Professional Documents

Culture Documents

54 10 Cmaasd

Uploaded by

Ronak ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

54 10 Cmaasd

Uploaded by

Ronak ShahCopyright:

Available Formats

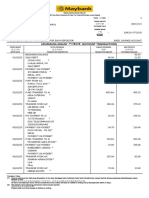

Bank

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS

FORM - I PARTICULARS OF EXISTING / PROPOSED LIMITS FROM THE BANKING SYSTEM (Limits from all Banks and Financial Institutions as on date of application) ( Rs.in lakhs )

T&ME - 1

Name:

Sl. No. NAME OF BANK / FINANCIALNATURE OF FACILITY INSTITUTION

EXISTING EXTENT TO WHICH LIMITS BAL.O/S LIMITS NOW LIMITS WERE UTILISED DURING AS ON REQUESTED LAST 12 MONTHS 31st March, 2008 2008 - 2009 MAX. MIN.

A. WORKING CAPITAL LIMITS: FUND BASED NON FUND BASED

B. TERM LOANS/DPGS EXCLUDING WORKING CAPITAL TERM LOANS

TOTAL CREDIT MONITORING ARRANGEMENT

WORKING CAPITAL ASSESSMENT

INFORMATION ON ASSOCIATE COMPANIES

(COMPANIES /FIRMS/CONCERNS IN WHICH DIRECTORS/PARTNERS/PROPRIETOR AND/OR THEIR FAMILY MEMBER OF THE BORROWER COMPANY IS/ARE ASSOCIATED WITH THE OTHER UNIT AS DIRECTORS/PARTNERS/PROPRIETOR OR HAS/HAVE FURNISHED GUARANTEES).

Name: Sl. No. Name of the Associate Company & Activity Annual makeup of A/c (Date of B/S) Name of Bank/finan cial Instn.

( Rs.in Lakhs ) Limits from all Banks and fincial institutions Working Capital Non-fund Based Term loan & DPG Overdues,if any

Funds Based

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM II : OPERATING STATEMENT Name: Page 1 As per Profit & Loss account actuals/ estimates for the year ended/ending LAST 2 YEARS ACTUALS AS PER AUDITED ACCOUNTS 31.03.2006 31.03.2007 (1) (2) Raw Material Consumption quantity Sales quantity ACTUALS ESTIMATES ESTIMATES ESTIMATES 31.03.2008 (3) 31.03.2009 (4) 31.03.2010 (5) 31.03.2011 (6) (Amount Rs. In Lakhs)

Total 1) GROSS INCOME: I) Sales (net of returns) a) Domestic Sales b) Export Sales c) Sub-total (a+b) Less: Excise Duty Net Sales d) Percentage rise (+) or fall (-) in sales turnover as compared to previous year II) Other Income a) Steel Processing Labour Charges b) Miscellaneous Income III) Total (I) + (II) 2. COST OF SALES: I) Raw Materials( Including Stores and other items used in the process of Manufacture ) - Imported - Indegeneous II) Power and Fuel III) Direct Labour ( Wages,Salaries, Bonus, Staff Welfare etc ) IV) Other Manufacturing expenses V) Depreciation Sub-total (I to V)

0.000

0.000

0.000

0.000

0.000

0.000

0.00%

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

0.00%

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

Contd...2

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM II : OPERATING STATEMENT Name: Page 2 As per Profit & Loss account actuals/ estimates for the year ended/ending LAST 2 YEARS ACTUALS AS PER AUDITED ACCOUNTS 31.03.2006 31.03.2007 (1) (2) IV) Add : Opening stock of W.I.P. V) Sub-total (III+IV) VI) Less : Closing Stock W.I.P. VII) Sub-total (V-VI)( Total Cost of Production ) VIII) Add : Opening stock of Finished Goods IX) Sub-total (VII+VIII) X) Less : Closing Stock of Finished Goods XI) Sub-total ( Total cost of Sales ) 3. SELLING, GENERAL & ADMINISTRATIVE EXPENSES 4. OPERATING PROFIT BEFORE INTEREST[1(III) - 2(XI) - 3] 5. INTEREST AND FINANCIAL CHARGES - Interest on Working Capital - Interest on Term Loan 7. OPERATING PROFIT AFTER INTEREST [4 - 5 - 6] 8. I) Add: Other non-operating Income (a) Interest received (b) Prior period income (c) Others (d) sub-total (INCOME) II) Less: Other non-operating expenses (a) Others (b) (c) Sub-total (EXPENSES) III) Net of other non-operating Income / Expenses [Net of 8 (I) & 8 (II) 9. PROFIT BEFORE TAX / (LOSS) [7 + 8(III)] 10. PROVISION FOR TAXES 11. NET PROFIT/LOSS (9-10) PBT to Sales % #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! ACTUALS ESTIMATES ESTIMATES ESTIMATES 31.03.2008 (3) #DIV/0! 31.03.2009 (4) #DIV/0! 31.03.2010 (5) #DIV/0! 31.03.2011 (6) #DIV/0! (Amount Rs. In Lakhs)

