Professional Documents

Culture Documents

Leverage BEP

Uploaded by

Asadur RahmanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leverage BEP

Uploaded by

Asadur RahmanCopyright:

Available Formats

BREAK-EVEN ANALYSIS Break-even analysis determine the the level of sales at which the total revenues are equal

to total cost. That is, at this point there is no profit or loss. Managers most often focus on the break-even level of sales. However, you might also look at other variables, for e ample, at how high costs could be before the pro!ect goes into the red. Most often, the break-even condition is defined in terms of accounting profits. More properly, however, it should be defined in terms of net present value. "e will start with accounting break-even, show that it can lead you astray, and then show how #$% break-even can be used as an alternative. B&'()-'%'# (#(*+,-,. (nalysis of the level of sales at which the company breaks even.

The break-even point for a product is the point where total revenue received equals the total costs associated with the sale of the product (TR=TC).

TR=TC P*Q=TFC+V*Q Q= TFC/(P-V) Q= Amount of s !"s TFC= Tot ! f#$"% &ost V= 'n#t ( )# *!" &ost P= 'n#t s"!!#n+ ,)#&" P-V= 'n#t Cont)#*ut#on ACC-'NTIN. BREAK-EVEN ANALYSIS The accounting break-even point is the level of sales at which profits are /ero or, equivalently, at which total revenues equal total costs. (s we have seen, some costs are fi ed regardless of the level of output. 0ther costs vary with the level of output. "hen you first analy/ed the superstore pro!ect, you came up with the following estimates.

#otice that variable costs are 12.34 percent of sales. ,o, for each additional dollar of sales, costs increase by only 5.1234. "e can easily determine how much business the superstore needs to attract to avoid losses. -f the store sells nothing, the income statement will show fi ed costs of 53 million and depreciation of 5647,777. Thus there will be a loss of 53.64 million. 'ach dollar of sales reduces this loss by 52.77 8 5.1234 9 5.21:4. Therefore, to cover fi ed costs plus depreciation, you need sales of 3.64 million;.21:4 9 52<.7=: million. (t this sales level, the firm will break even. More generally,

Table below shows how the income statement looks with only 52<.7=: million of sales. >igure below shows how the break-even point is determined. The 64-degree line shows accounting revenues. The cost line shows how costs vary with sales. -f the store doesn?t sell a cent, it still incurs fi ed costs and depreciation amounting to 53.64 million. 'ach e tra dollar of sales adds 5.1234 to these costs. "hen sales are 52<.7=: million, the two lines cross, indicating that costs equal revenues. >or lower sales, revenues are less than costs and the pro!ect is in the red@ for higher sales, revenues e ceed costs and the pro!ect moves into the black. -s a pro!ect that breaks even in accounting terms an acceptable investmentA -f you are not sure about the answer, here?s a possibly easier question. "ould you be happy about an investment in a stock that after 4 years gave you a total rate of return of /eroA "e hope not. +ou might break even on such a stock but a /ero return does not compensate you for the time value of money or the risk that you have taken. TABLE / In&om" St t"m"nt0 *)" 1-"("n s !"s (o!um"

FI.'RE/ A&&ount#n+ *)" 1-"("n n !2s#s

A ,)o3"&t t4 t s#m,!2 *)" 1s "("n on n &&ount#n+ * s#s +#("s 2ou 2ou) mon"2 * &1 *ut %o"s not &o(") t4" o,,o)tun#t2 &ost of t4" & ,#t ! t#"% u, #n t4" ,)o3"&t5 A ,)o3"&t t4 t *)" 1s "("n #n &&ount#n+ t")ms 6#!! su)"!2 4 (" n"+ t#(" NPV5

