Professional Documents

Culture Documents

Vat-Chapter Three-1

Uploaded by

rachna357Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat-Chapter Three-1

Uploaded by

rachna357Copyright:

Available Formats

CHAPTER THREE

VAT REGISTRATION Learning Objectives

When you have completed this chapter, you should be able to: Say who are the persons who : have to apply for compulsory registration may apply for VOLUN !"# registration

$%plain: &ow a person should apply for registration' the provisions relating to the certificate of registration and the V! "egistration number' the implications of not registering for V! ' the provision relating to business splitting' when a V! registration is cancelled'

3.0

INTRODUCTION (n order to be able to charge V! , a person has to be registered for V! ' V! registration is governed by )art IV of the V! !ct' (t provides when a person has to register for V! and when a person may voluntarily re*uest registration'

3.1 3.1.1

LICATION !OR CO" ULSOR# REGISTRATION

Registration under Section 15(1) ! person has to apply for compulsory registration b$ virt%e &' secti&n 1()1* where:

+i, +ii, 3.1.2

in the course or furtherance of his business, he ma-es ta%able supplies, and his annual turnover of ta%able supplies e%ceeds or is li-ely to e%ceed the limit as specified in the Si%th Schedule' he limit is currently two million rupees' Registration under Section 15(2)(a)(i)

! person engaged in a business or profession specified in )art ( of the

enth Schedule, and

whose turnover of ta%able supplies does not e%ceed or is not li-ely to e%ceed the amount specified in the Si%th Schedule is still liable to apply for compulsory registration, by virtue of Section 15(2)(a) (i) .usinesses and professions specified in )art ( of enth Schedule are as follows/ 0' 3' 5' 1' 4' 6' 7' 9' !ccountant and or auditor !dvertising agent !dviser including investment adviser and ta% !rchitect+draughtsman deleted w'e'f !ttorney and or solicitor .arrister <learing and forwarding agent under the <ustoms !ct' <onsultant including legal consultant, ta% consultant, management consultant and management company other than a holder of a management licence under the >inancial Services !ct 3==7 :' <ustoms house bro-er under the <ustoms !ct 33' ravel agent registered with the (nternational 0'0='=6, 0= ' 00 ' $ngineer $state agent 35' 31' ?eneral Sales !gents of !irlines w'e'f0'0='=5 @Car RentalA Beleted by >! 3==6 +deleted w'e'f 0'0='=6, !ir ransport !ssociation +(! !, +deleted w'e'f 30' our operator +deleted w'e'f 0'0='=6, 07' 09' 0:' 3=' )ro8ect manager )roperty valuer ;uantity surveyor Sworn auctioneer 01' 04' 06' 2otor surveyor Notary Optician

03 '

Land surveyor

34'

Bealers registered with the !ssay Office under the Cewellery !ct + w'e'f 0'0='=6,

05 ' 3.1.3

2arine surveyor

Registration under Section 15(2)(a)(ii) !ny person engaged in a business specified in )art (( of the enth Schedule is re*uired to apply for compulsory registration by virtue of section 15(2)(a)(ii) , irrespective of the turnover of his ta%able supplies' .usiness specified in )art (( of enth Schedule are as follows: 0' .an-ing by a company holding a ban-ing Licence under the .an-ing !ct 3==1 in respect of its ban-ing transactions other than with non/residents and corporations holding a ?lobal .usiness Licence under the >inancial Services !ct 3==7' 3' +a, (nsurance agent under the (nsurance !ct e%cept the business in respect of contracts of life insurance entered into prior to 0= Canuary 3==5' +b, (nsurance bro-er under the (nsurance !ct e%cept the business in respect of contracts of life insurance entered prior to 0 October 3==5' 3 2anagement services by a holder of a management licence under the >inancial Services !ct 3==7 in respect of services supplied other than those supplied to corporations holding a <ategory 0 ?lobal .usiness Licence or a <ategory 3 ?lobal .usiness Licence under that !ct' 1' Services in respect of credit cards issued by companies other than ban-s to merchants accepting such credit cards as payment for the supply of goods or services' N&te+ (1) ! person ma-ing e%clusively Dero/rated supplies is not bound to register for V! [section 15(3)]

