Professional Documents

Culture Documents

Mock 1 For Practice of T4 Partb Exam

Uploaded by

sadiq626Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mock 1 For Practice of T4 Partb Exam

Uploaded by

sadiq626Copyright:

Available Formats

D Unseen Mock

D Unseen material provided for Mock Additional (Unseen) information relating to the case is given on the following pages. Read all of the additional material before you answer the questions. ANSWER THE FOLLOWING QUESTIONS

You are the management accountant of D, reporting to the Main Boards Finance Director. You have been asked to provide advice and recommendations on the issues which D must address. Question 1 part (a) Prepare a report that prioritises, analyses and evaluates the issues facing D and makes appropriate recommendations. (Total marks for question 1(a) = 90 marks) Question 1 part (b) In addition to your report prepare a memo which will be sent to all employees to explain the importance of changing attitudes within D to ensure that CSR becomes more of a focal point for all employees. Your memo should also communicate your ideas on how this could be achieved. (Total marks for question 1(b) = 10 marks) Your script will be marked against the TOPCIMA Assessment Criteria shown on the next page.

Case Study Assessment Criteria

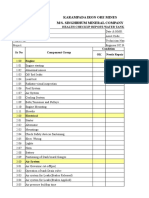

Analysis of Issues Technical Application Diversity Strategic Choices Focus Prioritisation Judgement Ethics Recommendations Logic Integration Ethics

25 5 15 5 35 5 5 20 5 40 30 5 5

Acquisition of AZ by D The Main Board of D are considering making an offer for AZ, a privately owned house building company which is based in Country Y and has a significant operational presence throughout many Asian countries. For example, AZ is currently involved in a major government funded project to build over 4,000 housing units in India and has profitable house building subsidiaries in China and the Middle East. Ds Chief Executive has been in contact with representatives of AZ who have been very forthcoming in providing him with company information and have indicated their willingness to sell the company for 575 million which they believe is a fair valuation based on the companys forecasts and long term earning potential. If the company was purchased it would be integrated into D as a separate, fourth division managed by the incumbent AZ Board with a gradual integration of senior D personnel planned for the short term. Ds main Board are very much in favour of the acquisition for the following reasons:

It would broaden the geographical scope of the group It would give D direct access to a market within a growth economy Ds Sales Director has family connections on the Board of AZ

Ds Main Board are willing to pay the price being asked by AZs shareholders provided that a prudent estimate of the companys value, including the long term value beyond 5 years from now, supports that conclusion. Ds institutional shareholders and lenders would insist on reducing the debt exposure within AZ, however, which would necessitate D repaying all of the bank loans in AZ falling due within the next 5 years. The Finance Director of D has presented you with some relevant data provided by AZ (shown in the table below) and has asked for your independent assessment of the opportunity and the issues that should be considered if it goes ahead.

Name of company Revenue for the last 3 years (AZ has a June year end) Geographical analysis of revenues in 2012

AZ 2012: 580 million; 2011: 505 million; 2010: 418 million India: 320 million China: 140 million Singapore: 97 million Middle East: 23 million

Book value of non-current assets in 2012 Profit after finance costs and tax for the last 3 years Number of employees (worldwide) in 2012 Current value of order book

120 million 2012: 12 million; 2011: 9.6 million; 2010: 8.4 million 1,640 1,600 million

Company estimates of forecast operating cashflows (post tax) for the next 5 years Gearing in 2012 Loan repayments due in the next 5 years Capital expenditure commitments for the next 5 years

2013: 118 million; 2014: 126 million; 2015: 140 million; 2016: 163 million; 2017: 189 million 45% 2013: 95 million; 2015: 131 million 2013: 30 million; 2014: 45 million; 2015: 70 million: 2016: 65 million; 2017: 80 million

The acquisition could be funded from a mixture of cash, loans and new equity which would increase Ds gearing to 30%. AZ have asked D for a decision within the next 2 weeks after which time the business will be offered for sale on the open market. The pre-tax cost of capital to be used in assessing this opportunity is 8%. Ignore taxation. Ds Sales Director has told the Board that he may be able to speak to his brother on the Board of AZ to see if the price can be reduced but that his brother would expect payment for this service.

