Professional Documents

Culture Documents

Market Conditon

Uploaded by

Bala ThandayuthamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Conditon

Uploaded by

Bala ThandayuthamCopyright:

Available Formats

QUT Research Week 2005

Conference Proceedings

Edited by A. C. Sidwell 45 July 2005, Brisbane, Australia

COBRA the Construction Research Conference of the RICS Foundation AUBEA the Australasian Universities' Building Educators Association Conference 3rd CIB Student Chapters International Symposium CIB W89 Building Education and Research CIB TG53 Postgraduate Research Training in Building and Construction

A COLLABORATION OF:

Australasian Universities Building Educators Association

The Queensland University of Technology Research Week International Conference

4-8 July 2005 Brisbane, Australia

Conference Proceedings

Editor: A. C. Sidwell July 2005

Published by: Queensland University of Technology Australia

ISBN 1-74107-101-1

FACTORS INFLUENCING MARKET VALUES OF RESIDENTIAL PROPERTIES

J.I.C. Mbachu* 1 and N. Lenono 2 Institute of Technology & Engineering (Wellington Campus), College of Sciences, Massey University, New Zealand 2 School of Construction Economics & Management, University of the Witwatersrand, South Africa

1

ABSTRACT

In a free-market economy, market forces and other factors influence the prices buyers are willing to pay for a listed property in the property market. In practice, the estimation of the market values of properties draws largely on heuristics or is made without due consideration to a holistic range of influential factors. In most instances, this has resulted in overpricing and a risky property market marked with ups and downs. Consequently demand has been discouraged or erratic thereby impacting negatively on the property business, the construction industry and the national economy. This paper presents the results of investigations into the factors influencing the market values of residential properties in the Johannesburg CBD. The investigations were limited to the views expressed by members of the South African Property Owners Association in Johannesburg who deal in property as developers, investors, consultants and managers. The descriptive survey method was used, which consisted of qualitative and quantitative data gathering using unstructured interviews and structured questionnaires, respectively. Content analyses and the multi-attribute methods were used in the analyses of the research data. Results showed that location, market conditions, micro and macro economic dynamics and building features are the most influential factors affecting the market values of residential properties in the Johannesburg CBD. The percentage relative influences of these factors on residential property prices could be as much as 16.3, 14.8, 14.6 and 14.4 percents, respectively. The relative influences of the underlying subcomponents under each broad category of factors are presented. Adjustment of the comparable sales records in line with the relative influences of the identified factors in the establishment of the asking prices of property is recommended for a closer forecast of the prices buyers are willing to pay. This is expected to stimulate demand and sales thereby improving the fortunes in the property business, the construction industry and the national economy.

Keywords: asking price, influential factors, property market, real estate, residential property, valuation.

1 2

* J.I.Mbachu@massey.ac.nz (corresponding author) lenon@galmail.co.za

Mbachu and Lenono

INTRODUCTION REINZ (1986) defines the open market value of a listed property as the best price, which the property may reasonably be expected to achieve by normal marketing means at the date of appraisal. It assumes both a willing seller and a willing and prudent buyer and a reasonable time to effect the sale, taking into account the nature of the property and the state of the market. This definition assumes a fair market value. In practice, Mockrealty (2005) observes that a range of value is usually established for the asking price of a listed property. At what price in the continuum a property is actually sold depends on the market conditions. A slow market is a buyers market, at which properties may languish on the market for some time and offers may be few and far between. At the slow market condition, asking prices are usually pitched at the lowest rung of the price range. The hot market condition is the sellers market, during which properties could sell within a few days of being listed, often marked with multiple offers. The asking price at this condition is pitched at the upper range of the price continuum. On the other hand, the fair price prevails when the market is steady or in transition. A review of the current approaches to establishing the market value of residential property in practice reveals three to five main methods, namely the direct capital comparison, the investment, residual, profits and cost of replacement approaches. Depending on the purpose, REINZ (1986) outlines four principal methods for assessing the value of real estate: the sales comparison, summation, investment and residual methods. However, Britton et al. (1989) observe that in practice the direct value comparison is the most commonly used method in the assessment of the market value of residential property. In the comparison process, a valuer is engaged to forecast the market value of a listed property. In doing this, the she or he judges what prices vendors generally would seek and do obtain, and what choices purchasers would make. S/he must therefore assess what is now or has recently been available in the market place and make comparisons between them. Britton et al. (1989) argue that the availability and nature of comparables provide the basis of whatever method of valuation is adopted, and indeed, the choice of the method itself. The method of comparison works best if the comparable properties are identical. However, every property is unique. The assumption of similarity is therefore faulty, and introduces some elements of risks in the appraisal process. This perhaps underlies the complexity of the process and the inability to accurately estimate the open market value of a listed property on the prime basis of comparable sales data.