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0! #DIV/0! 1.4 Contd...3

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM II : OPERATING STATEMENT Name: Page 3 As per Profit & Loss account actuals/ estimates for the year ended/ending LAST 2 YEARS ACTUALS AS PER AUDITED ACCOUNTS 31.03.2006 31.03.2007 (1) (2) 12. (a) Equity Dividend Paid (b) Dividend Rate 13. RETAINED PROFIT (11-12) 14. RETAINED PROFIT/NET PROFIT (%AGE) [13 / 11] 15. ADDITIONAL DATA: Break-up of Sales Turnover [ Inclusive of other income] (a) Domestic Sales: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Sub-total (b) Export Sales: Sub-total 16. TOTAL (a+b) [To agree with 1 (III)] ACTUALS ESTIMATES ESTIMATES ESTIMATES 31.03.2008 (3) 31.03.2009 (4) 31.03.2010 (5) 31.03.2011 (6) (Amount Rs. In Lakhs)

100.00

100.00

100.00

100.00

100.00

Contd...4

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM - III : ANALYSIS OF BALANCE SHEET Name: Page 4 As per Profit & Loss account actuals/ estimates for the year ended/ending LAST 2 YEARS ACTUALS AS PER AUDITED ACCOUNTS 31.03.2006 31.03.2007 (1) (2) CURRENT LIABILITIES 1. Short term borrowings from Banks (incldg. bills purchased, discounted & excess borrowings placed on repayment basis) (a) from applicant Bank (b) from other banks (c) (of which BP & BD) Sub-total (A) 2. Short term borrowings from others 3. Sundry Creditors (Trade) 4. Advance payments from customers / deposits from dealers 5. Provision for taxation 6. Dividend payable 7. Other statutory liabilities [due with in one year] 8. Deposits/Debentures/Instalments under term loans / DPGs etc.] ( due with in one year ) 9. Other current liabilities and Provisions (due with in one year) (Specify major Items) Sub-total (B) 10. TOTAL CURRENT LIABILITIES [ Total of 1 to 9] ACTUALS ESTIMATES ESTIMATES ESTIMATES 31.03.2008 (3) 31.03.2009 (4) 31.03.2010 (5) 31.03.2011 (6) (Amount Rs. In Lakhs)

(-) (-)

(-) -

(-) -

(-) -

(-) -

Contd...5

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM - III : ANALYSIS OF BALANCE SHEET Name: Page 5 As per Profit & Loss account actuals/ estimates for the year ended/ending LAST 2 YEARS ACTUALS AS PER AUDITED ACCOUNTS 31.03.2006 31.03.2007 (1) (2) TERM LIABILITIES 11. Debentures ( not maturing with in one year ) 12. Preference Shares ( redeemable after one year ) 13. Term loans (excluding instalments payable within one year) Term Loan Term Loan I and III Term Loan II Corporate Loan 14. Deferred Payment Credits ( excluding instalments due with in one year ) 15. Term deposits ( repayable after one year ) 16. Other term liabilities - Unsecured Loans 17. TOTAL TERM LIABILITIES (Total of 11 to 16) 18. TOTAL OUTSIDE LIABILITIES ( 10 + 17 ) NET WORTH 19. Share capital 20. General reserve 21. Revaluation Reserve 22. Other reserves ( excluding provisions ) 23. Surplus (+) or deficit (-) in Profit & Loss account 24. NET WORTH 25. TOTAL LIABILITIES ( 18 + 24 ) ACTUALS ESTIMATES ESTIMATES ESTIMATES 31.03.2008 (3) 31.03.2009 (4) 31.03.2010 (5) 31.03.2011 (6) (Amount Rs. In Lakhs)