*et?s check this with the superstore pro!ect. ,uppose that in each year the store has sales of 52<.7=: millionB!ust enough to break even on an accounting basis. "hat would be the cash flow from operationsA Cash flow from operations 9 profit after ta D depreciation 9 7 D 5647,777 9 5647,777 The initial investment is 54.6 million. -n each of the ne t 23 years, the firm receives a cash flow of 5647,777. ,o the firm gets its money back. Total cash flow from operations 9 initial investment 23 E 5647,777 9 54.6 million But revenues are not sufficient to repay the opportunity cost of that 54.6 million investment. #$% is negative. E$ m,!". (ssume we are selling a product for 53 each. The variable cost associated with producing and selling the product is =7 cents. (ssume that the fi ed cost related to the product is 52777. "hat is the break even pointA F9 >C;G$-%H9 2777 ; G3.77 - 7.=7H 9 :24 units.

-n this e ample, the firm would have to sell G2777 ; G3.77 - 7.=7H 9 :24H :24 units to break even.

-PERATIN. LEVERA.E ( pro!ect?s break-even point depends on both its fixed costs, which do not vary with sales, and the profit on each e tra sale. Managers often face a trade-off between these variables. >or e ample, we typically think of rental e penses as fi ed costs. But supermarket companies sometimes rent stores with contingent rent agreements. This means that the amount of rent the company pays is tied to the level of sales from the store. &ent rises and falls along with sales. The store thus replaces a fi ed cost with a variable cost that rises along with sales. Because a greater proportion of the company?s e penses will fall when its sales fall, its break-even point is reduced. 0f course, a high proportion of fi ed costs is not all bad. The firm whose costs are largely fi ed fares poorly when demand is low, but it may make a killing during a boom. *et us illustrate.

>inefodder has a policy of hiring long-term employees who will not be laid off e cept in the most dire circumstances. >or all intents and purposes, these salaries are fi ed costs. -ts rival, ,top and ,coff, has a much smaller permanent labor force and uses e pensive temporary help whenever demand for its product requires e tra staff. ( greater proportion of its labor e penses are therefore variable costs. ,uppose that if >inefodder adopted its rival?s policy, fi ed costs in its new superstore would fall from 53 million to 52.4= million but variable costs would rise from 12.34 to 16 percent of sales. Table below shows that with the normal level of sales, the two policies fare equally. -n a slump a store that relies on temporary labor does better since its costs fall along with revenue. -n a boom the reverse is true and the store with the higher proportion of fi ed costs has the advantage. -f >inefodder follows its normal policy of hiring long-term employees, each e tra dollar of sales results in a change of 52.77 8 5.1234 9 5.21:4 in preta profits. -f it uses temporary labor, an e tra dollar of sales leads to a change of only 52.77 8 5.16 9 5.2= in profits. (s a result, a store with high fi ed costs is said to have high o,") t#n+ !"(") +"5 High operating leverage magnifies the effect on profits of a fluctuation in sales. "e can measure a business?s operating leverage by asking how much profits change for each 2 percent change in sales. The %"+)"" of o,") t#n+ !"(") +"0 often abbreviated as 7-L0 is this measure.

>or e ample, Table below shows that as the store moves from normal conditions to boom, sales increase from 52= million to 52I million, a rise of 21.:4 percent. >or the policy with high fi ed costs, profits increase from 5447,777 to 52,223,777, a rise of 273.3 percent. Therefore,

, 0$'&(T-#J *'%'&(J' Kegree to which costs are fi ed.

K'J&'' 0> 0$'&(T-#J *'%'&(J' GK0*H $ercentage change in profits given a 2 percent change in sales.

TABLE/ Asto)" 6#t4 4#+4 o,") t#n+ !"(") +" ,")fo)ms )"! t#("!2 * %!2 #n f!ou)#s4"s #n *oom (f#+u)"s #n t4ous n%s of %o!! )s)

s!um, *ut

#ow look at the operating leverage of the store if it uses the policy with low fi ed costs but high variable costs. (s the store moves from normal times to boom, profits increase from 5447,777 to 52,7<7,777, a rise of 1:.< percent. Therefore,

Because some costs remain fi ed, a change in sales continues to have a magnified effect on profits but the degree of operating leverage is lower. -n fact, one can show that degree of operating leverage depends on fi ed charges Gincluding depreciationH in the following manner.

