Professional Documents

Culture Documents

WFCU Press Release

Uploaded by

windsorcityblog1Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWFCU Press Release

Uploaded by

windsorcityblog1News Release March 26, 2014

Corporate Office 3000 Marentette Avenue Windsor, ON N8X 4G2 p. 519.974.3100 f. 519.974.9098

For Release

WINDSOR FAMILY CREDIT UNION (WFCU) ANNOUNCES REORGANIZATION

EDDIE FRANCIS TO JOIN WFCU EXECUTIVE TEAM WINDSOR, ON On Wednesday, March 26, 2014, Windsor Family Credit Union (WFCU) President and Chief Executive Officer, Marty Komsa, announced a significant transformation to WFCUs organizational structure. The transformation will continue to position WFCU as a leading financial institution in Essex County.

Approximately fifteen years ago, WFCU began a journey to become the best financial institution in Essex County. Providing financial services to 15,000 members out of four locations and believing in a strong philosophy to be the best; WFCU would hire the best staff, treat them well, ensure they were well trained to deliver personal service and let them use their entrepreneurial skills to service members. Managed Assets were just shy of $200,000 million. Today, WFCUs Managed Assets have reached $1.6 Billion and soon Essex County will be served by nine retail locations. WFCU contributes back to the community through its WFCUs

Community Investment Program, marketing efforts are leading edge and its human resources practices are widely recognized as being at the forefront.

Komsa explained the credit union works hard at this process and continues to look to the future. WFCU does not look at its successes and bask in the glory. It does not have a monopoly. The financial services market place is changing; individuals looking for financial services are more knowledgeable and more demanding. Most financial product offerings are a commodity and pricing of products is finer than ever.

We will continue to strategize with a Plan for the Future. We will balance our initiatives. We will continue to hire the best. We will promote the best and we will watch as all staff use their entrepreneurial skills to succeed and perpetually move WFCU toward the goal of being the best, he said.

Today, Komsa announced a two phased organizational re-structure. In phase one, effective June 1, 2014 Mike Scott has accepted a new role within WFCU as its Executive Vice President, Credit Risk. Dare I say that Mike Scott is considered a legend in the area of credit and commercial services; for this reason his expertise is invaluable, said Komsa. At the end of Mikes first fiscal year with WFCU, commercial loans totalled over $8 million.

Making a career in the financial services industry for over 43 years, the last 17 with WFCU, takes dedication and commitment. In 1997 Scott brought his commercial banking and

lending experience to WFCU. Over the years, his focus on quality financial products and services and emphasis on member service has played an instrumental role in the credit unions growth. Under his leadership, the commercial services segment today accounts for 40 percent of the credit unions service totals; a portfolio garnering significant attention.

As Executive Vice President, Credit Risk, Scott will oversee the area of adjudication with a significant focus on strategic planning along with delinquency and risk management. Scotts new role has resulted in the search for a Vice President Commercial Services, which was advertised recently. This position will focus on business development for WFCUs commercial portfolio. In phase two, effective December 1, 2014, Gay Chong, currently WFCUs Executive Vice President Operations, will assume the new role of Executive Vice President, Member Services. With over thirty years experience in the financial services industry, including time with the trade association for Ontario credit unions, Gay joined WFCU in 1988. As Komsa explained, Over the years, her wealth of knowledge has been shared throughout the organization as she oversaw areas of business development, governance, marketing, operations, retail operations, service delivery channels, information systems, administration, wealth management and insurance.

Gay is well known and respected within the credit union system representing WFCU on various credit union system committees. Currently she is a member of the Board of Directors for the Ontario Credit Union Services Association, the credit unions banking system user group. In Gays role as Executive Vice President, Member Services she will continue to serve as the credit union Member Advocate and provide strategic oversight for the areas of information systems, policies and procedures and service delivery channels. Her new role will allow for an expanded focus in the areas of enterprise risk management and compliance, as well as new product development and member analysis, profitability and loyalty.

