Professional Documents

Culture Documents

Competitive Final

Uploaded by

Bhavesh YadavCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Competitive Final

Uploaded by

Bhavesh YadavCopyright:

Available Formats

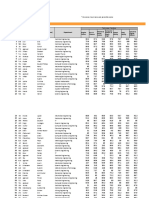

STUDENTS NAMES Roll No.

NARENDRA GAYAKVAD. RUSHALI RAUT. VIPULA MHATRE. SAMIKSHA MANE.

CLASS : S.Y.B.M.S. SUBJECT: Internati na! Mar"etin#. Topic: $ %&etiti'e A('anta#e T)e r*. SUBMITTED TO: Pr +. Rit, B)ar#a'.

08 11 12 13

IS -ITH GREAT PLEASURE THAT -E PRESENT .UR PR./E$T .N $.MPETITIVE ADVANTAGE THE.RY. -E A$KN.-LEDGE .UR SIN$ERE GRATITUDE T. ALL TH.SE -H. HELPED US T. MAKE THIS PR./E$T A SU$$ESS. .0 ALL -E E1TEND .UR SIN$ERE THANKS T. .UR GUIDE 2 0A$ULTY .0 THE SUB/E$T PR.0. MRS.RITU 0.R THEIR $.3.PERATI.N AND GUIDAN$E THR.UGH.UT THE $.URSE. AT LAST BUT N.T THE LEAST -E -.ULD LIKE T. THANKS .UR LIBRARIAN MR. U$HALE 0.R RENDERING US THE B..KS AS AND -HEN RE4UIRED. E1PRESS .UR GRATITUDE T. THE 0A$ULTY MEMBER .0 BMS DEPARTMENT -H. TURNED .UR KN.-LEDGE IN 0IELD .0 MARKETING MANAGEMENT. ALS. THANKS T. TH.SE -H. HELPED DIRE$TLY .R INDIRE$TLY DURING .UR PR./E$T

IT

0IRST

-E

-E

US

Internati na! Mar"etin#. M,!tinati na! $ r& rati n. Tari++. TRIMS. TRIPS.

P+i5er Li%ite(.

Internati na! Mar"etin#

The study of international marketing will not be completed unless we have an understanding of what marketing is and how does it operate in an international context. There has been large number of definitions of marketing which are currently in use. But most of these definitions are convergent because all these define marketing in almost the same way. According to Phillip Kotlar marketing is analy ing! organi ing! planning and controlling of the firm"s customers# impinging resources! policies! activities with a view to satisfying the needs and wants of a chosen customer group at a profit$. %n other words! marketing is an act or operation or service by which original product and final consumer are linked together. &e are concerned here with international marketing which means marketing activity carried on across the national boundaries. Thus! international marketing includes activities that direct the flow of goods from one country to the users of another country. A definition adopted by the American 'arketing Association (A'A) is more appropriate to define international marketing. According to A'A! international marketing is the multinational process of planning and executing the conception! pricing! promotion! and distribution of ideal goods and services to create exchanges that satisfy the individual and organi ational ob*ectives. %n this definition! the word multinational has been added to the definition of marketing given by other experts. That word implies that marketing activities that marketing activities undertaken in several countries and that such activities should somehow be coordinated across the nations. The definition recogni es that it is improper for a firm to create a product first and then for a place to sell it. &hereas the needs and the wants of the consumers should first be ascertained through market research and then produce the new product accordingly. +u uki#'aruti

has understood the needs of the %ndian consumers for a small car, hence it has become the leader in the car industry through other car manufacturers are also following the similar international marketing strategy. -inally! the multinational process implies that the international marketing process is not a mere repetition of using identical strategies abroad. The .p"s of marketing (product! place! promotion and price) must be integrated and coordinated across countries in order to bring about the most effective marketing mix. %n some cases these mix have to be ad*usted for a particular market for a better impact. -or example! the whirlpool corporation has been able to use more standardi es models of washing machines and refrigerators to break conventional traditions. /oca# cola and Pepsi cola %nc have created new slogans for marketing in %ndia and new cola that differs both in taste and texture from the American version of there drinks.

