Professional Documents

Culture Documents

BS2012 - Nirmal Exim

Uploaded by

ravibhartia1978Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BS2012 - Nirmal Exim

Uploaded by

ravibhartia1978Copyright:

Available Formats

NIRMAL EXIM PRIVATE LIMITED

209, Manglam, 24, Hemanta Basu Sarani, Kolkata- 700 001 Computation of Total Income for the year ended 31.03.2012 Rs. INCOME FROM BUSINESS / PROFESSION

Net Profit as per annexed Profit & Loss A/c. Add : Items treated separately Depreciation as per Books Less: Deduction /Exemptions Short term capital gain (To be treated seprately) Long Term Capital Gain [Exempt U/s 10(38)] Depreciation as per I.T.Rules Dividend Exempt U/s 10(34) 139,253 281,584 139,253 420,837 22,051 40,592 119,861 41,550

Rs.

(224,054) 196,784 22,051 218,835

CAPITAL GAINS

Short Term Capital Gain Round off Tax on STCG of Rs. 22051/- @ 15% Tax on Rs.196784/- @ 30% Less: MAT Credit A.Y. 2010-11 MAT Credit A.Y. 2011-12 Education Cess @ 3% 14,961 22,414

218,830 3,308 59,037 62,345 (37,375) 24,970 749 25,719 (30,000) 99 (4,182)

Add:

Less: Advance Tax Add : Interest u/s 234C Balance Refundable

NIRMAL EXIM PRIVATE LIMITED Balance Sheet as at 31 March, 2012 Particulars A EQUITY AND LIABILITIES 1 Shareholders funds (a) Share capital (b) Reserves and surplus (c) Money received against share warrants 2 Share application money pending allotment 3 Non-current liabilities (a) Long-term borrowings (b) Deferred tax liabilities (net) (c) Other long-term liabilities (d) Long-term provisions 4 Current liabilities (a) Short-term borrowings (b) Trade payables (c) Other current liabilities (d) Short-term provisions Note No. As at 31 March, 2012 ` As at 31 March, 2011 `

1 2

2,200,000.00 3,691,344.49 5,891,344.49

2,200,000.00 3,443,086.70 5,643,086.70

104,191.00 104,191.00 114,039.45 114,039.45 6,109,574.94

110,183.00 110,183.00 55,347.00 55,347.00 5,808,616.70

TOTAL ASSETS 1 Non-current assets (a) Fixed assets (i) Tangible assets (ii) Intangible assets (iii) Capital work-in-progress (iv) Intangible assets under development (v) Fixed assets held for sale (b) Non-current investments (c) Deferred tax assets (net) (d) Long-term loans and advances (e) Other non-current assets 2 Current assets (a) Current investments (b) Inventories (c) Trade receivables (d) Cash and cash equivalents (e) Short-term loans and advances (f) Other current assets TOTAL Significant Accounting Policies Notes on Financial Statements

1,093,894.55 1,093,894.55 1,093,894.55 2,137,436.10 1,150.00 472,281.29 2,404,813.00 5,015,680.39 6,109,574.94 -

1,205,114.38 1,205,114.38 1,205,114.38 2,063,845.52 1,150.00 482,011.80 2,056,495.00 4,603,502.32 5,808,616.70 -

5 6 7 8

Note 1 to 11

In terms of our report of even date annexed herewith

For S.K.S & Co.

Chartered Accountants ( S. K. AGARWAL ) Partner Memb. No. 52093 Kolkata

Dated : The day of 2012

NIRMAL EXIM PRIVATE LIMITED PROFIT & LOSS ACCOUNT FOR THE YEAR ENDED 31.03.2012 Particulars Note No. For the year ended 31 March, 2012 ` For the year ended 31 March, 2011 `

A 1

CONTINUING OPERATIONS Revenue from operations (gross) Less: Excise duty Revenue from operations (net) Other income Total revenue (1+2) Expenses (a) Cost of materials consumed (b) Purchases of stock-in-trade (c) Changes in inventories of finished goods, work-in-progress and stock-in-trade (d) Employee benefits expense (e) Finance costs (f) Depreciation and amortisation expense (g) Other expenses Total expenses 9 1,333,383.00 1,333,383.00 1,237,220.80 1,237,220.80

