Professional Documents

Culture Documents

MEDL Mobile Profile

Uploaded by

Dzemaludin PerajicCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MEDL Mobile Profile

Uploaded by

Dzemaludin PerajicCopyright:

Available Formats

MEDL Mobile, Inc.

(OTCQB: MEDL)

Company Overview

MEDL Mobile, Inc. (MEDL or the Company) develops, acquires and publishes a growing library of mobile applications that perform specific functions for the user on the Apple and Android platforms. User analytics are collected by the Company's growing Mobile Brain, which processes user data in order to create better distribution and monetization of mobile applications. MEDL has also designed a growing suite of tools to help developers better market and monetize their mobile applications. Additionally, the Company licenses its technology and performs custom development for key clients such as Monster.com, The New York Times, Teleflora, Telefonica and Medtronic, allowing the Company to grow its overall library of technology, greatly extending the potential reach of its Mobile Brain. MEDL also enters into partnerships to mobilize and monetize IP with such notable names as Encyclopaedia Britannica, MTV's Pauly D, Cheech & Chong, Rampage Jackson and Marlee Matlin. MEDL is establishing a business model in which it expects to generate multiple revenue streams, including development fees, download and in-app purchases, advertising, sponsorship and licensing of technology. Major digital platforms, such as Groupon, Google, and Facebook, have average lifetime values of between $100 and $200 per user. Using similar metrics, based on MEDLs total number of approximately 15 million users, at a lifetime value of only $25 to $35 per user, MEDLs current valuation should be between $375 million and $525 million.

Investment Highlights

Well-positioned to capitalize on explosive growth in mobile app space Led by seasoned, proven management team who is able to attract top ideas, talent, clients and partners Innovative business model with potential for multiple streams of high-margin revenue and multiple attractive exit opportunities Based on the Companys total number of approximately 15 million users, at a $25 to $35 lifetime value per user, MEDL Mobile should have a valuation of between $375 million and $525 million

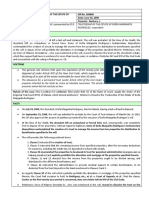

Financial Highlights

3 2 $2.3

Revenues (millions)

2 1 1 $0.08

0

$0.8

2009

2010

2011

Stock Information*

Current Price Market Cap Shares Outstanding Float 52-Week Range Avg. Volume (3 mon.) Revenue (ttm) EPS (ttm) P/E (ttm) P/S (ttm) Operating Margin (ttm) Cash (mrq) Fiscal Year End

*As of June 4, 2012

$0.54 $23.5M 43.5M 19.9M $0.30-$1.65 10,145 $3.0M ($0.10) N/A 5.8x -104.4% $2.4M Dec 31

Contact Information

MEDL Mobile, Inc. 18475 Bandilier Circle Fountain Valley, CA 92708 714.617.1991 local www.medlmobile.com

Corporate Information

Auditors: KBL, LLP Legal Counsel: Sichenzia Ross Friedman Ference LLP Transfer Agent: Island Stock Transfer

Investor Relations

RedChip Companies, Inc. 500 Winderley Place, Suite 100 Maitland, FL 32751 800.733.2447 toll-free 407.644.4256 local www.redchip.com

MEDL Mobile, Inc.

(OTCQB: MEDL)

Business Segments

MEDL Library & Recommendation / The MEDL Brain

The biggest challenge facing apps is discovery. Nearly one million apps are available today, and new apps are launched daily. With the immense size of the market, consumers need an easier way to discover new apps and relevant mobile content. MEDL has solved this challenge with the introduction of its proprietary MEDL Brain. The MEDL Brain gets to know users based on the types of apps they use, where they use them, when they use them, and how often they use them. The MEDL Brain, using scientific algorithms, can then make expert recommendations to the user from the MEDL Library. Users will be able to stop searching, and the apps they want can start finding them. Recommendations are based upon a metric called a Mobile Lifestyle. Based on a users Mobile Lifestyle, the MEDL Brain can actively recommend new apps and get smarter over time. The MEDL API, the Companys proprietary technology that powers the MEDL Brain, is expected to allow advertisers to take over individual apps or clusters of apps for a deep level of integrated brand engagement. The API is patent pending, has been successfully deployed and is currently collecting millions of data points.