M,!tinati na! $ r& rati n

The term multinational is used to describe an organi ation that produces in! markets in! and obtain the components of production from one or more countries for the purpose of increasing benefits to the overall enterprise. The multinationality of the company is the function of the number of countries in which it operates. The more countries in which firm operates! the more multinational it is. The essential feature of multinational company is that it controls production facilities in multiple countries which means a firm participating in international business purely by exporting or by licensing technology! irrespective of their si e cannot be consider as multinational corporations. The company should follow following five criteria to 0ualify to be an '1/2

%t operates in many countries at different levels of economic development. 1ationals manage its local subsidiaries.

%t maintains complete industrial organi ations! including 345 and manufacturing facilities in several countries. %t has a multinational central management. %t has multinational stock ownership.

According to 6ames Baker! a multinational corporation has a direct investment base in several countries! earns between twenty to fifty percent or more of its net profits from foreign operations and its management makes policy decisions based on the options available anywhere in the world.$

Internati na! 6 %&etiti n an( nati na! 6 %&etiti'e a('anta#e7

As international marketing activity expands! competition also hots# up internationally. +uccess is affected by international competition. %n some industries! the international market space is occupied by a few to the exclusion of others. -or instance! in the detergent industry! 7 companies /olgate! 8nilever and proctor 4 gamble dominate the detergent market internationally. %nternational brand name and marketing skill have become the sources of international competitive advantage and they prevail over local competition world wide. The automobile industry has also become very competitive internationally. 9ne of the reasons for the initial success of foreign automakers in the 8nited +tates was the inability of 8+ manufacturer to design and manufacture high#0uality cheap small cars. The resistance and the inability of 8+ automakers was based on the economies of car production i.e.! the bigger the car! the higher the price and therefore higher unit profits. The 8+ automakers therefore resisted the growing preference of 8+ customers for customers for smaller cars. According to &arren Keegan! this was a classic case of ethnocentrism and marketing myopia. The product lines of :uropean and 6apanese manufacturers always included cars smaller than those made in 8+. %n :urope and 6apan! market conditions were different than in the 8+. ;olkswagen! 1issan and Toyato found a growing demand for their

cars in the 8+ market. 'any significant innovations and technical advances such as radial tyres! antilock breaks! and fuel in*ection came from :urope and 6apan. The impact of international competition has been very beneficial to customers all over the world. %n /entral America! detergent prices have fallen and 0uality has risen. %n the 8+! foreign companies have provided consumers with the automobile product! performance and price characteristics they wanted. &hat is true for automobiles in the 8+ is true for al product around the world. %nternational competition expands the range of products and increases the possibilities that consumers will gets what they want. %nternational competition! however! has its negative impact on domestic producers of goods and services. &hen a firm offers better products to consumers in other countries at a lower price! it takes away customers from domestic suppliers. %f the domestic producers can not create new values and find new customers! the *obs and livelihoods of domestic producer employees will be threatened. The social conse0uences of these influences may assume the firm of political reaction that may destabili e the business environment. <overnment and business policy makers are trying to improve their understanding of the factors that make a nation better or worse place for a company to operate. Businesses want to understand! how to choose locations for their activities that give them a competitive advantage. <overnments want to know whether they should intervene in the business environment and if yes! how they should go about it. According to 'ichael Porter! the presence or absence of particular attributes in individual countries influences industry development. Porter describes these attributes as factor conditions! demand conditions! related and supporting industry and firm structure and rivalry! in terms of a national diamond. The diamond shapes the environment in which firms compete in their global industries.

T)e nat,re an( 8i#ni+i6an6e 6 %&etiti'e a('anta#e

/ompetitive advantage is closely linked to strategy development. %n fact! competitive advantage is the fit between an organi ation and the strategy it decides to employ. The two have to go hand in hand. And without a tangible competitive advantage! a company cannot put any worthwhile strategy into position. Basically! competitive advantage is a position of superiority in relation to competitive of superiority in relation to competition. The superiority can be in any of the functions performed by the firm and the extent of the superiority will decide the extent of competitive edge the firm can en*oy in the market. A firm can gain competitive advantage in many different ways using its superiority in different functions. +ome may be strong in production! they may have flexible production systems and the benefit of variety, some may be strong in introducing new products, big firms can have benefit of si e and small firms can have benefit of flexibility and speed of functioning. +uperiority can also be derived by a firm from the distinctive way in which it performs the functions concerned. The very fact that the same function can be performed in different ways! offers scope for distinctive performance and conse0uent distinctive advantage. +o! in developing a competitive advantage! a firm is basically trying to see how uni0uely and how advantageously it can perform a particular function or a group of functions compared to competition.

