Professional Documents

Culture Documents

Compliant Attitude in Africa

Uploaded by

Kapinga GaudenceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compliant Attitude in Africa

Uploaded by

Kapinga GaudenceCopyright:

Available Formats

1

Factors affecting tax compliant attitude in Africa:

Evidence from Kenya, Tanzania, Uganda and South Africa

Merima Ali

merima.ali@cmi.no

OddHelge Fjeldstad

odd.fjeldstad@cmi.no

Ingrid Hoem Sjursen

ingrid.sjursen@cmi.no

Chr.Michelsen Insitute

Bergen, Norway

Abstract: In this study, we explore factors that determine citizens tax compliance behavior in

Kenya, Tanzania, Uganda and South Africa using attitude and perception data from the new round

5 of Afrobarometer surveys. Using a binary logit regression, we find some similarities, but also

differences in factors that are correlated with tax compliance attitude in the four countries. An

increase in the perception of individuals about the difficulty of evading taxes is found to increase

the likelihood of tax compliant attitude in Kenya and South Africa. We also find evidence that

individuals who are more satisfied with public service provision are more likely to have a tax

compliant attitude in all the four countries. However, frequent payment to nonstate actors, e.g. to

criminal gangs in exchange for protection, reduces individuals tax compliant attitude.

Furthermore, those individuals who perceive that their ethnic group is treated unfairly are less

likely to have a tax compliant attitude in Tanzania and South Africa. Tax knowledge is also

significantly correlated with tax compliant attitude in Tanzania and South Africa. These findings

are robust for different econometric specifications.

1. Introduction

Raising moie uomestic ievenue is a piioiity foi most subSahaian Afiican countiies (Biummonu

et al. 2u12). Nobilizing ievenue is a way foi goveinments to cieate fiscal space, pioviue

essential public seivices, anu ieuuce foieign aiu anu single iesouice uepenuence. Bowevei, the

uomestic tax bases in most Afiican countiies aie unueimineu by wiuespieau tax avoiuance anu

evasion (INF 2u11). Although taxpayei noncompliance is a continual anu giowing global

pioblem (NcKeichai anu Evans 2uu9), many inuications suggest that ueveloping countiies,

many of them in SubSahaian Afiica, aie the haiuest hit (Cobham 2uuS; Fuest anu Rieuel 2uu9).

Bealing with the pioblem of tax evasion iequiies at least some unueistanuing of the factois

unueilying the inuiviuual taxpayeis uecision whethei to pay oi evaue taxes. Bowevei, little is

known about tax compliance behavioi in ueveloping countiies (Anuieoni et al. 1998; B'Aicy

2u11; Fjelustau anu Semboja 2uu1). This stuuy attempts to exploie factois that ueteimine

citizens tax compliance behavioi in selecteu Afiican countiies using attituue anu peiception

2

uata fiom a new iounu of Afiobaiometei suiveys (Rounu S; 2u1112)

1

. This suivey incluues a

seiies of questions about tax that aie new anu not incluueu in pievious iounus of

Afiobaiometei. This allows foi a moie compiehensive empiiical analysis of tax compliance

attituues baseu on nationally iepiesentative public opinion suivey uata fiom the selecteu

Afiican countiies.

Stuuying what factois ueteimine tax compliance attituue anu behavioi in Afiica is not only of

acauemic inteiest; it is also impoitant fiom a policy peispective. Attempts to bioauen the tax

base must builu on insights into how citizens expeiience anu peiceive the tax auministiation

anu enfoicement, anu whethei anu how theii tax behavioi is coiielateu with how they peiceive

the state. Noie systematic anu coheient infoimation on taxpayei attituues aie theiefoie

iequiieu foi bettei analysis anu a moie infoimeu tax policy uesign. By empiiically establishing

which factois affect tax compliance in the selecteu countiies, the papei ueiives feasible policy

iecommenuations foi policy makeis anu ievenue auministiations.

In the stuuy, we use an inuiiectly phiaseu question to captuie tax compliance attituue of

inuiviuuals in oiuei to avoiu uiiect implication of wionguoing by the iesponuent. In the

questionnaiie, iesponuents weie askeu to state theii opinion about othei people who uo not pay

taxes that they owe on theii income. They weie askeu to state whethei they think the action of

othei people who uo not pay taxes on theii income is not wiong at all, wiong but

unueistanuable oi wiong anu punishable. Baseu on these iesponses, inuiviuuals aie

consiueieu as having a tax compliant attituue if theii iesponse is wiong anu punishable anu

noncompliant attituue if theii iesponse is eithei not wiong at all oi wiong but

unueistanuable. 0sing a binaiy logit iegiession, we finu some similaiities, but also uiffeiences

in factois that aie coiielateu with tax compliance attituue in the foui countiies. An inciease in

the peiception of inuiviuuals about the uifficulty of evauing taxes is founu to inciease the

likelihoou of tax compliant attituue in Kenya anu South Afiica. We also finu eviuence that

inuiviuuals who aie moie satisfieu with public seivice piovision aie moie likely to have a tax

compliant attituue in all the foui countiies. Bowevei, fiequent payment to nonstate actois, e.g.

to ciiminal gangs in exchange foi piotection, ieuuces inuiviuuals tax compliant attituue.

Fuitheimoie, those inuiviuuals who peiceive that theii ethnic gioup is tieateu unfaiily aie less

likely to have a tax compliant attituue in Tanzania anu South Afiica. Tax knowleuge is also

significantly coiielateu with tax compliant attituue in Tanzania anu South Afiica. These finuings

aie iobust foi uiffeient econometiic specification, wheie we incluue all the thiee iesponses of

inuiviuuals iegaiuing othei peoples action about tax in an oiueieu logit iegiession.

The iemainuei of the papei is stiuctuieu as follows: The next section pioviues a biief

piesentation of theoietical peispectives on tax compliance. Section S piesents the uata anu

ieseaich uesign. Sections 4 anu S piesent the iesults. Finally, section 6 summaiizes anu

concluues.

1

Afrobarometer is an independent, nonpartisan research project which consists of national sample surveys on the

attitudes of citizens in selected countries towards democracy, markets, civil society and other aspects of

development. Because the instrument asks a standard set of questions, countries can be systematically compared.

For further details, see www.afrobarometer.org

3

2. Understanding taxpayer attitudes and behavior: theoretical foundations

Nouels of taxpayei behavioi, incluuing the uecision whethei oi not to pay taxes, tenu to ieflect

one of five theoiies that can be iefeiieu to as: (1) economic ueteiience; (2) fiscal exchange; (S)

social influences; (4) compaiative tieatment; anu (S) political accountability. These aie to some

extent inteiconnecteu, anu some iepiesent an evolution of otheis.

Economic deterrence

The economic ueteiience theoiy states that taxpayeis behavioi is influenceu by factois such as

the tax iate ueteimining the benefits of evasion, anu the piobability of uetection anu penalties

foi fiauu which ueteimine the costs (Allingham anu Sanumo 1972; Beckei 1968).

2

This implies

that if uetection is likely anu penalties aie seveie, few people will evaue taxes. In contiast, unuei

low auuit piobabilities anu low penalties, the expecteu ietuin to evasion is high. The mouel then

pieuicts substantial noncompliance. Although the mouel has been ciiticizeu foi focusing

exclusively on the coeicive siue of compliance, at the expense of the consensual (Sanumo 2uuS)

S

,

theie is some eviuence to suppoit the ielevance of ueteiience stiategies to auuiessing non

compliance (NcKeichai anu Evans 2uu9). Foi example, the feai of getting caught, oi the

piobability of uetection, has been founu in some contexts to be an effective stiategy to inuuce

tiuthful behavioi. The theoietical piinciples of economic ueteiience have also been wiuely

auopteu by tax auministiations when ueveloping enfoicement stiategies that iely piincipally on

penalties anu the feai of getting caught.

Fiscal exchange

The fiscal exchange theoiy suggests that the piesence of goveinment expenuituies may motivate

compliance anu that goveinments can inciease compliance by pioviuing goous that citizens

piefei in a moie efficient anu accessible mannei (Cowell anu uoiuon 1988; Levi 1988; Tilly

1992; Nooie 2uu4; 1998). Alm et al. (1992) note that compliance incieases with (peiceptions

of) the availability of public goous anu seivices. Accoiuingly, the main concein of taxpayeis is

what they get uiiectly in ietuin foi theii tax payments in the foim of public seivices (quid pro

quo). In this peispective, taxation anu the piovision of public goous anu seivices aie inteipieteu

as a contiactual ielationship between taxpayeis anu the goveinment (Nooie 2uu4). Inuiviuuals

may pay taxes because they value the goous pioviueu by the goveinment, iecognizing that theii

payments aie necessaiy both to help finance the goous anu seivices anu to get otheis to

contiibute (Fjelustau anu Semboja 2uu1). The existence of positive benefits may inciease the

piobability that taxpayeis will comply voluntaiily, without uiiect coeicion. Although most

taxpayeis cannot assess the exact value of what they ieceive fiom the goveinment in ietuin foi

taxes paiu, it can be aigueu that they have geneial impiessions anu attituues conceining theii

own anu otheis teims of tiaue with the goveinment (Richupan 1987). It is then ieasonable to

assume that a taxpayeis behavioi is affecteu by hishei satisfaction oi lack of satisfaction with

hishei teims of tiaue with the goveinment. Thus, if the system of taxes is peiceiveu to be

unjust, tax evasion may, at least paitly, be consiueieu as an attempt by the taxpayei to aujust his

2

Nearly all economic approaches to tax evasion are based on this economics-of-crime framework (Becker

1968). Cowell (1990) offers an insightful review of this analytical framework.

