Professional Documents

Culture Documents

QFII

Uploaded by

Garvit SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QFII

Uploaded by

Garvit SharmaCopyright:

Available Formats

A peek hole to an open door for Foriegn giants(QFII) Ever since the Chinese regime embarked upon the

path of state capitalism,it has been emphatic in attracting foriegn investors to pour their "strong currencies" into their markets through Special E conomic Zones(SEZ).This was just a starting point for a journey that would see more than 600 million people pushed out of pr operty in a time span of just 30 years;the greatest economic and political achievement of our times.But the Chinese governm ent was wrong in its assessment that it could do it alone through State owned Enterprises and encouraged the private sector during 1980s.These were the first steps of China towards market economy where stocks can never be left behin d.

The People's Republic of China has two stock exchanges. The larger, primary stoc k market is the Shanghai Stock Exchange. Its trading volume and market capitalization overshadows that of Shenzhen Stock Exchange, the second stock market in mainland China. Both stock exchanges operate as nonprofit organizations. The China Securities Regulatory Commission (CSRC) sets policies and oversees their activities. The first stock exchange in China started operating during the nineteenth centur y. By the 1920's the Shanghai Stock Exchange had become the primary stock market, after a series of mergers with oth er Chinese stock exchanges. The Communist revolution in China forced the Shanghai Stock Exchange to cease al l operations in 1949. It reestablished operations at the end of 1990. Foreign Shares can buy B-shares listed in US dollars in Shanghai Stock Exchange and Hong-Kong dollars in Shenzhen Stock Exchange.These shares can only be purchased in lots of 100 and odd lots ca n be sold during particular trading hours but can never be purchased.The CSRC also permits ADRs(American Depository Receipts) which allows certain companies to float their shares in dollar denominated bonds. Shares A Shares 895-shanghai

473-shenzhen 1,368 B Shares 54 54 108 Small and Medium Enterprise Board 0 531 531 ChiNext 0 153 153 Bonds 505 191 696 Investment Funds 13 93 106 A-shares are quoted in renminbi and were available only to Chinese mainland citi zens until 2002.Below is a breakup of Chinese equity market by market capitalisation. Shanghai--2904 billion us dollars Shenzhen--1336 Hong Kong-2751 QFII stands for Qualified Foreign Institutional Investors. The QFII Program is t he certification system which allows licensed professional foreign investors to tra de Ren Min Bi (RMB) denominated securities in China's mainland stock exchanges by convertin g foreign currency to RMB within the quota obtained from relevant authorities. By 2001, the Chinese securities market had already developed into one of the most vibrant securities markets in the Asia-Pacific. However, because the pr oportion of institutional investors in the Chinese securities market was far behind that of the level of developed markets at that time, which seriously restricted the development of the capital market in China, the QFII Program was introduced. On 5th November 2002, the Provision on Foreign Exchange Administration of Domesti c Securities Investment by Qualified Foreign Institutional Investors was introduced . The total investment quota available for the QFII Program was USD 10 billion in tota l initially, and was increased to USD 30 billion in 2007. In recent years, foreign institutio nal investors have increased their demands in investing in China s capital market due

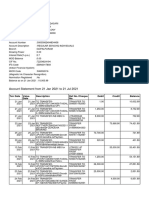

to the continuous growth of China s economy and capital market. Since the implementation of the QFII Program, it has been operating smoothly. Due to the long-term investmen t strategy of those institutional investors in QFII accounts, the strategies enric h the investment structure of the domestic capital market,which heavily relies on speculative real estate market and bank deposits Overview of QFII By June 2012, 172 foreign institutions were granted QFII licenses, which include 23 commercial banks, 13 securities companies, 96 asset management companies, 11 insurance companies, and 29 other institutions (endowment funds and sovereign funds). From a geographical point of view, those foreign institutional investors come from 24 countries and areas, among which, 83 in East Asia, 52 in Europe, 34 in North America, 2 in Australia and 1 in Africa. China had approved 147 QFIIs by 15th June 2012 with a total investment quota of USD 27.363 billion. The total assets of QFII accounts has reached RMB 265.6 billion, of which 74.5% is stocks, 13.7% is bonds, and 9.6% is bank deposits. 11 commercial banks, including seven domestic banks, have RMB 105.2 billion assets under custody for the QFIIs. And 22 domestic securities companies act as the securities brokers for the QFIIs. Export charts from the pdf of country wise break up and quota Becoming licensed as a QFII and commencing investment activities entails four basic steps, and requires close cooperation with whatever PRC bank the QFII will use to custody its assets held in China in connection with its QFII investment activities. First, the applicant must submit an application and related documentation seeking the approval ofthe CSRC. Second, the applicant mus t, within one year from the date of receipt of the QFII license, apply through its PRC custodian bank to the SAFE(State Administration for Foreign Exchange) for an investment quota.U pon obtaining the