Furthermore, Parnham and Rispin (2000) observe that personal opinion or subjective judgment is used in majority of the cases. In the sales comparison method of appraisal which is most widely used, REINZ (1986) cautions that the method diminishes rapidly in accuracy with the number of factors or adjustments that must be taken into account. In addition to this shortcoming, Britton et al. (1989) point out the unreliability of the use of past sales records with time. Most worrisome is the valuers bias in the appraisal process. For instance, Diaz (2002) reports that when faced with information overload, valuers use mental short cuts - called heuristics - in coming to their final

Factors influencing market values of residential properties

decisions even when they adversely influence a valuation. Diaz observes that valuers make preliminary judgments and then seek evidence that support them.

Several factors affect the market value of residential properties listed in the property market. Turner (2004) identifies the general and specific drivers of residential property values: population growth, level of development in the node, property use, the size and condition of improvements on the site and the demand and supply in the property class within the local real estate market. In addition, Meikle (2001) identifies four sets of main determinants of house prices, namely, the supply of housing, the supply of finance, the demand of housing, and the level of homebuilders / homebuyers confidence. The supply of housing is most strongly influenced by the volume of existing stock of dwellings available for sale, and less of new developments and conversions. The supply of housing finance is influenced by the financial circumstances of the average borrowers and to the lending requirements demanded by lending institutions. On the other hand, the demand for housing is related to the changes in the number of households seeking housing. This in turn is mainly influenced by the population increases, size of household formations and regional migration patterns. Two main groups could be fitted to Mockrealtys (2005) list of the factors influencing property market value. Specific or internal factors refer to the nature and condition of the property, including structural condition, quality of the finishes, building services, fixtures and fittings, and the level of major improvements needed. General or external factors include prevailing economic and market conditions, marketing strategies adopted and the experience of the real estate agent, as well as the motivation of the seller. A motivated seller in this instance is a seller who is under pressing conditions to make a quick deal even at prices below prevailing market price range. Typical instance could be a seller who has already bought his or her next home or is relocating to a new area, and who is under pressure to sell the home quickly or face the prospect of making two mortgage payments at the same time. Other instances include divorce and financial distress. Royal lePage (2003) emphasises strongly on location and type of mortgage debt financing as principal factors affecting the market value of listed property. Location has a major influence in terms of proximity to centres of interest, traffic congestion, crime levels, level of cleanliness or scenic beauty of the environment, infrastructure services and social amenities, security, planning laws, etc. On the other hand, the type of mortgage can affect the property value either up or down depending on the amount, terms and conditions applicable, rates of interests and method of repayment. There is the need to carefully consider the critical factors affecting market value of a property to be listed in the property market in order to guard against over-pricing. This is because when properties are overpriced, affordability levels are lowered and demand is seriously affected. This could introduce depression in the property market. The property sector is a major consumer of the products and services of the construction industry (Mbachu, 2003). A depression in the property market translates more dramatically to down-turn in the construction industry. This also has a rippling effect on the economy due to the effect on the GDP and the consumer price index.

Mbachu and Lenono

Consequently, establishing the right asking price at which buyers are willing to pay holds numerous benefits. Royal lePage (2003) argues that if the right marketing strategies are in place, pricing right is good for the seller and the property market in the following ways: 1) the property sells faster because it is exposed to more qualified buyers; 2) the property does not lose its marketability; 3) the closer to the market value the higher the offers; 4) a well priced property can generate competing offers; 5) the property market comes alive with stimulated demand. A review of related literature to date has revealed a listing of several factors affecting the market value of property. The question worth asking is, how could the valuer, property analyst or informed seller take into consideration the numerous factors influencing the market value of a property during the appraisal process? The answer to the question could lie in the ability to understand the critical factors and their relative influences so that comparable sales record could be more accurately adjusted in arriving at the asking price. Certainly, mere identification of factors is good, but not so helpful to the valuer. At worst it could lead to information overload, which Diaz (2002) identifies as the reason why valuers recoil to heuristics as the feasible method of determining the asking price of property. This study aims to contribute to the solution by investigating further the main factors affecting market values of listed property and their relative influences.