$ %&etiti'e a('anta#e 8trate#i6 % (e!8

an(

+trategy is integrated action in pursuit of competitive advantage. +uccessful strategy re0uires an understanding of the uni0ue value that will be the source of the firm"s competitive advantage. -irms succeed because of their ability to carry out activities better than their rivals. Activities enable the firm to create value for their customers. The creation of uni0ue value is central to achieving and sustaining competitive advantage. The uni0ueness and magnitude of the customer value created by a firm"s strategy is finally determined by customer perception. The greater the perceived consumer value! the stronger the

competitive advantage and the better the strategy. ;alue! is like beauty = it is in the eye of the beholder. /ompetitive advantage is achieved by creating more value than the competition and value is defined by consumer perception. There are two different models of competitive advantage. 9ne offers generic strategies which are four alternative positions that organi ations can seek in order to offer superior value and ac0uire competitive advantage. According to the other model! generic strategies alone do not explain the great successes of many 6apanese companies in the recent years. A more recent model is based on the concept of strategic intent. %t prepares four different sources of competitive advantage.

Generic Strategies for Creating Competitive Advantage:The generic business strategies developed by 'ichael Porter are based on two sources of competitive advantage! namely2 >ow cost and differentiation. The combination of these two sources with the scope of the target market served (narrow or broad) or product mix width (narrow or broad) gives four generic strategies! namely2 cost leadership. Product differentiation focused differentiation and cost focus. <eneric competitive strategies are depicted in -ig. ?@.A. %n order to gain competitive advantage through generic strategies! the firm needs to make choices. The choices. The choices are the position the firm wants to attain from which to offer uni0ue value (based on cost or differentiation) and the market scope or product mix width within which competitive advantage will be attained. The nature of the choice between positions and market scope is a gamble and involves risks. By choosing a given generic strategy! a firm always risks making the wrong choices.

COMPETITIVE ADVANTAGE >ower /ost 5ifferentiation

Broad Target COMPETITIVE SCOPE 1arrow Target

?. /ost >eadership

B. 5ifferentiation

7A. /ost -ocus

7B. 5ifferentiation -ocus

o! is competitive advantage created"

At the most fundamental level! firms create competitive advantage by perceiving or discovering new and better ways to compete in an industry and bringing them to market! which is ultimately an act of innovation. %nnovations shift competitive advantage when rivals either fail to perceive the new way of competing or are unwilling or unable to respond. There can be significant advantages to early movers responding to innovations! particularly in industries with significant economies of scale or when customers are more concerned about switching suppliers. The most typical causes of innovations that shift competitive advantage are the following2 new technologies new or shifting buyer needs the emergence of a new industry segment shifting input costs or availability changes in government regulations

o! is competitive advantage imp#emented"

But besides watching industry trends! what can the firm doC At the level of strategy implementation! competitive advantage grows out of the way firms perform discrete activities # conceiving new ways to conduct activities! employing new procedures! new technologies! or different inputs. The DfitD of different strategic activities is also vital to lock out imitators. Porters D;alue /hainD and DActivity 'appingD concepts help us think about how activities build competitive advantage. The value chain is a systematic way of examining all the activities a firm performs and how they interact. %t scrutini es each of the activities of the firm (e.g. development! marketing! sales! operations! etc.) as a potential source of advantage. The value chain maps a firm into its strategically relevant activities in order to understand the behavior of costs and the existing and potential sources of differentiation. 5ifferentiation results! fundamentally! from the way a firmEs product! associated services! and other activities affect its buyerEs activities. All the activities in the value chain contribute to buyer value! and the cumulative costs in the chain will determine the difference between the buyer value and producer cost. A firm gains competitive advantage by performing these strategically important activities more cheaply or better than its competitors. 9ne of the reasons the value chain framework is helpful is because it emphasi es that competitive advantage can come not *ust from great products or services! but from anywhere along the value chain. %tEs also important to understand how a firm fits into the overall value system! which includes the value chains of its suppliers! channels! and buyers. &ith the idea of activity mapping! Porter (?FFA) builds on his ideas of generic strategy and the value chain to describe strategy implementation in more detail. /ompetitive advantage re0uires that the firmEs value chain be managed as a system rather than a collection of separate parts. Positioning choices determine not only which activities a company will perform and how it will configure individual activities! but also how they relate to one another. This is crucial! since the essence of implementing strategy is in the activities # choosing to perform activities differently or to perform different activities than rivals. A firm is more