2 3 4

68,700.00 139,252.83 843,845.73 1,051,798.56

80,400.00 138,124.12 763,002.12 981,526.24

10

10

5 6 7 8 9 10

Profit / (Loss) before exceptional and extraordinary items and tax (3 - 4) Exceptional items Profit / (Loss) before extraordinary items and tax (5 + 6) Extraordinary items Profit / (Loss) before tax (7 + 8) Tax expense: (a) Current tax expense for current year (b) (Less): MAT credit (where applicable) (c) Current tax expense relating to prior years (d) Net current tax expense (e) Deferred tax (e) Adjustments

281,584.44

255,694.56

281,584.44 62,344.65 37,375.00 24,969.65 5,992.00 18,977.65 262,606.79 262,606.79 262,606.79 1.19 -

255,694.56 46,107.00 46,107.00 5,985.00 740.00 40,862.00 214,832.56 214,832.56 214,832.56 0.98 -

11 Profit / (Loss) from continuing operations (9 +10) C TOTAL OPERATIONS

12 Profit / (Loss) for the year Earning per equity share of Rs.10/- each Basic and diluted earning per Share after Tax. (Rs.) Significant Accounting Policies Notes on Financial Statements

Note 1 to 11

In terms of our report of even date annexed herewith

For S.K.S & Co.

Chartered Accountants ( S. K. AGARWAL ) Partner Memb. No. 52093 Kolkata

Dated : The day of 2012

NIRMAL EXIM PRIVATE LIMITED

NOTE -1 SHARE CAPITAL : Authorised 500000 Nos. Equity Shares of Rs.10/-each Issued, Subscribed & Paid up Capital 220000 Nos. Equity Shares of Rs.10/-each NOTE -2 RESERVE & SURPLUS Share Premium Account Profit & Loss Account As per last year Durring the year Appropriations(IT)

NOTE -3 CURRENT LIABILITIES & PROVISION: Liabilities for Expenses Travelling Expenses Payable S.K.S. & Co. Sandip & Siddhant (HUF) Provision for Income Tax(A.Y.2012-13)

For the year ended 31 March, 2012 `

For the year ended 31 March, 2011 `

5,000,000.00 2,200,000.00 2,200,000.00

5,000,000.00 2,200,000.00 2,200,000.00

1,200,000.00 2,243,086.70 262,606.79 (14,349.00) 3,691,344.49

1,200,000.00 2,028,254.14 214,832.56 3,443,086.70

66,334.00 20,529.80 2,206.00 24,969.65 114,039.45

52,692.00 1,655.00 1,000.00 55,347.00

NOTE -7 CASH & BANK BALANCE : Cash in Hand (As Certified) Balance in Current Account NOTE -8 LOANS & ADVANCES Advances recoverable in cash or in Kind or for value to be received ( Considered Good) Security Deposit Advance Income Tax Income Tax Refundable TDS Receivable Telephone Deposits Planet Commercial Pvt. Ltd. Vinline Engineering Pvt. Ltd. Merlin Project Ltd. Subhsri Realtech Pvt. Ltd.

15,331.03 456,950.26 472,281.29

19,865.53 462,146.27 482,011.80

1,500.00 30,000.00 2,370.00 6,832.00 750.00 500,000.00 1,863,361.00 2,404,813.00

1,500.00 2,370.00 750.00 2,051,875.00 2,056,495.00

NOTE -9

NIRMAL EXIM PRIVATE LIMITED For the year ended 31 March, 2012 `

For the year ended 31 March, 2011 `

INCOME

Dividend Interest Commission Misc. Income Short term Capital Gains Long Term Capital Gains NOTE -10 ADMINISTRATIVE CHARGES : Advertisement Bank Charges Books & Periodicals Corporation Tax Directors Remuneration Consultancy Charges Conveyance Expenses Donation Electricity Charges Fees & Subscription Filing Fees General Expenses Insurance Charges Legal Charges Maintenance charges Motor Car Expenses Postage & Telegram Printing & Stationary Profession Tax Repairs & Maintenance Telephone Charges Trade Licence Travelling & Conveyance Audit Fees 3,497.00 1,112.14 380.00 12,642.00 408,000.00 5,128.00 64,875.00 20,675.20 900.00 1,500.00 19,443.00 62,572.00 3,100.00 19,965.00 107,037.36 2,650.00 3,148.50 2,500.00 14,595.00 32,277.73 3,350.00 52,291.80 2,206.00 843,845.73 1,184.59 383.00 12,648.00 330,000.00 44,387.00 9,200.00 24,297.60 900.00 1,500.00 25,183.00 66,888.00 3,100.00 8,712.00 64,630.49 2,927.60 5,035.25 2,500.00 15,425.00 35,317.46 3,200.00 103,928.13 1,655.00 763,002.12

