Professional Documents

Culture Documents

New Accounting Standards For Leases Will Affect The Construction Industry

Uploaded by

Mike KarlinsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Accounting Standards For Leases Will Affect The Construction Industry

Uploaded by

Mike KarlinsCopyright:

Available Formats

NEW ACCOUNTING STANDARDS FOR LEASES WILL AFFECT THE CONSTRUCTION INDUSTRY

JOHN A. MASSARO AND TAMMY E. STRAUS JOHN A. MASSARO, CPA, has over 25 years of public accounting experience managing audits, reviews, and compilations for both public and private companies in a variety of industries including construction, real estate management, health care, and manufacturing. He also facilitated his previous firm's implementation of new accounting software and ensured the firm's staff was properly trained. John is also the president of the Chaminade High School Alumni Long Island Businessman's Association where he organizes a monthly networking event for alumni. In addition to being a licensed certified public accountant, John holds a bachelor's degree in accounting from the New York Institute of Technology at Old Westbury. TAMMY E. STRAUS, CPA, is a senior manager in Grassi & Co.'s quality control department with 20years of experience in public accounting in auditing, acquisition due diligence, and securities litigation support.While in a technical consulting role at a large firm, Ms. Straus provided clients with accounting assistance on complex financial services issues such as leasing, derivatives, and convertible financing.She has extensive experience managing SEC engagements, including initial and secondary public offerings.Ms. Straus was the primary drafter of Grassi's response letter to the FASB's 2013 Exposure Document for the Proposed Accounting Standards Update (Revised) - Leases (Topic 842). In 2010 she wrote and submitted a response letter on the original Exposure Document for the Proposed Accounting Standards Update - Leases (Topic 840). The Leases (Topic 842) exposure draft changes to the way leases are reported in financial statements of lessors and lessees. By the time the comment period ended on its exposure draft on proposed changes to lease accounting in Leases (Topic 842) in September 2013, the Financial Accounting Standards Board (FASB) had received over 600 comment letters from industry, accounting firm, and financial statement users. The FASB releases exposure drafts in advance of issuing final changes to existing accounting guidance to give the public a chance to provide feedback and suggest revisions. The Leases (Topic 842) Exposure Draft proposed significant changes to the way leases are reported in financial statements of lessors and lessees.

Currently, generally accepted accounting principles (GAAP) require companies to recognize capital leases in the balance sheet as both an asset and a liability, while operating leases are not recognized on the balance sheet. Operating lease liabilities are disclosed only in the footnotes to the financial statements. This "off-balance sheet" approach for operating leases has been criticized by many users of financial statements for distorting balance sheet ratios related to liabilities. The proposed changes would affect both lessors and lessees entering into leasing transactions, but companies can choose not to apply the accounting to short-term leases with terms of 12 months or less. For lessees, the changes would require the recognition of a right-of-use (ROU) asset and a lease liability in the balance sheet, regardless of whether the lease would have been considered a capital or operating lease under current guidance. This change would affect all industries but is especially significant for the construction industry, since it may greatly influence how lenders and bonding agents view the financial health of a company.

Overview of significant accounting changes

Under the proposed rules, the concepts of capital and operating leases would be replaced with a multistep model that would categorize leases as either Type A or Type B leases. On a simplified level, leases of assets other than real property (such as machinery, equipment, vehicles, and furniture and fixtures) would be categorized as Type A leases, while leases of real property would be categorized as Type B leases. However, there are some significant exceptions to this categorization rule. Type A leases would be presumed to cover more than an insignificant portion of the asset's total economic life or fair value. If the lease term was insignificant, however, such leases of non-property assets would be categorized as Type B instead. Conversely, Type B leases would be presumed to cover less than a significant portion of the asset's remaining economic life and fair value - but if the lease did represent a major part of the asset's life or substantially all of its fair value, such leases of property would be categorized as Type A. Regardless of the type of asset, any lease with a purchase option would be a Type A lease if the lessee had a significant economic incentive to exercise the option. The categorization is important because while the initial measurement of the ROU asset and lease liability would be the same for both Types A and B leases, the subsequent measurement and amortization of the ROU asset and lease liability would differ depending on how the lease is categorized. For both Types A and B leases, the ROU asset and lease liability would be recorded at the present value of

the future lease payments. Going forward, however, the monthly expense for Type A leases would be recorded in two different line items in the income statement. The ROU asset would be amortized on a straight-line basis over the lease term as amortization expense, while the discount on the lease liability would be recognized using the effective interest method as interest expense. In contrast, for Type B leases the amortization of the right-of-use asset would be combined with the discount on the lease liability and recorded in one line item on the income statement as lease expense. The amount would be recorded on a straight-line basis, measured as total undiscounted future lease payments divided by the lease term.

