Professional Documents

Culture Documents

BlackRock - Wikipedia, The Free Encyclopedia

Uploaded by

Fernanda FloresOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BlackRock - Wikipedia, The Free Encyclopedia

Uploaded by

Fernanda FloresCopyright:

Available Formats

BlackRock

From Wikipedia, the free encyclopedia

Not to be confused with Blackstone Group, a private equity and alternative investments firm. For other uses, see Black Rock. BlackRock, Inc. is a U.S.-headquartered multinational investment management corporation based in New York City. It was founded in 1988, initially as a risk management and fixed income institutional asset manager, and is the world's largest asset manager,[4] and a major provider of investment, advisory and risk management services. The company acquired Barclays Global Investors in December 2009. As of September 30, 2013, BlackRock had $4.096 trillion in assets under management.[5] Blackrock is a public company quoted on the New York Stock Exchange (NYSE). About 75% of its shares are owned by three financial institutions: Merrill Lynch & Co. (a subsidiary of Bank of America), PNC Financial Services Group and Barclays PLC. According to Ralph Schlosstein, CEO of Evercore Partners, a New York-based investment bank and a former BlackRock executive: BlackRock today is one of, if not the, most influential financial institutions in the world".[6] On May 8, 2009, in the wake of the global financial crisis, BlackRock was commissioned to help the U.S. government evaluate its distressed assets, and was subsequently awarded a $130 billion contract to manage these assets.[7]

BlackRock, Inc.

Type Traded as Public NYSE: BLK (http://www.nyse.com/about/listed/lcddata.html? ticker=blk) S&P 500 Component Industry Founded Investment management 1988

Headquarters New York City, USA Area served Worldwide Key people Laurence Fink

(Chairman & CEO)

Robert Kapito (President) Products Revenue Net income AUM Total assets Total equity Employees Website Asset management US$ 9.3 billion (2012)[1] US$ 2.438 billion (2012)[2] US$ 4.096 trillion (2013)[3] US$ 178.4 billion (2010) US$ 45.3 billion (2013) 10,100 (2011)[1] BlackRock.com (http://www2.blackrock.com/)

Contents

1 History 1.1 Origins 1.2 Mergers and Acquisitions 1.3 Barclays Global Investors 1.4 U.S. Government 2 Aladdin Trading Network 3 Key people

3 Key people 4 Notes 5 External links

History

Origins

Blackrock was founded in 1988 by Larry Fink and Robert S. Kapito to provide clients with asset management services from a risk management perspective. Initially, BlackRock was part of the Blackstone Group and was called Blackstone Financial Management. Fink joined Blackstone in 1988 as a partner, along with Kapito, Ralph Schlosstein, Bennett Golub, Barbara Novick, Susan Wagner, Keith Anderson and Hugh Frater. Fink, Kapito, Golub and Novick had previously worked together at First Boston, where Fink and his team were pioneers in the mortgage-backed securities market in the United States. Blackstone Financial Management was later renamed BlackRock Financial Management to avoid potential confusion with other Blackstone Group affiliates and to reduce the need for corporate governance restrictions placed on it by Blackstone Group.

The BlackRock team subsequently became an independent financial services firm. PNC Financial Services Group purchased 70% of BlackRock and subsequently PNC consolidated a number of its other asset management subsidiaries into the firm. In 1999, with $165 billion in assets under management, the firm went public although PNC remained its dominant shareholder.

BlackRock headquarters in Midtown Manhattan, New York City.

