Professional Documents

Culture Documents

Topic 3 Receipts and Collections

Uploaded by

Syaflin Butik Fesyen MOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 3 Receipts and Collections

Uploaded by

Syaflin Butik Fesyen MCopyright:

Available Formats

Topic

3

1. 2. 3. 4. 5.

Receipts and Collections

LEARNING OUTCOMES

By the end of this topic, you should be able to: Describe legal framework for receipts and collections; Identify the sources of school funds; Recognise the sources of school collections; Demostrate the procedure of recording receipts; and Practice in controling of receipts and collections.

INTRODUCTION

Have you ever thought where does the school money come from ?

Receivable is money that is acquired by a school from the government and public. All receivables must account exactly according to the procedure prescribed. This is to prevent lost of school money that may be caused by the failure to collect and record, negligence, deviation and limited knowledge. Receivables of a school can be divided into two groups - government and semigovernment. Receivables from the government is as subject service offering and assistance of non-subject. Receivables from other sources are such as collection from student, parent, public charity and charge imposed for the usage of school facilities.

64

TOPIC 3 RECEIPTS AND COLLECTIONS

3.1

LEGAL FRAMEWORK FOR RECEIPTS AND COLLECTIONS

School Pool of Money is made from a certain amount of money entrusted to the school manager in order for him/her to organise efficiently, effectively and with trust. These moneys are sourced from the government and other sources. These money also need to be managed according to accounting discipline such as shown in Figure 3.1.

Figure 3.1: A comic to highlight the issue of legal framework for receipts and collections. Sources: http://www.cartonstock. com

Collections of money that received by the school can be categorised into three groups as per Figure 3.2: (a) (c) Government Group Money; Hostel Pool of Money (School as have hostel). (b) SUWA Pool of Money (Public Funds Contribution); and

Figure 3.2: Categories of school money

TOPIC 3 RECEIPTS AND COLLECTIONS

65

Each pool of money is managed by separate and a bank account open for each stated of pool money. Schools that have less than 100 students incur less expenditure, therefore one bank account is sufficient. Government Group Money accounts all receivables acquired from Government Service Offering (including receivables from a statutory body and bank interest) except for government aid which is related to hostel. Among the causes which include in financial account of the Government Group Money is shown in Figure 3.3: (a) (c) Pre-school Service Offering; Plan Assistance Supplementary Food or Practical Device Food And Nutrition; Launching grant for new school open; Government Scholarship Assistance (State Institution / Petronas /FORWARD) and chartered bodies; (b) Per Service Offering Subject Capital and non subject;

(d) Capital Grant; (e) (f)

(g) Scheme Assistance Tuition Voucher (SBT);

Figure 3.3: Sources to government group of money

66

TOPIC 3 RECEIPTS AND COLLECTIONS

(h) Trust Fund Group Relief Poor Student (KWAPM); (i) (j) Special Allowance Assistance Special Education Student; Bank interest; and

(k) Other programs of grant according to Malaysias Education Ministry. Expenditures made from this pool of money must be in accordance with the assistance or grant stated.

3.1.2 SUWA Pool of Money

SUWA is a group of money that is received by the school apart from the government offering service and Hostel Pool of Money. The money will be considered as SUWA Pool of Money in cases such as: Fee from student, charity from the public, school canteen rent, income from school book shop, charge imposed on uses of property and school facility, bank interest, various receivable accepted from collateral example, moneys used for specific purpose, general purpose and other uses as shown in Figure 3.4.

Figure 3.4: Sources to SUWA Pool of Money

The uses of SUWA Pool of Money and other related items will be discussed in sub-topic 3.4.

3.1.3

Hostel Pool of Money

Hostel Pool of Money is made from all receivables related to hostel, either in the form of government assistance or collection made from students.

TOPIC 3 RECEIPTS AND COLLECTIONS

67

Among the causes for this financial certified under Hostel Pool of Money includes: (a) (c) (e) (f) Other assistance for regular hostel expenditures in the year; Hostel food fees; Laundry fee; Bank interest; and (b) Food aid grant for student; (d) Registration fee;

(g) Various fees were allowed in discipline present. Expenditures made from this Pool of Money must be related to hostel only. For hostel that is separated from school (centre hostel), appointed by chief of PTJ, must manage and operate finance and accounts related to Hostel Pool of Money. Chief Wardens must be responsible to collect hostel fees from the student.