METHODOLOGY The descriptive survey method was used, which consisted of qualitative data gathering using unstructured interviews and quantitative data gathering using structured questionnaires. The investigations were limited to the views expressed by members of the South African Property Owners Association in Johannesburg who deal in property as developers, investors, consultants and managers. Data analyses The multi-attribute method was used to analyse the ratings of the respondents with a view to establishing a representative or mean rating point assigned to each attribute in a subset. The analysis draws from the Multi-attribute Utility approach of Chang and Ive (2002), and involves the computation of the Mean Rating point (MR). The MR indicates the level of significance or effectiveness of each attribute within a subset. In each computation, the total number of respondents (TR) rating each attribute was used to calculate the percentages of the number of respondents associating a particular rating point to the attribute as shown in Equation 1. MRj =

(R

k =1

pjki

% Rjk )

(1)

(Where: MRj = Mean rating point for sub-factor j; Rpjk = Rating point k (ranging from 1 5); Rjk% = Percentage response to rating point k, for sub-factor j). The Relative Influence Index (RII) was used to compare the MR values of the factors in a given subset. It is computed as a unit of the sum of MRs in a given subset of factors as shown in Equation 2.

Factors influencing market values of residential properties

RIIj

n MRj / MR j j =1 (Where: RIIj = Relative Influence Index for sub-factor j).

(2)

RESULTS Survey results

Out of the 250 self administered questionnaires faxed to the registered members of the South African Property Owners Association (SAPOA), 53 were returned by the cut-off date set for data collection. Only 45 questionnaires were usable, representing an unimpressive response rate of 18 percent. The implication of the poor response rate is that the findings of the study cannot be generalised as being representative of the views of the SAPOA members. However, the random sampling method (Zikmund, 1997) adopted in the survey could give some measure of reliability to the findings, which could be useful as building blocks for future studies in this area. In addition, the demographic profiles of the respondents showed they are largely educated and experienced decision makers in their respective organisations. Their input could be of high value. This is evident from the 95 percent being directors or senior executives, 63 percent having first or higher degrees, and 98 percent having over 25 years of practical experience in the real estate business.

Factors affecting the market value of property

Pilot interviews were conducted at the first phase of this study amongst 15 directors and senior executives of companies that were enlisted in the SAPOA membership directory in Johannesburg. Recurring themes mentioned or alluded to by more than 3 interviewees as the key factors affecting the market value of residential property were articulated and subjected to content analyses. Results reveal seven major categories of factors as shown in Figure 1. These provided the conceptual framework for the research design.

Location Urban regeneration Demographic/ sociocultural Factors influencing market value of residential property

Micro & macro economic

Building features

Legal/statutory/political

Market conditions

Figure 1: Broad categories of factors influencing the market value of residential property

Mbachu and Lenono

Constructs underlying the major categories were incorporated into the questionnaire used in the quantitative data gathering. Using a five point rating scale, respondents rated the relative levels of influence of the sub-factors on the market value of a listed residential property. The responses were subjected to multi-attribute analysis as described in the Methodology section. Tables 1-8 in the appendix show the results of the analyses for each major category of factors. For brevity, only the significantly influential sub-factors are highlighted. Figure 2 summarizes the relative influences of the major factor categories on the market values of residential properties. Location factors influencing residential property values Table 1 shows that crime levels and security provisions, and accessibility/ proximity of the property to centres of interests were perceived as the first and second most influential sub-factors influencing the market value of a residential property under location group of factors. This finding is partly in agreement with the observations of Turner (1990) that the three most significant influences on property value are location, location and location. Most recurring additional factors supplied by respondents in the open ended section of the questionnaire under this group are the influences of development or installations nearby. Examples cited include sporting facilities and overhead power transmission lines. Next in importance under location are the influences of potential harm such as earthquakes, flooding, ground subsidence, land slippage, underground water table, etc. Macro and micro economic factors influencing property values Under this group of factors, exchange rates, interest rates fluctuations and inflation were believed to constitute the factors having the most profound influence on the market value of residential property. Apparently when the exchange rate declines, the values of all products and services also decline, residential property inclusive. The impact of exchange rate on residential property value was corroborated by Britton et al. (1989) who also noted that high interest rate does not only impact on the cost of mortgage financing, but also on the proportion of the purchase price which could be financed, thereby limiting affordability and demand, and consequently lowering the market values of listed properties. Legislative/ statutory control factors influencing property values The most influential sub-factors under this category are the various taxes relating to the sale, ownership and use of property, notably, Property Gains Tax Laws, municipality taxes and divergent tax rates (i.e. tax rates on service rates, electricity, water, telecommunications, etc). Planning controls were perceived to be the second most influential sub-factors influencing property values. Britton et al. (1989) provide further insights on these influences as including restrictions on the changes in the use of the building and the intensity of use of the land. Such restrictions were perceived by the respondents as limiting the utility and value of the building, as is and where is. Demographic/ socio-cultural factors The most significant set of factors influencing property values under this group is the population density and projected growth; followed by demographic mix. This agrees with Miekles (2001) observation that the demand for housing is driven by changes in the number of households seeking housing through natural increases in population, increased household formations and regional population shifts, among others.