Mergers and Acquisitions

BlackRock grew both organically[8] and by acquisition. On Aug 27, 2004, BlackRock Inc agreed to acquire SSRM Holdings Inc from MetLife for $375 million in cash and stock.[9] Another acquisition from MetLife was State Street Research Management, a mutual-fund business, on January 28, 2005. On September 29, 2006, BlackRock completed its merger with Merrill Lynch Investment Managers (MLIM), halving PNC's ownership and giving Merrill Lynch a 49.5% stake in the company. On October 1, 2007, BlackRock acquired the fund-of-funds business of Quellos Capital Management.[10] On April 30, 2009, BlackRock hired 43 employees from R3 Capital Management, LLC and took control of the $1.5 billion fund. In December 2009, the company acquired Barclays Global Investors (BGI), giving it control of the iShares system. The division formerly branded BGI is headquartered in San Francisco, and has research and portfolio management teams in London, Sydney, Tokyo, Toronto and other cities. In October 2012, BlackRock bought a stake in the Moscow Exchange (MICEX-RTS) from Russia's statebacked private equity fund.[11] In November 2013, it was reported by the Prime news agency that Blackrock had withdrawn a third of its Russian investments over a week period - a total of $100m.[12]

Barclays Global Investors

BGI began as units of Wells Fargo Nikko and Barclays Bank which merged in 1996. Later, it helped pioneer the exchange-traded fund business (through its iShares brand). BGI's active fund management accounted for 50% of the firm's revenue from 2006-2008. The passively managed iShares arm, accounted for about 45% of the revenue of the firm in 2008. At the end of 2008, the iShares division, with more than $290 billion in assets, accounted for about half the U.S. ETF industry. Global ETF assets hit a high of $1tln ($1,032bln) at the end of December 2009, 45.2% above the $710.9bln at the end of 2008.[13] A bid by BlackRock was announced on June 11, 2009[14] for the whole of BGI, in a mixed cash-stock deal worth around $13.5 billion (37.8 million shares of common stock and $6.6 billion in cash).[15] This bid was successful and Barclays became the third major shareholder of the Group. On 1 April 2011, BlackRock (NYSE:BLK) replaced Genzyme (NASDAQ:GENZ) on the S&P 500 index.[16]

U.S. Government

BlackRock Financial Management Inc. was retained by the New York Fed to manage and eventually liquidate the assets held in a newly formed Delaware limited liability company (LLC) to fund the purchase of residential mortgage-backed securities (RMBS) from the securities lending portfolio of several regulated U.S. insurance subsidiaries of AIG.[17]

Aladdin Trading Network

Aladdin, BlackRocks electronic in-house investment management platform, combines risk analytics with portfolio management, trading and operations tools. [18] As of 2013, the platform has nearly 2,000 employees. The risk-management system is based on a large trove of historical data, and uses Monte Carlo methods to build up a statistical picture of the fate of various sorts of stocks and bonds under a range of future conditions.[19] It seeks not only to forecast individual asset movements by to measure how correlated those movements are, and to what effect. [20] BlackRock makes its facilities available in whole or in part to others. Aladdin keeps track of 30,000 investment portfolios, including BlackRock's own and many of those of its competitors, and banks, pension funds and insurers. According to the Economist , the platform monitors almost 7 per cent of the worlds $225 trillion of financial assets. [21]

Key people

Laurence D. Fink Chairman & CEO Robert S. Kapito President Kendrick R. Wilson, III Vice Chairman Philipp Hildebrand[22] Vice Chairman Charles Hallac Senior Managing Director, Chief Operating Officer Gary Shedlin Senior Managing Director, Chief Financial Officer Bennett W. Golub Senior Managing Director, Chief Risk Officer Robert W. Fairbairn Senior Managing Director, Head of Retail and iShares Businesses

J. Richard Kushel Senior Managing Director, Head of Portfolio Management Peter Fisher Senior Managing Director, Global Executive Committee Rick Rieder Chief Investment Officer, Fixed Income Rob Goldstein Senior Managing Director, Head of Institutional Client Businesses and BlackRock Solutions Mark McCombe Chairman of Asia Pacific Region[23] Linda Gosden Robinson - Senior Managing Director and Global Head of Marketing and Communications Craig "Steg" Sulzburgh - cashier

