Professional Documents

Culture Documents

Chapter 18: The International Monetary System, 1870 - 1973 Multiple Choice Questions

Uploaded by

lucipigOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 18: The International Monetary System, 1870 - 1973 Multiple Choice Questions

Uploaded by

lucipigCopyright:

Available Formats

Chapter 18: The International Monetary System, 1870 1973 Multiple Choice Questions 1.

. Under the price-specie-flow mechanism, what happens when Germanys current account surplus is greater than its non-reserve capital account deficits? A. German loans will finance all foreign net imports. B. here will !e an automatic drop in German domestic prices and a rise in foreign prices. ". Gold reserves will flow into Germany. #. Gold reserves will flow out of Germany. $. %one of the a!ove. Answer& " '. A country see(ing to maintain internal !alance would !e most concerned with A. attaining low levels of unemployment. B. ensuring that savings is weighted more toward domestic investment than the current account. ". large fluctuations in output. #. an ade)uate stoc( of gold reserves. $. %one of the a!ove. Answer& " *. By internal !alance, most economists mean A. only full employment. B. only price sta!ility. ". full employment and price sta!ility. #. full employment and moderate increase in prices. $. %one of the a!ove. Answer& " +. By e,ternal !alance, most economists mean A. avoiding e,cessive im!alances in international payments. B. a !alance !etween e,ports and imports. ". a !alance !etween trade account and service account. #. a fi,ed e,change rate. $. %one of the a!ove. Answer& A -. .hich one of the following statements is true? A. /nflation can occur even under conditions of full employment only if the central !an( continues to in0ect money into the economy. B. /nflation can occur even under conditions of full employment only if the central !an( continues to withdraw money from the economy. ". #eflation can occur even under conditions of full employment only if the central !an( continues to in0ect money into the economy.

#. /nflation cannot occur even under conditions of full employment if the central !an( continues to in0ect money into the economy. $. %one of the a!ove. Answer& A 1. A sudden increase in the U.2. price level A. ma(es those with dollar de!ts worse off. B. ma(es those with dollar de!ts !etter off. ". does not affect those with dollar de!ts. #. ma(es those with #3 de!t !etter off. $. %one of the a!ove. Answer& B 4. A sudden increase in the U.2. price level A. ma(es creditors in dollars !etter off. B. ma(es creditors in dollars worse off. ". does not affect creditors in dollars. #. ma(es creditors in #3 worse off. $. %one of the a!ove. Answer& B 15. A sudden decrease in the U.2. price level A. ma(es those with dollar de!ts worse B. ma(es those with dollar de!ts !etter ". does not affect those with dollar de! #. ma(es those with #3 worse off. $. %one of the a!ove. Answer& A 11. A sudden decrease in the U.2. price level A. ma(es creditors in dollars !etter off B. ma(es creditors in dollars worse off ". do not affect creditors in dollars. #. ma(es creditors in #3 !etter off. $. %one of the a!ove. Answer& A 16. A current account surplus A. poses a pro!lem if domestic savings are !eing invested more profita!ly a!road than they would !e at home. B. may pose no pro!lem if domestic savings are !eing invested more profita!ly a!road than they would !e at home. ". may pose no pro!lem if domestic savings are !eing invested less profita!ly a!road than they would !e at home. #. there is no relation !etween current account surplus and !etween savings and investment.

$. %one of the a!ove. Answer& B 1-. A current account deficit A. poses a pro!lem if domestic savings are !eing invested more profita!ly a!road than they would !e at home. B. may pose a pro!lem if domestic savings are !eing invested more profita!ly a!road than they would !e at home. ". may pose no pro!lem if domestic savings are !eing invested less profita!ly a!road than they would !e at home. #. here is no relation !etween the current account surplus and !etween savings and investment. $. %one of the a!ove. Answer& B 11. .hich one of the following statements is true? A. "ountries with strong investment opportunities should invest little at home and channel their savings into more productive investment activity a!road. B. "ountries with wea( investment opportunities should invest little at home and channel their savings into more productive investment activity a!road. ". "ountries with wea( investment opportunities should invest more at home. #. "ountries with wea( investment opportunities should invest little a!road. $. %one of the a!ove. Answer& B 14. "ountries with A. strong investment opportunities should invest little at home and channel their savings into more productive investment activity a!road. B. strong investment opportunities should invest more at home and less a!road. ". wea( investment opportunities should invest more at home. #. wea( investment opportunities should invest little a!road. $. %one of the a!ove. Answer& B 75. "ountries where investment is relatively A. productive should !e net e,porters of currently availa!le output. B. unproductive should !e net importers of currently availa!le output. ". unproductive should !e net e,porters of currently availa!le output. #. unproductive should !e net e,porters of future availa!le output. $. %one of the a!ove. Answer& " 71. "ountries where investment is relatively A. productive should have current account deficits. B. productive should have current account surpluses. ". unproductive should have current account surpluses.

