Professional Documents

Culture Documents

India Spice Oleoresins G Paul PDF

Uploaded by

Phani KrishnaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India Spice Oleoresins G Paul PDF

Uploaded by

Phani KrishnaCopyright:

Available Formats

Paper presented at the IFEAT Conference in Cochin, India, 16-20 October 2005. Pp.

2-9 in the printed conference proceedings. __________________________________________________________________________

INDIAS SPICE OLEORESIN INDUSTRY George Paul Synthite Industrial Chemicals Ltd. Ajay Vihar, M.G. Road, Cochin 682 016, India. [ georgepaul@synthite.com ]

Let me begin with a quotation from the historical classic The Spice Route by John Keay: Globalisation began with the spice trade. It was the worlds first long distance exchange, its most profitable and for 2 millennia its most mysterious. In this 3rd millennium, India can claim to be the largest producer of value added versions of spices; i.e. spice oleoresins, which are natural isolates containing the goodness of spices in a concentrated form. Technology provides options to enrich or even separate components contributing to colour, odour, flavour and taste. Further, delivery of these functions via the oleoresin form is less cumbersome, more consistent and durable than via usage of whole spices. Overview of exports The scale of and trends in Indias recent exports are illustrated by the following charts and tables. Three products have displayed particularly good growth in recent years: the oleoresins of black pepper, paprika and chilli.

EXPORT OF BLACK PEPPER OLEORESIN (IN MT)

1200 1150 1150 1100 1050 QTY IN MT 1000 950 900 861 850 800 2000 2003 YEAR 2005 988

OLEORESIN PAPRIKA - EXPORT PERFORMANCE (IN MT)

2100

2048

1900

1700

QTY IN MT

1500 1306 1300

1100

900 744 700 2000 2003 YEAR 2005

OLEORESIN CHILLI - EXPORT PERFORMANCE (IN MT)

1000 944 900

800

QTY IN MT

700 618 600

500

400

360

300 2000 2003 YEAR 2005

Indias other oleoresin products are also performing well. Amongst these, turmeric and nutmeg are showing significant growth. Export performance of other major oleoresins (tonnes) Oleoresin 2000 2003 2005 Turmeric 224 265 277 Celery 173 188 183 Ginger 102 126 117 Nutmeg 63 106 125 Mace 16 23 35 Cumin 8 11 12 Fenugreek 8 22 21 Mustard 7 4 5 Garlic 6 5 40 Coriander 5 9 10 Cassia / cinnamon 12 22 20 Clove 3 4 11 Cardamom 0.6 2 4 Fennel 4 5 4 Rosemary 2 3 4 Good performance has been seen also with those spice oils that are co-products in the spice oleoresin manufacturing process. Export performance of the major spice oils (tonnes) Oil 2000 2003 2005 Pepper 29 60 61 Nutmeg 27 37 46 Celery 19 17 21 Ginger 10 16 16 Mustard 7 23 22 Clove 5 13 24 Cardamom 3 4 4 Garlic 0.3 1 16 Mace 2 2 2

Total volume and value of Indias exports of spice oleoresins and spice oils 2003 2004 tonnes US$ millions Spice oleoresins 5,376 98 Spice oils 224 10

Cochin the hub of the industry There are 15 spice oleoresin manufacturing units in India today and most of them are located in and around the city of Cochin in the state of Kerala, which has a long history as a major export centre for spices from the Malabar coast. The concentration of these manufacturing activities in Cochin is primarily due to its proximity to Indias major spice growing regions and its connectivity by sea and air. These transport facilities are in the process of further improvement: there is already a new international airport and Cochin will get an international container transhipment terminal soon. This will certainly give this city the status of an outsourcing destination, not only for the flavour and fragrance industry, but others as well. Raw material sources for the oleoresin industry Within India India is the worlds largest individual producer of spices, both in the total volume and in the wide range, which is possible because of its diverse agro-climatic regions. Amongst the Indian market centres for spices, Guntur and Byadgi are the major chilli sources, while Unjah is famous for seed spices. Sangli, Nizamabad and Erode are the markets for turmeric. Many Indian spices are known on the international market by their traditional port of export and these include Alleppey finger turmeric (AFT), Madras finger turmeric (MFT), Cochin ginger, Malabar pepper and Alleppey cardamom. Vanilla is the latest entrant to Indias list of spice crops. However, problems of supply occurred two years ago, which discouraged some of the flavour/food manufacturers from its use because of the unprecedented price of the material. In order to prevent a recurrence of this situation, the Indian oleoresin industry has become directly involved in vanilla plantations. Cultivation of herbs is also carried out in various regions of India. External sources The Indian spice oleoresin industry cannot depend on home-grown spices alone because of the competing, high demand for spices from the household market sector. The economic liberalization of the early 1990s moulded and made the Indian spice oleoresin industry more vibrant and competitive because it enabled easy access from other countries of those raw materials that have become expensive in the local market or not available at all. This has given us a

