Professional Documents

Culture Documents

Pet Coke

Uploaded by

zementheadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pet Coke

Uploaded by

zementheadCopyright:

Available Formats

Energy

Argus

M O N T H LY

Petroleum Coke

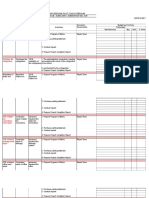

www.energyargus.com/coke.html Wednesday January 8, 2003 Report No. 03S-001 DECEMBER COKE INDEX

40 HGI 25.50 / 26.50 23.00 / 24.00 45 HGI 31.00 / 32.00 26.00 / 27.00 40 HGI 37.05 / 38.05 34.55/ 35.55 45 HGI 42.00 / 43.00 37.00 / 38.00 70HGI 26.00 /27.00 24.00 /25.00

ENERGY ARGUS PETROLEUM COKE

FOB US GULF COAST 4.5% Sulphur 6.5% Sulphur FOB US WEST COAST 3.0% Sulphur 4.5% Sulphur DEL SPANISH MED 4.5% Sulphur 6.5% Sulphur DELIVERED JAPAN 3.0% Sulphur 4.5% Sulphur $/mt

IN THIS ISSUE... Venezuela strikes at heart of the coke market ..........2 Trading stalls or goes underground ....................3

70HGI 37.55 / 38.55 35.55 / 36.55

$/mt

$/mt

ExxonMobil replaces Koch with ConocoPhillips..........5 Venezuelan crisis slashes coke production ..............8 Oil market faces fight on two fronts ........................8 Saudis want Opec output increase ..........................9 US coal prices leap higher ............................11 A market report from the publishers of

$/mt

Note:Delivered prices are calculated using fob prices plus Panamax freight

ENERGY ARGUS COAL DAILY

$/mt CAPP Nymex spec 12,000 Btu $/st Cif ARA 6,000 kcal Fob Richards Bay 6,000 kcal Fob Newcastle 6,700 kcal Cif Japan 6,700 Kcal COKE PERCENT OF COAL 4.5% 40 HGI 6.5% 40 HGI 3.0% 45 HGI

COAL INDEX

Next Month Delivery 12/30/02 December Avg 29.50 28.58 ------------Next Quarter Delivery 12/30/02 December Avg 30.50 29.42 35.35 34.79 27.50 27.00 25.25 24.28 30.75 29.89 cif ARA cif Japan 105.78% 98.59% 142.19% $/mmBtu 1.58 1.43 1.20 1.12 1.18 0.97 Btu % Coal

fob US Gulf Coast 88.38% 79.88% Spot 39.00 35.35 37.55 35.05 36.80 34.30

EUROPEAN BTU COMPARISON Coal Delivered Spanish Med Coal Delivered Northwest Europe Hard 4.5% Coke Delivered Spanish Med Hard 6.5% Coke Delivered Spanish Med Hard 4.5% Coke Delivered NW Europe Hard 6.5% Coke Delivered NW Europe

76% 71% 82% 77%

&

ENERGY ARGUS AIR DAILY

$/st SO2 Allowance Index

SO2 INDEX

12/30/02 135.00 December Average 132.15

PETROLEUM ARGUS

$/bl Maya US Gulf Coast ANS US West Coast WTI/Maya spread Brent/Dubai spread 1pc Fuel Oil New York Asphalt, Western Gulf Coast, $/st

CRUDE & PRODUCTS INDICES

12/30/02 25.73 30.00 -5.57 2.60 28.38 91.50 December Average 19.83 24.95 -6.57 1.66 26.59 89.17

For more information visit our website: www.energyargus.com/ coke.html

Copyright 2003 Argus Media Limited All rights reserved.

Page 1

Energy Argus Petroleum Coke

Report No. 03S-00-01 - Wednesday January 8, 2003

$/t

30 25 20 15 10 5 Sep

Hard Petroleum Coke Spot Price

Venezuela strikes at the heart of the fuel grade coke market

US petroleum coke prices have jumped by almost 20% since the start of the December 2 national strike in Venezuela. Atlantic basin coke supply has been cut by 20,000 t/day, and 500,000 tons are now irreplaceable.

Dec

Mar 4.50%

Jun 6.50%

Sep

Dec

The supply-side crisis has seized the market and European prices appear to have already crossed the point where coal is a better burn value than coke. Our subscribers should not be surprised. Argus warned in its March 5, 2002, issue that "one wild card remains hanging over the market, one that many have chosen to ignore at their peril, is Hugo Chavez." Our overview went on to say that "the coke industry in its short life has had experience with political risk in the form of regulation, but not in the form of unpredictable and unstable governments. Up until a few years ago, the overwhelming majority of cokers were located in the relatively stable economy of the United States. Now that balance is shifting with Venezuela taking a greater share."

3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 Jun Jul

$/t

Coke Quality Spreads

Aug

Sep

Oct

Nov

Dec

4.5% HGI Spread 40 HGI Sulphur spread

6.5% HGI Spread 70HGI Sulphur spread

$/t

38 34 30 26 22 18 14 Aug

Coke vs Coal 4.5% 40 HGI fob USGC

At March of last year, coke prices were at their weakest values in over two years. Few could take seriously the threat of a supply crisis when low sulphur hard coke was at $9.50 and coal in Europe was at $34. But today that same coke is at $26 and coal in Europe is at $35. European buyers of coke usually balk when the price of coke exceeds 65% of the price of coal on a Btu basis. In December, coke was valued at between 77% and 82% of coal on a Btu basis delivered into Northwest Europe. And it was between 71% and 76% of coal in the Mediterranean. This will be disconcerting to those with flexible demand, at least as disconcerting as a commodity price rise of 275% in ten months. What looked like an opportunity to the cement and industrial buyer last spring now looks much more like a liability.

Defaults spread

Sep Oct Nov ARA Coal Dec USGC Coke Nymex Spec Coal

One US utility, that utilizes coke sourced from Venezuela, said in December that force majeure letters were falling out of the sky. PdV declared force majeure on all crude and products exports shortly after the strike began, which includes the three new crude upgrading projects. The loss of coke may force the utility to solicit for additional coal, after already securing what it thought was ample coal for this year. Some market sources say that the high price of coke will prompt US end users to switch to coal, or at least to a higher percentage of coal usage. Even prior to this month's surge in prices, some end users like the City Public Service Board of San Antonio (Texas) had grown disenchanted with coke prices and opted not to use coke this year. Other utilities that burn only a small portion of coke in their fuel mix, such as Owensboro Municipal Utilities (OMU) in Kentucky, could easily switch away from coke altogether.

$/mt

12 11 10 9 8

Panamax Freight Rate, Petroleum Coke USGC to Spanish Med

7 Apr-02

Jun-02

Aug-02

Oct-02

Dec-02

Source: Clarksons

Copyright 2003 Argus Media Limited All rights reserved.

Page 2

Energy Argus Petroleum Coke

Report No. 03S-00-01 - Wednesday January 8, 2003

$/bl

16 15 14 13 12 11 10 9 8 2-Dec

USWC USGC

Light/Heavy Differential US Gulf Coast

Another US utility says the strike could end up costing it one or two cargoes, but that the primary impact of the strike has been the delay in vessels loading at PdV/Amerada Hess Hovensa refinery at St Croix, Virgin Islands.

Trading stalls or goes underground

All eyes are fixed on the strike to the point where very little else is being done or discussed. The holiday season combined with the Venezuelan strike proved to be the death knell for business, including the conclusion of several contracts which are still hanging in the negotiation balance. Many of the contracts waiting to be inked are for Venezuelan coke, so understandably the contracts are on hold pending the outcome of the strike. The shortfall of supply has given way to a lot of scrambling in the marketplace. But scramble as they may, potential buyers are finding precious little supply anywhere. One cargo sourced off the US Gulf coast in December fetched $25.50/t fob, for 4.5% sulphur, above 50 HGI. The 55,000 t cargo was lifting prompt. Another cargo was reportedly done at $27.00/t fob US Gulf coast, but confirmation was not obtained.

