Professional Documents

Culture Documents

Profitability Sustainability Ratios

Uploaded by

Rhodelbert Rizare Del SocorroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profitability Sustainability Ratios

Uploaded by

Rhodelbert Rizare Del SocorroCopyright:

Available Formats

Profitability Sustainability Ratios How well is our business performing over a specific period, will your social enterprise

have the financial resources to continue serving its constituents tomorrow as well as today?

Ratio Sales Growth = Current Period Previous Period Sales Previous Period Sales

What does it tell you? Percentage increase (decrease) in sales between two time periods !f overall costs and inflation are increasing, then you should see a corresponding increase in sales !f not, then may need to ad"ust pricing policy to #eep up with costs &easures the composition of an organi'ation(s revenue sources (e)amples are sales, contributions, grants) %he nature and ris# of each revenue source should be analy'ed !s it recurring, is your mar#et share growing, is there a long term relationship or contract, is there a ris# that certain grants or contracts will not be renewed, is there ade*uate diversity of revenue sources? +rgani'ations can use this indicator to determine long and short,term trends in line with strategic funding goals (for e)ample, move towards self,sufficiency and decreasing reliance on e)ternal funding) &easures the degree to which the organi'ation(s e)penses are covered by its core business and is able to function independent of grant support

Reliance on Revenue Source = $evenue Source %otal $evenue%otal $evenue

Operating Self-Sufficiency = -usiness $evenue %otal .)penses /or the purpose of this calculation, business revenue should e)clude any non, operating revenues or contributions %otal e)penses should include all e)penses (operating and non,operating) including social costs 0 ratio of 1 means you do not depend on grant revenue or other funding How much profit is earned on your products without considering indirect costs !s your gross profit margin improving? Small changes in gross margin can significantly affect profitability !s there enough gross profit to cover your indirect costs !s there a positive gross margin on all products? How much money are you ma#ing per every 4 of sales %his ratio measures your ability to cover all operating costs including indirect costs Percentage of indirect costs to sales

Gross Profit Margin = 2ross Profit %otal Sales %otal Sales et Profit Margin = 3et Profit Sales SG! to Sales =

!ndirect Costs (sales, general, admin) 5oo# for a steady or decreasing ratio which means you are controlling Sales overhead &easures your ability to turn assets into profit %his is a very useful measure of comparison within an industry Return on !ssets = 3et Profit 0verage %otal 0ssets 0 low ratio compared to industry may mean that your competitors have found a way to operate more efficiently 0fter ta) interest e)pense can be added bac# to numerator since $+0 measures profitability on all assets whether or not they are financed by e*uity or debt $ate of return on investment by shareholders %his is one of the most important ratios to investors 0re you ma#ing enough profit to compensate for the ris# of being in business? How does this return compare to less ris#y investments li#e bonds?

Return on "#uity = 3et Profit 0verage Shareholder .*uity

Operational "fficiency Ratios How efficiently are you utili'ing your assets and managing your liabilities? %hese ratios are used to compare performance over multiple periods

Ratio Operating "$pense Ratio =

What does it tell you? Compares e)penses to revenue

+perating .)penses 0 decreasing ratio is considered desirable since it generally indicates increased %otal $evenue efficiency !ccounts Receivable %urnover = 3umber of times trade receivables turnover during the year 3et Sales 0verage 0ccounts $eceivable %he higher the turnover, the shorter the time between sales and collecting cash &ays in !ccounts Receivable = 0verage 0ccounts $eceivable Sales ) 678 'nventory %urnover = Cost of Sales 0verage !nventory &ays in 'nventory = 0verage !nventory Cost of Sales ) 678 !ccounts Payable %urnover = Cost of Sales 0verage 0ccounts Payable &ays in !ccounts Payable = 0verage 0ccounts Payable Cost of Sales ) 678 %otal !sset %urnover = $evenue 0verage %otal 0ssets (i$ed !sset %urnover = $evenue 0verage /i)ed 0ssets )i#uidity Ratios ;oes your enterprise have enough cash on an ongoing basis to meet its operational obligations? %his is an important indication of financial health 9hat are your customer payment habits compared to your payment terms :ou may need to step up your collection practices or tighten your credit policies %hese ratios are only useful if ma"ority of sales are credit (not cash) sales

