Professional Documents

Culture Documents

MEBE-Case1 (AggregateDemand)

Uploaded by

Dipesh TekchandaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MEBE-Case1 (AggregateDemand)

Uploaded by

Dipesh TekchandaniCopyright:

Available Formats

Case-1: Dynamics of Aggregate Demand in India

Reserve Bank of India undertook first quarterly review of monetary policy for 2012-13. It also publis ed its assessment of !"acroeconomic and "onetary #evelopments$ in t e % t quarter of fiscal 2012-13 alon& wit t e quarterly review. 'tatus of a&&re&ate demand as been presented in a separate section of t e report. ()tracts are reproduced ere.

Aggregate demand continued to remain weak

* e e)penditure-side +#, indicates t at t e a&&re&ate demand of t e Indian economy durin& -% of 2012-13 remained slack .*able 1/. ,rivate final consumption e)penditure0 w ic is t e principal component of +#, at market prices0 continued to decelerate durin& t e quarter on t e back of weak a&ricultural production and persistent i& consumer price inflation. (ven so0 it remains t e lar&est contributor to &rowt in a&&re&ate demand .*able 2/. * e &rowt rate of &overnment final consumption e)penditure also moderated durin& -%0 reflectin& fiscal consolidation efforts. (ven t ou& t e &rowt rate of fi)ed investment durin& -% of 2012-13 was sli& tly i& er t an in t e correspondin& quarter of t e previous year0 a&&re&ate fi)ed investment in t e full year decelerated furt er.

Initiatives have started addressing infrastructure bottlenecks, although progress is slow

Infrastructure bottlenecks ave been a ma1or factor in India$s low &rowt . ,ro1ect implementations are &ettin& delayed due to delays in land acquisition0 forest2environment clearances0 insur&ency problems in minin& belts0 &eolo&ical surprises0 contractual issues0 etc. 3s on "ay 10 20130 nearly alf of 455 central sector pro1ects .of Rs.1.4 billion and above/ &ot delayed due to t ese problems0 for w ic cost overruns are estimated to be around 16.2 per cent. *o address t ese issues0 t e &overnment as taken several initiatives. 7or speedy clearance of pro1ects0 in addition to t e 8abinet 8ommittee on Infrastructure .88I/0 a ,ro1ect "onitorin& +roup .,"+/ as been set up by t e ,rime "inister$s 9ffice .,"9/ wit t e ob1ective of resolvin& urdles facin& me&a pro1ects .above Rs. 10 billion/. In t e power sector0 t e &overnment as initiated several measures0 suc as renovation and moderni:ation of old power plants0 improvement of coal and &as supplies0 and &reater emp asis on power &eneration from renewable sources. * e &overnment as also set up a committee .under t e c airmans ip of #r. ;i1ay <elkar/ to prepare a road map to en ance domestic production of oil = &as. >it re&ard to road pro1ects0 t e response to t e ,,, mode of road buildin& remained poor. 'everal pro1ects ave not elicited bids. * e developers ave been facin& a severe s orta&e of equity and0 consequently0 are unable to raise t e required debt. * e &overnment as decided to adopt t e (n&ineerin&0 ,rocurement and 8onstruction .(,8/ mode for national i& ways w ic are not viable on a ,,, basis. ?owever0 t e 8abinet 8ommittee on (conomic 3ffair$s .88(3/ decisions in @une 2013 to facilitate armonious substitution of concessionaire in on&oin& and completed Aational ?i& way pro1ects and insulatin& t e Aational ?i& way 3ut ority of India .A?3I/ from eavy financial claims and unnecessary disputes are likely to e)pedite t e implementation of road pro1ects. >it t e cancellation of 2+ licenses in 7ebruary 20120 t e telecommunications sector as been stru&&lin&0 wit a noticeable decline in investor interest. ?owever0 investor interest is e)pected to improve once t e recent decision by t e *elecom 8ommission approvin& 100 per cent 7#I in t e sector &ets ratified. Corporate investment intentions remain subdued 8orporate investment intentions remain subdued. 3dditionally0 some of t e institutionally assisted pro1ects w ic received sanction in 2010-11 and 2011-12 ave been cancelled. * e a&&re&ate pro1ect cost envisa&ed from new pro1ects for w ic assistance was sanctioned by ma1or banks27Is0 a&&re&ated Rs. 2.0 trillion in 2012-13 and remained almost at t e same level as t at of t e previous year .Rs.1.B trillion/ but si&nificantly below t at in