level playing ground with global competitors in terms of raw material cost and the range of potential products. Black pepper is a notable example. Domestic consumption of this spice is very high, and India has not been competitive as an exporter of this spice on the world market in the recent period. The introduction of liberalisation in the Indian economy has allowed its spice oleoresin industry to source black pepper from Vietnam, which achieved the status of the worlds largest exporter during the 1990s and supplies the raw material at a competitive price vis--vis other origins. Vietnam has been of major importance in permitting a steady growth in Indias production and exports of black pepper oleoresin. Indian paprika and chilli oleoresins The development of means of producing oleoresin paprika from Indian capsicums in 1985 was a major break through for the industry, and Dr. A G Mathew in the IFEAT Medal Lecture will describe the innovative approach in detail. The process yields two products: a paprika-type oleoresin with a high colour and a co-product, a chilli oleoresin that contains the pungent principles. The cost advantage thereof for the Indian industry has resulted in a dramatic jump in the volume of oleoresin exports. The growth in sales of Indian oleoresin paprika caused such a threat to other producing countries that an attempt was made to impose antidumping duty on India. Today, the world picture has changed and Spain, which was the major producer of paprika oleoresin up to till the late 1990s, now imports this product from India. To optimize cost reduction, the Indian industry has established processing units in capsicum producing centres. By invoking backward integration, the industry also supports the farming community, providing post harvest technology. Farmers are also given technical assistance for integrated pest management in order to discontinue the use of harmful pesticides. Contract farming has evolved to obtain high quality capsicums free from aflatoxin. The availability of paprika oleoresin from India at a steady and competitive price has enabled the consumer to widen its application in both the feed and food industries. This has prompted the industry to adopt forward integration and to develop more stable products and also to optimize quality with better absorption ratio. This in turn helps the customer to add value to the final product. The trend of growth in the export of oleoresin paprika certainly is promising. The market for oleoresin chilli has increased considerably because: The Indian industry has been able to substantially improve the functionality of the product, thereby widening its application. The unit price of capsaicin has been more or less steady for several years, as a consequence of the constant supply of Indian chillies at reasonable prices. The industry also takes care, to an extent, in maintaining prices for the customer by timely market intervention with the help of large-scale cold storage facilities. Oleoresins from non-indigenous raw materials In order to widen its product profile and to serve customer requirements, the Indian oleoresin industry has had to source non-indigenous raw materials, such as laurel, rosemary, sage, oreganum, thyme, horseradish, pimento, and cassia. Today, the Indian oleoresin industry is aiming at becoming a onestop shop for all spice and herb extractives.

Advances in manufacturing capabilities Let me now give you a run through of the manufacturing capabilities of the oleoresin industry. We employ steam distillation and solvent extraction with continuous, single or multi stage batch operations, as required for optimal processing. Oleoresin refining is also an integral part of the processing plant.

Batch solvent extractor

Continuous solvent extractor

Spinning cone distillation Oleoresin refinery

Recent innovations by the industry are the introduction of facilities for distillation by spinning cone column, in order to minimize thermal degradation, and super critical extraction. Microencapsulation and spray drying operations are in place in certain units to enhance functionality and unmatched flexibility in the application of oleoresins. New product development Plant derived natural product specialties has always been the business focus of the Indian industry. The role of technology and innovation in delivering value to its customers is well understood by the