#. productive should !alanced current account surpluses. $. %one of the a!ove. Answer& B 77. .hich one of the following statements is true? A. "ountries where investment is relatively productive should !e net importers of current output. B. "ountries where investment is relatively unproductive should !e net importers of current output. ". "ountries where investment is relatively productive should !e net e,porters of current output. #. "ountries where investment is relatively productive should not e,port or import current output. $. %one of the a!ove. Answer& A 7'. "ountries where investment is A. relatively unproductive should have current account deficits. B. relatively productive should have current account surpluses. ". relatively productive should have current account deficits. #. relatively productive should have !alanced current accounts. $. %one of the a!ove. Answer& " 7*. Governments prefer to avoid e,cessive current account surpluses !ecause A. the returns to domestic savings may !e easier to ta, than those on assets a!road. B. an addition to the home capital stoc( may reduce domestic unemployment and therefore lead to higher national income. ". domestic investment !y one firm may have !eneficial technological spillover effects on other domestic producers that the investing firm does not capture. #. All of the a!ove. $. %one of the a!ove. Answer& # 7+. Under the gold standard era of 11-5 8 141*, A. o(yo was the center of the international monetary system. B. 9aris was the center of the international monetary system. ". Berlin the center of the international monetary system. #. %ew :or( was the center of the international monetary system. $. ;ondon was the center of the international monetary system. Answer& $ 76. Under the gold standard era of 11-5 8 141*, A. central !an(s tried to have sharp fluctuations in the !alance of payments. B. central !an(s tried to avoid sharp fluctuations in the current account of the !alance of payments.

". central !an(s tried to avoid sharp fluctuations in the trade account of the !alance of payments. #. central !an(s tried to avoid sharp fluctuations in the capital account of the !alance of payments. $. central !an(s tried to avoid sharp fluctuations in the !alance of payments. Answer& $ *7. A converti!le currency is a currency that may !e freely e,changed for A. gold or silver. B. only silver. ". only copper. #. national currency. $. foreign currencies. Answer& $ **. he dollar of the United 2tates !ecame the postwar worlds (ey currency !ecause A. of the early converti!ility of the U.2. dollar in 14*+. B. of the special position of the dollar under the Bretton .oods system. ". of the strength of the American economy relative to the devastated economies of $urope and <apan. #. "entral !an(s naturally found it advantageous to hold their international reserves in the form of interest-!earing dollar assets.. $. All of the a!ove. Answer& $ *+. he 3arshall 9lan was a program of A. dollar grants from the United 2tates to $uropean countries initiated in 14*1. B. dollar grants from the United 2tates to $uropean countries initiated in 14*+. ". British pound grants from the $uropean countries to the United 2tates initiated in 14*1. #. British pound grants from the $uropean countries to the United 2tates initiated in 14*1. $. dollar grants from the United 2tates to Germany only initiated after .orld .ar //. Answer& A *6. he current account surplus is A. an increasing function of disposa!le income and an increasing function of the real e,change rate. B. a decreasing function of disposa!le income and a decreasing function of the real e,change rate. ". a decreasing function of disposa!le income and an increasing function of the real e,change rate. #. only a decreasing function of disposa!le income. $. only an increasing function of the real e,change rate. Answer& "

*-. Under fi,ed e,change rates, A. monetary policy is not an effective policy. B. fiscal policy is not an effective policy. ". monetary policy and fiscal policy are not effective. #. !oth monetary and fiscal policies are effective. $. %one of the a!ove. Answer& A *4. he == schedule shows how much A. fiscal e,pansion is needed to hold the current account surplus at = as the currency is devalued !y a given amount. B. monetary e,pansion is needed to hold the current account surplus at = as the currency is devalued !y a given amount. ". fiscal e,pansion is needed to hold the current account surplus at = as the currency is evaluated !y a given amount. #. fiscal and monetary e,pansions are needed to hold the current account surplus at = as the currency is devalued !y a given amount. $. %one of the a!ove. Answer& A +5. Advocates of floating rate suggested it is favora!le for economies for the following reasons $="$9 that A. it discourages attac( from foreign e,change speculators !ecause of the fact that e,change rate ad0ustment is immediate. B. it helps sta!ili>e the shoc( effect on unemployment in case of economic changes such as fall in e,port demand. ". it automatically matches the domestic inflation with ongoing foreign inflation. #. it gives every country the opportunity to guide its own monetary conditions at home. $. it !rings the ;? e,change rate to the level predicted !y 999 without government policy decisions. Answer& " +1. Governments would !e a!le to use monetary policy to reach A. internal !alance. B. e,ternal !alance. ". internal and e,ternal !alance. #. internal !ut not e,ternal !alance. $. e,ternal !ut not internal !alance. Answer& " +7. Advocates of fle,i!le e,change rates claim that under fle,i!le e,change rates, A. he United 2tates would now !e a!le to set world monetary conditions all !y itself. B. Germany would no longer !e a!le to set world monetary conditions all !y itself. ". he United @ingdom would no longer !e a!le to set world monetary conditions all !y itself.