Contd...6

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM - III : ANALYSIS OF BALANCE SHEET Name: Page 6 As per Profit & Loss account actuals/ estimates for the year ended/ending LAST 2 YEARS ACTUALS AS PER AUDITED ACCOUNTS 31.03.2006 31.03.2007 (1) (2) CURRENT ASSETS 26. Cash and bank balances 27. Investments (other than long term Investments) (I) Government & other trustee securities (II) Fixed deposits with Banks 28. (I) Receivables other than deferred & exports (Including bills purchased & discounted by bankers) (II) Export receivables (Including bills purchased/discounted by bankers 29. Instalments under deferred receivables (due within one year) 30. Raw Materials( including stores & other items) - Imported - Indigeneous Stocks in Process Finished goods Goods in Transit Other consumable spares 31. Advances to suppliers of merchandise 32. Advance payment of taxes 33. Other current assets (specify major Items) 34. TOTAL CURRENT ASSETS (Total of 26 to 33) ACTUALS ESTIMATES ESTIMATES ESTIMATES 31.03.2008 (3) 31.03.2009 (4) 31.03.2010 (5) 31.03.2011 (6) (Amount Rs. In Lakhs)

Contd...7

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM - III : ANALYSIS OF BALANCE SHEET Name: Page 7 As per Profit & Loss account actuals/ estimates for the year ended/ending LAST 2 YEARS ACTUALS AS PER AUDITED ACCOUNTS 31.03.2006 31.03.2007 (1) (2) FIXED ASSETS 35. Gross Block (land, building, machinery, furniture, fittings & vehicles) 36. Depreciation to date 37. NET BLOCK (35-36) OTHER NON-CURRENT ASSETS 38. Investments/book debt/advances / deposits which are not Current Assets (I)(a) Investments in subsidiary companies / affiliates (b) Others (II) Advances to suppliers of capital goods and contractors (III) Deferred receivables (maturity exceeding one year) (IV) Security deposits/tender deposits (V) Others 39. Obsolete Stocks 40. Other non-current assets (Incldg. dues from directors) 41. TOTAL OTHER NON-CURRENT ASSETS (Total of 38 to 40) 42. Intangible assets (patents,goodwill,preliminary expenses,bad/doubtful debts not provided for etc) 43. TOTAL ASSETS ( Total of 34,37,41 & 42 ) 44. TANGIBLE NET WORTH (24-42) 45. NET WORKING CAPITAL [(17+24)-(37+41+42)] To tally with (34-10) 46. CURRENT RATIO (34/10) 47. TOTAL OUTSIDE LIABILITIES/TANGIBLE NET WORTH (18/44) ADDITIONAL INFORMATION 48.(A) Arrears of depreciation (B) Contingent Liabilities : (a) Arrears of cumulative dividends (b) Gratuity liability not provided for (c) Disputed excise/customs tax liabilities (d) Bills accepted/guarnatees extended to accommodate associate / sister concerns or other third parties ACTUALS ESTIMATES ESTIMATES ESTIMATES 31.03.2008 (3) 31.03.2009 (4) 31.03.2010 (5) 31.03.2011 (6) (Amount Rs. In Lakhs)

#DIV/0! #DIV/0! -

#DIV/0! #DIV/0! -

#DIV/0! #DIV/0! -

#DIV/0! #DIV/0! -

#DIV/0! #DIV/0! -

#DIV/0! #DIV/0! -

Contd...8

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM - IV : COMPARATIVE STATEMENT OF CURRENT ASSETS AND CURRENT LIABILITIES Name: Page 8 As per Profit & Loss account actuals/ estimates for the year ended/ending LAST 2 YEARS ACTUALS AS PER AUDITED ACCOUNTS 31.03.2006 31.03.2007 A. CURRENT ASSETS 1. Raw Materials ( Including Stores and Spares) Imported ( Months' consumption ) Indigeneous [Including Goods in Transit] ( Months' consumption) 2. Stocks in Process ( Months' cost of Production ) 3. Finished Goods ( Months' cost of sales ) 4. Other consumable spares ( Months' consumption) 5. Receivables other than export & deferred receivables (incldg.bills purchased & discounted by bankers) (Months' domestic sales) 6. Export receivables (incl.bills purch.& disc.) 7. Advances to suppliers of merchandise 8. Other current assets incl.cash & bank balances & deferred receivables due within one year (specify major items) 9. TOTAL CURRENT ASSETS (To agree with item 34 in Form - III) B. CURRENT LIABILITIES (Other than bank borrowings for working capital) 10. Sundry Creditors ( Trade ) (Months' purchases) 11. Advances from customers/deposits from dealers 12. Statutory liabilities [Including Provision for Taxation] 13. Other current liabilities (specify major items) Short Term borrowings, unsecured loans, dividend payable, instalments of TL, DPG,public deposits, debentures etc.) 14. TOTAL ( To agree with sub total B Form - III ) #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! ACTUALS ESTIMATES ESTIMATES ESTIMATES 31.03.2008 31.03.2009 31.03.2010 31.03.2011 (Amount Rs. In Lakhs)

