Professional Documents

Culture Documents

Chapter 12a

Uploaded by

mas_999Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 12a

Uploaded by

mas_999Copyright:

Available Formats

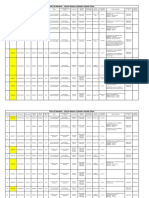

Chapter 12 The Design of the Tax System

Test A

1

In designing a tax system, policymakers have two objectives: a. equity and revenue. b. revenue and debt reduction. c. equity and efficiency. d. revenue and expenditure. !"#$%: c. equity and efficiency. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: -, 1 % !2,): '

-

&he most common explanation for "ocial "ecurity payments accounting for a larger share of federal government expenditures is a. falling payroll tax receipts. b. increases in life expectancy. c. increases in birth rates among teenagers and the poor. d. people becoming eligible for "ocial "ecurity benefits at an earlier age. !"#$%: b. increases in life expectancy. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

1

In general, the two most important taxes for state and local governments are a. sales taxes and property taxes. b. sin taxes and gasoline taxes. c. income taxes and estate taxes. d. excise taxes and corporate taxes. !"#$%: a. sales taxes and property taxes. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

3

&he biggest single expenditure for state and local governments is a. "ocial "ecurity. b. education. c. transportation. d. unemployment compensation. !"#$%: b. education. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

4

&he largest source of revenue for the federal government is the a. property tax. b. corporate income tax. c. individual income tax. d. import and export tax. !"#$%: c. individual income tax. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

+opyright 5 6arcourt, Inc.

111

11- +hapter 1-7&he 2esign of the &ax "ystem

8

s government debt increases, a. a trade9off with government deficits is inevitable. b. government must spend a larger share of its revenue on interest payments. c. evidence suggests that spending on social insurance programs will be reduced. d. all of the above !"#$%: b. government must spend a larger share of its revenue on interest payments. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

:

tax on the wages that a firm pays its workers is called a;n< a. payroll tax. b. excise tax. c. income tax. d. consumption tax. !"#$%: a. payroll tax. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

=

#hen government receipts exceed total government spending during a fiscal year the difference a. is a budget deficit. b. is a budget surplus. c. is the national debt. d. becomes federal tax refunds. !"#$%: b. is a budget surplus. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

>

#hen taxes are imposed on a commodity, a. there is never a deadweight loss. b. these taxes are considered nondistortionary. c. tax revenue will rise by the amount of the tax multiplied by the before9tax level of consumption. d. some consumers alter their consumption by not purchasing the taxed commodity. !"#$%: d. some consumers alter their consumption by not purchasing the taxed commodity. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: - % !2,): '

1?

&he @.". income tax a. encourages saving. b. has no effect on saving. c. discourages saving. d. will reduce the administrative burden of taxation. !"#$%: c. discourages saving. &'($: ) *$'1: 2 "$+&I,!: - ,./$+&I0$: - % !2,): '

11

#hen a taxpayer attempts to legally reduce her tax liability, she is engaging in a. tax evasion. b. tax avoidance. c. a tax return compensation plan. d. activities outside the intent of tax law. !"#$%: b. tax avoidance. &'($: ) *$'1: 2 "$+&I,!: - ,./$+&I0$: - % !2,): '

1-

#hen tax laws give preferential treatment to specific types of behavior it is called a. a political payoff. b. tax evasion. c. a tax loophole. d. compensation for the benefit of society. !"#$%: c. a tax loophole. &'($: ) *$'1: 2 "$+&I,!: - ,./$+&I0$: - % !2,): '

+opyright 5 6arcourt, Inc.

+hapter 1-7&he 2esign of the &ax "ystem 111

11

s tax laws become more complex, a. compliance costs are most likely to decrease. b. the administrative burden of taxes is increased. c. the government always collects more in tax revenue. d. the amount of tax revenue lost to tax evasion always decreases. !"#$%: b. the administrative burden of taxes is increased. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: - % !2,): '

13

If marginal tax rates increase, the a. average tax rate will be falling. b. deadweight loss from taxes will rise. c. deadweight loss from taxes is unaffected. d. deadweight loss from taxes will be reduced. !"#$%: b. deadweight loss from taxes will rise. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: - % !2,): '

14

&he extra taxes paid on an additional dollar of taxable income is called the a. average tax liability. b. average tax rate. c. marginal tax liability. d. marginal tax rate. !"#$%: d. marginal tax rate. &'($: ) *$'1: 2 "$+&I,!: - ,./$+&I0$: 1 % !2,): '

18

If the government were to impose a tax that assigned everyone the same tax liability, it would be a. an equitable tax. b. a lump9sum tax. c. supported by the poor. d. all of the above. !"#$%: b. a lump9sum tax. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: - % !2,): '