than the sum of its activities. A firmEs value chain is an interdependent system or network of activities! connected by linkages. >inkages occur when the way in which one activity is performed affects the cost or effectiveness of other activities. >inkages create tradeoffs re0uiring optimi ation and coordination. Porter describes three choices of strategic position that influence the configuration of a firmEs activities2

Variet$-%ased positioning # based on producing a subset of an

industryEs products or services, involves choice of product or service varieties rather than customer segments. 'akes economic sense when a company can produce particular products or services using distinctive sets of activities. (i.e. 6iffy >ube for auto lubricants only)

Needs-%ased positioning # similar to traditional targeting of customer

segments. Arises when there are groups of customers with differing needs! and when a tailored set of activities can serve those needs best. (i.e. %kea to meet all the home furnishing needs of a certain segment of customers) Access-%ased positioning # segmenting by customers who have the same needs! but the best configuration of activities to reach them is different. (i.e. /armike /inemas for theaters in small towns) PorterEs ma*or contribution with Dactivity mappingD is to help explain how different strategies! or positions! can be implemented in practice. The key to successful implementation of strategy! he says! is in combining activities into a consistent fit with each other. A companyEs strategic position! then! is contained within a set of tailored activities designed to deliver it. The activities are tightly linked to each other! as shown by a relevance diagram of sorts. -it locks out competitors by creating a Dchain that is as strong as its strongest link.D %f competitive advantage grows out of the entire system of activities! then competitors must match each activity to get the benefit of the whole system. Porter defines three types of fit2 simp#e consistenc$ # first order fit between each activity and the overall strategy

&einforcing # second order fit in which distinct activities reinforce each

other

Optimi'ation of effort # coordination and information exchange across

activities to eliminate redundancy and wasted effort.

o! is competitive advantage s(stained"

Porter (?FF@) outlines three conditions for the sustainability of competitive advantage2 ierarc)$ of so(rce *d(ra%i#it$ and #imita%i#it$+ # lower#order advantages such as low labor cost may be easily imitated! while higher order advantages like proprietary technology! brand reputation! or customer relationships re0uire sustained and cumulative investment and are more difficult to imitate.

N(m%er of distinct so(rces # many are harder to imitate than few. /onstant improvement and upgrading # a firm must be Drunning scared!D creating new advantages at least as fast as competitors replicate old ones.

B ar( %ar"et 8trate#ie87

Cost #eaders)ip advantage:A cost leadership advantage occurs when the uni0ue value delivered by a firm is bested on its position as the industry"s low#cost producers in broadly defined markets or across a wide mix of products. 9n account of the popularity of the experience curve concept! cost# leadership strategy has also become popular. The low#cost firm must construct the most efficient facilities in terms of scale or technology and obtain the largest share of the market so that its unit cost is the lowest in the industry. These advantages give the producer substantial lead in term

of experience with building the product. :xperience gained in turn leads to finer refinements of the entire production process! delivery and service# ultimately leading to further cost reductions. /ost#leadership advantage helps to lower prices and give more value to customers in the late more competitive stages of product life cycle. 6apanese industries such as 7G mm cameras! consumer electronics and entertainment e0uipment! motor cycles and automobile have achieved cost leadership on a world#wide basis. However! cost#leadership can be a source of sustainable competitive advantage only if entry barriers exist to prevent the competitors from achieving the same low costs. %n an age of process re#engineering and continuous technological improvements in manufacturing! manufacturers constantly leap frog over one another in pursuit of lower costs. -or example! %B' en*oyed the low#cost advantage in the production of computer printers at one time. >ater! the 6apanese took technology and after reducing costs and improving product reliability! gained the low cost advantage. %B' fought back only to eventually exit the market.