3

For instance, empirical data from Western countries reveal that taxpayers pay much more tax than what could

be accounted for even by the highest feasible levels of auditing, penalties and risk-aversion. The question

therefore has switched from why do people not evade taxes to why do people pay? Alm, J ., G. H.

McClelland & W. D. Schulze 1992. Why do people pay taxes? Journal of Public Economics, 48, 21-38,

Slemrod, J . 1992. Why people pay taxes: tax compliance and enforcement. In: Slemrod, J . (ed.). Ann Arbor: The

University of Michigan Press..

4

teims of tiaue with the goveinment. The fiscal exchange theoiy has ieceiveu much attention anu

is well establisheu theoietically. Empiiical eviuence to suppoit the theoiy is, howevei,

ambiguous (B'Aicy 2u11: S6).

Social influences

In the social influence mouel, compliance behavioi anu attituues towaius the tax system is

thought to be affecteu by the behavioi anu social noims of an inuiviuuals iefeience gioup

(Snavely 199u). It is ieasonable to assume that human behavioi in the aiea of taxation is

influenceu by social inteiactions much in the same way as othei foims of behavioi (ibiu).

Compliance behavioi anu attituues towaius the tax system may theiefoie be affecteu by the

behavioi of an inuiviuuals iefeience gioup such as ielatives, neighbois anu fiienus. Theiefoie, if

a taxpayei knows many people in gioups impoitant to him who evaue taxes, hishei

commitment to comply will be weakei. 0n the othei hanu, social ielationships may also help

uetei inuiviuuals fiom engaging in evasion in feai of the social sanctions imposeu once

uiscoveieu anu ievealeu publicly. Theoietical ieseaich on heiu behavioi in economic situations

(Baneijee 1992; Sah 1991) also inuicates that social influences may affect compliance, in

paiticulai by affecting the peiceiveu piobability of uetection. 0ne of the most consistent finuings

about taxpayei attituues anu behavioi in Westein countiies is that those who iepoit compliance

believe that theii peeis anu fiienus (anu taxpayeis in geneial) comply, wheieas those who

iepoit cheating believe that otheis cheat (Yankelovich et al. 1984). Eviuence suggests that

peiceptions about the honesty of otheis may affect compliance behavioi.

Comparative treatment

The compaiative tieatment mouel is baseu on equity theoiy anu posits that auuiessing

inequities in the exchange ielationship between goveinment anu taxpayeis woulu iesult in

impioveu compliance (NcKeichai anu Evans 2uu9). Citizens may not consiuei theii ielationship

with the state in a vacuum wheie both paities aie the only actois. Likewise, they may not think

about theii fellow citizens without consiueiing theii own ielationship with the state. They may

also consiuei how the state tieats them ielative to theii fellow citizens. This juugment is likely to

affect not only theii juugment of the state, but also how they view theii fellow citizens (B'Aicy

2u11: 7). If the state tieats ceitain gioups piefeientially, this may coloi the citizens ielationship

with the state anu the gioup ieceiving favois. A ciucial vaiiable is then not just what a peison

gets fiom the state, but what the peison gets fiom the state (anu how the state tieats the peison)

ielative to those who aie in the peisons wiuei national community. This social psychology

mouel highlights the impoitance of equity theoiy in the stuuy of compliance anu taxpayei

behavioi.

Political legitimacy

Finally, accoiuing to the political legitimacy theoiy, tax compliance is influenceu by the extent

that citizens tiust theii goveinment (Taylei 2uu6; Kiichlei et al. 2uu8; FauvelleAymai 1999).

Legitimacy coulu be uesciibeu as belief oi tiust in the authoiities, institutions, anu social

aiiangements to be appiopiiate, piopei, just anu woik foi the common goou. Political scientists

have auuiesseu how political legitimacy anu civic iuentification aie fosteieu. (Peisson 2uu8)

aigues that Afiican countiies that upon inuepenuence emphasizeu builuing national ovei ethnic

iuentity have been moie successful than those who alloweu ethnicity to become the main

animus of politics.

5

In the following empiiical analysis we will examine the extent to which the uiffeient theoiies of

taxpayei compliance contiibute to explaining peoples attituue towaius taxation in the selecteu

Afiican countiies.

3. Data and descriptive analysis

The main souice of uata foi the analysis is the Sth iounu of Afiobaiometei suivey collecteu in

2u112u12. The suivey collects uata on public attituues on uemociacy, goveinance, maikets,

taxation anu civil society, in moie than 2u Afiican countiies. The questionnaiie also incluues a

seiies of questions about tax, ueiiveu fiom the theoiies outlineu in the pievious section. Nost of

these questions aie new anu not incluueu in the pievious iounus of Afiobaiometei. Because the

questionnaiies aie similai acioss countiies, the uata allows a compiehensive empiiical analysis

of taxation theoiy in Afiican societies anu foi testing the ielevance of the vaiious theoiies about

taxpayei compliance. Nationally iepiesentative samples of inuiviuuals who aie moie than 18

yeais olu aie selecteu both in iuial anu uiban aieas of the uiffeient countiies. 2S99 ianuomly

selecteu inuiviuuals weie inteivieweu fiom 8 anu 9 uistiicts in Kenya anu South Afiica each,

iespectively. In Tanzania anu 0ganua, the sample size is 24uu in each countiies anu the

iespective numbei of uistiicts is 26 anu S.

Kenya, Tanzania anu 0ganua weie chosen foi this stuuy because they aie situateu in the same

geogiaphic iegion anu aie all membeis of the East Afiican Community (EAC).

4

Looking at

similaiities anu uispaiities in attituues towaius taxation in these thiee countiies coulu pioviue

useful infoimation about wheie they can make a collective effoit to impiove tax compliance anu

wheie countiy specific policies aie neeueu. South Afiica makes an inteiesting compaiison

because it has a moie uevelopeu anu extensive tax system as well as significantly highei uNI pei

capita than the EastAfiican countiies (see Table 1). As uepicteu in Table 1, theie aie also

institutional anu stiuctuial uiffeiences between the foui countiies. Though South Afiica is iateu

as the iichest anu most uemociatic countiy, it is also the most income unequal. Kenya has the

seconu highest uNI pei capita, but scoies seconu woist in teims of uemociacy anu inequality,

while Tanzania is the seconu most uemociatic anu has the lowest inequality. 0ganua has the

lowest uNI pei capita, scoies seconu best on inequality anu seconu woist on the uemociacy

inuex.

[Table 1 here]

Whit tax ievenues accounting foi 29% of uBP, South Afiica has the highest tax to uBP iatio of

the foui countiies. Since the abolishment of apaitheiu in 1994, the countiy has gone thiough

majoi tax iefoims (0ECBBAC 2u12). The iatio of tax to uBP iose fiom 2S% in 2uu4 to 29% in

2u1u. Although tax avoiuance anu evasion aie still consiueieu to be majoi challenges, the

implementation of populai taxpayei outieach anu euucation piogiams by the South Afiican

Revenue Seivice (SARS), combineu with new enfoicement techniques, have leu to impiovements

in public attituues to the impoitance of paying taxes (0ECBBAC 2u12: S1; SARS 2u11). Kenya

has the seconu laigest shaie of collecteu tax ievenues with 19.S% of uBP. Although this is

ielatively high compaieu to many othei Afiican countiies (Woilu Bank 2u12), the tax buiuen is

unevenly uistiibuteu, leaving a laige fiaction of the economy untaxeu (Waiis et al. 2uu9).

4

We do not have access to data from the two other members of EAC, Burundi and Rwanda.

6

Laige effoits to impiove taxpayei compliance have been maue by Tanzania Revenue Authoiity

in iecent yeais. Bespite this, the countiy comes thiiu with a tax to uBPiatio of 14% in 2u1u. Tax

evasion is a majoi challenge anu coaise estimates suggest that loss in tax ievenue uue to tax

evasion amounteu to one sixth of the entiie Tanzanian buuget in the fiscal yeai 2uu91u. As a

iesult, the countiy iemains heavily uepenuent on aiu which, accoiuing to the Afiican

Bevelopment Bank, accounts foi about S4% of the goveinments buuget (AfBB 2u1ua) .

With 12% of uBP acciuing fiom tax ievenue, 0ganua has the lowest tax to uBPiatio of the

stuuieu countiies. While the tax shaie is almost uoubleu fiom 199192 when the iatio was only

6.7%, the giowth in tax ievenue collection has been slow the last uecaue (AfBB 2u1ub).