industry and hence R&D has been given adequate importance. The industry has kept abreast with the latest developments in science and technology and has been paying attention to fast growing segments, such as functional foods. As a result, manufacture of nutraceutical ingredients has been initiated by the industry. Products today include isolated or enriched active principles, such as piperine from black pepper, curcumin from turmeric, gingerols from ginger, capsaicin from capsicums, carnosic acid from rosemary and polyphenols from green tea. In this context, intellectual property rights are an aspect to which the oleoresin industry has not been paying due attention. In the present scenario, patenting of products and/or a process whenever feasible is a must. Manufacturing of seasonings and colour blends is yet another value added function. To support this activity, there are creative and application laboratories to carry out trials for efficacy so as to provide functional support to the customers. We also have trained cross-functional sensory evaluation teams. Product quality control Quality control and quality assurance of products are crucial functions to remain in international trade in todays competitive environment. This is well achieved by system driven procedures under the ISO and HACCP standards. Chemical, organoleptic and instrumental assays are widely used to ensure quality and consistency. Also, we are living in an era of extreme health consciousness and the regulatory status of food products keep changing due to various factors. A recent cause for alarm was the contamination with textile dyes like Sudan red, Para red and Rhodamine B in commodities such as chilli and turmeric. The industry acted swiftly and devised methodologies to evaluate and prevent such contaminants, which were not known till then. The timely guidance and support of the worldwide clientele is to be acknowledged here. Markets- old and new The traditional export markets The traditional markets for Indian oleoresins have been the USA, Europe, Japan, Canada and Australia. These countries are on the look out for specialty products of natural origin and the quality norms are increasingly stringent. This makes the task of the Indian industry more challenging. New export markets China, India, Russia, Eastern Europe, Latin America and South Africa are the fast growing emerging markets for Indian oleoresins. Following the global fad in food preference, processed food industries introduced convenience and ready-to-eat food concepts in these countries. As a direct consequence, oleoresin sales increased. The growth of Chinas market in particularly has been phenomenal.

The market in India

Like China, Indias consumption also has grown dramatically. About 400 tons / year of spice oils, oleoresins and blended seasonings are being sold in the Indian market today, which is about 8% of the total production. The growth rate is estimated at 15% annually. Liberalisation has resulted in a total metamorphosis of the Indian processed food industry. The presence of multinational and transnational players in the foods area has brought in huge investments and the resultant market expansion indeed provides a lot of growth opportunities for Indias spice oleoresin industry. Marketing strategy A two-pronged strategy can be most appropriate for this industry at this stage of evolution. We should of course focus on existing and emerging markets to expand the ongoing business. We should also create and add value via diversification to other functional areas of plant derived specialty products, nutraceuticals and cosmaceuticals for example, wherein synergies arising out of the science base and/or technology can be leveraged advantageously.

George Paul, joined Synthite Industrial Chemicals Ltd. at its inception in 1972. Today, the company is a global leader in spice oleoresin manufacture. Mr. Paul is the Senior Director of Synthite, coordinating its planning and marketing. He is the Regional President of Indo-American Chamber of Commerce (South India Council) and, also has the distinction of holding the Chairmanship of the All India Spices Exporters Forum.

You might also like

- Synthite Company Product Profile PDFDocument19 pagesSynthite Company Product Profile PDFNipinNo ratings yet

- AsafoetidaDocument60 pagesAsafoetidarahulnavetNo ratings yet

- Gautham 03103 OLEORESINDocument65 pagesGautham 03103 OLEORESINpbvr0% (1)

- MNS Spices Report Aug10Document23 pagesMNS Spices Report Aug10nmjkl100% (1)

- 19 Oleoresins & Spice Oil 1Document8 pages19 Oleoresins & Spice Oil 1KarachibreezeNo ratings yet

- SMEDA Dehydration PlantDocument68 pagesSMEDA Dehydration PlantUmar NaseerNo ratings yet

- Turmeric Processing Guide by Mynampati Sreenivasa RaoDocument4 pagesTurmeric Processing Guide by Mynampati Sreenivasa RaoPandu MynampatiNo ratings yet

- Chilli ReportDocument12 pagesChilli ReportEba AliNo ratings yet

- Processing of TurmericDocument9 pagesProcessing of TurmericTarsem MittalNo ratings yet

- Pineapple: Origin and DistributionDocument11 pagesPineapple: Origin and DistributionSushant BhosleNo ratings yet

- Tridge Market Report - CinnamonDocument18 pagesTridge Market Report - Cinnamonmaherianto 29No ratings yet

- MADP Project - J K Singh - Training On Amla - FinalDocument67 pagesMADP Project - J K Singh - Training On Amla - FinalalchemistjkNo ratings yet