+3,

he registration of entities falling under item 0 of )art 00 of the respect of their ta%able supplies'

enth Schedule is in

+5,

Where the Birector/?eneral is satisfied that a person has split his business, so that the ta%able supplies are made by two or more legal entities to avoid registration, the Birector/?eneral may issue a direction regarding the liability for registration of a single ta%able person [section 15(5)]

3.,

LICATION !OR VOLUNTAR# REGISTRATION

!ny person, who in the course or furtherance of his business ma-es ta%able suppliesE and is not re*uired to apply for compulsory registration under Section 04,

may apply for voluntary registration, under section (16). "easons for opting for voluntary registration include / 3.3 a desire to conceal the small siDe of the business operationE the desire to recover input ta% on purchasesE and the reluctance of big companies to purchase from non V! "egistered persons' LICATION

"ODE O! A

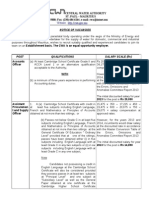

A--.icati&n '&r registrati&n is /a0e in s%c1 '&r/ an0 in s%c1 /anner as /a$ be a--r&ve0 b$ t1e Direct&r2Genera.. 2oreover, "egulation 1+0, provides that the applicant has to produce such documents and furnish such information in support of his application as may be re*uired by the Birector/ ?eneral' he following forms have been approved/ >orms V ! 0 !pplication under Section 04+0, or 06'

>orms V! 0! >orms V! 0.

!pplication under Section 04+3,+a,+a,+i, !pplication under Section 04+3,+ a,+ii,1

3.3

REGISTRATION O! A

LICANT

he Birector/?eneral has to register an applicant where he is satisfied that the person is re*uired to be registered @section 04+1,A he Birector/?eneral may register under section 06+3, an applicant who has applied for voluntary registration where he is satisfied that / 0' 3' he currently -eeps and maintains a proper record of his businessE he has -ept and maintained a proper record of his business for a period of at least one year preceding the year in which the application for registration is made, and 5' he has been discharging his obligations under the revenue laws'

Where a person is registered, the Birector/?eneral has to F 3.( allocate to him a V! "egistration Number issue to him a <ertificate of "egistration issue to him a V! Bistinctive 2ar-'

VAT REGISTRATION NU"4ER he Vat "egistration Number is allocated to a person when he is registered for V! ' his

"egistration Number is usually the !N of the person, preceded by the prefi% V! ' &owever, even if a person is not liable to (ncome a% but ma-es ta%able supplies, a !N is generated so that a V! "egistration Number is allocated to him' he V! "egistration Number has to be declared on all bills of entry submitted to <ustoms as well as all invoices and receipts issued by the person' 3.5 CERTI!ICATE O! REGISTRATION

Please see specimen copies of Forms at Appendix IV

When a person is registered for V! , he has to be issued with a <ertificate of "egistration' "egulation 1 provides for the following/ he certificate of "egistration has to be affi%ed in a conspicuous place of business of the Vat registered person' Where the person has more than one place of business, he has to display conspicuously a photocopy of the certificate at the other places of business' ! registered person has to notify 2"! and return the certificate of registration and its copies in the following instances F he changes his name or trading name he changes the address of any of his business premises he opens a new businessE or he changes the nature of his business'

On receipt of the notification, 2"! after considering such information as may be re*uired has to amend the certificate or issue a fresh certificate to the registered person' 3.6 VAT DISTINCTIVE "AR7 he V! Bistinctive 2ar- is provided to the Vat registered person at the time of registration for each of the places of business operated by him' his has to be affi%ed in a conspicuous place in addition to the <ertificate of "egistration so that consumers can readily ascertain whether an entity is vat registered or not' 3.8 DATE O! REGISTRATION AND DATE LIA4LE TO 4E REGISTERED. ! person is registered under section 04+0, from the date his application is approved' his date would be different from that on which he ought to have registered if he is already in business and has made ta%able supplies e%ceeding any of the specified limits' Similarly persons applying for registration under section 04+3,+ a,+i,, after 5= September 3==3 but who were already in business as at that date will be registered with effect from the date of approval but will be liable as from 0 October 3==3 or 0 October 3==5, depending on the business or profession concerned'