3.2 Measuring tax compliance attitude

In the questionnaiie, iesponuents weie askeu uiiectly if they have iefuseu to pay taxes oi fees

that they oweu to the goveinment uuiing the last yeai. Bowevei, stuuies show that inuiviuuals

tenu to answei untiuthfully when askeu questions about sensitive issues such as theii own tax

payment. Tax compliance is theiefoie likely to be oveiiepoiteu in suivey uata using such

measuies. While some authois aigue that obtaining ieliable quantitative infoimation about tax

compliance behavioi is piactically impossible, otheis (Kaufmann (1997) anu Reinikka anu

Svensson (2uu6)) maintain that application of appiopiiate suivey methous anu inteiview

techniques comes a long way in solving the pioblem. Following the woiks of Reinikka anu

Svensson (2uu6) on theii woik on coiiuption, we use an inuiiectly phiaseu question to captuie

tax compliance in oiuei to avoiu uiiect implication of wionguoing by the iesponuent. In the

questionnaiie, iesponuents weie askeu to state theii opinion about othei people who uo not pay

taxes that they owe on theii income. They weie askeu to state whethei they think the action of

othei people who uo not pay taxes on theii income is not wiong at all, wiong but

unueistanuable oi wiong anu punishable. Baseu on these iesponses, inuiviuuals aie

consiueieu as having a tax compliant attituue if theii iesponse is wiong anu punishable anu

noncompliant attituue if theii iesponse is eithei not wiong at all oi wiong but

unueistanuable.

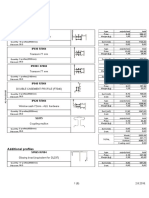

Figuie 1 shows the shaie of iesponuents with tax compliant attituues against the natuial

logaiithm of uNI pei capita in the foui countiies togethei with Benin, uhana, Nalawi anu

Zimbabwe. The figuie uepicts that theie is positive coiielation between uNI pei capita anu shaie

of inuiviuuals with taxcompliant attituue, with ielatively iichei countiies having a highei shaie.

Figuie 2 is equivalent to figuie 1, but without the outliei, South Afiica, which has a much highei

uNI pei capita than the othei countiies.

[Figure 1 here]

[Figure 2 here]

Table 2 fuithei shows the shaie of iesponuents with compliant anu noncompliant attituues

acioss uiffeient socioeconomic inuicatois. The fiist iow shows the shaie of iesponuents with a

compliant anu noncompliant tax attituue in the countiies of investigation. In both South Afiica

anu Kenya, moie than Su% of the iesponuents have a tax compliant attituue. In Tanzania anu

0ganua, on the othei hanu, the majoiity have a noncompliant attituue anu S4% of the

iesponuents in Tanzania, anu as many as 68% of the 0ganuans think that not paying taxes is

not wiong at all oi wiong, but unueistanuable.

7

[Table 1 here]

uenuei, employment statuses anu uiban location aie measuieu in peicentages, while age is

measuieu in mean yeais. Level of schooling is measuieu by a iange vaiiable wheie u= no

foimal schooling anu 9= postgiauuate qualifications, anu wealth is measuieu by a composite

vaiiable consisting of owneiship of iauio, Tv, cai, watei, latiine anu ioof mateiial

(u=iesponuent has none of the items, 1=iesponuent has all items). The only finuing consistent in

all foui countiies is the tenuency towaius a highei mean level of schooling among iesponuents

with a compliant tax attituue. In all countiies except 0ganua, we also finu that iesponuents with

a compliant tax attituue aie oluei, ielatively wealthiei anu to a laigei uegiee live in uiban aieas

than inuiviuuals with a noncompliant attituue.

In the questionnaiie, iesponuents aie also askeu what they think is the main ieason that some

people evaue taxes. As can be seen in Table S, in all the foui countiies, taxes aie too high anu

taxes aie unaffoiuable aie the most fiequently stateu ieasons, the foimei ianging fiom 22% in

South Afiica to 28% in 0ganua anu the lattei fiom 2S% in Tanzania to 29% in 0ganua. This

inuicates that tax iates aie peiceiveu as too high both in teims of what iesponuents can affoiu

anu in teims of what is ieasonable. Anothei fiequently mentioneu ieason is pooi public

seivices. In Tanzania as many as 16% of the iesponuents consiuei pooi public seivices to be

the main ieason why some people evaue taxes. The coiiesponuing peicentages aie 12%, 11%

anu 9% in South Afiica, 0ganua anu Kenya, iespectively. 0nfaii tax system anu goveinment

wastesteal taxes aie also given as main ieasons why people avoiu taxes by moie than 8% of

the iesponuents in all the countiies. veiy few iesponuents, 1% in South Afiica anu 0ganua anu

2% in Kenya anu Tanzania, state people know they wont get caught.

[Table 3 here]

4. Correlates of factors affecting tax compliance attitude: regression model and

variables

In this section, we will look at factois that aie coiielateu with tax compliance attituue in Kenya,

Tanzania, 0ganua anu South Afiica. We will specifically examine the extent to which the

uiffeient theoiies of taxpayei compliance biiefly outlineu in section 2 contiibute to explaining

peoples attituue towaius taxation.

In oiuei to captuie factois that coiielate with tax compliance attituue, we estimate the following

logit mouel.

Probobility (Iox_complioncc_ottiJutc

) = o

1

+ o

2

X

1

+ o

3

1

+ o

4

Z

1

+ e

(1)

Iox_complioncc_ottiJutc

is the uepenuent vaiiable which is a uummy with a value of 1 foi tax

compliant attituue anu a value of u foi noncompliant attituue as measuieu in section 2 above.

X

1

is a vectoi foi inuiviuual level chaiacteiistics; age, sex, euucation, employment status, wealth,

ethnicity of the iesponuent anu whethei the inuiviuual is uibaniuial iesiuent;

1

is a vectoi foi

vaiiables that captuie uiffeient factois affecting tax compliance attituue; Z

1

is a vectoi foi

vaiiables captuiing iegional fixeu effects. The o

s aie the iespective coefficients anu e

is the

eiioi teim. The vaiiables useu to examine the uiffeient theoiies of tax compliance aie uesciibeu

below.

8

Economic deterrence

As a measuie of economic ueteiience, we use a iank vaiiable baseu on inuiviuuals iesponses to

the question Baseu on youi expeiience, how easy oi uifficult is it to avoiu paying the income oi

piopeity taxes that you owe to the goveinment.. The vaiiable ianges fiom 1=veiy easy to

4=veiy uifficult.

Fiscal exchange

A hanuful of vaiiables aie incluueu in the iegiession to captuie iesponuents satisfaction with

goveinments piovision of uiffeient goous anu seivices that citizens piefei anu that may

motivate compliance attituue. These incluue satisfaction with i) goveinments piovision of basic

health seivices anu auuiessing euucational neeus; ii) infiastiuctuie (goveinment piovision of

watei anu sanitation seivices, maintaining ioaus anu biiuges, anu piovision of ieliable supply of

electiicity); anu iii) goveinments hanuling of ciime, conflict anu coiiuption. In auuition to these

vaiiables, we also contiol foi oveiall satisfaction with ease of getting basic seivices fiom the

goveinment such as issuing iuentity caiu, householu seivices anu police seivices. These

vaiiables all iange fiom 1=veiy bauly to 4=veiy well.

Nonstate actors as service providers

Nonstate actois such as poweiful people oi gioups othei than the goveinment may pioviue

basic infiastiuctuie to citizens when goveinments become weak anu fiagile (Sacks 2u12). This

in tuin may affect the tax compliant attituue of inuiviuuals, especially if inuiviuuals aie making

payments to nonstate actois in exchange foi piotecting them, theii business anu piopeity. The

iole of nonstate actois like uonois anu Nu0s in pioviuing basic infiastiuctuie anu how that in

tuin affects tax attituues is exploieu in pievious ieseaich (Fjelustau 2uu1; Sacks 2u12).

Bowevei, the piovision of public seivices by ciiminal oiganizations anu gangs anu its ielation to

tax compliance attituue has, to oui knowleuge, not been stuuieu.

S

In this papei, we incluue a

vaiiable that captuies tax to nonstate actois, paiticulaily to ciiminal oiganizations anu gangs.

The vaiiable is measuieu by how often inuiviuuals make a payment to poweiful people oi

gioups othei than the goveinment, such as ciiminals oi gangs in theii community in ietuin foi

piotecting them, theii piopeity oi theii businesses. The vaiiable ianges fiom 1= nevei maue

payment; 2= only once; S= a few times; anu 4= often.

Political legitimacy

We use iange of vaiiables to captuie political legitimacy such as tiust in tax officials, coiiuption

of tax officials, oveiall level of satisfaction with politicians, anu inuiviuuals peiception about

theii countiys level of uemociacy. Tiust in tax officials is measuieu as a iank iesponse foi the

extent of tiust that inuiviuuals have in tax officials. The vaiiable ianges fiom 1= no tiust at all

to S= tiust a lot. Coiiuption is captuieu by inuiviuuals iesponse to how many tax officials they

think aie involveu in coiiuption. The vaiiable ianges fiom 1= none of them to S= all of them.