Factors influencing market values of residential properties

Influence of residential property features on its market value Functionality and spatial adequacy in terms of size and number of rooms were perceived as the most significant factors influencing the market value of residential property. Next to these is the aesthetic appeal design, finishes, etc. It was surprising to note that these aspects were accorded high priority over running and maintenance costs and the age of building/ obsolescence. This could be as a result of the reported poor maintenance culture of most developing countries (ADB, 2005). Urban regeneration influences on residential property values Respondents believed that adequate provision and maintenance of basic infrastructure within an area constitutes the most significant factor influencing property values in an area. Such infrastructure includes roads, drainage, and sewerage and refuse disposal. Next in influence is the provision of sites and services on adjoining undeveloped areas. Perhaps the potential influence of new developments in the latter could be the reason for a perceived increase in the value of residential property in the existing area. Influence of market conditions on property values Under this group, perceived property market conditions, vacancy rates and general business confidence level were perceived to have the most significant impact on property values. The second most influential set of factors is constituted by demand and supply levels for the particular property class and the perceived general market conditions. This should be expected as market conditions and demand sub-factors are intricately interwoven.

Miscellaneous factors At the open ended sections of the questionnaire used for quantitative data gathering, respondents freely supplied additional factors influencing the market value of residential property. The most recurring additional factor which could not fit into any of the above major groups is the influence of the valuer or real estate agent involved in the valuation and marketing of the property. The respondents were of the view that local knowledge, expertise and nationwide property database at the disposal of the valuer or estate agent could significantly influence the valuation advice or the marketing services which invariably could affect the market value of the property in question. The second most recurring additional factor supplied is the degree of exposure of the property to potential hazards in relation to the ground upon which it is built, or the surrounding area. Such hazards as listed include erosion, subsoil instability and other natural havoc. They are of the view that site inspection, engineering geological report or Hazard Report should provide information about the extent of exposure of the property to a list of probable hazards. The third most recurring additional factor worth noting is the influence of improvements in the transport facilities which could encourage workers to operate from dispersed and distant locations thereby reducing demand in central cities.

Relative influences of the factor groups

In addition to rating the relative influences of the sub-factors under each group, respondents were also asked to rate the relative influences of the major factor groups. Figure 2 shows that location, as should be expected, was perceived to be the most

Mbachu and Lenono

significant set of factors influencing residential property value. Through the computation of the relative importance indices (Equation 2), the relative contribution each major group in quantitative terms were estimated. Location accounts for 16.3 percent of the market value of a listed residential property. Next in importance are market conditions (14.8 percent), while demographic/ socio cultural influences were perceived to have the least influence (12.6 percent). The additional groups of factors that emerged from the responses in the open-ended sections of the questionnaire were treated as qualitative data or constructs that could inform directions in further studies in this area. Such factors could be grouped under miscellaneous or extraneous variables.

Demographic/ sociocultural issues (7) 13%

Location (1) 16%

Legal/ statutory controls (6) 13%

Market conditions (2) 15%

Urban regeneration (5) 14%

Building features (4) 14%

Micro and macro economic (3) 15%

Figure 2: Relative influences of factor groupings on residential property values

CONCLUSIONS

This study has investigated the nature and magnitude of influences of the factors affecting the market values of residential properties listed in the property market. From the results of the investigations and analyses carried out, it was found that seven groups of factors affect the residential property value. In order of relative influence, these are location (16.3 percent), market conditions (14.8 percent), micro and macro economic factors (14.6 percent), building features (14.4 percent), urban regeneration (13.9 percent), legal/ statutory controls (13.4 percent) and demographic/ socio-cultural issues (12.6 percent). In the sales comparison method commonly adopted for the estimation of the market value of residential property, the relative weights of the major groups and sub-groups of factors could provide a more rationale basis for the adjustment of the comparable sales value of the property to arrive at the asking price that could be as close as possible to the price buyers are willing to pay. This could guard against overpricing of property, and stimulate demand for a more vibrant property market. The construction

Factors influencing market values of residential properties

industry and the national economy could benefit from the improved demand and sales spin offs in the property market.