SELF-CHECK 3.1

1. 2. 3. 4. How many types of school collection money are there? Give five examples of sources included in Government Group of Money. What are the sources cointained in the SUWA Pool of Money? What are the causes for Hostel Pool of Money?

ACTIVITY 3.1

Discuss with your friend which category of moneyGovernment Group Money or SUWA Pool of Moneythat distributes more money in the schools financial administration.

3.2

SOURCES OF SCHOOL FUNDS

Grant is money or goods that are allocated and distributed to the school to accommodate teaching and learning needs. For example, Grant Per Capita Aid. Grant also includes money or goods that are allocated and distributed to the school for accommodating the supply of cooked food or green feed for pre-school students and hostel, for example Plan Assistance Supplementary Food.

68

TOPIC 3 RECEIPTS AND COLLECTIONS

Grants are money or goods allocated and distributed to the school for students based on the criteria or qualification of parents or caretaker. It is to help sustain student needs and fund of schooling. Assistance that are given to students include Plan Assistance Supplementary Food (RMT), School Milk Programmes, Scheme Assistance Tuition Voucher (SBT), Trust Fund Group Relief Poor Student (KWAPM) and other that cases fixed time to times. The types of grant and funds to the school are as follows: 1. 2. 3. 4. 5. 6. 7. 8. 9. Pers Service Offering Capital For School; Supplementary Food Programs (RMT) In Primary School; Capital Grant; Grant Launching; Food Aid Grant Student; Scheme Service Offering Tuition Voucher (SBT) In Primary School; Trust Fund Group Relief Poor Student (KWAPM); Special Allowance Assistance Special Education Student; Grant and other assistance from Education Ministry of Malaysia.

3.2.1

Per Capita Grant (PCG)

PCG grant was created for financial assistance under allocation managing costs by Education Ministry to each student in government schools and nongovernment schools. This allocation grant includes PCG pre-school, PCG subject and PCG non-subject. 1. 2. Pre-school PCG consists of: (a) Pers Assistance Capital. Subject PCG comprise: (a) Core subject; (b) Compulsory subject; (c) Additional subject / Foreign Language; (d) Elective Subject Not subject PCG comprise from: (a) School Resource Centre; (b) Guidance and Counselling; (c) Recurring Expenditure Others Year / Others

3.

TOPIC 3 RECEIPTS AND COLLECTIONS

69

(d) Special Expenditure (LPBT / LPK); (e) LPBT / LPK Hostel. 4. 5. PCG group subject and not subject group PCG were analysed analytically in such Appendix 3-1; PCG Aid type and expenditure purpose settle by detailed in such as Appendix 3-2.

Rate, claim procedure, coordination claim and assistance transfer of PCG is based on circular, which was issued by Finance Division, Ministry of Education while operative: 1. 2. 3. Per Capital Grant for school; Distribution subject rate of core component such as Science, Mathematics and English. Turnover or purchase of capital property and coordination claim of PCG.

PCG allocation that is received by the school must be disbursed in the current year. However, the total purchase must not exceed 10 percent more than the originally accepted PCG in that year because it will be brought to next year. This provision will be accounted for in the Cash Book Government Group of Money, as follows: 1. 2. Pre-school PCG (i) Pre-school column. PCG subject clan not subject (i) Related items column.

3.2.2

Supplementary Food Programme (RMT)

RMT is a program that aims to help increase nutritional status and student health in primary school. Priority is given to the students from rural and lower income group. Student election, preparation and distribution of food and other relating task must refer to Supplementary Food Programme Guidelines Book, issued by Education Ministry. This provision must be accounted for in the Cash Book of Government Group Money under various column with organize Subsidiary Account.

70

TOPIC 3 RECEIPTS AND COLLECTIONS

RMT payment method in primary school must refer to the circular, which was issued by Finance Division, in Education Ministry.