This relationship makes it clear that operating leverage increases with fi ed costs.

LEVERA.E AN7 CAPITAL STR'CT'RE T4" C ,#t ! St)u&tu)" Qu"st#on How should a firm go about choosing its debt-equity ratioA Here, as always, we assume that the guiding principle is to choose the course of action that ma imi/es the value of a share of stock. However, when it comes to capital structure decisions, this is essentially the same thing as ma imi/ing the value of the whole firm, and, for convenience, we will tend to frame our discussion in terms of firm value. The "(CC G"eighted (verage Cost of CapitalH tells us that the firm?s overall cost of capital is a weighted average of the costs of the various components of the firm?s capital structure. "hen we described the "(CC, we took the firm?s capital structure as given. Thus, one important issue that we will want to e plore is what happens to the cost of capital when we vary the amount of debt financing, or the debt-equity ratio. ( primary reason for studying the "(CC is that the value of the firm is ma imi/ed when the "(CC is minimi/ed. The "(CC is the discount rate appropriate for the firm?s overall cash flows. ,ince values and discount rates move in opposite directions, minimi/ing the "(CC will ma imi/e the value of the firm?s cash flows. Thus, we will want to choose the firm?s capital structure so that the "(CC is minimi/ed. >or this reason, we will say that one capital structure is better than another if it results in a lower weighted average cost of capital. >urther, we say that a particular debt equity ratio represents the optimal capital structure if it results in the lowest possible "(CC. This optimal capital structure is sometimes called the firm?s target capital structure as well. C-NCEPT Q'ESTI-NS L "hat is the relationship between the "(CC and the value of the firmA L "hat is an optimal capital structureA

T4" Eff"&t of F#n n&# ! L"(") +" -n this section, we e amine the impact of financial leverage on the payoffs to stockholders. (s you may recall, financial leverage refers to the e tent to which a firm relies on debt. The more debt financing a firm uses in its capital structure, the more financial leverage it employs.

(s we describe, financial leverage can dramatically alter the payoffs to shareholders in the firm. &emarkably, however, financial leverage may not affect the overall cost of capital. -f this is true, then a firm?s capital structure is irrelevant because changes in capital structure won?t affect the value of the firm. T8E I9PACT -F FINANCIAL LEVERA.E "e start by illustrating how financial leverage works. >or now, we ignore the impact of ta es. (lso, for ease of presentation, we describe the impact of leverage in terms of its effects on earnings per share, '$,, and return on equity, &0'. These are, of course, accounting numbers and, as such, are not our primary concern. Msing cash flows instead of these accounting numbers would lead to precisely the same conclusions, but a little more work would be needed. TABLE B5: Current and proposed capital structures for the Trans Am Corporation

F#n n&# ! L"(") +"0 EPS0 n% R-E/ An E$ m,!" The Trans (m Corporation currently has no debt in its capital structure. The C>0, Ms. Morris, is considering a restructuring that would involve issuing debt and using the proceeds to buy back some of the outstanding equity. Table above presents both the current and proposed capital structures. (s shown, the firm?s assets have a market value of 51 million, and there are 677,777 shares outstanding. Because Trans (m is an all-equity firm, the price per share is 537. The proposed debt issue would raise 56 million@ the interest rate would be 27 percent. ,ince the stock sells for 537 per share, the 56 million in new debt would be used to purchase 56