3.9

C:ANGE IN ASSOCIATES:I AND "E"4ERS:I he liability under the V! !ct of a societe, club, association or similar organiDation, as a

ta%able person is not affected by any change in its associateship or membership' !ccordingly, even if membership changes, the organiDation is for registration purposes regarded as the same organiDation' 3.10 I" LICATION O! NON2REGISTRATION !OR VAT Until a trader is registered, no V! can be charged or recovered' >or this reason, a person who is about to commence business may see- to apply for advance registration' $very ta%able person shall be liable to pay to the Birector/?eneral, V! !ct' Omission to register for V! liability to pay V! to the 2"!' 2oreover, where a ta%able person fails to register for V! , he is liable to a penalty of "s 4,=== for every month or part of the month in respect of which he is liable to be registered up to the month preceding the month in which he submits his application, sub8ect to a ma%imum limit of "s 4=,===' he person who, being a ta%able person, fails to apply for registration when re*uired to do so also commits an offence +Section 41 of the Vat !ct, and is liable to prosecution by virtue of Section 41 of the V! !ct' 3.11 4USINESS S LITTING raders may avoid V! registration by splitting their businesses in order to ta-e advantage of the V! registration limits' he ta%able supplies are then planned in such a way that they are below the registration threshold' !s it is the person and not the business who is registered, the mere splitting of a business is of no advantage to a trader trying to fall below the registration limits' Bifferent persons have to own the different businesses' ! typical e%ample would be a husband and wife operating a restaurant' he husband could be the tenant running the main hey avoid having business but the wife may operate the snac-s etc' as a separate business' registration limits' on all his ta%able

supplies as from the date he is re*uired to be registered as a registered person under the V! when liable to do so does not affect the ta%able personGs

to account for the snac-Gs turnover if the turnover of the HseparatedG snac- falls below the

Where there is artificial business splitting to avoid liability to V! , the Birector/?eneral may by virtue of the anti F avoidance provision of section 56 !, disregard or vary the arrangement' .y virtue of Section 04+4, of the V! , where the Birector ?eneral is satisfied that the main reason or one of the main reasons for the splitting of the business is to avoid registration, he has the power to issue a direction to the person behind the splitting of the business directing that the persons named therein shall be treated as a single ta%able person and that single person shall be liable to be registered' (t is however to be noted that the onus to establish business splitting for the purpose of avoidance of V! "egistration lies with the 2"!' he mere fact that similar businesses are he factors to be considered and relevant being conducted by related entities is not enough' cases are referred to in paragraph 5'03 >or the purpose of issuing a direction, one must have regard to the specific circumstances of the case' he following factors would be indicative of the financial, economic and organiDational lin-s on which the 2"! may rely to issue a direction' !inancia. .in;s >inancial support by one entity to another' One entity not financially viable without the otherIs <ommon financial interest

Ec&n&/ica. .in;s See-ing to realiDe the same economic ob8ective !ctivities of one benefit the other Supplying same customers

Organisati&na. .in;s <ommon management <ommon employees <ommon premises <ommon e*uipment

Re.evant cases are <

3.1,

<hamberlain V< J $ <omrs Osman V< J $ <omrs 2rs 2 $ Williams 2C J ) Sammers West $nd &ealth J >itness <lub