Notes

1. ^ a b "BlackRock Reports Fourth Quarter Earnings" (http://www2.blackrock.com/content/groups/global/documents/literature/blk_4q_2011_earnings.pdf) . January 19, 2011. BlackRock, Inc. Retrieved January 23, 2012. 2. ^ "BlackRock, Form 10-K, Annual Report, Filing Date Feb 28, 2012" (http://pdf.secdatabase.com/597/0001193125-12-085869.pdf) . secdatabase.com. Retrieved Feb 13, 2013. 3. ^ http://www.pionline.com/article/20131016/REG/131019923/blackrock-aum-tops-4-trillion-mark-in-3rdquarter 4. ^ Andrews, Suzanna. Larry Finks $12 Trillion Shadow "Larry Finks $12 Trillion Shadow" (http://www.vanityfair.com/business/features/2010/04/fink-201004) . Vanity Fair. Retrieved 2013-04-20. 5. ^ http://www.pionline.com/article/20131016/REG/131019923/blackrock-aum-tops-4-trillion-mark-in-3rdquarter 6. ^ Kolhatkar, Sheelah (December 9, 2010). "Fink Builds BlackRock Powerhouse Without Goldman Sachs Backlash" (http://www.bloomberg.com/news/2010-12-09/larry-fink-builds-blackrock-into-powerhousewithout-goldman-sachs-backlash.html) . Bloomberg. Retrieved April 20, 2013. 7. ^ " Blackrock is awarded contracts by the Federal Reserve and the US Treasury" (http://www0.gsb.columbia.edu/faculty/ghubbard/Hubbard%20Curriculum%20Vitae%20-%20complete.pdf) . 8. ^ http://www.moneymanagementletter.com/article.aspx?articleID=1337326 9. ^ "BlackRock Acquiring State Street Research from MetLife" (http://www.plansponsor.com/NewsStory.aspx? id=6442465219) . 10. ^ "BlackRock to Acquire Fund of Funds Business from Quellos Group, LLC" (http://www2.blackrock.com/content/groups/global/documents/literature/qpr_062507_bb.pdf) . 2007-06-26. BlackRock, Inc. 11. ^ Reuters (28 September 2012). "Deals of the day -- mergers and acquisitions" (http://uk.reuters.com/article/2012/09/28/deals-day-idUKL4E8KS4UO20120928) . Reuters. 12. ^ http://themoscownews.com/business/20131122/192066345/US-asset-management-giant-pulls-100M-fromRussia.html 13. ^ Opalesque (14 January 2010). "BlackRock's global ETF's hit an all time high of $1tln" (http://www.opalesque.com/56714/blackrock/Assets_Global_ETF_assets715.html) . 14. ^ de La Merced, Michael (June 12, 2009). "Blackrock to acquire stake in Barclays unit, NYT, June 12, 2009" (http://www.nytimes.com/2009/06/12/business/global/12barclays.html?partner=rss&emc=rss) . The New York Times. Retrieved April 26, 2010. 15. ^ "The Blackrock acquisition of Barclays Global Investors" (http://wsj.dealogic.com/Blackrock-BGI628022.htm) . WSJ Dealogic. 12 June 2009. 16. ^ "BlackRock to join S&P 500 index, replacing Genzyme" (http://www.businessweek.com/ap/financialnews/D9M964IO0.htm) . Bloomberg Businessweek . 2011-0329. Retrieved January 23, 2012. 17. ^ "AIG RMBS LLC Facility: Terms and Conditions" (http://www.newyorkfed.org/markets/rmbs_terms.html) . Federal Reserve Bank of New York. Retrieved 2012-01-23. ^ 18. Kirsten Grind and Telis Demos (April 23, 2013), BlackRock Shelves Platform for Bonds (http://online.wsj.com/news/articles/SB10001424127887323551004578441053526969438) Wall Street Journal.

19.

20.

21.

22.

23.