Cost of compliance considerations

For a company that only has a handful of leases, the record-keeping and compliance issues may not be too burdensome. However, many construction companies have a large number of equipment leases, and real estate companies may have hundreds and even thousands of individual leases; thus, complying with the new standards would consume a significant amount of record-keeping hours and dollars. Such companies may incur costs associated with training accounting staff on how to account for leases under the new guidance; new software may be required to help companies evaluate, track, and account for their leases.

Impact on financial statement ratios

At first glance, one may expect that the changes would not have much of an impact on the financial statements of a company, as adding an asset and a liability in equal amounts appears to net out to zero. However, for companies with significant operating leases currently, the changes may have a large impact on the computation of working capital (current assets less current liabilities). As many loan covenants contain minimum working capital requirements, the new requirement to add the liability for operating lease payments to the balance sheet could cause a company to fall out of compliance with those requirements. The ROU asset would be a noncurrent asset, while the current portion of the lease liability would be a current liability. For example, assume a company has current assets of $6,000,000 and current liabilities of $5,900,000, with a requirement to maintain $60,000 in working capital. In addition, assume it has a five-year equipment lease with payments totaling $90,000 a year, discounted at 4 percent. Under the current guidance, the

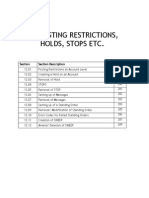

company would have positive working capital of $100,000, and thus would be close to (but in compliance with) its covenant threshold of $60,000. Under the proposed standards, however, the company would record the entry in Exhibit 1. Exhibit 1. Right-of-Use Asset and Lease Liability

After the entry shown in Exhibit 1 was recorded, the company would have only $26,000 in working capital, which would make it out of compliance with its debt covenant. Debt-to-equity and debt service ratios would also be affected by the proposed lease accounting changes because a company's debt would increase by the present value of the future lease payments. A debt-to-equity ratio that was in compliance under current guidance could turn unfavorable. For example, using the facts in the previously mentioned scenario and assuming the company has total stockholders' equity of $500,000 (and other long-term debt of $200,000), the debt-to-equity ratio would rise from 0.40 to 1.04 by adding the long-term portion of the lease liability. If the debt-to-equity covenant allowed a maximum ratio of 1:1, the company would fall out of compliance. Debt service costs would also increase due to the component of the lease payments that would be included in interest expense. In the previously mentioned example, interest expense would increase $16,000 in the first year, which is the difference between the $90,000 payment and the $74,000 present value of the lease liability in that year. As these aforementioned factors also are used in calculating a company's bonding capacity, they could have an adverse effect on the size of jobs on which a company can bid. Although the economic fundamentals of the company in Exhibit 1 have not changed in any way, it would now be out of compliance with loan covenants, and its bonding capacity would be negatively affected. What was once considered a healthy company now appears to be a poor credit risk, and the decreased ability to obtain funding would have a real, adverse effect on the financial health of the company.

Next steps for the FASB

The FASB discussed the feedback on the Leases exposure draft in their November 20, 2013 meeting, and acknowledged that there was much work to do before the guidance is finalized. Many respondents had stated in their comment letters on the exposure draft that the proposed new guidance appeared overly complex. They did not agree with the FASB's proposal to classify leases based on whether or not the underlying asset is real property, given the number of exceptions to the categorization rules. A strong theme among the responses was to consider a single model for all leases rather than either Type A or Type B, and the FASB members appeared amenable to considering this option during future deliberations. Another main theme of the responses and in the FASB's discussion of November 20, 2013 was to reconsider whether lessor and lessee accounting must be symmetrical given their different economics. The FASB's next steps are to continue its redeliberations on significant issues raised in the comment letters received throughout 2014. The FASB website has taken the issuance of the final statement off the 2014 calendar; it had been estimated as taking place in the first half of 2014 prior to the end of the comment letter period in September. Thus, the final standard will not be issued before 2015, and the effective date may not be until 2017 or 2018.