#. he United 2tates would no longer !e a!le to set world monetary conditions all !y itself. $. Germany would now !e a!le set world monetary conditions all !y itself. Answer& # +'. Advocates of fle,i!le e,change rates claim that under fle,i!le e,change rates, A. he United 2tates would no longer have the same opportunity as other countries to influence its e,change rate against foreign currencies. B. he United 2tates would have the same opportunity as other countries to influence its e,change rate against foreign currencies. ". he United @ingdom would not have the same opportunity as other countries to influence its e,change rate against foreign currencies. #. Germany would not have the same opportunity as other countries to influence its e,change rate against foreign currencies. $. %one of the a!ove. Answer B +*. Advocates of fle,i!le e,change rates claim that under fle,i!le e,change rates, if the central !an( faced unemployment A. and thus wished to decrease its money supply, there would no longer !e any legal !arrier to the currency depreciation this would cause. B. and thus wished to e,pand its money supply, there would no longer !e any legal !arrier to the currency depreciation this would cause. ". and wished to e,pand its money supply, there would no longer !e any legal !arrier to the currency appreciation this would cause. #. and wished to decrease its money supply, there now would !e legal !arriers to the currency depreciation this would cause. $. %one of the a!ove. Answer B ++. Advocates of fle,i!le e,change rates claim that under fle,i!le e,change rates, a currency A. depreciation caused !y increasing the money supply would reduce unemployment !y increasing world demand for them. B. appreciation caused !y increasing the money supply would reduce unemployment !y increasing world demand for them. ". appreciation caused !y decreasing the money supply would reduce unemployment !y increasing world demand for them. #. appreciation caused !y increasing the money supply would increase unemployment !y increasing world demand for them. $. appreciation caused !y increasing the money supply would increase unemployment !y decreasing world demand for them. Answer A +6. .hen all changes in the world are due to

A. fiscal policy, purchasing power parity holds true in the long run. B. monetary policy, purchasing power parity does not hold true in the long run. ". monetary policy, purchasing power parity holds true in the long run. #. monetary policy, purchasing power parity holds true even in the short run. $. %one of the a!ove. Answer& " +-. Under purchasing power parity, A. e,change rates immediately move to offset e,actly national differences in inflation.. B. e,change rates eventually move to offset e,actly national differences in inflation.. ". e,change rates eventually move to offset to some e,tent national differences in inflation.. #. e,change rates eventually move to offset e,actly national differences in unemployment. $. %one of the a!ove. Answer& A +1. Under purchasing power parity A999B, if U.2. monetary growth leads to a long-run dou!ling of the U.2. price level, while Germanys price level remains constant, 999 predicts that the A. long-run #3 price of the dollar will !e dou!led. B. long-run #3 price of the dollar will !e halved. ". long-run #3 price of the dollar will remain the same. #. short-run #3 price of the dollar will !e halved. $. %one of the a!ove. Answer& B +4. "omparing fi,ed to fle,i!le e,change-rate regimes, the response of an economy to a temporary fall in foreign demand for its e,ports is A. output actually falls less under fi,ed rate than under floating rate. B. output actually falls more under fi,ed rate than under floating rate. ". output actually remains the same under fi,ed rate than under floating rate. #. /t is impossi!le to tell. $. %one of the a!ove. Answer& B ssay !uestion 1+. CA monetary policy is not a policy tool under fi,ed e,change rates.D #iscuss. Answer& rue. Under fi,ed e,change rates, domestic asset transactions !y the central !an( can !e used to alter the level of foreign reserves !ut not to affect the state of employment and output. 17. .hat is a converti!le currency? Answer& A converti!le currency is a currency that may !e freely e,changed for foreign currencies.

Chapter "0: #ptimum Currency $reas an% the uropean &perience Multiple Choice Questions 1. .hat are the !iggest advantages the U.2. has a!ove the $U in terms of !eing an Eptimum "urrency Area? A. ;ow mo!ility of la!or, higher la!or productivity, lower level of intra-regional trade B. Figh unioni>ation of U.2. ;a!or force ". / dont (now. #. Figh mo!ility of la!or force, more transfer payments !etween regions $. Figher uniformity of populations taste in consumption Answer& # *. he $uropean $conomic and 3onetary Union A. set up a single currency and sole !an( for $uropean economic monetary policy. B. eliminated all !arriers to trade such as ta, differentials !etween !orders. ". produced a single government for handling $uropean affairs. #. created the "ommon Agricultural 9act . $. %one of the a!ove. Answer& A +. he !irth of the $uro A. resulted in fi,ed e,change rates !etween all $3U mem!er countries. B. resulted in fle,i!le e,change rates !etween all $3U mem!er countries. ". resulted in crawling-peg e,change rates !etween all $3U mem!er countries. #. resulted in non-currency !oard e,change rates !etween all $3U mem!er countries. $. %one of the a!ove. Answer& A 1. he $U countries were prompted to see( closer coordination of monetary policies and greater e,change rate sta!ility in the late 1465s in order A. to enhance $uropes role in the world monetary system. B. to turn the $uropean Union into a truly unified mar(et. ". !oth to enhance $uropes role in the world monetary system and to turn the $uropean Union into a truly unified mar(et. #. %one of the a!ove. $. !oth to turn the $uropean Union into a truly unified mar(et and to counter the rise of <apan in international financial mar(ets. Answer& " 4. .hich of the following statements is true? A. he 14+- reaty of ?ome founded the $U and created a custom union. B. he 14+- reaty of ?ome founded the $U. ". he 14+- reaty of ?ome founded the euro. #. he 14+- reaty of ?ome founded the $uropean "entral Ban(. $. he 14+- reaty of ?ome founded the 2ta!ility and Growth 9act.(nown as 2G9. Answer& A