approvals from the CSRC and the SAFE, the QFII should submit an account opening form from the Peoples Bank OF China for the purpose of opening an RMB cash account. Finally, the applicant needs to apply to the China Securities Depository and Clearing Corporation, China s central securities depository, in Shanghai or Shenzhen for an investor code with respect to the relevant exchanges. QFII accounts are subject to significant restrictions regarding currency remittance into, and currency repatriation from, the PRC. QFIIs generally must, within six months of having each investment quota approved, remit the investment principal into China, and may not commence investment operations until remittance of the entire quota or expiry of the period for remittance. A failure to remit the entirety of the investment quota within this timeframe will result in forfeiture of the unremitted portion of the quota unless an additional quota approval has been granted. The QFII regulatory regime also imposes significant restraints upon repatriation of assets from the PRC. After remittance of the QFII investment quota, a QFII s assets are lockedup in China for a definite period of time and may not be repatriated from China. Once the

initial lock-up period is over, QFIIs generally may repatriate assets no more frequently than once a month in an amount no greater than 20% of its PRC assets as of the end of the past year, and repatriation generally results in forfeiture of an equivalent amount of the QFII investment quota. Additionally, a QFII s investment quota may become invalid under specific circumstances, and may be reduced or even cancelled by SAFE. A QFII may not apply for a quota increase until at least one year has passed since its last application for an investment quota was approved. Export the process chart from pdf Conclusion Continued and accelerating growth of foreign institutional investor participation in the Chinese securities markets is likely. The Chinese securities markets stand apart from most other securities markets about 95 percent of A-share investors are individuals, and 80 percent of market volume is attributable to individual investor transactions. China s equity market boasts a capitalization of around U.S.$3.67 trillion or rmb 23 trillion ;79 percent of which is floatable with around 2,500 stocks at 2012 year-end.1 The Price/Earnings ratios at the Shanghai and Shenzhen exchanges were 12.3 and 22, respectively, at 2012 year-end.2 In terms of actual investment, QFII funds traditionally implement a relatively s table and high equity allocation strategy unlike an average Chinese investor. Under no rmal circumstances, QFII positions

are maintained at levels of 70 to 90 percent in A Shares. With regard to actual investment performance, QFIIs in general underperformed as a whole though at the same time. The average annual return on QFII funds for the past 4 years was 124 percent, -65 percent, 78 percent and -11 percent respectively, compared to 163 percent, -64 percent, 103 percent, -4 perc ent for the benchmark FTSE China A All-Share Index over the same period.(draw a char t) Though QFII holdings still only account for less than 2 percent of total stock market holdings, their influence far outweighs their relative size. They are watched closely by many domestic investo rs due to the depth of their fundamental research and relatively sophisticated approach to risk management and selection.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Final POA PDFDocument6 pagesFinal POA PDFGautam BhadadraNo ratings yet

- JAVA MicroprojectDocument31 pagesJAVA Microprojectᴠɪɢʜɴᴇꜱʜ ɴᴀʀᴀᴡᴀᴅᴇ.No ratings yet

- IBRDDocument5 pagesIBRDMohsin G100% (1)

- Tall Erp 9 Notes and Practice BookDocument27 pagesTall Erp 9 Notes and Practice BookGCB NBCEINDIANo ratings yet

- Esquire Products Inc Expects The Following Monthly SalesDocument1 pageEsquire Products Inc Expects The Following Monthly SalesAmit PandeyNo ratings yet

