Professional Documents

Culture Documents

Mudaraba Case Study 4 - Islamic Finance Case Study

Uploaded by

jmfaleelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mudaraba Case Study 4 - Islamic Finance Case Study

Uploaded by

jmfaleelCopyright:

Available Formats

Case Study 4 Mudaraba For more case studies : http://ifinanceexpert.wordpress.com/ Dr.

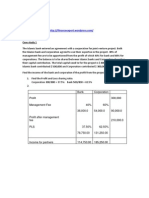

. Faleel Jamaldeen An Islamic Commercial Bank has the following accounts with current available balances. Both the stockholders fund and investment account holder funds, pooled for investment purpose. The pool works based on Mudaraba contract. The bank is the Mudarib and the investment account holders and stockholders are rab al maal (investors) Fund contributors Stockholders Account holders Savings accounts Investment accounts 3 months Investment accounts 6 months Investment accounts 1 years Investment accounts 5 years Total Funds available Fund balances 270,000,000 900,000,000 650,000,000 475,000,000 245,000,000 220,000,000 2,760,000,000 Investment rate 100% 50% 60% 70% 80% 90%

The bank agreed with an investment account holders when opening the account to share the profit and loss on the following basis. Account holders Savings accounts Investment accounts 3 months Investment accounts 6 months Investment accounts 1 years Investment accounts 5 years Mudarib share 30% 25% 20% 15% 10% Rab al maal share 70% 75% 80% 85% 90%

The Islamic bank earned $ 135,870,000 for the period. Find distributable profit for each account holder and profit rate. (The investors with long maturity period of investment accounts are given priority, given more share of profit. The investment rate can be used to find the weighted average for each investment account)

You might also like

- Musharaka Case Study 2Document1 pageMusharaka Case Study 2jmfaleelNo ratings yet

- Musharaka Case Study 1Document1 pageMusharaka Case Study 1jmfaleel75% (4)

- Mudaraba Case Study 1,2 and 3Document2 pagesMudaraba Case Study 1,2 and 3jmfaleel88% (8)

- Case Studies MurabahaDocument4 pagesCase Studies MurabahajmfaleelNo ratings yet

- Mudarabah: Instructor: Dr. Abidullah KhanDocument18 pagesMudarabah: Instructor: Dr. Abidullah KhanDavid Carl100% (1)

- Murabaha Case Studies PDFDocument4 pagesMurabaha Case Studies PDFHassham Yousuf100% (1)

- Case Studies MurabahaDocument1 pageCase Studies MurabahajmfaleelNo ratings yet

- Murabaha Case StudiesDocument2 pagesMurabaha Case StudiesOwais Ahmed86% (7)

- Structuring Musharakah Project Financing - Case StudyDocument30 pagesStructuring Musharakah Project Financing - Case StudyMuhammad-Suhaini67% (3)

- Case StudiesDocument3 pagesCase StudiesjmfaleelNo ratings yet

- AAOIFI Past PaperDocument43 pagesAAOIFI Past Papermohamed said omar100% (1)

- Problems and Their Solution in MudarabahDocument43 pagesProblems and Their Solution in Mudarabahatiqa tanveerNo ratings yet

- Introduction To Islamic Finance QuizDocument3 pagesIntroduction To Islamic Finance QuizSaad Nadeem 090100% (4)

- MCQ Islamic Finance 22Document16 pagesMCQ Islamic Finance 22Faisal khan63% (8)

- CIPA Sample QuestionsDocument7 pagesCIPA Sample Questionswarbaas100% (1)

- Diminishing Musharakah ProjectDocument98 pagesDiminishing Musharakah ProjectMuhsin Mohamed Said100% (8)

- Pool Management For Islamic BanksDocument27 pagesPool Management For Islamic Bankssjawaidiqbal83% (6)

- AFS2033 Lecture 10 Salam AccountingDocument22 pagesAFS2033 Lecture 10 Salam AccountingAna FienaNo ratings yet

- Accounting For MurabahaDocument10 pagesAccounting For MurabahanooramyNo ratings yet

- Case Study-Istisna NewDocument2 pagesCase Study-Istisna Newmali27a767100% (1)

- Cases Review Affin Bank BHD V Zulkifli Bin Abdullah (2006) 3 MLJ 67 High Court, Kuala Lumpur Abdul Wahab Patail J 1. FactsDocument6 pagesCases Review Affin Bank BHD V Zulkifli Bin Abdullah (2006) 3 MLJ 67 High Court, Kuala Lumpur Abdul Wahab Patail J 1. FactsMuhammad DenialNo ratings yet

- Islamic Accounting AssignmentDocument2 pagesIslamic Accounting AssignmentAhmad Saifuddin Che AbdullahNo ratings yet

- MurabahaDocument21 pagesMurabahaFiza kamran100% (1)

- Mudarabah and Its Application in Islamic BankingDocument26 pagesMudarabah and Its Application in Islamic Bankingsaif khanNo ratings yet

- 2 (A) Case Study-Istisna NewDocument20 pages2 (A) Case Study-Istisna Newafshi1850% (2)