41,550.00 68,318.00 1,160,872.00 22,050.58 40,592.42 1,333,383.00

27,850.00 5,667.00 984,966.00 8,950.00 49,132.11 160,655.69 1,237,220.80

Employee benefits expense Salary & Wages

68,700.00

68,700.00

68,700.00

68,700.00

NIRMAL EXIM PRIVATE LIMITED 209, MANGALAM, 24, HEMANTA BASU SARANI, KOLKATA - 700001

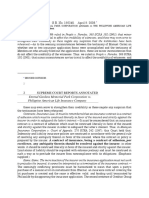

Note " 4 " of Fixed Assets annexed to and Forming part of the Balance Sheet as at 31.03.2012

PARTICULARS

AS ON 01.04.2010

GROSS BLOCK ADDITION SALE DURING DURING THE YEAR THE YEAR 11,350.00 16,683.00 28,033.00 369,811.00 -

TOTAL COST AS ON 31.03.2011 134079.85 25255.00 35578.00 7442.26 17500.00 1145761.00 968374.00 29738.00 2363728.11 2,335,695.11

UP TO 31.03.2010

DEPRECIATION FOR THE YEAR

TOTAL UPTO 31.03.2011 101694.75 14088.09 35578.00 7442.26

NET BLOCK AS ON AS ON 31.03.2011 31.03.2010

AIR CONDITIONER CELLUER PHONE COMPUTER ELECTRICAL INSTALLATION EPBX SYSTEM MOTOR CAR OFFICE PREMISES PRINTER

134079.85 13905.00 35,578.00 7442.26 17500.00 1145761.00 951691.00 29,738.00 2335695.11

88896.40 11303.39 33,847.19 7442.26 10726.00 773483.30 198350.52 6,531.67 1130580.73 992,456.61

12798.35 2784.70 1730.81

32385.10 11166.91 0.00 5537.00 263430.40 759224.14 22151.00 1093894.55 1,205,114.38

45183.45 2601.61 1730.81 0.00 6774.00 372277.70 753340.48 23206.33 1205114.38

1237.00 108847.30 10799.34 1055.33 139252.83 138,124.12

11963.00 882330.60 209149.86 7587.00 1269833.56 1,130,580.73

Previous Year

1965884.11

NIRMAL EXIM PRIVATE LIMITED

Depreciation as per Income Tax Rules for the year ended 31/03/2012

GROSS BLOCK Addition Addition SALE/ Up to After ADJUSTMENT 30.09.2011 30.09.2011 16,683.00 11,350.00 28,033.00 DEPRECIATION FOR THE YEAR up tp After 30.09.2011 30.09.2011 1,668.30 1,702.50 3,370.80 -

Annexure- "I"

Rate

PARTICULARS Office Premises Fax Machine Electrical Installation Air Conditioner Motor Car Celluear Phone Computer EPBX System Printer TOTAL

10.00% 15.00% 15.00% 15.00% 15.00% 15.00% 60.00% 15.00% 60.00%

W.D.V As On 01.04.2011 396,541.20 790.41 60.69 37,866.17 387,320.69 3,087.96 9,428.56 2,785.24 10,653.30 848,534.22

Total Cost As On 31.03.2012 413,224.20 790.41 60.69 37,866.17 387,320.69 14,437.96 9,428.56 2,785.24 10,653.30 876,567.22

On B/F W.D.V 39,654.12 118.56 9.10 5,679.93 58,098.10 463.19 5,657.14 417.79 6,391.98 116,489.91

Total for the year 41,322.42 118.56 9.10 5,679.93 58,098.10 2,165.69 5,657.14 417.79 6,391.98 119,860.71

W.D.V As On 31.03.2012 371,901.78 671.84 51.59 32,186.24 329,222.59 12,272.26 3,771.42 2,367.45 4,261.32 756,706.50

NIRMAL EXIM PRIVATE LIMITED

Notes-11 on Financial Statements for the Year ended 31st March, 2012

PART-I

A.

SIGNIFICANT ACCOUNTING POLICIES

B.

