Professional Documents

Culture Documents

Liverage Brigham Case Solution

Uploaded by

Shahid Mehmood100%(1)100% found this document useful (1 vote)

3K views8 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

3K views8 pagesLiverage Brigham Case Solution

Uploaded by

Shahid MehmoodCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 8

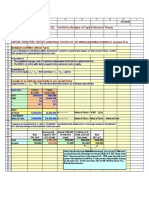

A B C D E F G H I

1 ffm13-ic-model 10/21/2009 5:37 2/10/2003

2

3 Chapter 13. Integrated Case Model

4

5 Assume that you have just been hired as business manager of Campus Deli (CD), which is located adjacent to the campus.

6 Sales were $1,100,000 last year; variable costs were 60 percent of sales; and fixed costs were $40,000. Therefore, EBIT

7 totaled $400,000. Because the university's enrollment is capped, EBIT is expected to be constant over time. Since no

8 expansion capital is required, CD pays out all earnings as dividends. Assets are $2 million, and 80,000 shares are

9 outstanding. The management group owns about 50 percent of the stock, which is traded in the over-the-counter market.

10

11 CD currently has no debt - it is an all-equity firm - and its 80,000 shares outstanding sell at a price of $25 per share, which

12 is also the book value. The firm's federal-plus-state tax rate is 40 percent. On the basis of statements made in your finance

13 text, you believe that CD's shareholders would be better off if some debt financing were used. When you suggested this to

14 your new boss, she encouraged you to pursue the idea, but to provide support for the suggestion.

15

16 In today's market, the risk-free rate, krf , is 6 percent and the market risk premium, kM - kRF , is 6 percent. CD's unlevered

17 beta, βu , is 1.0. Since CD currently has no debt, its cost of equity (and WACC) is 12 percent.

18

19 If the firm were recapitalized, debt would be issued, and the borrowed funds would be used to repurchase stock.

20 Stockholders, in turn, would use funds provided by the repurchase to buy equities in other fast-food companies similar to

21 CD. You plan to complete your report by asking and then answering the following questions.

22

23

24 INPUT DATA (for Campus Deli)

25 Sales (last year) $1,100,000

26 Variable costs as a % of sales 60%

27 Fixed costs $40,000

28 Total Assets $2,000,000

29 Shares Outstanding 80,000

30 Current Stock Price $25

31 BVPS $25

32 Tax rate 40%

33 k RF 6%

34 k M - k RF 6%

35 βu 1.0

36 WACC = ks 12%

37

38

39 PART A

40 (1) What is business risk? What factors influence a firm’s business risk?

41

42 Business risk is the riskiness inherent in the firm’s operations if it uses no debt. A firm’s business risk is affected by

43 many factors, including these:

44

45 (1) variability in the demand for its output,

46 (2) variability in the price at which its output can be sold,

47 (3) variability in the prices of its inputs,

48 (4) the firm’s ability to adjust output prices as input prices change,

49 (5) the amount of operating leverage used by the firm, and

50 (6) special risk factors (such as potential product liability for a drug company or the potential cost of a nuclear

51 accident for a utility with nuclear plants).

52

53 (2) What is operating leverage, and how does it affect a firm’s business risk?

54

55 Operating leverage is the extent to which fixed costs are used in a firm’s operations. If a high percentage of the firm’s total

56 costs are fixed, and hence do not decline when demand falls, then the firm is said to have high operating leverage. Other

57 things held constant, the greater a firm’s operating leverage, the greater its business risk.

A B C D E F G H I

58

59

60 PART B

61 (1) What is meant by the terms “financial leverage” and “financial risk”?

62

63 Financial leverage refers to the firm’s decision to finance with fixed-charge securities, such as debt and preferred stock.

64 Financial risk is the additional risk, over and above the company’s inherent business risk, borne by the stockholders as a

65 result of the firm’s decision to finance with debt.

66

67 (2) How does financial risk differ from business risk?

68

69 As we discussed above, business risk depends on a number of factors such as sales and cost variability, and operating

70 leverage. Financial risk, on the other hand, depends on only one factor--the amount of fixed-charge capital the company uses.

71

72

73 PART C

74 Now, to develop an example which can be presented to CD’s management as an illustration, consider two hypothetical firms,

75 Firm U, with zero debt financing, and Firm L, with $10,000 of 12 percent debt. Both firms have $20,000 in total assets and

76 a 40 percent federal-plus-state tax rate, and they have the following EBIT probability distribution for next year:

77

78 Probability EBIT

79 0.25 $2,000

80 0.50 $3,000

81 0.25 $4,000

82

83 (1) Complete the partial income statements and the firms' ratios in Table IC13-1.