REFERENCES

Asian Development Bank (ADB) (2005) Developing member countries perspectives. Report on Road, Funds and Maintenance. ADB, Manila, Philippines. Retrieved 14 March 2005 from: http://www.adb.org/Documents/Reports/Road_Funds_Maintenance/chap04.pdf Britton, W., Davies, K. and Johnson, T. (1989) Modern methods of valuation, 8th edition. Estate Gazette Ltd, London. Chang, C. and Ive, G. (2002) Rethinking the multi-attribute utility approach based procurement route selection technique. Construction Management & Economics, 20 (3), 275-284 Diaz, J. (2002) Valuers must be more aware of their own influence. RICSFoundation News, (16 September). Retrieved on 9 March 2005 from: http://www.rics-foundation.org/news/pressrelease.aspx?pid=59 Mbachu, J.I.C (2003) A critical study of client needs and satisfaction in the South African building industry. PhD thesis. Faculty of Economic and Building Sciences, University of Port Elizabeth, South Africa. Meikle, J. (2001) A review of recent trends in house construction and land prices in Great Britain. Construction Management and Economics, 19, pp. 259-265 Mockrealty (2005) Factors affecting your offer price. Mock Realty Inc., Boulder, Colaroda, USA. Retrieved 11 March 2005 from: www.mockrealty.com/buying/price.php Parnham, P. and Rispin, C. (2000) Residential property appraisal. Taylor and Francis Group, London. Real Estate Institute of New Zealand (REINZ) (1986) Real estate appraisal, 3rd Edition (September). The Real Estate Institute of New Zealand, Wellington. Royal lePage (2003) Determining the value of your home. Royal lePage Real Estate Services Ltd, Ontario, Canada. Retrieved on 14 September 2004 from:

http://www.royallepage.ca/selling/sell-overpricing.htm )

Turner, A. (1990) Building Procurement. Macmillan Education Ltd, London. Turner, R. (2004) The appraisal process and your taxes. The Property Appraisers Office, Hillborough County, Tampa, Florida. Retrieved on 14 September 2004 from: http://www.hcpafl.org/function.html ) Zikmund, W.G (1997) Business Research Methods, 5th Edition, Harcourt Brace College Publishers, Orlando, Florida, USA.

Mbachu and Lenono

APPENDIX

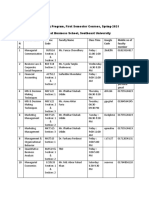

Table 1: Location factors influencing residential property values

*Levels of influence: 'VI' = Very influential; 'I' = Influential; 'SI' = Somewhat influential; 'LI' = Of little influence; 'NI' = Not influential *Levels of influence VI I SI LI NI 5 4 3 2 1 Location factors TR MR % % % % % 1 Crime levels, security network/ patrols 62.2 31.1 4.4 2.2 0.0 45 4.533 2 Accessibility and proximity to centres of interests e.g. shops, public services, transport nodes etc 3 Availability of social infrastructure and support services e.g. banks, offices, schools, hospital etc 4 Sanitary conditions, waste disposal system, general cleanliness of the area 44.4 33.3 42.9 25.0 17.8 14.3 42.2 40.5 23.8 50.0 62.2 52.4 8.9 19.0 21.4 18.2 13.3 21.4 4.4 4.8 7.1 4.5 4.4 9.5 0.0 2.4 4.8 2.3 2.2 2.4 45 42 42 44 45 42 4.267 3.976 3.929 3.909 3.889 3.667

5 Traffic congestion, parking spaces/permits 6 Property class and level of competition in the area 7 Nature of the neighbourhood: Quality of surrounding buildings, planning laws, sociocultural issues, etc 8 Environmental Conditions e.g. Atmospheric pollution, noise levels, etc 9 Topography: Soil conditions, landscape, views etc.

18.6 9.3

25.6 27.9

44.2 39.5

7.0 18.6

4.7 4.7

43 43

3.465 3.186

Table 2: Macro and micro economic factors influencing residential property value

*Levels of influence: 'VI' = Very influential; 'I' = Influential; 'SI' = Somewhat influential; 'LI' = Of little influence; 'NI' = Not influential VI 5 % 55.6 30.2 14.3 14.0 11.1 4.8 *Levels of influence I SI LI 4 3 2 % % % 26.7 11.1 4.4 34.9 31.0 27.9 24.4 14.3 7.0 35.7 27.9 37.8 47.6 23.3 9.5 20.9 15.6 19.0 NI 1 % 2.2 4.7 9.5 9.3 11.1 14.3

Macro and micro economic factors 1 Exchange rates, fluctuations in interest rates and Inflation 2 Average wages, affordability levels, availability of finance and repayment conditions 3 General capital growth in real estate business 4 Global economic trends affecting property business levels 5 Offshore investment opportunities and attractiveness 6 Energy crisis and its influence on main stream economy

