Professional Documents

Culture Documents

Windsor CT 2015 Budget Citizens Guide

Uploaded by

Gary JeanfaivreCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Windsor CT 2015 Budget Citizens Guide

Uploaded by

Gary JeanfaivreCopyright:

Available Formats

Citizens Guide to the Windsor Town Budget

In Windsor, the method we use to determine our town budget is an open process. Every adult citizen who is registered to vote property owners and those who rent is welcome to participate in determining the town budget. This is where your involvement is really important because your vote really does count. What you think makes a difference, right here in your home town. Please take the time to vote on your towns budget. This guide provides basic information about the budget process and, while understanding the process may not change how you feel about taxes, it can help you take part in the ongoing conversation about taxes and the services they pay for.

Budget Workshops for Windsor Residents

January 30 February 20 March 31 Windsor Town Hall 7:00 PM to 9:00 PM Meet with Town Manager Peter Souza in an informal setting to hear updates on the development of the scal year 2015 budget. Participate in group discussions with other residents to offer your thoughts on how to prioritize spending while meeting the needs of the community.

A message from the Town Manager

Each budget year presents difficult choices that have to be made and Windsors 2015 town budget will be no different. In addition to dealing with decreased revenues and the rising cost of maintaining services, theres a new challenge to add to the mix: revaluation. The last revaluation of Windsor real estate to determine fair market value was completed October 1, 2008. Since a revaluation is mandated by the State of Connecticut to be completed once every five years, the process in Windsor is well underway. The impact of revaluation, and how it effects your tax bill, is unique to each home. As the revaluation process progresses, we will keep you updated. Over the last decade, we have been very careful to control our costs and thats a good starting point for us now. Identifying cost efficiencies is an ongoing and integral component of the budget development process and significant savings have been realized in the past year. Solar panels are being installed at two schools as well as the L.P. Wilson Community Center. These panels will provide cost savings for the town in the years to come and were all funded by state grants. We have converted buildings to natural gas to achieve cost savings as well. While we all know the cost of health insurance, pension and retirement costs for town employees will increase, our recent efforts to have employees pay higher contributions, and aggressively negotiate new contracts with third party administrators will help mitigate those rising costs. I hope you will find this budget guide a useful introduction and accept it as an invitation to participate in creating a budget that maintains the services that we as Windsor residents expect. I will be out in the community often discussing our budget and asking for your ideas. Working together, we have met the budget challenge before and we can do it again. Peter Souza Town Manager

Get involved with the process

Creating a budget that maintains important services, provides a good education for our children and doesnt raise taxes to unacceptably high levels is a challenge and citizen input is an important ingredient. The town manager and the town council want to know what you think as they prepare our town budget. You dont need a background in accounting or a degree in public policy. You only need to have interest in Windsors future to come out and voice your ideas, needs and viewpoints. You can do that in a number of ways. First, you can attend any town council meeting and make yourself heard. If you arent comfortable with speaking before a group, you can send a note or email the town manager or any member of the town council outlining your ideas and concerns. Whats most important is to be heard. Windsor Town Council towncouncil@townofwindsorct.com Peter Souza, Town Manager townmanager@townofwindsorct.com 860-285-1800 Every comment and communication is appreciated and will be considered. Remember, everyone has a stake in this process. If you dont pay real estate taxes because you rent, your landlord does pay taxes and that will eventually affect you. If you dont have children in the Windsor School system, you should still have an interest in the quality of our schools because good schools are part of the foundation of every successful community and have a positive affect on the value of your home.

See more details on the revaluation process on page 18.

1

townofwindsorct.com

Seniors and Veterans You may be eligible for reduced taxes

A Guide to Tax Reductions and Benefits Available to Qualified Windsor Residents is a pamphlet that describes a variety of exemptions and benefits available to individuals meeting the income and/or age guidelines as determined by State of Connecticut regulations. To get your copy or to learn more, visit the towns website at townofwindsorct.com or call the Town Assessors office at 860-285-1816.

