Professional Documents

Culture Documents

mkt243 2011 S1

Uploaded by

rxzlajuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

mkt243 2011 S1

Uploaded by

rxzlajuCopyright:

Available Formats

CONFIDENTIAL

AC/APR 2011/ACC116/165/211

UNIVERSITI TEKNOLOGI MARA FINAL EXAMINATION

COURSE COURSE CODE EXAMINATION TIME

INTRODUCTION TO COST ACCOUNTING / COST ACCOUNTING ACC116/165/211 APRIL 2011 3 HOURS

INSTRUCTIONS TO CANDIDATES 1. 2. 3. This question paper consists of five (5) questions. Answer ALL questions in the Answer Booklet. Start each answer on a new page. Do not bring any material into the examination room unless permission is given by the invigilator. Please check to make sure that this examination pack consists of: i) ii) the Question Paper an Answer Booklet - provided by the Faculty

4.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 6 printed pages

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL QUESTION 1 A.

AC/APR 2011/ACC116/165/211

Choose a term (i-viii) that best describe each of the following situations(each term can only be used once): i. ii. iii. iv. v. vi. vii. viii. 1. Prime cost Fixed cost Product costs Period cost Conversion cost Controllable cost Direct cost Direct proportion Depreciation for the car used by the sales representative is treated as in the income statement. In terms of cost behaviour, it is a Wood used in making furniture is a . are costs that are necessary and integral part of producing the finished product. Variable costs are costs that vary in to changes in the level of activity. is a cost that a given manager can regulate or influence during a particular time period. Direct labour and overheads costs also known as Total direct cost is known as (4 marks)

2. 3. 4. 5. 6. 7.

B.

Listed below (i-vi) are various costs that are incurred in several organizations You are required to classify each cost a. b. i. ii. iii. iv. v. vi. according to its behaviour as variable or fixed costs and; according to its function as Production, Administration or Selling and Distribution costs Telekom Malaysia paid RM200.000 to advertise in TV3 for Chinese New Year promotion Steering wheels installed in Myvi car by Perodua Directors of Honda Bhd are paid bonuses based on profit for the year Astro Bhd pays its sales agent 5% commission for each unit sold Insurance on KFC Holding corporate building is paid yearly Sugar used in production of carbonated drink, Pepsi (6 marks)

There are several differences between Cost and Management Accounting and Financial Accounting. State any two (2) differences (2 marks) (Total: 12 marks) Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

C.

CONFIDENTIAL QUESTION 2 a)

AC/APR 2011 /ACC116/165/211

Berjaya Cetak Sdn Bhd prints Sunday Times newspaper. The company consumes 36,000 litres of ink every month. The cost of storing the ink is RM3 per litre per annum. The ordering cost is RM120 per order Required: i. Calculate the company's Economic Order Quantity using equation method. (2 marks) Calculate total cost (ordering and storage) for the ink. (3 marks)

ii.

b)

Tipah Restaurant, sells "Nasi Beriyani". The restaurant orders "Beras Basmathi" from Faiza Food Industries. The following transactions for "Beras Basmathi" are recorded in March 2011 March 1 Balance from last month, 15,000 kg @ RM8.50 per kg 3 Purchases 8,000 kg @ RM9.30 7 Issues 17,000 kg 12 Purchases 9,000 kg @ RM9.50 15 Purchases 8,000 kg @ RM9.70 17 2,000 kg of damaged "Beras Basmathi" were returned to Faiza Food Industries. This transaction should be recorded based on the last purchase price 20 Issues 12,000 kg 23 Purchases 7,500 kg @ RM 10.20 24 Purchases 6,000 kg @ RM10.40 28 Issues 15,000 kg 31 The physical stock taking showed a balance of 7,000 kg of "Beras Basmathi" in the store Required: i. Prepare the Store Ledger Card for "Beras Basmathi" during March 2011, using Last in First Out Method (LIFO). (15 marks) Briefly explain three (3) recorded stocks. causes of discrepancies between actual stocks and (5 marks) (Total: 25 marks)

ii.