TR 45 43 42 43 45 42

MR 4.289 3.628 3.310 3.163 3.089 2.762

Factors influencing market values of residential properties

Table 3: Legislative/ statutory control factors influencing property values

*Levels of influence: 'VI' = Very influential; 'I' = Influential; 'SI' = Somewhat influential; 'LI' = Of little influence; 'NI' = Not influential *Levels of influence VI 5 Legislative / statutory control factors 1 Property Gains Tax Laws, municipality taxes, divergent tax rates ( tax rates on service rates, electricity, water, telecommunications etc) 2 Planning controls: Town planning / zoning and country planning act 3 Legal requirements by the council, based on height restrictions, quality and class of residential property, etc 4 Deregulation / Liberalization of property market, e.g. allowing foreign investors involvement in property business 5 By - laws pertaining to safety, healthy working conditions, fire equipment, etc 6 Tenure of the property ( Price of property is valuated in terms of the time of lease). 7 Price paid on property on compulsory purchase (local authorities, statutory undertakings). 8 Periodic valuation of residential property for taxation purposes. % 51.1 I 4 % 28.9 SI 3 % 13.3 LI 2 % 4.4 NI 1 % 2.2 TR 45 MR 4.222

48.8 31.8

20.9 31.8

20.9 27.3

7.0 6.8

2.3 2.3

43 44

4.070 3.841

15.6

26.7

40.0

11.1

6.7

45

3.333

19.5 7.1 2.4 11.6

22.0 45.2 31.0 23.3

36.6 26.2 35.7 23.3

12.2 7.1 11.9 11.6

9.8 14.3 19.0 30.2

41 42 42 43

3.293 3.238 2.857 2.744

Table 4: Demographic/ socio-cultural factors influencing residential property values

*Levels of influence: 'VI' = Very influential; 'I' = Influential; 'SI' = Somewhat influential; 'LI' = Of little influence; 'NI' = Not influential. *Levels of influence VI I SI LI NI 5 4 3 2 1 Demographic/ socio-cultural factors TR MR % % % % % 1 Population density and projected growth 48.9 28.9 17.8 4.4 0.0 45 4.222 2 Demographic mix and resultant influence on property demand 3 Socio cultural dynamics and influence on property class 4 Nature of the residents: employment and social status, etc 5 Presence of destitute in the neighbourhood and the perceived menace 6 Multi ethnic co-habitation and perceived social tension 25.0 25.6 27.9 13.6 20.9 34.1 34.9 37.2 29.5 37.2 36.4 30.2 20.9 50.0 18.6 4.5 4.7 2.3 4.5 11.6 0.0 4.7 11.6 2.3 11.6 44 43 43 44 43 3.795 3.721 3.674 3.477 3.442

Mbachu and Lenono

Table 5: Residential property features influencing its market value

*Levels of influence: 'VI' = Very influential; 'I' = Influential; 'SI' = Somewhat influential; 'LI' = Of little influence; 'NI' = Not influential VI 5 % 40.0 51.1 41.9 26.7 *Levels of influence I SI LI 4 3 2 % % % 53.3 4.4 2.2 35.6 37.2 53.3 6.7 16.3 15.6 4.4 4.7 4.4 NI 1 % 0.0 2.2 0.0 0.0

Influential building features 1 Functionality and spatial adequacy: size and number of rooms, number of floors, etc 2 Aesthetics appeal : architectural design, style, fashion, concept, finishing 3 Security facilities: provision of fencing, burglar alarms, etc 4 Nature and quality of services: Adequacy of mechanical, electrical and plumbing installations. 5 Repairs and level of required refurbishment 6 Quality and durability of materials, components and construction. 7 Running and maintenance costs 8 Age of the building/ obsolescence 9 Adequacy of premises, parking space, landscape, etc

TR 45 45 43 45

MR 4.311 4.289 4.163 4.022

26.7 22.7 27.9 30.2 17.1

51.1 50.0 34.9 39.5 37.1

17.8 25.0 27.9 16.3 42.9

4.4 2.3 9.3 9.3 2.9

0.0 0.0 0.0 4.7 0.0

45 44 43 43 35

4.000 3.932 3.814 3.814 3.686

Table 6: Urban regeneration influences on residential property values

*Levels of influence: 'VI' = Very influential; 'I' = Influential; 'SI' = Somewhat influential; 'LI' = Of little influence; 'NI' = Not influential *Levels of influence VI I SI LI NI MR 5 4 3 2 1 TR Urban regeneration influences % % % % % Infrastructure provision and maintenance: 26.2 61.9 7.1 4.8 0.0 42 4.095 roads, drainage, sewerage & refuse disposal, etc Sites and services on adjoining undeveloped 24.4 39.0 29.3 2.4 4.9 41 3.756 areas Perceived impact of urban rejuvenation 26.2 42.9 14.3 11.9 4.8 42 3.738 programmes on property Values Level of development and maintenance of 20.0 40.0 35.0 0.0 5.0 40 3.700 property in the regenerated areas. 4.8 23.8 54.8 7.1 9.5 42 3.071