84

85 INPUT DATA (for Firms U and L)

86 Total Assets for both firms $20,000

87 Tax rate for both firms 40%

88 Debt ratio for Firm U 0%

89 Debt ratio for Firm L 50%

90 Cost of debt for Firm L 12%

91

92 TABLE IC13-1. INCOME STATEMENTS AND RATIOS

93

94 FIRM U FIRM L

95 ASSETS $20,000 $20,000 $20,000 $20,000 $20,000 $20,000

96 EQUITY $20,000 $20,000 $20,000 $10,000 $10,000 $10,000

97 PROBABILITY 0.25 0.50 0.25 0.25 0.50 0.25

98 SALES $6,000 $9,000 $12,000 $6,000 $9,000 $12,000

99 OPER. COSTS 4,000 6,000 8,000 4,000 6,000 8,000

100 EBIT $2,000 $3,000 $4,000 $2,000 $3,000 $4,000

101 INTEREST EXPENSE 0 0 0 1,200 1,200 1,200

102 EBT $2,000 $3,000 $4,000 $800 $1,800 $2,800

103 TAXES (40%) 800 1,200 1,600 320 720 1,120

104 NET INCOME $1,200 $1,800 $2,400 $480 $1,080 $1,680

105

106 BEP 10.0% 15.0% 20.0% 10.0% 15.0% 20.0%

107 ROE 6.0% 9.0% 12.0% 4.8% 10.8% 16.8%

108 TIE ∞ ∞ ∞ 1.7 2.5 3.3

109

110 E(BEP) 15.0% 15.0%

111 E(ROE) 9.0% 10.8%

112 E(TIE) ∞ 2.5

113

A B C D E F G H I

114 SD(BEP) 3.5% 3.5%

115 SD(ROE) 2.1% 4.2%

116 SD(TIE) ∞ 0.6

117

118 (2) Be prepared to discuss each entry in the table and to explain how this example illustrates the impact of financial

119 leverage on expected rate of return and risk.

120

121 Conclusions from the analysis:

122 (1) The firms' basic earning power, BEP = EBIT / Total Assets, is unaffected by financial leverage.

123 (2) Firm L has the higher expected ROE:

124 E(ROEU) = 0.25(6.0%) + 0.50(9.0%) + 0.25(12.0%) = 9.0%.

125 E(ROEL) = 0.25(4.8%) + 0.50(10.8%) + 0.25(16.8%) = 10.8%.

126 Therefore, the use of financial leverage has increased the expected profitability to shareholders. Tax

127 savings cause the higher expected ROEL. (If the firm uses debt, the stock is riskier, which then causes kd

128 and ks to increase. With a higher kd, interest increases, so the interest tax savings increases.)

129 (3) Firm L has a wider range of ROEs, and a higher standard deviation of ROE, indicating that its higher

130 expected return is accompanied by higher risk. To be precise:

131 Standard Deviation of ROE (unlevered) = 2.12%, and CV = 0.24.

132 Standard Deviation of ROE (levered) = 4.24%, and CV = 0.39.

133 Thus, in a stand-alone risk sense, firm L is twice as risky as firm U--its business risk is 2.12 percent, but

134 its stand-alone risk is 4.24 percent, so its financial risk is 4.24% - 2.12% = 2.12%.

135 (4) When EBIT = $2,000, ROEU > ROEL, and leverage has a negative impact on profitability. However, at the

136 expected level of EBIT, ROEL > ROEU.

137 (5) Leverage will always boost expected ROE if the expected unlevered ROA exceeds the after-tax cost of debt.

138 Here E (ROA) = E (unlevered ROE) = 9.0% > kd(1 - t) = 12%(0.6) = 7.2%, so the use of debt raises

139 expected ROE.

140 (6) Finally, note that the TIE ratio is huge (undefined, or infinitely large) if no debt is used, but it is relatively

141 low if 50 percent debt is used. The expected TIE would be larger than 2.5x if less debt were used, but

142 smaller if leverage were increased.

143

144

145 PART D

146 After speaking with a local investment banker, you obtain the following estimates of the cost of debt at different debt levels :

147

148 Amount D/A D/E Bond B-T

149 Borrowed Ratio Ratio Rating kd

150 $0 0.0000 0.0000 -- --

151 $250,000 0.1250 0.1429 AA 8.0%

152 $500,000 0.2500 0.3333 AA 9.0%

153 $750,000 0.3750 0.6000 BBB 11.5%

154 $1,000,000 0.5000 1.0000 BB 14.0%

155

156 Now consider the optimal capital structure for CD.

157 (1) To begin, define the terms “optimal capital structure” and “target capital structure.”