Final recommendations

Despite the FASB's reconsiderations of the Type A/Type B model, companies should not wait until the final rules are issued to consider the effects on their businesses, as it remains clear that the final guidance will require all leases to be shown on the balance sheet, even though the characterization of expenses is uncertain. Companies should consider this when negotiating long-term debt agreements and compensation arrangements in 2014 and beyond, perhaps by stipulating that any debt covenants or EBITDA calculations must be based on current U.S. GAAP or by scoping out all leases from such calculations. One of the biggest challenges will be educating banking professionals and bonding agents about these new requirements and preparing them for the changes well in advance of implementation. Existing loan agreements may have to be renegotiated or waivers granted so that companies do not fall into default because of the changes. It is important that business owners and their financial professionals become educated about these changes now and monitor updates as the FASB redeliberates its proposed guidance.

2014 Thomson Reuters/Tax & Accounting. All Rights Reserved.

You might also like

- EDLeasesSnapShot May2013Document16 pagesEDLeasesSnapShot May2013Keat YingNo ratings yet

- IFRS 16 Impact On Valuations v2 PDFDocument52 pagesIFRS 16 Impact On Valuations v2 PDFLeenin DominguezNo ratings yet

- Leases, Debt and ValueDocument57 pagesLeases, Debt and ValueGaurav ThakurNo ratings yet

- Little Book ValnDocument57 pagesLittle Book ValnHadi P.No ratings yet

- 10Document24 pages10JDNo ratings yet

- Leases Re-Exposed:: The Impact On BanksDocument7 pagesLeases Re-Exposed:: The Impact On Banksfildzah dessyanaNo ratings yet

- Accounting For Leases PDFDocument11 pagesAccounting For Leases PDFfrieda20093835No ratings yet

- Publisher Version (Open Access)Document27 pagesPublisher Version (Open Access)Antinolla LonaNo ratings yet

- Devel58 Leases May2013 (1) 1Document4 pagesDevel58 Leases May2013 (1) 1Saif QuaderNo ratings yet

- Accounting For LeasesDocument9 pagesAccounting For LeasesNelson Musili100% (3)

- Chapter 15Document33 pagesChapter 15Shiv NarayanNo ratings yet

- 3 TDocument3 pages3 TJoe DicksonNo ratings yet

- The Future of Leasing - Jan 2010Document5 pagesThe Future of Leasing - Jan 2010avinash_usa2003No ratings yet

- PWC Ifrs 16 The Leases Standard Is Changing 2016 02 enDocument16 pagesPWC Ifrs 16 The Leases Standard Is Changing 2016 02 envarhun4812No ratings yet

- Audit of Bonds and LoansDocument5 pagesAudit of Bonds and LoansNEstandaNo ratings yet

- Lease AccountingDocument95 pagesLease AccountingTamirat Eshetu WoldeNo ratings yet

- Capital Structure and The Changing RoleDocument62 pagesCapital Structure and The Changing RoleFantayNo ratings yet

- A Study On The Impact of Lease CapitalisationDocument20 pagesA Study On The Impact of Lease CapitalisationSeema BeheraNo ratings yet

- ROUDocument2 pagesROUAfiq BollimeNo ratings yet

- Ey Transitioning To New Leasing Standard Ind As 116 PDFDocument44 pagesEy Transitioning To New Leasing Standard Ind As 116 PDFGere TassewNo ratings yet

- New Fasb Rules On Accounting For LeasesDocument38 pagesNew Fasb Rules On Accounting For LeaseskurtqkurtqNo ratings yet

- Investor Perspective Financial Instruments July 2014Document6 pagesInvestor Perspective Financial Instruments July 2014Bheki TshimedziNo ratings yet

- Proposed Changes To Lease Accounting: Jpif 28,5Document6 pagesProposed Changes To Lease Accounting: Jpif 28,5Sindhu SinnasamyNo ratings yet