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0! Contd...9 #DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM - V : COMPUTATION OF MAXIMUM PERMISSIBLE BANK FINANCE FOR WORKING CAPITAL [MPBF] Name: Page 9 31.03.2007 LAST YEAR ACTUALS (1) METHOD OF LENDING: I 1. TOTAL CURRENT ASSETS (9 in Form -IV) 2. Other Current Liabilities (Other than bank borrowing) (14 of Form - IV) 3. Working capital gap (WCG) (1-2) 4. Minimum Stipulated Net Working Capital i.e.25% of WCG 5. Actual/projected net working capital (45 in Form III) 6. Item 3 minus Item 4 7. Item 3 minus Item 5 8. Maximum permissible bank finance [MPBF] (Item 6 or 7 whichever is lower) 9. Excess borrowings representing shortfall in NWC (4-5) #DIV/0! #DIV/0! #DIV/0! #DIV/0! Contd10 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! As per Balance Sheet as at 31.03.2008 31.03.2009 31.03.2010 31.03.2011 CURRENT FOLLOWINGFOLLOWING FOLLOWING YEAR YEAR YEAR YEAR ACTUALS ESTIMATES ESTIMATES ESTIMATES (2) (3) (4) (5) (Amount Rs. In Lakhs)

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM VI : FUNDS FLOW STATEMENT Name: Page 10 31.03.2007 LAST YEAR ACTUALS (1) 1. SOURCES a) Net Profit (after tax) b) Depreciation c) Miscellaneous Expenditure Written off d) Increase in capital e) Increase in Term Liabilities (Including public deposits) f) Decrease In: I) Fixed Assets II) Other non-current assets g) Others g) TOTAL 2. USES a) Net loss b) Decrease in Term Liabilities (Including public deposits) c) Increase In : I) Fixed Assets II) Other non-current assets d) Dividend payments e) Others f) TOTAL 3. Long Term Surplus (+) / Deficit (-) [1 - 2] 4. Increase/decrease in current assets (as per details given below) 5. Increase/decrease in current liabilities other than bank borrowings 6. Increase/decrease in Working Capital Gap 7. Net surplus (+)/deficit (-) [Difference of 3 and 6] 8. Increase/decrease in Bank borrowings INCREASE/DECREASE IN NET SALES Break-up of (4) i) Increase/Decrease in stock-in-trade ii) Increase/Decrease in Receivables a) Domestic b) Export iii) Increase/Decrease in other current assets NOTE : Increase/decrease under items 4 to 8 as also under break-up of (4) should be indicated by (+) / (-) As per Balance Sheet as at 31.03.2008 31.03.2009 31.03.2010 31.03.2011 CURRENT FOLLOWING FOLLOWING FOLLOWING YEAR YEAR YEAR YEAR ACTUALS ESTIMATES ESTIMATES ESTIMATES (2) (3) (4) (5) (Amount Rs. In Lakhs)

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS RATIO ANALYSIS Name: Page 11 As per Profit & Loss account actuals/ estimates for the year ended/ending LAST 2 YEARS ACTUALS AS PER AUDITED ACCOUNTS 31.03.2006 31.03.2007 (1) (2) ACTUALS ESTIMATES ESTIMATES ESTIMATES 31.03.2008 (3) 31.03.2009 (4) 31.03.2010 (5) 31.03.2011 (6)