New Centralised System At present, all divisions of D use a bespoke project management system which was designed and developed for them in 2009 after the integration of H, R and S into the group. The system, called DPM, is well liked by its users and has delivered consistent and reliable information since its installation. It is currently being depreciated over a 5 year period on a straight line basis. The financial systems, however, are much older, usually off the shelf packages with which the Finance Department at Main Board level has repeatedly had problems. These systems are different in each of the companies H, R and S and have never been integrated into a common platform. One of the major problems is the lack of integration between DPM and these financial systems. Each week it takes voluminous and time consuming reconciliations and manual updating to overcome this. The IT Manager and his team have had to work long hours installing upgrades, patches and bespoke interfaces to ensure the information from the DPM system is accurately transferred to the three financial systems and that data integrity is absolute. Last month the finance team had to work through the night to complete the manual update. External auditors to D have made strong recommendations that the financial systems be overhauled to ensure the accuracy and effectiveness of financial information. The Finance Director has identified two possible suppliers of a new, fully integrated Enterprise Resource Planning System (ERPS) with project management capabilities including network analysis and project evaluation review techniques (PERT). The new system would wholly replace both DPM and the finance system and offer a single, unified management information system across the group. The details are as follows (both companies have offered a 5 year support and maintenance service which is included in the quoted cost): M a leading global supplier based in Asia, which produces high quality ERPS packages which are widely used in the construction industry. The DPM package

currently in use at D was purchased from M in 2009. The cost is 9 million, payable in advance. This includes all necessary training. S a world class supplier based in Germany. The Finance Director does not consider this to be as sophisticated as the M system but the cost is 6 million, 50% of which is paid in advance and the remainder 12 months later. Training costs are 1,000 per person day and S believes D will require 350 person days of training each year.

The IT Manager and the Finance Director of D have estimated that in total an average of 100 person days of overtime and other salary related costs per year could be saved if the current problems could be eradicated. The average cost of each of these person days is 350. Additional annual costs associated with the existing finance package such as upgrades and external consultancy assistance amounts to 55,000. The Finance Director would like you to assess this proposal over a 5 year period using Ds interest cost of 8% and assuming that the cost of training will be invoiced at the end of each year. Ignore taxation. He has also asked you to suggest and evaluate any alternatives which D could consider in relation to the current problem, beyond investing in a new system.

Formal CSR Targets NN has been overtly critical of Ds lack of buy in and proactivity towards the zero carbon agenda and broader corporate social responsibility issues supported by the UK government and many of Ds rivals. She has described the culture within D as archaic and blinkered and has criticised an ingrained resistance among all levels of staff towards CSR. As a result, Ds Main Board has been considering a formal policy to develop a consistent Corporate Social Responsibility (CSR) code of practice for all employees and subcontractors / business partners using a Balanced Scorecard approach. Under this proposal, D intends to publish its targets and achievements to all stakeholders, both internal and external, at the end of each half year (at the end of June and the end of December). All employees, suppliers, agents and other outsourcing providers such as human resource bureaus, will be asked to support Ds policies on issues such as safety standards, minimising carbon footprints and wildlife conservation. The Chief Executive, a strong advocate of NNs stance on this issue, is very vocal in his support for Ds new CSR initiative and has put forward his belief that Ds divisions should refuse to work with suppliers and agents who do not promise to comply with the policy. He also believes that those who do should be asked to contractually agree to specific terms and conditions which will further Ds goals in this area. Although the aims of the policy are clear, the Finance Director is concerned about the implications of introducing the scheme as described and has asked for your assessment of this proposal together with suggested objectives and measures which could be included within the Balanced Scorecard system.