How our town budget works

Beginning in December each year, town employees begin to review programs and services to estimate how much it will cost to operate the town in the 12 months beginning July 1. That money comes from property taxes, federal and state grants and from town agencies that collect fees. At the same time, the town makes an estimate of how much it will have to spend to maintain and/or enhance the services that residents and businesses expect. Also during this period, the board of education and the Windsor schools administrative staff estimate how much it will cost to operate the schools and school-related services for the next year. The town manager then takes the estimate of the income the town expects along with the estimates of spending from the town staff and the board of education and presents them to the town council. This is called the Town Managers Proposed Budget and it is really just a starting point. Next, the town council examines the budget and conducts budget hearings with all town departments throughout the month of April to discuss and suggest changes. When the town council approves the final budget, it is put up for a vote at what is called an Adjourned Town Meeting Referendum, more commonly known as the budget referendum.

The voters in Windsor are then asked to approve or disapprove - the budget. If voters dont approve the budget, town staff and the Board of Education, through the Town Manager, modify and resubmit their proposals to the Town Council and then once again, to the voters. Only after the voters have approved the budget can it become the income and spending plan for the town.

The budget is about choices

In making budget choices, the town council has to face certain realities. There are many new services that we would all like the town to provide but that we simply cant afford. In fact, we may not be able to afford some things that we have enjoyed in the past. There are certain expenses that must be included in the budget at some level. For instance, we must have police services and schools. This is a question of the level of service delivery that our residents have a right to expect.

The Mill Rate: Calculating your taxes

One mill produces one dollar for each $1,000 of property assessment. For example: If your house has a current fair market value of $200,000. (The assessment is 70% of its current market value: $140,000) The current Mill Rate is 27.33 therefore 140 X 27.33 = $3,826 in tax.

Windsors expenditures for Fiscal Year 2014

Board of Education $63,394,900

Recreation & Leisure Services $1,377,520

General Government $926,530

Library Services $1,545,260

Development Services $1,772,080

Community Development $92,500

Information Services $441,180

Human Services $792,520

Health $469,650

Public Works $5,021,000

Administrative Services $2,049,040

General Sevices $8,931,100

Town Support for Education $4,304,520

Safety Services $9,196,050

townofwindsorct.com

The Towns Household Budget

Your Household Mortgage or rent Taxes Utilities, food, gas Savings account Maintenance projects Phone, Cable, Internet Nice-to-have items The Town Debt service Mandates, required services Utilities, gas, salaries, benefits Fund balance, reserves Capital Improvement Plan (CIP) Technology, replacement equipment Enhanced services/programs

The reverse is also true. If we include a new service of some kind in our budget now, we could be obligating ourselves as a community to continue it in future years. The taxes we pay on real estate, automobiles and other personal property have a long-term influence on our town. We must be aware of our residents ability and willingness to pay for services. If our tax rate is perceived as being too high, residents living on fixed incomes will move away and those shopping for new homes will avoid us. Businesses, that now pay approximately 40% of all town taxes, may relocate to areas that are cheaper. The vitality and diversity that make our town such a good place to live would quickly disappear. Like any household or business, we have to be careful about what we borrow. We must repay money that we, as a community, made a decision to borrow in the past. The money used to renovate Windsor High School and the Windsor Public Library are good examples of this. Also like any family, we need to maintain a savings account. For the town, thats called our Fund Balance and it represents revenues that we have collected over the years but did not spend. It is tempting to dip into those savings to cover our ongoing expenses but that may not be fiscally responsible because the size of our Fund Balance is closely watched by the financial community and various government agencies. If our Fund Balance gets too low, our credit rating will be affected and it may cost us more to borrow in the future. Our challenge then, is to figure out just how much, if anything, we can spend on each service the town provides. After the town manager presents his budget to the town council in early April, the council will begin evening meetings with various town departments. The public is always welcome at these meetings, which are televised on WGTV, Channel 96. Once the town council votes on a final budget, it sets the date of the referendum. The towns website, townofwindsorct.com is also a great resource for learning more about the budget. You can view a videocast of budget meetings live or view archived meetings and stay updated on meeting schedules to keep pace with the process.

If we choose to reduce what we are willing to pay for these and other essential services too far, our town will change in ways that none of us want. There are other fixed costs in the towns budget that continue to rise, and that the town is obligated to absorb. High on the list are fuel costs, the MDCs fees for sewer service, utilities, salaries that are mandated by collective bargaining agreements, and health insurance costs for town and school employees.