%he number of times you turn inventory over into sales during the year or how many days it ta#es to sell inventory %his is a good indication of production and purchasing efficiency 0 high ratio indicates inventory is selling *uic#ly and that little unused inventory is being stored (or could also mean inventory shortage) !f the ratio is low, it suggests overstoc#ing, obsolete inventory or selling issues

%he number of times trade payables turn over during the year %he higher the turnover, the shorter the period between purchases and payment 0 high turnover may indicate unfavourable supplier repayment terms 0 low turnover may be a sign of cash flow problems Compare your days in accounts payable to supplier terms of repayment

How efficiently your business generates sales on each dollar of assets 0n increasing ratio indicates you are using your assets more productively

Ratio *urrent Ratio = Current 0ssets Current 5iabilities

What does it tell you? &easures your ability to meet short term obligations with short term assets , a useful indicator of cash flow in the near future 0 social enterprise needs to ensure that it can pay its salaries, bills and e)penses

on time /ailure to pay loans on time may limit your future access to credit and therefore your ability to leverage operations and growth 0 ratio less that 1 may indicate li*uidity issues 0 very high current ratio may mean there is e)cess cash that should possibly be invested elsewhere in the business or that there is too much inventory &ost believe that a ratio between (also #nown as Wor+ing *apital 1 < and < = is sufficient Ratio) %he one problem with the current ratio is that it does not ta#e into account the timing of cash flows /or e)ample, you may have to pay most of your short term obligations in the ne)t wee# though inventory on hand will not be sold for another three wee#s or account receivable collections are slow 0 more stringent li*uidity test that indicates if a firm has enough short,term assets (without selling inventory) to cover its immediate liabilities ,uic+ Ratio = Cash >0$ > &ar#etable Securities Current 5iabilities %his is often referred to as the ?acid test@ because it only loo#s at the company(s most li*uid assets only (e)cludes inventory) that can be *uic#ly converted to cash) 0 ratio of 1A1 means that a social enterprise can pay its bills without having to sell inventory 9C is a measure of cash flow and should always be a positive number !t measures the amount of capital invested in resources that are sub"ect to *uic# turnover 5enders often use this number to evaluate your ability to weather hard times &any lenders will re*uire that a certain level of 9C be maintained ;etermines the number of months you could operate without further funds received (burn rate)

Wor+ing *apital = Current 0ssets Current 5iabilities !de#uacy of Resources = Cash > &ar#etable Securities > 0ccounts $eceivable &onthly .)penses )everage Ratios

%o what degree does an enterprise utili'e borrowed money and what is its level of ris#? 5enders often use this information to determine a business(s ability to repay debt

Ratio

What does it tell you? Compares capital invested by ownersBfunders (including grants) and funds provided by lenders

&ebt to "#uity =

5enders have priority over e*uity investors on an enterprise(s assets 5enders want to see that there is some cushion to draw upon in case of financial difificulty %he Short %erm ;ebt > 5ong %erm more e*uity there is, the more li#ely a lender will be repaid &ost lenders impose ;ebt limits on the debtBe*uity ratio, commonly <A1 for small business loans %otal .*uity (including grants) %oo much debt can put your business at ris#, but too little debt may limit your potential +wners want to get some leverage on their investment to boost profits %his has to be balanced with the ability to service debt 'nterest *overage = &easures your ability to meet interest payment obligations with business income $atios close to 1 indicates company having difficulty generating enough cash flow .-!%;0 !nterest to pay interest on its debt !deally, a ratio should be over 1 8 .)pense

You might also like

- Balance Sheet Ratio Analysis FormulaDocument9 pagesBalance Sheet Ratio Analysis FormulaAbu Jahid100% (1)

- SME Indonesia BahasaDocument20 pagesSME Indonesia Bahasailham np100% (1)

- Jamaica energy project financial management specialistDocument4 pagesJamaica energy project financial management specialistEmil LeauNo ratings yet

- Lean Software DevelopmentDocument6 pagesLean Software DevelopmentYasir KazmNo ratings yet

- Grant Management GuidelinesDocument10 pagesGrant Management GuidelinesSyed Muhammad Ali SadiqNo ratings yet

