also like

- If We Hold On TogetherDocument2 pagesIf We Hold On TogetherBing Mendoza100% (1)

- The Impossible DreamDocument1 pageThe Impossible DreamBing Mendoza100% (2)

- My WayDocument2 pagesMy WayBing MendozaNo ratings yet

- My WayDocument2 pagesMy WayBing MendozaNo ratings yet

- My WayDocument2 pagesMy WayBing MendozaNo ratings yet

- Can You Read My Mind - Melody1Document1 pageCan You Read My Mind - Melody1Bing MendozaNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingDocument1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingRISACA100% (1)

- .2021 Signature FormsDocument5 pages.2021 Signature FormsASHLEY GRIESEMER100% (2)

- PANUNUMPADocument2 pagesPANUNUMPABing Mendoza88% (8)

- Affidavit of Truth and Fact To Mr. ComputerDocument2 pagesAffidavit of Truth and Fact To Mr. Computerfreedompool11391567% (3)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Taxation LawDocument13 pagesTaxation LawThe Supreme Court Public Information Office100% (2)

- Don't Cry For Me ArgentinaDocument2 pagesDon't Cry For Me ArgentinaBing Mendoza100% (1)

- Don't Cry For Me ArgentinaDocument2 pagesDon't Cry For Me ArgentinaBing Mendoza100% (1)

- REMREV1 - CIVPRO (Atty. Brondial)Document44 pagesREMREV1 - CIVPRO (Atty. Brondial)Pauline de la PeñaNo ratings yet

- Take Me Home Country Roads - Melody1Document1 pageTake Me Home Country Roads - Melody1Bing MendozaNo ratings yet

- You Needed Me - MelodyDocument1 pageYou Needed Me - MelodyBing Mendoza100% (1)

- Wells Fargo Loss Mitigation Package (2011)Document13 pagesWells Fargo Loss Mitigation Package (2011)Chris QualmannNo ratings yet

- Instructions For Form 1120Document31 pagesInstructions For Form 1120A.F. GRANADANo ratings yet

- National Internal Revenue CodeDocument164 pagesNational Internal Revenue CodeJenny Kenn CanonizadoNo ratings yet

- Tax Code PDFDocument459 pagesTax Code PDFChristian MuhiNo ratings yet

- National Internal Revenue CodeDocument143 pagesNational Internal Revenue CodeJing DalaganNo ratings yet

- Remedies - Tax AdministrationDocument12 pagesRemedies - Tax AdministrationJade ViguillaNo ratings yet

- Sources of Tax Laws Page 8Document16 pagesSources of Tax Laws Page 8nazhNo ratings yet

- Digest-Cir vs. V.G. Sinco EducDocument2 pagesDigest-Cir vs. V.G. Sinco Educsandy522100% (1)

- You Needed MeDocument2 pagesYou Needed MeBing MendozaNo ratings yet

- You Needed MeDocument2 pagesYou Needed MeBing MendozaNo ratings yet

- Maceda VS Macaraig, GR No 88291, May 31, 1981Document43 pagesMaceda VS Macaraig, GR No 88291, May 31, 1981KidMonkey2299No ratings yet

- Nirc Tax CodeDocument203 pagesNirc Tax CodeLeah MarshallNo ratings yet

- Can You Read My Mind - Melody1Document1 pageCan You Read My Mind - Melody1Bing MendozaNo ratings yet

- Must-Read Tax Cases in the PhilippinesDocument20 pagesMust-Read Tax Cases in the Philippinespeanut47100% (1)

- Ra 8424 - NircDocument123 pagesRa 8424 - NircJOHAYNIENo ratings yet

- 14 - CIR v. San Roque Power Corp, GR No. 187485Document2 pages14 - CIR v. San Roque Power Corp, GR No. 187485Lloyd Liwag100% (4)

- Province of Batangas vs. RomuloDocument3 pagesProvince of Batangas vs. RomuloElyn ApiadoNo ratings yet