Graduate scheme NN has also criticised Ds uncoordinated approach to human resource management, in particular the recruitment and development of house designers. Design, often outsourced to independent agencies, is a key part of a house builders value chain, helping the business

tap into MMC innovations and standardisation opportunities which help to minimise costs but also by overcoming the downsides of such trends in relation to design by ensuring the houses look attractive, sufficiently differentiated and that they fit in with the surrounding environment. Standardised housing developments are frequently criticised for incongruous ugliness but innovative designers can overcome these restrictions. Some housebuilding companies employ in-house designers but D has traditionally outsourced this activity to agents who act on behalf of several housebuilding companies at any one time. Keen to tap into up-and-coming design talent, the Board would like to set up a corporate graduate scheme in the UK to attract promising design graduates coming out of civil engineering university courses. This would enable D to establish a small core of in-house designers. Successfully establishing the scheme would require sponsorship of graduates in their final year, marketing of the scheme and additional investments in training and development, including the costs of professional post-graduate qualifications which technical design staff will pursue. Experienced graduate scheme co-ordinators will also need to be recruited. The annual costs of the scheme are predicted to be in the region of 450k but the Board believes that the payback will be significant if genuine talent is attracted to D as a result and the gap between D and its rivals will be closed sooner. One of Ds direct rivals launched a similar scheme 2 years ago and two of the designers recruited through the scheme have won design awards for MMC houses, significantly increasing the reputation and profile of the company concerned.

Project subcontractor In November 2011 the H business obtained planning permission to construct a new housing development of premium properties on a brownfield site in the Northern Region. The development began with site clearance in December 2011 and is scheduled to complete in March 2013. All construction work is currently on target for completion within budget and with no delays. In net present value terms, the overall value of the contract is approximately 76 million using Ds quoted interest cost of capital of 8%. Following the most recent Northern Divisional Board meeting the Project Manager from within H who is responsible for the development was asked to present his findings to the Main Board of D at the companys Head Office. He revealed a problem with one of the major subcontractors involved in the project, called X. This company had worked on the project since May 2012, installing roof partitions, internal walls, flooring and loft space. H has never worked with X before but the Northern Division has been under great pressure to maximise profit on this contract and decisions were taken throughout the process to use cheaper subcontractors and suppliers wherever possible to try to reduce costs and generate a positive return. A recent internal inspection by H surveyors has revealed that some of the material used by X in the houses breaches Hs policies on hazardous materials as there are suspected, though yet unproven, links to cancers and other lung diseases. In the UK, there has been growing pressure from health and safety watchdogs and the scientific community to ban this substance, although at present the material is not illegal and the Northern Divisions contract with X did not specifically preclude its use. Over 85% of this work has been completed already at a cost of 6.5 million. The estimated cost of stripping out the material and appointing a different supplier to install different material is in the region of 11.5 million and this is expected to delay the completion of the development by up to 5 months. Some of the houses have already been sold and buyers are expecting to move in during the next few weeks.

The Project Manager has revealed to the Main Board that X has offered a 2 million cash rebate on the cost of the contract on the condition that no further action is taken in relation to this matter.

End of Unseen

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Why File A Ucc1Document10 pagesWhy File A Ucc1kbarn389100% (4)

- O Levels English Language NotesDocument125 pagesO Levels English Language Notessadiq626100% (13)

- O Level Important FileDocument25 pagesO Level Important Filesadiq626No ratings yet

- CIMA F2 Financial Management Quick Review SlidesDocument50 pagesCIMA F2 Financial Management Quick Review Slidessadiq626No ratings yet

- Test Bank For Managerial AccountingDocument54 pagesTest Bank For Managerial Accountingsadiq626100% (2)

- The EL Car Company CaseDocument14 pagesThe EL Car Company Casesadiq626No ratings yet

- Important Information On Books Published by BPP and Very Helpful To Inform Them of The Choice of BooksDocument12 pagesImportant Information On Books Published by BPP and Very Helpful To Inform Them of The Choice of Bookssadiq626No ratings yet

- Comprehension Practice Passage For English Reading and Writing Skills. It Will Help Students of Standard 10th and 11th GradeDocument4 pagesComprehension Practice Passage For English Reading and Writing Skills. It Will Help Students of Standard 10th and 11th Gradesadiq62617% (6)

- Motives For Holding Cash Supplementary ReadingDocument4 pagesMotives For Holding Cash Supplementary Readingsadiq626No ratings yet