Eastern USGC Barge Midwest US Barge Southwest Spain

9-Dec

16-Dec

23-Dec

$/t

220 200 180 160 140 120 100 80 A M

Asphalt prices: US and Europe

$tl

30.00 29.50 29.00 28.50 28.00 27.50 27.00 26.50 26.00 25.50 25.00 10/1

Daily Coal Prices Nymex Spec Central App Prompt Month

Bullish stories in the coke market in 2002, such as the surprise entrance of China as a buyer into the market, take on even more impact given the current supply situation. China, in the first 11 months of 2002, purchased almost 1.3mn tons of coke, or 112,000 tons per month. In November, Premcor closed its Hartford, Illinois, refinery, with its 325,000 t/yr high sulphur, hard coke output. Last spring, JEA brought the first of two, coke-fired circulating fluidized bed (CFB) boilers online, with the second just behind it. The utility faced challenges finding the right coke and coal mix, but still utilized up to 500,000 tons of coke in 2002. When the units begin to use 100% coke, they will combine for up to 1.6mn t/yr of consumption.

Watch this space

Nine months before the latest strike began, Chavez was facing internal mutiny within PdV, had found dissent among his own military cohorts and was running out of cash. Argus suggested that there was a chance that Chavez, in an effort to boost his public appeal among Venezuelans, could move to nationalize the Orinoco belt joint ventures with ExxonMobil, TotalFinaElf, Statoil, ConocoPhillips and ChevronTexaco. Chavez did not do that, but the net effect has been nearly as bad. And we would be foolish to think that the crisis in Venezuela could not evolve even further and become perhaps intractable. Coke is borrowing this volatility from the oil markets. In the best of times, the coke price is driven by many vectors including oil, coal, shipping, new supply, and the steady growth in demand. But no factor, not coal nor demand nor shipping, can cause a sudden supply shock. Supply shocks are the expertise of the petroleum markets and coke traders who are not well versed in oil and refining markets and in international oil politics become standing targets in no man's land.

10/22

11/12

12/3

12/24

$/st

32.00 31.50 31.00 30.50 30.00 29.50 29.00 28.50 28.00 27.50 27.00 26.50 1st Month

Coal Forward Curve Nymex Spec Central App Coal

2nd Month

1st Q 1-Dec

2nd Q 1-Jan

3rd Q

Copyright 2003 Argus Media Limited All rights reserved.

Page 3

Energy Argus Petroleum Coke

Report No. 03S-00-01 - Wednesday January 8, 2003

Coke Price as % of Coal Nymex Spec Coal

90%

% 20 18 16

Spanish Cement Consumption Year-on-Year Change

60%

14 12

30%

10 8 6

Jul Aug Sep 4.5% 40 Oct 6.5% 40 Nov Dec

0%

4 2 0

mt

250,000

Chinese Coke Imports

-2 -4 1/97 6/97 1/98 6/98 1/99 6/99 1/00 6/00 1/01 6/01 1/02 6/02

200,000

Calcined Uncalcined

150,000

mt

Spanish Domestic Cement Consumption

4.4 4.2 2002 2001

100,000

50,000

4.0 3.8

Mar Apr May Jun Jul Aug Sep Oct Nov

3.6

,000 t

600,000 500,000 400,000 300,000 200,000 100,000 0 Mar Apr May Jun Jul Aug Sep Oct

3.4

US Exports to Spain and Italy

3.2 Feb Mar Apr May Jun

Italy

Jul

Aug Sep Oct Nov

Spain

ENERGY ARGUS

As of December 30, 2002 New York Diesel New York 0.3% Fuel Oil* New York 1% Fuel Oil Transco Zone 6 Gas Nymex spec Coal Gulf Coast 4.5% 40 HGI Coke Gulf Coast 6.5% 40 HGI Coke PJM Power

BTU COMPARISONS

Heat Value in Spark Spread $/mmBtu in $/MWH 6.27 -21.58 6.12 -20.03 4.44 -3.32 5.35 -12.36 1.38 27.29 1.28 28.36 1.39 27.24 41.13

000 t

1,700 1,500 1,300 1,100 900 700 500 May

US Exports of Non-Calcined Coke by region

CLARKSONS

60,000 mt (Panamax) $/mt US Gulf Coast to European Continent to Spanish Mediterranean to Black Sea US West Coast to European Continent to Spanish Mediterranean to Japan

COKE FREIGHT RATES

1/3/02 10.80 11.55 12.50 16.00 16.50 16.00

Jun Europe

Jul Asia

Aug

Sep

Oct

Latin America

Copyright 2003 Argus Media Limited All rights reserved.

Page 4

Energy Argus Petroleum Coke

Report No. 03S-00-01 - Wednesday January 8, 2003 (EAPC, February 5, p6). In the spring of 2002, Power Park also awarded 250,000 tons of coke to trader Capex, and 50,000 tons to TCP for 2002 delivery. St Johns is in a comfortable position with regard to inventories, as it has up to four months worth of coke supplies on the ground. Last year, the utility consumed 650,000 tons of petroleum coke, up 50,000 tons from a year earlier. And the same amount is projected to be burned this year. St Johns, which is permitted to utilize coke in up to 20% of its fuel mix at any given time, increased its annual coke usage from 15.5% to 17% in 2002 (EAPC, September 3, 2001, p6). But the utility will pursue using more coke in the future, which will require re-permitting and making boiler modifications, a company official says. With regard to the strike in Venezuela, St Johns has not been significantly impacted. The strike could result in up to two cargoes being delayed or cancelled, but that has not happed yet. The biggest impact so far is that vessels are taking longer to load at Hovensas St Croix refinery in the Caribbean, which typically processes Venezuelan crude. JEA, which witnessed the ups and downs of bringing two new boilers utilizing circulating fluidized bed (CFB) technology on line back-to-back in 2002 at its Northside 1 and 2 units, is being adversely affected by the Venezuelan strike. The utility has reportedly received several force majeure letters, and says it may have to put out a solicitation for coal if the situation is not resolved soon. But JEA said nothing was known at the time with regard to what it will decide to do. The utility last month said it will solicit for 2003 coke supplies this month or next (EAPC, December 5, 2002, p5). JEA has some coke supply contracts that extend into this year, but exact details are unavailable. In March 2002, JEA awarded up to 1.3mn tons of coke to Koch Carbon, TCP and SSM, and prior to that time awarded a supply contract to Aimcor for an unspecified volume of coke (EAPC, November 5, 2001, p6). JEAs 2002 coke burn was estimated between 400,000 and 500,000 tons, but once the two 300MW Northside units are utilizing 100% coke, they will combine for an annual burn of up to 1.6mn tons (EAPC, September 3, 2001, p6). JEA has yet to discover why it is having problems burning 100% coke at the units, and continues to run them on a 70:30 blend of coke and coal. But it is still the utilitys intention to run Units 1 and 2 on 100% coke as soon as they are able to do so. JEA, which conducted planned, two-week outages on its coke and coal burning Northside Units 1 and 2 in Jacksonville, Florida, last October and November, has announced additional maintenance for this spring (EAPC, December 6, 2002, p5). While last autumns outages prepared the units for the winter, JEA is planning to take both units down in March and April, for two to three weeks each, to make improvements for the summer run. The utility will do the work during the low load period, and will make engineering improvements and other various fixes, including limestone feed problems. Northside Units 1 and 2 will continue to burn a mixture of coke and coal

Coke Market News

US trader Koch Carbon will not have a share of ExxonMobils Torrance, California, petroleum coke marketing for 2003. Rather, ExxonMobil has added ConocoPhillips to the mix, which makes this the first known deal wherein one US refiner has a lifting contract with another refiner. Like last year, US trader Aimcor will market 50% of ExxonMobils 1.2mn t/yr of 1.4%, 45-50 HGI coke, and will have this percentage for the next three years (EAPC, February 5, p6). The balance of this years marketing will be split between ConocoPhillips, Mitsui Energy, Oxbow Carbon & Minerals, Energy Coal Spa and Mitsubishi. ConocoPhillips and Mitsui were each awarded less than 100,000 tons, market sources say. ExxonMobil was able to increase its 2003 contract price by $1 per ton from 2002 levels, sources say. Sincor shipped approximately 1.1mn tons of petroleum coke in 2002, well placed sources report. Production in 2002 was slightly less than 1.1mn tons, but the prolonged Venezuelan general strike has made it difficult to obtain exact figures. Sincors massive 2mn t/yr coker at the port of Jose, in eastern Venezuela, began startup sequence in March 2002, and produces 4.5% sulphur, 45 HGI coke (EAPC, April 5, p5). Sincor, the PdV/TotalFinaElf/Statoil joint venture, shipped its first coke in early September when its new shipping installation was completed (EAPC, October 4, 2002, p5). Sincors upgrader was taken off line on December 13 due to the strike, and the loading facility was also shut down by the same day. The Italcementi Group reports that it is still in the process of negotiating some of its supply contracts for this year, but the general strike in Venezuela has prevented it from completing all of its contracts. The cement producer reports that some of its suppliers are counting on Venezuelan coke, and that it is approaching the deadline by which it needs to have its contracts in place. As a result, a prolonged strike in Venezuela could force it to look elsewhere for a portion of its 2mn mt annual coke take (EAPC, October 4, 2002, p6). Apart from Venezuela, the cement producer also receives petroleum coke from the US, Italy and Spain. Italcementi, sometimes referred to as the fifth global player, has five suppliers, with contracts ranging from spot, quarterly, six-month, annual and index-related. While Florida utility St Johns River Power Park, the JEA and Florida Power & Light joint venture, has three coke supply contracts that expire the middle of this year, it does not believe now is the best time to enter the market for new contracts. The utility has a contract with US trader Aimcor for 150,000 tons of coke to be delivered from last month through the end of June. Additionally, St Johns is in the last six months of three-year contracts with US trader TCP and ConocoPhillips. A third, three-year contract that began in 2000 with Enron, was cancelled, but only consisted of 100,000 tons

Copyright 2003 Argus Media Limited All rights reserved.