The budget is about fiscal responsibility and looking ahead

The reality is that the choices we make as to how much income we can expect and how much we can spend this year, have an affect on future years as well. If, for instance, we elected to reduce the size of our public works department to the point where we could no longer maintain one or more of our parks or town buildings, we would be placing the extra cost of reclaiming those facilities on some future years budget.

Windsors revenues for Fiscal Year 2014

General Property Tax $82,536,630

Complete definitions of both expenditures and revenues are listed on page 4. You can stay updated on all things budget at townofwindsorct.com/budget

State School Aid $13,155,860

State Grants in Lieu of Taxes $1,630,410

Fines and Penalties $38,000

Revenues from other Agencies $133,100

Revenues from use of Assets $493,830

Licenses And Permits $499,550

Other State Grants $104,160

Charges for Current Services $793,710

townofwindsorct.com

Other Revenues $25,600

Federal Grants $3,000

Opening Cash $900,000

Where our money goes

Our expenditure budget for fiscal year 2014 (July 1, 2013 to June 30, 2014) is $100,313,850 and that is broken down as follows: Board of Education: $63,394,900 (63.2% of the budget) This amount was allocated directly to the Windsor Public Schools to operate our school system. Safety Services: $9,196,050 (9.2% of the budget) - Police, Volunteer Fire and Ambulance services. General Services: $8,931,100 (8.9% of the budget) This is the cost for sewer services, insurance, retirement services, revaluation, recycling and it includes the towns, but not Board of Educations, debt service payments. Public Works: $5,021,000 (5.0% of the budget) This pays for maintenance of the towns roads and parks, snow plowing, town facilities and traffic safety. Town Support for Education: $4,304,520 (4.3% of the budget) These are funds allocated to meet mandated assistance to private schools, property maintenance, insurance, debt service and administrative services for our school system. Administrative Services: $2,049,040 (2.0% of the budget) Internal operation of the towns organization including the Finance, Information Technology, Risk Management, Human Resources, Assessing and Tax Departments. Development Services: $1,772,080 (1.8% of the budget) This includes the cost of guiding the public and private development of land through departments such as Planning, Building, Fire Marshals Office, Economic Development and the Town Engineer. Library: $1,545,260 (1.5% of the budget) This is what the town spends to operate the Windsor Public Library and the Wilson Branch Library. Recreation and Leisure Services: $1,377,520 (1.4% of the budget) - Leisure, cultural and educational programs and services offered by the Recreation Department, Northwest Park and the Youth Service Bureau. General Government: $926,530 (0.9% of the budget) This includes the cost of operating the activities of the towns elected officials, boards and commissions, Town Managers office, community contributions, Town Attorney, Town Treasurer, Probate Court and the Independent Auditor. Human Services: $792,520 (0.8% of the budget) - This department includes the Senior Center, Social Services and transportation and services for adults with disabilities. Health: $469,650 (0.5% of the budget) This amount is provided for the towns Health Department. Information Services: $441,180 (0.4% of the budget) Operation of the Town Clerks Office and Public Relations. Community Development: $92,500 (0.09% of the budget) This department is funded through the Small Cities Block Grant, but occasionally performs functions for the town that are outside the scope of the grant. Those programs are funded through this appropriation.

Where our money comes from

Since our revenues must balance against our expenses, our revenue budget for fiscal year 2014 (July 1, 2013 to June 30, 2014) is also $100,313,850 and that is broken down as follows: Property Taxes: $82,536,630 (82.3% of the budget) This is the amount the town collected from taxes on real estate, automobiles and personal property. State School Aid: $13,155,860 (13.1% of the budget) Education cost sharing, transportation, funds for adult education and special education and the blind and handicapped. State Grants In Lieu of Taxes: $1,630,410 (1.6% of the budget) Revenue received from the state in a number of categories including partial compensation for taxes not collected on state property. Opening Cash: $900,000 (0.9% of the budget) - The amount determined by the Town Council to be taken from Fund Balance and used to reduce the tax rate for the year. Charges For Current Services: $793,710 (0.8% of the budget) Covers 18 sources of revenue, the largest of which are recording of legal documents, conveyance fees and special education tuition from other towns. Revenue From Use of Assets: $493,830 (0.5% of the budget) Includes revenue from earned interest, rental of town property and income from cell tower leases. Licenses & Permits: $499,550 (0.5% of the budget) Revenue received from the five types of licenses and the seven types of permits the town issues. Other State Grants: $104,160 (0.1% of the budget) Grants and subsidies concerning school buildings, libraries and bond interest. Revenues From Other Agencies: $133,100 (0.1% of the budget) Includes income from the Windsor Housing Authority, certain in-lieu of tax payments and the telecommunications property tax. Fines & Penalties: $38,000 (0.04% of the budget) Revenue from court and parking fines. Other Revenues: $25,600 (0.03% of the budget) Mainly miscellaneous revenue not categorized elsewhere. Federal Grants: $3,000 (0.003% of the budget) Grants for elderly transportation and emergency preparedness.