- Spice Grinding Unit Chilli, Turmeric, CuminDocument12 pagesSpice Grinding Unit Chilli, Turmeric, Cuminveer marathaNo ratings yet

- ITC SpicesDocument21 pagesITC SpicesJyoti AnandNo ratings yet

- World: Onions (Dry) - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Onions (Dry) - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- SpicesDocument19 pagesSpicesSiddharth MishraNo ratings yet

- Spices Board of IndiaDocument10 pagesSpices Board of IndiaSehar BanoNo ratings yet

- 40221390-Dehydrated-Onion - MarketDocument13 pages40221390-Dehydrated-Onion - MarketGourav TailorNo ratings yet

- Dehydrated OnionDocument10 pagesDehydrated Onionsales1382No ratings yet

- Ginger VCA Report Final - 1321858136Document82 pagesGinger VCA Report Final - 1321858136anon_13466937100% (2)

- Hot Air Dry VegetablesDocument12 pagesHot Air Dry Vegetables124swadeshiNo ratings yet

- Production of Indian Kitchen Spices - 319424 PDFDocument76 pagesProduction of Indian Kitchen Spices - 319424 PDFLoknath AgarwallaNo ratings yet

- Chillies of IndiaDocument5 pagesChillies of IndiaSriram SridaranNo ratings yet

- Project Report On Extraction of Curcumin and Turmeric OilDocument10 pagesProject Report On Extraction of Curcumin and Turmeric OilEIRI Board of Consultants and PublishersNo ratings yet

- Large CardamomDocument20 pagesLarge CardamomSunsari TechnicalNo ratings yet

- © Sandesh PaudelDocument32 pages© Sandesh PaudelSunsari Technical50% (2)

- Pest Name Crop Name Group Name Trade Name Company Name Dose APDocument6 pagesPest Name Crop Name Group Name Trade Name Company Name Dose APM Mohsin ChowdhuryNo ratings yet

- Ginger Final Report FIGTF 02Document80 pagesGinger Final Report FIGTF 02Nihmathullah Kalanther Lebbe100% (2)

- Pre-Feasibility Study: Potato Starch Manufacturing UnitDocument27 pagesPre-Feasibility Study: Potato Starch Manufacturing UnitosamaNo ratings yet

- Adani Wilmar Certificate Draft RSPO DNV GL ENG India Signed S Hasamnis-69Document1 pageAdani Wilmar Certificate Draft RSPO DNV GL ENG India Signed S Hasamnis-69lalitNo ratings yet

- Spices FinalDocument17 pagesSpices FinalSaif KhanNo ratings yet

- The Spices and Herbs Market in The Eu 2009Document49 pagesThe Spices and Herbs Market in The Eu 2009Vlad KitaynikNo ratings yet

- Activist Post - Tumeric SpiceDocument21 pagesActivist Post - Tumeric Spicekilimandzaro70No ratings yet

- Malabar Fruit Products Company: A Project Report On Organizational Study atDocument43 pagesMalabar Fruit Products Company: A Project Report On Organizational Study atAnees SalihNo ratings yet

- Final Main Report HariomDocument50 pagesFinal Main Report HariomVijay ChauhanNo ratings yet

- Chilli CommodityDocument9 pagesChilli CommoditySandeep LoluguNo ratings yet

- Red Chilli de Hydration PlantDocument29 pagesRed Chilli de Hydration PlantAbhas GargNo ratings yet

- Spices Cryo-Grinding UnitDocument7 pagesSpices Cryo-Grinding Unitbenrakesh75No ratings yet

- Book Organic Food Marketing in Urban Center of IndiaDocument147 pagesBook Organic Food Marketing in Urban Center of IndiaSaibal ChakrabortyNo ratings yet

- Yeast Production IndustryDocument71 pagesYeast Production IndustryShabir TrambooNo ratings yet

- Solvent Extraction PresentationDocument5 pagesSolvent Extraction PresentationBartwell TazvingaNo ratings yet

- Exotic Spices of EthiopiaDocument12 pagesExotic Spices of Ethiopiamule DemissieNo ratings yet

- Pre Fesiblity of Medicinal PlantsDocument17 pagesPre Fesiblity of Medicinal Plantsbaloch75No ratings yet

- Essential Oil of OrangeDocument14 pagesEssential Oil of Orangebig johnNo ratings yet