- Fiscal AdministrationDocument34 pagesFiscal AdministrationBon Carlo Medina Melocoton100% (5)

- Case Digest in Taxation, GoncenaDocument15 pagesCase Digest in Taxation, GoncenaMaRites GoNcenANo ratings yet

- CIR vs Burroughs Tax Credit RulingDocument2 pagesCIR vs Burroughs Tax Credit RulingAngela Marie AlmalbisNo ratings yet

- Archbishop Reyes Ave, Cebu City, Cebu, 6000Document5 pagesArchbishop Reyes Ave, Cebu City, Cebu, 6000Ralf Arthur Silverio100% (1)

- Sample PANDocument5 pagesSample PANArmie Lyn Simeon100% (1)

- Republic Act No. 10026Document2 pagesRepublic Act No. 10026Jesse Myl MarciaNo ratings yet

- Republic Act No. 9337Document2 pagesRepublic Act No. 9337Mike RossNo ratings yet

- Labor Law Week 5Document12 pagesLabor Law Week 5Rhealyn RagosNo ratings yet

- SBN-0591: Condonation of All Unpaid Income Taxes Due From Local Water DistrictsDocument7 pagesSBN-0591: Condonation of All Unpaid Income Taxes Due From Local Water DistrictsRalph RectoNo ratings yet

- BmbeDocument4 pagesBmbeJoel MangallayNo ratings yet

- First Regular Session: 13" OF The Republic of The PhilippinesDocument4 pagesFirst Regular Session: 13" OF The Republic of The PhilippinesDexter TadeoNo ratings yet

- Ra 9400Document8 pagesRa 9400HjktdmhmNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument4 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJen AnchetaNo ratings yet

- Revenue Memorandum Circular No. 27 - 2007: Bureau of Internal RevenueDocument6 pagesRevenue Memorandum Circular No. 27 - 2007: Bureau of Internal Revenuelantern san juanNo ratings yet

- XYZ Water Inc. FAN ProtestDocument16 pagesXYZ Water Inc. FAN ProtestRalf Arthur SilverioNo ratings yet

- RA 9400 Amends Bases Conversion Act Providing Tax Incentives for SEZsDocument5 pagesRA 9400 Amends Bases Conversion Act Providing Tax Incentives for SEZsEman VillacorteNo ratings yet

- Republic Act No 8424Document206 pagesRepublic Act No 8424YanoNo ratings yet

- Ra 11534Document41 pagesRa 11534Jan Aristhedes AsisNo ratings yet

- House of RepresentativesDocument5 pagesHouse of RepresentativesAnna Dominique Gevaña MarmolNo ratings yet

- Amendments to Revenue Regulations on Special Economic ZonesDocument3 pagesAmendments to Revenue Regulations on Special Economic ZonesSy HimNo ratings yet

- Republic of The Philippines RA 8424Document235 pagesRepublic of The Philippines RA 8424MikeeMouse07No ratings yet

- Regular: Republic of The PhilippinesDocument13 pagesRegular: Republic of The PhilippinesHjktdmhmNo ratings yet

- T - 1 The BIRDocument4 pagesT - 1 The BIRNina CastilloNo ratings yet

- R.A. No. 11534 Create LawDocument42 pagesR.A. No. 11534 Create LawJessa PuerinNo ratings yet

- Background or Conditions Existing Before The Enactment of The LawDocument6 pagesBackground or Conditions Existing Before The Enactment of The LawFlorie-May GarciaNo ratings yet

- Tax - BMBE CompilationDocument35 pagesTax - BMBE CompilationWatashi o matte je t'attendraiNo ratings yet

- RA 8748-Amending RA 7916 PEZA (1999)Document3 pagesRA 8748-Amending RA 7916 PEZA (1999)Duko Alcala EnjambreNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument6 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledAdeline HoodhemwinfordNo ratings yet

- Tax Reform Act of 1997 SummaryDocument199 pagesTax Reform Act of 1997 Summarydoc dacuscosNo ratings yet

