Professional Documents

Culture Documents

Course Guide

Uploaded by

fmdeenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Course Guide

Uploaded by

fmdeenCopyright:

Available Formats

COURSE GUIDE

xi

COURSE GUIDE DESCRIPTION

You must read this Course Guide carefully from the beginning to the end. It tells you briefly what the course is about and how you can work your way through the course material. It also suggests the amount of time you are likely to spend in order to complete the course successfully. Please keep on referring to the Course Guide as you go through the course material as it will help you to clarify important study components or points that you might miss or overlook.

INTRODUCTION

BBAP2103 Management Accounting is one of the courses offered by the Faculty of Business and Management at Open University Malaysia (OUM). This course is worth 3 credit hours and should be covered over 8 to 15 weeks.

COURSE AUDIENCE

This course is offered to students undertaking the Bachelor of Business Management and Bachelor of Hospitality Management programmes as well as the Bachelor of Human Resource Management programme, for which it is a major basic course. As an open and distance learner, you should be able to learn independently and optimise the learning modes and environment available to you. Before you begin this course, please ensure that you have the right course material and understand the course requirements, as well as how the course is conducted.

STUDY SCHEDULE

It is a standard OUM practice that learners accumulate 40 study hours for every credit hour. As such, for a three-credit hour course, you are expected to spend 120 study hours. Table 1 gives an estimation of how the 120 study hours could be accumulated.

xii

COURSE GUIDE

Table 1: Estimation of Time Accumulation of Study Hours Study Activities Briefly go through the course content and participate in initial discussion Study the module Attend 3 to 5 tutorial sessions Online participation Revision Assignment(s), Test(s) and Examination(s) TOTAL STUDY HOURS Study Hours 3 60 10 12 15 20 120

COURSE OUTCOMES

By the end of this course, you should be able to: 1. 2. 3. 4. 5. Explain the environment and importance of management accounting; Discuss marginal costing and absorption costing systems and their importance; Prepare accounting information from the beginning to the completion of the accounting cycle; Differentiate between job-order costing and process costing, and their uses; and Use management accounting techniques or analyses to assist management in making decisions.

COURSE SYNOPSIS

This course is divided into eight topics. The synopsis for each topic is as follows: Topic 1 discusses the management accounting environment that focuses on information used in decision making. It highlights the role of management accounting and compares it with financial accounting. The topic then covers the features and importance of management accounting information. You will also learn about the concept of cost and its classification. Topic 2 discusses two traditional product systems, which are marginal costing and absorption costing. The differences between these two costing methods from

COURSE GUIDE

xiii

the aspects of product costing, inventory evaluation and income statement will also be discussed. You will see how the adjustment of net income between the two costing methods is done. The topic ends with a discussion on the advantages and disadvantages of marginal costing and absorption costing. Topic 3 discusses job-order costing. In this topic, the purpose and features of joborder costing is explained. You will be exposed to the use of document flow in joborder costing. This topic also explains manufacturing cost flow in job-order costing. Topic 4 discusses process costing. You will be exposed to the differences between process costing and job-order costing. You will learn about equivalent units in process costing. The later section discusses the preparation of the production report using the weighted average method and the first in-first out method. This topic also explains the effects of increase in non-uniform manufacturing input and the existence of various production departments. Topic 5 discusses cost-volume-profit (CVP) analysis. It highlights the importance of CVP analysis. It also touches on the assumptions made in CVP analysis, methods of calculating the break-even point (BEP), approach to CVP analysis and applications of CVP analysis. Finally, you will learn about the advantages and disadvantages of CVP analysis in matters concerning decision making. Topic 6 explains how the budget is used as a planning and operations control tool, and a performance measurement tool. The first part of this topic defines and demonstrates the preparation of a budget. Then, the preparation of the master budget that consists of the operating budget and the financial budget for a manufacturing organisation and a non-manufacturing organisation is illustrated. The preparation of the pro-forma financial statement is shown as the final product of this process. This topic also touches on flexible budget and the mechanism of its preparation as well as its advantages as a performance evaluation tool. Topic 7 discusses the use and importance of standard costing that represents a value level that becomes a benchmark for measuring actual achievement against standard achievement arrived at through the cost variance analysis method. Cost variance analysis is divided into three types, which are, direct material variance, direct labour variance and overhead variance. The topic also discusses the uses and advantages of variance analysis. Topic 8 discusses decision making. In this last topic, you will be exposed to the role of the management accountant in the decision-making process. It is shown here that making decisions is not an easy process. The manager has to consider each and every factor before making any decision. You will also learn relevant information on making decisions and the constraints faced by an organisation. At

xiv

COURSE GUIDE

the end of the topic, a detailed explanation on the types of decision making is given.