1

2010-11 .Rs. 3.6 trillion/. 3n industry-wise analysis revealed t at durin& -% of 2012-130 t e s are of envisa&ed e)penditure on new pro1ects is t e i& est in t e metal = metal products sector .45.0 per cent/0 followed by t e power industry .30.0 per cent/. Sales growth remained sluggish during Q4 of 20 2! " 'ales &rowt for listed Aon-+overnment Aon-7inancial .A+A7/ companies decelerated furt er in -% of 2012-13 to %.1 per cent .*able 3/. * e decline in sales was more distinct in t e case of motor ve icles0 electricity &eneration and supply0 iron = steel and real estate. In tandem wit t e slow &rowt in sales0 net profits went down in -% of 2012-13 due to i& er employee e)penses and lower support from ot er income. 'equentially .q-o-q/0 owever0 net profit recorded an improvement in -% .*able %/. 7urt er0 profitability in terms of (BI*#3 and (BI* mar&ins improved mar&inally in -% in comparison wit t e previous quarter. * e net profit mar&in0 owever0 recorded a mar&inal decline. Inventory accumulation .as reflected in c an&e in stock-in-trade to sales ratio/0 w ic went up in -2 of 2012-130 as reverted to earlier levels. (arly results for -1 of 2013-1% su&&est t at sales &rowt as decelerated furt er.

Corporate leverage has increased graduall# * e levera&e of t e corporate sector at t e a&&re&ate level0 as measured by t e total borrowin& to equity ratio0 increased in 2011-120 reversin& a &radual and declinin& trend in t e previous two years. Based on t e available annual results of 521 non&overnment non-financial public limited companies0 levera&e is observed to ave increased furt er in 2012-13.

$iscal consolidation resumed during 20 2! " mainl# through e%penditure cutbacks

* e central &overnment restricted its &ross fiscal deficit .+7#/ to %.B per cent of +#, durin& 2012-130 less t an t e bud&et estimate of 4.1 per cent. * e containment in +7#0 despite lower ta) and non-ta) revenues0 was ac ieved mainly t rou& a cutback in plan e)penditure. Aon-plan e)penditure0 on t e ot er and0 was i& er due to a s arp increase in e)penditure on t e revenue account. 'ubsidies on food0 fertili:ers and petroleum accounted for 2.4 per cent of +#, as a&ainst t e 1.6 per cent t at ad been bud&eted for t e year. 9verall0 t e revenue e)penditure as a proportion of +#, was lower t an t e bud&et estimate by 0.3 percenta&e points0 alt ou& it could not offset t e s ortfall in revenue receipts0 w ic resulted in a i& er revenue deficit.

&a% collection remains weak during 20 "! 4 so far

#urin& 3pril-"ay 20130 key deficits of t e 8entre as percenta&es to bud&et estimates were i& er t an in t e correspondin& period of last year. * e widenin& of t e revenue deficit and i& er capital e)penditure resulted in a i& er &ross fiscal deficit durin& 3pril-"ay 2013 t an a year a&o. * e revenue deficit as a percenta&e to bud&et estimate durin& 3pril-"ay 2013 was i& er due to bot i& er revenue e)penditure and lower ta) revenues. +ross ta) revenue in absolute terms declined mainly due to a decline in revenues from corporation ta) and union e)cise duties. * e collection of income ta) and service ta) as percenta&es to bud&et estimates were also lower t an a year a&o. *otal e)penditure0 as a percenta&e of t e bud&et estimate in t e first two mont s .3pril-"ay/ of 2013-1%0 was i& er t an a year a&o0 mainly due to i& er plan and capital e)penditure0 w ic re&istered &rowt rates of 42.5 per cent and %6.B per cent0 respectively0 over 3pril-"ay 2012. 9n t e ot er and0 despite i& er payments of subsidies0 non-plan e)penditure in t e revenue account was lower t an in t e correspondin& period of t e previous year. If t e &overnment$s revenues fall s ort of t e tar&et due to slowdown in &rowt 0 a cutback in e)penditure will be required to ac ieve t e bud&eted fiscal deficit. It is0 t erefore0 important to contain subsidies and reprioriti:e e)penditure towards plan and capital e)penditures0 t ereby en ancin& t e &rowt prospects of t e economy.