"

million;37 9 377,777 shares, leaving 377,777 outstanding. (fter the restructuring, Trans (m would have a capital structure that was 47 percent debt, so the debt-equity ratio would be 2. #otice that, for now, we assume that the stock price will remain at 537. To investigate the impact of the proposed restructuring, Ms. Morris has prepared Table below, which compares the firm?s current capital structure to the proposed capital structure under three scenarios. The scenarios reflect different assumptions about the firm?s 'B-T. Mnder the e pected scenario, the 'B-T is 52 million. -n the recession scenario, 'B-T falls to 5477,777. -n the e pansion scenario, it rises to 52.4 million. To illustrate some of the calculations in Table below, consider the e pansion case. 'B-T is 52.4 million. "ith no debt Gthe current capital structureH and no ta es, net income is also 52.4 million. -n this case, there are 677,777 shares worth 51 million total. '$, is therefore 52.4 million;677,777 9 5<.:4 per share. (lso, since accounting return on equity, &0', is net income divided by total equity, &0' is 52.4 million;1 million 9 21.:4N. "ith 56 million in debt Gthe proposed capital structureH, things are somewhat different. ,ince the interest rate is 27 percent, the interest bill is 5677,777. "ith 'B-T of 52.4 million, interest of 5677,777, and no ta es, net income is 52.2 million. #ow there are only 377,777 shares worth 56 million total. '$, is therefore 52.2 million;377,777 9 54.4 per share versus the 5<.:4 per share that we calculated above. >urthermore, &0' is 52.2 million;6 million 9 3:.4N. This is well above the 21.:4 percent we calculated for the current capital structure. EPS (")sus EBIT The impact of leverage is evident in Table below when the effect of the restructuring on '$, and &0' is e amined. -n particular, the variability in both '$, and &0' is much larger under the proposed capital structure. This illustrates how financial leverage acts to magnify gains and losses to shareholders. -n >igure below, we take a closer look at the effect of the proposed restructuring. This figure plots earnings per share, '$,, against earnings before interest and ta es, 'B-T, for the current and proposed capital structures. The first line, labeled O#o debt,P represents the case of no leverage. This line begins at the origin, indicating that '$, would be /ero if 'B-T were /ero. >rom there, every 5677,777 increase in 'B-T increases '$, by 52 Gbecause there are 677,777 shares outstandingH.

TABLE Capital structure scenarios for the Trans Am Corporation

The second line represents the proposed capital structure. Here, '$, is negative if 'B-T is /ero. This follows because 5677,777 of interest must be paid regardless of the firm?s profits. ,ince there are 377,777 shares in this case, the '$, is 853 per share as shown. ,imilarly, if 'B-T were 5677,777, '$, would be e actly /ero. The important thing to notice in >igure is that the slope of the line in this second case is steeper. -n fact, for every 5677,777 increase in 'B-T, '$, rises by 53, so the line is twice as steep. This tells us that '$, is twice as sensitive to changes in 'B-T because of the financial leverage employed. (nother observation to make in >igure is that the lines intersect. (t that point, '$, is e actly the same for both capital structures. To find this point, note that '$, is equal to 'B-T;677,777 in the no-debt case. -n the with-debt case, '$, is G'B-T 8 5677,777H;377,777. -f we set these equal to each other, 'B-T is. 'B-T;677,777 9 G'B-T 8 5677,777H;377,777 'B-T 93 Q G'B-T 8 5677,777H 'B-T 9 5177,777

1$

"hen 'B-T is 5177,777, '$, is 53 per share under either capital structure. This is labeled as the break-even point in >igure@ we could also call it the indifference point. -f 'B-T is above this level, leverage is beneficial@ if it is below this point, it is not. There is another, more intuitive, way of seeing why the break-even point is 5177,777. #otice that, if the firm has no debt and its 'B-T is 5177,777, its net income is also 5177,777. -n this case, the &0' is 5177,777;1,777,777 9 27N. This is precisely the same as the interest rate on the debt, so the firm earns a return that is !ust sufficient to pay the interest. E;A9PLE/ BREAK-EVEN EBIT The M$K Corporation has decided in favor of a capital restructuring. Currently, M$K uses no debt financing. >ollowing the restructuring, however, debt will be 52 million. FI.'RE Financial leverage: EPS and EBIT for the Trans Am Corporation