0veiall satisfaction with politicians is captuieu as a iank iesponse on inuiviuuals opinion

whethei they appiove oi uisappiove of the way the piesiuent, membei of pailiaments, the

5

There is a large literature on how protection or security money can be extorted in the classical, well-known

mafia style, where organised criminals use insecurity, harassment and intimidation to extort money from

individual citizens, private businesses and public officials (Gambetta, 1993; Grossman, 1995). However, this

literature does not address how these practises may impact on tax compliance.

9

piemium of the piovinces anu electeu local officials peifoimeu theii job in the past 12 months.

The iesponses iange fiom 1= stiongly uisappiove to 4= stiongly appiove. Baseu on these

iesponses, factoi analysis is maue in oiuei to have on inuicatoi foi inuiviuuals satisfaction with

politicians. Bemociacy is captuieu as a iank iesponse on inuiviuuals opinion on how much of a

uemociacy theii countiy is. The iesponse ianges fiom 1= no uemociacy to S= a full

uemociacy.

Social influence

To measuie the influence of othei peoples behavioi on tax compliance attituue, we use a

uummy that has a value of 1 if inuiviuuals think that othei people avoiu taxeu anu u otheiwise.

Comparative treatment

In oiuei to captuie inequities in the exchange ielationship between goveinment anu taxpayeis,

we use a vaiiable that is measuieu as a iank iesponse on how often inuiviuuals believe that theii

own ethnic gioup is tieateu unfaiily by the goveinment. The vaiiable ianges fiom 1= nevei to

4= always.

Knowledge about taxes

In auuition to the above stateu factois, the knowleuge base of inuiviuuals iegaiuing the types of

taxes to pay may also mattei in affecting compliance attituue. We theiefoie contiol foi tax

knowleuge, which is measuieu as a iank iesponse foi the extent of uifficulty to know the type of

taxes to pay. The iesponse ianges fiom 1=veiy easy to 4=veiy uifficult.

4.1 Results

Results in table 4 show the maiginal effects of the logit iegiession foi the foui countiies. The

stanuaiu eiiois aie piesenteu in biackets anu aie clusteieu at the uistiict level. Table S fuithei

shows the Walutest foi the fit of the logit mouel of the foui countiies. As can be seen in table S,

the null hypothesis that all the iegiessing coefficients aie jointly zeio is iejecteu at 1% level of

significance. This implies that the vaiiables incluueu in the iegiession cieate a statistically

significant impiovement in the fit of the mouel foi all the countiies.

[Table 4 here]

Although theie aie some similaiities in factois that aie coiielateu with tax compliant attituue

acioss the foui countiies, theie aie also uiffeiences. While employeu people in 0ganua aie 7%

moie likely to have tax compliant attituue, we finu the opposite effect in Kenya by almost the

same peicent. Noie yeais of schooling is founu to inciease the piobability of having a tax

compliant attituue by about S% both in Kenya anu Tanzania. We uo not finu significant vaiiation

in tax compliant attituue between male anu female, with incieaseu age oi wealth of inuiviuuals

in any of the foui countiies.

An inciease in the peiception of inuiviuuals about the uifficulty of evauing taxes of one unit

incieases the likelihoou of tax compliant attituue by S% anu 8% in Kenya anu South Afiica,

iespectively. This gives suggestive eviuence foi the economic ueteiience theoiy, which posits

that the peiception of incieaseu enfoicement that makes moie evasion uifficult will inciease tax

compliance attituue at least in Kenya anu South Afiica.

[Table 5 here]

10

In Kenya, inuiviuuals who aie moie satisfieu with goveinment piovision of infiastiuctuie such

as ioaus anu electiicity aie moie likely to have tax compliant attituue by about 1u%. In 0ganua

anu Tanzania, inuiviuuals who aie moie satisfieu with the goveinments piovision of basic

health seivices anu euucational neeus aie moie likely to have compliant attituue by 8% anu

1u%, iespectively. In auuition to basic health seivices anu euucation, satisfaction with

goveinments hanuling of ciime, conflict anu coiiuption incieases the likelihoou of having a

compliant attituue in 0ganua with 7%. In South Afiica, inuiviuuals who aie moie satisfieu with

the ease of getting vaiious seivices fiom the goveinment such as issuing of iuentity caiu,

householu seivices anu police seivices aie moie likely to have a taxcompliant attituue by about

8%. The uiffeient iesults fiom the foui countiies suggest that goveinment expenuituies may

motivate compliance anu that goveinments can inciease compliance by pioviuing goous that

citizens piefei in a moie efficient anu accessible mannei (Cowell anu uoiuon 1988; Levi 1988;

Tilly 1992; Nooie 2uu4).

Fiequent payment to nonstate actois such as ciiminals anu gangs ieuuces the likelihoou of

having a tax compliant attituue in all the foui countiies. The effect ianges fiom a uecline in

compliant attituue fiom 6% in Kenya, to 8% in 0ganua anu South Afiica anu as high as 12% in

Tanzania.

We uo not finu stiong eviuence on political legitimacy except foi a few vaiiables in South Afiica

anu Tanzania. Coiiuption of tax officials is founu to ieuuce the likelihoou of tax compliant

attituue by S% in South Afiica. In Tanzania, incieaseu level of satisfaction with the oveiall

peifoimance of politicians is founu to inciease the likelihoou of tax compliant attituue by S%.

The extent to which inuiviuuals think that theii own ethnic gioup is tieateu unfaiily compaieu

to otheis is also significantly coiielateu with compliant attituue in Tanzania anu South Afiica. As

the extent to which inuiviuuals think that theii own ethnic gioup is tieateu unfaiily incieases by

one point, the piobability of having a tax compliant attituue uecieases by S% anu 4% in

Tanzania anu South Afiica, iespectively. This may pioviue inuication towaius the compaiative

tieatment mouel, which is baseu on equity theoiy anu posits that auuiessing inequities in the

exchange ielationship between goveinment anu taxpayeis matteis foi tax compliance (Peisson,

2uu8; Rothstein 2uuS).

Tax knowleuge is significantly coiielateu with tax compliant attituue in Tanzania anu South

Afiica. An inciease in the extent of uifficulty to know the type of taxes to pay by one point

ieuuces the piobability of tax compliance attituue by 4% anu 1u% in Tanzania anu South Afiica

iespectively. This is equivalent to ieuucing the cuiient shaie of people with tax compliant

attituue, which is S4% in Tanzania anu S7% in South Afiica, to close to S1% in both countiies

uue to lack of appiopiiate tax knowleuge.

5. Robustness check

In oui pievious measuie of tax compliance attituue, we use a uummy vaiiable wheie we

categoiize inuiviuuals who iesponueu that not paying tax is not wiong anu wiong, but

unueistanuable as having a noncompliant attituue. Bowevei, it coulu also be the case that

inuiviuuals who iesponueu that not paying tax is wiong anu unueistanuable have a compliant

attituue. In this section we conuuct a iobustness check wheie we incluue all the thiee iesponses:

not wiong at all, wiong, but unueistanuable anu wiong anu punishable in a iegiession.

uiven the oiuinal natuie of the iesponses, we use oiueieu logit mouel.

11

We iefoimulate the econometiic mouel in equation (1) as follows. The uepenuent vaiiable

(Iox_complioncc_ottiJutc

) in equation (2) is an oiueieu categoiical vaiiable which ianges

fiom 1 to S (1=not wiong at all, 2=wiong but unueistanuable, anu S=wiong anu punishable). We

assume that theie is a latent vaiiable Iox_complioncc_ottiJutc

given by the following

expiession;

Iox_complioncc_ottiJutc

= o

1

+ o

2

X

1

+ o

3

1

+ o

4

Z

1

+ e

(2)

Assuming that e

is a ianuom, noimally uistiibuteu, vaiiable, the link between the obseiveu anu

the latent vaiiable is given by;

P [Iox

CompI

= 1|I

= (p

1

-I

y)

P [Iox

CompI

= 2|I

= (p

2

-I

y) -(p

1

- I

y)

P [Iox

CompI

= S|I

= 1 - (p

2

- I

y),

wheie is a cumulative noimal uistiibution function of e

, y = |o

1

, o

2

, o

3,

o

4

] aie the

coefficients of the explanatoiy vaiiables in equation 2, anu p

1

anu p

2

aie the unknown thiesholu

paiameteis that uiffeientiate the categoiies. The mouel is estimateu by maximum likelihoou foi

each countiy.

5.1 Results

Table 6 shows the maiginal effects of the oiueieu logit iegiession foi the thiee iesponses of the

foui countiies. Nost of oui iesults aie consistent with the finuings of the binaiy logit iegiession

piesenteu in table S. Bowevei, we finu even stiongei eviuence foi the economic ueteiience

theoiy foi all the foui countiies in the iegiession. An inciease in the peiception of inuiviuuals

about the uifficulty of evauing taxes by one point incieases the likelihoou of iesponuing wiong

not to pay taxes by 4% in Kenya, S% in 0ganua, 6% in Tanzania anu 7% in South Afiica. 0n the

othei hanu, an inciease in uifficulty of evasion ieuuces the likelihoou of iesponuing wiong but

unueistanuable anu not wiong at all in all the foui countiies.