2

State finances e%pected to remain on the consolidation track #espite an increase in t e consolidated +7#-+#, ratio in 2012-13 .R(/0 over t e previous year0 t e +7#-+#, ratio was wit in t e tar&et set by t e * irteent 7inance 8ommission. * e revenue account at t e consolidated level recorded a surplus in 2012-13 .R(/0 albeit lower t an bud&eted. * e consolidated position of t e state &overnments for 2013-1% is bud&eted to s ow an increase in t e revenue surplus-+#, ratio and a mar&inal improvement in t e +7#-+#, ratio. * e surplus in revenue account would be ac ieved by a reduction in t e revenue e)penditure-+#, ratio0 w ile t e revenue receipts-+#, ratio is bud&eted to remain unc an&ed from t e previous year$s level. * e e)penditure pattern of t e states s ows t at w ile t e development e)penditure-+#, ratio is bud&eted to decline0 t e non-development e)penditure-+#, ratio is bud&eted to increase mar&inally durin& 2013-1%. ?owever0 t e capital outlay-+#, ratio is bud&eted to be i& er in 2013-1% t an in 2012-13 .R(/. Combined government finances budgeted to improve in 20 "! 4 #ata on combined finances s ow t at t e revenue deficit and fiscal deficit as ratios to +#, in 2012-13 .R(/ were lower by 0.5 percenta&e points and 0.2 percenta&e points0 respectively0 over t e previous year. * e decline in t e combined +7#-+#, ratio was entirely on account of t e lower fiscal deficit of t e 8entre. In 2013-1%0 t e combined fiscal position is bud&eted to improve furt er on account of fiscal plans of bot t e 8entre and t e states.

'eed to keep the momentum of the fiscal consolidation and increase government investment in productive sectors

* e &overnment$s fiscal consolidation process as contributed to improvin& t e state of public finances in India at a critical 1uncture. * e low collection of bot ta) and non-ta) revenue durin& 2012-13 complicated t e task of reducin& fiscal imbalances. * us0 t e containment of +7# in 2012-13 was brou& t about by e)penditure compression on plan revenue account and also plan and non-plan capital account. * e cuts in union &overnment$s capital e)penditure were undertaken at a time w en private investment ad already decelerated. * is raised concerns about t e quality of fiscal consolidation. It is0 t erefore0 important for t e 8entre to take steps to contain its nonplan revenue e)penditure wit in t e limit set in t e Cnion Bud&et 2013-1% t rou& subsidy reforms. 'tayin& on t e pat of fiscal consolidation in t e current year0 owever0 remains c allen&in&. "oderation in a&&re&ate demand poses risks to bud&etary pro1ections for revenue. * e recent e)c an&e rate depreciation as compounded t e problems in restrainin& subsidies. 3t t e present 1uncture0 it is important t at t e &overnment restrains its subsidy commitments0 strikes a 1udicious balance under its various bud&etary eads by increasin& investment in t e productive sectors so as to crowd-in private investments. *a) reforms also need to be e)pedited to improve t e ta)2+#, ratio.

Conclusion

3&&re&ate demand0 as reflected on t e e)penditure side of +#,0 remained slu&&is durin& -% of 2012-13. 3part from investment0 private consumption decelerated0 addin& to t e dra& on demand durin& 2012-13. #epressed private consumption0 to a lar&e part0 as been t e result of i& consumer price inflation. 8orporate investment intentions also remained lan&uid0 reflectin& t e overall ne&ative business sentiment arisin& from slack cyclical conditions and structural factors. 8orporate sales decelerated durin& -% of 2012-130 w ile earnin&s contracted. * is0 in turn0 may ave an adverse impact on new investment. In t is situation0 t e key to turnin& around t e economy will be re-balancin& &overnment spendin& from current to capital e)penditures wit a view to !crowdin&-in$ private investment.

Table 1: Expenditure Side GD !"##$-#% prices&

3

.,er cent/ Item 2011-12D 2012-13E -1 Gro't( )ates +#, at market prices *otal 8onsumption ()penditure .i/ ,rivate .ii/ +overnment +ross 7i)ed 8apital 7ormation 8 an&e in 'tocks ;aluables Aet ()ports 5.3 6.1 6.0 6.5 %.% -30.5 5.5 -%2.4 3.2 3.B %.0 3.B 1.F F3.% -12.0 -1F.3 6.3 5.B 5.5 6.% 13.B -2F.4 15.1 -1%.6 5.% F.0 5.3 10.F 3.6 -30.% -13.3 -1F.F 4.6 B.0 B.2 6.1 -1.F -32.0 6.% -62.1 4.2 B.3 B.F F.5 2.5 -32.% 15.0 -63.3 3.% %.F %.3 F.2 -2.2 5B.6 -20.B -5.F 2.4 %.0 3.4 5.B 1.1 F1.F %.3 -21.% %.1 3.6 %.2 2.2 %.4 F4.6 -5.B -23.F 3.0 3.3 3.6 0.5 3.% F5.0 -20.2 -15.% 2011-12 -2 -3 -% -1 2012-13 -2 -3 -%