Early tests of MEDL Brain have yielded positive results: Sample A: Approximately 20,000 users of MEDLs Learn to Draw application were sent a recommendation to purchase a $.99 lesson pack. - The push resulted in approximately 825 purchases - a 3.75% conversion rate. Sample B: Approximately 100,000 users of a MEDL game were pushed a recommendation to download a second MEDL game for free. - The push yielded approximately 12,000 downloads for a 12% conversion rate. Based on these sample tests and the freemium business model, MEDL expects to drive growth and revenue by pushing free apps and subsequently recommending in-app purchases.

Custom Development

MEDL Mobile is able to drive millions of app downloads through the Companys Custom Development Division, which works to develop and execute mobile strategies for some of the worlds most recognized brands. Not only does this strategy allow MEDL to leverage the marketing prowess and budgets of its clients and partners, it also has the potential to create high-margin revenues and client-sponsored R&D.

Incubation & Partnerships

The MEDL App Incubator has generated more than 85,000 submissions from individuals, companies and institutions who have submitted their idea for a mobile app to MEDL. Incubator apps are funded and owned by MEDL with a percentage of post-profit revenues shared with the ideator. MEDL Mobile is also partnered with some of the worlds most famous people, organizations and holders of intellectual property thereby gaining access to valuable technologies, fan bases, marketing initiatives and expertise. In many cases, partners cover all or a portion of development costs. Partnerships include: Encyclopaedia Britannica, MTV's Pauly D, Cheech & Chong, Rampage Jackson, Sarah Silverman, and Marlee Matlin MEDL Alliance - MEDL has begun an aggressive roll-up strategy that capitalizes on the fact that developers are having problems with discovery. Developers are spending significant resources to create apps, only to face the even greater hurdle of breaking through the clutter. MEDL believes the app marketplace is an ocean of distressed IP, begging to be aggregated. By leveraging MEDL Mobiles reputation as a trusted custom developer and app marketing powerhouse, MEDL believes it can quickly roll up a divers e catalog of quality apps. The solution is a win-win. MEDL grows the library, and developers can finally generate revenue from their app investment.

MEDL Mobile, Inc.

(OTCQB: MEDL)

Market

WHAT IS AN APP?

An app is a piece of software that performs a specialized function. It plays a game, it finds a restaurant, it saves you time, it does any one of a million things. And that number is growing every day. iPhone, Android, Windows Mobile, BlackBerry, Amazon Kindle, Motorola, Samsung and dozens more are building a new generation of mobile devices and platforms - from tablets to TV sets - all powered by apps. Across these multiple devices and platforms, apps are generating billions of dollars in revenue. These revenues come in multiple forms such as micropayments, digital purchases, subscriptions, advertising and sponsorship. And new models are springing up every day.

Management

Andrew Maltin Founder, Chief Executive Officer, and Director Mr. Maltin has served as CEO and director since June 2011. Mr. Maltin co-founded MEDL in March 2009. Prior to founding MEDL, Mr. Maltin served as the CEO of Momentum Gaming, Inc., where he led the company's marketing, business development and technology efforts to build a world-class online gaming infrastructure that both operated independently and licensed its technology to several of the world's leading gaming sites. He has been featured in Entrepreneur, 944, Success, The Wall Street Journal and The L.A. Times. He holds a Bachelor of Arts degree in Marketing from California State University, Northridge, and an Entrepreneurial Degree from the University of Southern California. Paul Caceres Chief Financial Officer Prior to MEDL, Mr. Caceres provided management consulting services to small emerging growth companies in the technology, biotechnology and mobile software industries. From 1987 to 2008, he served as CFO of CAM Commerce Solutions, a company engaged in the business of marketing e-commerce software solutions and providing payment processing services, web hosting services, technical support services, and application software. Paul left CAM Commerce Solutions in 2008 after helping to orchestrate a successful exit for its shareholders by selling to a private equity firm for $180 million in cash. Mr. Caceres is a CPA. He received a bachelor's degree in business administration from the University of Southern California. Dave Swartz Founder, Chief Creative Officer, and Director Mr. Swartz has served as President, Secretary and director since June 2011. He co-founded MEDL in March 2009 and has served as MEDLs creative director since its inception. From 1999 until 2007, Mr. Swartz was at DGWB Advertising, named by Creativity Magazine as one of the top 20 Creative Agencies in the U.S. At DGWB, where Mr. Swartz was creative director for six years, he led strategic and creative marketing efforts for regional and national advertising accounts in a variety of industries such as publishing, banking, multi-unit retail, fast food, healthcare and technology. Mr. Swartz holds a Bachelor of Science in Communications from Boston University.