Similai to finuings in the logit iegiession, in Tanzania anu 0ganua inuiviuuals who aie moie

satisfieu with the goveinments piovision of basic health seivices anu auuiessing euucational

neeus aie moie likely to iesponu wiong not to pay taxes, anu aie also less likely to iesponu

wiong but unueistanuable anu not wiong at all. In 0ganua, satisfaction with goveinments

hanuling of ciime, conflict anu coiiuption is moie likely to make inuiviuuals iesponu wiong not

to pay taxes, anu less likely to iesponu wiong but unueistanuable anu not wiong at all.

Again, similai to the finuings in the logit iegiession, iesponuents in Kenya who aie moie

satisfieu with goveinment hanuling of infiastiuctuie such as ioaus anu electiicity aie moie

likely to iesponu wiong not to pay taxes anu less likely to iesponu wiong anu

unueistanuable anu not wiong at all. In South Afiica, satisfaction with goveinment piovision

of basic seivices such as issuing iuentity caiu, householu seivices anu police seivices make

people moie likely to iesponu that wiong not to pay taxes anu less likely to iesponu wiong

anu unueistanuable anu not wiong at all.

[Table 6 here]

12

Consistent iesults aie also founu with nonstate actois as in the logit iegiession. Inuiviuuals who

make fiequent payment to nonstate actois such as ciiminals anu gangs aie less likely to

iesponu wiong not to pay taxes anu moie likely to iesponu wiong anu unueistanuable anu

not wiong at all.

In the oiueieu logit iegiession, we uo not finu much eviuence on political legitimacy except foi

coiiuption in South Afiica, which uepicts similai iesults as in the logit iegiession. Inuiviuuals

who think that tax officials aie coiiupt aie less likely to iesponu wiong not to pay taxes anu

moie likely to iesponu wiong anu unueistanuable anu not wiong at all.

Knowleuge about tax is still impoitant anu an inciease in the extent of uifficulty to know the

type of taxes to pay ieuuces the likelihoou of inuiviuuals to iesponu wiong not to pay taxes

anu incieases the likelihoou to iesponu wiong anu unueistanuable anu not wiong at all in

South Afiica, Kenya anu Tanzania, although the lattei is significant only at 1u%.

6. Conclusion

In this papei, we exploie factois that ueteimine citizens tax compliance behavioi in Kenya,

Tanzania, 0ganua anu South Afiica using attituue anu peiception uata fiom the new iounu S of

Afiobaiometei suiveys. The suivey incluues a seiies of theoietically iooteu questions about

citizens views about taxation. A main challenge was to finu an accuiate pioxy foi taxpayei

compliance since inuiviuuals iepoiting of own compliance is likely to be oveiiepoiteu. Thus we

useu an inuiiectly phiaseu question on iesponuents opinion about othei peoples action of

whethei not paying taxes is wiong oi not.

Results fiom the logit iegiession pioviue iobust iesults foi two ueteiminants of tax compliance.

We finu that inuiviuuals aie moie likely to expiess tax compliant attituue if they peiceive that

enfoicement makes evasion moie uifficult in South Afiica anu Kenya. This is in line with the

piesciiption of the stanuaiu economic theoiy of ueteiience. The analysis also finus eviuence

that those who aie moie satisfieu with public seivice piovision aie moie likely to suppoit the

goveinments iight to tax in all the foui countiies, suppoiting ceitain elements of the fiscal

exchange theoiy. Bowevei, the link between tax compliance attituue anu public seivice

piovision uepenus on the specific seivice in question anu uiffeis between countiies. While

access to infiastiuctuie such as ioaus anu electiicity encouiage tax compliant attituue in Kenya,

iesponuents in Tanzania anu 0ganua iefei to euucation anu health seivices as key to theii tax

compliance. In South Afiica, goveinment piovision of issuing iuentity caius anu police seivices

aie moie likely to suppoit tax compliant attituue.

A key finuing of the stuuy that applies to all the selecteu countiies is that payment to nonstate

actois such as ciiminal gangs foi piotection ieuuces tax compliant attituue. Pievious ieseaich

suggests that the way the state tieats inuiviuuals oi gioups ielative to theii fellow citizens is an

impoitant factoi in ueteimining taxpayei compliance attituue (BAicy 2u11). We have testeu

this hypothesis by examining how citizens peiceive theii ethnic gioup is tieateu by the

goveinment compaieu to othei gioups. 0nly in South Afiica anu Tanzania this seems to mattei

foi tax compliant attituue. The stuuy finus no stiong eviuence that political legitimacy, e.g. tiust

in goveinment policy anu institutions, impacts on taxpayeis compliance attituue. These finuings

aie iobust foi a uiffeient econometiic estimation, wheie we incluue all the iesponses of

inuiviuuals iegaiuing othei peoples action about tax in an oiueieu logit iegiession.

13

The stuuy pioviues us with some uiiections foi fuithei ieseaich. Foi an impioveu

unueistanuing of tax compliance attituue anu behavioi in Afiica, theie is a neeu foi a moie

thoiough examination of the concept of faiiness in fiscal exchange, i.e., the contiactual

ielationship between taxpayeis anu the goveinment. In this context it is also ielevant to analyze

if anu when usei chaiges aie to be piefeiieu insteau of geneial taxes to finance public

seivices. Ciitical factois in this iespect aie citizens' peiceptions about the iole of the state, how

the tax law is auministiateu, peiceptions about enfoicement, goveinment tiustwoithiness, anu

impacts of payments to nonstate actois may have on tax compliance. Fuitheimoie, theie is a

neeu foi ieseaich focusing on faiiness in tax collection anu compaiative tieatments of taxpayeis.

Can, anu unuei what conuitions, compliance be establisheu in Afiican countiies without an

extensive anu costly enfoicement appaiatus. This question is impoitant because it is likely that

goveinments, seeking powei on the basis of populai consent, face iestiictions in theii use of

coeicion in tax collection. Thus, the challenge foi taxation in Afiica is to iaise uomestic ievenues

fiom consenting citizens.

14

References

AfBB 2u1ua. Bomestic iesouice mobilization foi poveity ieuuction in East Afiica: Tanzania Case

Stuuy. Afiican Bevlopment Bank.

AfBB 2u1ub. Bomestic iesouice mobilization foi poveity ieuuction in East Afiica: 0ganua Case

Stuuy. Afiican Bevelopment Bank.

Allingham, N. u. & A. Sanumo 1972. Income tax evasion: a theoietical analysis. Journal of Public

Economics, 1, S2SSS8.

Alm, }., u. B. NcClellanu & W. B. Schulze 1992. Why uo people pay taxes. Journal of Public

Economics, 48, 21S8.

Anuieoni, }., B. Eiaiu & }. Feinstein 1998. Tax compliance. Journal of Economic Literature, S6,

81886u.

Baneijee, A. v. 1992. A simple mouel of heiu behavioi. The Quarterly Journal of Economics, 1u7,

797817.

Beckei, u. 1968. Ciime anu punishment: an economic appioach. Journal of Political Economy, 76,

167217.

Cobham, A. 2uuS. Tax evasion, tax avoiuance anu uevelopment finance. Queen Elisabeth House

Working Paper No. 129. 0xfoiu: 0xfoiu 0niveisity.

Cowell, F. A. 199u. Cheating the government: The economics of evasion: The NIT Piess.

Cowell, F. A. & }. P. F. uoiuon 1988. 0nwillingness to pay: Tax evasion anu public goou piovision.

Journal of Public Economics S6, SuSS21.

B'Aicy, N. 2u11. Why uo citizens assent to pay tax. Legitimacy, taxation anu the Afiican state.

Afrobarometer Working Paper No. 126.

Biummonu, P., W. Baal, N. Siivastava & L. E. 0liveiia 2u12. Nobilizing ievenue in subSahaian

Afiica: empicial noims anu key ueteiminants. IMF Working Paper WP/12/108. .

Washington BC.: Inteinational Nonetaiy Funu.

Economist Intelligence 0nit 2u11. Bemociacy inuex 2u11: Bemociacy unuei stiess.

FauvelleAymai, C. 1999. The political anu tax capacity of goveinment in ueveloping countiies.

Kyklos, S2, S9141S.

Fjelustau, 0.B. 2uu1. Taxation, coeicion anu uonois. Local goveinment tax enfoicement in

Tanzania. The Journal of Modern African Studies, S9, 289Su6.

Fjelustau, 0.B. & }. Semboja 2uu1. Why people pay taxes: The case of the uevelopment levy in

Tanzania. World Development, 29, 2uS92u74.

Fuest, C. & N. Rieuel 2uu9. Tax evasion, tax avoiuance anu tax expenuituies in ueveloping

countiies: A ieview of the liteiatuie. Report prepared for the UK Department for

International Development. 0xfoiu: 0xfoiu 0niveisity Centie foi Business anu Taxation.

INF 2u11. Revenue mobilization in ueveloping countiies. Policy Paper prepared by the Fiscal

Affairs Department (8 March). Washington B.C.: Inteinational Nonetaiy Funu.

Kaufmann, B. 1997. Coiiuption: Some myths anu facts. Foreign Policy, 1141S1.

Kiichlei, E., E. Boelzl & I. Wahl 2uu8. Enfoiceu veisus voluntaiy tax compliance: The slippeiy

slope fiamewoik. Journal of Economic Psychology, 29, 21u22S.