1:

&he benefits principle of taxation can be used to argue that the wealthy should pay higher taxes than the poor on the basis that a. the poor are more active in political processes. b. police services are more frequently used in poor neighborhoods. c. there is more crime in rich neighborhoods than poor neighborhoods. d. the wealthy benefit more from services provided by government than the poor. !"#$%: d. the wealthy benefit more from services provided by government than the poor. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

1=

#hen the marginal tax rate exceeds the average tax rate, the tax is a. progressive. b. regressive. c. proportional. d. non9egalitarian. !"#$%: a. progressive. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

+opyright 5 6arcourt, Inc.

113 +hapter 1-7&he 2esign of the &ax "ystem

1>

&he Aflypaper theoryB of taxation suggests that a. taxes are never paid by the most wealthy citiCens. b. the benefits principle of taxation is not a viable option for policymakers. c. the individual or corporation who actually pays the tax cannot share the burden of the tax. d. the individual or corporation who actually pays the tax is able to shift the burden of the tax to others !"#$%: c. the individual or corporation who actually pays the tax cannot share the burden of the tax. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 3 % !2,): '

-?

A D1,??? tax paid by a poor person may be a larger sacrifice than a D1?,??? tax paid by a wealthy personB is an argument based on the a. regressive tax argument. b. horiContal equity principle. c. ability9to9pay principle. d. benefits principle. !"#$%: c. ability9to9pay principle. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 3 % !2,): '

-1

0ertical equity states that taxpayers with a greater ability to pay taxes should a. contribute a larger amount. b. be less subject to administrative burdens of a tax. c. be less subject to tax distortions that lead to deadweight losses. d. contribute a decreasing proportion of each increment in income to taxes. !"#$%: a. contribute a larger amount. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

--

#hich of the following is a tax system in which all taxpayers pay the same percentage of their income in taxesE a. regressive b. progressive c. proportional d. horiContal equity !"#$%: c. proportional &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

-1

#hen the government levies a tax on a corporation, a. all the burden of the tax ultimately falls on owners. b. there are very few distortions to individual incentives. c. it is meeting all of the requirements for vertical equity. d. the corporation is more like a tax collector than a taxpayer. !"#$%: d. the corporation is more like a tax collector than a taxpayer. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 3 % !2,): '

-3

&he essence of most proposals for a flat tax are captured in a. a single, low tax rate applied to all income above a certain level. b. an initial low flat tax rate that increases as a taxpayerFs income increases. c. a single tax rate with many exemptions that provide incentives to people who save. d. a lump9sum tax that all taxpayers must pay, and then a fixed low tax rate for all income above a certain level. !"#$%: a. a single, low tax rate applied to all income above a certain level. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

+opyright 5 6arcourt, Inc.

+hapter 1-7&he 2esign of the &ax "ystem 114

-4

Incentives to work and save are reduced when a. income taxes are higher. b. (igovian taxes are implemented. c. consumption taxes replace income taxes. d. all of the above !"#$%: a. income taxes are higher. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: 3 % !2,): '

+opyright 5 6arcourt, Inc.

!"#$%: c. equity and efficiency. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: -, 1 % !2,): '

-

!"#$%: b. increases in life expectancy. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

1

!"#$%: a. sales taxes and property taxes. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

3

!"#$%: b. education. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

4

!"#$%: c. individual income tax. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

8

!"#$%: b. government must spend a larger share of its revenue on interest payments. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

:

!"#$%: a. payroll tax. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

=

!"#$%: b. is a budget surplus. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

>

!"#$%: d. some consumers alter their consumption by not purchasing the taxed commodity. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: - % !2,): '

1?

!"#$%: c. discourages saving. &'($: ) *$'1: 2 "$+&I,!: - ,./$+&I0$: - % !2,): '

11

!"#$%: b. tax avoidance. &'($: ) *$'1: 2 "$+&I,!: - ,./$+&I0$: - % !2,): '

1-

!"#$%: c. a tax loophole. &'($: ) *$'1: 2 "$+&I,!: - ,./$+&I0$: - % !2,): '

11

&'($: )

13

!"#$%: b. the administrative burden of taxes is increased. *$'1: + "$+&I,!: - ,./$+&I0$: - % !2,): '

!"#$%: b. deadweight loss from taxes will rise. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: - % !2,): '

14

!"#$%: d. marginal tax rate.