- MS - Spice WorldDocument17 pagesMS - Spice WorldAditya MathuriaNo ratings yet

- Package Aromatic HerbsDocument46 pagesPackage Aromatic HerbsMaria RomerTeNo ratings yet

- Ramdev Supply ChainDocument30 pagesRamdev Supply Chaingudiaa_akta67% (3)

- Portable Turmeric Boiling System: Project Review 2Document12 pagesPortable Turmeric Boiling System: Project Review 2Akash JaiswalNo ratings yet

- Packaging of Spices and Spice Products ReportDocument14 pagesPackaging of Spices and Spice Products ReportKrishna Kotturi75% (4)

- Herbs Export From NepalDocument41 pagesHerbs Export From Nepalbharat33% (3)

- Being Desi - LC List of ProductsDocument6 pagesBeing Desi - LC List of ProductsSuman SatishNo ratings yet

- 09 Peanut Processing PDFDocument8 pages09 Peanut Processing PDFkalaamolNo ratings yet

- Jaggery Plant Powered by Free of Cost SteamDocument4 pagesJaggery Plant Powered by Free of Cost SteamMichael Odiembo100% (1)

- Project Report On Turmeric Processing (Turmeric Powder, Curcumin and Turmeric Oil)Document8 pagesProject Report On Turmeric Processing (Turmeric Powder, Curcumin and Turmeric Oil)EIRI Board of Consultants and PublishersNo ratings yet

- Mango Processing IndustryDocument41 pagesMango Processing IndustrySami MarufiNo ratings yet

- CFTRIDocument6 pagesCFTRIKumareshangrdcsNo ratings yet

- APMCDocument34 pagesAPMCAbhijit Prabhu PatturhallimathNo ratings yet

- Project Report On Onion Dehydration-Powder, Flakes / Kibbled and Minced (Onion Products Garlic Powder)Document10 pagesProject Report On Onion Dehydration-Powder, Flakes / Kibbled and Minced (Onion Products Garlic Powder)Sachin SharmaNo ratings yet

- Rent Agreement Policy (Version 1.0)Document6 pagesRent Agreement Policy (Version 1.0)Phani KrishnaNo ratings yet

- University Hub E-Brochure2Document4 pagesUniversity Hub E-Brochure2Phani KrishnaNo ratings yet

- Installation Guide Telegram ShareServiceDocument4 pagesInstallation Guide Telegram ShareServicePhani KrishnaNo ratings yet

- Algo Convention 2021 ScheduleDocument2 pagesAlgo Convention 2021 SchedulePhani KrishnaNo ratings yet

- JNTUKDocument7 pagesJNTUKPhani KrishnaNo ratings yet

- Miscellaneous OCI FormDocument1 pageMiscellaneous OCI FormPhani KrishnaNo ratings yet

- Only Α- Sniper Shot 3: MyfnoDocument10 pagesOnly Α- Sniper Shot 3: MyfnoPhani KrishnaNo ratings yet

- Pondichery TenderDocument3 pagesPondichery TenderPhani KrishnaNo ratings yet

- Importance of Netwrok SecurityDocument4 pagesImportance of Netwrok SecurityPhani KrishnaNo ratings yet

- Lab ReportsDocument6 pagesLab ReportsPhani KrishnaNo ratings yet

- Plant Area: Molasses Storage TanksDocument2 pagesPlant Area: Molasses Storage TanksPhani KrishnaNo ratings yet

- Sikkim Enviromental Pollution in IndiaDocument8 pagesSikkim Enviromental Pollution in IndiaPhani KrishnaNo ratings yet

- Soap Noodles2Document1 pageSoap Noodles2Phani KrishnaNo ratings yet

- Soap Noodle MethodologyDocument2 pagesSoap Noodle MethodologyPhani KrishnaNo ratings yet

- Export NamesDocument1 pageExport NamesPhani KrishnaNo ratings yet

- Durian Technology Package: Durio SPPDocument7 pagesDurian Technology Package: Durio SPPPutchong Sara100% (1)

- Vietnamese Beef Noodle Called PhoDocument10 pagesVietnamese Beef Noodle Called Photan nguyen vanNo ratings yet

- Chapter 2: Theory: 2.1 The History of TerrariumDocument3 pagesChapter 2: Theory: 2.1 The History of TerrariumAndreas Yogi SantosoNo ratings yet