1 2 3 4

5 Style of the inner city culture

Factors influencing market values of residential properties

Table 7: Market conditions influencing residential property values

*Levels of influence: 'VI' = Very influential; 'I' = Influential; 'SI' = Somewhat influential; 'LI' = Of little influence; 'NI' = Not influential *Levels of influence VI 5 Market conditions 1 Property market conditions, vacancy rates, general business confidence level 2 Demand and supply of the class of residential property 3 Fitness for purpose 4 Rate of capital growth for the property type & node 5 Publicity/ marketing strategies; level of experience of estate agent 6 Conditions and price charges of residential property on the market 7 Commission fee included in the sale of property % 40.0 40.9 22.7 20.9 24.4 19.5 9.5 I 4 % 51.1 43.2 45.5 39.5 39.0 39.0 14.3 SI 3 % 6.7 15.9 27.3 34.9 24.4 22.0 28.6 LI 2 % 2.2 0.0 4.5 0.0 0.0 14.6 19.0 NI 1 % 0.0 0.0 0.0 4.7 12.2 4.9 28.6 TR 45 44 44 43 41 41 42 MR 4.28 9 4.25 0 3.86 4 3.72 1 3.63 4 3.53 7 2.57 1

Table 8: Relative influences of factor groups on residential property values

*Levels of influence: 'VI' = Very influential; 'I' = Influential; 'SI' = Somewhat influential; 'LI' = Of little influence; 'NI' = Not influential *Levels of influence VI 5 Factor group 1 Location 2 Market conditions 3 Micro and macro economic 4 Building features 5 Urban regeneration 6 Legal / statutory controls 7 Demographic / socio cultural % 73.3 46.7 48.9 44.4 44.4 39.0 20.0 I 4 % 26.7 37.8 35.6 31.1 31.1 29.3 35.0 SI 3 % 0 15.6 11.1 22.2 13.3 14.6 35 LI 2 % 0.0 0.0 0.0 2.2 6.7 17.1 10.0 NI 1 % 0.0 0.0 4.4 0.0 4.4 0.0 0.0 TR 45 45 45 45 45 41 40 MR 4.73 4.31 4.24 4.18 4.04 3.90 3.65 29.06 RII 0.163 0.148 0.146 0.144 0.139 0.134 0.126 1.00 % 16.3 14.8 14.6 14.4 13.9 13.4 12.6 100

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- French & Bell (1995)Document17 pagesFrench & Bell (1995)Bala ThandayuthamNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- RTI Singhania UniversityDocument4 pagesRTI Singhania UniversityBala ThandayuthamNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- 03 Cinnamon Ej Spring 14Document11 pages03 Cinnamon Ej Spring 14Bala ThandayuthamNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Kamaraj Universit RTI - Form ModelDocument1 pageKamaraj Universit RTI - Form ModelBala ThandayuthamNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Marketing MCQ From DR CSKDocument7 pagesMarketing MCQ From DR CSKBala ThandayuthamNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- No.F. 2-103/2014 (GA) Dated. 03.02.2016: Office OrderDocument101 pagesNo.F. 2-103/2014 (GA) Dated. 03.02.2016: Office OrderBala ThandayuthamNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- RTI Singhania University PDFDocument1 pageRTI Singhania University PDFBala ThandayuthamNo ratings yet

- Periyar University RTI Form ModelDocument1 pagePeriyar University RTI Form ModelBala ThandayuthamNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- (Pojem Guerilla Marketing A Další Možnosti Výzkumu) : Guerrilla Marketing Concept and Further Research PossibilitiesDocument9 pages(Pojem Guerilla Marketing A Další Možnosti Výzkumu) : Guerrilla Marketing Concept and Further Research PossibilitiesBala ThandayuthamNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Project Extension: (57 % Market in World)Document5 pagesProject Extension: (57 % Market in World)Bala ThandayuthamNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Rural Women and Micro-Credit Schemes: Cases From The Lawra District of GhanaDocument104 pagesRural Women and Micro-Credit Schemes: Cases From The Lawra District of GhanaBala Thandayutham100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Mba IbDocument19 pagesMba IbBala ThandayuthamNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- GuerrillaDocument16 pagesGuerrillaDamian EduardNo ratings yet

- House SatisfactionDocument5 pagesHouse SatisfactionBala ThandayuthamNo ratings yet

