Professional Documents

Culture Documents

Consumer Behaviour Case

Uploaded by

Arveen KaurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Behaviour Case

Uploaded by

Arveen KaurCopyright:

Available Formats

520

Con sume r Behaviour and Branding

The case has been w ritten from secondary data available in public domain and its academic interpretation by the authors. The survey was sponsored by Indian Institute of Management, Bangalore, India. The case does not illustrate right or wrong handling with regard to any brand . It is purely written for academic purposes. The incorporated survey do!,s not have a fo cus towards any brand's strategies.

Motorcycle Ind ustry: An Overview

The Indian motorcycle ind ustry has been gaining momentum in the last two decades. Changing lifestyles, commuting to work, fun and leisure and the

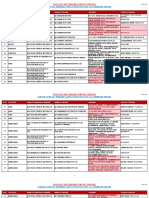

Table 1 Two:whee lers: Sales t re nd

Year

9~00

No Of Units

3,468 ,99 1 3,574,356 4,306 ,057 5,054, 142 5,629,663 6 ,575,584

00--0 1 0 1-02 0 2- 03 03-04

04-05

Table 2 Two-whe ele rs: Bran d-wise volu me sales (nos)

Hero Honda

1999-2000 2000-'01 2001-'02 2002-'03 2003-'04 2004-'05

761 ,700 97 1,394 780,366 1,029 ,591 1,42 5,3 0 2 1,677, 562 1,25 1,85S 1,119,309 167,033 2,072 ,903 1,288 ,9 10 1, 146,696 341,450 2, 621 ,400

Bajaj Auto TVS Moto r

888,728 1, 198 ,227 863 ,442 865,68 1 5S ,S90

1,602,565

1, 16 7,515 55 1,84 7

Honda

Motorcycl e &

Scooters

Yamaha

M Oto rs

251 ,937 120,232 162 ,507 25,504 3,468,99 1

171 ,307 127 ,663 152,465 21 ,928

231,387 126,687 123,729 24 ,623

302,718 133,5 19 101,039 28, 294 5,054, 142

26 4, 673 126 ,435 81,594 28,3 61 5,6 29 ,663

252,196 10 7,814 73, 536 29 ,576 6,575,5 8:'

Kinetic Motor Ki netic Enginee ring

Royal En fie ld

Motors

Tota l

3 ,574 ,356 4 ,3 06,0 5 7

Source: SIAM

Fiery Th rills or Windy Rides

521

em ergence of upwardly mobile youngsters who like to associate themselves with motorcycle brands to reflect their lifestyles in urban markets are some of the reasons for the increasing demand for this ty pe of two wheelers' The rural market too, has a traditional orientation towa rds two wheelers not only as a mode of personal transport but also as a mode of transport for a small family. Besides, it also serves as a means to transport goods for the small vendor a nd shows promising signs of growth potentiaL Going by the behaviour of rural consumers in severa l conspicuous categories, the yo ungsters in these markets are likely to have their counterparts in urban markets as role models in the two-wheeler ca tegory. The expected rise in household income, easy availability of consumer finance, growing replacement demand, frequent introduction of newer trendy models by players ana the growing aggressiveness by key players are the factors aiding the growth of the two-wheeler market. This will drive the overall two-wheeler sales g rowth by around 12.7 per cent to 11 .9 million units by 2009- '10. Tables 1-7-provid e an overvi.;w-about the various aspects of the motorcycl e market in India.

Crowth of Motorcycle segments in the Indian context

Motorcycle production started in 1952with Royal Enfield as the only producer till the early sixties, with the production of 2,500 units per annum . The growth in production increased to 39,000 between 1963 and 1971 with Ideal Java and Escorts entering the field. 1972-'79 was a p eriod of slow down for motorcycle segment due to lower fuel efficiency and lack of design improvement. 1980-'86 was a period of foreign collaboration and broad banding of capacity, as a result of which the d emand grew by 47 per cent by 1987, b ut the momentum could not be su stained after 1989, when the prices of all the motor cycles were hiked and there was an economic slowdown. The p eriod between 1994--2002 saw the consumer preference shifted towards motorcycles in the whole of two wheeler markets . After registering a remarkable growth of 15.1 per cent (CAGR) between 2000-'01 and 2004--'05 (see Figure 1.1), the m otorcycle segment is expected to expand a t Table 3 .. Motorcycle dem an d forecas t (20 09- 20 10)

Motorcycle

Urban

Rural

2003-'04

1,787,0 14 2,383 ,432 4, 170,446

2004-'05

1,985 ,777 2,978,665 4,964,442

2009-' 10 (P)

2,951 ,645 6,526,354 9,478,000

CAGR (%)

8.2 1 7.0 13.8

Total

Source: CRI SINFAC

'I< Manohar Laza ru s, "To cut clu tter, personify How these brand s did it", The Hin du Busines sline , 14 5ep t. ,2006

