Professional Documents

Culture Documents

Summary RDLaw Measures On Refinancing and Restructuring Corporate Debt FC

Uploaded by

jarizaraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary RDLaw Measures On Refinancing and Restructuring Corporate Debt FC

Uploaded by

jarizaraCopyright:

Available Formats

Summary note: Royal Decree-Law on measures on refinancing and restructuring of corporate debt

Background and rationale Since 2010, non-financial corporations have reduced their indebtedness to 130% of GDP. However, such level is still high and above the average of the Eurozone (c. 97% of GDP). Given the high level of debt of non-financial corporations, the deleveraging process must proceed further. An orderly deleveraging process will contribute to the flow of credit to dynamic and solvent activities. Moreover, in a low inflation environment, measures to promote and facilitate the deleveraging of the economy become even more important. Against this background, it is essential to further strengthen the corporate insolvency regime to support early debt restructurings and debt refinancings of viable companies and to overcome existing shortcomings that make the deleveraging of the highly indebted companies more challenging. Shortcomings in the 2003 Insolvency Regime Although originally designed to facilitate restructuring of viable firms, in practice under the 2003 Insolvency Regime most proceedings end in the liquidation of the company after lengthy and costly court proceedings. Comprehensive and effective restructurings are feasible before formal insolvency proceedings begin, through refinancing agreements between the debtor and a majority of creditors. The right to annulling agreements constitutes an obstacle in refinancing processes. The 2003 Insolvency Law allows the revocation of any agreement that has been reached in the 2 years prior to the initiation of insolvency proceedings and that is deemed to have been detrimental to the company. Secondly, under the current regime, individual refinancing agreements are difficult to reach, since they require the approval of a relevant majority of creditors. The Insolvency Law aims to facilitate refinancings through collective agreements, which are far more complex and more difficult to reach. The objective of the Royal Decree is to provide adequate incentives for early rescue of viable firms. The reform seeks to promote debt refinancing agreements as an instrument to facilitate the use of deferral of payments, debt releases and debt for equity swaps.

Summary of key measures of the Royal Decree 1. Individual Refinancing Agreements The Royal Decree-Law enables individual refinancing agreements with one or more creditors, provided the agreement improves the net worth of the company and without requiring endorsement by a majority of the creditors. Individual refinancing agreements may only be terminated by a judge, upon request by the insolvency administrators. 2. Collective refinancing agreements without court approval The requirement of a report by an independent expert is eliminated and is replaced by a certificate of an external auditor verifying that the collective refinancing agreement is endorsed by creditors representing 60% of total liabilities. Collective refinancing agreements cannot be revoked or annulled when the company enters into insolvency proceedings, (unless the agreement failed to comply with the essential requirements). In order to foster the capitalization of liabilities in collective agreements, if debtors refuse the agreement without reasonable cause, the resulting insolvency proceeding will be deemed as negligent. This reasonable cause will be declared by independent experts. 3. Collective refinancing agreements with court approval a) Streamlining the role of courts when approving collective refinancing agreements. In order to approve the agreement, the judge will only have to examine its formal requirements and confirm that the relevant majority is met. Likewise, once a collective refinancing agreement is approved by court, it cannot be revoked when the company enters into a bankruptcy proceeding. b) The requirement of a report by an independent expert is eliminated and is substituted by a certificate of an external auditor which verifies that the relevant majority has been met c) The majority required for collective agreements with court approval is lowered from 55% to 51%. d) Collective refinancing agreements approved by court will be extended to non-participating or dissenting creditors, under different terms. e) Secured creditors can be affected by refinancing agreements under certain terms. f) Debt to equity swaps. Refinancing agreements can include debt to equity swaps. The simple majority of shareholders must give their consent. Non-

participating or dissenting creditors will be offered the choice to enter the swap operation or a debt release. If debtors refuse the agreement without reasonable cause, the resulting insolvency proceeding will be deemed as negligent. This reasonable cause will be declared by independent experts.

4. Common measures applicable to refinancing agreements, with and without court approval: Interruption of the enforcement of guarantees during the negotiation of refinancing agreements In order for negotiations to succeed, the enforcement of guarantees on assets essential for the stability and continuity of the professional activities of the company is interrupted. The interruption will not last more than four months.

All fresh money to have super senior consideration (in the event of liquidation). The extension of the super senior treatment to 100% of any fresh money (from 50% currently) will contribute to the success of refinancing agreements, since it will facilitate the raising of new funds.

