Professional Documents

Culture Documents

(WWW - Entrance-Exam - Net) - JAIIB Exam in 2013 Sample Questions 2

Uploaded by

Vineeth VsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(WWW - Entrance-Exam - Net) - JAIIB Exam in 2013 Sample Questions 2

Uploaded by

Vineeth VsCopyright:

Available Formats

About JAIIB Sample Paper III Here are the details of JAIIB Sample Paper III job in Indian

Institute of Banking & Finance - IIBF

JAIIB Sample Paper III with Answers.

1) Which one of the Non Resident Deposit schemes is not permitted. a) b) c) d) FCNR a/cs

NRNR a/cs NRE a/cs NRO a/cs

Ans:- (b)

2) At the time of receipt of a garnishee order your customers accounts showed :

i)SB a/c uncleared balance Rs.2,000.35 (Cleared balance Rs 550.35) ii) An overdue fixed deposit for Rs.25,753.22 matured one week earlier

iii)OD account showed a credit balance of Rs.8,728.96 iv)CC account showed a credit balance of Rs,2,247.18

3) Indicate the amount which can be attached by the garnishee order?

a) Rs.28,550.75 b) Rs.10,228.96 c) Rs.37,729.71 d) Rs 4,247.53

Ans:- (c)

4) )You receive a cheque in an overdraft account for Rs.27,000.00.

The debit balance in the account is Rs.30,000.00 and the OD state while returning

limit is Rs 55,000.00.What reason you will

a) Refer to drawer b) Effects Not cleared c) Exceeds arrangement d) Endorsement not correct

Ans:- (b)

5) Match the following:

i) Payment in Due Course ii) Karta iii) IRDA B) C)

A)

Insurance

Cash Credit HUF

iv) Hypothecation of Inventory

D)

Paying Banker

a) b) c) d)

i-D,ii-C,iii-A,iv-B i-A,ii-B,iii-C,iv-D i-B,ii-A,iii-D,iv-C i-D,ii-C,iii-B,iv-A

Ans:- (a)

6) Match the following: Identify the Committees:

i)Classification of

Assets

A) Nayak B) Tarapore C) Narasimham D) Rangarajan

ii)Computerisation in Banks iii)Working Capital for SSIs iv)Capital Account Convertability

a) b) c) d)

i-B,ii-D,iii-C,iv-A i-D,ii-C,iii-A,iv-B i-B,ii-A,iii-C,iv-D i-C,ii-D,iii-A,iv-B

Ans:- (d)

7) Match the following:

i) Financial intermediaries ii)ATMs iii)Certificate of Deposits iv)Book debts

A) Mutual funds B) E- Banking C) Money Markets D)Assignment

a) b) c) d)

i-C,ii-D,iii-A,iv-B i-D,ii-C,iii-B,iv-A i-A,ii-B,iii-C,iv-D i-A,ii-C,iii-B,iv-D

Ans:- (c)

8) When a cheque is drawn on a bank, the bank is called the

a)Payee b)Drawee c)Drawer d)Endorsee

Ans:- (b)

9) One of the State Government avails of a India. This type of finance is called :

temporary financial

assistance

from Reserve Bank of

a)Overdraft b)Temporary loan c)Short term finance d) Ways and Means advance

Ans:- (d)

10) Maximum Bank Rate is:

a) 6% b) 20% c) 25% d) None

Ans:- (d)

11) Obligation of a Banker to maintain secrecy is applicable to

a) Only in case of existing deposit accounts b) Only in respect existing loan accounts c) Only in case of closed accounts d) All types of deposit/loan accounts (existing/closed)

Ans:- (d)

12) Bank A allows one of its clients to withdraw against clearing of a cheque. The banker is called as:

a) Collecting and Paying banker b) Holder in due course c) Holder for value d) Reimbursement banker

Ans:- (c)

13) As per the provisions of NI Act,1881 a banker gets protection for payment of a cheque only if it is a :

a) b) c) d)

Holder in due course Payment in due course Holder for value All of the above

(b)

14)

One of your NRI customers wants to place FCNR deposits in Canadian $ with your bank. You will

a) b) c) d)

Accept his request and open a FCNR a/c Will not accept his request to open FCNR a/c in Canadian $ Will inform the customer to place FCNR in any one of the currencies (US$/GBP/JPY/EUR) Both b and c

Ans:- (a)

15) In a demand draft the word order is changed to bearer by the holder of the dd. It is called as:

a)Endorsement b)Material alteration c)Crossing d)None of the above

Ans:- (b)

Ads by Google

You might also like

- Bank Exams Computer AwarenessDocument18 pagesBank Exams Computer AwarenessbsbhangaleNo ratings yet

- Computer: FunctioningDocument5 pagesComputer: FunctioningVineeth VsNo ratings yet

- Biodata FormDocument6 pagesBiodata FormRohit DahreNo ratings yet

- MB0052 SLM Unit 16Document30 pagesMB0052 SLM Unit 16chavansujay100% (1)

- Answer Key For Acountancy Q No 1Document1 pageAnswer Key For Acountancy Q No 1Vineeth VsNo ratings yet

- PM0018 SLM Unit 15Document19 pagesPM0018 SLM Unit 15Vineeth VsNo ratings yet

- 597183Document2 pages597183Bhavesh KumarNo ratings yet

- PrelimsDocument10 pagesPrelimschavansujayNo ratings yet

- PM 0015 Quantitative Methods in Project Management: Unit 1Document6 pagesPM 0015 Quantitative Methods in Project Management: Unit 1Vineeth VsNo ratings yet