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL QUESTION 3

AC/APR 2011/ACC116/165/211

The Machining Department in Taming Seri Sdn Bhd has three workers.Along, Angah and Uda. The following information relates to the performance of each worker in Machining department for the first week of February 2011. Along is a skilled worker, while Angah is a semi skilled worker and Uda is an unskilled worker Worker Along Angah Uda Actual output 268 230 200 Standard per unit RM2.50 RM2.30 RM2.00 rate Actual hours worked 43 45 49 Rate per hour RM15 RM12 RM9

The normal working hour for the business is 8 hours a day for five days. Each worker is eligible for overtime. The overtime premium is 50% of hourly rate. Required: (a) Determine the gross pay for each employee according to: i. Time based (includes overtime) (9 marks) ii. Output based(straight piecework) (3 marks) Taming Sari is planning to change the method of remuneration of employee by introducing differential piecework. The scheme will be as below First 100 units of output in a week RM2.00 per unit Output 101 to 200 units in a week RM2.30 per unit on additional units over 100 Output 201 to 250 units in a week RM2.50 per unit on additional units over 200 Output over 250 units in a week RM3.00 per unit on additional units over 250 (b) Determine the gross pay for each employee according to differential piecework. (9 marks) Give two (2) advantages and two (2) disadvantages of piecework method. (4 marks) (Total: 25 marks)

(c)

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL QUESTION 4

AC/APR 2011/ACC116/165/211

Budgeted production overheads allocated and apportioned to cost centres in a factory for a year 20X1, along with additional data, are: Production Cost Centre P3 P1 P2 RM18,543 RM41.256 RM13,579 RM28.230 RM48.750 RM25.240 Service Cost Maintenance RM4.230 RM4.575 Centre Canteen RM6.250 RM5.250

Allocated overheads Apportioned overheads Additional data: No of employees Direct labour hours Machine hours Maintenance hours

15 6,500 3,500 450

18 7,250 1,250 525

21 4,680 6,500 300

225

Overheads allocated and apportioned to Service Cost Centre (Maintenance and Canteen) are reapportioned to the Production Cost Centre using repeated distribution method. Production overheads are absorbed based on the direct labour hour for P1 and P2, while for P3 based on machine hour Required: (a) Reapportion the service cost centre overheads using suitable basis (to two decimal places). (13 marks) Calculate an overhead absorption rate for each production cost centre. (3 marks) (c) At the end of year 20X1 .actual overheads and activities are as follows: Department P1 P2 P3 Production overheads Direct labour hours RM55.000 7,560 RM105,000 7,323 RM45.000 4,721 Machine hours 3,454 2,250 7,123

(b)

Determine under or over absorption of overhead in each of the three (3) production departments (6 marks) (d) State an appropriate basis of apportionment for each of the following production overhead costs: i. ii. iii. Factory rent; Insurance for machine; Materials handling. (3 marks) (Total: 25 marks)

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL QUESTION 5

AC/APR 2011/ACC116/165/211

Emmanuelle Bhd has three (3) production departments which involve in producing special product "Gambit". In the March 2011, a special order of Job M1601 was received. The following costs had been incurred for Job M1601: Direct Materials Material AB Material CD Direct Labour Department XX Department YY Department ZZ Administration expenses Selling and distribution cost Hire of special machine Machine hours Department XX Department YY Department ZZ

8,500 units @ RM13.50 per unit 7,250 units @ RM12.50 per unit 3000 hours @ RM8.50 per direct labour hour 4500 hours @ RM9.25 per direct labour hour 7500 hours @ RM6.50 per direct labour hour 5% on production cost RM53.250 RM50.250 175 hours 350 hours 450 hours

Additional information for Job M1601: Production overhead absorption rate for Department XX and YY are based on direct labour hour. For Department ZZ, it is based on machine hour rate. Data for the cost centres are as follows: Department XX RM45,000 5,250 5,150 3,250 3,150 Department YY RM58,000 6,250 6,150 3,750 3,500 Department ZZ RM65.000 4,500 4,250 3,150 3,450

Budgeted overheads Budgeted labour hours Actual direct labour hours Budgeted machine hours Actual machine hours