158

159 The optimal capital structure is the capital structure at which the tax-related benefits of leverage are exactly offset by debt’s

160 risk-related costs. At the optimal capital structure, (1) the total value of the firm is maximized, (2) the WACC is minimized, and

161 the price per share is maximized. The target capital structure is the mix of debt, preferred stock, and common equity with

162 which the firm plans to raise capital.

163

A B C D E F G H I

164 (2) Why does CD’s bond rating and cost of debt depend on the amount of money borrowed?

165

166 Financial risk is the additional risk placed on the common stockholders as a result of the decision to finance with debt.

167 Conceptually, stockholders face a certain amount of risk that is inherent in a firm’s operations. If a firm uses debt (financial

168 leverage), this concentrates the business risk on common stockholders. Financing with debt increases the expected rate of

169 return for an investment, but leverage also increases the probability of a large loss, thus increasing the risk borne by

170 stockholders. As the amount of money borrowed increases, the firm increases its risk so the firm’s bond rating decreases

171 and its cost of debt increases.

172

173 (3) Assume that shares could be repurchased at the current market price of $25 per share. Calculate CD’s expected EPS

174 and TIE at debt levels of $0, $250,000, $500,000, $750,000, and $1,000,000. How many shares would remain after

175 recapitalization under each scenario?

176

177 The analysis for the debt levels being considered (in thousands of dollars and shares) is shown below:

178

179 First, we will need to calculate CD's EBIT, from the data input section at the top of the model.

180 EBIT $400,000

181

182 At D = $0

183

184 [ EBIT - k d (D) ] (1-T) [ $400,000 - 0.00($0) ] ( 1- 0.4 )

EPS = = = $3.00

185 Shares outstanding 80,000

186

187 EBIT $400,000

TIE = = = #VALUE!

188 Interest exp. #VALUE!

189

190 At D = $250,000

191

192 Shares repurchased = $250,000 / $25 = 10,000

193

194 Remaining shares outstanding = 80,000 - 10,000 = 70,000

195

196 [ EBIT - k d (D) ] (1-T) [ $400,000 - 0.08($250,000) ] ( 1- 0.4 )

EPS = = = $3.26

197 Shares outstanding 70,000

198

199 EBIT $400,000

TIE = = = 20.00

200 Interest exp. $20,000

201

202 At D = $500,000

203

204 Shares repurchased = $500,000 / $25 = 20,000

205

206 Remaining shares outstanding = 80,000 - 20,000 = 60,000

207

208 [ EBIT - k d (D) ] (1-T) [ $400,000 - 0.09($500,000) ] ( 1- 0.4 )

EPS = = = $3.55

209 Shares outstanding 60,000

210

211 EBIT $400,000

TIE = = = 8.89

212 Interest exp. $45,000

213

A B C D E F G H I

214 At D = $750,000

215

216 Shares repurchased = $750,000 / $25 = 30,000

217

218 Remaining shares outstanding = 80,000 - 30,000 = 50,000

219

220 [ EBIT - k d (D) ] (1-T) [ $400,000 - 0.115($750,000) ] ( 1- 0.4 )

EPS = = = $3.77

221 Shares outstanding 50,000

222

223 EBIT $400,000

TIE = = = 4.64

224 Interest exp. $86,250

225

226 At D = $1,000,000

227

228 Shares repurchased = $1,000,000 / $25 = 40,000

229

230 Remaining shares outstanding = 80,000 - 40,000 = 40,000

231

232 [ EBIT - k d (D) ] (1-T) [ $400,000 - 0.14($1,000,000) ] ( 1- 0.4 )

EPS = = = $3.90

233 Shares outstanding 40,000

234

235 EBIT $400,000

TIE = = = 2.86

236 Interest exp. $140,000

237

238

239 (4) Using the Hamada equation, what is the cost of equity if CD recapitalizes with $250,000 of debt? $500,000? $750,000?

240 $1,000,000?

241

242 At this point, we have referenced the applicable data from the input data section that was displayed at the beginning of the model. We

243 do this, so we can see all of the inputs and outputs at once.

244

245 k RF 6.0%

246 k M - kRF 6.0%

247 βu 1.0

248 Total Assets $2,000,000

249 Tax rate 40%

250

251 From this data, we shall construct a table that calculates the cost of equity at various debt levels. Our table shall consist of five

252 columns. We will include the amount of debt assumed, the debt-to-assets ratio, the debt-to-equity ratio, the appropriate leveraged beta,

253 and the corresponding cost of equity.