3.2.3

Capital Assistance

Capital assistance is made from financial allocation under development expense, which is administered to Full Assistance Non- Government School, Education Ministry, where the building and land belong to the federal government. Land or school building owned by individuals, Mubalighs side or state government.

There are four categories of schools that accept capital help as illustrated in Figure 3.5: 1. 2. 3. 4. Primary School / Secondary Missionary; Chinese National Type School (SJK(C)); Tamils National Type School (SJK(T)); National Religious School (SAR).

Grant application procedure, project implementation, grant criteria, capital help guide capital and other related task must refer to Circular Procedure of Capital Grant that is distributed to the Full Assistance Non- Government School issued by Development Division and Earnings. This provision must be accounted for in the Cashbook of Government Group Money under various column with organised Subsidiary Account.

Figure 3.5: Types of school that receive capital assistance

TOPIC 3 RECEIPTS AND COLLECTIONS

71

3.2.4

Launching Grant

Launching grant is the provision provided by Development and Earnings Department (BPP), Malaysia Education Ministry (KPM) for the schools that have just started operation. The purpose of the provision is to help new school management to start their operation of administration. Approved rate depend on the school category according to guidelines, which was issued by BPP, Ministry of Education. This provision must be accounted into Cash Book of Government Group Money under various columns. School managers can use this provision to buy goods that are listed by Development and Earnings Department (BPP), KPM.

3.2.5

Student Food Aid Grant

Student Food Aid Grant is given to pre-schoolers and students who live in either a government hostel or state-government hostel. Food aid rate is the same for all pre-school classes throughout the country. Food aid rate for the students who live in hostel depend on food supply to the hostel - feed cooked or green feed. Rate, claim procedure, co-ordination claim and other related task were according to circular, which was issued by Finance Division of KPM. Accepted allocation is accounted as follows: 1. 2. Pre-school expenditure is accounted for in Cash Book of Government Group Money as pre-school item. Hostel expenses are entered into Cash Book of Hostel Pool of Money as Food Aid.

72

TOPIC 3 RECEIPTS AND COLLECTIONS

3.2.6

Assistance Provision of Tuition Voucher Plan (SBT)

SBT aims to give tuition and extra guidance to poor students who are weak in Malay Language, English, Mathematics and Science. This programme is targeted at providing the students concerned with fundamental knowledge and basic skills. Tuition under this scheme is expected to supplement the normal learning activities at school. SBT must be implemented according to the guidelines stipulated in the Guidelines Book of Assistance Provision of Tuition Voucher that was issued by School Division, KPM. The provision for this activity must be accounted in the Cash Book of Government Group Money or Hostel Pool of Money under the column Subsidiary Account.

3.2.7

Group Financial Assistance Poor Student Trust Fund (KWAPM)

KWAPM financial assistance applies to those who are: 1. 2. 3. Malaysia citizen and poor students from government schools such as SK, SJK (C) and SJK (T); tudents from economically-disadvantaged background; Students who are not getting schooling assistance from any party or the assistance provided is not enough.

Procedural rate, payment assistance and other task related are based on Payment Procedure of KWAPM Assistance which was issued by Scholarship Department, KPM. This provision must be accounted in Cash Book of Government Group Money under various columns which maintain subsidiary account.

TOPIC 3 RECEIPTS AND COLLECTIONS

73

3.2.8

Special Allowance Assistance For Special Education Students

Special Allowance Assistance for Special Education Students is made available to all special students. The rate that was given is RM 25 one month per student. School will receive instruction from Special Educational Department, KPM. The payment are made to school managers through Malaysia Accountant Department (JANM). Cheques that are received from JANM must be accounted in the Cashbook of Government Group Money under various column which maintain Subsidiary Account. School must ensure that report of cost performance is updated and submitted to Special Education Department, KPM beginning of each month. The aid distribution by the school to students must be done in accordance to the procedures issued by Special Educational Department, KPM.

ACTIVITY 3.2

1. 2. Discuss with your friends what is the difference between Subject PCG and Non-Subject PCG. In your opinion, why should the Supplementary Food Programme (RMT) continue to be implemented in school?

SELF-CHECK 3.2

1. 2. What are the grant types and funds in school? What are the four types of schools that receive capital assistance?