- Local Fiscal Mod 3Document21 pagesLocal Fiscal Mod 3Athy CloyanNo ratings yet

- Tax CodeDocument177 pagesTax CodeMark MlsNo ratings yet

- Tax Incentives 10708Document5 pagesTax Incentives 10708Hib Atty TalaNo ratings yet

- 63-2003 Local Water District Franchise and Income TaxDocument2 pages63-2003 Local Water District Franchise and Income Taxapi-247793055100% (1)

- CREATE Bill - Draft Enrolled Copy 02.16.21Document77 pagesCREATE Bill - Draft Enrolled Copy 02.16.21Joshua CustodioNo ratings yet

- RA 10963 Tax Reform For Acceleration and InclusionDocument54 pagesRA 10963 Tax Reform For Acceleration and Inclusionjpeb100% (2)

- RMC No 45-2015Document4 pagesRMC No 45-2015GoogleNo ratings yet

- Pacto Fiscal IIDocument10 pagesPacto Fiscal IIJuan Francisco FreudenthalNo ratings yet

- Republic Act No. 8748: June 1, 1999Document4 pagesRepublic Act No. 8748: June 1, 1999Jp CoquiaNo ratings yet

- FINAL CREATE BICAM BILL (As of 1 Feb 540pm)Document198 pagesFINAL CREATE BICAM BILL (As of 1 Feb 540pm)KimNo ratings yet

- First Regular Session: S. BillDocument3 pagesFirst Regular Session: S. BillEdu ParungaoNo ratings yet

- Emmanuel M. Naag Lm6A: Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument5 pagesEmmanuel M. Naag Lm6A: Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledEmmans Marco NaagNo ratings yet

- A. RA 8748Document3 pagesA. RA 8748Karen UmangayNo ratings yet

- Republic Act No 8424 NIRC of 1997Document166 pagesRepublic Act No 8424 NIRC of 1997jeemee0320No ratings yet

- Ra 9178 BmbeDocument5 pagesRa 9178 BmbeBrian James RubioNo ratings yet

- Module-3 1Document8 pagesModule-3 1Ronald AlmarezNo ratings yet

- RA No. 10963 - Tax Reform For Acceleration and Inclusion (TRAIN Law)Document54 pagesRA No. 10963 - Tax Reform For Acceleration and Inclusion (TRAIN Law)Anostasia NemusNo ratings yet

- Amendments to the Bases Conversion and Development Act of 1992Document5 pagesAmendments to the Bases Conversion and Development Act of 1992HjktdmhmNo ratings yet

- Republic Act No. 8748 - Amendments To R.A. No. 7916 (Special EconomicDocument2 pagesRepublic Act No. 8748 - Amendments To R.A. No. 7916 (Special EconomicMaria Celiña PerezNo ratings yet

- Ra 10708Document6 pagesRa 10708Miguel CardenasNo ratings yet

- Bir Ruling No. 313-15Document4 pagesBir Ruling No. 313-15Stacy Lyn LiongNo ratings yet

- BMBEs (RA 9178)Document5 pagesBMBEs (RA 9178)tagabantayNo ratings yet

- Tax Nirc PDFDocument93 pagesTax Nirc PDFHeber BacolodNo ratings yet

- BABE - Styx - Organ and Guitar ChordsDocument1 pageBABE - Styx - Organ and Guitar ChordsBing MendozaNo ratings yet

- BABE - Styx - Organ and Guitar ChordsDocument1 pageBABE - Styx - Organ and Guitar ChordsBing MendozaNo ratings yet

- An Affair To RememberDocument1 pageAn Affair To RememberBing MendozaNo ratings yet

- Criminal Law 1-IntroductionDocument17 pagesCriminal Law 1-IntroductionBing MendozaNo ratings yet

- Gabriel's Oboe - MelodyDocument1 pageGabriel's Oboe - MelodyBing MendozaNo ratings yet