- Marketing Strategy For Small and Medium Enterprise (Smes) of Coconut Furniture in The Regency of Tomohon Minahasa, IndonesiaDocument16 pagesMarketing Strategy For Small and Medium Enterprise (Smes) of Coconut Furniture in The Regency of Tomohon Minahasa, IndonesiaGlobal Research and Development ServicesNo ratings yet

- APP Sustainability Report 2010-2011Document152 pagesAPP Sustainability Report 2010-2011Asia Pulp and PaperNo ratings yet

- Basic Accounting Level IIDocument63 pagesBasic Accounting Level IIjustvicky1000No ratings yet

- Format CoA - SAIDocument8 pagesFormat CoA - SAIarlinaNo ratings yet

- Chapter 21:accounting For Not-for-Profit OrganizationsDocument52 pagesChapter 21:accounting For Not-for-Profit OrganizationsMareta Vina ChristineNo ratings yet

- The Seven Deadly Sins of Strategy ImplementationDocument4 pagesThe Seven Deadly Sins of Strategy ImplementationNavigators ReunionNo ratings yet

- Business Success of Small and Medium Sized Enterprises in Russia!!!Document9 pagesBusiness Success of Small and Medium Sized Enterprises in Russia!!!Elgarsia Setya NugrahaNo ratings yet

- Domestic Bank RTGS and Online Code ListDocument14 pagesDomestic Bank RTGS and Online Code Listfadli_zulNo ratings yet

- 2017 Top 20 Enterprise Resource Planning Software ReportDocument8 pages2017 Top 20 Enterprise Resource Planning Software ReportSagePartnerNo ratings yet

- Financial Deepening Challenge Fund Strategic Project ReviewDocument58 pagesFinancial Deepening Challenge Fund Strategic Project ReviewArini Putri Sari IINo ratings yet

- IJSMEDocument142 pagesIJSMEInternational Society for Small and Medium EnterprisesNo ratings yet

- InventoryDocument45 pagesInventoryjoyabyssNo ratings yet

- SME Database and Analysis of SME DataDocument37 pagesSME Database and Analysis of SME DataADBI EventsNo ratings yet

- Budgetary Control ExplainedDocument21 pagesBudgetary Control ExplainedNitin PathakNo ratings yet

- Budgeting and Budgetary ControlDocument44 pagesBudgeting and Budgetary ControlPrâtèék Shâh100% (1)

- Business Process Re EngineeringDocument29 pagesBusiness Process Re EngineeringProfessor Ayman Aly OmarNo ratings yet

- Who Does What in Grant ManagementDocument1 pageWho Does What in Grant ManagementPraveen KumarNo ratings yet

- New Term of ReferenceDocument12 pagesNew Term of Referencejurnal politikNo ratings yet

- Micro, Small & Medium EnterpriseDocument27 pagesMicro, Small & Medium EnterpriseniyatiNo ratings yet

- ERP Implementation Life CycleDocument18 pagesERP Implementation Life Cyclekrismmmm100% (1)

- A Study On Risk Assessment For Small and Medium Software Development ProjectsDocument11 pagesA Study On Risk Assessment For Small and Medium Software Development ProjectsInternational Journal of New Computer Architectures and their Applications (IJNCAA)No ratings yet

- Zoho CRM BenefitsDocument19 pagesZoho CRM BenefitsDeepak RvNo ratings yet

- Disaster Recovery PlanningDocument22 pagesDisaster Recovery PlanningrachelNo ratings yet

- Marco Kirsch Baum - NGO Manager Organizational Assessment Tool (OAT)Document24 pagesMarco Kirsch Baum - NGO Manager Organizational Assessment Tool (OAT)BurmaClubNo ratings yet

- Accounting Principles for Not-for-Profit OrganizationsDocument19 pagesAccounting Principles for Not-for-Profit OrganizationsLJ AggabaoNo ratings yet

- ASEAN SEC - Indo SME FinancingDocument167 pagesASEAN SEC - Indo SME FinancingLinh DinhNo ratings yet

- Inventory Management SystemDocument5 pagesInventory Management SystemDipto KarNo ratings yet

- AccountAid Handbook On NGO Accounting and Regulation PDFDocument315 pagesAccountAid Handbook On NGO Accounting and Regulation PDFJamiaAlHabib100% (4)