INDUSTRY & TRENDS

According to Forrester Research, mobile is the single most transformational technology since the creation of the Internet. 419.1 million mobile devices were sold in Q1 2012*. Smartphone sales reached 144.4 million units sold in Q1 2012, up 44.7% year-over-year*. 56 million tablets purchased worldwide in 2011; expected to reach 375 million in 2016a CAGR of 46%**. Mobile app revenue forecasted to reach $54 billion in 2015** and $101 billion in 2017***.

Source: * Gartner ** Forrester Research *** Global Industry Analysts, Inc.

MEDL Mobile, Inc.

(OTCQB: MEDL)

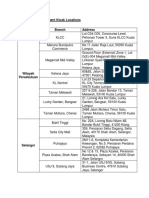

Symbol MEDL AUGT ZNGA VRNG GLUU Price 6/4/12 $0.54 $2.18 $5.71 $4.15 $4.22 52-Week High $1.65 $4.32 $15.91 $4.63 $6.10 52-Week Low $0.30 $1.17 $5.65 $0.68 $1.80 30-Day Change -40.0% -0.9% -36.6% 7.2% 4.2% 180-Day Change -38.6% -31.4% -23.9% 166.0% 54.0% 52-Week Change N/A -46.2% 14.2% 88.6% 80.4%

Symbol MEDL AUGT ZNGA VRNG GLUU

Revenues (ttm) $3.0M $12.0M $1.2B $0.7M $71.3M

Revenue Per Share $0.09 $0.14 $3.49 $0.10 $1.19

Market Cap $23.5M $206.0M $4.2B $58.4M $272.2M

Float 19.9M 94.5M 197.9M 9.9M 52.5M

% Held by Insiders 54.3% 0.0% 0.2% 6.0% 0.4%

Shares Outstanding 43.5M 94.5M 229.6M 14.1M 64.5M

Symbol MEDL AUGT ZNGA VRNG GLUU

EPS (ttm) ($0.10) ($0.39) ($1.35) ($1.41) ($0.40)

P/E (ttm) N/A N/A N/A N/A N/A

Price to Sales Institutional (ttm) Ownership (%) 5.8x 15.5x 1.7x 42.6x 3.6x N/A 0.4% 79.5% 18.0% 74.9%

Company Name MEDL Mobile Holdings, Inc. Augme Technologies, Inc. Zynga, Inc. Vringo, Inc. Glu Mobile, Inc.

* Data provided by Bloomberg

Disclosures None of the profiles issued by RedChip Companies, Inc., constitutes a recommendation for any investor to purchase or sell any particular security or that any security is suitable for any investor. Any investor should determine whether a particular security is suitable based on the investors objectives, other securities holdings, financial situation needs, and tax status. RedChip Companies, Inc., employees and affiliates may maintain positions and buy and sell the securities or options of the issuers mentioned herein. All materials are subject to change without notice. Information is obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. MEDL Mobile Holdings, Inc. (MEDL) is a client of RedChip Companies, Inc. and of RedChip Vi sibility, a division of RedChip Companies. MEDL agreed to build a RedChip mobile application at no charge in lieu of paying the RedChip Visibility Research fee for twelve (12) months of RedChip Visibility Program services. The cost of this app shall not exceed $30,000. RedChip Visibility Program services include the preparation of the equity research report(s). The equity research report(s) were prepared for informational purposes only and were paid for by the company portrayed in the report. Information contained in the equity research report(s) is obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. The equity research report(s) are not a recommendation or a solicitation to purchase or sell any security, nor do they constitute investment advice. RedChip Companies, Inc., is currently engaged by this company to provide investor awareness services. Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. MEDL agreed to pay RedChip Companies, Inc., a fee of $ $4,000 in cash per month and 200,000 shares of common stock under Rule 144 for twelve (12) months of these investor relations services.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Deadlands - Hell On Earth - BrainburnersDocument129 pagesDeadlands - Hell On Earth - BrainburnersKS100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Power of GodDocument100 pagesThe Power of GodMathew CookNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mass of Christ The Savior by Dan Schutte LyricsDocument1 pageMass of Christ The Savior by Dan Schutte LyricsMark Greg FyeFye II33% (3)