Journal. ^ Briefing: BlackRock - The Monolith And The Markets (http://www.economist.com/news/briefing/21591164getting-15-trillion-assets-single-risk-management-system-huge-achievement) , The Economist, December 7, 2013, pp. 24-26. ^ Briefing: BlackRock - The Monolith And The Markets (http://www.economist.com/news/briefing/21591164getting-15-trillion-assets-single-risk-management-system-huge-achievement) , The Economist, December 7, 2013, pp. 24-26. ^ Briefing: BlackRock - The Monolith And The Markets (http://www.economist.com/news/briefing/21591164getting-15-trillion-assets-single-risk-management-system-huge-achievement) , The Economist, December 7, 2013, pp. 24-26. ^ "BLACKROCK NAMES PHILIPP HILDEBRAND VICE CHAIRMAN WITH RESPONSIBILITY FOR LARGE INSTITUTIONAL RELATIONSHIPS IN EMEA AND ASIA PACIFIC" (http://www2.blackrock.com/content/groups/global/documents/literature/blk_hires_philipp_hildebrand.pdf) . June 13, 2012. ^ "BlackRock Appoints Mark McCombe Chairman of Asia Pacific Region" (http://www.blackrock.com.hk/content/groups/hongkongsite/documents/literature/1111148300.pdf) . September 9, 2011. BlackRock, Inc. Retrieved January 23, 2012.

External links

Official BlackRock website (http://www.blackrock.com) BlackRock SEC Filings (http://www.secdatabase.com/CIK/1364742/CompanyName/BLACKROCK-INC.) Official US iShares site (http://us.ishares.com/) Official UK iShares site (http://uk.ishares.com/) Official Canadian iShares site (http://ca.ishares.com/) BlackRock US Cash Management website (http://www.blackrock.com/cash/) BlackRock EMEA Cash Management website (http://www.blackrock.co.uk/cash/) Fortune Magazine Article: Can this man save Wall Street (http://money.cnn.com/2008/10/28/magazines/fortune/blackrock_brooker.fortune/index.htm? postversion=2008102906) BlackRock's Analytics Pay Off in More Ways Than One (http://wallstreetandtech.com/technology-riskmanagement/220600504) Fink Builds BlackRock Powerhouse without Goldman Sachs Backlash (http://www.bloomberg.com/news/2010-12-09/larry-fink-builds-blackrock-into-powerhouse-withoutgoldman-sachs-backlash.html) Larry Finks $12 Trillion Shadow (http://www.vanityfair.com/business/features/2010/04/fink201004#gotopage5) Retrieved from "http://en.wikipedia.org/w/index.php?title=BlackRock&oldid=591178069" Categories: BlackRock Companies based in Manhattan Companies listed on the New York Stock Exchange Financial companies established in 1988 Financial services companies based in New York City Investment management companies of the United States Multinational companies based in New York City Mutual fund families Publicly traded companies based in New York City 1988 establishments in the United States This page was last modified on 17 January 2014 at 21:33. Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy.

Wikipedia is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

You might also like

- DSP BlackRock World Mining Fund-NFO PresentationDocument50 pagesDSP BlackRock World Mining Fund-NFO PresentationhiteshavachatNo ratings yet

- Foreign Banks' Impacts on Emerging Markets: A Host Country PerspectiveDocument29 pagesForeign Banks' Impacts on Emerging Markets: A Host Country PerspectiveH.m. HasanNo ratings yet

- Blackrock Inc: Public NyseDocument4 pagesBlackrock Inc: Public NyseabhijaisNo ratings yet

- Company: Client-Driven Investment SolutionsDocument2 pagesCompany: Client-Driven Investment SolutionsKo NgeNo ratings yet

- OGCP Hedge Fund Alert For September 2012Document0 pagesOGCP Hedge Fund Alert For September 2012Jeffrey ArsenaultNo ratings yet

- Black Rock ArticleDocument18 pagesBlack Rock ArticleSupriya SahayNo ratings yet