- PGDIEM SyllabusDocument17 pagesPGDIEM SyllabusBala ThandayuthamNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- 2009 Servqual AgencyDocument14 pages2009 Servqual AgencyBala ThandayuthamNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Stress Management Through YogaDocument7 pagesStress Management Through YogaBala ThandayuthamNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- AMG RobotDocument33 pagesAMG RobotShanNo ratings yet

- It Happened in IndiaDocument5 pagesIt Happened in IndiaNivedh VijayakrishnanNo ratings yet

- Application of Inventory Management in Construction IndustryDocument3 pagesApplication of Inventory Management in Construction IndustryEditor IJRITCCNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Case 1 - Promoting A Breakfast CerealDocument4 pagesCase 1 - Promoting A Breakfast CerealArpit Chaudhary0% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Lehman Brothers:: Too Big To Fail?Document13 pagesLehman Brothers:: Too Big To Fail?abbiecdefgNo ratings yet

- Marketing MythsDocument2 pagesMarketing MythsMuhammad Hasbi BaharuddinNo ratings yet

- Supply Chain Drivers and Obstacles: © 2007 Pearson EducationDocument10 pagesSupply Chain Drivers and Obstacles: © 2007 Pearson Educationrks32No ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDr. Shoaib MohammedNo ratings yet

- Discourse Community of BusinessDocument6 pagesDiscourse Community of Businessapi-254493285No ratings yet

- Armenia Pharma Market: Pharmexcil HyderabadDocument9 pagesArmenia Pharma Market: Pharmexcil HyderabadAayushi TomarNo ratings yet

- SL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty MemberDocument2 pagesSL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty Memberএ.বি.এস. আশিকNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Financial Analysis of Krishna Maruti LTDDocument7 pagesFinancial Analysis of Krishna Maruti LTDAnsh SardanaNo ratings yet

- CFAP 6 AARS Winter 2017Document3 pagesCFAP 6 AARS Winter 2017shakilNo ratings yet

- A Research Porposal Dak BahadurDocument6 pagesA Research Porposal Dak BahadurNabin AnupamNo ratings yet

- SLCM PDFDocument382 pagesSLCM PDFEverything RandomlyNo ratings yet

- Oxford Closes $200,000 Private PlacementDocument2 pagesOxford Closes $200,000 Private PlacementPR.comNo ratings yet

- Goods and Service Tax: Without Input CreditDocument44 pagesGoods and Service Tax: Without Input CreditpranjalNo ratings yet

- Anas WCMDocument5 pagesAnas WCMAnas FareedNo ratings yet

- Primark EthicsDocument4 pagesPrimark Ethicsapi-505775092No ratings yet

- ABC MCQ'sDocument10 pagesABC MCQ'sMuhammad FaizanNo ratings yet

- Advantages-Disadvantages of E-Commerce (Group-4)Document17 pagesAdvantages-Disadvantages of E-Commerce (Group-4)payal patraNo ratings yet

- Chapter 9 - Responsibility AccountingDocument44 pagesChapter 9 - Responsibility Accountingsathishiim1985No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ministry of Education: English ExamDocument17 pagesMinistry of Education: English ExamisaNo ratings yet

- ECONOMY: Ecological EconomicsDocument18 pagesECONOMY: Ecological EconomicsPost Carbon Institute100% (2)

- Regional Hotel Market Analysis and Forecasting May 2016Document131 pagesRegional Hotel Market Analysis and Forecasting May 2016Abhi ReddyNo ratings yet

- Hospitality Financial Management 1St Edition Chatfield Test Bank Full Chapter PDFDocument28 pagesHospitality Financial Management 1St Edition Chatfield Test Bank Full Chapter PDFJeremyMitchellkgaxp100% (11)

- Economics 2B Study GuideDocument86 pagesEconomics 2B Study GuideHasan EvansNo ratings yet

- A Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreDocument74 pagesA Study On Customer Awareness On E-Banking Services at Union Bank of India, MangaloreThasleem Athar95% (40)

- Business Name: Address Line 1 Phone Address Line 2 Email City, State, Zip WebDocument2 pagesBusiness Name: Address Line 1 Phone Address Line 2 Email City, State, Zip WebJear ComerosNo ratings yet

- International Payment Methods Clean Payments Advance Payment Open Account Payment Collection of Bills in InternaDocument2 pagesInternational Payment Methods Clean Payments Advance Payment Open Account Payment Collection of Bills in InternaPankaj SinghNo ratings yet

- Medical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldFrom EverandMedical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldRating: 4.5 out of 5 stars4.5/5 (2)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersFrom EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersNo ratings yet