Levi, N. 1988. Of rule and revenue, Beikeley: 0niveisity of Califoinia Piess.

NcKeichai, N. & C. Evans 2uu9. Sustaining giowth in ueveloping economies thiough impioveu

taxpayei compliance: Challenges foi policy makeis anu ievenue authoiities. eJournal of

Tax Research, 7, 1712u1.

Nooie, N. 1998. Beath without taxes: Bemociacy, state capacity, anu aiu uepenuence in the

fouith woilu. In: White, u. & Robinson, N. (eus.) Towards a democratic developmental

state. 0xfoiu: 0xfoiu 0niveisity Piess.

Nooie, N. 2uu4. Revenues, state foimation, anu the quality of goveinance in ueveloping

countiies. International Political Science Review, 2S, 297S19.

0ECBBAC 2u12. Tax anu uevelopment. Aiu moualities foi stiengthening tax systems. Paiis:

0iganisation foi Economic Co0peiation anu Bevelopment (August).

Peisson, A. 2uu8. The institutional sources of statehood Assimilation, multiculturalism and

taxation in SubSaharan Africa Boctoial Thesis, uothenbuig 0niveisity.

15

Reinikka, R. & }. Svensson 2uu6. 0sing miciosuiveys to measuie anu explain coiiuption. World

Development, S4, SS9S7u.

Richupan, S. 1987. Beteiminants of income tax evasion: Role of tax iates, shape of tax scheuules

anu othei factois. In: uanuhi, v. P. (eu.). Inteinational Nonetaiy Funu.

Sacks, A. 2u12. Can uonois anu nonstate actois unueimine citizens' legitimating beliefs. World

Bank Policy Research Working Paper No. 6158. Woilu Bank.

Sah, R. K. 1991. Social osmosis anu patteins of ciime. Journal of Political Economy, 99, 1272

129S.

Sanumo, A. 2uuS. The theoiy of tax evasion: A ietiospective view. National Tax Journal, S8, 64S

6SS.

SARS 2u11. SARSs coie outcomes anu its philosophy on taxpayei anu tiauei compliance Leaflet

based on SARS Strategic Plan 2011/122013/14. Pietoiia: South Afiican Revenue Seivices

Slemiou, }. 1992. Why people pay taxes: tax compliance anu enfoicement. In: Slemiou, }. (eu.).

Ann Aiboi: The 0niveisity of Nichigan Piess.

Snavely, K. 199u. uoveinmental policies to ieuuce tax evasion: coeiceu behavioi veisus seivices

anu values uevelopment. Policy Sciences, 2S, S772.

Taylei, T. R. 2uu6. Psychological peispectives on legitimacy anu legitimation. Annual Review of

Psychology, S7, S7S4uu.

Tilly, C. 1992. Coercion, capital and European states: AD 9901992, Naluen, Nassachusetts:

Blackwell Publisheis Inc.

Waiis, A., N. Kohonen, }. Ranguma & A. Nosioma 2uu9. Taxation anu statebuiluing in Kenya:

Enhancing ievenue capacity to auvance human welfaie. Kenya Report. Tax }ustice

Netwoik foi Afiica.

Woilu Bank 2u11. World Development Indicators 2011, Washington B.C.: Woilu Bank.

Woilu Bank 2u12. World Development Indicators 2012, Washington, B.C.: The Woilu Bank.

Yankelovich, Skelly & White 1984. Taxpayei attituues stuuy: Final iepoit. Public opinion survey

prepared for the Internal Revenue Services. Washington, BC: Inteinal Revenue Seivice,

0.S. Bepaitment of the Tieasuiy.

16

Tables

Table 2: Biffeiences in backgiounu vaiiables between iesponuents with tax compliant anu non

compliant attituue

South Afiica Kenya Tanzania 0ganua

Non

complian

t attituue

Compliant

attituue

Non

compliant

attituue

Compliant

attituue

Non

compliant

attituue

Compliant

attituue

Non

compliant

attituue

Compliant

attituue

Total 4S % S7 % 46 % S4 % S4 % 47 % 68 % S2 %

Nale Su % Su % 47 % SS % S1 % S1 % S2 % 49 %

Employeu SS % S9 % 47 % 4S % S9 % S4 % 48 % S1 %

Self

employeu

1S % 1S % 68 % 6S % S2 % SS % 8S % 77 %

0iban 68 % 69 % S8 % 4u % Su % SS % 16 % 1S %

Age (mean) S7.7 4u.S SS.4 S6.2 S8.1 S9.1 SS.4 S4.4

Level of

schooling

(mean)

4.2 4.4 S.8 4.1 2.9 S.2 S.S S.4

Wealth u.S8 u.6S u.49 u.S4 u.S9 u.41 u.21 u.2u

6

All numbers are from World Development Indicators 2012 (World Bank 2012) unless else is specified

7

World Development Indicators 2011 (World Bank 2011)

8

Economist Intelligence Unit (EIU) democracy index 2011, 0 =authoritarian regime and 10=full democracy

(EIU 2011: 30)

Table 1: Nacioeconomic inuicatois

Inuicatoi6 South Afiica Kenya Tanzania 0ganua SSA

Population (million) Su 41 4S SS 84u

uNI pei capita (cuiient 0SB) 6 u9u 79u SSu Suu 1 127

Tax ievenue of uBP (%) 29 19.S 14 12 187

0iban population (% of total) 62 22 26 1S S7

uini inuex u.6S u.48 u.S8 u.44

Bemociacy inuex8, 2u11 7.8 4.7 S.6 S.1 4.S

17

Table S: Reasons why some people evaue taxes, %

South Afiica Kenya Tanzania 0ganua

0nfaii tax system 8 8 11 11

Taxes aie too high 22 2S 2S 28

Taxes aie unaffoiuable 27 26 2S 29

Pooi public seivices 12 9 16 11

The goveinment waste steal taxes 11 1u 9 8

People know they won't get caught 1 2 2 1

0thei 2u 2S 12 12

Total 1uu 1uu 1uu 1uu

Table 4: Walu test foi binaiy logit iegiessions

South Afiica Kenya Tanzania 0ganua

Chi2 S78 S42 61u 1S48

Begiees of fieeuom S4 SS S2 S1

Piob > chi2 = u.uu u.uu u.uu u.uu

18

Table S: Binaiy logistic iegiessions with maiginal effects

South Afiica Kenya Tanzania 0ganua

Individual characteristics

Age u.uu u.uu u.u1* u.uu

(u.u1) (u.u1) (u.u1) (u.u1)

Age2 u.uu u.uu u.uu u.uu

(u.uu) (u.uu) (u.uu) (u.uu)

Nale (u) u.u2 u.u1 u.uS u.u2

(u.uS) (u.uS) (u.u2) (u.uS)

Selfemployeu (u) u.u1 u.u1 u.uu u.u8

(u.u4) (u.u4) (u.uS) (u.u7)

Employeu (u) u.u2 u.u8** u.uS u.u7**

(u.u4) (u.u4) (u.uS) (u.u4)

Schooling u.uu u.uS** u.uS** u.u1

(u.u1) (u.u1) (u.u1) (u.u1)

Wealth u.u7 u.1u u.uS u.u8

(u.uS) (u.u6) (u.u8) (u.u8)

0iban (u) u.u2 u.u4 u.u2 u.u6

(u.u4) (u.u4) (u.u4) (u.u6)

Economic deterrence

Bifficulty of evauing tax u.u8*** u.uS** u.u4 u.uS

(u.uS) (u.u2) (u.uS) (u.u2)

Fiscal exchange

Bealth anu euucation u.uu u.u1 u.1u*** u.u8***

(u.uS) (u.uS) (u.u2) (u.u2)

Infiastiuctuie u.uu u.u9*** u.uu u.u1

(u.u4) (u.uS) (u.uS) (u.uS)

Ciime, conflict anu coiiuption u.u4 u.uS u.u1 u.u7**

(u.u4) (u.uS) (u.uS) (u.uS)

Basic seivices fiom the goveinment u.u8*** u.uS u.u1 u.u1

(u.u2) (u.uS) (u.uS) (u.u2)

Social influence

Peiceiveu compliance of otheis u.uS u.u1 u.u9*** u.u2

(u.uS) (u.u4) (u.uS) (u.u4)

Comparative treatment

0nfaii tieatment of own ethnic gioup u.u4* u.u2 u.uS** u.uS

(u.u2) (u.u1) (u.u2) (u.uS)

Political legitimacy

Tiust u.u1 u.u2 u.u1 u.u1

(u.u2) (u.u2) (u.u1) (u.u1)

Coiiuption u.uS*** u.u2 u.uu u.u2

(u.u1) (u.u2) (u.u1) (u.u2)

Satisfaction with politicians u.u1 u.u1 u.uS* u.u1

(u.u2) (u.u2) (u.u2) (u.uS)

Bemociacy u.u2 u.u2 u.u1 u.uu

19

(u.u2) (u.u2) (u.u1) (u.u2)

Nonstate actors

Payments to nonstate actois u.u8** u.u6** u.12*** u.u8**

(u.u4) (u.uS) (u.u4) (u.u4)