11. he $uropean 3onetary 2ystem was founded on the initiative of A. Grance and Germany. B. Grance, Germany, and Belgium. ". Grance, Germany, Belgium, and ;u,em!urg. #. Grance, Germany, Belgium, ;u,em!urg, and the %etherlands. $. Grance, Germany, Belgium, ;u,em!urg, the %etherlands, and Austria. Answer& A 1+. "entral !an( independence appears to !e associated with A. high inflation. B. low unemployment. ". low inflation. #. high unemployment. $. high government deficit. Answer& " 11. Under the $32, Germany set the systems A. monetary policy while the other $uropean countries pegged their currencies to the #3. B. fiscal policy while the other $uropean countries pegged their currencies to the #3. ". monetary policy while the other $uropean countries (ept their currencies fluctuating relative to the #3. #. fiscal policy while the other $uropean countries pegged their currencies to the #3. $. %one of the a!ove. Answer& A 75. he most important feature of the 2ingle $uropean Act of 1416, which amended the founding reaty of ?ome, was dropping the re)uirement of A. unanimous consent for measures related to mar(et completion and ma(ing it a decision that only Germany and Grance agreed a!out. B. unanimous consent for measures related to mar(et completion. ". ma0ority consent for measures related to mar(et completion and ma(ing it a decision that only Germany and Grance agreed a!out. #. unanimous consent for measures related to agricultural policies only. $. unanimous consent for measures related only to fiscal policies. Answer& B 71. o 0oin the $3U, a country should have no more than a A. 1.+ percent inflation rate a!ove the average of the three $U mem!er states with the highest inflation. B. ' percent inflation rate a!ove the average of the three $U mem!er states with the lowest inflation. ". * percent inflation rate a!ove the average of the three $U mem!er states with the lowest inflation.

#. 1.+ percent inflation rate a!ove the average of the three $U mem!er states with the lowest inflation. $. %one of the a!ove. Answer& # 77. o 0oin the $3U, a country must have A. a pu!lic-sector deficit no higher than ' percent of its G#9 in general. B. a pu!lic-sector deficit no higher than 7 percent of its G#9 in general. ". a pu!lic-sector deficit no higher than 1 percent of its G#9 in general. #. a >ero pu!lic-sector deficit. $. %one of the a!ove. Answer& A 7'. o 0oin the $3U, a country must have a pu!lic de!t !elow or approaching a reference level of A. +5 percent of its G#9. B. 15 percent of its G#9. ". 65 percent of its G#9. #. 155 percent of its G#9. $. + percent of its G#9. Answer& " 7*. A ma0or economic A. !enefit of fi,ed e,change rates it that they simplify economic calculations and provide a more predicta!le !asis for decisions that involve international transactions than do floating rates.. B. !enefit of floating e,change rates it that they simplify economic calculations and provide a more predicta!le !asis for decisions that involve international transactions than do fi,ed rates. ". cost of fi,ed e,change rates it that they simplify economic calculations and provide a more predicta!le !asis for decisions that involve international transactions than do currency !oard rates. #. !enefit of fle,i!le e,change rates it that they simplify economic calculations and provide a more predicta!le !asis for decisions that involve international transactions than do crawling peg rates. $. %one of the a!ove. Answer& A 76. he monetary efficiency A. loss from pegging the %orwegian (rone to the euro Afor e,ampleB will !e higher if factors of production can migrate freely !etween %orway and the euro area. B. gain from pegging the %orwegian (rone to the euro Afor e,ampleB will !e lower if factors of production can migrate freely !etween %orway and the euro area. ". gain from pegging the %orwegian (rone to the euro Afor e,ampleB will !e higher if factors of production cannot migrate freely !etween %orway and the euro area.

#. gain from pegging the %orwegian (rone to the euro Afor e,ampleB will !e higher if factors of production can migrate freely !etween %orway and the euro area. $. Fard to tell. Answer& # 7-. .hich one of the following statements is true? A. he less e,tensive are cross-!order trade and factor movements, the greater is the gain from a fi,ed cross-!order e,change rate. B. he more e,tensive are cross-!order trade and factor movements, the greater is the loss from a fi,ed cross-!order e,change rate. ". he more e,tensive are cross-!order trade and factor movements, the greater is the gain from a fi,ed cross-!order e,change rate. #. he more e,tensive are cross-!order trade, the greater is the loss from a fi,ed cross!order e,change rate. $. he more e,tensive are factor movements, the greater is the loss from a fi,ed cross!order e,change rate. Answer& " '5. A country that 0oins an e,change rate area A. gives up its a!ility to use the e,change rate for the purpose of sta!ili>ing output and employment. B. does not give up its a!ility to use the e,change rate and monetary policy for the purpose of sta!ili>ing output and employment. ". gives up its a!ility to use the e,change rate and monetary policy for the purpose of sta!ili>ing output and employment. #. gives up its a!ility to use only monetary policy for the purpose of sta!ili>ing output and employment. $. gives up its a!ility to use only monetary policy for the purpose of sta!ili>ing output and employment. Answer& " '1. .hen the economy is distur!ed !y a change in the output mar(et, A. a fi,ed e,change rate has an advantage over a fle,i!le rate. B. a floating e,change rate has an advantage over a fi,ed rate. ". a crawling peg e,change rate has an advantage over a fi,ed rate. #. a floating e,change rate has the same effect as a fi,ed rate. $. %one of the a!ove. Answer& B '7. .hich one of the following statements is true? A. A fi,ed e,change rate automatically cushions the economys output and employment !y allowing an immediate change in the relative price of domestic and foreign goods. B. A fle,i!le e,change rate does not automatically cushion the economys output and employment !y allowing an immediate change in the relative price of domestic and foreign goods.