CANCELLATION O! REGISTRATION Where the Birector/?eneral is satisfied that a registered person should cease to be registered under the V! !ct , he may , by notice in writing, re*uire the registered person , within 01 days of the date of the notice, to show cause why he should not cease to be registered and if the Birector/?eneral is satisfied that, having regard to all circumstances of the case, it is e%pedient to do so, he may cancel the registration with effect from such date as the Birector/?eneral may determine and give notice thereof to the person' ! person is usually deregistered at the end of a month or *uarter, depending upon whether he submits monthly return or *uarterly return' Where the registration of a registered person is cancelled, the person must / cease to hold himself to be a registered person submit a return and pay all ta% due including the ta% due on any goods forming part of the assets of the business other than motor cars and other motor vehicles for the transport of not more than : persons including the driver, motorcycles and mopeds, for own use or consumption, and their spare parts and accessories immediately return to the Birector/?eneral his certificate of registration and all its copies'

=%esti&ns '&r c1a-ter 3

=3.1 =3., =3.3 =3.3

When is a person compulsorily re*uired to register for V! K Why is it important for a business to register for V! K What are the conditions a person must satisfy if he wishes to apply for voluntary registrationK "egistration under the V! !ct brings with it both duties and rights for the person concerned'

List some of the duties and the most important rightK =3.( What are the implications of not registering for V! when a person is liable to do soK

= 3.5 !llan has been the owner of a hardware shop for a number of years' &e has not previously registered for V! as his turnover has consistently been below the minimum criteria' &owever he now feels that he should register and see-s the advice of the 2"!' 3==: has been as indicated below:/ 3==: "s Canuary >ebruary 2arch !pril 2ay Cune Culy !ugust September October November Becember !dvise !llan =3.6 $%plain why it may be to a personGs advantage to register voluntarily as a ta%able person when there is no legal re*uirement for him to do so' 93,4== :4,=== 0==,=== :4,=== 14,=== 004,=== 01=,=== 013,4== 04=,=== 044,=== 067,4== 34=,=== 3=0= "s 077,4== 014,=== 33=,=== 0==,=== 07=,=== 35=,=== estimate estimate urnover since Canuary

=3.8

Lu-e .lac- is about to commence business as a plumber, and see-s the help of the 2"! regarding problems with Value !dded a%' .lac- has obtained a contract with a local builder to install all the plumbing fittings, sanitary ware, etc' for a new housing development' .lac-Gs only other income will be from small repair 8obs which he will carry out in the evenings' .lac- estimates that his receipts will total "s3'42 in the first year of business with his only ma8or e%pense being the purchase of an estate car which he estimates will be used 6=L for the business and 1=L for private motoring' "e*uired: +a, State what advice you, as 2"! officer, would give .lac- regarding whether or not he has a liability to be registered for V! registration' +b, +c, State with reasons whether .lac- has to charge V! on the wor- he carries out' $%plain how .lac- should deal with the V! on: +i, +ii, +iii, the materials he purchases for the building contract and the repair wor- carried outE the purchase of the motor carE the petrol purchased for the motor car' and e%plain fully the rules which govern

=3.9

$%plain the conditions that a person registered for V! must fulfill to be allowed to cancel his registration'

=3.10 ! property developer intends to construct villas for sale to foreigners who will then entrust the villas to a well/-nown hotel operator for commercial letting to holiday/ma-ers for periods not e%ceeding := days' $ach foreign owner would be entitled to use the villa for personal purposes for not more than 6 wee-s each year' he hotel operator will pay to each foreign owner a rental fee based on his share of pooled income from the letting of the villas' foreign owner is li-ely to e%ceed "s 3 2illion' Should +i, +ii, the property developer be registered for V! K the foreign owner as well be registered for V! K he rental fee to each

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Common Law Distress On Third PartiesDocument7 pagesCommon Law Distress On Third Partiesnorris1234No ratings yet

- Model ByeLaws of Housing Cooperative SocietiesDocument65 pagesModel ByeLaws of Housing Cooperative SocietiesbluedremzNo ratings yet

- Free Accounting Firm Business PlanDocument1 pageFree Accounting Firm Business PlansolomonNo ratings yet

- A Level Economics Revision NotesDocument63 pagesA Level Economics Revision NotesMajida Ghandour84% (19)