254

255 Amount D/A D/E Leveraged Cost of equity

256 Borrowed Ratio Ratio Beta ks

257 $0 0.0000 0.0000 1.00 12.00%

258 $250,000 0.1250 0.1429 1.09 12.51%

259 $500,000 0.2500 0.3333 1.20 13.20%

260 $750,000 0.3750 0.6000 1.36 14.16%

261 $1,000,000 0.5000 1.0000 1.60 15.60%

262

263 The costs of equity at the different debt levels are accented in the final column of the table.

264

A B C D E F G H I

265 (5) Considering only the levels of debt discussed, what is the capital structure that minimizes CD’s WACC?

266

267 We can extend our previous table to incorporate the cost of debt information ascertained above. Together, we can calculate the

268 WACC.

269

270 Amount D/A E/A D/E Leveraged Cost of equity B-T A-T

271 Borrowed Ratio Ratio Ratio Beta ks kd k d ( 1-T ) WACC

272 $0 0.00% 100.00% 0.00% 1.00 12.00% -- -- 12.00%

273 $250,000 12.50% 87.50% 14.29% 1.09 12.51% 8.0% 4.80% 11.55%

274 $500,000 25.00% 75.00% 33.33% 1.20 13.20% 9.0% 5.40% 11.25%

275 $750,000 37.50% 62.50% 60.00% 1.36 14.16% 11.5% 6.90% 11.44%

276 $1,000,000 50.00% 50.00% 100.00% 1.60 15.60% 14.0% 8.40% 12.00%

277

278 The capital structure which yields the lowest WACC is accented in the table.

279

280 (6) What would be the new stock price if CD recapitalizes with $250,000 of debt? $500,000? $750,000? $1,000,000? Recall that

281 the payout ratio is 100 percent, so g = 0.

282

283 We can calculate the price of a constant growth stock as DPS divided by ks minus g, where g is the expected growth rate in dividends:

284 P0 = D1/(ks - g). Since in this case all earnings are paid out to the stockholders, DPS = EPS. Further, because no earnings are

285 plowed back, the firm's EBIT, is not expected to grow, so g = 0.

286

287 Amount Dividends Cost of equity Stock

288 Borrowed per share ks price

289 $0 $3.00 12.00% $25.00

290 $250,000 $3.26 12.51% $26.03

291 $500,000 $3.55 13.20% $26.89

292 $750,000 $3.77 14.16% $26.59

293 $1,000,000 $3.90 15.60% $25.00

294

295 The capital structure which yields the greatest stock price is accented in the table.

296

297 (7) Is EPS maximized at the debt level which maximizes share price? Why or why not?

298

299 We have seen that EPS continues to increase beyond the $500,000 optimal level of debt. Therefore, focusing on EPS when making

300 capital structure decisions is not correct--while the EPS does take account of the differential cost of debt, it does not account for the

301 increasing risk that must be borne by the equity holders.

302

303 (8) Considering only the levels of debt discussed, what is CD’s optimal capital structure?

304

305 A capital structure with $500,000 of debt produces the highest stock price, $26.89; hence, it is the best of those considered.

306

307 (9) What is the WACC at the optimal capital structure?

308

309 Looking at the chart above, we can see that the WACC at the optimal capital structure is 11.25%. Notice, that the capital structure

310 which minimizes WACC also maximizes stock price.

311

312 Note: If we had (1) used the equilibrium price for repurchasing shares and (2) used market value weights to calculate WACC, then we

313 could be sure that the WACC at the price-maximizing capital structure would be the minimum. Using a constant $25 purchase price,

314 and book value weights, inconsistencies may creep in.

315

316

A B C D E F G H I

317 PART E

318 Suppose you discovered that CD had more business risk than you originally estimated. Describe how this would affect the analysis.

319 What if the firm had less business risk than originally estimated?

320

321 If the firm had higher business risk, then, at any debt level, its probability of financial distress would be higher. Investors would

322 recognize this, and both kd and ks would be higher than originally estimated. It is not shown in this analysis, but the end result would

323 be an optimal capital structure with less debt. Conversely, lower business risk would lead to an optimal capital structure that included

324 more debt.

325

326

327 PART F

328 What are some factors a manager should consider when establishing his or her firm’s target capital structure?

329

330 Since it is difficult to quantify the capital structure decision, managers consider the following judgmental factors when making

331 capital structure decisions:

332

333 (1) The average debt ratio for firms in their industry.

334 (2) Pro forma tie ratios at different capital structures under different scenarios.