Also part of phase two, Komsa announced that Eddie Francis will join WFCU effective December Experience. Komsa stated, Since 2003, Eddie has led the City of Windsor with his heart, soul and with the tenacious mind of a savvy businessperson. These are qualities that fit perfectly with Windsor Family Credit Union and its future. We are pleased that he accepted the opportunity to now bring his expertise to the members, staff, management and Board of WFCU. 1st, 2014 as Executive Vice President, Operations and Member

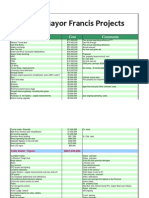

Francis has represented the rights of the citizens of Windsor, resulting in: Fiscal reform Increased reserves Increased capital spending Infrastructure improvements A downtown cultural hub Airport improvements and a cargo hub Downtown campuses for St. Clair College and the University of Windsor New downtown transit terminal New recreational facilities o o WFCU Centre WIATC and Adventure Bay

Increased profile for the City through involvement in high profile events The Herb Gray Parkway increasing the original $300 million highway connection to a $1.8 billion roadway and new bridge

In his role as Executive Vice President, Operations and Member Experience, Francis will provide strategic oversight for the areas of Finance, Accounting, Administration, Human Resources, Governance, Marketing, Community Investment and Business Development including: Retail Operations, WFCU Wealth Management, Conditional Sales & Auto Leasing and Insurance Services. We are very excited to have Eddie join our executive management team and we look forward to his contributions to the future of WFCU. The knowledge, dedication and professionalism of these three individuals play a key role in the current and future success of Windsor Family Credit Union. Our Board is committed. Our Vice Presidents are poised to perform, our organizational structure is in place and it is all for the benefit of our membership, expressed Komsa

Komsa also announced he will continue in his position as President and CEO and has committed to another five years at WFCU.

### About Windsor Family Credit Union - attached

For further information please contact:

Marty Komsa President and Chief Executive Officer 519-974-3100

Susan Stockwell Andrews Vice President, External Affairs and Corporate Secretary 519-974-3100

Windsor Family Credit Union (WFCU) has long been recognized as one of the leading, progressive financial organizations in the City of Windsor and Essex County. Serving Windsor and surrounding communities for over 70 years, WFCU began in 1941 with assets of less than $10,000 and now has $1.6 billion in Managed Assets and Member Service Totals of $2.4 billion. WFCU is the seventh largest in Ontario operating seven (7) retail locations and serving over 33,000 members including 30,000 Personal members in 15,700 households, 1,800 Businesses and 1,360 Organizations. WFCU membership is open to anyone who lives and/or works in Ontario. The credit union having roots in the community is dedicated to offering the products and services that will enable members to conveniently handle all their financial business with WFCU. WFCU's Financial, Investment, Insurance and Trust product and service offerings are tailored to each member segment. Accessing the credit union and conducting everyday financial transactions is a priority for WFCU, providing a number of access channels to members including its above noted retail locations, live and automated telephone banking, online and mobile banking, MasterCard credit card and merchant services, secure pre-authorized debit and credit services and 24 hour account access using a WFCU Member Card at ATMs and retailers. Over the last 20 years WFCU has enhanced the financial strength of the credit union. Regulatory Capital remains strong at $77.2 million and represents 7.2% of total assets and 11.9% of risk weighted assets. These ratios are substantially above regulatory standards of 4.0% and 8.0% respectively. The Deposit Insurance Corporation of Ontario (DICO) is the provincial deposit insurer equivalent to the federal Canada Deposit Insurance Corporation. WFCU's financial and operational strength is a result of planned initiatives developed in order to ensure that it strives to be the best. WFCU is a loyal and active member of Central 1, the credit union's banker, trade association, and a financial cooperative. Central 1's role is to serve as central financial facility, liquidity manager, payments processor and trade association for the provincial credit union systems of British Columbia and Ontario. It provides leadership, advocacy, technology, and a range of support services in fulfilment of these key functions. Central 1 holds $12.2 billion in assets. Committed to the communities it serves, WFCU is proud to display the Imagine Caring Company logo. Every year hundreds of local community organizations experience first-hand the benefits of several elements of WFCU's overall Community Investment Program, such as The Community 1 Free Chequing Account, Community Rooms, Scholarships, Donations, Sponsorships, Multi-Year Capital Giving and the Community Donations Fund. WFCU stresses the importance of quality by maintaining an internal 5 Star Quality Program. Reflective of offering a progressive work environment and culture supported by a strong focus on its employees and goals, WFCU has been repeatedly recognized as a Best Small and Medium Sized Employer and received multi-year ranking as one of the Best Workplaces in Canada. A Gord Smith Healthy Workplace Award recipient, WFCU is committed to promoting the importance of health and well-being among its employees. WFCU's solid attributes of financial strength; innovation; local ownership; quality products and service; community mindedness; and strong human resource management, have resulted in the on-going success of the organization. WFCU is proud to serve the Windsor and Essex County community and to be a leading financial services provider. February 2014