&'($: ) *$'1: 2 "$+&I,!: - ,./$+&I0$: 1 % !2,): '

18

!"#$%: b. a lump9sum tax. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: - % !2,): '

1:

!"#$%: d. the wealthy benefit more from services provided by government than the poor. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

1=

!"#$%: a. progressive. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

1>

!"#$%: c. the individual or corporation who actually pays the tax cannot share the burden of the tax. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 3 % !2,): '

-?

!"#$%: c. ability9to9pay principle. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 3 % !2,): '

-1

!"#$%: a. contribute a larger amount. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

--

!"#$%: c. proportional &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

-1

!"#$%: d. the corporation is more like a tax collector than a taxpayer. &'($: ) *$'1: 2 "$+&I,!: 1 ,./$+&I0$: 3 % !2,): '

-3

!"#$%: a. a single, low tax rate applied to all income above a certain level. &'($: ) *$'1: + "$+&I,!: 1 ,./$+&I0$: 1 % !2,): '

-4

!"#$%: a. income taxes are higher. &'($: ) *$'1: + "$+&I,!: - ,./$+&I0$: 3 % !2,): '

You might also like

- Chapter 15bDocument8 pagesChapter 15bmas_999No ratings yet

- Chapter 9-Application International TradeDocument11 pagesChapter 9-Application International TradeBrandon BarkerNo ratings yet

- Effect of Income Taxes On Capital Budgeting DecisionsDocument3 pagesEffect of Income Taxes On Capital Budgeting Decisionssalehin1969No ratings yet

- Chapter 18 International Capital BudgetingDocument26 pagesChapter 18 International Capital BudgetingBharat NayyarNo ratings yet

- The Design of The Tax System: Test BDocument7 pagesThe Design of The Tax System: Test Bmas_999No ratings yet

- Chapter 06bDocument8 pagesChapter 06bmas_999No ratings yet

- Chapter 22aDocument7 pagesChapter 22amas_999No ratings yet

- Chapter 08aDocument7 pagesChapter 08amas_999No ratings yet

- Ten Principles of Economics: Test BDocument7 pagesTen Principles of Economics: Test Bmas_999No ratings yet

- Chapter 10bDocument7 pagesChapter 10bmas_999No ratings yet

- Chapter 08bDocument7 pagesChapter 08bmas_999No ratings yet

- Chapter 13bDocument8 pagesChapter 13bmas_999No ratings yet

- Chapter 24aDocument7 pagesChapter 24amas_999No ratings yet

- Chapter 24Document62 pagesChapter 24mas_999No ratings yet

- Chapter 02bDocument9 pagesChapter 02bmas_999No ratings yet

- Chapter 13Document77 pagesChapter 13mas_999No ratings yet

- Measuring GDP & Economic GrowthDocument4 pagesMeasuring GDP & Economic GrowthKrittima Parn Suwanphorung100% (1)

- Chapter 05bDocument7 pagesChapter 05bmas_999No ratings yet

- Chapter 5Document78 pagesChapter 5mas_999No ratings yet

- Consumers, Producers, and The Efficiency of Markets: Test BDocument7 pagesConsumers, Producers, and The Efficiency of Markets: Test Bmas_999No ratings yet

- Supply, Demand, and Government Policies: Test ADocument8 pagesSupply, Demand, and Government Policies: Test Amas_999No ratings yet

- Measuring A Nation's Income: Test BDocument7 pagesMeasuring A Nation's Income: Test Bmas_999No ratings yet

- Chapter 21aDocument10 pagesChapter 21amas_999No ratings yet

- Chapter 18Document66 pagesChapter 18mas_999No ratings yet

- Public Goods and Common Resources: Test BDocument7 pagesPublic Goods and Common Resources: Test Bmas_999No ratings yet

- Chapter 6Document80 pagesChapter 6mas_999No ratings yet

- Monopolistic Competition: Test ADocument7 pagesMonopolistic Competition: Test Amas_999No ratings yet

- Application: International Trade: Test BDocument9 pagesApplication: International Trade: Test Bmas_999No ratings yet

- Public Goods and Common Resources: Test ADocument6 pagesPublic Goods and Common Resources: Test Amas_999No ratings yet

- Positive MidtermDocument7 pagesPositive MidtermShuyao LiNo ratings yet

- Chapter 07aDocument9 pagesChapter 07amas_999No ratings yet

- Interdependence and The Gains From Trade: Test ADocument7 pagesInterdependence and The Gains From Trade: Test Amas_999No ratings yet

- Chapter 05aDocument7 pagesChapter 05amas_999No ratings yet

- Chapter 21Document76 pagesChapter 21mas_999No ratings yet

- Firms in Competitive Markets: Test BDocument8 pagesFirms in Competitive Markets: Test Bmas_999No ratings yet