- Notes: Sikkim Manipal University Page No. 465Document2 pagesNotes: Sikkim Manipal University Page No. 465Vineeth VsNo ratings yet

- PrelimsDocument10 pagesPrelimschavansujayNo ratings yet

- Cyber Laws Chapter in Legal Aspects BookDocument20 pagesCyber Laws Chapter in Legal Aspects BookJatan Gandhi100% (1)

- Block FiDocument10 pagesBlock FiVineeth VsNo ratings yet

- MB0052 SLM Unit 01Document18 pagesMB0052 SLM Unit 01Mahesh ChandrashekarNo ratings yet

- As Per 10% Hike ClerksDocument1 pageAs Per 10% Hike ClerksVineeth VsNo ratings yet

- Jaiib - Paper IDocument2 pagesJaiib - Paper IkirthikasingaramNo ratings yet

- Clerk 2013 List2Document11 pagesClerk 2013 List2Vineeth VsNo ratings yet

- SAP FI New SyllabusDocument14 pagesSAP FI New SyllabusVineeth VsNo ratings yet

- SAP CO New SyllabusDocument6 pagesSAP CO New SyllabusVineeth VsNo ratings yet

- SM001 Intro SAP Solution ManagerDocument21 pagesSM001 Intro SAP Solution ManagerSandeep Patil100% (7)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Disco-Bijender Us 138Document19 pagesDisco-Bijender Us 138Imtiyaz HussainNo ratings yet

- High Level Solution BlueprintDocument3 pagesHigh Level Solution BlueprintrajeshkriNo ratings yet

- Canara Bank ProfileDocument13 pagesCanara Bank ProfileRaveendra BatageriNo ratings yet

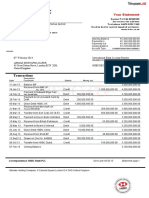

- HSBC Bank Australia statement overviewDocument6 pagesHSBC Bank Australia statement overviewDani PermanaNo ratings yet

- Rural DevelopmentDocument17 pagesRural DevelopmentBhavya SharmaNo ratings yet

- CHFS QuestionnaireDocument102 pagesCHFS QuestionnaireNameNo ratings yet

- Prospectus - SbacDocument541 pagesProspectus - SbacMd. Mehedi HasanNo ratings yet

- Soneri Bank Internship ReportDocument37 pagesSoneri Bank Internship Reportbbaahmad89100% (1)

- Banking PPT Group 1 - Structure of Indian Banking SystemDocument53 pagesBanking PPT Group 1 - Structure of Indian Banking Systemrohit75% (4)

- Dutch Bangla BankDocument3 pagesDutch Bangla Bankagmnoven2012No ratings yet

- The Next Normal - DMCInsights May - 2021Document41 pagesThe Next Normal - DMCInsights May - 2021Rama SubramanianNo ratings yet

- BPI Vs Lifetime Marketing CorpDocument8 pagesBPI Vs Lifetime Marketing CorpKim ArizalaNo ratings yet

- Funds Transfers - OverviewDocument7 pagesFunds Transfers - OverviewCajita FelizNo ratings yet

- TSYS Bank Request Change Document-101Document1 pageTSYS Bank Request Change Document-101Keller Brown JnrNo ratings yet

- Analyzing Bank Performance: Using The UbprDocument70 pagesAnalyzing Bank Performance: Using The UbpraliNo ratings yet

- Questions On Journal Entry For StudentsDocument8 pagesQuestions On Journal Entry For Studentsveraji3735No ratings yet

- Account Number Account Description Balance As at 28 February 2023 Total Credit Interest Total Debit InterestDocument1 pageAccount Number Account Description Balance As at 28 February 2023 Total Credit Interest Total Debit InterestBakang Brian MothobiNo ratings yet

- SWOT Analysis For AMUL:: StrengthDocument14 pagesSWOT Analysis For AMUL:: StrengthISTKHAR AHAMADNo ratings yet

- Brazil IT BPO BookDocument92 pagesBrazil IT BPO BookIT DecisionsNo ratings yet

- Bond Market in IndiaDocument27 pagesBond Market in Indiashahbinal17No ratings yet

- Tender No DCT7111P22Document75 pagesTender No DCT7111P22Gautom BorahNo ratings yet

- Avendu: List of Top 10 Investment Banks in IndiaDocument4 pagesAvendu: List of Top 10 Investment Banks in IndiaBipin TitusNo ratings yet

- Online Banking Services of India: 2/16/2022 Devanshi ParmarDocument96 pagesOnline Banking Services of India: 2/16/2022 Devanshi ParmarFLEX FFNo ratings yet

- Test Receivables Oracle Cloud - 3 - FIMDocument68 pagesTest Receivables Oracle Cloud - 3 - FIMMariana SalgadoNo ratings yet

- Sip ReportDocument3,648 pagesSip Reportdipakmajethia89No ratings yet

- HDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"Document18 pagesHDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"janu_ballav9913No ratings yet

- Global Financial Turbulence and Financial Sector in India: A Practitioner's PerspectiveDocument15 pagesGlobal Financial Turbulence and Financial Sector in India: A Practitioner's PerspectiveRamasundaram TNo ratings yet

- HSBC Bank StatementDocument1 pageHSBC Bank Statementwilliams edwards75% (8)

- A Study On Rural Banking in India: 1) SummaryDocument72 pagesA Study On Rural Banking in India: 1) SummarySagar A. BarotNo ratings yet

- Doucmentation Manual of Bank PDFDocument518 pagesDoucmentation Manual of Bank PDFSamsul ArfinNo ratings yet