Professional Documents

Culture Documents

Customs Regulations For Greece

Uploaded by

kaeinternational0 ratings0% found this document useful (0 votes)

193 views2 pages- Documents are required to import household goods and vehicles to Greece duty-free, including passports, an inventory of items stamped by the Greek consulate, and a certificate of repatriation or secondary residence.

- Personal effects and household goods are generally duty-free but must be re-exported if the owner leaves Greece permanently or customs duties will be assessed. Vehicles must be owned for at least 6 months to import duty-free.

- Tourists can import vehicles for personal use for up to 6 months but they must be exported or immobilized afterwards. Repatriating individuals can import vehicles and household items duty-free if they have lived abroad for 2+ years and intend to reside

Original Description:

Original Title

Customs Regulations for Greece

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- Documents are required to import household goods and vehicles to Greece duty-free, including passports, an inventory of items stamped by the Greek consulate, and a certificate of repatriation or secondary residence.

- Personal effects and household goods are generally duty-free but must be re-exported if the owner leaves Greece permanently or customs duties will be assessed. Vehicles must be owned for at least 6 months to import duty-free.

- Tourists can import vehicles for personal use for up to 6 months but they must be exported or immobilized afterwards. Repatriating individuals can import vehicles and household items duty-free if they have lived abroad for 2+ years and intend to reside

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

193 views2 pagesCustoms Regulations For Greece

Uploaded by

kaeinternational- Documents are required to import household goods and vehicles to Greece duty-free, including passports, an inventory of items stamped by the Greek consulate, and a certificate of repatriation or secondary residence.

- Personal effects and household goods are generally duty-free but must be re-exported if the owner leaves Greece permanently or customs duties will be assessed. Vehicles must be owned for at least 6 months to import duty-free.

- Tourists can import vehicles for personal use for up to 6 months but they must be exported or immobilized afterwards. Repatriating individuals can import vehicles and household items duty-free if they have lived abroad for 2+ years and intend to reside

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

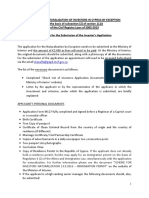

DOCUMENTS REQUIRED

Passport for Customer and spouse (previous passport

if current one is less than two years old)

Inventory, detailed and stamped by Greek Consulate

in country of origin, (must include make, model and

serial number of ALL APPLIANCES, the quality, and

quantity, square feet, and color of any woven floor

covering in the shipment and auto, if any)

Law 1599 Form (Ipefthini dilosi) stating that you will

keep the goods in your possession for at least

one year

Letter from owner of goods authorizing Destination

Agent to clear shipment Repatriating Greeks, persons

with Greek ancestry, persons married to or children

of Greek citizens, Greek Military and foreign

EEC members

Customer must have been abroad for at least

two years

Certificate of Repatriation (allows a Customer to

bring goods into Greece duty-free) Inventory list

Foreigners coming to work

Certificate of Secondary Residence

Housing Contract

CUSTOMS REGULATIONS

CUSTOMER MUST BE IN GREECE AT TIME OF

CUSTOMS CLEARANCE AND HIS PASSPORT MUST

BE PRESENTED

If shipment belongs to GREEK REPATRIATE, OWNER

MUST PERSONALLY ATTEND CLEARANCE

Personal effects and household goods are generally

duty-free

ALL ITEMS brought in must be re-exported,

or customs duty will be assessed when leaving

For foreigners coming to work in Greece, VAT

(Value Added Tax) is payable on all goods

DUTIABLE/RESTRICTED ITEMS

Only one of each appliance allowed advise make

and serial number on inventory

Office equipment such as facsimile, photocopies and

telephone systems are dutiable

PROHIBITED ITEMS

Alcohol and tobacco

products

Matches

Firearms

Drugs and medicines

Playing cards

MOTOR VEHICLES

Must be in owners possession for at least six months

Restrictions apply to vehicles with diesel engines

Duties vary according to make, model and length of

time car owned

Documents required:

Consular Certificate from origin

Must be listed on household goods inventory

Registration plates and vehicle road license

showing that the appropriate road tax has been

paid in the country of origin

Drivers Licence

Customs Duties For Vehicles and

Household Goods

Note: This information has been obtained from Greek

Customs Authorities and the Ministry of Finance, and

is accurate as of April 1999. However, if you plan

to bring property into Greece duty-free, you should

obtain current information directly from the Greek

Consulates in the area of your residence, or by the

Greek Customs Office (DIPEA) Akti Kondili 32, Pirae-

us, tel. 210 4623-615 & 210 462-7705; or through the

18th General Directorate of Customs, of the Greek

Ministry of Finance, 40 Amalias Street, 105 58 Athens,

tel. 210 324-5552/5587, fax 210-324-5593,

website: www.gsis.gr.

Please be careful to comply with customs regulations:

violations can result in fines or confiscation of the

items involved.

Importation of a Car by Tourists

A tourist in Greece is allowed to import into the coun-

try duty free a vehicle intended only for his/her per-

sonal use for the period of his/her visit. This provision

applies only to those who meet the Greek definition of

a tourist: persons arriving in Greece who have their

habitual residence abroad and stay abroad at least 185

days in a period of twelve months.

A tourist may not engage in any work while

in Greece. The vehicle of such a tourist can be driven in

Greece for a maximum of six months in one year. Subse-

quently, the car must be either taken out of the

country or be immobilized, (sealed by Greek Customs

Authorities and stored in a designated parking facility

or at a place designated by the vehicles owner).

It is not necessary for the vehicle to circulate for six con-

secutive months. Every time the owner departs Greece,

the vehicle must be sealed. To circulate again after six

months the cars owner must prove that he/she was

abroad for those six months.

The spouse, parents, and children of the importer may

use the vehicle, provided they are also tourists as de-

fined above. The vehicle cannot be transferred, leased,

loaned, or donated in any other manner. Use of the

vehicle other than the private use of the owner and the

members of his/her immediate family will result in fines

from approximately 800 euro to the full duties and tax

for the vehicle.

If the vehicle does not leave the country or remains

immobilized for over six months, its owner will be

asked to pay a fine for over the legal limit. The Customs

Authorities may seize the car if the legal limit has been

exceeded by one year.

Those who use the special provisions of Customs regula-

tions to import their household items at duty-free or

reduced Customs duty rates when they repatriate

to Greece (see below) are not permitted to import a

vehicle under tourist status until three years after

the date of their original repatriation. At that time,

the importer will have to provide proof that he/she has

established a permanent residence elsewhere and is a

true tourist in Greece.

Importation of Vehicles and Household

Effects for Permanent Residence

Persons who are taking up permanent legal residence in

Greece (repatriating) may be allowed to import their

vehicle and household effects without payment of Cus-

toms duty. This special provision of Greek law can apply

to someone only if he/she is granted a residence per-

mit before arriving in Greece. In general, such permit is

granted only to those who are of Greek descent, are

married to Greek citizens, or are also being granted

work permits. (A Greek citizen may also be allowed to

use this provision of law if he/she is moving back

to Greece after having been legally residing outside of

Greece.) The studies at a University or another faculty

of a country do not mean that the person has his/her

usual residence in this country. In any case, the person

wishing to import the items must contact the nearest

Greek consulate in his/her country of residence,

providing a list of all the items and proof of foreign

residence; the Greek Consulate will provide the certifi-

cate required for duty-free import.

A vehicle imported under this provision must have

been owned by the person settling in Greece for at

least six months immediately prior to his/her move to

Greece. New vehicles are subject to VAT. All vehicles

are subject to the normal fees for license plates (circu-

lation fees).