Basis of Preparation of Financial Statements The financial statements are prepared under the historical cost convention, except for certain fixed assets which are revalued, in accordance with the generally accepted accounting principles in India and the provisions of the Companies Act, 1956. Use of Estimates The preparation of financial statements requires estimates and assumptions to be made that affect the reported amount of assets and liabilities on the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Difference between the actual results and estimates are recognised in the period in which the results are known/ materialised. Own Fixed Assets Fixed Assets are stated at cost net of recoverable taxes and includes amounts added on revaluation, less accumulated depreciation and impairment loss, if any. All costs, including financing costs till commencement of commercial production, net charges on foreign exchange contracts and adjustments arising from exchange rate variations attributable to the fixed assets are capitalised. Intangible Assets Intangible Assets are stated at cost of acquisition net of recoverable taxes less accumulated amortisation / depletion. All costs, including financing costs till commencement of commercial production, net charges on foreign exchange contracts and adjustments arising from exchange rate variations attributable to the intangible assets are capitalised. Depreciation and Amortisation Depreciation on fixed assets is provided to the extent of depreciable amount on written down value method (WDV) at the rates and in the manner prescribed in Schedule XIV to the Companies Act, 1956 over their useful life.

C.

D.

E.

Impairment of Assets An asset is treated as impaired when the carrying cost of asset exceeds its recoverable value. An impairment loss is charged to the Profit and Loss Account in the year in which an asset is identified as impaired. The impairment loss recognised in prior accounting period is reversed if there has been a change in the estimate of recoverable amount. G. Foreign Currency Transactions a) Transactions denominated in foreign currencies are recorded at the exchange rate prevailing on the date of the transaction or that approximates the actual rate at the date of the transaction. b) Monetary items denominated in foreign currencies at the year end are restated at year end rates. In case of items which are covered by forward exchange contracts, the difference between the year end rate and rate on the date of the contract is recognised as exchange difference and the premium paid on forward contracts is recognised over the life of the contract. c) Non monetary foreign currency items are carried at cost. d) In respect of branches, which are integral foreign operations, all transactions are translated at rates prevailing on the date of transaction or that approximates the actual rate at the date of transaction. Branch monetary assets and liabilities are restated at the year end rates. e) Any income or expense on account of exchange difference either on settlement or on translation is recognized in the Profit and Loss account except in case of long term liabilities, where they relate to acquisition of fixed assets, in which case they are adjusted to the carrying cost of such assets. H. Investments Current investments are carried at lower of cost and quoted/fair value, computed category wise. Long Term Investments are stated at cost. Provision for diminution in the value of long-term investments is made only if such a decline is other than temporary. Inventories Items of inventories are measured at lower of cost and net realisable value after providing for obsolescence, if any. Cost of inventories comprises of cost of purchase, cost of conversion and other costs including manufacturing overheads incurred in bringing them to their respective present location and condition.

F.

I.

J.

Revenue Recognition

NIRMAL EXIM PRIVATE LIMITED

Revenue is recognized only when it can be reliably measured and it is reasonable to expect ultimate collection. Revenue from operations includes sale of goods, services, sales tax, service tax, excise duty and sales during trial run period, adjusted for discounts (net), Value Added Tax (VAT) and gain / loss on corresponding hedge contracts. Dividend income is recognized when right to receive is established. Interest income is recognized on time proportion basis taking into account the amount outstanding and rate applicable. K. Excise Duty / Service Tax and Sales Tax / Value Added Tax Excise duty / Service tax is accounted on the basis of both, payments made in respect of goods cleared / services provided as also provision made for goods lying in bonded warehouses. Sales tax / Value added tax paid is charged to Profit and Loss account. L. Employee Benefits (i) Short-term employee benefits are recognised as an expense at the undiscounted amount in the profit and loss account of the year in which the related service is rendered. (ii) Post employment and other long term employee benefits are recognised as an expense in the Profit and Loss account for the year in which the employee has rendered services. The expense is recognised at the present value of the amounts payable determined using actuarial valuation techniques. Actuarial gains and losses in respect of post employment and other long term benefits are charged to the Profit and Loss account. (iii) In respect of employees stock options, the excess of fair price on the date of grant over the exercise price is recognised as deferred compensation cost amortised over the vesting period. M. Employee Separation Costs Compensation to employees who have opted for retirement under the voluntary retirement scheme of the Company is charged to the Profit and Loss account in the year of exercise of option. Borrowing Costs Borrowing costs that are attributable to the acquisition or construction of qualifying assets are capitalised as part of the cost of such assets. A qualifying asset is one that necessarily takes substantial period of time to get ready for its intended use. All other borrowing costs are charged to Profit and Loss account. Financial Derivatives and Commodity Hedging Transactions In respect of derivative contracts, premium paid, gains / losses on settlement and losses on restatement are recognised in the Profit and Loss account except in case where they relate to the acquisition or construction of fixed assets, in which case, they are adjusted to the carrying cost of such assets. Provision for Current and Deferred Tax Provision for current tax is made after taking into consideration benefits admissible under the provisions of the Incometax Act, 1961. Deferred tax resulting from timing difference between taxable and accounting income is accounted for using the tax rates and laws that are enacted or substantively enacted as on the balance sheet date. Deferred tax asset is recognised and carried forward only to the extent that there is a virtual certainty that the asset will be realised in future. Premium on Redemption of Bonds / Debentures Premium on redemption of bonds / debentures, net of tax impact, are adjusted against the Securities Premium Account. Provisions, Contingent Liabilities and Contingent Assets Provisions involving substantial degree of estimation in measurement are recognized when there is a present obligation as a result of past events and it is probable that there will be an outflow of resources. Contingent Liabilities are not recognised but are disclosed in the notes. Contingent Assets are neither recognized nor disclosed in the financial statements.