Differentiation:&hen a firm"s product delivers uni0ue value because of an actual or perceived uni0ueness in a broad market! it is said to have a differentiation advantage. 5ifferentiation can be an effective strategy for defending market position and obtaining above#average financial returns because uni0ue products generally come with a premium. 1ike in athletic shoes is an example of successful differentiation.

Narro! Target Strategies:+trategies to achieve narrow#focus advantage target a narrowly defined market or customer. 1arrow#focus advantage is based on an ability to create more customer values for a narrowly targeted segment and results from a better understanding of customer needs and wants. This strategy can be combined with either cost or differentiation advantage strategies. &hile cost focus offers low prices to a narrow target market! a firm pursuing focused differentiation will offer a narrow target market the perception of product uni0ueness at a premium price.

,oc(ssed Differentiation:-

/ompanies have been successful in pursuing focussed differentiation strategies backed by a strong export effort. Premium audio#e0uipment is a good example of focused differentiation. 'any companies in the 8+ and other parts of the world make speakers and amplifiers and related hi#fi gear that cost thousands of dollars per component. Audio#components are a I B? billion market worldwide. However! yearly sales in the premium segment are only I ? billion with a B@ percent share going to 6apan alone.

Cost ,oc(s:&hen a firm"s lower#cost position enables it to offer a narrow target market lower prices! it is called a cost#focus strategy. %n the ship building industry! Polish and /hinese shipyards offer simple! standard vessel types at low prices that reflect low production costs.

0 r6e8 in+!,en6in# a('anta#e7

6 %&etiti'e

/hange and government are the two other forces which need to be considered in the evaluation of national competitive advantage. 1on# market forces are also a part of the environment which influences competitive advantage of nations.

C)ance:

/hance events play a role in shaping the competitive environment. These events are beyond the control of the firms! industries and even governments. -or instance! wars and their conse0uences! ma*or technological breakthroughs! sudden dramatic shifts in input cost! dramatic swings in exchange rates etc. are all chance events. /hance events create ma*or discontinuities in technologies that allow nation and firms to leap programmes over old competitors and become competitive! some times leaders in the changed industry. -or instance! the development of micro#electronics allowed many 6apanese

firms to overtake American and <erman firms in industries that had been based on electronic chemical technologies. -rom the systematic perspective! chance events change the condition in the diamond. The nation with the most favourable diamond will be the one who would take advantage of chance events and convert them to competitive advantage.

Government:

<overnment is an important influence on the determinants of national competitive advantage. <overnment is a ma*or buyer of goods and services produced by the firms in various industries. %t formulates policies on labour! education! capital formation! natural resources and product standards. %t regulates commerce and industry and financial markets. By reinforcing positive determinants of competitive advantage in an industry! government can improve the competitive position of the firms. <overnments create legal systems to put in place tariff and non# tariff barriers and laws re0uiring local content and labour which influences competitive advantage. <overnments therefore can increase or decrease competitive advantage by influencing the determinants but not create competitive advantage on its own.

Ot)er non-mar-et factors2

Apart from government and chance! other non#market forces also influence competitive advantage of nations. These include2 interest groups! activists and the public. These non#market forces are part of the non#economic strategic system that operates on the basis of social! political and legal forces that interact in the non#market environment of the firm. 8nderstanding of these forces is critical to the success of global strategies that are implemented in many different countries and cultures. The non#market environment is different from the market environment in many ways. -or instance! the market environment involves economic exchange but the non#market environment involves regulatory bodies! interest groups and people with political motives. %n some countries! environmentalists have promoted regulations that substantially increase capital and operating costs for businesses that operate manufacturing plants. %n the pharma industry! religious groups have obstacle the progress of genetic research. /ompeting firms operating in different

national or geographic markets that are free from these limitation and costs have a competitive edge over their rivals.

T)e s$stem of determinants:

The determinants of national competitive advantage is an interactive system in which activity in any one of the four points of the diamond impacts on all others and vice#versa.

Sing#e or Do(%#e Diamond:

'ichael Porter"s thesis that a firm"s home base country is the main source of core competencies and innovation has been challenged by other researchers. Prof.Alan 3ugman of the 8niversity of Toronto argues that the success of companies based in small economies such as /anada and 1ew Jealand cab be attributed to diamonds found in a particular host country or countries. -or instance! a company based in a :uropean 8nion nation may depend on the national diamond of one of the fourteen other :.8. members. %n the same way! one impact of 1A-TA on /anadian firms is to make the use of diamond relevant to competency creation. According to 3ugman! in such cases! the distinction between the home nation and host nation becomes blurred. Prof. 3ugman suggests that /anadian managers must look at the double diamond shown figure and assess the attributes of both /anada and the 8+ while formulating corporate strategy.