- Financial Ratio Analysis for Nonprofit ManagementDocument23 pagesFinancial Ratio Analysis for Nonprofit ManagementJibran Sheikh100% (1)

- Change Management 2023Document76 pagesChange Management 2023Joshua BlessingNo ratings yet

- Full Year 2016 Jakarta Hotel Market OverviewDocument6 pagesFull Year 2016 Jakarta Hotel Market OverviewDarrel CartwrightNo ratings yet

- Accounting For Non Accountants 2019Document39 pagesAccounting For Non Accountants 2019gina100% (1)

- Cost Variance Analysis and Standard Cost CalculationsDocument20 pagesCost Variance Analysis and Standard Cost CalculationsMukesh ManwaniNo ratings yet

- Standard Cost and Variance AnalysisDocument22 pagesStandard Cost and Variance AnalysisAbbas Jan Bangash100% (1)

- Erp The Implementation Cycle PDFDocument2 pagesErp The Implementation Cycle PDFBrianNo ratings yet

- MRP Erp MRP II PDFDocument35 pagesMRP Erp MRP II PDFSaad Khadur EilyesNo ratings yet

- Aggregates Sales and Operations PlanningDocument31 pagesAggregates Sales and Operations PlanningIan Kenneth MarianoNo ratings yet

- Implications For GAAP From An Analysis of Positive Research in AccountingDocument41 pagesImplications For GAAP From An Analysis of Positive Research in AccountingZhang PeilinNo ratings yet

- Module 5 Capacity Planning Aggregate PlanningDocument11 pagesModule 5 Capacity Planning Aggregate PlanningVi H ArNo ratings yet

- Ebook GettingStartedwithLaserficheGuide 0817 FDocument74 pagesEbook GettingStartedwithLaserficheGuide 0817 FGrazza KamalNo ratings yet

- Module 3 Small & Medium EnterprisesDocument18 pagesModule 3 Small & Medium EnterprisesJanardhan ShettyNo ratings yet

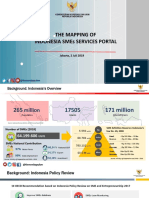

- Paparan Indonesia SMEs Service Portal - FinalDocument7 pagesPaparan Indonesia SMEs Service Portal - FinalChelsea Yolanda SitumorangNo ratings yet

- Top 20 Erp PDFDocument8 pagesTop 20 Erp PDFCardeas XuNo ratings yet

- Responsible Business For The FutureDocument148 pagesResponsible Business For The FutureAgustinus RhezaNo ratings yet

- ERP Implementation Fundamentals: Richard Byrom Oracle Consultant, Speaker and AuthorDocument23 pagesERP Implementation Fundamentals: Richard Byrom Oracle Consultant, Speaker and AuthorZain Ul Abidin RanaNo ratings yet

- Activity Based BudgetingDocument13 pagesActivity Based BudgetingAlvin Adrian67% (3)

- Basic Financial Management for Non-ProfitsDocument52 pagesBasic Financial Management for Non-ProfitsnjugusNo ratings yet

- Zoho CRMDocument11 pagesZoho CRMVinusahu VinuNo ratings yet

- NGO GuidelinesDocument116 pagesNGO GuidelinesSusman786100% (3)

- Business Process Reengineering (A Prerequisite For Process Model Design)Document31 pagesBusiness Process Reengineering (A Prerequisite For Process Model Design)Milind GadhaviNo ratings yet

- Commonly Used Ratios I. LiquidityDocument7 pagesCommonly Used Ratios I. LiquidityJohn Lexter GravinesNo ratings yet

- Financial Ratios and Quality IndicatorsDocument7 pagesFinancial Ratios and Quality IndicatorsSanny MostofaNo ratings yet

- Ratio AnalysisDocument14 pagesRatio AnalysisJanani Bharathi100% (1)

- Understanding Financial RatiosDocument10 pagesUnderstanding Financial RatiosAira MalinabNo ratings yet

- Commissioner v. Goodyear Philippines tax treaty governs redemptionDocument2 pagesCommissioner v. Goodyear Philippines tax treaty governs redemptionAnn QuebecNo ratings yet

- Avcbvi †Μwwu Kvw© Av‡E'‡Bi Rb¨ ¸Iæz¡C~Y© Z - ¨Vw': Mövnk A½XkvibvgvDocument4 pagesAvcbvi †Μwwu Kvw© Av‡E'‡Bi Rb¨ ¸Iæz¡C~Y© Z - ¨Vw': Mövnk A½Xkvibvgvtanvir019No ratings yet