N.

O.

P.

Q.

R.

PART-II

Additional information to the financial statements

Note Particulars 10.1 Related Party Disclosure as per Accounting Standard- 18 a) Particulars of Subsidiary/ Associate Company: NA b) Key Management Personnel & Their Relatives : Sri Radhey Shyam Agarwal Smt. Nirmala Agarwal Sri Yogesh Agarwal Smt Aditi Agarwal 10.2 Segment Reporting : Nil

10.3 Capital Expenditure commitments not provided for (net of advance)

NIRMAL EXIM PRIVATE LIMITED

Current Year : Nil Previous Year : Nil 10.4 Expenditure incurred on employees U/s 217(2A) of the companies Act.1956 Current Year : Nil Previous Year : Nil 10.4 Earnings / Expenditure in foreign currency Current Year : Nil Previous Year : Nil 10.5 There is no liability under the payment of Gratuity Act for the year under review as such no provisions have been made. 10.6 Figures for the previous year have been re-grouped and/or re-arranged wherever necessary.

S.K.S. & CO.

CHARTERED ACCOUNTANTS

18, RAJA BASANTA ROY ROAD, KOLKATA 700 026 TELEPHONE NO 2465 9724

AUDITORS REPORT TO THE MEMBERS OF NIRMAL EXIM PRIVATE LIMITED.

1. We have audited the attached Balance Sheet of NIRMAL EXIM PVT. LTD. as at March 31, 2012 and also the Profit and Loss Account for the year ended on that date annexed thereto. These financial statements are the responsibility of the Companys management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in India. Those Standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. Since all the three conditions laid down for exemption of a Private Limited Company from the applicability of Companies (Auditors Report) (Amendment) Order, 2003 issued by the Central Government of India in terms of sub-section (4A) of Section 227 of the Companies Act, 1956 are fulfilled, no statement has been annexed on the matters specified in paragraphs 4&5 of the said order Further we report that : (i) We have obtained all the information and explanations, which to the best of our knowledge and belief, were necessary for the purpose of our audit; In our opinion, proper books of account as required by law have been kept by the company so far as it appears from our examination of such books; The Balance Sheet and the Profit & loss Account referred to in this report are in agreement with the books of account; In our opinion, the Balance Sheet and Profit and Loss Account dealt with by this report comply with the Accounting Standards referred to in sub-section (3C) of Section 211 of the Companies Act, 1956; On the basis of written representation received from the directors, as on March 31, 2012, and taken on record by the Board of Directors, we report that non of the directors is disqualified as on March 31, 2012, from being appointed as a director in terms of clause (g) of sub- section (1) of Section 274 of the Companies Act, 1956.

2.

4.

(ii)

(iii) (iv)

(v)

5.

In our opinion and to the best of our information and according to the explanations given to us, the said statements of account give the information required by the Companies Act, 1956 in the manner so and give a true and fair view in conformity with the accounting principles generally accepted in India: i) ii) in the case of the Balance Sheet, of the state of affairs of the Company as at March 31, 2012; in the case of the Profit and Loss Account, of the Profit for the year ended on that date.