You might also like

- National Underwriter Sales Essentials (Life & Health): ProspectingFrom EverandNational Underwriter Sales Essentials (Life & Health): ProspectingNo ratings yet

- Accounting Cycle Project-ROMANDocument22 pagesAccounting Cycle Project-ROMANAbid Hasan Roman75% (4)

- Allied Bank - Case StudyDocument32 pagesAllied Bank - Case StudyKathlyn Kaye Sanchez100% (1)

- OFS Message FormateDocument25 pagesOFS Message FormateAswani Mucharla100% (2)

- Basic Accounting PrincipleDocument17 pagesBasic Accounting PrincipleGilbert LimNo ratings yet

- Partnership Theories and FormationsDocument6 pagesPartnership Theories and Formationsmachelle francisco100% (9)

- Detailed Lesson Plan - Fabm 1 (Second)Document12 pagesDetailed Lesson Plan - Fabm 1 (Second)Maria Benna Mendiola100% (5)

- Teller - User Guide: Release - R18AMRDocument61 pagesTeller - User Guide: Release - R18AMRZakaria AlmamariNo ratings yet

- Lugo Z - Grade 11 Fabm1 AbmDocument63 pagesLugo Z - Grade 11 Fabm1 AbmCar MelaNo ratings yet

- SAP FICO Course ContentDocument3 pagesSAP FICO Course ContentSridhar MuthekepalliNo ratings yet

- Code MIGO-Transfer Posting Accounting EntriesDocument3 pagesCode MIGO-Transfer Posting Accounting EntriesShiv P100% (1)

- The Credit Union World: Theory, Process, Practice--Cases & ApplicationFrom EverandThe Credit Union World: Theory, Process, Practice--Cases & ApplicationNo ratings yet

- Certified Credit Union Financial Counselor Training Program: The Vermont StoryDocument9 pagesCertified Credit Union Financial Counselor Training Program: The Vermont StoryREAL SolutionsNo ratings yet

- Wescom Financial Services and Simplicity Life Partner For Insurance ServicesDocument3 pagesWescom Financial Services and Simplicity Life Partner For Insurance ServicesPR.comNo ratings yet

- Group Project3Document15 pagesGroup Project3Shaquille Smith0% (1)

- SME TrifoldsDocument2 pagesSME TrifoldsRavi KhandgeNo ratings yet

- Final Draft - MFIDocument38 pagesFinal Draft - MFIShaquille SmithNo ratings yet

- 2012 WCMS Corporate SponsorsDocument11 pages2012 WCMS Corporate Sponsorsjana7980No ratings yet

- EHL - Q4FY16 - May 9, 2016 - Earnings Call-FinalDocument22 pagesEHL - Q4FY16 - May 9, 2016 - Earnings Call-FinalSolero CorpNo ratings yet

- Fsu Strategy Document 2023-26Document15 pagesFsu Strategy Document 2023-26leviremingtonNo ratings yet

- Importance of SACCOS in TanzaniaDocument16 pagesImportance of SACCOS in TanzaniaMichael Nyaongo75% (4)

- 2011 Annual ReportDocument202 pages2011 Annual ReportGary NgNo ratings yet

- Wu2011ar PDFDocument169 pagesWu2011ar PDFSaad JanNo ratings yet

- 58a2136bcced4 - M1 Maritimes Credit Union - W16455-PDF-ENGDocument8 pages58a2136bcced4 - M1 Maritimes Credit Union - W16455-PDF-ENGMarcoNo ratings yet

- Article Managing Student Financial Aid and Loan Debt During Economic TimesDocument2 pagesArticle Managing Student Financial Aid and Loan Debt During Economic TimesWTSusa81No ratings yet

- Al Baraka Bank Pakistan OverviewDocument9 pagesAl Baraka Bank Pakistan OverviewRida ZehraNo ratings yet

- Summit Bank Final-1Document48 pagesSummit Bank Final-1ABDUL BASIT100% (2)

- Chapter 1 Company History EBDocument6 pagesChapter 1 Company History EBVictoria Stephanie AshleyNo ratings yet

- Literature Review of Standard Chartered BankDocument7 pagesLiterature Review of Standard Chartered Bankafdtsdece100% (1)

