Professional Documents

Culture Documents

Maturity Claims

Uploaded by

bhavanatiwariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maturity Claims

Uploaded by

bhavanatiwariCopyright:

Available Formats

Maturity Claims

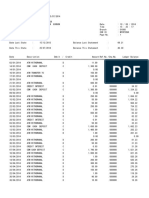

Endowment Plans Table Nos. 14 & 48: The Sum Assured along with the vested Bonus is paid to the policyholder on the date of maturity of the policy. Money back Plans Table Nos. 74, 75, & 93: The final instalment of the survival benefit is paid to the policyholder along with the vested bonuses. Whole Life Plans Table Nos. 2, 5 & 28: By definition, a whole life policy bears no maturity date. Sum Assured along with bonuses are payable only on the life assureds death. However, LICI has made a concession to its valued whole life policyholders; A maturity value is payable on LICIs whole life policies provided the policies run at least 40 years and the assured has crossed 80 years of age. Payment of maturity value terminates the contract of whole life policy. Smart Life Policies (Table Nos. 134 & 135): The sum assured along with the guaranteed additions is paid to the policyholder on the date of maturity of the policy. Aspire Childrens Plans (Table Nos. 601, 602 & 603): The final instalment of the survival benefit/ educational benefit is paid to the policyholder along with the vested bonuses on the policy anniversary falling after the childs attainment of his or her 20th birthday. Requirements: 1. Discharge Voucher form completed, signed and witnessed. 2. Original Policy document to be returned to LICI. IMPORTANT: If the policyholder does not receive his discharge voucher at least one month before the maturity date, he or she must contact LICI office.

choose between the dozens of products, why not check out the claims record of the insurer first? Recent data from the Insurance Regulatory and Development Authority (IRDA) shows that in 2012-13, life insurers such as DLF Pramerica, Edelweiss Tokio, Aegon Religare, Shriram Life and Future Generali rejected one out of every five claims they received from policyholders. The claims settlement ratio of these insurers was below 80 per cent. The claims settlement ratio is the number of policies on which the insurer has actually paid out any sum towards damages, compared to the number of policies filed in a year. But why do some insurers refuse a good number of claims made by policyholders, while others settle them? Some industry players point to their recent entry into the sector for this. Most insurers have explicit rules which turn down claims made in the first two to three years of a life policy. Yash Mohan Prasad, Head of Sales at Edelweiss Tokio Life Insurance, which entered the life insurance business in May 2011, said: For any insurer who is in the initial 2-3 years of operations, the claims settlement ratio would be skewed because of a small base. Even a single rejection can lead to a large impact on the claims ratio, if the base is low. The insurer with the best-in-town claims settlement record is public sector behemoth Life Insurance Corporation (LIC). In 2012-13, it settled 97.7 per cent of the claims its investors made on it, paying out Rs 7,223 crore. This is better than the previous years record of 97.4 per cent.

However, as LICs term plan premia are far more expensive than those of the private insurers, you may want to check out large private insurers too. ICICI Prudential topped private insurers, when it comes to claims settlement, reporting a claims settlement ratio of 96.3 per cent in 201213. Of the total 14,948 claims received, it settled 14,393 and paid out an amount of Rs 293 crore. Others with a record of paying up over 90 per cent are HDFC Standard, SBI Life, MAX Life and Kotak Mahindra Life.

You might also like

- PracticalDocument11 pagesPracticalbhavanatiwariNo ratings yet

- Project Report On Industrial VisitDocument24 pagesProject Report On Industrial VisitbhavanatiwariNo ratings yet

- C Programming:: Numerals: 0, 1, 2, 3, 4, 5, 6, 7, 8, 9 Alphabets: A, B, .ZDocument13 pagesC Programming:: Numerals: 0, 1, 2, 3, 4, 5, 6, 7, 8, 9 Alphabets: A, B, .ZbhavanatiwariNo ratings yet

- Amir KapoorDocument25 pagesAmir KapoorbhavanatiwariNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Microeconomics: Production, Cost Minimisation, Profit MaximisationDocument19 pagesMicroeconomics: Production, Cost Minimisation, Profit Maximisationhishamsauk50% (2)