Page 5

Energy Argus Petroleum Coke this year, but JEAs goal is to have both units consuming 100% coke in 2004. Taiwan's Formosa Petrochemical has pushed ahead with its Mailiao refinery's new power plant despite persisting problems with the petroleum coke unit, using coal as a blend to make up for the shortfall on coke supply (EAPC, December 6, 2002, p5). The coker is designed to produce around 1mn t/yr, all of which is intended for consumption by the power plant at the 450,000 b/d refinery. But technical problems have prevented the coker getting up to full speed, although the situation does appear to be improving. Testing on the unit began way back in June. "We still have some time to go to get it running smoothly," a source at the privately owned refinery said. "But the power units are running." The source would not say exactly how much petroleum coke is currently being produced, but indicated that the situation has recently improved. A test run at 50% capacity in November could only be sustained for a few days. Electricity from the two new 150MW circulating fluidized bed (CFB) boilers at the plant is to be sold to Taiwan's national grid as well as supplying the Mailiao refinery itself. Formosa has enough coke of its own to blend with coal to run the power plants, the source said. No purchases of petroleum coke are being contemplated. The 540,000 b/d Reliance refinery at Jamnagar, on Indias northwest coast, is reportedly back to normal, and is producing close to 8,000mt/day of petroleum coke, a company official says. Industry sources in late 2002 suspected that Reliance had raised coke output from early year levels of 6,800mt/day, but the figures were never confirmed until now (EAPC, December 6, 2002, p7). Technical problems that surfaced at the refinery late last summer interrupted some output, and the problems have only now been corrected. With the additional coke production, Reliance has increased domestic sales, primarily into the cement industry. The Indian producer will export any surplus coke that is not utilized in the domestic market, but cannot commit any material in the near term, an official says. Venezuelan crisis slashes over 500,000 tons of production Venezuelas political crisis is showing no sign of resolution, over five weeks into a national strike aimed at removing President Hugo Chavez from power. The operations of stateowned PdV remain paralyzed, and prospects for a quick recovery from the crisis appear more remote with every passing day. Global crude and products have been impacted, and prices have shot higherincluding petroleum coke. Shortly after the strike began, PdV was forced to declare force majeure on all exports. Industry sources agree that close to 15,000 t/d of Venezuelan coke production is being lost due to the strike, and an additional 5,000 t/d at affected US Gulf coast and Caribbean

Report No. 03S-00-01 - Wednesday January 8, 2003 refineries. The strike started December 2, but not all refineries or upgraders were closed down that day. Closings came at different times, and some, such as Sincor, the PdV/TotalFinaElf/Statoil joint venture upgrader in Jose, Venezuela, came down as late as December 13. As a result, the industry estimates that over 500,000 tons of coke has been lost since the inception of the strike, at a time when the global coke market was already tight on supply. Some have put that figure closer to 1mn tons, and are quick to point out that even if the strike ended today, it would take another two to four weeks for refineries to ramp up after being shut down cold. Reports have emerged claiming serious damage to oil fields, refineries and other infrastructure that could delay a return to production when the current stalemate is resolved. One coke market participant called the Venezuelan situation a ticking time bomb, and said most people have yet to fully understand all the implications of the prolonged strike. In Venezuela alone, the three upgrading projects plus PdVs two coke-making refineries produce a combined 6.2mn tons of coke per year. PdVs coke output at the Cardon/Judibana refinery is 1.2mn t/yr, and another 800,000 tons is produced at the Amuay refinery. And the Cerro Negro, Sincor and Petrozuata upgraders account for the remainder of the coke production. Additionally, subsidiaries of PdV and Amerada Hess own the Hovensa refinery in St Croix, which has a capacity of 1.3mn t/yr. The exact status of US refiner Citgo, a wholly-owned subsidiary of PdV, is unknown, but most agree that it has avoided force majeure, but is scrambling to replace 650,000 b/d of Venezuelan crude. It has so far avoided deep run cuts at its Lake Charles, Louisiana and Corpus Christi, Texas, refineries. But the 260,000 b/d Citgo Lyondell Chemical refinery in Houston, which is 42pc owned by Citgo, has cut runs by roughly 50pc. Citgo produces 2.91mn t/yr of coke at its three refineries. Several US Gulf coast refineries have been directly affected by the strike. Murphys Meraux, Louisiana, plant, was running 15,000 b/d below capacity, while Lyondell-Citgo in Houston, Texas, slashed runs by half as of late December. ConocoPhillips in Sweeney, Texas, was about 40,000 b/d below capacity. Hovensa was reportedly well below capacity in December. With regard to coke production, Hovensa is operating anywhere from 60% to 100% of normal levels on a daily basis, industry sources say. The refiner is buying spot crudes, some of which are actually better quality than Venezuelan crude. Overall, Hovensa coke production has fallen one quarter since the beginning of the strike, sources say. But the producer has not had to cancel any coke deliveries due to the lower production. Many end users are reluctant to say how the Venezuelan strike is affecting them. One of the major cement producers says the strike has impacted them, but due to the complicated force

Copyright 2003 Argus Media Limited All rights reserved.

Page 6

Energy Argus Petroleum Coke majeure situation it cannot comment on anything. The producer said the strike impacts all buyers of coke, and hopes the matter is solved as soon as possible. Another cement producer in the Asia Pacific region does not know how the strike is affecting them at this time. Some lifters of Venezuelan coke say that the true implications of the strike could depend on how contracts with PdV are set up. The force majeure complicates the issue, and some contracts may end up being cancelled due to the strike. At least one US utility, JEA in Jacksonville, Florida, has hinted that it might be forced to put out a tender for coal, as its coke suppliers rely heavily on Venezuelan material. The utility previously fulfilled its 2003 coal requirements, but may need extra supplies now. Coke prices at the US Gulf coast have jumped about 20pc since the beginning of December due to the strike. The global coke market is very tight on supply, and most producers do not have any excess material to sell. The lingering question is how long will the strike last. But even if the strike ends today, the effects of the strike will persist throughout the year. Western Kentucky Energy (WKE ) has announced that it will receive spot bids on January 24 and term bids on February 7 for either coal or petroleum coke. The utility has not set any certain volumes for the solicitations, primarily given current market conditions. But the minimum monthly bid is for 5,000 t from any bidder or supplier. WKE has not been active in the coke market recently due to the current pricing of coke versus coal. The utility says it would be surprised to see many bids for petroleum coke given current market conditions.

Report No. 03S-00-01 - Wednesday January 8, 2003

Copyright 2003 Argus Media Limited All rights reserved.

Page 7

Energy Argus Petroleum Coke

Report No. 03S-00-01 - Wednesday January 8, 2003 after hurricanes shut in offshore production. The shortfall in the Gulf coast will soon spread inland to the high-consuming midcontinent region, where crude stocks have been close to historic lows for several months. There is now a strong argument for Washington to release some of the 600mn bl Strategic Petroleum Reserve (SPR). But it is unlikely to do so, even if consumers are hit by high prices, because SPR oil is seen an insurance policy against supply disruptions during an attack on Iraq. With no end to the political stand-off in sight, crude prices look set to rise further. And higher product prices will follow swiftly if US demand remains close to the current 20mn b/d. Colder than average temperatures on the US Atlantic coast have boosted distillate deliveries to their highest level in two years. And robust gasoline demand is keeping pressure on refiners to rebuild inventories before the start of the next driving season. A shortage of crude now could mean tight gasoline supplies and high pump prices in the spring.