335 (3) Lender/rating agency attitudes.

336 (4) Reserve borrowing capacity.

337 (5) Effects of financing on control.

338 (6) Asset structure.

339 (7) Expected tax rate.

340

341

342 PART G

343 Put labels on Figure IC 13-1, and then discuss the graph as you might use it to explain to your boss why CD might want to use some

344 debt.

345

346 Value

347 of

348 Stock

349 MM result

350

351

352

353 Actual

354

355

356 No leverage

357

358 D/A

0 D1 D2

359

360

361 The use of debt permits a firm to obtain tax savings from the deductibility of interest. So the use of some debt is good; however, the

362 possibility of bankruptcy increases the cost of using debt. At higher and higher levels of debt, the risk of bankruptcy increases,

363 bringing with it costs associated with potential financial distress. Customers reduce purchases, key employees leave, and so on.

364 There is some point, generally well below a debt ratio of 100 percent, at which problems associated with potential bankruptcy more

365 than offset the tax savings from debt.

366

367 Theoretically, the optimal capital structure is found at the point where the marginal tax savings just equal the marginal bankruptcy-

368 related costs. However, analysts cannot identify this point with precision for any given firm, or for firms in general. Analysts can

369 help managers determine an optimal range for their firm’s debt ratios, but the capital structure decision is still more judgmental than

370 based on precise calculations.

371

A B C D E F G H I

372

373 PART H

374 How does the existence of asymmetric information and signaling affect capital structure?

375

376 The asymmetric information concept is based on the premise that management’s choice of financing gives signals to investors.

377 Firms with good investment opportunities will not want to share the benefits with new stockholders, so they will tend to finance with

378 debt. Firms with poor prospects, on the other hand, will want to finance with stock. Investors know this, so when a large, mature firm

379 announces a stock offering, investors take this as a signal of bad news, and the stock price declines. Firms know this, so they try

380 to avoid having to sell new common stock. This means maintaining a reserve of borrowing capacity so that when good investments

381 come along, they can be financed with debt.

382

383

384

385

386

You might also like

- Dupont AnalysisDocument5 pagesDupont AnalysisNoraminah IsmailNo ratings yet

- FIM Anthony CH End Solution PDFDocument287 pagesFIM Anthony CH End Solution PDFMosarraf Rased50% (6)

- Capital BudgetingDocument7 pagesCapital BudgetingnurmazkiyaniNo ratings yet

- Multiple Choice Questions: Financial Statements and AnalysisDocument29 pagesMultiple Choice Questions: Financial Statements and AnalysisHarvey PeraltaNo ratings yet

- Chapter 24 - AnswerDocument12 pagesChapter 24 - AnswerAgentSkySkyNo ratings yet

- The Dilemma at Day 21Document4 pagesThe Dilemma at Day 21Christian AndreNo ratings yet

- Question and Answer - 24Document30 pagesQuestion and Answer - 24acc-expertNo ratings yet

- Leslie Fay Case Study Red FlagsDocument5 pagesLeslie Fay Case Study Red FlagsMhelka TiodiancoNo ratings yet

- Chapter 12, Problem 29C: Sell or Process Further DecisionDocument5 pagesChapter 12, Problem 29C: Sell or Process Further DecisionMaritza Aulia ShakiraniNo ratings yet

- ProformaDocument4 pagesProformadevanmadeNo ratings yet

- Example of Investment Analysis Paper PDFDocument24 pagesExample of Investment Analysis Paper PDFYoga Nurrahman AchfahaniNo ratings yet

- 4partnership DissolutionEDITED OnlineDocument15 pages4partnership DissolutionEDITED OnlinePaul BandolaNo ratings yet

- Advanced audit threats and controlsDocument8 pagesAdvanced audit threats and controlsKafonyi JohnNo ratings yet

- CR Par Value PC $ 1,000 $ 40: 25 SharesDocument4 pagesCR Par Value PC $ 1,000 $ 40: 25 SharesBought By UsNo ratings yet

- Accounting Chapter 10 Solutions GuideDocument56 pagesAccounting Chapter 10 Solutions GuidemeaningbehindclosedNo ratings yet

- Accounting Case AnalysisDocument11 pagesAccounting Case Analysissuresh sivadasan0% (1)

- AMG&Forsythe CaseDocument14 pagesAMG&Forsythe CaseSaumitra NandaNo ratings yet

- Calculate Equilibrium Stock Price with Declining EarningsDocument12 pagesCalculate Equilibrium Stock Price with Declining EarningsJenelle ReyesNo ratings yet