- GC - PREPARE and MAINTAIN FINANCIAL RECORDSDocument15 pagesGC - PREPARE and MAINTAIN FINANCIAL RECORDSJKcristovalNo ratings yet

- Fin 346 Commercial Banking Chapter 1 Homework # 1 Slides 1-10Document2 pagesFin 346 Commercial Banking Chapter 1 Homework # 1 Slides 1-10Timothy HartNo ratings yet

- About Your Intermediary (Insurance Brokerage)Document3 pagesAbout Your Intermediary (Insurance Brokerage)JabuNo ratings yet

- Stock Market Crash in Bangladesh 2010-11 - A Case StudyDocument4 pagesStock Market Crash in Bangladesh 2010-11 - A Case StudyMainul HossainNo ratings yet

- DIGEST-5. Bank of America v. American Realty Corp.Document3 pagesDIGEST-5. Bank of America v. American Realty Corp.Karl EstavillaNo ratings yet

- 04 Bloomberry v. BIRDocument1 page04 Bloomberry v. BIRCP LugoNo ratings yet

- Linear Tech FY03 Exec Summary Recommends Dividend HikeDocument9 pagesLinear Tech FY03 Exec Summary Recommends Dividend HikeTestNo ratings yet

- Essentials of Life Insurance ProductsDocument113 pagesEssentials of Life Insurance ProductsApril ShowersNo ratings yet

- 2016 Bar Exam Coverage on Political and International LawDocument105 pages2016 Bar Exam Coverage on Political and International LawMartin Espinosa100% (1)

- CFA Level 1 Ethical Standards NotesDocument23 pagesCFA Level 1 Ethical Standards NotesAndy Solnik100% (7)

- HSBC Bank Bangladesh Powervantage Account (Pva)Document7 pagesHSBC Bank Bangladesh Powervantage Account (Pva)carinagtNo ratings yet

- Chart of AccountsDocument1 pageChart of Accountssharomeo castroNo ratings yet

- CFA Level 1 Quantitative Analysis E Book - Part 1Document26 pagesCFA Level 1 Quantitative Analysis E Book - Part 1Zacharia VincentNo ratings yet

- National Bank of Pakistan Internship Report (Approved)Document185 pagesNational Bank of Pakistan Internship Report (Approved)Reader96% (28)

- Security Agreement 1Document6 pagesSecurity Agreement 1Nate Bruce100% (2)

- Brgy Tax OrdinanceDocument3 pagesBrgy Tax OrdinanceLouie Ivan Maiz94% (50)

- CA IPCC Group 2 Accounting StandardsDocument53 pagesCA IPCC Group 2 Accounting Standardskisan83% (23)

- Soal Kuis Minggu 11Document7 pagesSoal Kuis Minggu 11Natasya ZahraNo ratings yet

- Muslim Law PDFDocument4 pagesMuslim Law PDFsanolNo ratings yet

- Unit-5 Legal Aspects of Purchasing Management: An IntroductionDocument25 pagesUnit-5 Legal Aspects of Purchasing Management: An IntroductionAnuj SinghNo ratings yet

- Reigis Steel CompanyDocument3 pagesReigis Steel CompanyDesy BodooNo ratings yet

- Forensic AccountingDocument28 pagesForensic AccountingADITYA MAHAJAN63% (8)

- Clay McCormack IndictmentDocument13 pagesClay McCormack IndictmentThe Jackson SunNo ratings yet

- AF208 Revision Package S2 2019Document30 pagesAF208 Revision Package S2 2019Navin N Meenakshi ChandraNo ratings yet

- Securities Regulation Outline #1Document50 pagesSecurities Regulation Outline #1tuyaNo ratings yet

- Financial Analysis of Unilever PakistanDocument7 pagesFinancial Analysis of Unilever Pakistanzainab malikNo ratings yet

- 1991 US-Argentina BITDocument12 pages1991 US-Argentina BITCalMustoNo ratings yet

- Investing in Stocks and Shares GuideDocument7 pagesInvesting in Stocks and Shares GuideRifqi Novriyandana100% (1)