- Project Report On "Role of Banks in International Trade": Page - 1Document50 pagesProject Report On "Role of Banks in International Trade": Page - 1Adarsh Rasal100% (1)

- Acquisition Analysis and RecommendationsDocument49 pagesAcquisition Analysis and RecommendationsAnkitSawhneyNo ratings yet

- Veneracion v. Mancilla (2006)Document2 pagesVeneracion v. Mancilla (2006)Andre Philippe RamosNo ratings yet

- ConclusionDocument1 pageConclusionrachna357No ratings yet

- 2281 s12 QP 22Document4 pages2281 s12 QP 22rachna357No ratings yet

- Rose Ltd.'s Income Tax Computation - Year of Assessment 2013Document2 pagesRose Ltd.'s Income Tax Computation - Year of Assessment 2013rachna357No ratings yet

- Assistant Permanebnt Secretary EXT 18FEB14Document3 pagesAssistant Permanebnt Secretary EXT 18FEB14rachna357No ratings yet

- Queuing 1Document7 pagesQueuing 1Rajshree DewooNo ratings yet

- Fvgdxzgbfzencyclopedia of Dfbgdsbzxatabase Systems Multi-TierArchitectureDocument3 pagesFvgdxzgbfzencyclopedia of Dfbgdsbzxatabase Systems Multi-TierArchitecturerachna357No ratings yet

- Bid Executive Summary ReportDocument2 pagesBid Executive Summary Reportrachna357No ratings yet

- Importance of The Term Resident For The Application of A DTADocument1 pageImportance of The Term Resident For The Application of A DTArachna357No ratings yet

- Importance of The Term Resident For The Application of A DTADocument1 pageImportance of The Term Resident For The Application of A DTArachna357No ratings yet

- Role of Marriage in SocietyDocument25 pagesRole of Marriage in SocietyRunaway Brebel0% (1)

- Tax Vehicle - 9.12.2013Document3 pagesTax Vehicle - 9.12.2013rachna357No ratings yet

- Topic 2,2Document5 pagesTopic 2,2Naveed ShaikhNo ratings yet

- Adidas Case StudyDocument4 pagesAdidas Case StudyIrfanUllahNo ratings yet

- China ProtocolDocument4 pagesChina Protocolrachna357No ratings yet

- Travel & TourismDocument2 pagesTravel & TourismRajshree DewooNo ratings yet

- Bopreport 5Document69 pagesBopreport 5rachna357No ratings yet

- Aligning Sec Wbus Final Mini 080115Document7 pagesAligning Sec Wbus Final Mini 080115rachna357No ratings yet

- Syllabus: Cambridge O Level SociologyDocument23 pagesSyllabus: Cambridge O Level Sociologymstudy123456No ratings yet

- Fxhofficer Trfhxxfin Charge 02 Aug 2013 PDFDocument2 pagesFxhofficer Trfhxxfin Charge 02 Aug 2013 PDFrachna357No ratings yet

- Invest Prom Act PDFDocument29 pagesInvest Prom Act PDFrachna357No ratings yet

- fjnghfxPaptrher2N Pickering-Tax PDFDocument32 pagesfjnghfxPaptrher2N Pickering-Tax PDFrachna357No ratings yet

- 1 G CastroDocument34 pages1 G Castrorachna357No ratings yet

- CWA recruitment for accounts, procurement rolesDocument3 pagesCWA recruitment for accounts, procurement rolesrachna357No ratings yet

- Invest Prom Act PDFDocument29 pagesInvest Prom Act PDFrachna357No ratings yet

- HEDGING Fixed Interest Rate ExposuresDocument3 pagesHEDGING Fixed Interest Rate Exposuresrachna357No ratings yet

- HEDGING Fixed Interest Rate ExposuresDocument3 pagesHEDGING Fixed Interest Rate Exposuresrachna357No ratings yet

- Other Pertinent Issues and Recommendations: CautionDocument5 pagesOther Pertinent Issues and Recommendations: Cautionrachna357No ratings yet