". A fle,i!le e,change rate automatically cushions the economys output and employment !y allowing an immediate change in the relative price of domestic and foreign goods. #. A fle,i!le e,change rate automatically cushions the economys output and employment !y allowing an immediate change in the a!solute price of domestic and foreign goods $. %one of the a!ove. Answer& " ''. .hen the e,change rate is A. fle,i!le, purposeful sta!ili>ation is more difficult !ecause monetary policy has no power at all to affect domestic output and employment. B. fi,ed, purposeful sta!ili>ation is less difficult !ecause monetary policy has no power at all to affect domestic output and employment. ". fi,ed, purposeful sta!ili>ation is more difficult !ecause monetary policy has no power at all to affect domestic output and employment. #. a crawling peg, rather than fi,ed, purposeful sta!ili>ation is more difficult !ecause monetary policy has no power at all to affect domestic output and employment. $. fi,ed rather than crawling peg, purposeful sta!ili>ation is more difficult !ecause fiscal policy has no power at all to affect domestic output and employment. Answer& " '1. /f %orways la!or and capital mar(ets are highly correlated with those of its euro >one neigh!ors, A. unemployed wor(ers can easily move a!road to find wor(, and domestic capital can !e shifted to more profita!le uses in other countries. B. unemployed wor(ers cannot easily move a!road to find wor(, and domestic capital cannot !e shifted to more profita!le uses in other countries. ". while unemployed wor(ers can easily move a!road to find wor(, domestic capital cannot !e shifted to more profita!le uses in other countries. #. while capital can easily move a!road to !e put to a more profita!le use, unemployed wor(ers cannot easily move a!road to find wor(. $. %one of the a!ove. Answer& A '4. he a!ility of factors to migrate a!road A. reduces the severity of unemployment and the fall in the rate of return availa!le to investors. B. increases the severity of unemployment and the fall in the rate of return availa!le to investors. ". reduces the severity of unemployment !ut increases the fall in the rate of return availa!le to investors. #. cannot change the severity of unemployment and the constant rate of return availa!le to investors. $. %one of the a!ove. Answer& A

*1. he intersection of GG and ;; determines A. the optimal level of integration desired !y %orway. B. the ma,imum integration level desired !y %orway. ". the minimum level of integration that will cause %orway to 0oin the fi,ed e,change rate regime. #. the ma,imum level of integration that will cause %orway to 0oin the fi,ed e,change rare regime. $. %one of the a!ove. Answer& " *7. he $uropean "entral Ban( has its head)uarter in A. ;ondon. B. Berlin. ". Gran(furt. #. 9aris. $. Brussels. Answer& " *'. he level of fiscal federalism in the $uropean Union is A. too !ig to cushion mem!er countries from adverse economic events. B. too small to cushion mem!er countries from adverse economic events. ". appropriate to cushion mem!er countries from adverse economic events. #. too !ig relative to the one in the U.2. $. similar in its level to that of the U.2. Answer& B ssay !uestion 1'. #iscuss the !enefits and costs of 0oining a fi,ed-e,change area. 17. C he costs and !enefits for a country from 0oining a fi,ed-e,change rate area such as the $32 depend on how well-integrated its economy is with those of its potential partners.D #iscuss. Answer& /n general, true. his is the theory of optimum currency area. 3undell was awarded the %o!el 9ri>e for developing the theory.

You might also like

- The Millionaire Next Door (Review and Analysis of Stanley and Danko's Book)From EverandThe Millionaire Next Door (Review and Analysis of Stanley and Danko's Book)Rating: 4.5 out of 5 stars4.5/5 (4)

- Summary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionFrom EverandSummary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionNo ratings yet

- What are Stocks? Understanding the Stock Market - Finance Book for Kids | Children's Money & Saving ReferenceFrom EverandWhat are Stocks? Understanding the Stock Market - Finance Book for Kids | Children's Money & Saving ReferenceNo ratings yet

- Explain Corporate Governance, The Five Key ElementsDocument10 pagesExplain Corporate Governance, The Five Key Elementslucipig0% (1)

- The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in BetweenFrom EverandThe Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in BetweenRating: 4.5 out of 5 stars4.5/5 (16)

- Sermon Notes: "True Greatness" (Luke 9:46-50)Document3 pagesSermon Notes: "True Greatness" (Luke 9:46-50)NewCityChurchCalgary100% (1)

- The Defense of The Faith Cornelius Van TilDocument8 pagesThe Defense of The Faith Cornelius Van TilEmanuel Gutiérrez100% (1)

- Fund - Finance - Lecture 2 - Time Value of Money - 2011Document101 pagesFund - Finance - Lecture 2 - Time Value of Money - 2011lucipigNo ratings yet