)elati*e s(ares

*otal 8onsumption ()penditure .i/ ,rivate .ii/ +overnment +ross 7i)ed 8apital 7ormation 8 an&e in 'tocks ;aluables Aet ()ports

F0.4 4B.2 11.3 33.F 2.3 2.% -6.6

F1.0 4B.5 11.3 33.2 3.6 2.0 -10.0

F1.2 50.5 10.5 34.F 2.% 2.6 -B.3

F1.6 51.2 10.4 34.1 2.% 2.1 -B.3

F3.F 51.% 12.3 31.6 2.2 2.2 -B.4

54.F 4%.3 11.4 32.4 2.2 2.3 -F.%

F2.1 51.1 11.0 33.6 3.B 2.1 -B.5

F2.6 51.6 11.0 3%.5 %.0 2.2 -11.0

F3.4 51.% 12.1 32.0 3.F 2.0 -11.3

54.B 4%.F 11.2 32.5 3.6 1.6 -6.%

GD at mar+et prices !)s, %-.1$ %/1.0 billion& 1 2irst re*ised estimates3 4 ro*isional Estimates

1."%"

1."#0

1$$0.

1%./"

1.0#"

1.%.-

1%#-"

1%/. -

Table ": Contribution-5eig(ted Gro't( )ates of Expenditure-Side GD !"##$-#% rices&6

.,er cent/ Item -1 1. ,rivate 7inal 8onsumption ()penditure 2. +overnment 7inal 8onsumption ()penditure 3. +ross 7i)ed 8apital 7ormation %. 8 an&e in 'tocks 4. ;aluables 5. Aet ()ports .i/ ()ports .ii/ Imports F. 'um .1 to 5/ 6. #iscrepancies B. +#, at "arket ,rices %.1 0.B %.F -1.0 0.% -1.3 %.3 4.5 F.6 0.4 6.3 2011-12 -2 3.B 1.1 1.% -1.1 -0.3 -1.4 %.3 4.6 3.% 3.0 5.% -3 4.% 1.0 -0.5 -1.1 0.2 -%.5 2.% 5.B 0.% 4.% 4.6 -% 4.0 0.B 0.B -1.1 0.3 -3.5 3.1 5.5 2.% 2.F 4.2 -1 2.5 0.6 -0.6 1.F -0.5 -0.5 3.0 3.5 3.0 0.% 3.% 2012-13 -2 2.2 0.F 0.% 1.F 0.1 -2.0 1.2 3.2 3.1 -0.5 2.4 -3 2.5 0.3 1.% 1.F -0.2 -2.3 -0.B 1.% 3.4 0.5 %.1 -% 2.1 0.1 1.1 1.F -0.4 -1.2 -0.2 1.1 3.2 -0.3 3.0

GH 8ontribution-wei& ted &rowt rate of a component of e)penditure-side +#, is obtained as followsH .I-o-y c an&e in t e component J I-o-y c an&e in +#, at constant market prices/ K I-o-y &rowt rate of +#, at constant market prices.

Table .: erformance of 7on-Go*ernment 7on-2inancial Companies

.,er cent/ -% of 2011-12

7o, of companies 'ales ;alue of ,roduction ()penditure0 of which Raw "aterials 'taff 8ost ,ower = 7uel 9peratin& ,rofits .(BI*#3/ 9t er IncomeG #epreciation +ross ,rofits .(BI*/ Interest *a) ,rovision Aet ,rofits .wit out A9,/ Aet ,rofits 8 an&e in stock to 'ales E Interest Burden (BI*#3 to 'ales (BI* to 'ales Aet ,rofit to 'ales 14.5 1%.1 15.F 15.F 1%.3 30.5 -0.F %B.% 10.F %.0 %0.2 1.2 -5.F -5.% 0.B 25.5 13.3 12.5 F.1

-1 of 2012-13

-2 of 2012-13

-3 of 2012-13

-% of 201213

"$18 Gro't( )ates !y-o-y& 1%.0 11.F 13.% 12.% 15.% 13.5 1F.F 25.2 -3.% 26.% 10.% -2.4 36.% -3.% -16.4 -B.F 0.6 32.4 12.B 11.5 5.1 12.5 1%.5 14.3 20.B 11.3 %B.2 10.1 16.B 11.3 11.0 25.2 23.1 Select )atios 1.% 2F.2 13.2 12.6 F.1