- P6Document56 pagesP6sadiq626No ratings yet

- Syllabus For A LevelsDocument30 pagesSyllabus For A LevelsMuhammad SadiqNo ratings yet

- Progress Report 1Document3 pagesProgress Report 1api-302815786No ratings yet

- 0 BA Design ENDocument12 pages0 BA Design ENFilho AiltonNo ratings yet

- Morse Potential CurveDocument9 pagesMorse Potential Curvejagabandhu_patraNo ratings yet

- Formal Letter LPDocument2 pagesFormal Letter LPLow Eng Han100% (1)

- Land of PakistanDocument23 pagesLand of PakistanAbdul Samad ShaikhNo ratings yet

- Hindi ShivpuranDocument40 pagesHindi ShivpuranAbrar MojeebNo ratings yet

- Countable 3Document2 pagesCountable 3Pio Sulca Tapahuasco100% (1)

- Topic Group Present (Week 8) Chapter 1:sociology and Learning ManagementDocument2 pagesTopic Group Present (Week 8) Chapter 1:sociology and Learning ManagementLEE LEE LAUNo ratings yet

- Catálogo MK 2011/2013Document243 pagesCatálogo MK 2011/2013Grupo PriluxNo ratings yet

- Cad Data Exchange StandardsDocument16 pagesCad Data Exchange StandardskannanvikneshNo ratings yet

- Power Control 3G CDMADocument18 pagesPower Control 3G CDMAmanproxNo ratings yet

- LG Sigma+EscalatorDocument4 pagesLG Sigma+Escalator강민호No ratings yet

- Acampamento 2010Document47 pagesAcampamento 2010Salete MendezNo ratings yet

- Technical Data Sheet TR24-3-T USDocument2 pagesTechnical Data Sheet TR24-3-T USDiogo CNo ratings yet

- Water Tanker Check ListDocument8 pagesWater Tanker Check ListHariyanto oknesNo ratings yet

- Alpha Sexual Power Vol 1Document95 pagesAlpha Sexual Power Vol 1Joel Lopez100% (1)

- Sistine Chapel Ceiling Lesson PlanDocument28 pagesSistine Chapel Ceiling Lesson PlannivamNo ratings yet

- Paramount Healthcare Management Private Limited: First Reminder Letter Without PrejudiceDocument1 pageParamount Healthcare Management Private Limited: First Reminder Letter Without PrejudiceSwapnil TiwariNo ratings yet

- Business CombinationsDocument18 pagesBusiness Combinationszubair afzalNo ratings yet

- Grade9 January Periodical ExamsDocument3 pagesGrade9 January Periodical ExamsJose JeramieNo ratings yet

- N50-200H-CC Operation and Maintenance Manual 961220 Bytes 01Document94 pagesN50-200H-CC Operation and Maintenance Manual 961220 Bytes 01ANDRESNo ratings yet

- Buildingawinningsalesforce WP DdiDocument14 pagesBuildingawinningsalesforce WP DdiMawaheb ContractingNo ratings yet

- Revit 2023 Architecture FudamentalDocument52 pagesRevit 2023 Architecture FudamentalTrung Kiên TrầnNo ratings yet

- Jurnal Ekologi TerestrialDocument6 pagesJurnal Ekologi TerestrialFARIS VERLIANSYAHNo ratings yet

- Principles of Business Grade 10 June 2021 Time: 1 1/2 Hrs. Paper 2 Answer ONLY 1 Question in Section I. Section IDocument3 pagesPrinciples of Business Grade 10 June 2021 Time: 1 1/2 Hrs. Paper 2 Answer ONLY 1 Question in Section I. Section Iapi-556426590No ratings yet

- Fair & LovelyDocument10 pagesFair & LovelyAymanCheema100% (3)

- MCQs - Chapters 31 - 32Document9 pagesMCQs - Chapters 31 - 32Lâm Tú HânNo ratings yet

- IBPS Clerk Pre QUANT Memory Based 2019 QuestionsDocument8 pagesIBPS Clerk Pre QUANT Memory Based 2019 Questionsk vinayNo ratings yet

- P. E. and Health ReportDocument20 pagesP. E. and Health ReportLESSLY ABRENCILLONo ratings yet