74

TOPIC 3 RECEIPTS AND COLLECTIONS

3.3

RECORDING PROCEDURES FOR RECEIPTS

There are two types of receipt recording: 1. 2. Recording procedures for cash or cheque receipts. Recording procedures for collection through bank account.

Each receivable must issue receipt. The receipt is official document to prove each receivable. Usually, receivable is money in the form of cheque, remittance and others but the school must use the official receipts that is recommended.

Figure 3.6: A cartoon to describe the many reason people do for money Sources: http://www.cartonstock.com

3.3.1

Procedures of Cash/Cheque Receivable

Official receipts which are used in school can be divided into two types as diagram 3.7:

Figure 3.7: Type of Receipts

Office Official Receipt (RP01) is issued by school manager or authorised officers to teachers / wardens or hostel supervisors. 1. 2. Format receipt is like in Appendix 3-3; Filling guide receipt such as Appendix 3-3A.

TOPIC 3 RECEIPTS AND COLLECTIONS

75

Student Official Receipt is issued by teachers / wardens / hostel supervisors to students. These receipts are divided into three types as follows: 1. RM01 - utilised by all schools except Chinese SJK and SJK Tamil. �� Format receipt is like in Appendix 3-4; �� Filling guide student receipt such as Appendix 3-4A. 2. 3. RM02 - utilised by Chinese SJK. �� Format receipt is-like in Appendix 3-5. RM03 - utilised by SJK Tamil. �� Format receipt is-like in Appendix 3-6. Schools can only get a receipt book from Percetakan Nasional Malaysia Berhad. All school fees that are collected must be issued with receipts by the form teacher and must be noted in a register book. School manager must make sure that all receipt numbers and total collections must be recorded in that book. Collections that were made by form teacher need to be recorded in Receive and Submitted Form as per Appendix 3-7. It must be filled in two copies. A copy must be submitted together with receipt book and the money collected to school manager on the same day. Filling guide for this form is shown in Appendix 3-7A. All receivables through the post need to be recorded in Money and Goods List through Post Form as per Appendix 3-8. This receivable receipt needs to be sent through the post to the payer. Receipt number needs to be stated in the register and transaction must be recorded in the cashbook. By referring to the receipts that have been issued, the school manager must determine the type of receivable before recording in the cashbook. School manager who is assigned to collect the money is required to:

Cash collection exceeding RM500 or total collection (include cash, cheque, post money etc) which exceeded RM2,000 or what total lesser which has been prescribed by Responsibility Centre respectively, must be banked-in on that day and if it have been late in receiving, it must be done on the following working day. However, each cheque received must be credited to the schoolbook period of a week after the receipt.

76

TOPIC 3 RECEIPTS AND COLLECTIONS

Collections that have not been counted also must be credited into the bank by the end of the month. All funds collected must be accounted for before the end of the year. Bank-in slips must be filled up before transferring the funds into the bank. The slips can be obtained from the bank where the school account is opened. Bank-in slips must be prepared according to the pool of money. The account number must be written on the slips before the money is banked in. The counterfeit of the bank-in slip that has been acknowledged must be checked against the cashbook by the school manager before it is filed accordingly.

3.3.2

Procedure of Payment Collection through Bank

Boarding school, polytechnic, vocational school and secondary school are allowed to bank-in the funds directly into the school account and the requirements are as follows: 1. School must obtain written approval from the bank concerned to start this system. The bank-in slip format must be discussed by the relevant parties as shown in Appendix 3-9. Special bank-in slips must be printed according to the need of the school and bank. The information to be included in the bank-in slip are: (a) Print on the form. �� World No. Serial of Bank in Slip Payment (beginning with the letter K (KW Government), S (KW SUWA) and A (KW Hostel). (b) Name and school address. �� Bank Account Number; �� Purpose of the payment (fee type / term / year). (c) Fill by student. �� Name; �� Identity Card Number; �� Form; �� Total. A written approval from the Finance Division of Accounts Department must be submitted with: 1. Written consent from bank;

2.

TOPIC 3 RECEIPTS AND COLLECTIONS

77

2.