- TOCMarketingPlanDocument4 pagesTOCMarketingPlanJustin Dan A. OrculloNo ratings yet

- Case AnalysisDocument10 pagesCase AnalysisAmenu AdagneNo ratings yet

- 2014 Annual ReportDocument78 pages2014 Annual ReportRia DumapiasNo ratings yet

- Annual Report 2014-15Document10 pagesAnnual Report 2014-15Rodrigo TeixeiraNo ratings yet

- Axis BankDocument9 pagesAxis BankPrasad MoreNo ratings yet

- Introduction of BanksDocument4 pagesIntroduction of BanksNoman AnsariNo ratings yet

- Project of MCBDocument55 pagesProject of MCBSana JavaidNo ratings yet

- Human Resource Management Policies of Metropolitan Bank for 2021-2022Document36 pagesHuman Resource Management Policies of Metropolitan Bank for 2021-2022Mark Joaquin AlcalaNo ratings yet

- Banking and Financial Services Supported by ECMDocument16 pagesBanking and Financial Services Supported by ECMshivasharanaNo ratings yet

- Boa On ForeclosureDocument252 pagesBoa On ForeclosureCarolyn WilderNo ratings yet

- FM 133 Capital-Wps OfficeDocument10 pagesFM 133 Capital-Wps OfficeJade Del MundoNo ratings yet

- Interoffice MemorandumDocument2 pagesInteroffice Memorandumnioriatti8924No ratings yet

- Cortez Mary Grace B.Lesson-1 - MicrofinanceDocument8 pagesCortez Mary Grace B.Lesson-1 - MicrofinanceMary grace CortezNo ratings yet

- Corporations Awarded For Corporate Governance and Corporate Social ResponsibilitiesDocument5 pagesCorporations Awarded For Corporate Governance and Corporate Social ResponsibilitiesMaya BarcoNo ratings yet

- The BankDocument11 pagesThe BankRiziRockNo ratings yet

- Project of Commercial Banking: "Comparison of Islamic Bank and Conventional Bank Investment Activities"Document33 pagesProject of Commercial Banking: "Comparison of Islamic Bank and Conventional Bank Investment Activities"jannat2No ratings yet

- Accounting, or Accountancy, Is The Measurement, Processing and Communication of FinancialDocument5 pagesAccounting, or Accountancy, Is The Measurement, Processing and Communication of FinancialnatchredNo ratings yet

- MoveUP 2016 Annual Financial ReportDocument8 pagesMoveUP 2016 Annual Financial ReportMoveUP, the Movement of United ProfessionalsNo ratings yet

- Kenya MicroDocument4 pagesKenya MicroThanasis DimasNo ratings yet

- September/October 2013 Cadillac Area Business MagazineDocument16 pagesSeptember/October 2013 Cadillac Area Business MagazineCadillac Area Chamber of CommerceNo ratings yet

- Life Project Report ON: Submitted By: Deepanshu Mehta Bba 3 Semester Jims Lajpat Nagar 1090110496Document32 pagesLife Project Report ON: Submitted By: Deepanshu Mehta Bba 3 Semester Jims Lajpat Nagar 1090110496dakshmehra217549No ratings yet

- CORPORATE GOVERNANCE AWARDSDocument5 pagesCORPORATE GOVERNANCE AWARDSMaya BarcoNo ratings yet

- 2 Company DescriptionDocument2 pages2 Company DescriptionManjit Kour SinghNo ratings yet

- Otc FSRL 2019Document65 pagesOtc FSRL 2019Vinayak BagayaNo ratings yet

- MidUSA Credit Union 2015 Busine - Kayla ManuelDocument45 pagesMidUSA Credit Union 2015 Busine - Kayla ManuelChizitere OnyeNo ratings yet

- Strama Sem Project PDFDocument6 pagesStrama Sem Project PDFIvy PeraltaNo ratings yet

- Business Comments August 2013Document8 pagesBusiness Comments August 2013Julie Johnston SabbaghNo ratings yet

- BDO AnnualreportDocument66 pagesBDO AnnualreportJm ╭∩╮⎝⎲⎵⎲⎠╭∩╮No ratings yet

- FM ReportDocument7 pagesFM ReportMaryam KamranNo ratings yet

- Gapol, Rach Au C. Pantia, Patrik Oliver E. Pasaol, Devvie Mae ADocument3 pagesGapol, Rach Au C. Pantia, Patrik Oliver E. Pasaol, Devvie Mae APatrik Oliver PantiaNo ratings yet