- Monopolistic Competition: Test BDocument7 pagesMonopolistic Competition: Test Bmas_999No ratings yet

- Chapter 7Document73 pagesChapter 7mas_999No ratings yet

- Thinking Like An Economist: Test ADocument5 pagesThinking Like An Economist: Test Amas_999No ratings yet

- Chapter 1Document47 pagesChapter 1mas_999No ratings yet

- Chapter 4Document83 pagesChapter 4mas_999No ratings yet

- Public Goods and Common Resources: True/FalseDocument47 pagesPublic Goods and Common Resources: True/Falsemas_999No ratings yet

- Chapter 03bDocument7 pagesChapter 03bmas_999No ratings yet

- Chapter 22Document48 pagesChapter 22mas_999No ratings yet

- The Markets For The Factors of Production: Test BDocument7 pagesThe Markets For The Factors of Production: Test Bmas_999No ratings yet

- Chapter 3Document74 pagesChapter 3mas_999No ratings yet

- Chapter 2Document76 pagesChapter 2mas_999No ratings yet

- Econ 6306Document4 pagesEcon 6306Nikie50% (2)

- Chapter 14aDocument8 pagesChapter 14amas_999No ratings yet

- Chapter 13aDocument8 pagesChapter 13amas_999No ratings yet

- Chapter 21bDocument10 pagesChapter 21bmas_999No ratings yet

- Chapter 8Document63 pagesChapter 8mas_999No ratings yet

- CH 24Document28 pagesCH 24lbengtson1100% (1)

- Chapter 9Document66 pagesChapter 9mas_999No ratings yet

- Chapter 15aDocument7 pagesChapter 15amas_999No ratings yet

- Chapter 1-Ten Principles of EconomicsDocument27 pagesChapter 1-Ten Principles of EconomicsBrandon BarkerNo ratings yet

- 43 Absolute ValueDocument8 pages43 Absolute Valueapi-299265916No ratings yet

- Personal Hygiene Importance for Personality DevelopmentDocument2 pagesPersonal Hygiene Importance for Personality DevelopmentBethel Aleli MonesNo ratings yet

- Barringer 01 Intro To EntrepreneurshipDocument27 pagesBarringer 01 Intro To EntrepreneurshipPutera FirdausNo ratings yet

- Chapter 3-Interdependance and Gains From TradeDocument29 pagesChapter 3-Interdependance and Gains From TradeBrandon Barker0% (1)

- Chapter 16: Test Bank Some Answers and Comments On The Text Discussion QuestionsDocument9 pagesChapter 16: Test Bank Some Answers and Comments On The Text Discussion Questionsbekbek12No ratings yet

- Chapter 29Document62 pagesChapter 29mas_999100% (1)

- Chapter 25Document57 pagesChapter 25mas_999No ratings yet

- Chapter 29bDocument7 pagesChapter 29bmas_999No ratings yet

- Chapter 29aDocument7 pagesChapter 29amas_999No ratings yet

- Chapter 24bDocument9 pagesChapter 24bEhab AbazaNo ratings yet

- Unemployment and Its Natural Rate: Test BDocument7 pagesUnemployment and Its Natural Rate: Test Bmas_999No ratings yet

- Chapter 28Document77 pagesChapter 28mas_999100% (1)

- Money Growth and Inflation: Test BDocument7 pagesMoney Growth and Inflation: Test Bmas_999No ratings yet

- Chapter 28aDocument7 pagesChapter 28amas_999No ratings yet

- Unemployment and Its Natural Rate: Test ADocument7 pagesUnemployment and Its Natural Rate: Test Amas_999No ratings yet

- Chapter 27aDocument7 pagesChapter 27amas_999No ratings yet

- Chapter 24aDocument7 pagesChapter 24amas_999No ratings yet

- Chapter 27bDocument7 pagesChapter 27bmas_999No ratings yet

- Chapter 27Document60 pagesChapter 27mas_999100% (1)

- Chapter 26Document66 pagesChapter 26mas_999No ratings yet

- Chapter 25bDocument7 pagesChapter 25bmas_999No ratings yet

- Chapter 23Document60 pagesChapter 23mas_999No ratings yet

- Chapter 25aDocument7 pagesChapter 25amas_999No ratings yet

- Measuring A Nation's Income: Test BDocument7 pagesMeasuring A Nation's Income: Test Bmas_999No ratings yet

- Measuring The Cost of Living: Test BDocument7 pagesMeasuring The Cost of Living: Test Bmas_999No ratings yet