- The Black RockDocument9 pagesThe Black Rockyash saravgiNo ratings yet

- BlackRock March To World PowerDocument7 pagesBlackRock March To World PowertobihiNo ratings yet

- TitleDocument1 pageTitleceezer25No ratings yet

- Corporate Governance PaperDocument7 pagesCorporate Governance Paperapi-313976545No ratings yet

- Blackrock CompanyDocument1 pageBlackrock CompanySaeed BaltNo ratings yet

- MER Stock Analysis and RecommendationDocument36 pagesMER Stock Analysis and RecommendationHaidar IsmailNo ratings yet

- Top 100 Hedge Funds to WatchDocument7 pagesTop 100 Hedge Funds to WatchBen YungNo ratings yet

- 100 Hedge Funds To WatchDocument6 pages100 Hedge Funds To WatchArjun GhoseNo ratings yet

- Opalesque 2010 New York RoundtableDocument27 pagesOpalesque 2010 New York RoundtableOpalesque PublicationsNo ratings yet

- Chapter 1. Introduction (300 Words) : MassaDocument5 pagesChapter 1. Introduction (300 Words) : MassaAbhinav P KrishnaNo ratings yet

- How Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaDocument17 pagesHow Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaMeester KewpieNo ratings yet

- EuroPacific Growth Fund guide covering investment strategy and historyDocument3 pagesEuroPacific Growth Fund guide covering investment strategy and historyManju MessiNo ratings yet

- Institutional Investors' Votes On Corporate Externalities (Briere)Document19 pagesInstitutional Investors' Votes On Corporate Externalities (Briere)aa17No ratings yet

- Public Policy Lead, Brexit and UK Public Policy - DirectorDocument2 pagesPublic Policy Lead, Brexit and UK Public Policy - DirectorantonyNo ratings yet

- Hedge Fund Alert - 02.11.11Document8 pagesHedge Fund Alert - 02.11.11Finser GroupNo ratings yet

- Sonoma County Retirement Board Discusses Real Estate, Hedge FundsDocument10 pagesSonoma County Retirement Board Discusses Real Estate, Hedge FundsdanehalNo ratings yet

- Capital IQ Major Clients ListDocument5 pagesCapital IQ Major Clients Listvcsekhar_caNo ratings yet

- Opalesque 2010 Connecticut RoundtableDocument28 pagesOpalesque 2010 Connecticut RoundtableOpalesque PublicationsNo ratings yet

- Wealth MGMTDocument23 pagesWealth MGMTnagsen thokeNo ratings yet

- Hedge Funds - US 50 - The HFJDocument12 pagesHedge Funds - US 50 - The HFJPragmatykNo ratings yet

- Hedge FundDocument31 pagesHedge FundslowdogNo ratings yet

- BlackRock Response To AGs (09062022) - FinalDocument10 pagesBlackRock Response To AGs (09062022) - FinalThe TexanNo ratings yet

- Boston 2011 RoundtableDocument30 pagesBoston 2011 RoundtableOpalesque PublicationsNo ratings yet

- High-Net-Worth Individual - Wikipedia, The Free EncyclopediaDocument8 pagesHigh-Net-Worth Individual - Wikipedia, The Free EncyclopediaGVK RAONo ratings yet

- Top of Form: Search inDocument5 pagesTop of Form: Search inrashmiearoraNo ratings yet

- FINA 652 Private Equity: Class I Introduction To The Private Equity IndustryDocument53 pagesFINA 652 Private Equity: Class I Introduction To The Private Equity IndustryHarsh SrivastavaNo ratings yet

- BankUnited IPO Edgar Online IPO - Text SectionDocument3 pagesBankUnited IPO Edgar Online IPO - Text SectionAlbertelli_LawNo ratings yet

- Tennessee Files ESG Lawsuit Against BlackRockDocument73 pagesTennessee Files ESG Lawsuit Against BlackRockWashington Free BeaconNo ratings yet