The management had set a target profit of 35% on selling price for Job M1601

Required: (a) Calculate the overhead absorption rate for each department. (3 marks) (b) Prepare a Job Cost Sheet for Job M1601 and show clearly the prime cost, total production cost, total cost and the selling price. (10 marks) (Total: 13 marks)

END OF QUESTION PAPER

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

You might also like

- Pyq Acc 116Document7 pagesPyq Acc 116HaniraMhmdNo ratings yet

- COEB442 - Sem - 2 - 2015-2016 RevisionDocument37 pagesCOEB442 - Sem - 2 - 2015-2016 RevisionNirmal ChandraNo ratings yet

- Engineering Economics RevisionDocument43 pagesEngineering Economics RevisionDanial IzzatNo ratings yet

- 97 ZaDocument7 pages97 ZaMeow Meow HuiNo ratings yet

- Bmac 5203Document10 pagesBmac 5203ShaanySirajNo ratings yet

- This Examination Paper Consists of 7 Printed Pages: © Hak Cipta Universiti Teknologi MARADocument7 pagesThis Examination Paper Consists of 7 Printed Pages: © Hak Cipta Universiti Teknologi MARAFaiz Mohamad0% (1)

- Institute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsNaveed Mughal AcmaNo ratings yet

- Cost Accounting Past Paper 2016 B Com Part 2Document4 pagesCost Accounting Past Paper 2016 B Com Part 2Sana BudhwaniNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2006/ACC165/211Document6 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2006/ACC165/211Mamek Zaidi KuddiqNo ratings yet

- Wef2012 Pilot MAFDocument9 pagesWef2012 Pilot MAFdileepank14No ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/OCT 2009/TAX370Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/OCT 2009/TAX370Ainnur ArifahNo ratings yet

- Cost Accounting 2013Document3 pagesCost Accounting 2013GuruKPO0% (1)

- Budget: Profit Planning and Control System: Learning ObjectivesDocument16 pagesBudget: Profit Planning and Control System: Learning ObjectivesFayz Sam0% (1)

- Management Accounting Level 3: LCCI International QualificationsDocument17 pagesManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (2)

- 2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersDocument15 pages2006 LCCI Cost Accounting Level 2 Series 4 Model AnswersHon Loon SeumNo ratings yet

- August 2007 CPPADocument19 pagesAugust 2007 CPPAAhmed Raza MirNo ratings yet

- Take Home Quiz UasDocument6 pagesTake Home Quiz UasNadya Priscilya HutajuluNo ratings yet

- BMAC5203 Assignment Jan 2015 (Amended)Document6 pagesBMAC5203 Assignment Jan 2015 (Amended)Robert WilliamsNo ratings yet

- Cost Accounting RTP CAP-II June 2016Document31 pagesCost Accounting RTP CAP-II June 2016Artha sarokarNo ratings yet

- 8508 Managerial AccountingDocument10 pages8508 Managerial AccountingHassan Malik100% (1)

- T1 - Tutorial MaDocument10 pagesT1 - Tutorial Matylee970% (1)

- Cost Estimation and CVP AnalysisDocument10 pagesCost Estimation and CVP AnalysisQudwah HasanahNo ratings yet

- Acca f2 Management Accountant Topicwise Past PapersDocument44 pagesAcca f2 Management Accountant Topicwise Past PapersIkram Naguib100% (1)

- Module Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceDocument9 pagesModule Code: PMC Module Name: Performance Measurement & Control Programme: MSC FinanceRenato WilsonNo ratings yet

- Aqa Acc7 W QP Jun08Document8 pagesAqa Acc7 W QP Jun08Aimal FaezNo ratings yet

- Exam OC MAC Period 1 OC104E72.1 October 2012Document5 pagesExam OC MAC Period 1 OC104E72.1 October 2012Azaan KaulNo ratings yet

- Set2P3116q Basic Cost AccDocument4 pagesSet2P3116q Basic Cost AccscorefullNo ratings yet

- Cost Accounting: Level 3Document18 pagesCost Accounting: Level 3Hein Linn KyawNo ratings yet

- AccountingDocument9 pagesAccountingVaibhav BindrooNo ratings yet

- Cost Accounting Past PapersDocument66 pagesCost Accounting Past Paperssalamankhana100% (2)