S .K. S. & CO.

Chartered Accountants.

Kolkata Dated:

2012,

S. K. AGARWAL a Partner Membership No. 52093

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- GSTR 3B Excel FormatDocument2 pagesGSTR 3B Excel Formatravibhartia1978No ratings yet

- 4) Principles of International Taxation (Mulligan EmerOats Lynne) PDFDocument883 pages4) Principles of International Taxation (Mulligan EmerOats Lynne) PDFElgun JafarovNo ratings yet

- Gautam Engineers Limited requests cancellation of Airtel Hotspot number due to battery issuesDocument1 pageGautam Engineers Limited requests cancellation of Airtel Hotspot number due to battery issuesravibhartia1978No ratings yet

- Atlas Jute - Only Rent CapDocument6 pagesAtlas Jute - Only Rent Capravibhartia1978No ratings yet

- Statement of Accounts: OfficeDocument1 pageStatement of Accounts: Officeravibhartia1978No ratings yet

- Girdhari Estates PVT - LTD.: NoticeDocument1 pageGirdhari Estates PVT - LTD.: Noticeravibhartia1978No ratings yet

- Bhagwati Devcon Private LimitedDocument2 pagesBhagwati Devcon Private Limitedravibhartia1978No ratings yet

- 27a Cala01174f 26Q Q2 201516Document1 page27a Cala01174f 26Q Q2 201516ravibhartia1978No ratings yet

- U67120WB1981PTC033586Document2 pagesU67120WB1981PTC033586ravibhartia1978No ratings yet

- Manoj Kr. Agarwal - GIRDHARIDocument1 pageManoj Kr. Agarwal - GIRDHARIravibhartia1978No ratings yet

- Gautam Engineers Limited requests cancellation of Airtel Hotspot number due to battery issuesDocument1 pageGautam Engineers Limited requests cancellation of Airtel Hotspot number due to battery issuesravibhartia1978No ratings yet

- Statement of Accounts: OfficeDocument1 pageStatement of Accounts: Officeravibhartia1978No ratings yet

- Letter From MCO To Anirudh Jalan Dated 19-1-2018Document1 pageLetter From MCO To Anirudh Jalan Dated 19-1-2018ravibhartia1978No ratings yet

- Auditor's Report on Bhagwati Devcon Private LimitedDocument3 pagesAuditor's Report on Bhagwati Devcon Private Limitedravibhartia1978No ratings yet

- 27a Cala01174f 26Q Q3 201516Document1 page27a Cala01174f 26Q Q3 201516ravibhartia1978No ratings yet

- Commercial CircularDocument1 pageCommercial Circularravibhartia1978No ratings yet

- MINISTRY OF CORPORATE AFFAIRS RECEIPTDocument1 pageMINISTRY OF CORPORATE AFFAIRS RECEIPTravibhartia1978No ratings yet

- Hindi Book Prem Chand Aur Subhasit Aur Suktiya PDFDocument196 pagesHindi Book Prem Chand Aur Subhasit Aur Suktiya PDFravibhartia1978No ratings yet

- Ministry of Corporate Affairs: Receipt G.A.R.7Document1 pageMinistry of Corporate Affairs: Receipt G.A.R.7ravibhartia1978No ratings yet

- Atlas JuteDocument9 pagesAtlas Juteravibhartia1978No ratings yet

- Lli I: LimitedDocument10 pagesLli I: Limitedravibhartia1978No ratings yet

- Ministry of Corporate Affairs: Receipt G.A.R.7Document1 pageMinistry of Corporate Affairs: Receipt G.A.R.7ravibhartia1978No ratings yet

- 86Document5 pages86ravibhartia1978No ratings yet

- Director Report: To The Members of M/S. Bhagwati Devcon Private LimitedDocument2 pagesDirector Report: To The Members of M/S. Bhagwati Devcon Private Limitedravibhartia1978No ratings yet

- 85Document2 pages85ravibhartia1978No ratings yet

- Oct 17 News PaperDocument8 pagesOct 17 News Paperravibhartia1978No ratings yet

- Accounting Policies and Notes for Hanuman EstatesDocument3 pagesAccounting Policies and Notes for Hanuman Estatesravibhartia1978No ratings yet

- Balance Sheet Abstract & Company'S General Business Profile: I. Registration DetailsDocument3 pagesBalance Sheet Abstract & Company'S General Business Profile: I. Registration Detailsravibhartia1978No ratings yet