- Tactical Theorems Appendix FM 2010Document21 pagesTactical Theorems Appendix FM 2010MizulIkhsanMazlanNo ratings yet

- Bases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 FactsDocument1 pageBases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 Factsaudrich carlo agustinNo ratings yet

- Chap 009Document127 pagesChap 009limed1100% (1)

- Don't Invest and Forget: A Look at the Importance of Having a Comprehensive, Dynamic Investment PlanFrom EverandDon't Invest and Forget: A Look at the Importance of Having a Comprehensive, Dynamic Investment PlanNo ratings yet

- Solutions Chapter 5 Balance of PaymentsDocument13 pagesSolutions Chapter 5 Balance of Paymentsfahdly67% (3)

- District MeetDocument2 pagesDistrict MeetAllan Ragen WadiongNo ratings yet

- Chap 012Document77 pagesChap 012limed1100% (1)

- AEF3 Files1-5 ProgTestBDocument6 pagesAEF3 Files1-5 ProgTestBnayra100% (1)

- CEIL Engineers Annexure ADocument2 pagesCEIL Engineers Annexure AZeeshan PathanNo ratings yet

- TBCH 18Document24 pagesTBCH 18Bill BennttNo ratings yet

- TBCH 17Document23 pagesTBCH 17Bill Benntt100% (3)

- Chapter 25aDocument7 pagesChapter 25amas_999No ratings yet

- Int'l Finance, HW#1-7,2011Document81 pagesInt'l Finance, HW#1-7,2011Cody SimonNo ratings yet

- Answers To End of Chapter 2's Questions: SPD4205: Multinational Business Finance 1Document2 pagesAnswers To End of Chapter 2's Questions: SPD4205: Multinational Business Finance 1Wan MP WilliamNo ratings yet

- TBCH 19Document22 pagesTBCH 19Bill BennttNo ratings yet

- Chapter 4 MishkinDocument23 pagesChapter 4 MishkinLejla HodzicNo ratings yet

- TBCH 16Document19 pagesTBCH 16Bill Benntt100% (1)

- Chapters 31 and 32Document6 pagesChapters 31 and 32Christopher Aaron BaldwinNo ratings yet

- CH 4Document14 pagesCH 4Kamal YagamiNo ratings yet

- Bài tập Tài chính Quốc tếDocument3 pagesBài tập Tài chính Quốc tếLinh VũNo ratings yet

- Chap 019Document41 pagesChap 019saud1411No ratings yet

- Econ 442 - Problem Set 3Document6 pagesEcon 442 - Problem Set 3Nguyễn Hải GiangNo ratings yet

- Shapiro Chapter 05 SolutionsDocument18 pagesShapiro Chapter 05 SolutionsRuiting ChenNo ratings yet

- Macroeconomics MCDocument8 pagesMacroeconomics MCHelen ChyNo ratings yet

- TBCH 01Document13 pagesTBCH 01Bill BennttNo ratings yet

- MQ10 13 BDocument16 pagesMQ10 13 BCresca Cuello CastroNo ratings yet

- Mankiw-Test Chapter 19Document5 pagesMankiw-Test Chapter 19Đặng Hoàng Nhật AnhNo ratings yet

- Chapter Seventeen Mutual Funds and Hedge FundsDocument17 pagesChapter Seventeen Mutual Funds and Hedge FundsBiloni KadakiaNo ratings yet

- EconomicsDocument7 pagesEconomicschangumanguNo ratings yet

- Solutions Manual The Investment SettingDocument7 pagesSolutions Manual The Investment SettingQasim AliNo ratings yet

- TBCH 12Document18 pagesTBCH 12Bill BennttNo ratings yet

- Import of Services. Interest, Profit and Dividends PaidDocument23 pagesImport of Services. Interest, Profit and Dividends PaidMohd Shahid ShamsNo ratings yet

- Assignment Week 9 Part 2 - Group 1Document9 pagesAssignment Week 9 Part 2 - Group 1Muhammad Fariz IbrahimNo ratings yet

- Econ 102 Quiz 2 A Spring 2016-17Document4 pagesEcon 102 Quiz 2 A Spring 2016-17e110807No ratings yet

- International Finance-Final ExamDocument5 pagesInternational Finance-Final ExamTrang ĐoànNo ratings yet

- Running Head: International Trade and Finance 1Document7 pagesRunning Head: International Trade and Finance 1Winny Shiru MachiraNo ratings yet

- Chapter 29aDocument7 pagesChapter 29amas_999No ratings yet

- Should India Issue Sovereign BondsDocument7 pagesShould India Issue Sovereign BondsMonu SharmaNo ratings yet

- Running Head: International Trade and Finance 1Document8 pagesRunning Head: International Trade and Finance 1Winny Shiru MachiraNo ratings yet

- Macro Revision Final ExamDocument12 pagesMacro Revision Final ExamOb h Ouuoc9ucNo ratings yet

- C. The Difference Between GDP and NDP: Multiple-Choice Questions SolutionsDocument2 pagesC. The Difference Between GDP and NDP: Multiple-Choice Questions SolutionsSonakshi BhatiaNo ratings yet