- Revision Questions - Q&ADocument3 pagesRevision Questions - Q&Arosario correiaNo ratings yet

- Role of Financial Management in OrganizationDocument8 pagesRole of Financial Management in OrganizationTasbeha SalehjeeNo ratings yet

- Question Cpa-00102: Becker Professional Education Registered To: Dominique DantonioDocument111 pagesQuestion Cpa-00102: Becker Professional Education Registered To: Dominique DantonioNhel Alvaro100% (1)

- CVP AnalysisDocument7 pagesCVP AnalysisKat Lontok0% (1)

- Chapter 7 Materials Controlling and CostingDocument43 pagesChapter 7 Materials Controlling and CostingNabiha Awan100% (1)

- Complete C7Document15 pagesComplete C7tai nguyenNo ratings yet

- Problem 1. Estimating Hugo Boss' Equity Value (Updated 1-2011)Document4 pagesProblem 1. Estimating Hugo Boss' Equity Value (Updated 1-2011)Walm KetyNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Look Before Leveraging ExpansionDocument17 pagesLook Before Leveraging ExpansionBunbun 221No ratings yet

- Gitman CH 14 15 QnsDocument3 pagesGitman CH 14 15 QnsFrancisCop100% (1)

- Problem 13-1 - Chapter 13 - SolutionDocument6 pagesProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- Bob's Dilemma: Should Symonds Electronic Raise Capital Through Debt or EquityDocument7 pagesBob's Dilemma: Should Symonds Electronic Raise Capital Through Debt or EquityRaffin AdarshNo ratings yet

- Chapter 19Document34 pagesChapter 19chinyNo ratings yet

- Finance Chapter 15Document34 pagesFinance Chapter 15courtdubs100% (1)

- TVM Activity 4 SolutionsDocument2 pagesTVM Activity 4 SolutionsAstrid BuenacosaNo ratings yet

- Gitman Ch09 01 StudentDocument42 pagesGitman Ch09 01 StudentFatima AdamNo ratings yet

- Chapter 3 Problems AnswersDocument11 pagesChapter 3 Problems AnswersOyunboldEnkhzayaNo ratings yet

- New Microsoft Word DocumentDocument10 pagesNew Microsoft Word DocumentMashud RiadNo ratings yet

- Ventura, Mary Mickaella R - Chapter8p.256-258Document3 pagesVentura, Mary Mickaella R - Chapter8p.256-258Mary VenturaNo ratings yet

- Multiple Choice Questions: Chapter 8 Consolidations - Changes in Ownership InterestsDocument36 pagesMultiple Choice Questions: Chapter 8 Consolidations - Changes in Ownership InterestsHamza JalalNo ratings yet

- Test Bank For Auditing A Risk Based Approach 11th Edition by Karla M Johnstone Zehms PDFDocument78 pagesTest Bank For Auditing A Risk Based Approach 11th Edition by Karla M Johnstone Zehms PDFAnthony Koko CarlobosNo ratings yet

- Case 03Document9 pagesCase 03Sajieda FuadNo ratings yet

- Hilton 2222Document70 pagesHilton 2222Dianne Garcia RicamaraNo ratings yet

- The Impact of Client Intimidation On Auditor Independence in An Audit Conflict SituationDocument26 pagesThe Impact of Client Intimidation On Auditor Independence in An Audit Conflict SituationblakukakNo ratings yet

- Can One Size Fit All?Document21 pagesCan One Size Fit All?Abhimanyu ChoudharyNo ratings yet

- Homework CH 3Document12 pagesHomework CH 3LNo ratings yet

- Solution Manual For Advanced Accounting 4th Edition Jeter, ChaneyDocument7 pagesSolution Manual For Advanced Accounting 4th Edition Jeter, ChaneyAlif Nurjanah0% (2)

- Case Study #3Document5 pagesCase Study #3Jenny OjoylanNo ratings yet

- Chap6 PDFDocument46 pagesChap6 PDFعبدالله ماجد المطارنهNo ratings yet

- HICOM Case Analysis: Recommendations to Improve Subsidiary PerformanceDocument5 pagesHICOM Case Analysis: Recommendations to Improve Subsidiary Performanceezra reyesNo ratings yet

- ch18, IFRS 15Document107 pagesch18, IFRS 15Bayan KttbNo ratings yet

- Case Assignment 2 (Rocky Mountain Chocolate Factory) TEMPLATEDocument10 pagesCase Assignment 2 (Rocky Mountain Chocolate Factory) TEMPLATESindhu KatireddyNo ratings yet