B.% 6.1 6.2 B.3 13.1 11.0 F.B 0.3 10.3 4.5 1F.1 4.1 -0.F 2%.3 0.6 33.1 12.5 11.3 4.6

%.1 %.0 %.F 2.5 13.4 3.4 -0.2 -1.% 6.% -2.F 11.1 -2.F -B.2 -14.4 0.B 30.4 12.F 11.6 4.F

EH 7or companies reportin& t is item e)plicitly GH 9t er income e)cludes e)traordinary income2e)penditure if reported e)plicitly

Table $: erformance of 7on-Go*ernment 7on-2inancial Companies !Se9uential Gro't(&

.--o--L per cent/

Indicator 2011-12 ;$ 'ales ;alue of ,roduction ()penditure0 of which Raw "aterials 'taff 8ost ,ower = fuel 9peratin& ,rofits .(BI*#3/ 9t er IncomeGG #epreciation +ross ,rofits .(BI*/ InterestG *a) ,rovision Aet ,rofits GH 'ome companies report on net basis B.4 6.% F.F 10.0 2.1 3.% 13.F 30.3 5.2 1B.2 F.5 14.3 42.0 ;1 -%.4 -%.5 -%.2 -5.1 5.0 B.F -F.3 -22.5 -1.F -12.1 F.3 -0.B -1F.6 ;" 0.F 1.2 0.B 1.B 3.% -3.2 3.% %1.1 1.6 11.0 -F.1 3.% 1F.0 7umber of Companies: ":$18 2012-13 ;. 3.6 3.2 3.B 3.6 1.3 0.1 -0.B -2F.B 3.F -6.F 10.B -11.0 -14.0 ;$ %.% %.% %.% 3.0 2.% -2.% %.B 23.2 3.1 B.0 0.F 5.4 3.1

GGH 9t er income e)cludes e)traordinary income2e)penditure0 if reported e)plicitly

;uestions for discussion 1. > at were t e key reasons of slowdown in a&&re&ate demand in India durin& t e %t quarter of t e year 2012-13M 2. ?ow did it impact t e businessM 3. ?ow will increase in &overnment e)penditure on infrastructure boost t e a&&re&ate demand and ence t e +#,M

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- MitsubishiDocument2 pagesMitsubishiDipesh TekchandaniNo ratings yet

- About Mirus SolutionsDocument7 pagesAbout Mirus SolutionsDipesh TekchandaniNo ratings yet

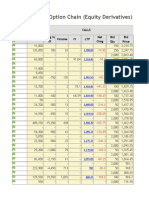

- Option Chain (Equity Derivatives) : Calls Chart OI CHNG in OI IV LTP Net CHNGDocument9 pagesOption Chain (Equity Derivatives) : Calls Chart OI CHNG in OI IV LTP Net CHNGDipesh TekchandaniNo ratings yet

- Certificate of Guidance: Project GuideDocument81 pagesCertificate of Guidance: Project GuideDipesh TekchandaniNo ratings yet

- DipeshDocument13 pagesDipeshDipesh TekchandaniNo ratings yet

- Registration Form: Jaipuria Institute of Management, IndoreDocument2 pagesRegistration Form: Jaipuria Institute of Management, IndoreDipesh TekchandaniNo ratings yet

- Small Miscellaneous Lllustrations Doc.0001Document15 pagesSmall Miscellaneous Lllustrations Doc.0001Dipesh TekchandaniNo ratings yet

- Macrofinaljuly 14Document46 pagesMacrofinaljuly 14Sumit SimlaiNo ratings yet

- .In Rdocs Publications PDFs 78902Document16 pages.In Rdocs Publications PDFs 78902Dipesh TekchandaniNo ratings yet

- Data Can Be "Distributed" (Spread Out) in Different Ways: More On The RightDocument5 pagesData Can Be "Distributed" (Spread Out) in Different Ways: More On The RightDipesh TekchandaniNo ratings yet

- 5 Important Concepts of Budgetary Deficit Is As FollowsDocument9 pages5 Important Concepts of Budgetary Deficit Is As FollowsDipesh TekchandaniNo ratings yet

- BBA-302 Business Policy & Strategy (I. P.University)Document39 pagesBBA-302 Business Policy & Strategy (I. P.University)Dipesh TekchandaniNo ratings yet