Format slip pay enter bank that has been agreed.

To make sure that the bank-in slip given to a student is in accordance with the purpose of payment before end of the year. Bank-in slip must be recoded in the Register of Bank-in Slip as shown in Appendix 3-10. For filling example, refer to Appendix 3-10A. Three copies of bank-in slips must be produced for the use of bank, school and student. Besides the original copy, the other two will be carbon copies. Schools should not prevent parents who opt to pay using the conventional method . For payment using this system, receipt can only be issued after the bank acknowledges the schools bank-in slip payment. A form teacher who receives the bank-in slip payment must issue the Student Official Receipt and make notes in the Class Register Book by providing the serial number and date of the Bank In Slip Payment. The serial number of Bank in Slip Payment must be stated in the receipt together with a note stating if the payment was made using cash or cheque. Bank-in slip payment needs to be recorded in Receive and Submitted Form for School Office on the same day or latest by the next day. School must provide Office Official Receipt to the teachers, hostel wardens and hostel supervisors who receive the student fees on behalf of the school. Office Official Receipt date must be the same with the date in Receive and Submitted Form to School Office. The recording in the cashbook should be done immediately based on Office Official Receipt. Bank reconciliation must be prepared at the end of the month to identify the difference between cashbook and bank statement.

SELF-CHECK 3.3

1. 2. What are the two types of receipts in school ? What is the name of the company that provides the school receipts?

78

TOPIC 3 RECEIPTS AND COLLECTIONS

3.4

SOURCES FOR SCHOOL COLLECTIONS

SUWA is a group of money that is received by the school apart from the government service and Hostel Pool of Money. The following can be considered as SUWA Pool of Money: 1. 2. 3. 4. 5. 6. 7. Fee from student; Charity from the public; School canteen rent; Income from school book shop; Charge imposed on uses of property and school facilities; Bank interest;

Figure 3.8: A cartoon to explain the increasing and decreasing of financial

Various receivables accepted from Sources: http://www.cartonstock.com collateral such as, moneys pick used for specific purposes, general purposes and other uses. Money Pick Special for Specific Purpose When school collects funds from student or public in the form of: 1. 2. 3. Special fee from student for sport, library, art and painting; Additional fees such as exercise books, paper, internal examination, cocurriculum management and school magazines; Collection on behalf of a third party as living insurance, School Sport Associations Fees and other fees as directed by Ministry of Education.

(a)

(b) Money Pick for General Purpose Collection such as canteen rental, general charity and other collections which are for specific purposes. This money can be used by the school, for example: 1. 2. 3. 4. Expenditure to carry out student activity; Expenditure for giving students emergency treatments when necessary; Student transportation cost; Other expenditure that are beneficial to the students.

TOPIC 3 RECEIPTS AND COLLECTIONS

79

(c)

Money Different Uses SUWA Expenditure apart from (a) and (b) must obtain the approval from the chief of PTJ.

SELF-CHECK 3

Search for an article on the Internet that shows the difference between money picked for a specific purpose with money picked for a general purpose.

ACTIVITY 3.3

Give five examples of sources that are included in the SUWA Pool of Money.

3.5

CONTROL OF RECEIPTS AND COLLECTIONS

All fees of a school must be collected as per the rules set by the relevant bodies. By right, the fees are to be collected by the school manager only. In case this is not possible, the school manager must appoint a representative in writing. Appendix 3-11, shows the format of the empowerment letter. The example of the Letter of Authority Collection Public Money is made available in Appendix 3-11A. School managers are allowed to receive cheque as payment. All cheques are to be issued under the name of the schools principal or headmaster. The cheques must be crossed ACCOUNT PAYEE ONLY. If the cheque is rejected by the bank, the following actions are to be taken by the school: 1. 2. 3. To make adjustment in payment section of the cashbook with a note which states contra cheque dishonoured. Get the collection back immediately. When getting repayment, the receivable procedure need to be observed again.

The process of Office Official Receipt must be carried out by two officers. One officer will issue the receipt while the other collects the money and acknowledges on the receipt.