Knowledge about taxes

Bifficulty finuing out what taxes to pay u.1u*** u.uS u.u4** u.uu

(u.uS) (u.u2) (u.u2) (u.u2)

value auueu tax u.19*** u.Su*** u.17*** u.17***

(u.uS) (u.uS) (u.u4) (u.u4)

Region fixeu effects Yes Yes Yes Yes

Ethnicity fixeu effects Yes Yes Yes Yes

Religion fixeu effects Yes Yes Yes Yes

Numbei of obseivations 1Su8 14S2 19uu 141u

Pseuuo R2 u.12 u.1S u.12 u.1u

20

Table 6 : 0iueieu logistic iegiessions with maiginal effects

South Africa Kenya Tanzania Uganda

Wiong

Wiong, but

unueistanu

able

Not

wiong

Wiong

Wiong, but

unueistanu

able

Not

wiong

Wiong

Wiong, but

unueistan

uable

Not

wiong

Wiong

Wiong, but

unueistanu

able

Not

wiong

Inuiviuual fixeu effects Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes

Economic deterrence

Bifficulty of evauing tax u.u7** u.u6** u.u1** u.uS*** u.u4*** u.u1** u.u6*** u.uS*** u.uS*** u.uS** u.u2** u.uS*

(u.uS) (u.u2) (u.uu) (u.u2) (u.u1) (u.u1) (u.u2) (u.u1) (u.u1) (u.uS) (u.u1) (u.u2)

Fiscal exchange

Bealth anu euucation u.u1 u.u1 u.uu u.u1 u.u1 u.uu u.u8*** u.u4*** u.u4*** u.u7*** u.uS*** u.u4***

(u.uS) (u.u2) (u.uu) (u.uS) (u.u2) (u.u1) (u.u2) (u.u1) (u.u1) (u.u2) (u.u1) (u.u1)

Infiastiuctuie u.u1 u.u1 u.uu u.u9*** u.u6*** u.u2*** u.uu u.uu u.uu u.u1 u.u1 u.u1

(u.u4) (u.uS) (u.u1) (u.uS) (u.u2) (u.u1) (u.uS) (u.u1) (u.u1) (u.u2) (u.u1) (u.u1)

Ciime, conflict anu

coiiuption

u.uS u.u2 u.uu u.u2 u.u1 u.u1 u.u2 u.u1 u.u1 u.u8** u.u4** u.uS**

(u.u4) (u.uS) (u.u1) (u.uS) (u.u2) (u.u1) (u.uS) (u.u1) (u.u1) (u.uS) (u.u2) (u.u2)

Basic seivices u.u8*** u.u7*** u.u1*** u.u4 u.uS u.u1 u.u2 u.u1 u.u1 u.u2 u.u1 u.u1

(u.u2) (u.u2) (u.uu) (u.uS) (u.u2) (u.u1) (u.uS) (u.u1) (u.u1) (u.u2) (u.u1) (u.u1)

21

Social influence

Compliance of otheis u.uS u.u4 u.u1 u.u4 u.uS u.u1 u.u8** u.u4** u.u4** u.u2 u.u1 u.u1

(u.uS) (u.uS) (u.u1) (u.u4) (u.uS) (u.u1) (u.uS) (u.u2) (u.u2) (u.u4) (u.u2) (u.u2)

Comparative

treatment

0wn ethnic gioup

tieateu unfaiily

u.u6** u.uS** u.u1* u.u2 u.u1 u.u1 u.uS u.u1 u.u2 u.uS u.u1 u.u1

(u.uS) (u.u2) (u.uu) (u.u1) (u.u1) (u.uu) (u.u2) (u.u1) (u.u1) (u.u2) (u.u1) (u.u1)

Political lecitimacy

Tiust u.u1 u.u1 u.uu u.u2 u.u1 u.u1 u.u1 u.uu u.uu u.u1* u.u1 u.u1

(u.u2) (u.u1) (u.uu) (u.u1) (u.u1) (u.uu) (u.u1) (u.u1) (u.u1) (u.u1) (u.uu) (u.uu)

Coiiuption u.u4*** u.u4*** u.u1*** u.u1 u.uu u.uu u.u1 u.uu u.uu u.u2 u.u1 u.u1

(u.u1) (u.u1) (u.uu) (u.u2) (u.u1) (u.u1) (u.u1) (u.u1) (u.u1) (u.u2) (u.u1) (u.u1)

Satisfaction with

politicians

u.u1 u.u1 u.uu u.u1 u.u1 u.uu u.u2 u.u1 u.u1 u.u1 u.uu u.uu

(u.u2) (u.u2) (u.uu) (u.u1) (u.u1) (u.uu) (u.u2) (u.u1) (u.u1) (u.uS) (u.u1) (u.u2)

Bemociacy u.u2 u.u1 u.uu u.uS u.u2 u.u1 u.u2 u.u1 u.u1 u.u1 u.u1 u.u1

(u.u1) (u.u1) (u.uu) (u.u2) (u.u2) (u.u1) (u.u1) (u.u1) (u.u1) (u.u2) (u.u1) (u.u1)

Nonstate actors

Payments to nonstate

actois

u.u9*** u.u8*** u.u1*** u.u7** u.uS* u.u2** u.12*** u.u6*** u.u7*** u.u6** u.u2* u.uS**

22

(u.uS) (u.u2) (u.uu) (u.u4) (u.uS) (u.u1) (u.u4) (u.u2) (u.u2) (u.uS) (u.u1) (u.u1)

Knowledge about

taxes

Bifficulty finuing out

what taxes to pay

u.11*** u.u9*** u.u2*** u.u7*** u.uS*** u.u2*** u.uS* u.u1* u.u2* u.uu u.uu u.uu

(u.uS) (u.u2) (u.uu) (u.u2) (u.u2) (u.u1) (u.u2) (u.u1) (u.u1) (u.u2) (u.u1) (u.u1)

value auueu tax u.2u*** u.16*** u.u4*** u.29*** u.18*** u.11*** u.19*** u.u9*** u.1u*** u.2u*** u.1u*** u.1u***

(u.u4) (u.u4) (u.u1) (u.uS) (u.uS) (u.uS) (u.u4) (u.u2) (u.u2) (u.u4) (u.u2) (u.u2)

Region fixeu effects Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes

Ethnicity fixeu effects Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes

Religion fixeu effects Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes

Numbei of

obseivations

1Su8 1Su8 1Su8 14S2 14S2 14S2 19uu 19uu 19uu 141u 141u 141u

Pseuuo R

2

u.11 u.11 u.11u u.11 u.11 u.11 u.u9 u.u9 u.u9 u.u8 u.u8 u.u8

23

Figures

Figure1:TaxcompliantattitudeandGNIpercapita

Figure2:TaxcompliantattitudeandGNIpercapitawithoutSouthAfrica

24

Appendix1

Table A1: Descriptive statistics for all variables

South Africa Kenya Tanzania Uganda

Description

Mea

n

Std.

Dev.

Mi

n

Ma

x

Mea

n

Std.

Dev.

Mi

n

Ma

x

Mea

n

Std.

Dev.

Mi

n

Ma

x

Mea

n

Std.

Dev.

Mi

n

Ma

x

Dependent variable

Tax compliant attitude

Dummy =1 if individual think

it is wrong and punishable not

to pay taxes, 0 otherwise

0.57 0.49 0 1 0.54 0.50 0 1 0.47 0.50 0 1 0.32 0.47 0 1

Individual characteristics

Age Age of respondent 39.2 15.9 18 95 35.8 13.5 18 93 38.6 14.3 18 99 35.2 12.8 18 84

Male

Dummy =1 if respondent is

male

0.50 0.50 0 1 0.50 0.50 0 1 0.50 0.50 0 1 0.50 0.50 0 1

Self-employment

Dummy1 =if self-employed, 0

otherwise

0.13 0.34 0 1 0.65 0.48 0 1 0.53 0.50 0 1 0.80 0.40 0 1

Employment

Dummy =1 if employed, 0 if

unemployed

0.37 0.48 0 1 0.45 0.50 0 1 0.36 0.48 0 1 0.48 0.50 0 1

Schooling

9 =postgraduate qualifications,

0 =no formal schooling,

4.27 1.56 0 9 3.91 1.81 0 9 3.01 1.39 0 9 3.28 1.86 0 9

Wealth

Index for ownership of radio,

TV, car, water, latrine and roof

material. 1=respondent has all

items and 0 =respondent has

none

0.62 0.33 0 1 0.51 0.25 0 1 0.39 0.23 0 1 0.20 0.23 0 1

Urban

Dummy =1 if household is

located in urban area

0.67 0.47 0 1 0.38 0.49 0 1 0.32 0.47 0 1 0.14 0.35 0 1

Economic deterrence

Ease of evasion 1 =very easy, 4 =very difficult 2.96 0.80 1 4 3.25 0.76 1 4 3.22 0.79 1 4 3.26 0.80 1 4

Fiscal exchange

Health and education

Factor for satisfaction with

health and educational services.