- Chapter 18 LeasingDocument4 pagesChapter 18 LeasingTham Ru JieNo ratings yet

- ACC3100 Advanced Finance Accounting: Research Assignment S2 2019Document15 pagesACC3100 Advanced Finance Accounting: Research Assignment S2 2019haroon nasirNo ratings yet

- Background On: Insurance AccountingDocument5 pagesBackground On: Insurance AccountingSheena Doria de VeraNo ratings yet

- Lease Accounting Changes: The Impact To The Hospitality IndustryDocument13 pagesLease Accounting Changes: The Impact To The Hospitality IndustryjohnmeedzanNo ratings yet

- Intermediate Accounting Volume 2 Canadian 11th Edition Kieso Test BankDocument53 pagesIntermediate Accounting Volume 2 Canadian 11th Edition Kieso Test BankJenniferMartinezbisoa100% (19)

- IFRS 16 - Mepov20Document4 pagesIFRS 16 - Mepov20Ahmed MohamadyNo ratings yet

- Ind AS 116Document13 pagesInd AS 116Akhil KhandelwalNo ratings yet

- IFRS 16: The Leases Standard Is Changing: Are You Ready?Document16 pagesIFRS 16: The Leases Standard Is Changing: Are You Ready?romNo ratings yet

- Lease Accounting at FedExDocument1 pageLease Accounting at FedExETCASESNo ratings yet

- Slaughter and May: Equipment LeasingDocument53 pagesSlaughter and May: Equipment LeasingpitamberNo ratings yet

- The Financial Accounting Standards BoardDocument11 pagesThe Financial Accounting Standards BoardAsfiroyanNo ratings yet

- Effects of Operating Vs Capital LeasesDocument2 pagesEffects of Operating Vs Capital Leasesdajeca7No ratings yet

- Chapter 10Document33 pagesChapter 10Usman ShabbirNo ratings yet

- AmortizationDocument2 pagesAmortizationVishal GajjarNo ratings yet

- Chapter 13Document26 pagesChapter 13YolandaNo ratings yet

- IFRS 16 Effects AnalysisDocument104 pagesIFRS 16 Effects AnalysisKhaled SherifNo ratings yet

- Solution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian EditionDocument38 pagesSolution Manual For Modern Advanced Accounting in Canada Hilton Herauf 7th Canadian Editionwarpingmustacqgmael100% (14)

- MODULE 5 - Issues in Valuing Financial Service FirmsDocument3 pagesMODULE 5 - Issues in Valuing Financial Service Firmschristian garciaNo ratings yet

- LeaseDocument3 pagesLeaseCee KayNo ratings yet

- NOTESDocument20 pagesNOTESGraziella CathleenNo ratings yet

- Restricted Cash - GAAP and IFRSDocument49 pagesRestricted Cash - GAAP and IFRSTai D GiangNo ratings yet

- Ifrs 16 Leases Implications For The Shipping IndustryDocument6 pagesIfrs 16 Leases Implications For The Shipping IndustryViseshNo ratings yet

- Accounting For Leases and The Failure of Convergence: by Roger HusseyDocument18 pagesAccounting For Leases and The Failure of Convergence: by Roger HusseyreemmajzoubNo ratings yet

- 10 Minutes Future Lessee AccountingDocument8 pages10 Minutes Future Lessee AccountingRazii KamaliNo ratings yet

- Buy or Lease SummaryDocument5 pagesBuy or Lease SummaryjasNo ratings yet

- Leases: Source: World Leasing Yearbook Excludes Property LeasingDocument5 pagesLeases: Source: World Leasing Yearbook Excludes Property LeasingShreejith nairNo ratings yet

- SLFRS 16 - Leasing: Please Note: LKAS 17: LEASING (Will Not Be Questioned) - For Additional Information OnlyDocument7 pagesSLFRS 16 - Leasing: Please Note: LKAS 17: LEASING (Will Not Be Questioned) - For Additional Information Onlyganraj100% (1)

- KPMG Financial Instruments - The Complete StandardDocument4 pagesKPMG Financial Instruments - The Complete Standardhui7411No ratings yet

- Critique Paper Bdo - Far4Document9 pagesCritique Paper Bdo - Far4John Jet TanNo ratings yet