A vehicle brought into Greece duty-free cannot be

sold or transferred for one year after customs clear-

ance. In the event that the beneficiary wishes

to sell the household effects and the vehicle(s), before

the restrictive year lapses, he must pay the duties that

a relief was granted on top of the dues for overdue

payment form the time of the import. After the

restrictive year the beneficiary, with the approval of

the Customs Authority, may sell the vehicle, provided

that a percentage of the registration duties is paid

depending on the time that has lapsed from the date

the vehicle was imported. During the annual restric-

tive period vehicles may be driven, apart from the

beneficiary, by his/her spouse or single children. If the

beneficiary is single, then his/her parents and single

brothers and sisters are allowed to drive the vehicle.

Persons who wish to transfer their usual residence

in Greece, in order to enjoy reduced taxation on the

imported items, need to produce to the customs au-

thorities a certificate (Pistopiitiko metoikesias), issued

by the competent Greek consulate in the area of their

residence abroad.

You might also like

- Uruguay: Goods Documents Required Customs Prescriptions RemarksDocument9 pagesUruguay: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: United KingdomDocument6 pagesGoods Documents Required Customs Prescriptions Remarks: United KingdomKelz YouknowmynameNo ratings yet

- BelgiumDocument4 pagesBelgiumKelz YouknowmynameNo ratings yet

- FranceDocument3 pagesFranceKelz YouknowmynameNo ratings yet

- HungaryDocument6 pagesHungaryKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: IrelandDocument4 pagesGoods Documents Required Customs Prescriptions Remarks: IrelandKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions RemarksDocument8 pagesGoods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- UgandaDocument2 pagesUgandaKelz YouknowmynameNo ratings yet

- MozambiqueDocument1 pageMozambiqueKelz YouknowmynameNo ratings yet

- NetherlandsDocument3 pagesNetherlandsKelz YouknowmynameNo ratings yet

- Export VehiclesDocument1 pageExport VehiclesAM STARTNo ratings yet

- Custom Regulations For CzechDocument6 pagesCustom Regulations For CzechkaeinternationalNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: MartiniqueDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: MartiniqueKelz YouknowmynameNo ratings yet

- GhanaDocument2 pagesGhanaKelz YouknowmynameNo ratings yet

- Carnet de Passage InformationDocument2 pagesCarnet de Passage InformationTudor PosaNo ratings yet

- Car Importation RequirementsDocument6 pagesCar Importation Requirementsbfac2024No ratings yet

- Goods Documents Required Customs Prescriptions Remarks: VenezuelaDocument4 pagesGoods Documents Required Customs Prescriptions Remarks: VenezuelaKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: AustriaDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: AustriaKelz YouknowmynameNo ratings yet

- BulgariaDocument3 pagesBulgariaKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: EgyptDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: EgyptKelz Youknowmyname0% (1)

- Thailand: Goods Documents Required Customs Prescriptions RemarksDocument5 pagesThailand: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Import DocumentDocument11 pagesImport DocumentChristopher BrowningNo ratings yet

- Vietnam: Goods Documents Required Customs Prescriptions RemarksDocument6 pagesVietnam: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Import Export Document &export Order ProcessDocument14 pagesImport Export Document &export Order ProcessbhawiimNo ratings yet

- Ecuador PDFDocument4 pagesEcuador PDFAndy HidalgoNo ratings yet

- Goods Documents Required Customs Prescriptions: JordanDocument4 pagesGoods Documents Required Customs Prescriptions: JordanKelz YouknowmynameNo ratings yet

- GuineaDocument1 pageGuineaKelz YouknowmynameNo ratings yet

- NigeriaDocument4 pagesNigeriaKelz YouknowmynameNo ratings yet

- Malta Car Registration GuidelinesDocument38 pagesMalta Car Registration GuidelinesaquaristNo ratings yet

- TourismDocument2 pagesTourismOkky HartonoNo ratings yet

- NamibiaDocument3 pagesNamibiaKelz YouknowmynameNo ratings yet

- Clearing Vehicles Through Swiss CustomsDocument5 pagesClearing Vehicles Through Swiss CustomsLeonardo L. ImpettNo ratings yet