Usual Norm EFFICIENCY RATIOS: Net Sales / Total Tangible Assets (Times) PBT / TTA (%) Operating Cost / Net Sales (%) Bank Finance / Current Assets (%) Inventory+Receivables / Net Sales (Days) LIQUIDITY RATIOS: Current Ratio Acid Test Ratio Bank Finance to WCG Ratio LEVERAGE RATIOS: Debt Equity Ratio TOL / TNW Debt-Assets Ratio Fixed Assets Coverage Interest Coverage Ratio TURNOVER RATIOS: Inventory Turnover Period (Days) Average Collection Period (Days) Total Assets Turnover (Times) Average Credit Period (Days) - Creditors Bank Finance Turnover (Times) Current Assets Turnover (Times) PROFITABILITY RATIOS: Net Profit Margin after tax (%) Net Income to Assets Ratio (%) Return on Investment (%) [PBDIT/TTA] Return on Equity (%) Operating Profitability (%) Pre-Tax Profitability (%) PBT / TTA (%) STRUCTURAL RATIOS: Retained Profit (%) Raw Material Content (%) Operating Cost / Sales (%) Signs: < = Less Than > = More Than

>1.50 >5.00% <75.00% <50.00% <60 Days

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

>1.33 >1.00 <0.75

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

<2.00 <3.00 <0.60 <0.60 >2.00

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

<30 Days <30 Days >1.00 <30 Days >5.00 >3.00

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

>5.00% >10.00% >20.00% >18.00% >20.00% >15.00% >10.00%

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

>20.00% <50.00% <75.00%

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0!

You might also like

- Bank of America statement summaryDocument4 pagesBank of America statement summaryleinad423100% (1)

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Statement - Chase PDFDocument2 pagesStatement - Chase PDFN NNo ratings yet

- Commercial BanksDocument37 pagesCommercial Banksshanpearl100% (2)

- Cash and Bank Recon Illustrative ExamplesDocument6 pagesCash and Bank Recon Illustrative ExamplesRia BryleNo ratings yet

- Attempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDocument23 pagesAttempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDiabolic Colt100% (1)

- Chapter 03 The Government Accounting ProcessDocument20 pagesChapter 03 The Government Accounting ProcessRygiem Dela CruzNo ratings yet

- Detailed Project Report for Trading ConcernDocument15 pagesDetailed Project Report for Trading ConcernbsdNo ratings yet

- Pbcom vs. CaDocument2 pagesPbcom vs. Camakicaniban100% (2)

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- Bank of India Fund BasedDocument33 pagesBank of India Fund Basedhariram v choudharyNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Banking CasesDocument82 pagesBanking CasesJas MineNo ratings yet

- 40 - Copy of 42 - Cma Format For BankDocument20 pages40 - Copy of 42 - Cma Format For Bankcvrao04100% (4)

- Assessment of Working Capital RequirementsDocument13 pagesAssessment of Working Capital RequirementsAkash RanabhatNo ratings yet

- CMA Format for Working Capital AssessmentDocument11 pagesCMA Format for Working Capital AssessmentRajesh BogulNo ratings yet

- Creative Mind v1Document14 pagesCreative Mind v1Vivek SharmaNo ratings yet

- Assessment of Working Capital RequirementsDocument13 pagesAssessment of Working Capital Requirementssantosh kumarNo ratings yet

- Padma Agencies Financial Statements AnalysisDocument12 pagesPadma Agencies Financial Statements Analysistriplete123No ratings yet

- CMA WASHIMDocument12 pagesCMA WASHIMDeep ChandraNo ratings yet

- CMA PIZZA (1)Document12 pagesCMA PIZZA (1)Deep ChandraNo ratings yet

- Assessment of Working Capital Requirements Form I: AS ON 27.05.08Document11 pagesAssessment of Working Capital Requirements Form I: AS ON 27.05.08SAP CONSULTANT FIORINo ratings yet

- CMA HARVINDER (1)Document12 pagesCMA HARVINDER (1)Deep ChandraNo ratings yet

- Cma-Vatsalya MineralsDocument13 pagesCma-Vatsalya MineralsAtul BhandariNo ratings yet

- Cma REVISEDDocument19 pagesCma REVISEDMahesh VekariyaNo ratings yet

- Assessment of Working Capital Requirements: Form - I Particulars of Existing / Proposed Limits From The Banking SystemDocument12 pagesAssessment of Working Capital Requirements: Form - I Particulars of Existing / Proposed Limits From The Banking SystemsubbupisipatiNo ratings yet

- Cma Data PDFDocument14 pagesCma Data PDFMonika ShuklaNo ratings yet

- Noble Tech Industries Private LimitedDocument3 pagesNoble Tech Industries Private Limitedkarthikeyan A INo ratings yet