Our Build-a-Budget online similator is an informative and interactive tool that lets you build a budget you think will support the needs of our community. Find it with other budget information at townofwindsorct.com

townofwindsorct.com

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Black Book of Copywriting SecretsDocument30 pagesThe Little Black Book of Copywriting SecretsJeeva2612100% (27)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Newtown-Sandy Hook Community Foundation, Inc.Document10 pagesNewtown-Sandy Hook Community Foundation, Inc.Gary JeanfaivreNo ratings yet

- Chapter 13 Capital Budgeting Estimating Cash FlowsDocument5 pagesChapter 13 Capital Budgeting Estimating Cash FlowsStephen Ayala100% (1)

- EQUITY SECURITIES With Answer For Uploading PDFDocument10 pagesEQUITY SECURITIES With Answer For Uploading PDFMaricon Berja100% (1)

- Tissue Paper Converting Unit Rs. 36.22 Million Mar-2020Document29 pagesTissue Paper Converting Unit Rs. 36.22 Million Mar-2020Rana Muhammad Ayyaz Rasul100% (1)

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocument3 pagesINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoice2018hw70285No ratings yet

- Pre-Incorporation Founders Agreement SummaryDocument13 pagesPre-Incorporation Founders Agreement SummaryAmal Mulia100% (2)

- Simsbury Budget Referendum ResultsDocument1 pageSimsbury Budget Referendum ResultsGary JeanfaivreNo ratings yet

- Connecticut State Road Paving ListDocument8 pagesConnecticut State Road Paving ListGary JeanfaivreNo ratings yet

- Oxford BOE Approved 2014-15 School BudgetDocument59 pagesOxford BOE Approved 2014-15 School BudgetGary JeanfaivreNo ratings yet

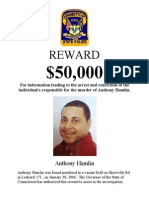

- Anthony Hamlin Reward PosterDocument2 pagesAnthony Hamlin Reward PosterGary JeanfaivreNo ratings yet

- Newtown CT 2014-15 BudgetDocument317 pagesNewtown CT 2014-15 BudgetGary JeanfaivreNo ratings yet

- Newtown CT Road Work Schedule April 14 - April 18Document1 pageNewtown CT Road Work Schedule April 14 - April 18Gary JeanfaivreNo ratings yet

- New York Freshwater Fishing GuideDocument84 pagesNew York Freshwater Fishing GuideGary JeanfaivreNo ratings yet

- Stip 20140416 AetnaDocument3 pagesStip 20140416 AetnaCeleste KatzNo ratings yet

- Peck Place 2014 5K in Orange, Conn.Document1 pagePeck Place 2014 5K in Orange, Conn.Gary JeanfaivreNo ratings yet

- 2014-2015 BudgetDocument60 pages2014-2015 BudgetABoyd8No ratings yet

- NTSB Medical Factual Report For Metro-North Train Derailment at Spuyten Duyvil StationDocument8 pagesNTSB Medical Factual Report For Metro-North Train Derailment at Spuyten Duyvil StationGary JeanfaivreNo ratings yet

- Rules For VolunteerSquare/Patch High School Essay ContestDocument4 pagesRules For VolunteerSquare/Patch High School Essay ContestGary JeanfaivreNo ratings yet

- Fairfield County Gives: Participating NonprofitsDocument6 pagesFairfield County Gives: Participating NonprofitsGary JeanfaivreNo ratings yet

- Metro-North 100 Day Action Plan For ConnecticutDocument5 pagesMetro-North 100 Day Action Plan For ConnecticutGary JeanfaivreNo ratings yet