- Alcpt 27R (Script)Document21 pagesAlcpt 27R (Script)Matt Dahiam RinconNo ratings yet

- Budget Finance For Law Enforcement Module 7 Ggonzales 2Document9 pagesBudget Finance For Law Enforcement Module 7 Ggonzales 2api-526672985No ratings yet

- ORENDAIN vs. TRUSTEESHIP OF THE ESTATE OF DOÑA MARGARITA RODRIGUEZ PDFDocument3 pagesORENDAIN vs. TRUSTEESHIP OF THE ESTATE OF DOÑA MARGARITA RODRIGUEZ PDFRhev Xandra Acuña100% (2)

- Capability' Brown & The Landscapes of Middle EnglandDocument17 pagesCapability' Brown & The Landscapes of Middle EnglandRogério PêgoNo ratings yet

- Debit Card Replacement Kiosk Locations v2Document3 pagesDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Roman Catholic Archbishop of Manila Vs CADocument5 pagesRoman Catholic Archbishop of Manila Vs CALiaa AquinoNo ratings yet

- Intro To OptionsDocument9 pagesIntro To OptionsAntonio GenNo ratings yet

- ЛексикологіяDocument2 pagesЛексикологіяQwerty1488 No nameNo ratings yet

- Wearables & Homestyle Accomplishment Report - CY 2023Document6 pagesWearables & Homestyle Accomplishment Report - CY 2023Jonathan LarozaNo ratings yet

- Chapter 3Document56 pagesChapter 3percepshanNo ratings yet

- Marxism and Brontë - Revenge As IdeologyDocument8 pagesMarxism and Brontë - Revenge As IdeologyJonas SaldanhaNo ratings yet

- Bakst - Music and Soviet RealismDocument9 pagesBakst - Music and Soviet RealismMaurício FunciaNo ratings yet

- Best Answer For Language of ParadosDocument2 pagesBest Answer For Language of Paradosrafiuddin003No ratings yet

- Nationalization of Industries by 1971Document2 pagesNationalization of Industries by 1971alamNo ratings yet

- Oracle IRecruitment Setup V 1.1Document14 pagesOracle IRecruitment Setup V 1.1Irfan AhmadNo ratings yet

- Ganal Vs PeopleDocument8 pagesGanal Vs PeopleGyan PascualNo ratings yet

- 173 RevDocument131 pages173 Revmomo177sasaNo ratings yet

- Cmvli DigestsDocument7 pagesCmvli Digestsbeth_afanNo ratings yet

- Dreaded Homework Crossword ClueDocument9 pagesDreaded Homework Crossword Clueafnahsypzmbuhq100% (1)

- Impact of Brexit On TataDocument2 pagesImpact of Brexit On TataSaransh SethiNo ratings yet

- Ortiz, Mery Rose H. SeatworkDocument4 pagesOrtiz, Mery Rose H. Seatworkmery rose ortizNo ratings yet

- IBRO 2011 Inter Regional PosterDocument1 pageIBRO 2011 Inter Regional PosterInternational Brain Research OrganizationNo ratings yet

- Rothkopf, in Prase of Cultural ImperialismDocument17 pagesRothkopf, in Prase of Cultural Imperialismmystery1871No ratings yet

- Student Notice 2023-07-15 Attention All StudentsDocument1 pageStudent Notice 2023-07-15 Attention All StudentsTanmoy SinghaNo ratings yet

- Kuki KukaDocument3 pagesKuki KukaDikiNo ratings yet

- Strategic Action Plans and Alignment GuideDocument13 pagesStrategic Action Plans and Alignment GuideAbeer AzzyadiNo ratings yet

- Who Am I NowDocument7 pagesWho Am I Nowapi-300966994No ratings yet