11

The interest rate on the debt will be I percent. M$K currently has 377,777 shares outstanding, and the price per share is 537. -f the restructuring is e pected to increase '$,, what is the minimum level for 'B-T that M$K?s management must be e pectingA -gnore ta es in answering. To answer, we calculate the break-even 'B-T. (t any 'B-T above this the increased financial leverage will increase '$,, so this will tell us the minimum level for 'B-T. Mnder the old capital structure, '$, is simply 'B-T;377,777. Mnder the new capital structure, the interest e pense will be 52 million Q .7I 9 5I7,777. >urthermore, with the 52 million proceeds, M$K will repurchase 52 million;37 9 47,777 shares of stock, leaving 247,777 outstanding. '$, is thus G'B-T 8 5I7,777H;247,777. #ow that we know how to calculate '$, under both scenarios, we set them equal to each other and solve for the break-even 'B-T. 'B-T;377,777 9 G'B-T 8 5I7,777H;247,777 'B-T 9G6;<H Q G'B-T 8 5I7,777H 'B-T 9 5<=7,777 %erify that, in either case, '$, is 52.17 when 'B-T is 5<=7,777. Management at M$K is apparently of the opinion that '$, will e ceed 52.17.

12

You might also like

- Abdullah Bin Baj (Rah) PDFDocument5 pagesAbdullah Bin Baj (Rah) PDFAsadur Rahman0% (1)

- Ihsan Elahi Jahir (Rah)Document28 pagesIhsan Elahi Jahir (Rah)Asadur RahmanNo ratings yet

- SunaneIbnNasaiSharif Part-04 PDFDocument712 pagesSunaneIbnNasaiSharif Part-04 PDFAsadur RahmanNo ratings yet

- Sunan An-Nasa'i Sharif (Part 01) PDFDocument398 pagesSunan An-Nasa'i Sharif (Part 01) PDFAsadur RahmanNo ratings yet

- Smart Resume For Sales PositionDocument2 pagesSmart Resume For Sales PositionAsadur RahmanNo ratings yet

- CV Format BDDocument11 pagesCV Format BDAsadur Rahman64% (111)

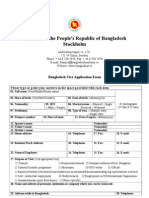

- Embassy of The People's Republic of Bangladesh Stockholm: Bangladesh Visa Application FormDocument3 pagesEmbassy of The People's Republic of Bangladesh Stockholm: Bangladesh Visa Application FormAsadur RahmanNo ratings yet

- MNC BangladeshDocument11 pagesMNC BangladeshAsadur RahmanNo ratings yet

- Upcoming HotelDocument5 pagesUpcoming HotelAsadur RahmanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Randomization List H2B de (M A W)Document25 pagesRandomization List H2B de (M A W)Elaine SantosNo ratings yet

- CIPS Level 4 - Diploma in Procurement and Supply Module 1 - Scope and Influence of Procurement and SupplyDocument4 pagesCIPS Level 4 - Diploma in Procurement and Supply Module 1 - Scope and Influence of Procurement and SupplyJalal Quteineh100% (1)

- (Pro-Forma) : WHEREAS, The RE Developer Is Authorized To Proceed To The Development Stage of Its RenewableDocument13 pages(Pro-Forma) : WHEREAS, The RE Developer Is Authorized To Proceed To The Development Stage of Its RenewableJoy AlamedaNo ratings yet

- Carga Suspensiones PDFDocument82 pagesCarga Suspensiones PDFmarioNo ratings yet

- CNS04 Columbia LL PDFDocument10 pagesCNS04 Columbia LL PDFGabriel CurtosiNo ratings yet

- MSDS Temprid SC365,4 - EngDocument10 pagesMSDS Temprid SC365,4 - EngArman AsnanNo ratings yet