TEXT ARRANGEMENT GUIDE

Before you go through this module, it is important that you note the text arrangement. Understanding the text arrangement will help you to organise your study of this course in a more objective and effective way. Generally, the text arrangement for each topic is as follows: Learning Outcomes: This section refers to what you should achieve after you have completely covered a topic. As you go through each topic, you should frequently refer to these learning outcomes. By doing this, you can continuously gauge your understanding of the topic. Self-Check: This component of the module is inserted at strategic locations throughout the module. It may be inserted after one sub-section or a few subsections. It usually comes in the form of a question. When you come across this component, try to reflect on what you have already learnt thus far. By attempting to answer the question, you should be able to gauge how well you have understood the sub-section(s). Most of the time, the answers to the questions can be found directly from the module itself. Activity: Like Self-Check, the Activity component is also placed at various locations or junctures throughout the module. This component may require you to solve questions, explore short case studies, or conduct an observation or research. It may even require you to evaluate a given scenario. When you come across an Activity, you should try to reflect on what you have gathered from the module and apply it to real situations. You should, at the same time, engage yourself in higher order thinking where you might be required to analyse, synthesise and evaluate instead of only having to recall and define. Summary: You will find this component at the end of each topic. This component helps you to recap the whole topic. By going through the summary, you should be able to gauge your knowledge retention level. Should you find points in the summary that you do not fully understand, it would be a good idea for you to revisit the details in the module. Key Terms: This component can be found at the end of each topic. You should go through this component to remind yourself of important terms or jargon used throughout the module. Should you find terms here that you are not able to explain, you should look for the terms in the module.

COURSE GUIDE

xv

References: The References section is where a list of relevant and useful textbooks, journals, articles, electronic contents or sources can be found. The list can appear in a few locations such as in the Course Guide (at the References section), at the end of every topic or at the back of the module. You are encouraged to read or refer to the suggested sources to obtain the additional information needed and to enhance your overall understanding of the course.

PRIOR KNOWLEDGE

Learners of this course are required to pass BBAW2103 Financial Accounting course.

ASSESSMENT METHOD

Please refer to myVLE.

REFERENCES

Horngren C. T., Harrison, W. T. Jr., & Bamber, L. S. (2002). Accounting (5th ed.). New Jersey: Prentice Hall. Larson, K. D., Wild, J. J., & Chiappetta, B. (2004). Fundamental accounting principles (17th ed.). New York: McGraw-Hill. Roger, H. H. et al. (1997). Accounting: A business perspective (7th ed.). United Stated: Irwin US. Warren, C. S., Reeve, J. M., & Fess, P. E. (2004). Accounting (21st ed.). Ohio, United States: International Thompson Publishing. Weygandt, J. J., Keiso, D. E., & Kimmel, P. D. (2004). Accounting principles (7th ed.). Hoboken, New Jersey: John Wiley & Sons. Inc.

xvi

COURSE GUIDE

TAN SRI DR ABDULLAH SANUSI (TSDAS) DIGITAL LIBRARY

The TSDAS Digital Library has a wide range of print and online resources for the use of its learners. This comprehensive digital library, which is accessible through the OUM portal, provides access to more than 30 online databases comprising e-journals, e-theses, e-books and more. Examples of databases available are EBSCOhost, ProQuest, SpringerLink, Books24x7, InfoSci Books, Emerald Management Plus and Ebrary Electronic Books. As an OUM learner, you are encouraged to make full use of the resources available through this library.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- AnswersDocument28 pagesAnswersfmdeen100% (1)

- Tugasan Hmef 5143Document2 pagesTugasan Hmef 5143fmdeen67% (3)

- Kurikulum TersembunyiDocument2 pagesKurikulum TersembunyifmdeenNo ratings yet

- Amalan Komuniti Pembelajaran ProfesionalDocument29 pagesAmalan Komuniti Pembelajaran Profesionalfmdeen100% (2)

- Oumh 1103 Learning Skills For Open Distance LearnersDocument9 pagesOumh 1103 Learning Skills For Open Distance LearnersfmdeenNo ratings yet

- BBPP1103 OUM CourseDocument5 pagesBBPP1103 OUM Coursebjtiew100% (1)

- Assignment Submission and AssessmentDocument6 pagesAssignment Submission and AssessmentfmdeenNo ratings yet

- Penyerahan Dan Penilaian TugasanDocument5 pagesPenyerahan Dan Penilaian TugasanfmdeenNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Kyle Pape - Between Queer Theory and Native Studies, A Potential For CollaborationDocument16 pagesKyle Pape - Between Queer Theory and Native Studies, A Potential For CollaborationRafael Alarcón Vidal100% (1)