- Quiz 526Document9 pagesQuiz 526Haris NoonNo ratings yet

- Chapter 22aDocument7 pagesChapter 22amas_999No ratings yet

- Quiz 525Document23 pagesQuiz 525Haris NoonNo ratings yet

- Spring2005 Econ1012 Midterm2 Ver1Document11 pagesSpring2005 Econ1012 Midterm2 Ver1Kshitij AgrawalNo ratings yet

- Practice Multiple Choice QuestionsDocument5 pagesPractice Multiple Choice QuestionsAshford ThomNo ratings yet

- Remarks by Governor Ben S. Bernanke: The Global Saving Glut and The U.S. Current Account DeficitDocument14 pagesRemarks by Governor Ben S. Bernanke: The Global Saving Glut and The U.S. Current Account DeficitCathy ChenNo ratings yet

- Exercise - C9Document4 pagesExercise - C9Kayden ĐỗNo ratings yet

- Practice Test - Chapter 1831Document6 pagesPractice Test - Chapter 1831lurjnoaNo ratings yet

- Assignment 3 Part II - KeyDocument2 pagesAssignment 3 Part II - KeyzbqzwNo ratings yet

- Chapter 29bDocument7 pagesChapter 29bmas_999No ratings yet

- TBCH 10Document12 pagesTBCH 10Bill BennttNo ratings yet

- 2015 With SolutionDocument8 pages2015 With SolutiondasmeshNo ratings yet

- Homework Topic 6 - To SendDocument4 pagesHomework Topic 6 - To SendThùy NguyễnNo ratings yet

- Suggested Answers MEBEDocument2 pagesSuggested Answers MEBESameer SharmaNo ratings yet

- TbankDocument118 pagesTbankDostmuhammad01No ratings yet

- International Economics 6th Edition James Gerber Solutions ManualDocument6 pagesInternational Economics 6th Edition James Gerber Solutions Manualcalanthalovelloa5100% (30)

- International Economics 6Th Edition James Gerber Solutions Manual Full Chapter PDFDocument27 pagesInternational Economics 6Th Edition James Gerber Solutions Manual Full Chapter PDFRebeccaBartlettqfam100% (6)

- Brief Principles of Macroeconomics 7Th Edition Gregory Mankiw Solutions Manual Full Chapter PDFDocument36 pagesBrief Principles of Macroeconomics 7Th Edition Gregory Mankiw Solutions Manual Full Chapter PDFlois.guzman538100% (11)

- Chap 012Document46 pagesChap 012saud1411100% (5)

- M21 Krugman 46657 09 IE C21 FDocument46 pagesM21 Krugman 46657 09 IE C21 FlucipigNo ratings yet

- M19 Krugman 46657 09 IE C19 FDocument68 pagesM19 Krugman 46657 09 IE C19 FlucipigNo ratings yet

- M14 Krugman 46657 09 IE C14 FDocument50 pagesM14 Krugman 46657 09 IE C14 FlucipigNo ratings yet

- M18 Krugman 46657 09 IE C18 FDocument56 pagesM18 Krugman 46657 09 IE C18 FlucipigNo ratings yet

- CHapt20 Krugman 46657 09 IE C20 FDocument50 pagesCHapt20 Krugman 46657 09 IE C20 FsarahjohnsonNo ratings yet

- M22 Krugman 46657 09 IE C22 FDocument74 pagesM22 Krugman 46657 09 IE C22 FlucipigNo ratings yet

- M15 Krugman 46657 09 IE C15 FDocument43 pagesM15 Krugman 46657 09 IE C15 FlucipigNo ratings yet

- IFtestbankchapter1,2,3,4 5,6Document49 pagesIFtestbankchapter1,2,3,4 5,6lucipigNo ratings yet

- Minicase SolutionDocument2 pagesMinicase SolutionlucipigNo ratings yet

- Capital Structure DecisionsDocument14 pagesCapital Structure DecisionsMukesh MukiNo ratings yet

- What Is The Balance of Payments?: Norman S. Fieleke Vice President and Economist Federal Reserve Bank of BostonDocument12 pagesWhat Is The Balance of Payments?: Norman S. Fieleke Vice President and Economist Federal Reserve Bank of BostonsnehabopaiyaNo ratings yet

- Discussion PointsDocument7 pagesDiscussion PointslucipigNo ratings yet

- Fund - Finance - Lecture 7 - Intro To Risk & ReturnDocument47 pagesFund - Finance - Lecture 7 - Intro To Risk & ReturnlucipigNo ratings yet

- Fund - Finance Lecture 1 Introduction 2011Document28 pagesFund - Finance Lecture 1 Introduction 2011lucipigNo ratings yet

- Fund - Finance Lecture 8 Capital StructureDocument29 pagesFund - Finance Lecture 8 Capital StructurelucipigNo ratings yet

- Fund - Finance Lecture 5 Investment Decision 2012Document48 pagesFund - Finance Lecture 5 Investment Decision 2012lucipigNo ratings yet

- Fund - Finance Lecture 4 Valuing Stock S1.2011Document35 pagesFund - Finance Lecture 4 Valuing Stock S1.2011lucipigNo ratings yet

- InstructionsDocument1 pageInstructionslucipigNo ratings yet

- Fund - Finance Lecture 6 Investment Decision Process 2012Document39 pagesFund - Finance Lecture 6 Investment Decision Process 2012lucipigNo ratings yet