- Criminal Law 1: Atty. Ambrosio S. Mendoza IiiDocument18 pagesCriminal Law 1: Atty. Ambrosio S. Mendoza IiiBing MendozaNo ratings yet

- Criminal Law 1 - 3Document11 pagesCriminal Law 1 - 3Bing MendozaNo ratings yet

- Criminal Law 1 - Introduction 2Document28 pagesCriminal Law 1 - Introduction 2Bing MendozaNo ratings yet

- An Affair To RememberDocument1 pageAn Affair To RememberBing MendozaNo ratings yet

- SSS Portability LawDocument5 pagesSSS Portability LawMaria Jennifer SantosNo ratings yet

- Bahay Kubo Two VoicesDocument4 pagesBahay Kubo Two VoicesBing MendozaNo ratings yet

- An Affair To RememberDocument1 pageAn Affair To RememberBing MendozaNo ratings yet

- Kordero AquinoDocument1 pageKordero AquinoBing MendozaNo ratings yet

- Aba Ginoong Maria (DM)Document1 pageAba Ginoong Maria (DM)Bing MendozaNo ratings yet

- I Will Sing ForeverDocument1 pageI Will Sing ForeverBing MendozaNo ratings yet

- RMC No 14-2015Document12 pagesRMC No 14-2015anorith88No ratings yet

- CIR Vs Procter & GambleDocument44 pagesCIR Vs Procter & GambleDario G. TorresNo ratings yet

- Prescriptive RulesDocument15 pagesPrescriptive Ruleslizherrero100% (3)

- 17) Smi-Ed Philippines Technology, Inc., Petitioner, vs. Commissioner of Internal Revenue, Respondent, G.R. No. 175410Document9 pages17) Smi-Ed Philippines Technology, Inc., Petitioner, vs. Commissioner of Internal Revenue, Respondent, G.R. No. 175410ZackNo ratings yet

- Guide: Tax ReturnDocument84 pagesGuide: Tax ReturnLars Renteria SilvaNo ratings yet

- IRS Code 6055 & 6056 New Filing Under HCRDocument3 pagesIRS Code 6055 & 6056 New Filing Under HCRAutomotive Wholesalers Association of New EnglandNo ratings yet

- BIR Citizens Charter 2020 2nd Edition RR RDODocument228 pagesBIR Citizens Charter 2020 2nd Edition RR RDOJessa TadeoNo ratings yet

- 8 Accenture V CIRDocument21 pages8 Accenture V CIRBianca Margaret TolentinoNo ratings yet

- GDI Letter - Ken Buck April 18, 2023Document2 pagesGDI Letter - Ken Buck April 18, 2023Gabe KaminskyNo ratings yet

- SILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Document7 pagesSILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Francise Mae Montilla MordenoNo ratings yet

- G.R. No. L-9692Document10 pagesG.R. No. L-9692mar corNo ratings yet

- Philippines Supreme Court Ruling on Prescription of Corporate Tax CaseDocument4 pagesPhilippines Supreme Court Ruling on Prescription of Corporate Tax CaseJuvy B.No ratings yet

- Tax1 Lifeblood DoctrinesDocument22 pagesTax1 Lifeblood DoctrinesJoahnna Paula CorpuzNo ratings yet

- Taxlaw Review Outline - General Principles and RemediesDocument13 pagesTaxlaw Review Outline - General Principles and RemediesJacqueline TimbrenaNo ratings yet

- Bir RMC 51-2009Document5 pagesBir RMC 51-2009Reg YuNo ratings yet

- Supreme Court of the Philippines Decision on Income Tax Liability of Siblings Who Sold Inherited LandDocument5 pagesSupreme Court of the Philippines Decision on Income Tax Liability of Siblings Who Sold Inherited LandJo BatsNo ratings yet

- Department of The Treasury: WASHINGTON, D.C. 20220Document26 pagesDepartment of The Treasury: WASHINGTON, D.C. 20220ForkLogNo ratings yet