- Latihan Budget 20142015Document48 pagesLatihan Budget 20142015AnnaNo ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Chapter 03 Im 10th EdDocument32 pagesChapter 03 Im 10th EdAzman MendaleNo ratings yet

- Auditing Chapter 2 Part IIIDocument3 pagesAuditing Chapter 2 Part IIIRegine A. AnsongNo ratings yet

- Net Present Value and Other Investment CriteriaDocument50 pagesNet Present Value and Other Investment CriteriaQusai BassamNo ratings yet

- Auditing Theory - Solution ManualDocument21 pagesAuditing Theory - Solution ManualAj de CastroNo ratings yet

- Campus Deli Case 4Document15 pagesCampus Deli Case 4Ash RamirezNo ratings yet

- Capital Structure Theory: MM Models Analyze Effects of LeverageDocument11 pagesCapital Structure Theory: MM Models Analyze Effects of LeverageJITIN ARORANo ratings yet

- Mergers and Acquisitions Valuation TechniquesDocument6 pagesMergers and Acquisitions Valuation TechniquesAndhika Arya AratamaNo ratings yet

- SME ProjectDocument118 pagesSME ProjectShahid Mehmood100% (2)

- HR Score CardDocument11 pagesHR Score CardShahid Mehmood80% (5)

- Impact of Interest Rate On Stock Exchange Research Final (MGT-799)Document27 pagesImpact of Interest Rate On Stock Exchange Research Final (MGT-799)Shahid MehmoodNo ratings yet

- Stock Market AnalysisDocument66 pagesStock Market AnalysisShahid MehmoodNo ratings yet

- Frauds in Financial StatementsDocument73 pagesFrauds in Financial Statements✬ SHANZA MALIK ✬No ratings yet

- MCB Internship ReportDocument151 pagesMCB Internship ReportShahid Mehmood82% (11)

- Pepsi Cola Internship ReportDocument102 pagesPepsi Cola Internship ReportShahid Mehmood90% (10)

- PTC ProjectDocument31 pagesPTC ProjectShahid MehmoodNo ratings yet

- PTC Internship ReportDocument86 pagesPTC Internship ReportShahid Mehmood100% (2)

- ISE Internship ReportDocument35 pagesISE Internship ReportShahid MehmoodNo ratings yet

- NBP Internship ReportDocument142 pagesNBP Internship ReportShahid Mehmood78% (9)

- Forecasting Brigham Case SolutionDocument7 pagesForecasting Brigham Case SolutionShahid Mehmood100% (1)

- Nestle ReportDocument19 pagesNestle ReportShahid MehmoodNo ratings yet

- Mithchell's Financial AnalysisDocument55 pagesMithchell's Financial AnalysisShahid Mehmood100% (1)

- Inflation Causes in PakistanDocument71 pagesInflation Causes in PakistanShahid Mehmood100% (1)

- HR Support Function or Strategic PartnerDocument124 pagesHR Support Function or Strategic PartnerShahid MehmoodNo ratings yet

- Financial Analysis of Ogdcl and SSGCLDocument24 pagesFinancial Analysis of Ogdcl and SSGCLShahid MehmoodNo ratings yet

- Financial Ratio Analysis TemplateDocument6 pagesFinancial Ratio Analysis Template✬ SHANZA MALIK ✬No ratings yet

- Financial Analysis of Selected Textile CompaniesDocument76 pagesFinancial Analysis of Selected Textile CompaniesShahid Mehmood80% (10)

- Effect of Key Economic Variables On KSEDocument53 pagesEffect of Key Economic Variables On KSEShahid MehmoodNo ratings yet

- HBL ReportDocument63 pagesHBL ReportShahid Mehmood100% (6)

- Financial Planning and Forecasting Brigham SolutionDocument29 pagesFinancial Planning and Forecasting Brigham SolutionShahid Mehmood100% (6)

- Cost of Capital Brigham Case SolutionDocument7 pagesCost of Capital Brigham Case SolutionShahid Mehmood100% (13)

- Commercial Banking ServiceDocument56 pagesCommercial Banking ServiceShahid Mehmood100% (1)

- Cash Flow Estimation Brigham Case SolutionDocument8 pagesCash Flow Estimation Brigham Case SolutionShahid MehmoodNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Car Lease and Customer PreferenceDocument86 pagesCar Lease and Customer PreferenceShahid MehmoodNo ratings yet

- Capital Market ReformsDocument150 pagesCapital Market ReformsShahid Mehmood100% (1)

- Capital Structure and Liverge Bigham SoltutionDocument15 pagesCapital Structure and Liverge Bigham SoltutionShahid MehmoodNo ratings yet