- Gautam Engineers LTDDocument1 pageGautam Engineers LTDravibhartia1978No ratings yet

- Useful 1Document15 pagesUseful 1ravibhartia1978No ratings yet

- S.B.Dandeker & CoDocument3 pagesS.B.Dandeker & Coravibhartia1978No ratings yet

- PHPH C2 D4 NDocument72 pagesPHPH C2 D4 NNATSOIncNo ratings yet

- 5 Fort Bonifacio Development Corporation Vs Cir Consolidated 2Document45 pages5 Fort Bonifacio Development Corporation Vs Cir Consolidated 2Nikki Diane CadizNo ratings yet

- Bba ProjectDocument52 pagesBba Projectravishivhare100% (1)

- Buc-Ee's Econominc Development Agreement With City of AmarilloDocument20 pagesBuc-Ee's Econominc Development Agreement With City of AmarilloJamie BurchNo ratings yet

- ASSIGNMENT 5 - Depreciation and Income TaxesDocument6 pagesASSIGNMENT 5 - Depreciation and Income TaxesKhánh Đoan Lê ĐìnhNo ratings yet

- Final Details For Order #113-4867259-8534609: Shipped On April 23, 2018Document2 pagesFinal Details For Order #113-4867259-8534609: Shipped On April 23, 2018Giovanni CocchiNo ratings yet

- Commercial Affiliate Program Overview For Ormita Commerce NetworkDocument4 pagesCommercial Affiliate Program Overview For Ormita Commerce NetworkJonathan MitchellNo ratings yet

- Invoice 1447 From LDK ElectricalDocument1 pageInvoice 1447 From LDK ElectricalJason GoddardNo ratings yet

- InvoiceDocument1 pageInvoiceavinash.grey.bizNo ratings yet

- 2 1 InsuranceDocument6 pages2 1 InsuranceLeo GuillermoNo ratings yet

- ACCT 553 Week 7 HW SolutionDocument3 pagesACCT 553 Week 7 HW SolutionMohammad Islam100% (1)

- Income Statement and Balance Sheet ForecastingDocument2 pagesIncome Statement and Balance Sheet ForecastingAkshay GourNo ratings yet

- 2-5hkg 2007 Jun QDocument11 pages2-5hkg 2007 Jun QKeshav BhuckNo ratings yet

- BIR Ruling 317 92Document1 pageBIR Ruling 317 92Russel LaquiNo ratings yet

- Case 11-2 - Amerbran Company (A)Document2 pagesCase 11-2 - Amerbran Company (A)Sway ParamNo ratings yet

- Basic Principles QuizzerDocument16 pagesBasic Principles Quizzerbobo kaNo ratings yet

- Taxation AssignmentDocument4 pagesTaxation AssignmentSabika LindaNo ratings yet

- Bangladesh Tax Handbook 2009-2010 SummaryDocument69 pagesBangladesh Tax Handbook 2009-2010 Summaryvictoire2177No ratings yet

- ACW2491 - 2018 S1 - WK 2 Lecture ExampleDocument2 pagesACW2491 - 2018 S1 - WK 2 Lecture Examplehi2joeyNo ratings yet

- Prelude To The Awesome Power of Taxation.Document24 pagesPrelude To The Awesome Power of Taxation.Accounterist ShinangNo ratings yet

- Chapter TwoDocument54 pagesChapter Twoyechale tafereNo ratings yet

- Business Law PDFDocument16 pagesBusiness Law PDFjtpNo ratings yet

- Tax1 Course Syllabus BreakdownDocument15 pagesTax1 Course Syllabus BreakdownnayhrbNo ratings yet

- Independent Sales Representative AgreementDocument7 pagesIndependent Sales Representative AgreementCarlos GonzalezNo ratings yet

- F6mwi QPDocument15 pagesF6mwi QPangaNo ratings yet

- Economic Growth (Main Macro Objective) Essay (Edexcel)Document3 pagesEconomic Growth (Main Macro Objective) Essay (Edexcel)Atom SonicNo ratings yet

- Evergreen Corporation: Sti College Santa Rosa, LagunaDocument16 pagesEvergreen Corporation: Sti College Santa Rosa, LagunaChristine Joyce Magote100% (1)

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- Proforma Invoice : Kalelker Surgical IndustriesDocument2 pagesProforma Invoice : Kalelker Surgical IndustriesskrameerNo ratings yet