- ACCA F 2 Managment Accountant Topic Wise Q A PDFDocument44 pagesACCA F 2 Managment Accountant Topic Wise Q A PDFSaurabh KaushikNo ratings yet

- Malaysia) Past Paper Series 2 2010Document7 pagesMalaysia) Past Paper Series 2 2010Fong Yee JeeNo ratings yet

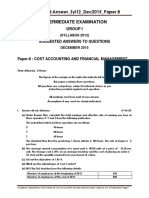

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8Document15 pagesIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8JOLLYNo ratings yet

- Costing FM Model Paper - PrimeDocument17 pagesCosting FM Model Paper - Primeshanky631No ratings yet

- Chapter 1 Budgeting Exercises: Management Accounting TechniquesDocument7 pagesChapter 1 Budgeting Exercises: Management Accounting TechniquesLolAnonNo ratings yet

- Paper - 4: Cost Accounting and Financial ManagementDocument20 pagesPaper - 4: Cost Accounting and Financial ManagementdhilonjimyNo ratings yet

- Chapter 7 (Tutorial) : Job Order Costing AccountingDocument31 pagesChapter 7 (Tutorial) : Job Order Costing AccountingNurin QistinaNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/APR 2007/FAR100/FAR110/ FAC100kaitokid77No ratings yet

- Decision Making LCCIDocument9 pagesDecision Making LCCIRith TryNo ratings yet

- 2016 Accountancy IDocument4 pages2016 Accountancy IDanish RazaNo ratings yet

- QuestionsDocument7 pagesQuestionsTsiame Emmanuel SarielNo ratings yet

- Revalidation Test Paper Intermediate Group II: Revised Syllabus 2008Document6 pagesRevalidation Test Paper Intermediate Group II: Revised Syllabus 2008sureka1234No ratings yet

- Factory OverheadDocument2 pagesFactory Overheadenchantadia0% (1)

- 895BCMMDocument4 pages895BCMMGanesh AganeshNo ratings yet

- Sample Paper Cost & Management Accounting Question BankDocument17 pagesSample Paper Cost & Management Accounting Question BankAnsh Sharma100% (1)

- Cost AccountingDocument14 pagesCost AccountingAdv Kamran Liaqat50% (2)

- Management Accounting/Series-3-2007 (Code3023)Document15 pagesManagement Accounting/Series-3-2007 (Code3023)Hein Linn Kyaw100% (1)

- Homework Akaun Cuti ChinaDocument5 pagesHomework Akaun Cuti ChinaAnonymous ICYc0CNo ratings yet

- ProblemSet Cash Flow Estimation QA1Document13 pagesProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- Management Accounting QuestionsDocument54 pagesManagement Accounting QuestionsArap Rono LeonardNo ratings yet

- Part A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Document5 pagesPart A Answer ALL Questions.: Confidential AC/OCT 2010/FAR360 2Syazliana KasimNo ratings yet

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNo ratings yet

- Takt Time: A Guide to the Very Basic Lean CalculationFrom EverandTakt Time: A Guide to the Very Basic Lean CalculationRating: 5 out of 5 stars5/5 (2)

- Technical and Vocational Education and Training in the Philippines in the Age of Industry 4.0From EverandTechnical and Vocational Education and Training in the Philippines in the Age of Industry 4.0No ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Make Up Test - 2012156637Document2 pagesMake Up Test - 2012156637rxzlajuNo ratings yet

- GP&SP Presentation Slide-BiDocument23 pagesGP&SP Presentation Slide-BirxzlajuNo ratings yet

- 207305502-Colle-System VariationDocument105 pages207305502-Colle-System Variationrxzlaju100% (3)

- BEL 311 Sample Final ExamDocument9 pagesBEL 311 Sample Final ExamrxzlajuNo ratings yet

- One After Another - BELDocument3 pagesOne After Another - BELrxzlajuNo ratings yet

- Book 1 ADocument1 pageBook 1 ArxzlajuNo ratings yet

- References FinalDocument15 pagesReferences FinalMia Siong CatubigNo ratings yet