- Working Report 2022 30 June English Single Page Artwork Low ResDocument36 pagesWorking Report 2022 30 June English Single Page Artwork Low ResAparajita RB SinghNo ratings yet

- NeerajDocument2 pagesNeerajSheelu SinghNo ratings yet

- Nikhil Equitas StatementDocument2 pagesNikhil Equitas Statementprem yadav100% (1)

- Banking Enquiry: Payment Cards and Interchange Fee HearingsDocument18 pagesBanking Enquiry: Payment Cards and Interchange Fee HearingssanjayjogsNo ratings yet

- Tutorial 2 Actg Equation QDocument7 pagesTutorial 2 Actg Equation QHazim YusoffNo ratings yet

- 2017 Annual Report UpdatedDocument263 pages2017 Annual Report UpdatedPat Dela CruzNo ratings yet

- Project Number: 1: Submitted To: Prof. Dennis RagauskasDocument5 pagesProject Number: 1: Submitted To: Prof. Dennis RagauskasDilrajSinghNo ratings yet

- Chapter 11Document44 pagesChapter 11Ishita SoodNo ratings yet

- FinancialInclusion RecentInitiativesandAssessmentDocument39 pagesFinancialInclusion RecentInitiativesandAssessmentShaneel AnijwalNo ratings yet

- FINMGT 1 Final Exam Questions for BSMA StudentsDocument9 pagesFINMGT 1 Final Exam Questions for BSMA StudentsMiconNo ratings yet

- PF Withdrawal Application (Sample Copy)Document5 pagesPF Withdrawal Application (Sample Copy)Ashok Mahanta100% (1)

- MCB Bank InformationDocument26 pagesMCB Bank Informationatifatanvir1758No ratings yet

- Update Customer Account DetailsDocument1 pageUpdate Customer Account DetailsvipinNo ratings yet

- Clark ODE County Statement of AccountDocument2 pagesClark ODE County Statement of AccountShi Yuan ZhangNo ratings yet

- Global Macro Investment IdeasDocument13 pagesGlobal Macro Investment IdeasJan KaskaNo ratings yet

- ACF Project ReportDocument17 pagesACF Project Reportpranita mundraNo ratings yet

- Effect of Budgetary Control On Financial Performance of Savings and Credit Cooperative Organizations in Nairobi CountyDocument21 pagesEffect of Budgetary Control On Financial Performance of Savings and Credit Cooperative Organizations in Nairobi CountyNATASHA ATHIRA BINTI RUSLI UPMNo ratings yet

- Black Book On Direct Tax EffectDocument49 pagesBlack Book On Direct Tax Effectshiakhrustam621No ratings yet

- Financial Performance Analysis of TJSB Sahakari Bank Ltd.Document12 pagesFinancial Performance Analysis of TJSB Sahakari Bank Ltd.Yash KhairnarNo ratings yet

- The 5 C's of BankingDocument5 pagesThe 5 C's of BankingEman SultanNo ratings yet

- FINCA Microfinance Bank (FINCA MFB) : Rating ReportDocument5 pagesFINCA Microfinance Bank (FINCA MFB) : Rating ReportAmar AliNo ratings yet

- Dbppol JLMSFDocument2 pagesDbppol JLMSFNoel Chu BragatNo ratings yet

- Capital Gains Tax Questions AnsweredDocument4 pagesCapital Gains Tax Questions AnsweredRedfield GrahamNo ratings yet

- Derivatives: Forward ContractsDocument4 pagesDerivatives: Forward ContractsSAITEJA DASARINo ratings yet

- STQ1A: FORECASTING EXCHANGE RATESDocument5 pagesSTQ1A: FORECASTING EXCHANGE RATESMoud KhalfaniNo ratings yet

- EMA-RSI-MACD 15min System - ProfitF - Website For Forex, Binary Options Traders (Helpful Reviews)Document5 pagesEMA-RSI-MACD 15min System - ProfitF - Website For Forex, Binary Options Traders (Helpful Reviews)Sonarat MoulnengNo ratings yet

- Financial Advertising......... FinalDocument12 pagesFinancial Advertising......... FinalomthakerNo ratings yet

- Functional Specialization of Members of Stock ExchangeDocument14 pagesFunctional Specialization of Members of Stock ExchangeTaresh Baru100% (1)

- BootcampX Day 6Document15 pagesBootcampX Day 6Vivek LasunaNo ratings yet

- Fixed Income Fundamentals: Interest Rate CalculationsDocument167 pagesFixed Income Fundamentals: Interest Rate CalculationsRavi KumarNo ratings yet