Coke Industry News

Venezuelan disruptions slash Atlantic basin oil supply

The political strife in Venezuela has slashed oil supplies to the Atlantic basin, and US crude stocks are brushing 20-year lows after a massive drawdown late last month. Virtually no oil has come out of Venezuela since the countrys strike began five weeks ago normally it exports 2.5mn b/d, of which 60% goes to the US. The loss of supplies from a major source just five days sailing from the Gulf coast has slashed US imports, cut inventory levels, and sent crude prices soaring to their highest level in two years. Last months Opec decision to adjust targets and cut production is now irrelevant in a market which has switched from potential oversupply to acute shortage in just four weeks. Middle East producers are already gaining from the troubles in Venezuela, as Atlantic basin and Asian refiners compete for scarce prompt supplies. Opec output this month is unlikely to bear much resemblance to the new ceilings. The loss of a major short-haul exporter is a bigger blow for western buyers than cuts in Middle East supplies, which are a six-week voyage away. US refiners have no immediate substitute for 1.5mn b/d of Venezuelan crude, and their only recourse is to bid up prices to attract other grades across the Atlantic. But they are facing severe competition, particularly from Asia-Pacific refiners. Seasonal demand and fears about security of Middle East supply have prompted a surge in Asian buying in the last two months. Westbound spot chartering from the Mideast Gulf has fallen sharply since October as crude flooded east. Chinese crude imports hit a record 1.8mn b/d in November, after a restrained third quarter. West African producers are also benefiting from US demand for their crudes, which pushed prices to a 12month high against Brent at the end of last year. But the wider differential between Brent and Dubai has not deterred Asian buyers that need crude with high distillate yields, and are prepared to pay whatever they must to secure them. The strike in Venezuela could hardly have come at a worse time for the US. It would have been problematic enough in an ordinary year, halfway through a cold winter and with the economy still dangerously susceptible to higher oil prices. But this year, with a military strike against Iraq imminent, it is more than just a temporary nuisance. Even before the strike began, US crude stocks were at the low end of the fourth-quarter average. The halt in Venezuelan exports reduced US imports to 7.6mn b/d at the end of last month, the lowest weekly volume in almost three years. The immediate impact was on Gulf coast inventories, which fell by 9mn bl in just one week, leaving total US stocks close to the 20-year low of 270mn bl reached at the end of September

Opinion: Oil market faces a fight on two fronts

The US "is capable of fighting two regional conflicts," against both Iraq and North Korea, says defence secretary Donald Rumsfeld. But can the US handle two simultaneous oil supply disruptions? The month-long strike in Venezuela, one of the US closest and largest suppliers, has removed 2.5mn b/d from the world market, boosting WTI prices towards the highs of two years ago. Even if the strike ends soon, it is already too late to avoid large stockdraws in the US this month. If Washington presses ahead with war against Iraq, at least 2mn b/d more is likely to be lost. This will keep prices high and threaten serious damage to the economy. The Bush administration now faces a political conundrum. If the US goes to war, the dire economic consequences could cost President Bush the election next year. But if it is seen to back down over Iraq, Washington will lose credibility, which will have major long-term consequences for US interests. As with the developing tension in North Korea, it seems that Washingtons eye has been fixed so firmly on Iraq that trouble on its own doorstep has caught it unawares. The Venezuelan strike has had an immediate impact on US supply. Venezuela provides 1.5mn b/d of crude, or almost a sixth of US imports. It accounts for over 40% of the heavy crude run by refiners on the US Gulf coast. The full impact of the disruption is only now appearing in trade statistics, but it is clear that the loss over a prolonged period will slash industry stocks from already critically low levels. US crude stocks are brushing 20year lows and global stocks are at their lowest level since early 2000. Opec also seems to have been taken by surprise. A month ago, ministers resolved to cut output to a new lower ceiling of 23mn b/d. This week, they belatedly acknowledged

Copyright 2003 Argus Media Limited All rights reserved.

Page 8

Energy Argus Petroleum Coke the Venezuelan crisis, indicating that output may be raised if the upper $28/bl limit is breached for 20 days. The Opec promise temporarily stemmed the rise in prices. But extra supplies from the Middle East will be of little immediate help to Gulf coast refiners. There is no ready substitute for short-haul Venezuelan supply. And strong demand from Asia has already cut the volume of long-haul oil moving west this month. Political debate in the US has focused on the countrys dependence on Middle East oil. But the loss of a major source of supply just a few days away by sea is potentially much more serious. Any disruption to Iraqi output could be more easily managed, as western refiners would be cushioned by the six-week voyage. Losses of short-haul supply give little time to find alternative supplies and this is precisely why stocks need to be maintained at reasonable levels. Yet in the past four years Opec has drained the industry of stocks in order to push up prices. Crude stocks held by US refiners are close to historical lows, and there is now a compelling case for Washington to release oil from the Strategic Petroleum Reserve (SPR). But Washington has its own agenda. It has been building up stocks in the SPR ahead of the expected assault on Iraq, and now refuses to release oil to cover the crisis in Venezuela. How quickly the oil market has flipped from feast to famine faster, perhaps, than policy makers can think or respond. Two months ago, after a $5/bl slide in prices, Opec ministers were worried about oversupply. Now prices are at a two-year high, Venezuela has stopped exporting and war looms in the Middle East. But there has been minimal political reaction to the changed circumstances, either from the US or Opec. Politicians did not foresee the change. The industry will have to cope alone. No country plans to fight two wars simultaneously, and the industry does not plan for two oil crises. This year it may have to find a way to do just that.

Report No. 03S-00-01 - Wednesday January 8, 2003 The parties have committed to significantly increase both the refining and smelting capacities at Pingguo over the next few years. The current alumina expansion should be completed in the middle of this year, at with time the capacity of the alumina plant will be 850,000 t/yr. There are also plans to expand the 130,000mt/yr aluminum smelter at Pingguo by 250,000mt/yr, bring total capacity to 380,000mt/yr by 2006. Both parties expect to finalize the necessary arrangements and obtain government approvals by the second half of this year. No US regulatory approvals are required. Chalco is the sole alumina producer and the largest producer of primary aluminum in China, and was ranked 2nd in terms of alumina production volume in 2001 in the world. Its mining, refining and smelting operations are the largest in the Chinese aluminum industry. Alcoa is the worlds leading producer of primary aluminum, fabricated aluminum and alumina, and is active in all major aspects of the industry.

Asia-Pacific coal: Australia flexes producer muscle

Asia-Pacific steam coal prices have been nudged back on to a gentle upward path with the help of a concerted effort by the major Australian producers to capitalize on the strength of domestic demand in China. As the robust Chinese demand continues to eat into coal available for export, and even sucks imports into the heavily industrialized south of the country, the top four Australian producers are using their market muscle to convince north Asian consumers that the rebound from the spot market's mid-year lows still has some room to go. Those four producers control more than 80% of the shipments from Australia, the world's top coal exporter. They have staunchly kept their offers into recent water-testing tenders by Japanese and South Korean power companies to a minimum of $26/t on a Newcastle fob basis well above the levels closer to $24/t at which spot Newcastle trades have been done. That has allowed some Indonesian producers to snap up a bit of extra business, but it has also grabbed the attention of the major consumers, which in the end would prefer the higher-quality Australian coal if the price is competitive. Still, Australian producers are also coming to a mindset in which their own price ambitions are limited by how high the Chinese domestic price can go. If the Asia-Pacific spot price were to get back to a point somewhat higher than $26-27/t Newcastle fob, then extra Chinese coal would be drawn back out into the international market a phenomenon seen a year ago that set off a steep dive in steam coal prices.

Chalco, Alcoa announce revised joint venture timetable

Aluminum Corporation of China Limited (Chalco) and Alcoa Inc have announced that their joint venture at Pingguo, China, will now be formalized this year. This revised schedule will allow the parties to complete the necessary commercial terms and to obtain the necessary government approvals for the JV. Both Chalco and Alcoa are satisfied with the substantial progress of preparations made during 2002 toward the finalization of the Pingguo JV. Under the previously announced strategic alliance, Chalco and Alcoa are forming a 50/50 JV at Chalcos facility at Pingguo, which is one of the most efficient alumina and production facilities in China. Alcoa believes that the proposed JV will allow it to benefit from the growth of Chinas aluminum market, the fastest growing in the world. Chalco believes that the cooperation with Alcoa on the Pingguo JV will improve business performance within Chalco.