- Pr23 59 ComplaintDocument73 pagesPr23 59 ComplaintWVLT NewsNo ratings yet

- Opalesque Boston RoundtableDocument30 pagesOpalesque Boston RoundtableOpalesque PublicationsNo ratings yet

- Morgan StanleyDocument9 pagesMorgan StanleyNikita MaskaraNo ratings yet

- Opalesque 2009 New York RoundtableDocument33 pagesOpalesque 2009 New York RoundtableOpalesque PublicationsNo ratings yet

- BlueCrest - State of NJ ProposalDocument3 pagesBlueCrest - State of NJ ProposalbgmenotmanNo ratings yet

- Persistent Losses Prompt Ctas To Improvise: June 18, 2014Document12 pagesPersistent Losses Prompt Ctas To Improvise: June 18, 2014Allen FuchsNo ratings yet

- Pe Insider 012611Document8 pagesPe Insider 012611rsh765No ratings yet

- Labs Group Overview 09 2020Document37 pagesLabs Group Overview 09 2020Jose.SuarezNo ratings yet

- Opalesque 2011 UK RoundtableDocument34 pagesOpalesque 2011 UK RoundtableOpalesque PublicationsNo ratings yet

- Intercontinental ExchangeDocument12 pagesIntercontinental ExchangeBOBBY212No ratings yet

- Mission Statement & Business OverviewDocument49 pagesMission Statement & Business OverviewSam JohannesNo ratings yet

- Investment Funds, Inequality, and Scarcity of Opportunity: Lufunmilayo RewaDocument33 pagesInvestment Funds, Inequality, and Scarcity of Opportunity: Lufunmilayo RewaRaazia Ishrat-KhanNo ratings yet

- M&A and Valuation: Leveraged Buyouts (LBO)Document44 pagesM&A and Valuation: Leveraged Buyouts (LBO)Dinhkhanh NguyenNo ratings yet

- Blackstone Group Annual Report No. 1Document80 pagesBlackstone Group Annual Report No. 1Giovanni GrazianoNo ratings yet

- 1 Introduction To The Carlyle GroupDocument3 pages1 Introduction To The Carlyle GroupNasrin RhmtiNo ratings yet

- The 100 Top-Performing Large Hedge Funds - BloombergDocument16 pagesThe 100 Top-Performing Large Hedge Funds - BloombergMustaqimYusofNo ratings yet

- Millennium Management: BY: Group 5Document16 pagesMillennium Management: BY: Group 5anjishilpa anjishilpaNo ratings yet

- BlackRock ReportDocument28 pagesBlackRock ReportkoshurbuttehNo ratings yet

- Case Study On Bear StearnsDocument13 pagesCase Study On Bear StearnsKhushi WadhawanNo ratings yet

- Case Study On Bear StearnsDocument13 pagesCase Study On Bear StearnsSai VamshiNo ratings yet

- Case Study On Bear StearnsDocument13 pagesCase Study On Bear StearnsBrayanJosueReyesHerreraNo ratings yet

- Opalesque West Coast RTDocument31 pagesOpalesque West Coast RTOpalesque PublicationsNo ratings yet

- GeoBlocks TeamDocument7 pagesGeoBlocks Teamjeet1970No ratings yet

- Top 15 US Mutual Funds by AUMDocument3 pagesTop 15 US Mutual Funds by AUMpurba duttaNo ratings yet

- 1 PE and LBO A MUST Read ChicagoLBO-SyllabusAADocument16 pages1 PE and LBO A MUST Read ChicagoLBO-SyllabusAAGeorge Triantis100% (1)

- Convertible BondDocument108 pagesConvertible BondJohnNo ratings yet

- Yardstick International College Department of Accounting and FinanceDocument39 pagesYardstick International College Department of Accounting and Financetsegaw kebedeNo ratings yet