- Digging For DinosDocument7 pagesDigging For Dinosapi-645698424No ratings yet

- Funds Flow AnalysisDocument20 pagesFunds Flow AnalysisRajeevAgrawalNo ratings yet

- Health Safety Environment & SD Specification For Ionising RadiationDocument40 pagesHealth Safety Environment & SD Specification For Ionising RadiationcgnanaponNo ratings yet

- Excel Solver Sensitivity Analysis PDFDocument2 pagesExcel Solver Sensitivity Analysis PDFMaurice100% (1)

- Pressure Boosting Sets GuideDocument99 pagesPressure Boosting Sets Guideminki2008No ratings yet

- Workstation Specifications: Specification Sub-SpecDocument12 pagesWorkstation Specifications: Specification Sub-Specmanasvi__sriparnikaNo ratings yet

- ABC - The Good Doctor 1x01 (Pilot)Document62 pagesABC - The Good Doctor 1x01 (Pilot)Vishnu SinhaNo ratings yet

- Consumer Behavior Case StudyDocument27 pagesConsumer Behavior Case StudyBehdad KhosoorNo ratings yet

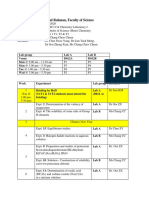

- UTAR Faculty of Science Chemistry Lab SessionsDocument3 pagesUTAR Faculty of Science Chemistry Lab SessionsYong LiNo ratings yet

- Mufon Ufo Journal - May 1985Document20 pagesMufon Ufo Journal - May 1985Carlos RodriguezNo ratings yet

- Ethical Issues in Internet UseDocument15 pagesEthical Issues in Internet UseRohan SharmaNo ratings yet

- Diya CopDocument26 pagesDiya CopDebojit Koley DCE 8852No ratings yet

- Understanding Compound Words in Malay LanguageDocument8 pagesUnderstanding Compound Words in Malay Languagerajaaqila1311No ratings yet

- Alat Kesehatan Dalam Bahasa InggrisDocument19 pagesAlat Kesehatan Dalam Bahasa InggrisAriska Oktavera 26No ratings yet

- Practice Set 4 DEM GSCM 2022Document6 pagesPractice Set 4 DEM GSCM 2022Romit BanerjeeNo ratings yet

- Adjusting Entries in Your Accounting JournalsDocument2 pagesAdjusting Entries in Your Accounting JournalsNadie LrdNo ratings yet

- Banking & Finance IndustryDocument3 pagesBanking & Finance IndustryHrithik SaxenaNo ratings yet

- Bounce Now HSW Level 6 PDFDocument28 pagesBounce Now HSW Level 6 PDFdarketo2280% (5)

- S4 Aceiteka 2017 AccountsDocument7 pagesS4 Aceiteka 2017 AccountsEremu ThomasNo ratings yet

- Double Taxation Avoidance Agreement (DTAA) in IndiaDocument28 pagesDouble Taxation Avoidance Agreement (DTAA) in IndiakhanafshaNo ratings yet

- Affect and Cognition As Psychological ResponsesDocument17 pagesAffect and Cognition As Psychological ResponsesHarley David Reyes BlancoNo ratings yet

- Penilaian Risiko Pada Onshore Pipeline Menggunakan Metode RiskDocument6 pagesPenilaian Risiko Pada Onshore Pipeline Menggunakan Metode RiskAksanul's CreatorNo ratings yet

- BSBPMG635 Task 1Document6 pagesBSBPMG635 Task 1Aroosa MirzaNo ratings yet

- Vizio User ManualDocument76 pagesVizio User ManualcastleNo ratings yet

- Fresh MBA graduate seeking marketing opportunitiesDocument1 pageFresh MBA graduate seeking marketing opportunitiesPari RastogiNo ratings yet

- Management Vocabulary ListDocument3 pagesManagement Vocabulary Listcoconut108No ratings yet

- Ciptonugroho 2016Document13 pagesCiptonugroho 2016baizidiNo ratings yet

- Financial Accounting Essentials You Always Wanted To Know: 4th EditionDocument21 pagesFinancial Accounting Essentials You Always Wanted To Know: 4th EditionVibrant Publishers100% (2)