Saudis want 1.5mn-2mn b/d Opec output increase

Saudi Arabia wants Opec to increase its output ceiling by 1.5mn-2mn b/d to offset a supply shortfall caused by the Venezuelan strike. "Saudi Arabia and other countries think there is a need for 1.5mn-2mn b/d of extra oil on the market,"

Copyright 2003 Argus Media Limited All rights reserved.

Page 9

Energy Argus Petroleum Coke an Opec delegate told Argus. Opec ministers are holding consultations over the telephone to decide the exact amount of the increase, which would use the new 23mn b/d January output target for Opec s 10 participating members as a baseline, said the Opec delegate. An extraordinary Opec meeting is being convened in Vienna on 12 January to discuss an increase in production, indicating that some of the group's members disagree with the proposal to officially hike output by up to 2mn b/d. Kuwait's acting oil minister Sheikh Ahmad al-Fahd alSabah said his country favors a 1mn b/d increase, while others appear to favor sticking to the 500,000 b/d increase called for by the mechanism. One of the issues under discussion is how to allocate the increase on a pro-rata basis, given that the level of Venezuela s output will remain unknown. Asked if Opec s nine members excluding Iraq and Venezuela have enough spare capacity to offset a possible simultaneous export halt by these two countries, the first Opec delegate said: "We are not going to deal with ifs." If a US-led war on Iraq coincides with a continued curtailment in Venezuelan exports, some 4mn5mn b/d would be lost, straining Opec's spare capacity to the limit. Momentum for an output rise has been building within Opec since last weekend.

Report No. 03S-00-01 - Wednesday January 8, 2003 stand around 4.5mn t, of which 1.8mnt is iron ore. Market sources say that while there were fewer vessels than expected during December, activity is forecast to increase at the port over the next few days. The EMO terminal handled 20mn t of coal last year, while the smaller port of EBS processed 3mn t. EMO's maximum coal-unloading capacity is roughly 175,000 t/d. The EBS terminal, in Rotterdam's Botlek area, offers facilities for efficiently discharging ships up to 70,000 tons. But EBS offers board-board facilities for longer vessels in the Beneluxhaven (Europoort).

European coal sector agrees pricing specifications

European coal market participants agreed to keep standard pricing specifications unchanged at a key London industry gathering today, while continuing the drive to boost transparency across the sector. TFS a large, international coal broker arranged the gathering after concerns over the construction of the TFS API indices and confusion as to how reporting agencies like Argus obtain their prices were voiced by a handful of market participants. Standard specified coal is currently material which is scheduled for delivery within the next 90 days. A number of participants had previously voiced concern over such a wide timing window, claiming that in a liquid market a shorter pricing window of 60 days would provide more accurate price assessments. But, the majority of participants agreed to maintain the pricing window period at 90 days. One delegate also stressed that the TFS API index needed to take the next step forward and that the index was not transparent enough. Other players suggested that one way to boost transparency may be to publish a list of people contacted by the price reporting houses during the week. A published pool of contacted market members would provide a guiding principle to other players across the sector, one dealer said. Global Coal trades were also discussed, and it was noted that while deals concluded on the e-trading platform were an easy way to signal prices, there was still insufficient traded volume on the platform to be fully reflective of the market. The lack of liquidity on the TFS API 3 (fob Newcastle) index concerned a few individuals. But again the general consensus was that the contract needed a boost of confidence. The potential of a cif Japan physical index was also mentioned and participants at the gathering remarked that this contract was likely to receive a large amount of interest. The majority of the 26 participants at the London meeting agreed that they were generally satisfied with the way in which both price reporting houses assessed the TFS API cif Rotterdam and fob Richards Bay indices, and it was reiterated that greater transparency across the market was needed for price assessments to improve.

Steam coal loadings at Australia's Newcastle up

The amount of Australian steam coal loaded at Newcastle's major coal export terminals rose 8.7pc to 5.089mn t in December from 4.644mn t in November. The average queue for loading lengthened to 20 vessels last month from 12 in November, raising the average turnaround time to 10 days from six days. The number of ships loaded jumped to 81 from 66 in November, according to latest data from Port of Waratah Coal Services (PWCS). PWCS is owned by a consortium of Australian coal producers and major consumers, and operates the main Carrington and Kooragang facilities. Using the Japanese fiscal year ending 31 March as the basis for its data, PWCS said its steam coal shipments so far in 2002-03 are 41.013mn t. Steam coal represented 78pc of all the coal shipped, down from 82pc in November. The PWCS data did not specify the breakdown between the destinations of steam coal and coking coal, but the figures suggest a rebound in Japanese demand. Japan took 57pc of the coal shipped from the terminals in December, up from 55pc in November. South Korea's share slumped to 6pc in December from 15pc in November, while China's share fell to 4pc from 6pc. Taiwan's share jumped to 12pc from 8pc. So far in 2002-03, Japan has taken 56pc of steam and coking coal exports through the PWCS terminals, followed by Taiwan with 15pc and South Korea with 11pc. China's share is 3pc.

Rotterdam coal stocks edge up

Coal stocks at the giant EMO terminal in Rotterdam have edged up slightly to 2.7mn t, sources say. Stocks at the port

Copyright 2003 Argus Media Limited All rights reserved.

Page 10

Energy Argus Petroleum Coke

Report No. 03S-00-01 - Wednesday January 8, 2003

Coal Markets

European physical coal prices have leapt up around $1/t during the past four weeks, following a spate of buying by a number of Scandinavian utilities and concerns over the further tightening of South African supply. Scandinavian buyers have been seen in the market purchasing coal for prompt delivery at higher levels after lower hydro output helped to boost coal burn. Physical coal prices in Europe (cif Rotterdam) currently stand at $35.65/t, while South African fob prices are reported at $27.71/t. Driven by the onset of winter temperatures in the US and increased buying activity from utilities, eastern US spot coal prices strengthened noticeably during the past month. Prices for most coal specifications have increased by at least $1/ton since the beginning of December, and may strengthen further, especially if utilities continue to increase their coal burns. A substantial amount of coal remains available among eastern coal producers, but many utilities may be forced to enter the market at the same time in the coming months, resulting in a much-anticipated price spike. Many utilities are working with smaller stockpiles than normal during the winter season. Although there were alternative sources of coal being offered into the ARA region, strengthening freight rates were helping to keep these products off the market. Towards the end of the month the route 4 freight rate reached $10.70/t.

Crude Markets

Crude prices were driven sharply higher in December as a strike by employees at Venezuela's PdV erased over 2mn b/d of supply from the market. Since much of the country's output is higher-sulphur crude, the loss was felt most sharply among prices for alternatives like US domestic Mars and Ecuador's Oriente. The cash price for US benchmark WTI hit its highest level since November of 2000 at more than $32/bl, even as liquidity in the Americas crude markets dried up alongside falling supply. Worsening jitters over a possible war in Iraq also supported crude prices as the month wore on, and the premium for prompt oil over forward oil soared. Yet US purchases of Iraqi crude accelerated as refiners scrambled to replace lost Venezuelan supply. Availabilities of even light sweet crude from the North Sea and west Africa were quickly snapped up in the US at everincreasing premiums to WTI. And in a testament to the bad timing inherent in trying to manage a commodity as complex as oil, Opec met mid-month to ratify a cut to real output of up to 1.7mn b/d. Only weeks later it was reconsidering that decision as prices stayed above the organisation's price band. Traders watched closely to see if the US Strategic Petroleum Reserve (SPR) could be tempted to release some of its stocks, which finished the month nearing the 600mn bl mark. But reserve officials instead agreed only to allow deferrals of deliveries scheduled for December and January.

SO2 Markets

The SO2 emissions market stayed within its post-Enron range between $125 and $135. The market finished up at $131. The bulk of SO2 volume for last week took place on just two days where 29,000t and 15,000t traded respectively. Trading of SO2 forwards and future vintages in December was extremely light, due to the major decline of speculative trading, another result of the Enron collapse.

Fuel Oil Markets

US high sulphur fuel oil prices were highly volatile throughout December and early January, but remained exceptionally strong relative to crude oil after Venezuelan exports ground to a halt in early December. US Gulf coast 3pc sulphur fuel oil price hit a 15-year of 29.00/bl on 6 January, at approximately 90pc the values of WTI. Despite the high prices, Gulf coast refiners chose not to increase fuel oil output, as tight sour crude oil supplies made the move unprofitable. Soaring prices in the US Gulf and Atlantic coasts also opened an arbitrage for high sulphur fuel oil from Europe, with several Russian M-100 cargoes scheduled for delivery in January. The spread between low and high sulphur fuel oil price was exceptionally wide, as slack low sulphur imports and changes in the contractual arrangements of northeast US refiners severely curtailed low sulphur blendstocks supplies on the spot market.