5. Improvement of the treatment of bank loan loss provisions Bank of Spain will be empowered to improve the treatment given to any outstanding debts following the approval of a refinancing agreement.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Simple GST Invoice Format in Excel PDFDocument1 pageSimple GST Invoice Format in Excel PDFJugaadi Bahman100% (1)

- List of Officers Who Attended Courses at NCRB-2019Document189 pagesList of Officers Who Attended Courses at NCRB-2019Manish Bhardwaj100% (1)

- Online Auction: 377 Brookview Drive, Riverdale, Georgia 30274Document2 pagesOnline Auction: 377 Brookview Drive, Riverdale, Georgia 30274AnandNo ratings yet

- BACK EmfDocument12 pagesBACK Emfarshad_rcciitNo ratings yet

- PAS 36 Impairment of AssetsDocument10 pagesPAS 36 Impairment of AssetsFhrince Carl CalaquianNo ratings yet

- Carl Schmitt and Donoso CortésDocument11 pagesCarl Schmitt and Donoso CortésReginaldo NasserNo ratings yet

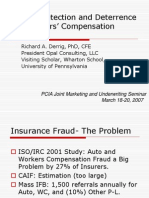

- Fraud Detection and Deterrence in Workers' CompensationDocument46 pagesFraud Detection and Deterrence in Workers' CompensationTanya ChaudharyNo ratings yet

- Maple Ridge Pitt Meadows News - December 31, 2010 Online EditionDocument24 pagesMaple Ridge Pitt Meadows News - December 31, 2010 Online EditionmapleridgenewsNo ratings yet

- Kashmir Problem and SolutionssDocument7 pagesKashmir Problem and SolutionssmubeenNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAljur Salameda50% (2)

- Henry E. Prunier v. Commissioner of Internal Revenue, 248 F.2d 818, 1st Cir. (1957)Document7 pagesHenry E. Prunier v. Commissioner of Internal Revenue, 248 F.2d 818, 1st Cir. (1957)Scribd Government DocsNo ratings yet

- Ultra 3000 Drive (2098-In003 - En-P)Document180 pagesUltra 3000 Drive (2098-In003 - En-P)Robert BarnetteNo ratings yet

- FEE SCHEDULE 2017/2018: Cambridge IGCSE Curriculum Academic Year: August 2017 To July 2018Document1 pageFEE SCHEDULE 2017/2018: Cambridge IGCSE Curriculum Academic Year: August 2017 To July 2018anjanamenonNo ratings yet

- Miske DocumentsDocument14 pagesMiske DocumentsHNN100% (1)

- ParlPro PDFDocument24 pagesParlPro PDFMark Joseph SantiagoNo ratings yet

- Receivable Financing IllustrationDocument3 pagesReceivable Financing IllustrationVatchdemonNo ratings yet

- FortiClient EMSDocument54 pagesFortiClient EMSada ymeriNo ratings yet

- The Carta de Jamaica 1815. Simon BolivarDocument16 pagesThe Carta de Jamaica 1815. Simon BolivarOmarNo ratings yet

- Page 6Document1 pagePage 6Ekushey TelevisionNo ratings yet

- Making Money On Autopilot V3 PDFDocument6 pagesMaking Money On Autopilot V3 PDFGatis IvanansNo ratings yet

- Consti (Taxation)Document2 pagesConsti (Taxation)Mayra MerczNo ratings yet

- Adverb18 Adjective To Adverb SentencesDocument2 pagesAdverb18 Adjective To Adverb SentencesjayedosNo ratings yet

- MIH International v. Comfortland MedicalDocument7 pagesMIH International v. Comfortland MedicalPriorSmartNo ratings yet

- Jamii Cover: Type of PlansDocument2 pagesJamii Cover: Type of PlansERICK ODIPONo ratings yet

- Position Paper in Purposive CommunicationDocument2 pagesPosition Paper in Purposive CommunicationKhynjoan AlfilerNo ratings yet

- 70ba5 Inventec KRUG14 DIS 0503Document97 pages70ba5 Inventec KRUG14 DIS 0503Abubakar Siddiq HolmNo ratings yet

- Document 5Document6 pagesDocument 5Collins MainaNo ratings yet

- Architect / Contract Administrator's Instruction: Estimated Revised Contract PriceDocument6 pagesArchitect / Contract Administrator's Instruction: Estimated Revised Contract PriceAfiya PatersonNo ratings yet

- ManeDocument2 pagesManeMukesh Manwani100% (2)

- RLW Midterms ExamDocument7 pagesRLW Midterms ExamMatthew MadlangbayanNo ratings yet