4 =Very well, 1 =very badly,

0 =dont know

2.73 0.79 0 4 2.69 0.79 0 4 2.38 0.82 0 4 2.58 0.72 0 4

Infrastructure Factor for satisfaction with 2.64 0.73 0 4 2.59 0.91 0 4 2.18 0.71 0 4 1.94 0.69 0 4

25

water, roads, electricity and

environment.4 =Very well, 1 =

very badly, 0 =dont know

Crime and conflict

Factor for satisfaction with

crime, conflict, corruption and

terrorism. 4 =Very well, 1 =

very badly, 0 =dont know

2.14 0.78 0 4 2.11 0.74 0 4 2.33 0.70 0 4 2.16 0.73 0 4

Infrastructure

Factor for satisfaction with

electricity, water, sewage, cell

phone services and paved road.

4 =Very well, 1 =very badly,

0 =dont know

2.64 0.73 0 4 2.59 0.91 0 4 2.18 0.71 0 4 1.94 0.69 0 4

Social influence

Tax compliance of

others

Perceived tax avoidance of

others 1=never or rarely, 0 =

always or often

0.61 0.49 0 1 0.72 0.45 0 1 0.70 0.46 0 1 0.75 0.43 0 1

Comparative treatment

Unfair treatment of

own ethnic group

Perceived frequency of

discrimination against own

ethnic group. 4 =always, 1 =

never

1.67 0.94 1 4 1.97 1.02 1 4 1.48 0.79 1 4 2.13 1.01 1 4

Political legitimacy

Trust

Trust in tax department. 5 =a

lot, 1 =not at all

3.55 1.31 1 5 2.99 1.34 1 5 3.15 1.34 1 5 2.74 1.37 1 5

Corruption

Perceived corruption among

tax officials. 5 =all, 1 =none

2.48 1.12 1 5 2.98 1.13 1 5 2.84 1.17 1 5 3.11 1.24 1 5

Satisfaction with

politicians

Factor for satisfaction with

president, prime minister, MP

and local government. 5 =

Strongly approve, 1 =strongly

disapprove.

3.22 1.01 1 5 2.86 1.14 1 5 3.45 1.09 1 5 3.19 1.04 1 5

Democracy

Perception/satisfaction with

democracy. 5 =full

democracy/very satisfied, 1 =

not a democracy/not satisfied

3.39 1.13 1 5 2.96 1.10 1 5 3.70 1.06 1 5 3.08 1.18 1 5

Non-state actors

26

Payments to non-state

actors

Payments to powerful

people/groups other than the

government. 4 =Often and 1 =

Never

1.18 0.57 1 4 1.24 0.68 1 4 1.17 0.50 1 4 1.25 0.62 1 4

Knowledge about tax

Ease of finding out

which taxes to pay

4 =Very difficult and 1 =very

easy

2.68 0.81 1 4 3.10 0.83 1 4 3.14 0.88 1 4 3.10 0.89 1 4

Required to pay VAT

Dummy =1 if respondent is

required to pay value added tax

0.76 0.43 0 1 0.73 0.44 0 1 0.42 0.49 0 1 0.39 0.49 0 1

Number of

observations

2399 2399 2400 2400

You might also like

- Mangrove Project TangaDocument18 pagesMangrove Project TangaKapinga GaudenceNo ratings yet

- Moshi Municipal ProfileDocument157 pagesMoshi Municipal ProfileKapinga Gaudence100% (1)

- Africa Attractiveness Survey 2013 AU1582Document76 pagesAfrica Attractiveness Survey 2013 AU1582Kapinga GaudenceNo ratings yet

- Research DesignDocument16 pagesResearch DesignKapinga GaudenceNo ratings yet

- Forming Subsidiary CompanyDocument9 pagesForming Subsidiary CompanyKapinga GaudenceNo ratings yet

- Gender Mainstreaming Training Manual 2007Document84 pagesGender Mainstreaming Training Manual 2007Kapinga Gaudence100% (1)

- Sub Saharan AfricaDocument29 pagesSub Saharan AfricaKapinga GaudenceNo ratings yet

- Business PlanningDocument94 pagesBusiness PlanningKapinga GaudenceNo ratings yet

- Participatory Planning in Community OrgsDocument128 pagesParticipatory Planning in Community OrgsKapinga GaudenceNo ratings yet

- Article-How To Write A Project ProposalDocument6 pagesArticle-How To Write A Project ProposalSamer AjlawiNo ratings yet

- Holistic Approach To Sustainable Community DevelopmentDocument76 pagesHolistic Approach To Sustainable Community DevelopmentKapinga GaudenceNo ratings yet

- Micro FinanceDocument9 pagesMicro FinanceKapinga GaudenceNo ratings yet

- Adelman PDFDocument28 pagesAdelman PDFWitness Wii MujoroNo ratings yet

- Leading and Managing Change - 6Document9 pagesLeading and Managing Change - 6Swapnil SharmaNo ratings yet

- Maternal MobidityDocument4 pagesMaternal MobidityKapinga GaudenceNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Internship Report-2020Document77 pagesInternship Report-2020Hossen ImamNo ratings yet

- QUARTER 3, WEEK 9 ENGLISH Inkay - PeraltaDocument43 pagesQUARTER 3, WEEK 9 ENGLISH Inkay - PeraltaPatrick EdrosoloNo ratings yet

- Adventure Shorts Volume 1 (5e)Document20 pagesAdventure Shorts Volume 1 (5e)admiralpumpkin100% (5)

- The Court of Heaven 1Document2 pagesThe Court of Heaven 1Rhoda Collins100% (7)

- Equilibrium of Firm Under Perfect Competition: Presented by Piyush Kumar 2010EEE023Document18 pagesEquilibrium of Firm Under Perfect Competition: Presented by Piyush Kumar 2010EEE023a0mittal7No ratings yet

- K Unit 1 SeptemberDocument2 pagesK Unit 1 Septemberapi-169447826No ratings yet

- Oniom PDFDocument119 pagesOniom PDFIsaac Huidobro MeezsNo ratings yet

- Lista Materijala WordDocument8 pagesLista Materijala WordAdis MacanovicNo ratings yet

- Project Procurement Management: 1 WWW - Cahyo.web - Id IT Project Management, Third Edition Chapter 12Document28 pagesProject Procurement Management: 1 WWW - Cahyo.web - Id IT Project Management, Third Edition Chapter 12cahyodNo ratings yet

- The Squeezing Potential of Rocks Around Tunnels Theory and PredictionDocument27 pagesThe Squeezing Potential of Rocks Around Tunnels Theory and PredictionprazNo ratings yet

- Birnbaum - 2006 Registration SummaryDocument14 pagesBirnbaum - 2006 Registration SummaryEnvironmental Evaluators Network100% (1)

- t10 2010 Jun QDocument10 pagest10 2010 Jun QAjay TakiarNo ratings yet

- Simple Past Story 1Document7 pagesSimple Past Story 1Ummi Umarah50% (2)

- Anchoring ScriptDocument2 pagesAnchoring ScriptThomas Shelby100% (2)

- Keir 1-2Document3 pagesKeir 1-2Keir Joey Taleon CravajalNo ratings yet

- Ebook PDF The Irony of Democracy An Uncommon Introduction To American Politics 17th Edition PDFDocument42 pagesEbook PDF The Irony of Democracy An Uncommon Introduction To American Politics 17th Edition PDFscott.stokley449100% (39)

- Experiment No 5 ZenerDocument3 pagesExperiment No 5 ZenerEugene Christina EuniceNo ratings yet

- Elc650 Ws Guidelines (250219)Document3 pagesElc650 Ws Guidelines (250219)panda_yien100% (1)

- HeavyReding ReportDocument96 pagesHeavyReding ReportshethNo ratings yet

- Fdar For UtiDocument2 pagesFdar For UtiCARL ANGEL JAOCHICONo ratings yet

- Assignment 1 TVM, Bonds StockDocument2 pagesAssignment 1 TVM, Bonds StockMuhammad Ali SamarNo ratings yet

- Fundamentals of Biochemical Engineering Dutta Solution ManualDocument6 pagesFundamentals of Biochemical Engineering Dutta Solution Manualhimanshu18% (22)

- Birth Control Comparison Chart 2018Document1 pageBirth Control Comparison Chart 2018Eric SandesNo ratings yet

- Caucasus University Caucasus Doctoral School SyllabusDocument8 pagesCaucasus University Caucasus Doctoral School SyllabusSimonNo ratings yet

- ENVSOCTY 1HA3 - Lecture 01 - Introduction & Course Overview - Skeletal NotesDocument28 pagesENVSOCTY 1HA3 - Lecture 01 - Introduction & Course Overview - Skeletal NotesluxsunNo ratings yet

- Novel Synthesis of BarbituratesDocument3 pagesNovel Synthesis of BarbituratesRafaella Ferreira100% (2)

- Introducing Identity - SummaryDocument4 pagesIntroducing Identity - SummarylkuasNo ratings yet

- Message To St. MatthewDocument3 pagesMessage To St. MatthewAlvin MotillaNo ratings yet

- FrankensteinDocument51 pagesFrankensteinapi-272665425100% (1)

- Cayman Islands National Youth Policy September 2000Document111 pagesCayman Islands National Youth Policy September 2000Kyler GreenwayNo ratings yet