- Power For All - Myth or RealityDocument11 pagesPower For All - Myth or RealityAshutosh BhaktaNo ratings yet

- Dreamweaver Lure v. Heyne - ComplaintDocument27 pagesDreamweaver Lure v. Heyne - ComplaintSarah BursteinNo ratings yet

- VISCOROL Series - Magnetic Level Indicators: DescriptionDocument4 pagesVISCOROL Series - Magnetic Level Indicators: DescriptionRaduNo ratings yet

- Bank Statement SampleDocument6 pagesBank Statement SampleRovern Keith Oro CuencaNo ratings yet

- Design of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Document11 pagesDesign of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Burlacu AndreiNo ratings yet

- Department of Labor: 2nd Injury FundDocument140 pagesDepartment of Labor: 2nd Injury FundUSA_DepartmentOfLabor100% (1)

- UBITX V6 MainDocument15 pagesUBITX V6 MainEngaf ProcurementNo ratings yet

- Week 7 Apple Case Study FinalDocument18 pagesWeek 7 Apple Case Study Finalgopika surendranathNo ratings yet

- SH210 5 SERVCE CD PDF Pages 1 33Document33 pagesSH210 5 SERVCE CD PDF Pages 1 33Em sulistio87% (23)

- Introduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions ManualDocument12 pagesIntroduction To Wireless and Mobile Systems 4th Edition Agrawal Solutions Manualethelbertsangffz100% (34)

- Tindara Addabbo, Edoardo Ales, Ylenia Curzi, Tommaso Fabbri, Olga Rymkevich, Iacopo Senatori - Performance Appraisal in Modern Employment Relations_ An Interdisciplinary Approach-Springer Internationa.pdfDocument278 pagesTindara Addabbo, Edoardo Ales, Ylenia Curzi, Tommaso Fabbri, Olga Rymkevich, Iacopo Senatori - Performance Appraisal in Modern Employment Relations_ An Interdisciplinary Approach-Springer Internationa.pdfMario ChristopherNo ratings yet

- ReviewerDocument2 pagesReviewerAra Mae Pandez HugoNo ratings yet

- Document 3Document3 pagesDocument 3AdeleNo ratings yet

- Tenancy Law ReviewerDocument19 pagesTenancy Law ReviewerSef KimNo ratings yet

- Customer Satisfaction-ICICI Bank-Priyanka DhamijaDocument85 pagesCustomer Satisfaction-ICICI Bank-Priyanka DhamijaVarun GuptaNo ratings yet

- Lecture 1Document11 pagesLecture 1Taniah Mahmuda Tinni100% (1)

- MBA - Updated ADNU GSDocument2 pagesMBA - Updated ADNU GSPhilip Eusebio BitaoNo ratings yet

- Te 1569 Web PDFDocument272 pagesTe 1569 Web PDFdavid19890109No ratings yet

- Tracker Pro Otm600 1.5Document19 pagesTracker Pro Otm600 1.5Camilo Restrepo CroNo ratings yet

- Fracture and FatigueDocument15 pagesFracture and FatigueZou JiaweiNo ratings yet

- Health, Safety & Environment: Refer NumberDocument2 pagesHealth, Safety & Environment: Refer NumbergilNo ratings yet

- Agoura Hills DIVISION - 6. - NOISE - REGULATIONSDocument4 pagesAgoura Hills DIVISION - 6. - NOISE - REGULATIONSKyle KimNo ratings yet

- Surface CareDocument18 pagesSurface CareChristi ThomasNo ratings yet

- Payment of GratuityDocument5 pagesPayment of Gratuitypawan2225No ratings yet

- ABB Price Book 524Document1 pageABB Price Book 524EliasNo ratings yet

- V Series: Three Wheel, Counterbalanced Lift TruckDocument126 pagesV Series: Three Wheel, Counterbalanced Lift TruckВиктор МушкинNo ratings yet

- AkDocument7 pagesAkDavid BakcyumNo ratings yet

- Economies and Diseconomies of ScaleDocument7 pagesEconomies and Diseconomies of Scale2154 taibakhatunNo ratings yet

- TOEFLDocument6 pagesTOEFLSekar InnayahNo ratings yet