- Coffee Importers in KoreaDocument22 pagesCoffee Importers in KoreazmahfudzNo ratings yet

- SVG ConcessionDocument16 pagesSVG ConcessionShanica Paul-RichardsNo ratings yet

- List of Documents RequiredDocument2 pagesList of Documents Requiredrock_worldNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: TunisiaDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: TunisiaKelz YouknowmynameNo ratings yet

- List of Documents PDFDocument4 pagesList of Documents PDFMohamed NabilNo ratings yet

- FinlandDocument5 pagesFinlandKelz YouknowmynameNo ratings yet

- FXD 07 1998Document32 pagesFXD 07 1998Habtom MeresssaNo ratings yet

- Process of Export of New or Used Vehicles From RSADocument7 pagesProcess of Export of New or Used Vehicles From RSAmarshy bindaNo ratings yet

- Trinidad & TobagoDocument3 pagesTrinidad & TobagoKelz YouknowmynameNo ratings yet

- SCHENGEN ChecklistDocument3 pagesSCHENGEN Checklistharshavardhan210No ratings yet

- GermanyDocument4 pagesGermanyKelz YouknowmynameNo ratings yet

- Import Procedures & DocumentationDocument20 pagesImport Procedures & DocumentationM HarikrishnanNo ratings yet

- List of Mandatory Documents: Document Checklist For Tourism VisaDocument2 pagesList of Mandatory Documents: Document Checklist For Tourism VisaGulf Steel SalamNo ratings yet

- Cyprus-Guidelines Investor Citizenship ApplicationDocument4 pagesCyprus-Guidelines Investor Citizenship ApplicationVictor JR. AustriaNo ratings yet

- Ethiopia-Country-Guide-IAM PetDocument4 pagesEthiopia-Country-Guide-IAM PetMastika GebrehiewotNo ratings yet

- DS 182-2013-EF - Equipaje de Mano y Menaje de Casa - Versión en InglésDocument12 pagesDS 182-2013-EF - Equipaje de Mano y Menaje de Casa - Versión en Ingléslima2OI5No ratings yet

- Switzerland: Goods Documents Required Customs Prescriptions RemarksDocument4 pagesSwitzerland: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Visa InformationDocument3 pagesVisa InformationA Different HistoryNo ratings yet

- JamaicaDocument3 pagesJamaicaKelz YouknowmynameNo ratings yet

- Customs ValuationDocument22 pagesCustoms ValuationRochelle Ann SamsonNo ratings yet

- Shipping BillDocument2 pagesShipping Billjehangir0000100% (6)

- Thailand Customs Information Foreign Citizens: Documents RequiredDocument4 pagesThailand Customs Information Foreign Citizens: Documents RequiredsnowgardNo ratings yet

- Customs GuideDocument8 pagesCustoms Guidejose300No ratings yet

- Oman (Sultanate) : Goods Documents Required Customs Prescriptions RemarksDocument4 pagesOman (Sultanate) : Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- The immigration offices and statistics from 1857 to 1903From EverandThe immigration offices and statistics from 1857 to 1903No ratings yet

- Custom Regulations For CzechDocument6 pagesCustom Regulations For CzechkaeinternationalNo ratings yet

- Origin Performance ReportDocument1 pageOrigin Performance ReportkaeinternationalNo ratings yet

- Destination Performance ReportDocument1 pageDestination Performance ReportkaeinternationalNo ratings yet

- Banking DetailsDocument1 pageBanking DetailskaeinternationalNo ratings yet

- Motorbike Condition ReportDocument1 pageMotorbike Condition ReportkaeinternationalNo ratings yet

- Vehicle Condition ReportDocument1 pageVehicle Condition ReportkaeinternationalNo ratings yet

- WDD Study D-FineDocument12 pagesWDD Study D-FineuiprailNo ratings yet

- Unit+1 +Highway+&+Railroad+Engineering+PDFDocument167 pagesUnit+1 +Highway+&+Railroad+Engineering+PDFDexter SerranoNo ratings yet