- Stakeholder Report For New London Public SchoolsDocument45 pagesStakeholder Report For New London Public SchoolsGary JeanfaivreNo ratings yet

- Settlement Agreement Between The United States of America and The Stamford Public School SystemDocument29 pagesSettlement Agreement Between The United States of America and The Stamford Public School SystemGary JeanfaivreNo ratings yet

- DOCUMENT: 2014 State of The State Address (2/6/14)Document14 pagesDOCUMENT: 2014 State of The State Address (2/6/14)The BulletinNo ratings yet

- Orange CT Schools Plan For PaxDocument2 pagesOrange CT Schools Plan For PaxGary JeanfaivreNo ratings yet

- UTC & Connecticut Governor Malloy Announce $500 Million AgreementDocument10 pagesUTC & Connecticut Governor Malloy Announce $500 Million AgreementGary JeanfaivreNo ratings yet

- Public Feedback On Connecticut LawsDocument1,240 pagesPublic Feedback On Connecticut LawsGary JeanfaivreNo ratings yet

- Pepper Street Reconstruction Project TimelineDocument7 pagesPepper Street Reconstruction Project TimelineGary JeanfaivreNo ratings yet

- Acctg for changes in group structureDocument4 pagesAcctg for changes in group structureJane KoayNo ratings yet

- Income Tax Test BankDocument65 pagesIncome Tax Test Bankwalsonsanaani3rdNo ratings yet

- Business Math - Discounts Rate Interest (Version 1)Document56 pagesBusiness Math - Discounts Rate Interest (Version 1)grace paragasNo ratings yet

- Audit:2auditing Unit 2Document31 pagesAudit:2auditing Unit 2Lalatendu MishraNo ratings yet

- Bank ManagementDocument4 pagesBank ManagementsujathalaviNo ratings yet

- Spanish Town High Entrepreneurship Unit 2 Multiple Choice QuestionsDocument4 pagesSpanish Town High Entrepreneurship Unit 2 Multiple Choice Questionspat samNo ratings yet

- Cash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaDocument26 pagesCash Transfer Methods: Berito, Quennie Bernal, Jessamie Cacho, CarminaJewelyn CioconNo ratings yet

- Gift Case InvestigationsDocument17 pagesGift Case InvestigationsFaheemAhmadNo ratings yet

- Solution To Chapter 15Document9 pagesSolution To Chapter 15Ismail WardhanaNo ratings yet

- Definition of A ChequeDocument2 pagesDefinition of A Chequeashutoshkumar31311No ratings yet

- Ifrs Framework PDFDocument23 pagesIfrs Framework PDFMohammad Delowar HossainNo ratings yet

- 2nd Set SVFCDocument15 pages2nd Set SVFCim_donnavierojoNo ratings yet

- SEC Vs BalwaniDocument23 pagesSEC Vs BalwaniCNBC.comNo ratings yet

- Dissolution QuizDocument2 pagesDissolution QuizveriNo ratings yet

- Hamilton County Board of Commissioners LetterDocument2 pagesHamilton County Board of Commissioners LetterCincinnatiEnquirerNo ratings yet

- Moodys Presentation 2005Document146 pagesMoodys Presentation 2005Nauman KhanNo ratings yet

- 2016pk Panels8-17Document18 pages2016pk Panels8-17pkconferenceNo ratings yet

- SUPA Economics Presentation, Fall 2023Document47 pagesSUPA Economics Presentation, Fall 2023bwangNo ratings yet

- Report On Industrial Visit: Visited Professor Visited StudentsDocument10 pagesReport On Industrial Visit: Visited Professor Visited StudentsRishabh MishraNo ratings yet

- Bosch Performance by Ratio AnalysisDocument34 pagesBosch Performance by Ratio AnalysisSantosh KumarNo ratings yet

- EC3114 Autumn 2022 CourseworkDocument2 pagesEC3114 Autumn 2022 Courseworkjanani8No ratings yet

- North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformDocument84 pagesNorth Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformTax Foundation100% (1)

- 1 Use Worksheet 11 1 To Determine Whether The Woodsons HaveDocument2 pages1 Use Worksheet 11 1 To Determine Whether The Woodsons Havetrilocksp SinghNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionAnnabeth BrionNo ratings yet