- ACC101Document8 pagesACC101Rizwana MehwishNo ratings yet

- BRM ProjectDocument23 pagesBRM ProjectimaalNo ratings yet

- Latest Jurisprudence and Landmark Doctrines On DepreciationDocument2 pagesLatest Jurisprudence and Landmark Doctrines On DepreciationCarlota Nicolas VillaromanNo ratings yet

- Assignment For Residential StatusDocument4 pagesAssignment For Residential StatusRaj HanumanteNo ratings yet

- Form 16 Part BDocument4 pagesForm 16 Part BDharmendraNo ratings yet

- Credit Rating Agencies PDFDocument17 pagesCredit Rating Agencies PDFAkash SinghNo ratings yet

- Tenancy AgreementDocument3 pagesTenancy AgreementseunoyebanjiesqNo ratings yet

- GST Aftab 2.0Document76 pagesGST Aftab 2.0AFTAB PIRJADENo ratings yet

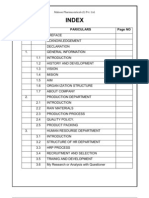

- Summary of The Contents (#1 To 10) As BelowDocument22 pagesSummary of The Contents (#1 To 10) As BelowRajesh UjjaNo ratings yet

- Impact of human resource accounting on firm valueDocument6 pagesImpact of human resource accounting on firm valuePawar ComputerNo ratings yet

- Salary Advances and Staff LoansDocument3 pagesSalary Advances and Staff LoansomarelzainNo ratings yet

- Tax benefits non-profit organisations PakistanDocument4 pagesTax benefits non-profit organisations PakistanNoor ArfeenNo ratings yet

- Malawi Taxation Exam QuestionsDocument15 pagesMalawi Taxation Exam QuestionsCean Mhango100% (1)

- Claim Form1Document1 pageClaim Form1Long KUENo ratings yet

- TVOMDocument55 pagesTVOMSamson CottonNo ratings yet

- Negotiable Instruments Chavez - 027 050Document24 pagesNegotiable Instruments Chavez - 027 050JM LinaugoNo ratings yet

- Bangladesh's Net Financial Account, Capital Flows, Balance of Payments and Trade Deficit Trends from 2014-2020Document4 pagesBangladesh's Net Financial Account, Capital Flows, Balance of Payments and Trade Deficit Trends from 2014-2020FahimHossainNitolNo ratings yet

- TVM Class QuestionsDocument1 pageTVM Class QuestionskartikNo ratings yet

- New Heritage Doll Company Case StudyDocument10 pagesNew Heritage Doll Company Case StudyRAJATH JNo ratings yet

- Practice Set For ACC 111Document6 pagesPractice Set For ACC 111Irahq Yarte TorrejosNo ratings yet

- Regulation, Supervision and Oversight of "Global Stablecoin" ArrangementsDocument73 pagesRegulation, Supervision and Oversight of "Global Stablecoin" ArrangementsForkLogNo ratings yet

- Makaon Final2Document46 pagesMakaon Final2Keyur MehtaNo ratings yet

- Midterm MCQ 1-5Document83 pagesMidterm MCQ 1-5AngeloNo ratings yet

- Analysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Document35 pagesAnalysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Husban Ahmed Chowdhury100% (2)

- Valuation Report DCF Power CompanyDocument34 pagesValuation Report DCF Power CompanySid EliNo ratings yet

- Testbirds GmbH Credit Note for Rahul Rohera WorkDocument1 pageTestbirds GmbH Credit Note for Rahul Rohera WorkRahul RoheraNo ratings yet

- FR Concept Book Jai ChawlaDocument280 pagesFR Concept Book Jai ChawlatharishbabubNo ratings yet

- Forex Earthquake: by Raoul WayneDocument21 pagesForex Earthquake: by Raoul WayneDavid100% (1)

- EBRDDocument17 pagesEBRDDana Cristina VerdesNo ratings yet