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Helmet Licencees List PDFDocument26 pagesHelmet Licencees List PDFSmita Sawant Bhole0% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 2906182850afd Dealer List - 25 6 18 PDFDocument281 pages2906182850afd Dealer List - 25 6 18 PDFVenkatesh BNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Harley-Davidson Manuals OEM Numbers PDFDocument30 pagesHarley-Davidson Manuals OEM Numbers PDFgreaternorthroad8820100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Classic MotorCycle - May 2018 USADocument116 pagesThe Classic MotorCycle - May 2018 USADương TúNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- All Motorcycles 2008Document45 pagesAll Motorcycles 2008AyulenNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Honda Xr500Document2 pagesHonda Xr500huguslourNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Engine: Motorcycle CatalogueDocument86 pagesEngine: Motorcycle CatalogueJulito Santa CruzNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Dis PadDocument1 pageDis PadRanesh Kumar100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- NTPC Ta EntitlementDocument1 pageNTPC Ta EntitlementParmanand RautNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Polini Ric MollecontrDocument2 pagesPolini Ric MollecontrScooter TaiwanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- FCL TW Mumbai Online Auction - 13/11/2020: Event CatalogueDocument54 pagesFCL TW Mumbai Online Auction - 13/11/2020: Event Catalogueatul4uNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Sabita Sahu (41) Shammi Khaihra (46) Abhimanyu Bajaj (02) Rimmyt Thakur (38) Udit Gupta (55) Garima Pandey (17) Rahul KhullarDocument24 pagesSabita Sahu (41) Shammi Khaihra (46) Abhimanyu Bajaj (02) Rimmyt Thakur (38) Udit Gupta (55) Garima Pandey (17) Rahul KhullarSabita SahuNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Automatic Side Stand Removing Lever1Document2 pagesAutomatic Side Stand Removing Lever1Jagadeeswaran Ravi100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Low Budget Cafe Racer - Guide PDFDocument16 pagesLow Budget Cafe Racer - Guide PDFJure Fijten100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Data Besar Diameter Klep Sepeda Motor Untuk Modifikasi: Suzuki Satria Fu 150Document5 pagesData Besar Diameter Klep Sepeda Motor Untuk Modifikasi: Suzuki Satria Fu 150AprilliaNo ratings yet

- Lista Extra-Oficial de Inscritos SERTÕES 2021 (SSV) : Por NumeralDocument4 pagesLista Extra-Oficial de Inscritos SERTÕES 2021 (SSV) : Por NumeralIgor NatalNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- KTM & DukeDocument42 pagesKTM & Dukeviveksbdesai99@yahoo.co.in0% (1)

- Yamaha Model Index 1958-2010Document442 pagesYamaha Model Index 1958-2010gabysurf40% (5)

- Scalvini PricelistDocument5 pagesScalvini PricelistHerryBlazusiakNo ratings yet

- Harley Davidson India Marketing PlanDocument23 pagesHarley Davidson India Marketing PlanAnkit Sakhuja88% (8)

- Catalogo PietcardDocument69 pagesCatalogo PietcardGermán Bacik50% (2)

- Training Plan 3Document13 pagesTraining Plan 3Bhaskar GautamNo ratings yet

- Kawasaki. NINJA 650R, ER-6f ABS, ER-6f. Motorcycle Service Manual PDFDocument625 pagesKawasaki. NINJA 650R, ER-6f ABS, ER-6f. Motorcycle Service Manual PDFКонстантинNo ratings yet

- Bony Catalogue New-1Document21 pagesBony Catalogue New-1Jagotta Corp - Pravin BorgudeNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Latest Product Range - MK Lide DT 310720Document6 pagesLatest Product Range - MK Lide DT 310720Taher MotorwalaNo ratings yet

- Dampak Kebijakan Transportasi Online (Studi Kelurahan Bumi Nyiur Kec. Wanea Kota Manado) Zefanya F Telap Salmin Dengo Alden LalomaDocument9 pagesDampak Kebijakan Transportasi Online (Studi Kelurahan Bumi Nyiur Kec. Wanea Kota Manado) Zefanya F Telap Salmin Dengo Alden LalomaAri AlhamidNo ratings yet

- History: T. V. Sundaram IyengarDocument4 pagesHistory: T. V. Sundaram Iyengarxicecec166No ratings yet

- ARYAN JAIN Project 2Document68 pagesARYAN JAIN Project 2Aryan JainNo ratings yet

- Tabla de Aplicacion Brake Pads Ap RacingDocument9 pagesTabla de Aplicacion Brake Pads Ap RacingCentauros BCNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Öhlins: High Performance Suspension FluidsDocument1 pageÖhlins: High Performance Suspension FluidsНикола КарагьозовNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)