- Hydraulic Cylinder - Mill TypeDocument28 pagesHydraulic Cylinder - Mill TypeLe Van TamNo ratings yet

- 2015-2-JOHOR-SMKdatoAMARmuar - MATHS QADocument10 pages2015-2-JOHOR-SMKdatoAMARmuar - MATHS QAXue Yi LamNo ratings yet

- 1.2 Working With Vectors: Question PaperDocument7 pages1.2 Working With Vectors: Question PaperMohamed AlsanNo ratings yet

- N304DN/15 JUL/RBR-TBT: - Not For Real World NavigationDocument21 pagesN304DN/15 JUL/RBR-TBT: - Not For Real World NavigationFrancisco FortesNo ratings yet

- Chinese Characters Confirm Christian Concept (Revised)Document6 pagesChinese Characters Confirm Christian Concept (Revised)Sammy Lee100% (1)

- Annex 8Document91 pagesAnnex 8senthil_suruliNo ratings yet

- 0.6 - 1 KV MICA-XLPE-LSHF CAT A MC Rev.02Document19 pages0.6 - 1 KV MICA-XLPE-LSHF CAT A MC Rev.02Supakanit LimsowanNo ratings yet

- Worksheet Unit 1 Health Problems 6th Grade 2022Document8 pagesWorksheet Unit 1 Health Problems 6th Grade 2022amandaNo ratings yet

- The Vocabulary of Analytical Chemistry: Chapter OverviewDocument22 pagesThe Vocabulary of Analytical Chemistry: Chapter OverviewAwash TinsaeNo ratings yet

- Hannah SchizopreniaDocument5 pagesHannah SchizopreniaEliezah RodriguezNo ratings yet

- Philippine Navy Enlisted Rating Structure: Military Science (Ms-2)Document10 pagesPhilippine Navy Enlisted Rating Structure: Military Science (Ms-2)Kristine AquitNo ratings yet

- Smart Cities - A Case Study in Waste Monitoring and ManagementDocument10 pagesSmart Cities - A Case Study in Waste Monitoring and Managementfaris100% (1)

- 2.1 Pre Lab Stage 2019Document61 pages2.1 Pre Lab Stage 2019Mohd Hilmi Bin MalekNo ratings yet

- DKC Spoilers Arc 1 PDFDocument139 pagesDKC Spoilers Arc 1 PDFdysry100% (4)

- CHEMISTRY Edexcel (9-1) Student Book Answers: Download NowDocument1 pageCHEMISTRY Edexcel (9-1) Student Book Answers: Download NowTiannaNo ratings yet

- Chapter 12 - Measuring Performance in OperationsDocument23 pagesChapter 12 - Measuring Performance in OperationsHAN LIEU GIANo ratings yet

- GROUP 4 - Theravada PDFDocument23 pagesGROUP 4 - Theravada PDFMarcus CaraigNo ratings yet

- CMCA Case ScenarioDocument3 pagesCMCA Case ScenarioPatricia DoNo ratings yet

- Lect 6.3 PDFDocument8 pagesLect 6.3 PDFHorlar YeankahNo ratings yet

- The Western Desert Versus Nile Delta A C PDFDocument17 pagesThe Western Desert Versus Nile Delta A C PDFSohini ChatterjeeNo ratings yet

- Marketing Midterm - Mohamed Serageldin - PEPSIDocument14 pagesMarketing Midterm - Mohamed Serageldin - PEPSIHossam SamyNo ratings yet

- HLR 7965A: Hydraulic Interface ValveDocument2 pagesHLR 7965A: Hydraulic Interface ValveMalique AdamNo ratings yet

- A3233q48 140313 V01 enDocument15 pagesA3233q48 140313 V01 enfreezsoli4576No ratings yet

- Krezo 2016 Field Investigation and Parametric Study of Greenhouse GasDocument14 pagesKrezo 2016 Field Investigation and Parametric Study of Greenhouse GasAbhiram shuklaNo ratings yet