Asphalt Markets

Higher feedstock costs forced US asphalt producing refiners to raise their asphalt winter-fill prices. The higher quotes have come at a time when US buyers typically expect to see the lowest wholesale prices of the season. Surging prices for highdensity fuel oil in northwest Europe and the Mediterranean failed to have an impact on bitumen prices. Many marketers expect pressure on bitumen prices of up to Euros 25/t in January, the result of rising feedstock costs. Southeast Asian asphalt prices found support on strengthening fuel oil and crude, but demand for prompt supplies petered out ahead of the year-end holidays. North Asian asphalt demand slowed in the winter season as refiners switched to fuel oil production.

Copyright 2003 Argus Media Limited All rights reserved.

Page 11

Energy Argus Petroleum Coke WHAT IS ENERGY ARGUS?

Energy Argus is the publisher of Coal Daily, the accepted benchmark for trade in the US and international markets for coal, and Air Daily, the index for sulphur allowance trading. Energy Argus is part of the larger Argus Media Ltd, which has existed for over 30 years as Petroleum Argus. Petroleum Argus publishes numerous price reports and analytical newsletters, and is widely used as an index for trade in crude oil, refined products, and LPG. Argus Petroleum Coke brings our experience in market analysis and indexing to an important but often neglected corner of the industry. Our goal is to produce index-quality assessments of the coke market, and to analyze coke prices and their direction. Argus is uniquely able to provide market news and analysis from its global team of reporters covering related industries such as coal, crude, gas, power and refining. Our coke indices assess spot market values for coke which is a great challenge in an elusive and illiquid market. We are assessing the value that coke has traded at or would trade at during the most recent month, for delivery in the next 90 days. We are not assessing long term contracts, nor are we including prices that were transacted months ago and are now being delivered. The prompt value of a commodity is always the best index. We welcome your comments and suggestions. Contact us at coke@energyargus.com.

Report No. 03S-00-01 - Wednesday January 8, 2003 FOR FURTHER INFORMATION:

Energy Argus Inc. 4801 Woodway, 270W Houston, TX 77056 Phone: 713.622.3996 Fax: 713.622.2991 Email: coke@energyargus.com Web: www.energyargus.com/coke.html New York office 129 Washington Street, Suite 201 Hoboken, NJ 07030 Tel: (201) 659 4400, Fax: (201) 659 6006 email: info@energyargus.com Washington office 1012 14th Street NW, Suite 1500, Washington, DC 20005 Tel: (202) 775 0240, Fax: (202) 872 8045 London office: 93 Shepperton Road London N1 3Df Tel: (44 20) 7359 8792 Fax: (44 20) 7226 0695 email: sales@petroleumargus.com Singapore office: 22 Malaccaa Street #10-02 Royal Brothers Building Singapore 048980 Tel: (65) 533 3638 Fax: (65) 533 4181 Russia office: Suite 52,ul. Petrovka 17/4 Moscow 103031 Publisher Adrian Binks CEO Abudi Zein Editorial Americas: David Love Phone: 406.494.0061 Fax: 406.494.0062 Email: Love@us.petroleumargus.com Europe: Oliver Adelman Phone: 011.44.207.7044.723 Email: adelman@petroleumargus.com Asia Pacific: Ronnie Hau Phone: 011.65.533.3638 Email: hau@petroleumargus.com Executive Daniel Massey President, Petroleum Argus Inc. Phone: 713.968.0000 x107 Email: massey@petroleumargus.com Sales Houston: Karen Johnson Phone: 713.968.0000 x122 Chris Bozell Phone: 713.968.0000 x119 Email: sales@petroleumargus.com London: Richard Cretollier Washington: Ron Lippock Singapore: Feisel Sham Moscow: Yelena Timofeeva Support Michelle Conyers Phone: 713.968.0000 x102 Email: support@petroleumargus.com For trials and subscription enquiries: sales@energyargus.com Energy Argus Petroleum Coke is published by Energy Argus. Copyright 2003 by Argus Media Limited. Reproduction, scanning into an electronic retrieval system, or copying to a database is prohibited without the written permission of the publisher. ISSN 1538-9316

ARGUS INDEX METHODOLOGY:

Argus Petroleum Coke Index: The Argus Petroleum Coke index is an assessment of spot market activity for the grades assessed. Spot activity is defined as transactions or negotiations during the month assessed for delivery within the next 90 days. We base our assessments on a market consensus of the commodity value. We consider spot transactions and negotiations at the market in question (as in fob US Gulf Coast and US West Coast), delivered prices netted back for freight, contract renegotiations, and estimates of market participants. Forward loading or delivery dates will be considered up to 90 days from the end of the month assessed. Prices for volumes loading or delivering in those 90 days that were negotiated prior to the month assessed will not be considered in the assessment, as they reflect historical not current market fundamentals. Prices for contracts negotiated in the month assessed but for delivery over a term that spans beyond the next 90 days will not be considered in the assessment. We are reflecting intelligent index values for the grades assessed: where specifications of actual trades differ from the index, we will seek a market consensus as to how to adjust the traded value to properly inform the index specification. Where actual trades are not available, we will assess the value of the grade by seeking a consensus of participants and considering other connected markets. Where a range is assessed for a particular grade, it reflects the range of trade for that grade in the month assessed. If there is no trade, it reflects the range within which a willing buyer and seller could close a deal. Our survey includes producers, electricity generators, marketers/traders, heavy industry endusers, and other market participants. Coke percent of coal: As of February 5, 2002 issue, this table calculates the coke price as a percent of the coal price using estimated delivered coke prices for Europe and Japan. The US values compare Nymex specification CAPP coal to fob Gulf coast coke. The ARA values compare cif ARA 6,000 kcal coal to cif ARA coke by adding the USGC to ARA freight to the fob USGC coke price. The Japan value compares the price of cif Japan 6,700 kcal coal to cif Japan coke by adding the USWC to Japan freight to the fob USWC coke price. CFR quotes for Japanese coal are based on current freight added to fob China and fob Newcastle markets.

Coal forward curve: Represents the level of contango or backwardation in the coal markets by charting the price for forward delivery on the day quoted. BTU Comparison: Compares the relative values of different fuels on a BTU basis. Conversions for mmBtu per unit are: Diesel 5.79/bl, 0.3pc fuel oil 6.258/bl, 1pc fuel oil 6.384/bl, Coal 24/short ton (12,000 btu), Coke 30.86/metric ton (14,000 btu). New York 0.3% fuel oil is high pour and includes New York taxes. Coal and coke values include cost of sulphur allowances. Spark Spread: Indicates the relative profitability of burning various fuels in a northeastern US power plant. The spark spread is the difference between the spot power price and the cost of generating output from a given fuel based on a heat rate of 10,000. Coal and coke adjusted for SO2 allowances: A comparison of the true cost of coal and coke at a US electric generating plant after sulphur allowances are included. The spot price of coal and coke is adjusted for the cost of sulphur dioxide emissions, assuming the plant applies sulfur dioxide allowances at the current market price for those allowances. The SO2 index price is listed on page 1 of the report. Light/Heavy Product Spread A measure of the profitability of coking. For the Gulf coast, the spread is the average of prompt 87 octane conventional gasoline and prompt diesel in Houston, less the price of 3pc sulphur fuel oil fob US Gulf coast. For the West coast, the spread is the average of prompt 87 octane CARB gasoline and prompt CARB diesel in Los Angeles, less the price of 380 CST fuel oil in Los Angeles. US Exports of Non-Calcined Coke Source: United States International Trade Commission, http://dataweb.usitc.gov/. Clarkson's Freight Rates Rates are assessments for day quoted and assume a 65,000 metric ton dry bulk vessel, with a 45 foot draft at load port and no other restrictions.

Copyright 2003 Argus Media Limited All rights reserved.