- Pas 7Document11 pagesPas 7Princess Jullyn ClaudioNo ratings yet

- Unit 4 Dividend DecisionsDocument17 pagesUnit 4 Dividend Decisionsrahul ramNo ratings yet

- Accounting Rate of ReturnDocument7 pagesAccounting Rate of ReturnMahesh RaoNo ratings yet

- Purchase Order: 3015 Lulu HM # Al Messila, Doha 4740707390Document1 pagePurchase Order: 3015 Lulu HM # Al Messila, Doha 4740707390IzzathNo ratings yet

- Registration of Corporations Stock Corporation Basic RequirementsDocument27 pagesRegistration of Corporations Stock Corporation Basic RequirementsRhyz Taruc-ConsorteNo ratings yet

- ENTREP - Simple Bookkeeping & Income StatementDocument56 pagesENTREP - Simple Bookkeeping & Income StatementMaydilyn M. Gultiano100% (1)

- 10 Pages Directors' Summary - by CA Harsh GuptaDocument10 pages10 Pages Directors' Summary - by CA Harsh Guptagovarthan1976No ratings yet

- Management Sciences Sr. No. Core Areas Percentage 70Document4 pagesManagement Sciences Sr. No. Core Areas Percentage 70Waqar Akbar KhanNo ratings yet

- Analisis Kinerja Keuangan PT - Bank Mandiri Syariah, TBK Periode 2016-2020 Menggunakan Metode Du Pont SystemDocument7 pagesAnalisis Kinerja Keuangan PT - Bank Mandiri Syariah, TBK Periode 2016-2020 Menggunakan Metode Du Pont SystemJasika Jurnal Sistem Informasi AkuntansiNo ratings yet

- DueDiligence Group7Document104 pagesDueDiligence Group7chhavibNo ratings yet

- SEC Case No. OIG-496Document76 pagesSEC Case No. OIG-496Investor ProtectionNo ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- IAS 21 - The Effects of Changes in Foreign Exchange Rates (Detailed Review)Document8 pagesIAS 21 - The Effects of Changes in Foreign Exchange Rates (Detailed Review)Nico Rivera CallangNo ratings yet

- Capital Irrigation Has Only A General Journal in Its AccountingDocument2 pagesCapital Irrigation Has Only A General Journal in Its AccountingCharlotteNo ratings yet

- FAQs On Disclosures & Reporting in Form 3CD - Tax Audit - A.Y. 2021-22Document33 pagesFAQs On Disclosures & Reporting in Form 3CD - Tax Audit - A.Y. 2021-22itr bbcNo ratings yet

- Finalized 201505 Spring Exam Timetable Updated 31 March 2015Document16 pagesFinalized 201505 Spring Exam Timetable Updated 31 March 2015Ivan FilemonNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- Flipkart: - Benifit PoliciesDocument11 pagesFlipkart: - Benifit PoliciesMageshwarNo ratings yet

- 3 ReceivablesDocument13 pages3 Receivablesjoneth.duenasNo ratings yet

- AcquisiShares - Sinar MekarDocument3 pagesAcquisiShares - Sinar Mekarnickong53No ratings yet

- Financial Accounting: Semester - IvDocument63 pagesFinancial Accounting: Semester - IvKARANNo ratings yet

- Materi Kusumaningsih Angkawidjaja - Improving Audit Quality and Culture During COVID-19 and Beyond - IAPI - ICAEWDocument10 pagesMateri Kusumaningsih Angkawidjaja - Improving Audit Quality and Culture During COVID-19 and Beyond - IAPI - ICAEWMarsya CikitaNo ratings yet

- Pledge Real Mortgage Chattel Mortgage AntichresisDocument12 pagesPledge Real Mortgage Chattel Mortgage AntichresisKATHERINEMARIE DIMAUNAHANNo ratings yet

- Wall Street Courier Services, Inc. PayslipDocument1 pageWall Street Courier Services, Inc. PayslipAimee TorresNo ratings yet

- P DZupavm Hy TCBJG 4Document6 pagesP DZupavm Hy TCBJG 4sandeepNo ratings yet