- 12 - Advanced Corporate Reporting For Strategic BusinessDocument3 pages12 - Advanced Corporate Reporting For Strategic BusinessFatima FXNo ratings yet

- Assessing Working Capital NeedsDocument13 pagesAssessing Working Capital NeedsYogesh R LahotiNo ratings yet

- Annexure E Financial Follow-Up Report (FFR Ii) : Half-Yearly Operating StatementDocument9 pagesAnnexure E Financial Follow-Up Report (FFR Ii) : Half-Yearly Operating StatementNarendra Ku MalikNo ratings yet

- Capsa UnitedDocument12 pagesCapsa Unitedvenkat rajNo ratings yet

- Loan Application FormDocument9 pagesLoan Application FormrohitNo ratings yet

- F-1919-B.b.a. - Semester-Iv - Paper - 119-Financial ManagementDocument2 pagesF-1919-B.b.a. - Semester-Iv - Paper - 119-Financial Managementhimanshu ranjanNo ratings yet

- Form 23ACDocument6 pagesForm 23ACNikkhil GuptaaNo ratings yet

- Financial Anaylsis 1Document27 pagesFinancial Anaylsis 1Nitika DhatwaliaNo ratings yet

- Mba 4 Sem Fa Project Planning Appraisal and Control K 580 Oct 2020Document2 pagesMba 4 Sem Fa Project Planning Appraisal and Control K 580 Oct 2020Vampire KNo ratings yet

- Advanced Financial Management (Singapore) : Thursday 4 June 2009Document13 pagesAdvanced Financial Management (Singapore) : Thursday 4 June 2009Lim CZNo ratings yet

- Cma DataDocument18 pagesCma DataPriti Ranjan NaskarNo ratings yet

- Coptech Wire IndustryDocument4 pagesCoptech Wire IndustryKarthi KarthiNo ratings yet

- Appendix 2 Assessment of Working Capital Requirement:: (A) Justification For Estimated / Projected SalesDocument55 pagesAppendix 2 Assessment of Working Capital Requirement:: (A) Justification For Estimated / Projected SaleskhetaramNo ratings yet

- DT A MTP 1 Final May22Document14 pagesDT A MTP 1 Final May22Kanchana SubbaramNo ratings yet

- Ngineering: R S I L - (S L)Document1 pageNgineering: R S I L - (S L)Hasan ShahriarNo ratings yet

- (A) Shareholding of Promoter and Promoter GroupDocument6 pages(A) Shareholding of Promoter and Promoter GroupVimal AgrawalNo ratings yet

- FORM NO. MGT 9 EXTRACT OF ANNUAL RETURNDocument6 pagesFORM NO. MGT 9 EXTRACT OF ANNUAL RETURNAbhishek RaiNo ratings yet

- Paper 19Document6 pagesPaper 19mohanraj parthasarathyNo ratings yet

- Template For Financial ProjectionDocument32 pagesTemplate For Financial ProjectionRussel Jess HeyranaNo ratings yet

- Appraisal Memo Cash Credit LimitDocument23 pagesAppraisal Memo Cash Credit LimitMuana LalthlaNo ratings yet

- Managing Financial Resources and DecisionsDocument8 pagesManaging Financial Resources and Decisionsesha_eraNo ratings yet

- 17 Case For Working Capital AssessmentDocument3 pages17 Case For Working Capital AssessmentJay GuptaNo ratings yet

- Firm Ka CR OM MEDICAL BOARD NOTE AND CONFIDENTIAL REPORT 1Document19 pagesFirm Ka CR OM MEDICAL BOARD NOTE AND CONFIDENTIAL REPORT 1apurva adviserNo ratings yet

- R.Kanchanamala: Faculty Member IibfDocument74 pagesR.Kanchanamala: Faculty Member Iibfmithilesh tabhaneNo ratings yet

- CMA FormatDocument21 pagesCMA Formatapi-377123878% (9)

- NR 310106 MepaDocument8 pagesNR 310106 MepaSrinivasa Rao GNo ratings yet

- BA P3 AnalysisDocument11 pagesBA P3 AnalysisfkvojpjfNo ratings yet

- IIBMS Finance Case Study on Zip Zap Zoom Car CompanyDocument18 pagesIIBMS Finance Case Study on Zip Zap Zoom Car Companysainath mistryNo ratings yet