Page 12

You might also like

- Energy Argus Petroleum CokeDocument19 pagesEnergy Argus Petroleum CokeJohanMargono100% (1)

- Low Sulphur Petcoke SpecificationsDocument1 pageLow Sulphur Petcoke SpecificationsPedro Secol PanzelliNo ratings yet

- Petroleum Cokes Summary PDFDocument22 pagesPetroleum Cokes Summary PDFBayu Handika PrasetyoNo ratings yet

- Use of Pet Coke in Cement Manufacturing and Its Comparitve Propreties With CoalDocument23 pagesUse of Pet Coke in Cement Manufacturing and Its Comparitve Propreties With Coalnitesh1985100% (1)

- Energy Argus: Petroleum CokeDocument21 pagesEnergy Argus: Petroleum CokeSwarup Singh DeoNo ratings yet

- Petcoke For Cement IndustryDocument39 pagesPetcoke For Cement Industryrsvasanrss100% (2)

- Raw Petroleum Coke SpecificationsDocument1 pageRaw Petroleum Coke SpecificationsHuyentrang NguyenNo ratings yet

- Refractory IndustryDocument39 pagesRefractory IndustryAnsu Mishra100% (2)

- UNCTAD Report Analyzes 2008-2010 Iron Ore MarketDocument99 pagesUNCTAD Report Analyzes 2008-2010 Iron Ore MarketppmusNo ratings yet

- Coak CalcinationDocument3 pagesCoak CalcinationcpsankarNo ratings yet

- Tutorial Petroleum Coke Calcining andDocument30 pagesTutorial Petroleum Coke Calcining andSyakbani100% (2)

- Platts SBB Steel DailyDocument11 pagesPlatts SBB Steel DailydxkarthikNo ratings yet

- CRU Group - Global Sulphur Market OutlookDocument22 pagesCRU Group - Global Sulphur Market OutlookHvalbye Capital MarketsNo ratings yet

- PCI Coal SelectionDocument16 pagesPCI Coal Selectionamitabh shankar100% (1)

- Petcoke in Cement Industry - Global Cement Conference - MumbaiDocument28 pagesPetcoke in Cement Industry - Global Cement Conference - MumbairsvasanrssNo ratings yet

- Benchmarks, Facts and Methodology for 100% Petcoke UsageDocument24 pagesBenchmarks, Facts and Methodology for 100% Petcoke UsageSamehibrahemNo ratings yet

- Energy Petroleum CokeDocument9 pagesEnergy Petroleum Cokesoumyarm942No ratings yet

- Managing China's Petcoke ProblemDocument34 pagesManaging China's Petcoke ProblemCarnegie Endowment for International PeaceNo ratings yet

- Analyses of The Coal Densification Behaviour and The Coal Cake Stability Within The Stamped Charge Coke Making OperationDocument16 pagesAnalyses of The Coal Densification Behaviour and The Coal Cake Stability Within The Stamped Charge Coke Making OperationBhadra1964100% (2)

- Argus Asian Petroleum Coke 2016 PDFDocument4 pagesArgus Asian Petroleum Coke 2016 PDFDedik DermadyNo ratings yet

- Mazut-100 Specification (Russia Origin)Document1 pageMazut-100 Specification (Russia Origin)Tariq B ShamsiNo ratings yet

- Nut CokeDocument10 pagesNut Cokescribdaccount0No ratings yet

- Representation of Coal and Coal Derivatives in Process ModellingDocument16 pagesRepresentation of Coal and Coal Derivatives in Process ModellingPrateek PatelNo ratings yet

- 2M BRL of Blco Loaded For Ghana Waters N65 Less 4Document25 pages2M BRL of Blco Loaded For Ghana Waters N65 Less 4miracle ambrose100% (2)

- List of Oil RefineriesDocument29 pagesList of Oil RefineriesSafyan ManzoorNo ratings yet

- Draft Contract GLIIT-BMI GAR 5500-5300Document12 pagesDraft Contract GLIIT-BMI GAR 5500-5300Julian Nico100% (1)

- The Syntroleum Process of Converting Natural Gas Into Ultraclean HydrocarbonsDocument10 pagesThe Syntroleum Process of Converting Natural Gas Into Ultraclean HydrocarbonsBharavi K SNo ratings yet

- Oil Accounting and Excise Duties at IOCL Mathura RefineryDocument127 pagesOil Accounting and Excise Duties at IOCL Mathura RefineryMohit Agarwal0% (1)

- AETHER Cement - ECRA Barcelona PresentationDocument23 pagesAETHER Cement - ECRA Barcelona PresentationGilsayan100% (1)

- 450F HsdviDocument2 pages450F HsdviJoJo kNo ratings yet

- Sesa GoaDocument8 pagesSesa Goamek00sNo ratings yet

- Indian Cement Industry Technology AdvancementsDocument12 pagesIndian Cement Industry Technology Advancementsreubenmth100% (1)

- Energy Argus Petroleum Coke PDFDocument18 pagesEnergy Argus Petroleum Coke PDFNagarajan TNo ratings yet

- Coke Oven - Byproduct Plant DetailsDocument5 pagesCoke Oven - Byproduct Plant Detailsanoopunni100% (1)

- Portland CementDocument58 pagesPortland CementNani DeskaaNo ratings yet

- Коротк Нотатки Про Хемiю ЦементiвDocument33 pagesКоротк Нотатки Про Хемiю ЦементiвCementarNo ratings yet

- Chemical CharacterisationDocument66 pagesChemical Characterisationvenkatakrishna chalapaathiNo ratings yet

- What is PET-COKE: A guide to properties and use in cementDocument38 pagesWhat is PET-COKE: A guide to properties and use in cementfaheemqc100% (1)

- FCO Zakamura 70'000 TM FOB PDFDocument20 pagesFCO Zakamura 70'000 TM FOB PDFOmar MagañaNo ratings yet

- Iron Ore Sales and Purchase Contract: Date XX March 2021Document10 pagesIron Ore Sales and Purchase Contract: Date XX March 2021Note BuriNo ratings yet

- Coal Gasification: HistoryDocument3 pagesCoal Gasification: HistoryTalha Jamil MalikNo ratings yet

- CFB units reference list with operating dataDocument9 pagesCFB units reference list with operating dataRadhakrishnan MelukoteNo ratings yet

- Graphite OutlookDocument21 pagesGraphite OutlookMasna PrudhviNo ratings yet

- Low Sulfer Coal BlendingDocument18 pagesLow Sulfer Coal BlendingSuparjianto Qhaedir Al FaatihNo ratings yet

- Virtual CemTrans Proceedings 16 June 2020 PDFDocument94 pagesVirtual CemTrans Proceedings 16 June 2020 PDFStockKingNo ratings yet

- Low NOx Burners in High Temp SerDocument21 pagesLow NOx Burners in High Temp SerIman Akbari100% (1)

- Benchmarking Report Cement Sector PDFDocument76 pagesBenchmarking Report Cement Sector PDFGuilherme Pierre PaivaNo ratings yet

- Iso 8217 2005Document2 pagesIso 8217 2005Sara ScaramelliNo ratings yet

- Gold Mining and Processing in IndiaDocument27 pagesGold Mining and Processing in IndiaSpandan PrasadNo ratings yet

- Benchmarking of Integrated Steel PlantsDocument38 pagesBenchmarking of Integrated Steel PlantsAnaruzzaman Sheikh100% (1)

- General Characteristic of Crude OilDocument20 pagesGeneral Characteristic of Crude Oildassi99No ratings yet

- Lignites - Their Occurrence, Production and Utilisation PDFDocument220 pagesLignites - Their Occurrence, Production and Utilisation PDFzmnerNo ratings yet

- Oil Gram Price Report 101911Document21 pagesOil Gram Price Report 101911Khurram KhaliqNo ratings yet

- Petroleum Coke Utilization For Cement Kiln FiringDocument8 pagesPetroleum Coke Utilization For Cement Kiln FiringSyeed SofieNo ratings yet

- DCM PFD CalculationDocument8 pagesDCM PFD CalculationManish GautamNo ratings yet

- Natural Gas/ Power News: NY Opens Hearings On Hydraulic FracturingDocument11 pagesNatural Gas/ Power News: NY Opens Hearings On Hydraulic FracturingchoiceenergyNo ratings yet

- Natural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightDocument10 pagesNatural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightchoiceenergyNo ratings yet

- Energy Data Highlights: Upper Devonian May Hold As Much Gas As Marcellus Shale: Range ExecutiveDocument9 pagesEnergy Data Highlights: Upper Devonian May Hold As Much Gas As Marcellus Shale: Range ExecutivechoiceenergyNo ratings yet

- ShaleGas JaffeRice WSJ050510Document11 pagesShaleGas JaffeRice WSJ050510Matthew PhillipsNo ratings yet

- Natural Gas/ Power News: Market Changes Contribute To Growing Marcellus Area Spot Natural Gas TradingDocument9 pagesNatural Gas/ Power News: Market Changes Contribute To Growing Marcellus Area Spot Natural Gas TradingchoiceenergyNo ratings yet