- Proposed Lease Accounting For Lessees: Journal of Business & Economics Research - January, 2011 Volume 9, Number 1Document8 pagesProposed Lease Accounting For Lessees: Journal of Business & Economics Research - January, 2011 Volume 9, Number 1Jihad DarwishNo ratings yet

- Sinking Funds, Reserve Funds and Depreciation Charges in Commercial PropertiesDocument14 pagesSinking Funds, Reserve Funds and Depreciation Charges in Commercial Propertiesgherman_george100% (1)

- Chapter 03 - Analyzing Financing ActivitiDocument72 pagesChapter 03 - Analyzing Financing ActivitiMuhammad HamzaNo ratings yet

- IFRS Accounting of Financial LiabilitiesDocument6 pagesIFRS Accounting of Financial LiabilitiesSajan CvNo ratings yet

- JW MarriottDocument4 pagesJW MarriottroshanNo ratings yet

- Case 5.15 Audit 202Document3 pagesCase 5.15 Audit 202DonNo ratings yet

- Top 10 Hurricane Preparedness Practices For Construction SitesDocument7 pagesTop 10 Hurricane Preparedness Practices For Construction SitesMike KarlinsNo ratings yet

- An Overview of The AIA's 2017 Revised DocumentsDocument5 pagesAn Overview of The AIA's 2017 Revised DocumentsMike KarlinsNo ratings yet

- Technology: Construction's Modern-Day Judge and Jury: by Rick KolbDocument5 pagesTechnology: Construction's Modern-Day Judge and Jury: by Rick KolbMike KarlinsNo ratings yet

- Key Financial Indicators of Project ProgressDocument7 pagesKey Financial Indicators of Project ProgressMike KarlinsNo ratings yet

- Measure KPIs To Keep Projects On TrackDocument6 pagesMeasure KPIs To Keep Projects On TrackMike KarlinsNo ratings yet

- Enterprise Risk ManagementDocument8 pagesEnterprise Risk ManagementMike Karlins100% (1)

- Key Factors in Construction Project ControlsDocument11 pagesKey Factors in Construction Project ControlsMike KarlinsNo ratings yet

- Asset Protection and Recovery For Construction Facilities and Jobsites in The 21st CenturyDocument4 pagesAsset Protection and Recovery For Construction Facilities and Jobsites in The 21st CenturyMike KarlinsNo ratings yet

- Protecting From CyberattacksDocument7 pagesProtecting From CyberattacksMike KarlinsNo ratings yet

- Are You Managing Your Contract RisksDocument3 pagesAre You Managing Your Contract RisksMike KarlinsNo ratings yet

- But They'Ll Never RetireDocument7 pagesBut They'Ll Never RetireMike KarlinsNo ratings yet

- The Top Five Ownership Transition Inflection PointsDocument3 pagesThe Top Five Ownership Transition Inflection PointsMike KarlinsNo ratings yet

- The Lien WaiverDocument5 pagesThe Lien WaiverMike KarlinsNo ratings yet

- A Checklist For Construction Risk ManagementDocument4 pagesA Checklist For Construction Risk ManagementMike KarlinsNo ratings yet

- Fundamentals of Issue Resolution and EscalationDocument5 pagesFundamentals of Issue Resolution and EscalationMike KarlinsNo ratings yet

- Code of Ethics Model: A Sample Model Developed by The USDOT/ AGC / ARTBA / AASHTO Suspension & Debarment Work GroupDocument9 pagesCode of Ethics Model: A Sample Model Developed by The USDOT/ AGC / ARTBA / AASHTO Suspension & Debarment Work GroupMike KarlinsNo ratings yet

- Accounting For Employee Use of Company VehiclesDocument12 pagesAccounting For Employee Use of Company VehiclesMike KarlinsNo ratings yet

- 01 2015 Houston Economy at A GlanceDocument11 pages01 2015 Houston Economy at A GlanceMike KarlinsNo ratings yet

- Building A Fraud Free WorksiteDocument2 pagesBuilding A Fraud Free WorksiteMike KarlinsNo ratings yet

- All Elections Are ImportantDocument1 pageAll Elections Are ImportantMike KarlinsNo ratings yet

- The Twists and Turns of Education Construction SpendingDocument5 pagesThe Twists and Turns of Education Construction SpendingMike KarlinsNo ratings yet