- Unit 7AccountingforMurabaha&AmpDocument27 pagesUnit 7AccountingforMurabaha&AmpSon Go Han0% (1)

- Accounting Issues - Islamic BanksDocument42 pagesAccounting Issues - Islamic BanksAbubakar Bakulka100% (1)

- Murabaha Accounting-1Document22 pagesMurabaha Accounting-1AbdullahiNo ratings yet

- Islamic Banking McqsDocument20 pagesIslamic Banking McqsAllauddinagha17% (6)

- FIN 2024 AnswersDocument6 pagesFIN 2024 AnswersBee LNo ratings yet

- Meezan Bank - Banking ProductsDocument103 pagesMeezan Bank - Banking Productsskepticalbeing63% (19)

- Different Between Islamic Letter of Credit and Conventional Letter of CreditDocument4 pagesDifferent Between Islamic Letter of Credit and Conventional Letter of Creditfatinchegu78% (9)

- Ijarah and Mudharabah ExerciseDocument3 pagesIjarah and Mudharabah ExerciseAhmadNajmi100% (1)

- An Analysis of The Courts' Decisions On Islamic Finance DisputesDocument23 pagesAn Analysis of The Courts' Decisions On Islamic Finance DisputesMahyuddin KhalidNo ratings yet

- Investment Bank in BangladeshDocument13 pagesInvestment Bank in BangladeshTopu RoyNo ratings yet

- Practical Application of Mudarabah and MusharakahDocument7 pagesPractical Application of Mudarabah and MusharakahFaizan Ch50% (2)

- Chap 3 True FalseDocument24 pagesChap 3 True FalseSaadat ShaikhNo ratings yet

- Case Studies For Discussion PDF For IBFDocument16 pagesCase Studies For Discussion PDF For IBFAmna Naseer100% (1)

- IFQ Sample QsDocument14 pagesIFQ Sample Qspuliyanam100% (1)

- Accounting For Mudarabah Financing: at The End of The Chapter, You Should Be Able ToDocument10 pagesAccounting For Mudarabah Financing: at The End of The Chapter, You Should Be Able ToRaihah Nabilah HashimNo ratings yet

- Chapter 1Document22 pagesChapter 1Low Joey100% (1)

- Sample Answers For The Questions of Final TermDocument11 pagesSample Answers For The Questions of Final TermUsama Khan0% (1)

- Bai Al UrbunDocument8 pagesBai Al UrbunSiti Hajar Ghazali100% (2)

- Banking and Insurance Chapter Seven Solution (4-10)Document5 pagesBanking and Insurance Chapter Seven Solution (4-10)MD. Hasan Al Mamun100% (1)

- Assignment Chapter 6Document5 pagesAssignment Chapter 6Zaid Harithah67% (3)

- Group OneDocument14 pagesGroup OneOmer WarsamehNo ratings yet

- Islamic Forex ForwardDocument10 pagesIslamic Forex Forwardjmfaleel100% (1)

- Report On Different Modes of Investment of IBBLDocument72 pagesReport On Different Modes of Investment of IBBLMickey Nicholson83% (6)

- Current Issues in Istisna & Tijarah (Final)Document12 pagesCurrent Issues in Istisna & Tijarah (Final)Hasan Irfan Siddiqui100% (1)

- Ijarah (Islamic Leasing)Document26 pagesIjarah (Islamic Leasing)hina ranaNo ratings yet

- Bonds and Stocks SolutionsDocument3 pagesBonds and Stocks SolutionsLucas AbudNo ratings yet

- MurabahaDocument21 pagesMurabahaUsama Gadit100% (1)

- A 2 - Roles and Functions of Various Participants in Financial MarketDocument2 pagesA 2 - Roles and Functions of Various Participants in Financial MarketOsheen Singh100% (1)

- Meezan Bank Internship ReportDocument32 pagesMeezan Bank Internship ReportRanaAakashAhmadNo ratings yet

- Liquidity Management by Islamic BanksDocument9 pagesLiquidity Management by Islamic BanksMiran shah chowdhury100% (3)

- Introduction & Updating The Global Islamic Banking OperationsDocument53 pagesIntroduction & Updating The Global Islamic Banking OperationsNoraini LaudinNo ratings yet

- Islamic Banking: A Brief Summary of The IndustryDocument6 pagesIslamic Banking: A Brief Summary of The IndustryAbimbola Adewale MonsurNo ratings yet

- Askri BankDocument17 pagesAskri Bankanon_772670No ratings yet

- Deposit Mobilization by IBsDocument17 pagesDeposit Mobilization by IBsAAM26No ratings yet

- Dubai Islamic BankDocument3 pagesDubai Islamic Bankumair20062010100% (1)

- Case Studies MurabahaDocument1 pageCase Studies MurabahajmfaleelNo ratings yet

- Case StudiesDocument3 pagesCase StudiesjmfaleelNo ratings yet

- Islamic Commercial BankingDocument26 pagesIslamic Commercial BankingjmfaleelNo ratings yet

- Islamic Forex ForwardDocument10 pagesIslamic Forex Forwardjmfaleel100% (1)