- Trucker Ghost Stories and Other True Tales of Haunted Highways, Weird Encounters, and Legends of The RoadDocument12 pagesTrucker Ghost Stories and Other True Tales of Haunted Highways, Weird Encounters, and Legends of The RoadMacmillan Publishers25% (4)

- Excavations OSHA Competent Person Course 2Document17 pagesExcavations OSHA Competent Person Course 2MelchezadekNo ratings yet

- The PedestrianDocument4 pagesThe PedestrianVanessa ContenteNo ratings yet

- P94-6145 ManualDocument28 pagesP94-6145 Manualmeinit100% (2)

- Part 2-Drainage Design ManualDocument138 pagesPart 2-Drainage Design Manualkimt100% (8)

- Kapalaran Bus Line Vs CoronadoDocument1 pageKapalaran Bus Line Vs CoronadoDarby MarNo ratings yet

- 上外全新版大学英语综合教程讲义Document6 pages上外全新版大学英语综合教程讲义贺冬梅No ratings yet

- Technical Standards For The MRT in Bangladesh December 2014Document102 pagesTechnical Standards For The MRT in Bangladesh December 2014siddharth gautamNo ratings yet

- Parking Permit Form 2019-2020Document2 pagesParking Permit Form 2019-2020api-372319899No ratings yet

- DaraitanDocument4 pagesDaraitanLeida Kristin A. GardeNo ratings yet

- Traffic Management Plan (TMP) - CW-04Document31 pagesTraffic Management Plan (TMP) - CW-04Hossain RakibNo ratings yet

- Lifelinesofnationaleconomy PPT (1) - 1Document55 pagesLifelinesofnationaleconomy PPT (1) - 1Rishi SrivastavaNo ratings yet

- Pci Leasing v. Ucpb General Insurance Co.Document3 pagesPci Leasing v. Ucpb General Insurance Co.Iris GallardoNo ratings yet

- Peugeot 3008Document566 pagesPeugeot 3008Lập Nguyễn Tấn100% (1)

- Break DownDocument5 pagesBreak DownFührer Magdi BadranNo ratings yet

- Richa Novidades 2017Document39 pagesRicha Novidades 2017fernando_mart859243No ratings yet

- Vin WmiDocument17 pagesVin WmirahulNo ratings yet

- Highway Engineering Chapter 1-4Document59 pagesHighway Engineering Chapter 1-4Ibrahim AbdiNo ratings yet

- Introduction To Pothole Repair Using AnyWay's Natural Soil Stabilizer ANSS - NewDocument10 pagesIntroduction To Pothole Repair Using AnyWay's Natural Soil Stabilizer ANSS - NewKou Simorn100% (1)

- NPWD Sor 2010Document269 pagesNPWD Sor 2010jaxen101No ratings yet

- Method Statement Wet Mix Macadam PatelDocument2 pagesMethod Statement Wet Mix Macadam Patelp.v.n. lakshman0% (1)

- New Summary Earth WorkDocument30 pagesNew Summary Earth WorkRajaImranNo ratings yet

- Infrastructure SectorDocument42 pagesInfrastructure SectorMadge Ford100% (1)

- North Shore Master PlanDocument1 pageNorth Shore Master PlanAndrewBrownNo ratings yet

- Channel PromotionDocument27 pagesChannel PromotionSrinivas Reddy PalugullaNo ratings yet

- Surat (: Gujarati Indian State Gujarat Surat DistrictDocument17 pagesSurat (: Gujarati Indian State Gujarat Surat DistrictrenjurajuNo ratings yet

- MAP READING 1 2019 (Part 1)Document21 pagesMAP READING 1 2019 (Part 1)Nagaveni ANo ratings yet

- Jimny-Brochure 4 PDFDocument12 pagesJimny-Brochure 4 PDFNargo Malingo100% (1)