- PC Model Answer Paper Winter 2016Document27 pagesPC Model Answer Paper Winter 2016Deepak VermaNo ratings yet

- Sample Resume For Supply Chain Logistics PersonDocument2 pagesSample Resume For Supply Chain Logistics PersonAmmar AbbasNo ratings yet

- Man As God Created Him, ThemDocument3 pagesMan As God Created Him, ThemBOEN YATORNo ratings yet

- ELEVATOR DOOR - pdf1Document10 pagesELEVATOR DOOR - pdf1vigneshNo ratings yet

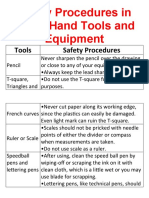

- Safety Procedures in Using Hand Tools and EquipmentDocument12 pagesSafety Procedures in Using Hand Tools and EquipmentJan IcejimenezNo ratings yet

- Economic Review English 17-18Document239 pagesEconomic Review English 17-18Shashank SinghNo ratings yet

- Performance Monitoring and Coaching FormDocument3 pagesPerformance Monitoring and Coaching Formjanine masilang100% (2)

- World Insurance Report 2017Document36 pagesWorld Insurance Report 2017deolah06No ratings yet

- EqualLogic Release and Support Policy v25Document7 pagesEqualLogic Release and Support Policy v25du2efsNo ratings yet

- Chapter 4 Achieving Clarity and Limiting Paragraph LengthDocument1 pageChapter 4 Achieving Clarity and Limiting Paragraph Lengthapi-550339812No ratings yet

- Iguana Joe's Lawsuit - September 11, 2014Document14 pagesIguana Joe's Lawsuit - September 11, 2014cindy_georgeNo ratings yet

- Acute Appendicitis in Children - Diagnostic Imaging - UpToDateDocument28 pagesAcute Appendicitis in Children - Diagnostic Imaging - UpToDateHafiz Hari NugrahaNo ratings yet

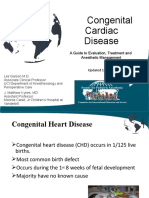

- Congenital Cardiac Disease: A Guide To Evaluation, Treatment and Anesthetic ManagementDocument87 pagesCongenital Cardiac Disease: A Guide To Evaluation, Treatment and Anesthetic ManagementJZNo ratings yet

- Sandstorm Absorbent SkyscraperDocument4 pagesSandstorm Absorbent SkyscraperPardisNo ratings yet

- Quarter 1-Week 2 - Day 2.revisedDocument4 pagesQuarter 1-Week 2 - Day 2.revisedJigz FamulaganNo ratings yet

- Prevention of Waterborne DiseasesDocument2 pagesPrevention of Waterborne DiseasesRixin JamtshoNo ratings yet

- 1 - 2020-CAP Surveys CatalogDocument356 pages1 - 2020-CAP Surveys CatalogCristiane AokiNo ratings yet

- DeliciousDoughnuts Eguide PDFDocument35 pagesDeliciousDoughnuts Eguide PDFSofi Cherny83% (6)

- Sources of Hindu LawDocument9 pagesSources of Hindu LawKrishnaKousikiNo ratings yet

- Heimbach - Keeping Formingfabrics CleanDocument4 pagesHeimbach - Keeping Formingfabrics CleanTunç TürkNo ratings yet

- Bachelor of Arts in Theology: Christian Apologetics/ Seventh-Day Adventist Contemporary IssuesDocument13 pagesBachelor of Arts in Theology: Christian Apologetics/ Seventh-Day Adventist Contemporary IssuesRamel LigueNo ratings yet

- Systems Analysis and Design in A Changing World, Fourth EditionDocument41 pagesSystems Analysis and Design in A Changing World, Fourth EditionKoko Dwika PutraNo ratings yet

- Head Coverings BookDocument86 pagesHead Coverings BookRichu RosarioNo ratings yet

- Physics Education Thesis TopicsDocument4 pagesPhysics Education Thesis TopicsPaperWriterServicesCanada100% (2)

- Fast Track Design and Construction of Bridges in IndiaDocument10 pagesFast Track Design and Construction of Bridges in IndiaSa ReddiNo ratings yet

- Modlist - Modlist 1.4Document145 pagesModlist - Modlist 1.4Tattorin vemariaNo ratings yet

- Applied Economics 2Document8 pagesApplied Economics 2Sayra HidalgoNo ratings yet

- Deep Hole Drilling Tools: BotekDocument32 pagesDeep Hole Drilling Tools: BotekDANIEL MANRIQUEZ FAVILANo ratings yet

- Antena TelnetDocument4 pagesAntena TelnetMarco PiambaNo ratings yet