80

TOPIC 3 RECEIPTS AND COLLECTIONS

The process of release of Student Official Receipt must be dealt with the form teacher who has been assigned with the task. Amendments on the receipt are strictly prohibited. Should there be an error, the receipt must be cancelled and a fresh one issued. The cancelled receipt must be stamped with Void and filed for auditing purposes. The new receipt books accepted from the supplier must be thoroughly checked to determine if the serial numbers are running. Officer who is doing the check must make a note behind the first receipt of a book. The sample is as follows:

This receipt book has been checked and found satisfactory with the serial number . to . Date : ___________ Collector Signature : ___________ Collector Full Name : __________

It is advisable for the school manager to create a Receipt Book Register as shown in Appendix 3-12 to record the receipt books movements. Receipt book is to be issued to the authorised officer who will be making the collections. The officer in charge must acknowledge on the Receipts Book Register after getting a receipt book. Receipt book needs to be issued according to the serial number in ascending order. An example of the filing guide can be found in Appendix 3-12A. The unused receipts must be cancelled at the en of the financial year. However, if a need arises the receipts can also be utilised the following year. The unused receipts must be recorded in the Receipts Book Register. All the schools collection of the day must be kept in a safe box and this includes cash and cheques exceeding RM1,000.00. If the school does not have a safe box, the collection must then be kept in a nearby police station and a receipt is to be obtained from the police officer in charge.

TOPIC 3 RECEIPTS AND COLLECTIONS

81

SUMMARY

�� Legal framework for receipts and collections. 1. 2. 3. Government Group Money; SUWA Pool of Money; Hostel Pool of Money.

�� Sources of school funds. 1. 2. 3. 4. 5. 6. 7. 8. 9. Pers Service Offering Capital For School; Supplementary Food Programs (RMT) In Primary School; Capital Grant; Grant Launching; Food Aid Grant Student; Scheme Service Offering Tuition Voucher (SBT) In Primary School; Trust Fund Group Relief Poor Student (KWAPM); Special Allowance Assistance Special Education Student; Grant and other assistance from Education Ministry of Malaysia.

�� Sources of school collection. 1. 2. 3. 4. 5. 6. Fee from student; Charity from the public; School canteen rent; Income from school book shop; Charge imposed on uses of property and school facility; Bank interest.

�� Recording procedures for receipts; 1. 2. Office Official Receipt; Student Official Receipt.

82

TOPIC 3 RECEIPTS AND COLLECTIONS

Assistance Provision of Tuition Voucher Plan (SBT) Capital Assistance Capital Grant Charity Collections Food Aid Grant Student Government Group of Money Group Financial Assistance Poor Student Trust Fund (KWAMP) Hostel Pool of Money

Launching Grant Office Official Receipt Per Capital Grant (PCG) Receipts Receivable Student Official Receipt School Pool of Money Supplementary Food Programme (RMT) SUWA Pool of Money

REFERENCES

Bahagian Kewangan Kementerian Pelajaran Malaysia. (2005). Tatacara Pengurusan Kewangan dan Perakaunan Kumpulan Wang Sekolah. KPM; Putrajaya. Fowler, W. J. Junior. (1990). Financial Accounting for Local and State School Systems. Washington, DC: U.S. Departemnt of Education

You might also like

- Topic 1 Theoretical FrameworkDocument34 pagesTopic 1 Theoretical FrameworkSyaflin Butik Fesyen MNo ratings yet

- Topic 2 BudgetingDocument28 pagesTopic 2 BudgetingSyaflin Butik Fesyen MNo ratings yet

- Mini MPI Circuit DiagramsDocument41 pagesMini MPI Circuit DiagramsbdruettNo ratings yet

- Assg Curikulum ManagementDocument9 pagesAssg Curikulum ManagementSyaflin Butik Fesyen MNo ratings yet

- Tutorial 3d Cad Pemula Buat BelajarDocument228 pagesTutorial 3d Cad Pemula Buat BelajarNur KhoirNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pedagogy of Teaching HistoryDocument8 pagesPedagogy of Teaching HistoryLalit KumarNo ratings yet

- Rite of Sodomy Vol 1Document690 pagesRite of Sodomy Vol 1Von Erarich.No ratings yet