- Chapter One Introduction and BackgroundDocument19 pagesChapter One Introduction and BackgroundSamwel PoncianNo ratings yet

- Corporations Awarded For Corporate Governance and Corporate Social ResponsibilitiesDocument5 pagesCorporations Awarded For Corporate Governance and Corporate Social ResponsibilitiesJulie Pearl GuarinNo ratings yet

- IMARA TRUST Brochure 2020Document11 pagesIMARA TRUST Brochure 2020preetam PrayagNo ratings yet

- HSBC Holdings PLC Annual Report and Accounts 2015Document502 pagesHSBC Holdings PLC Annual Report and Accounts 2015lucindaNo ratings yet

- 2015 BOC Annual ReportDocument168 pages2015 BOC Annual ReportMarius AngaraNo ratings yet

- Saccos' Financial Services and Growth of Members' Enterprises in Luweero District in UgandaDocument9 pagesSaccos' Financial Services and Growth of Members' Enterprises in Luweero District in UgandaInternational Journal of Business Marketing and ManagementNo ratings yet

- A - 24 - IB Assignment 1Document7 pagesA - 24 - IB Assignment 1KAJAL RAINo ratings yet

- Beapartofitall: Financial Services Commission of OntarioDocument7 pagesBeapartofitall: Financial Services Commission of OntariomrsundeepNo ratings yet

- Training & DevelopmentDocument27 pagesTraining & Developmentbushra saeedNo ratings yet

- Algerian Islamic Banks: The Role of Relationships Marketing Tactics and Customer LoyaltyFrom EverandAlgerian Islamic Banks: The Role of Relationships Marketing Tactics and Customer LoyaltyNo ratings yet

- Ontario Auditor General P3 ReportDocument25 pagesOntario Auditor General P3 Reportwindsorcityblog1No ratings yet

- MDOT DRIC Expenses LetterDocument2 pagesMDOT DRIC Expenses Letterwindsorcityblog1No ratings yet

- Champlain Bridge TollsDocument26 pagesChamplain Bridge Tollswindsorcityblog1No ratings yet

- DRIC Road Accounting VFM ReportDocument19 pagesDRIC Road Accounting VFM Reportwindsorcityblog1No ratings yet

- OEB Salary DecisionDocument7 pagesOEB Salary Decisionwindsorcityblog1No ratings yet

- Paul Martin (Marty) BuildingDocument11 pagesPaul Martin (Marty) Buildingwindsorcityblog1No ratings yet

- Enwin Customer ComplaintDocument16 pagesEnwin Customer Complaintwindsorcityblog1No ratings yet

- Dilkens Inaugural Address 2014Document12 pagesDilkens Inaugural Address 2014windsorcityblog1No ratings yet

- River City Aecom DefenceDocument46 pagesRiver City Aecom Defencewindsorcityblog1No ratings yet

- DRIC Road DrainageDocument9 pagesDRIC Road Drainagewindsorcityblog1No ratings yet

- Windsor PovertyDocument13 pagesWindsor Povertywindsorcityblog1No ratings yet

- 2013 Windsor Council RemunerationDocument10 pages2013 Windsor Council Remunerationwindsorcityblog1No ratings yet

- Millson Letter To FordDocument1 pageMillson Letter To Fordwindsorcityblog1No ratings yet

- Wolfe Statement of ClaimDocument42 pagesWolfe Statement of Claimwindsorcityblog1No ratings yet

- Roselawn ProjectDocument4 pagesRoselawn Projectwindsorcityblog1No ratings yet

- Marty BuildingDocument4 pagesMarty Buildingwindsorcityblog1No ratings yet

- Orillia Administration Report On Tribal Partners Development ProposalDocument40 pagesOrillia Administration Report On Tribal Partners Development Proposalwindsorcityblog1No ratings yet

- Windsor Sunshine List 2013Document13 pagesWindsor Sunshine List 2013windsorcityblog1No ratings yet

- Ambassador Bridge Gateway ProjectDocument9 pagesAmbassador Bridge Gateway Projectwindsorcityblog1No ratings yet

- Windsor Schools RankingDocument8 pagesWindsor Schools Rankingwindsorcityblog1No ratings yet

- Windsor Hum ReportDocument137 pagesWindsor Hum Reportwindsorcityblog1No ratings yet