- DPG Coal FeederDocument11 pagesDPG Coal FeederPanimanPalengaiNo ratings yet

- Intellectual Property RightsDocument13 pagesIntellectual Property RightsThisho NanthNo ratings yet

- Karina Dinda Putri, N.L. Ari Yusasrini, K.A. NocianitriDocument20 pagesKarina Dinda Putri, N.L. Ari Yusasrini, K.A. NocianitriRhida AmaliaNo ratings yet

- Pricelist ObeliaDocument2 pagesPricelist ObeliaYolandaNo ratings yet

- 04 Terpenoides CompilationDocument209 pages04 Terpenoides Compilationrustyryan77No ratings yet

- 3Document20 pages3khairunnisa P.O.V.PNo ratings yet

- Residence Time Distribution For Chemical ReactorsDocument71 pagesResidence Time Distribution For Chemical ReactorsJuan Carlos Serrano MedranoNo ratings yet

- Amaranthu and Minor Leafy Vege-MergedDocument486 pagesAmaranthu and Minor Leafy Vege-MergedTyagi AnkurNo ratings yet

- King Abdullah II IrbidDocument19 pagesKing Abdullah II Irbidعمر رائد مشتهى احمدNo ratings yet

- MTAP Grade1 Division Orals 2007Document2 pagesMTAP Grade1 Division Orals 2007Gwen Palomar Guarino100% (14)

- PGT Computer Science Kendriya Vidyalaya Entrance Exam Question PapersDocument117 pagesPGT Computer Science Kendriya Vidyalaya Entrance Exam Question PapersimshwezNo ratings yet

- 9.algaeDocument5 pages9.algaeMukbsNo ratings yet

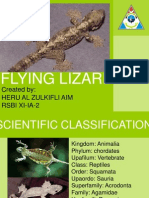

- About Flying LizardDocument11 pagesAbout Flying LizardRiswan Hanafyah HarahapNo ratings yet

- IPSS Draft Handbook 2014Document45 pagesIPSS Draft Handbook 2014soumenhazraNo ratings yet

- 2021 Level L Biology Practical Based QuestionsDocument61 pages2021 Level L Biology Practical Based Questions-Bleh- WalkerNo ratings yet

- Filogenia de Avispas Del Género Netelia (Hymenoptera: Ichneumonidae) Con Énfasis en Las Especies CostarricensesDocument30 pagesFilogenia de Avispas Del Género Netelia (Hymenoptera: Ichneumonidae) Con Énfasis en Las Especies CostarricensesJames Coronado RiveraNo ratings yet

- Chapter-13: Photosynthesis in Higher PlantsDocument8 pagesChapter-13: Photosynthesis in Higher PlantssujushNo ratings yet

- Irrigation SchedulingDocument3 pagesIrrigation SchedulingLuojisi CilNo ratings yet

- Alpaflor Gigawhite 2018Document6 pagesAlpaflor Gigawhite 2018PauletteNo ratings yet

- Systematics Based On Evolutionary Relationships: Taxonomy/Cladistics and PhylogenyDocument3 pagesSystematics Based On Evolutionary Relationships: Taxonomy/Cladistics and PhylogenyPatricia PascualNo ratings yet

- Packed Column Pressure DropDocument1 pagePacked Column Pressure DropdinakaranpatelNo ratings yet

- Orchid Optimisation - of - Encapsulation-DehydratioDocument15 pagesOrchid Optimisation - of - Encapsulation-DehydratiojammesNo ratings yet

- Kenaf and Hemp Identifying The Differences by Thomas A. RymszaDocument5 pagesKenaf and Hemp Identifying The Differences by Thomas A. RymszaSamuel NitisaputraNo ratings yet

- Resolution Approving A Cooperative Purchasing Agreement With West Coast Arborists 09-10-13Document10 pagesResolution Approving A Cooperative Purchasing Agreement With West Coast Arborists 09-10-13L. A. PatersonNo ratings yet

- Zahras Arabian Oud CatalogDocument79 pagesZahras Arabian Oud CatalogZahra GajNo ratings yet

- Rumah Tembakau Yogyakarta: New PricelistDocument7 pagesRumah Tembakau Yogyakarta: New Pricelistgede wasisthaNo ratings yet

- Alley CroppingDocument19 pagesAlley CroppingbalsalchatNo ratings yet