- Instant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full ChapterDocument32 pagesInstant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full Chapteralicenhan5bzm2z100% (3)

- Magsaysay v. NLRCDocument17 pagesMagsaysay v. NLRCJohn BernalNo ratings yet

- HDFC BankDocument6 pagesHDFC BankGhanshyam SahNo ratings yet

- 5 6271466930146640792Document1,225 pages5 6271466930146640792Supratik SarkarNo ratings yet

- RA 8293 Key Provisions on Compulsory Licensing and Patent RightsDocument30 pagesRA 8293 Key Provisions on Compulsory Licensing and Patent RightsPrincessNo ratings yet

- Liberal Arts Program: Myanmar Institute of TheologyDocument6 pagesLiberal Arts Program: Myanmar Institute of TheologyNang Bu LamaNo ratings yet

- ULI Europe Reshaping Retail - Final PDFDocument30 pagesULI Europe Reshaping Retail - Final PDFFong KhNo ratings yet

- Lecture 3 SymposiumDocument20 pagesLecture 3 SymposiumMakkNo ratings yet

- iOS E PDFDocument1 pageiOS E PDFMateo 19alNo ratings yet

- United BreweriesDocument14 pagesUnited Breweriesanuj_bangaNo ratings yet

- Charlotte Spencer - Student - SalemMS - Manifest Destiny and Sectionalism Unit PacketDocument9 pagesCharlotte Spencer - Student - SalemMS - Manifest Destiny and Sectionalism Unit Packetcharlotte spencerNo ratings yet

- Indirect Questions BusinessDocument4 pagesIndirect Questions Businessesabea2345100% (1)

- Harmony Ville, Purok 3, Cupang, Muntinlupa CityDocument2 pagesHarmony Ville, Purok 3, Cupang, Muntinlupa CityJesmar Quirino TutingNo ratings yet

- Recolonizing Ngugi Wa Thiongo PDFDocument20 pagesRecolonizing Ngugi Wa Thiongo PDFXolile Roy NdlovuNo ratings yet

- Office 365 - Information Security Management System (ISMS) ManualDocument18 pagesOffice 365 - Information Security Management System (ISMS) ManualahmedNo ratings yet

- Find Offshore JobsDocument2 pagesFind Offshore JobsWidianto Eka PramanaNo ratings yet

- GT Letters - Notes and Practice QuestionDocument14 pagesGT Letters - Notes and Practice Questionओली एण्ड एसोसिएट्स बुटवलNo ratings yet

- VA-25 Grammar 5 With SolutionsDocument11 pagesVA-25 Grammar 5 With SolutionsSOURAV LOHIANo ratings yet

- Invitation to Kids Camp in Sta. Maria, BulacanDocument2 pagesInvitation to Kids Camp in Sta. Maria, BulacanLeuan Javighn BucadNo ratings yet

- Computer Shopee - Final Project SummaryDocument3 pagesComputer Shopee - Final Project Summarykvds_2012No ratings yet

- Lecture Law On Negotiable InstrumentDocument27 pagesLecture Law On Negotiable InstrumentDarryl Pagpagitan100% (3)

- Petitioner: First DivisionDocument7 pagesPetitioner: First DivisionUser 010897020197No ratings yet

- Dukin DonutsDocument1 pageDukin DonutsAnantharaman KarthicNo ratings yet

- Location - : Manhattan, NyDocument15 pagesLocation - : Manhattan, NyMageshwarNo ratings yet

- Annex D Initial Evaluation Results IER 2Document6 pagesAnnex D Initial Evaluation Results IER 2ruffaNo ratings yet

- Russian SU-100 Tank Destroyer (30 CharactersDocument5 pagesRussian SU-100 Tank Destroyer (30 Charactersjason maiNo ratings yet

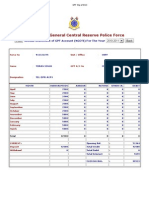

- Annual GPF Statement for NGO TORA N SINGHDocument1 pageAnnual GPF Statement for NGO TORA N SINGHNishan Singh Cheema56% (9)

- City of Baguio vs. NiñoDocument11 pagesCity of Baguio vs. NiñoFD BalitaNo ratings yet