- Chapter 24Document62 pagesChapter 24mas_999No ratings yet

- Chapter 23aDocument7 pagesChapter 23amas_999No ratings yet

- Chapter 22Document48 pagesChapter 22mas_999No ratings yet

- Chapter 21aDocument10 pagesChapter 21amas_999No ratings yet

- Chapter 21bDocument10 pagesChapter 21bmas_999No ratings yet

- Chapter 21Document76 pagesChapter 21mas_999No ratings yet

- Income Inequality and Poverty: Test ADocument7 pagesIncome Inequality and Poverty: Test Amas_999No ratings yet

- Income Inequality and Poverty: Chapter 20Document9 pagesIncome Inequality and Poverty: Chapter 20Bobby HealyNo ratings yet

- Chapter 20Document57 pagesChapter 20mas_999No ratings yet

- Contact and Profile of Anam ShahidDocument1 pageContact and Profile of Anam ShahidSchengen Travel & TourismNo ratings yet

- Brick TiesDocument15 pagesBrick TiesengrfarhanAAANo ratings yet

- Ancient Greek Divination by Birthmarks and MolesDocument8 pagesAncient Greek Divination by Birthmarks and MolessheaniNo ratings yet

- Innovation Through Passion: Waterjet Cutting SystemsDocument7 pagesInnovation Through Passion: Waterjet Cutting SystemsRomly MechNo ratings yet

- Budgetary ControlsDocument2 pagesBudgetary Controlssiva_lordNo ratings yet

- 2nd Pornhub Awards - WikipediaaDocument13 pages2nd Pornhub Awards - WikipediaaParam SinghNo ratings yet

- AFNOR IPTDS BrochureDocument1 pageAFNOR IPTDS Brochurebdiaconu20048672No ratings yet

- Marshal HMA Mixture Design ExampleDocument2 pagesMarshal HMA Mixture Design ExampleTewodros TadesseNo ratings yet

- Yellowstone Food WebDocument4 pagesYellowstone Food WebAmsyidi AsmidaNo ratings yet

- FR Post-10Document25 pagesFR Post-10kulich545No ratings yet

- GIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyDocument17 pagesGIS Multi-Criteria Analysis by Ordered Weighted Averaging (OWA) : Toward An Integrated Citrus Management StrategyJames DeanNo ratings yet

- IDocument2 pagesIsometoiajeNo ratings yet

- CIT 3150 Computer Systems ArchitectureDocument3 pagesCIT 3150 Computer Systems ArchitectureMatheen TabidNo ratings yet

- Iq TestDocument9 pagesIq TestAbu-Abdullah SameerNo ratings yet

- Polytechnic University Management Services ExamDocument16 pagesPolytechnic University Management Services ExamBeverlene BatiNo ratings yet

- 2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTDocument5 pages2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTIbrahim JaberNo ratings yet

- MODULE+4+ +Continuous+Probability+Distributions+2022+Document41 pagesMODULE+4+ +Continuous+Probability+Distributions+2022+Hemis ResdNo ratings yet

- Insider Threat ManagementDocument48 pagesInsider Threat ManagementPatricia LehmanNo ratings yet

- Preventing and Mitigating COVID-19 at Work: Policy Brief 19 May 2021Document21 pagesPreventing and Mitigating COVID-19 at Work: Policy Brief 19 May 2021Desy Fitriani SarahNo ratings yet

- Mazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedDocument5 pagesMazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedAnderson LodiNo ratings yet

- 1.2 - Venn Diagram and Complement of A SetDocument6 pages1.2 - Venn Diagram and Complement of A SetKaden YeoNo ratings yet

- Striedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsDocument22 pagesStriedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsOsny SillasNo ratings yet

- AgentScope: A Flexible Yet Robust Multi-Agent PlatformDocument24 pagesAgentScope: A Flexible Yet Robust Multi-Agent PlatformRijalNo ratings yet

- Lecture Ready 01 With Keys and TapescriptsDocument157 pagesLecture Ready 01 With Keys and TapescriptsBảo Châu VươngNo ratings yet

- Merchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaDocument29 pagesMerchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaSanghamitra KalitaNo ratings yet

- Krok2 - Medicine - 2010Document27 pagesKrok2 - Medicine - 2010Badriya YussufNo ratings yet

- Rounded Scoodie Bobwilson123 PDFDocument3 pagesRounded Scoodie Bobwilson123 PDFStefania MoldoveanuNo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- RACI Matrix: Phase 1 - Initiaton/Set UpDocument3 pagesRACI Matrix: Phase 1 - Initiaton/Set UpHarshpreet BhatiaNo ratings yet

- Electronics Ecommerce Website: 1) Background/ Problem StatementDocument7 pagesElectronics Ecommerce Website: 1) Background/ Problem StatementdesalegnNo ratings yet