- 9709 Y14 SyDocument44 pages9709 Y14 Syrachna357No ratings yet

- A2 - AllahabadDocument2 pagesA2 - AllahabadVbs ReddyNo ratings yet

- 8 Inventory ManagementDocument19 pages8 Inventory ManagementMohammad DwidarNo ratings yet

- Extinguishment of Obligations by Confusion and CompensationDocument38 pagesExtinguishment of Obligations by Confusion and CompensationMaicah Marie AlegadoNo ratings yet

- Cir Vs Metro Star SuperamaDocument2 pagesCir Vs Metro Star SuperamaDonna TreceñeNo ratings yet

- Responsibility Accounting and Profitability RatiosDocument13 pagesResponsibility Accounting and Profitability RatiosKhrystal AbrioNo ratings yet

- Is LM and General EquilibrimDocument28 pagesIs LM and General EquilibrimBibek Sh Khadgi100% (2)

- RCBC vs Alfa RTW Manufacturing Corp Bank Loan Dispute DecisionDocument6 pagesRCBC vs Alfa RTW Manufacturing Corp Bank Loan Dispute DecisionAlecsandra ChuNo ratings yet

- International Financial Management Chapter 6 - Government Influence On Exchang RateDocument54 pagesInternational Financial Management Chapter 6 - Government Influence On Exchang RateAmelya Husen100% (2)

- Role of Derivatives in Economic Growth and DevelopmentDocument22 pagesRole of Derivatives in Economic Growth and DevelopmentKanika AnejaNo ratings yet

- Total For Reimbursements: Transportation Reimbursements Date Transpo To BITSI March 23 To May 5, 2022Document4 pagesTotal For Reimbursements: Transportation Reimbursements Date Transpo To BITSI March 23 To May 5, 2022IANNo ratings yet

- Online Transfer Claim FormDocument2 pagesOnline Transfer Claim FormSudhakar JannaNo ratings yet

- Zillow 2Q22 Shareholders' LetterDocument17 pagesZillow 2Q22 Shareholders' LetterGeekWireNo ratings yet

- 2122 s3 Bafs Notes STDocument3 pages2122 s3 Bafs Notes STKiu YipNo ratings yet

- Essentials of a Contract - Formation, Validity, Performance & DischargeDocument25 pagesEssentials of a Contract - Formation, Validity, Performance & Dischargesjkushwaha21100% (1)

- Coforge LimitedDocument215 pagesCoforge LimitedJaydev JaydevNo ratings yet

- Croissance Economique Taux Change Donnees Panel RegimesDocument326 pagesCroissance Economique Taux Change Donnees Panel RegimesSalah OuyabaNo ratings yet

- Internship Report (11504725) PDFDocument39 pagesInternship Report (11504725) PDFpreetiNo ratings yet

- Statement of Compliance - Auditor Review Report On CoCGDocument3 pagesStatement of Compliance - Auditor Review Report On CoCGManagerHRDNo ratings yet

- Jupiter Intelligence Report On Miami-Dade Climate RiskDocument11 pagesJupiter Intelligence Report On Miami-Dade Climate RiskMiami HeraldNo ratings yet

- Auditing and Assurance: Specialized Industries: M12 Group WorkDocument4 pagesAuditing and Assurance: Specialized Industries: M12 Group WorkEleonor ClaveriaNo ratings yet

- Invoice #100 for Project or Service DescriptionDocument1 pageInvoice #100 for Project or Service DescriptionsonetNo ratings yet

- Esteriana Haskasa - General ResumeDocument3 pagesEsteriana Haskasa - General ResumeEster HaskaNo ratings yet

- Central Surety and Lnsurance Company, Inc. vs. UbayDocument5 pagesCentral Surety and Lnsurance Company, Inc. vs. UbayMarianne RegaladoNo ratings yet

- Consistent Compounders: An Investment Strategy by Marcellus Investment ManagersDocument27 pagesConsistent Compounders: An Investment Strategy by Marcellus Investment Managersvra_pNo ratings yet