- Air SeperatorDocument35 pagesAir SeperatorzementheadNo ratings yet

- 11489stoplock55698 PDFDocument1 page11489stoplock55698 PDFzementheadNo ratings yet

- Modeling cement kiln energy useDocument16 pagesModeling cement kiln energy usezementheadNo ratings yet

- Presentation Carbon Service ReductionDocument30 pagesPresentation Carbon Service ReductionzementheadNo ratings yet

- Deep Cone Paste ThicknerDocument38 pagesDeep Cone Paste ThicknerzementheadNo ratings yet

- What Are We Trying To Achieve When Firing Fuel in A Rotary KilnDocument5 pagesWhat Are We Trying To Achieve When Firing Fuel in A Rotary KilnzementheadNo ratings yet

- Feeder "Te" Rotary (Airlock) : ApplicationDocument5 pagesFeeder "Te" Rotary (Airlock) : ApplicationzementheadNo ratings yet

- Cement Mill Ball Mill TestingDocument30 pagesCement Mill Ball Mill Testingzementhead100% (2)

- Clinker Cooler SystemDocument69 pagesClinker Cooler SystemzementheadNo ratings yet

- 3-5 stage cement kiln comparison chartDocument1 page3-5 stage cement kiln comparison chartzementheadNo ratings yet

- Refractory failure at nose ring and cooling zoneDocument69 pagesRefractory failure at nose ring and cooling zonezementhead100% (3)

- Products 1, 14-24, Doi: 10.4177/CCGP-D-09-00017.1Document0 pagesProducts 1, 14-24, Doi: 10.4177/CCGP-D-09-00017.1Amal KhanNo ratings yet

- Subzero Design GuideDocument96 pagesSubzero Design GuidezementheadNo ratings yet

- Life of DC Bags 10000 ReversalsDocument1 pageLife of DC Bags 10000 ReversalszementheadNo ratings yet

- Clinker FormationDocument120 pagesClinker FormationDragos PlaesuNo ratings yet

- Maximum Kiln Shell Temperature Guide for Cement PlantsDocument8 pagesMaximum Kiln Shell Temperature Guide for Cement PlantsGiequatNo ratings yet

- Wood Combustion - CurkeetDocument36 pagesWood Combustion - CurkeetzementheadNo ratings yet

- Draft guidance on mercury emissions from cement clinker productionDocument38 pagesDraft guidance on mercury emissions from cement clinker productionzementheadNo ratings yet

- IT500 User Manual 16pp 028 NCDocument24 pagesIT500 User Manual 16pp 028 NCzementheadNo ratings yet

- Pre HeaterDocument53 pagesPre Heaterzementhead100% (2)

- FL Smidth - Plant Overview - Water ConsumptionDocument16 pagesFL Smidth - Plant Overview - Water ConsumptionzementheadNo ratings yet

- FLS - Components CatalogDocument170 pagesFLS - Components CatalogzementheadNo ratings yet

- Chapman - Senior Workshop CalculationsDocument252 pagesChapman - Senior Workshop Calculationszementhead100% (3)

- Modena 80 E ManualDocument44 pagesModena 80 E ManualpmcerleanNo ratings yet

- V Sepa PresentationDocument13 pagesV Sepa Presentationzementhead0% (1)

- RT500BC Spec Sheet New Style 0051Document1 pageRT500BC Spec Sheet New Style 0051zementheadNo ratings yet

- Energy Saving Cement PlantDocument19 pagesEnergy Saving Cement PlanttankeanleongNo ratings yet

- The To Global Warming Skepticism: Scientific GuideDocument16 pagesThe To Global Warming Skepticism: Scientific GuidezementheadNo ratings yet

- Portland (W/C 0.485) 242: (Air-Entraining Portland (W/C 0.460) 230 Non-Portland (As Required For Flow of 110) )Document3 pagesPortland (W/C 0.485) 242: (Air-Entraining Portland (W/C 0.460) 230 Non-Portland (As Required For Flow of 110) )Anuradha RumeshNo ratings yet

- How To Repair Tire and Roller WearDocument7 pagesHow To Repair Tire and Roller WearzementheadNo ratings yet

- Accounting Crossword Puzzle Answer KeyDocument1 pageAccounting Crossword Puzzle Answer KeyFru RyNo ratings yet

- J H: A E M C S F M: Umping Edges N Xamination of Ovements in Opper Pot and Utures ArketsDocument21 pagesJ H: A E M C S F M: Umping Edges N Xamination of Ovements in Opper Pot and Utures ArketsKumaran SanthoshNo ratings yet

- Chanakya Neeti on ManagementDocument19 pagesChanakya Neeti on ManagementShivamNo ratings yet

- Performance Review and GoalsDocument3 pagesPerformance Review and GoalsTaha NabilNo ratings yet

- MIC 2e Study Guide Complete 2Document230 pagesMIC 2e Study Guide Complete 2anna_jankovskaNo ratings yet

- FedEx Strategic AnalysisDocument30 pagesFedEx Strategic Analysishs138066No ratings yet

- Union BankDocument7 pagesUnion BankChoice MyNo ratings yet

- Find the perfect candidate for Wakil Kepala Klinik Utama GR Setra CMIDocument2 pagesFind the perfect candidate for Wakil Kepala Klinik Utama GR Setra CMIRscmi Dan LaboratoriumNo ratings yet

- Etr - Siti Zubaidah Azizan M at 14 - 5Document5 pagesEtr - Siti Zubaidah Azizan M at 14 - 5Aziful AiemanNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Secrets of Self Made Millionaires by Adam Khoo PDFDocument291 pagesSecrets of Self Made Millionaires by Adam Khoo PDFdiego2190100% (2)

- Case 1 - Iguazu Offices Financial ModelDocument32 pagesCase 1 - Iguazu Offices Financial ModelapoorvnigNo ratings yet

- Thermo-020H Decanter DownLoadLy - IrDocument6 pagesThermo-020H Decanter DownLoadLy - IrLuis Rodriguez GonzalesNo ratings yet

- Innovative Business Models in The Era of Ubiquitous NetworksDocument13 pagesInnovative Business Models in The Era of Ubiquitous NetworksWan Sek ChoonNo ratings yet

- BT India Factsheet - NewDocument2 pagesBT India Factsheet - NewsunguntNo ratings yet

- Cases On CommodatumDocument10 pagesCases On CommodatumAlfons Janssen MarceraNo ratings yet

- Exploring Supply Chain Collaboration of Manufacturing Firms in ChinaDocument220 pagesExploring Supply Chain Collaboration of Manufacturing Firms in Chinajuan cota maodNo ratings yet

- DECISION MAKING TECHNIQUES AND PROCESSESDocument11 pagesDECISION MAKING TECHNIQUES AND PROCESSESMishe MeeNo ratings yet

- Bonny SCM 1Document30 pagesBonny SCM 1Atikah ANo ratings yet

- 60MT TraderDocument71 pages60MT TradersriNo ratings yet

- Murphy Et Al v. Kohlberg Kravis Roberts & Company Et Al - Document No. 16Document15 pagesMurphy Et Al v. Kohlberg Kravis Roberts & Company Et Al - Document No. 16Justia.comNo ratings yet

- MTC Strategic Plan 2012 To 2016Document42 pagesMTC Strategic Plan 2012 To 2016Ash PillayNo ratings yet

- Project Proposal: ESC472 - Electrical and Computer Capstone Design Division of Engineering ScienceDocument19 pagesProject Proposal: ESC472 - Electrical and Computer Capstone Design Division of Engineering Scienceapi-140137201No ratings yet

- HDFC StatementDocument8 pagesHDFC StatementAnonymous 3Mycs5No ratings yet

- Basel III Capital Regulations and Liquidity StandardsDocument40 pagesBasel III Capital Regulations and Liquidity Standardsrodney101No ratings yet

- Export Manager or Latin America Sales ManagerDocument3 pagesExport Manager or Latin America Sales Managerapi-77675289No ratings yet

- Kwality WallsDocument18 pagesKwality WallsKanak Gehlot0% (2)

- AIP WFP 2019 Final Drps RegularDocument113 pagesAIP WFP 2019 Final Drps RegularJervilhanahtherese Canonigo Alferez-NamitNo ratings yet

- Capital Market: Unit II: PrimaryDocument55 pagesCapital Market: Unit II: PrimaryROHIT CHHUGANI 1823160No ratings yet

- OPD Course OutlineDocument3 pagesOPD Course OutlinearpitashusinghNo ratings yet