- The External Environment: by Prof. Pradip K. MukherjeeDocument33 pagesThe External Environment: by Prof. Pradip K. MukherjeeDipesh TekchandaniNo ratings yet

- Whole QuizDocument96 pagesWhole QuizDipesh TekchandaniNo ratings yet

- Competitive Advertising: by Dipesh TekchandaniDocument28 pagesCompetitive Advertising: by Dipesh TekchandaniDipesh Tekchandani100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- G12 Pol Sci Syllabus FinalDocument8 pagesG12 Pol Sci Syllabus FinalChrisjohn MatchaconNo ratings yet

- Sales Agency and Credit Transactions 1Document144 pagesSales Agency and Credit Transactions 1Shaneen AdorableNo ratings yet

- DR Sebit Mustafa, PHDDocument9 pagesDR Sebit Mustafa, PHDSebit MustafaNo ratings yet

- Safe Work Method Statement TemplateDocument5 pagesSafe Work Method Statement Templatebmb00No ratings yet

- Thesis On Performance Appraisal SystemDocument8 pagesThesis On Performance Appraisal Systemydpsvbgld100% (2)

- Cost-Effective Sustainable Design & ConstructionDocument6 pagesCost-Effective Sustainable Design & ConstructionKeith Parker100% (2)

- AbramelinDocument340 pagesAbramelinMarvin BurenNo ratings yet

- MBA Program SrtuctureDocument23 pagesMBA Program SrtuctureVaibhav LokegaonkarNo ratings yet

- Manual de DestilacionDocument173 pagesManual de DestilacionchispanNo ratings yet

- Cyberjaya: Name: Ainira Binti Muhasshim DATE: 18 MAY 2015Document11 pagesCyberjaya: Name: Ainira Binti Muhasshim DATE: 18 MAY 2015reenNo ratings yet

- Bangalore & Karnataka Zones Teachers' Summer Vacation & Workshop Schedule 2022Document1 pageBangalore & Karnataka Zones Teachers' Summer Vacation & Workshop Schedule 2022EshwarNo ratings yet

- LetterDocument4 pagesLetterapi-247847830No ratings yet

- Rosary Meditations ShortDocument6 pagesRosary Meditations ShortthepillquillNo ratings yet

- District MeetDocument2 pagesDistrict MeetAllan Ragen WadiongNo ratings yet

- Pointers For FinalsDocument28 pagesPointers For FinalsReyan RohNo ratings yet

- Wonder 6 Unit 7 ConsolidationDocument1 pageWonder 6 Unit 7 ConsolidationFer PineiroNo ratings yet

- The Teaching ProfessionDocument18 pagesThe Teaching ProfessionMary Rose Pablo ♥No ratings yet

- Department of Education: Republic of The PhilippinesDocument6 pagesDepartment of Education: Republic of The PhilippinesJojo Ofiaza GalinatoNo ratings yet

- Program Evaluation RecommendationDocument3 pagesProgram Evaluation Recommendationkatia balbaNo ratings yet

- 40 Days of ProsperityDocument97 pages40 Days of ProsperityGodson100% (3)

- Conflict of Laws (Notes)Document8 pagesConflict of Laws (Notes)Lemuel Angelo M. EleccionNo ratings yet

- Investment Phase of Desire EngineDocument21 pagesInvestment Phase of Desire EngineNir Eyal100% (1)

- Auditors' Report On LADWP TrustsDocument88 pagesAuditors' Report On LADWP TrustsLos Angeles Daily NewsNo ratings yet

- Upstream Pre B1 Unit Test 9Document3 pagesUpstream Pre B1 Unit Test 9Biljana NestorovskaNo ratings yet

- Best Loved Aussie Poems Ballads SongsDocument36 pagesBest Loved Aussie Poems Ballads SongsMartina BernieNo ratings yet

- StarBucks (Case 7)Document5 pagesStarBucks (Case 7)Александар СимовNo ratings yet

- Chandrababu NaiduDocument4 pagesChandrababu NaiduSneha More PandeyNo ratings yet

- Food Court ProposalDocument3 pagesFood Court ProposalJoey CerenoNo ratings yet

- ØÁ L Nu T Uz È: Federal Negarit GazetaDocument29 pagesØÁ L Nu T Uz È: Federal Negarit GazetaNurNo ratings yet

- Ellison C ct807 m8 MediaanalysisprojectDocument9 pagesEllison C ct807 m8 Mediaanalysisprojectapi-352916175No ratings yet