- Fund - Finance Lecture 3 Valuing Bond 2011 RevisedDocument38 pagesFund - Finance Lecture 3 Valuing Bond 2011 RevisedlucipigNo ratings yet

- The Link Between Housing Prices and Current Account Deficit: A Study of 10 OECD CountriesDocument22 pagesThe Link Between Housing Prices and Current Account Deficit: A Study of 10 OECD CountrieslucipigNo ratings yet

- 394 HW 2 New SolutionsDocument6 pages394 HW 2 New SolutionslucipigNo ratings yet

- BE Case 4.2 Question 1Document5 pagesBE Case 4.2 Question 1lucipigNo ratings yet

- Review of BA II PLUS Calculator FunctionsDocument31 pagesReview of BA II PLUS Calculator FunctionsbookosmailNo ratings yet

- Using The BA II PlusDocument1 pageUsing The BA II PlusHa MinhNo ratings yet

- New Banking Value ChainDocument10 pagesNew Banking Value Chainapi-276166864No ratings yet

- Ebook PDF Data Mining For Business Analytics Concepts Techniques and Applications With Xlminer 3rd Edition PDFDocument41 pagesEbook PDF Data Mining For Business Analytics Concepts Techniques and Applications With Xlminer 3rd Edition PDFpaula.stolte522100% (35)

- Art Martinez de Vara - Liberty Cities On DisplaysDocument16 pagesArt Martinez de Vara - Liberty Cities On DisplaysTPPFNo ratings yet

- Koro:: Entrance Songs: Advent Song Ent. Halina, HesusDocument7 pagesKoro:: Entrance Songs: Advent Song Ent. Halina, HesusFray Juan De PlasenciaNo ratings yet

- Malimono Campus Learning Continuity PlanDocument7 pagesMalimono Campus Learning Continuity PlanEmmylou BorjaNo ratings yet

- Security Guard or Corrections or Probations or Direct TV InstallDocument3 pagesSecurity Guard or Corrections or Probations or Direct TV Installapi-121377446No ratings yet

- Service Marketing Notes1 RejinpaulDocument47 pagesService Marketing Notes1 RejinpaulEr. THAMIZHMANI MNo ratings yet

- Final Internship Report As Marketing Intern Under SURETI IMFDocument24 pagesFinal Internship Report As Marketing Intern Under SURETI IMFDebopriyo RoyNo ratings yet

- Wonder 6 Unit 7 ConsolidationDocument1 pageWonder 6 Unit 7 ConsolidationFer PineiroNo ratings yet

- SAA Committee GlossaryDocument29 pagesSAA Committee GlossarysanjicamackicaNo ratings yet

- Financial Policy For IvcsDocument11 pagesFinancial Policy For Ivcsherbert pariatNo ratings yet

- Epartment of Hemical Ngineering: Muhammad Nawaz Sharif University of Engineering & Technology, Multan, PakistanDocument3 pagesEpartment of Hemical Ngineering: Muhammad Nawaz Sharif University of Engineering & Technology, Multan, PakistanMina ArshadNo ratings yet

- Mahabharata of KrishnaDocument4 pagesMahabharata of KrishnanoonskieNo ratings yet

- Chapter 11 - Cost-Volume-Profit Analysis: A Managerial Planning ToolDocument19 pagesChapter 11 - Cost-Volume-Profit Analysis: A Managerial Planning ToolSkyler LeeNo ratings yet

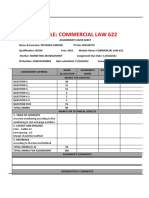

- Claw 622 2022Document24 pagesClaw 622 2022Priyanka GirdariNo ratings yet

- AMGPricelistEN 09122022Document1 pageAMGPricelistEN 09122022nikdianaNo ratings yet

- Essays On Hinduism-PDF 04Document54 pagesEssays On Hinduism-PDF 04YaaroNo ratings yet

- De Thi Anh Ngu STB Philosophy 2022Document4 pagesDe Thi Anh Ngu STB Philosophy 2022jhsbuitienNo ratings yet

- Tiruchendurmurugan - Hrce.tn - Gov.in Ticketing Reports e Acknowledgement View - PHP Transid 20240131103116000190Document2 pagesTiruchendurmurugan - Hrce.tn - Gov.in Ticketing Reports e Acknowledgement View - PHP Transid 20240131103116000190vadivoo.1967No ratings yet

- CO1 Week 3 Activities Workbook ExercisesDocument2 pagesCO1 Week 3 Activities Workbook ExercisesFrank CastleNo ratings yet

- Pattaya Today Volume 8 Issue 24 PDFDocument52 pagesPattaya Today Volume 8 Issue 24 PDFpetereadNo ratings yet

- Cyberjaya: Name: Ainira Binti Muhasshim DATE: 18 MAY 2015Document11 pagesCyberjaya: Name: Ainira Binti Muhasshim DATE: 18 MAY 2015reenNo ratings yet

- Case Study On Federal ExpressDocument3 pagesCase Study On Federal ExpressDipanjan RoychoudharyNo ratings yet

- Imran Khan: The Leader, The Champion and The Survivor: November 2022Document62 pagesImran Khan: The Leader, The Champion and The Survivor: November 2022Imran HaiderNo ratings yet