Working on the project of Competitive Advantage Theory was a great experience. By preparing this project we got lot of knowledge we also !nderstood the importance of planning designing a project. "aking of this project was very m!ch enjoya#le moment in st!dying s!#ject. We also get experience to how to interact with people$ how to do s!rvey for getting information$ how to analy%e the s!rvey how to come to the concl!sion on given topic. &t was really very interesting topic to st!dy also very !sef!l in c!rrent sit!ation. Thank yo! "A" for giving this wonderf!l and very interesting project.

.e%#iograp)$: !!!/goog#e/com !!!/$a)oo/com

0i%#iograp)$:

Prod(ction 1 Operations Management -&/C/Manoc)a/ Operations Management # S/S)iva&am(/ Prod(ction 1 Operations Management

- S/N/C)ar$/

You might also like

- EconomyDocument1 pageEconomyBhavesh YadavNo ratings yet

- EXIM ConceptsDocument3 pagesEXIM ConceptsBhavesh YadavNo ratings yet

- Enviornmental ManagementDocument26 pagesEnviornmental ManagementBhavesh YadavNo ratings yet

- Computer Ergonomics RushinaDocument11 pagesComputer Ergonomics RushinaBhavesh Yadav0% (1)

- Effects of Organizational CultureDocument9 pagesEffects of Organizational CultureBhavesh YadavNo ratings yet

- Erp Vendors Drop Prices by Fifty Per CentDocument3 pagesErp Vendors Drop Prices by Fifty Per CentBhavesh YadavNo ratings yet

- Deming RuchiDocument10 pagesDeming RuchiBhavesh YadavNo ratings yet

- E-Banking: 1 Board and Management Oversight 2Document1 pageE-Banking: 1 Board and Management Oversight 2Bhavesh YadavNo ratings yet

- Economic EnvironmentDocument15 pagesEconomic EnvironmentBhavesh YadavNo ratings yet

- Districts ProjectDocument2 pagesDistricts ProjectBhavesh YadavNo ratings yet

- E Banking 4 ProjectDocument5 pagesE Banking 4 ProjectBhavesh YadavNo ratings yet

- Cock ProjcetDocument21 pagesCock ProjcetBhavesh YadavNo ratings yet

- E - Banking 2Document18 pagesE - Banking 2Bhavesh YadavNo ratings yet

- Dinesh 007 ProDocument21 pagesDinesh 007 ProBhavesh YadavNo ratings yet

- Paddy Info in UpDocument1 pagePaddy Info in UpBhavesh YadavNo ratings yet

- Chi ProjectDocument2 pagesChi ProjectBhavesh YadavNo ratings yet

- Darsika JobDocument12 pagesDarsika JobBhavesh YadavNo ratings yet

- Cover Page VrishinDocument2 pagesCover Page VrishinBhavesh YadavNo ratings yet

- Critical Path Method - YatriDocument14 pagesCritical Path Method - YatriBhavesh YadavNo ratings yet

- Crops Production 2002Document3 pagesCrops Production 2002Bhavesh YadavNo ratings yet

- Hospital ManagementDocument27 pagesHospital ManagementBhavesh YadavNo ratings yet

- Computer Ergonomics RushinaDocument11 pagesComputer Ergonomics RushinaBhavesh Yadav0% (1)

- Cost Sheet ProDocument3 pagesCost Sheet ProBhavesh YadavNo ratings yet

- Curriculam VitaeDocument2 pagesCurriculam VitaeBhavesh YadavNo ratings yet

- Coca Cola ProjectDocument24 pagesCoca Cola ProjectBhavesh YadavNo ratings yet

- Cinematic Thinking PratikshaDocument8 pagesCinematic Thinking PratikshaBhavesh YadavNo ratings yet

- Cash FlowDocument1 pageCash FlowBhavesh YadavNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow StatementBhavesh YadavNo ratings yet