- Schedule III - Companies Act Integrated Ready Reckoner - Companies Act 2013 - CAIRRDocument65 pagesSchedule III - Companies Act Integrated Ready Reckoner - Companies Act 2013 - CAIRRShweta AgarwalNo ratings yet

- Unit 3 & 4 - Accountingformanager - AnanduDocument46 pagesUnit 3 & 4 - Accountingformanager - Ananducraziestidiot31No ratings yet

- UCO Bank SSI Application FormDocument32 pagesUCO Bank SSI Application FormKuldeep KalsiNo ratings yet

- West Coast Paper Mills LTDDocument6 pagesWest Coast Paper Mills LTDRavi KNo ratings yet

- CNC Machine Project Summary Under PMEGP SchemeDocument21 pagesCNC Machine Project Summary Under PMEGP Schemeraiyani sampatNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 8567 1st AssignmentDocument14 pages8567 1st AssignmentUbedullah DahriNo ratings yet

- Question Paper Unsolved - Special Study in FinanceDocument18 pagesQuestion Paper Unsolved - Special Study in FinanceAbhijeet KulshreshthaNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- What Is KitingDocument8 pagesWhat Is KitingWawex DavisNo ratings yet

- RBI Classification of MoneyDocument10 pagesRBI Classification of Moneyprof_akvchary75% (4)

- Reporting Structure For HR Related Queries Escalations Level of Escalation Service Offered Contact NameDocument56 pagesReporting Structure For HR Related Queries Escalations Level of Escalation Service Offered Contact NameMuvin KoshtiNo ratings yet

- Dedication: (University of Central Punjab, PCBA-PICS)Document54 pagesDedication: (University of Central Punjab, PCBA-PICS)Abubakar ShafiNo ratings yet

- Cash Problem 1Document3 pagesCash Problem 1Dawson Dela CruzNo ratings yet

- Allahabad Bank - Settlement-Deceased-DepositorsDocument20 pagesAllahabad Bank - Settlement-Deceased-DepositorsNobodyNo ratings yet

- Concurrent Audit ReportDocument12 pagesConcurrent Audit ReportRUPESH KEDIANo ratings yet

- Do The Drill Cash Intaud1Document3 pagesDo The Drill Cash Intaud1ダニエルNo ratings yet

- Part Two-Overview of DBBLDocument15 pagesPart Two-Overview of DBBLMasud Khan ShakilNo ratings yet

- 01 NIC Annual Report 64-65Document84 pages01 NIC Annual Report 64-65Ronit KcNo ratings yet

- UBA Ghana 2021 Q3 Financial StatementsDocument1 pageUBA Ghana 2021 Q3 Financial StatementsFuaad DodooNo ratings yet

- Ipoh Main 1 28/02/23Document6 pagesIpoh Main 1 28/02/23Remy YamahaNo ratings yet

- V1 09 May 2023Document5 pagesV1 09 May 2023Tushita RNo ratings yet

- Internship Report of MCB 2010Document120 pagesInternship Report of MCB 2010Sadaf Zreen50% (2)

- DeKalb FreePress: 02-22-19Document16 pagesDeKalb FreePress: 02-22-19Donna S. SeayNo ratings yet

- Account Opening Form: Maldives Islamic BankDocument2 pagesAccount Opening Form: Maldives Islamic BankmikeNo ratings yet

- PTI Financial Statement For Financial Year 2013-14Document7 pagesPTI Financial Statement For Financial Year 2013-14PTI Official100% (3)

- Specom Cases Outline FinalsDocument29 pagesSpecom Cases Outline FinalsJas Em BejNo ratings yet

- Ratio Analysis of Kumari Bank Limited: Submitted byDocument35 pagesRatio Analysis of Kumari Bank Limited: Submitted bySamyag ShresthaNo ratings yet

- KCB Kenya Tariff Guide 2019Document1 pageKCB Kenya Tariff Guide 2019clement muriithiNo ratings yet

- 5 6147540231550665007Document23 pages5 6147540231550665007JAGJIT SINGHNo ratings yet

- Gempesaw Vs CADocument7 pagesGempesaw Vs CAbrendamanganaanNo ratings yet

- Grace Corporation Confirmation of Bank Balances DECEMBER 31, 20X1Document2 pagesGrace Corporation Confirmation of Bank Balances DECEMBER 31, 20X1Joshua ComerosNo ratings yet

- Revised Form 3CD by Pankaj GargDocument17 pagesRevised Form 3CD by Pankaj GargAditya HalderNo ratings yet