- United States-Canada Border Infrastructure Investment Plan (BIIP)Document50 pagesUnited States-Canada Border Infrastructure Investment Plan (BIIP)keithedwhiteNo ratings yet

- 2014 Capital Budget SummaryDocument5 pages2014 Capital Budget Summarywindsorcityblog1No ratings yet

- 2014 Capital Budget StatsDocument3 pages2014 Capital Budget Statswindsorcityblog1No ratings yet

- Mayor Francis ProjectsDocument3 pagesMayor Francis Projectswindsorcityblog1No ratings yet

- City Solicitor Re Indian RoadDocument17 pagesCity Solicitor Re Indian Roadwindsorcityblog1No ratings yet

- DRIC Road Supplemental Report of The IERDocument35 pagesDRIC Road Supplemental Report of The IERwindsorcityblog1No ratings yet

- Huron Lodge Costs AwardDocument6 pagesHuron Lodge Costs Awardwindsorcityblog1No ratings yet

- DRIC Road Girders PhotosDocument18 pagesDRIC Road Girders Photoswindsorcityblog1No ratings yet

- Review of Spending Practices by Former Westfield State University President Evan DobelleDocument77 pagesReview of Spending Practices by Former Westfield State University President Evan DobellecraiggimaNo ratings yet

- Instructions D. Advanced Financial Accounting and Reporting AFAR.3101 Partnership DrillDocument1 pageInstructions D. Advanced Financial Accounting and Reporting AFAR.3101 Partnership Drillvane rondinaNo ratings yet

- Auditing Problems Ap.401 Audit of Cash and Cash Equivalents: Internal Control Measures For CashDocument9 pagesAuditing Problems Ap.401 Audit of Cash and Cash Equivalents: Internal Control Measures For CashMarjorie PonceNo ratings yet

- Question Chapter2 Final 1Document19 pagesQuestion Chapter2 Final 1Tran An KhanhNo ratings yet

- Bank Reconciliation - StudentsDocument6 pagesBank Reconciliation - Studentskyomugisha evelyneNo ratings yet

- Chap 10Document43 pagesChap 10Boo LeNo ratings yet

- 11632434Document2 pages11632434potchMCITPNo ratings yet

- ToA - Quizzer 9 Inty PPE & BiologicalDocument15 pagesToA - Quizzer 9 Inty PPE & BiologicalRachel Leachon100% (1)

- Name and Address of Branch/ Office in Which The Deposit Is HeldDocument7 pagesName and Address of Branch/ Office in Which The Deposit Is Heldvvnrao123No ratings yet

- Vat Act 1991 Updated Upto Nov 2012 in EnglishDocument97 pagesVat Act 1991 Updated Upto Nov 2012 in Englishsayempathan5655No ratings yet

- Final Accounts of Banking CompaniesDocument28 pagesFinal Accounts of Banking CompaniesAmit_Agarwal_7219No ratings yet

- e-StatementBRImo 505401016699530 Feb2023 20230816 043553Document3 pagese-StatementBRImo 505401016699530 Feb2023 20230816 043553805akgaming25No ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisRONALD SSEKYANZINo ratings yet

- FABM1 11 Quarter 4 Week 4 Las 3Document2 pagesFABM1 11 Quarter 4 Week 4 Las 3Janna PleteNo ratings yet

- School of Accountancy & Management Accounting For Special Transaction Midterm ExaminationDocument11 pagesSchool of Accountancy & Management Accounting For Special Transaction Midterm ExaminationTasha MarieNo ratings yet

- Accounting CH 14Document34 pagesAccounting CH 14Juan JohnNo ratings yet

- Umme Zainab Accounting AssighnmentDocument2 pagesUmme Zainab Accounting Assighnmentzm65012No ratings yet

- Materi Lab 1 - Home Office and Branch Office PDFDocument11 pagesMateri Lab 1 - Home Office and Branch Office PDFPUTRI YANINo ratings yet

- Accounting Principles: Submitted To-Dr. Meru Sehgal Submitted by - Sarabpreet Batra MBE - 1 Semester Roll Number - 8101Document29 pagesAccounting Principles: Submitted To-Dr. Meru Sehgal Submitted by - Sarabpreet Batra MBE - 1 Semester Roll Number - 8101Sarab Gurpreet BatraNo ratings yet

- Capital & RevenueDocument14 pagesCapital & RevenueNeha KumariNo ratings yet

- DocxDocument5 pagesDocxSylvia Al-a'maNo ratings yet