- Cash FlowDocument1 pageCash FlowBhavesh YadavNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TM Matematika X IPA 8Document31 pagesTM Matematika X IPA 8Muhammad Ilyas ArradyaNo ratings yet

- 1) Two Vectors A, B Are Orthogonal IfDocument9 pages1) Two Vectors A, B Are Orthogonal IfRamesh MallaiNo ratings yet

- Labacha CatalogueDocument282 pagesLabacha CatalogueChaitanya KrishnaNo ratings yet

- Session ManagementDocument4 pagesSession ManagementahamedyaseenNo ratings yet

- Computer Graphics BasicsDocument3 pagesComputer Graphics BasicsBharath RNo ratings yet

- Abstract On Budgetary ControlDocument22 pagesAbstract On Budgetary ControlIhab Hosny AhmedNo ratings yet

- Critical Incident Stress DebriefingDocument20 pagesCritical Incident Stress DebriefingatenampNo ratings yet

- Bayan Ko Linis Ko ProgramDocument43 pagesBayan Ko Linis Ko ProgramCymagne Donna Aquino DelarosaNo ratings yet

- A New Approach To Economic Development in NunavutDocument26 pagesA New Approach To Economic Development in NunavutNunatsiaqNewsNo ratings yet

- Skripsi Tanpa Bab Pembahasan PDFDocument67 pagesSkripsi Tanpa Bab Pembahasan PDFaaaaNo ratings yet

- The Mooladhara ChakraDocument13 pagesThe Mooladhara Chakraimamith100% (1)

- ABAP Performance Tuning Tips and TricksDocument4 pagesABAP Performance Tuning Tips and TricksEmilSNo ratings yet

- EEM336 - 01 - Introduction To The Microprocessor and ComputerDocument53 pagesEEM336 - 01 - Introduction To The Microprocessor and ComputersakalanNo ratings yet

- OM Version 1Document497 pagesOM Version 1Sushant SinghNo ratings yet

- Interview Call Letter - DR K R SwaroopDocument2 pagesInterview Call Letter - DR K R SwaroopDr-Swaroop KRNo ratings yet

- Chimney Design UnlineDocument9 pagesChimney Design Unlinemsn sastryNo ratings yet

- Confidence Limits in StatisticsDocument30 pagesConfidence Limits in StatisticsaassmmrrNo ratings yet

- 432 HZ - Unearthing The Truth Behind Nature's FrequencyDocument6 pages432 HZ - Unearthing The Truth Behind Nature's FrequencyShiv KeskarNo ratings yet

- ESL BOOKS - IELTS Academic Writing Task 1 Vocabulary by ESL Fluency - PreviewDocument7 pagesESL BOOKS - IELTS Academic Writing Task 1 Vocabulary by ESL Fluency - Previewanirudh modhalavalasaNo ratings yet

- Innoventure List of Short Listed CandidatesDocument69 pagesInnoventure List of Short Listed CandidatesgovindmalhotraNo ratings yet

- A Dynamic Model For Automotive Engine Control AnalysisDocument7 pagesA Dynamic Model For Automotive Engine Control Analysisekitani6817No ratings yet

- Natural Law and The Theory of Society 1500 To 1800 (Scan Perso) PDFDocument508 pagesNatural Law and The Theory of Society 1500 To 1800 (Scan Perso) PDFjcfichte100% (1)

- Hawk RoostingDocument11 pagesHawk RoostingMOKIBUL ISLAM MOKIPSNo ratings yet

- Part 1 - Install PfSense On ESXi - Calvin BuiDocument8 pagesPart 1 - Install PfSense On ESXi - Calvin Buiandrei2andrei_3No ratings yet

- French DELF A1 Exam PDFDocument10 pagesFrench DELF A1 Exam PDFMishtiNo ratings yet

- HT 02 Intro Tut 07 Radiation and ConvectionDocument46 pagesHT 02 Intro Tut 07 Radiation and ConvectionrbeckkNo ratings yet

- English 4 Realistic FictionDocument5 pagesEnglish 4 Realistic FictionRose Marie RebutaNo ratings yet

- Evidence DoctrinesDocument5 pagesEvidence DoctrinesChezca MargretNo ratings yet

- Assignment 4: Chitresh KumarDocument7 pagesAssignment 4: Chitresh KumarChitreshKumarNo ratings yet