- Building A Skilled WorkforceDocument3 pagesBuilding A Skilled WorkforceMike KarlinsNo ratings yet

- 2021 BEA1101 Study Unit 5 SolutionsDocument13 pages2021 BEA1101 Study Unit 5 SolutionsKhanyisileNo ratings yet

- Acs102 Fundamentals of Actuarial Science IDocument6 pagesAcs102 Fundamentals of Actuarial Science IKimondo King100% (1)

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyNo ratings yet

- Ad Account Question PaperDocument3 pagesAd Account Question PaperAbdul Lathif0% (1)

- Module 4Document3 pagesModule 4Robin Mar AcobNo ratings yet

- Abhishek ReportDocument67 pagesAbhishek ReportAbhishek KarNo ratings yet

- Module 07.5 - Foreign Currency Accounting PSDocument5 pagesModule 07.5 - Foreign Currency Accounting PSFiona Morales100% (2)

- Simple InterestDocument24 pagesSimple InterestAgatha JenellaNo ratings yet

- HW Due 022213Document8 pagesHW Due 022213xxshoopxxNo ratings yet

- BP, Reliance in $7.2 BN Oil Deal: Market ResponseDocument22 pagesBP, Reliance in $7.2 BN Oil Deal: Market ResponseAnkit PareekNo ratings yet

- EPC Document (05-10-2010)Document200 pagesEPC Document (05-10-2010)Superb HeartNo ratings yet

- Silo - Tips - Trading With An Edge Multiple Systems Multiple Time FramesDocument44 pagesSilo - Tips - Trading With An Edge Multiple Systems Multiple Time Framesshailesh233No ratings yet

- All Fiori ApplicationDocument49 pagesAll Fiori ApplicationRehan KhanNo ratings yet

- Period Cash Flow Future Value: Investment 2Document2 pagesPeriod Cash Flow Future Value: Investment 2Kim FloresNo ratings yet

- Phrasal Verbs Related To MoneyDocument3 pagesPhrasal Verbs Related To MoneyFrancisco Antonio Farias TorresNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- 5-Non-Banking Financial InstitutionsDocument19 pages5-Non-Banking Financial InstitutionsSharleen Joy TuguinayNo ratings yet

- FICO Vox Pop Report - Fine Tuning Our Financial FuturesDocument16 pagesFICO Vox Pop Report - Fine Tuning Our Financial FuturesChidera UnigweNo ratings yet

- Financial Aid Reflection Lesson 14Document2 pagesFinancial Aid Reflection Lesson 14api-287801256No ratings yet

- Transpo ReviewerDocument22 pagesTranspo ReviewerPéddiéGréiéNo ratings yet

- Axis Bank SR 2018 Final Report - v1 0 PDFDocument114 pagesAxis Bank SR 2018 Final Report - v1 0 PDFAnurag KhareNo ratings yet

- JM Financial Asset Reconstruction Company Limited (JMFARC) : Corporate PresentationDocument28 pagesJM Financial Asset Reconstruction Company Limited (JMFARC) : Corporate PresentationbestdealsNo ratings yet

- MainMenuEnglishLevel-3 RLD2014016Document291 pagesMainMenuEnglishLevel-3 RLD2014016Asif RafiNo ratings yet

- PSNT of MFSDocument8 pagesPSNT of MFSPayal ParmarNo ratings yet

- Urban Sprawl PDFDocument32 pagesUrban Sprawl PDFAndrei AntonNo ratings yet

- Solutions Manual: Modern Auditing & Assurance ServicesDocument17 pagesSolutions Manual: Modern Auditing & Assurance ServicessanjanaNo ratings yet

- ECON 1000 Final Exam-AID Review Package PDFDocument75 pagesECON 1000 Final Exam-AID Review Package PDFJanani PriyaNo ratings yet

- Ratio and Fs AnalysisDocument74 pagesRatio and Fs AnalysisRubie Corpuz SimanganNo ratings yet

- International Settlement Letter of CreditDocument80 pagesInternational Settlement Letter of CreditveroNo ratings yet

- Alfursan Membership Guide (English) 3 PDFDocument15 pagesAlfursan Membership Guide (English) 3 PDFZulfikarNo ratings yet