Professional Documents

Culture Documents

Basel II 3basel II 3 PDF

Uploaded by

Mehedi HasanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basel II 3basel II 3 PDF

Uploaded by

Mehedi HasanCopyright:

Available Formats

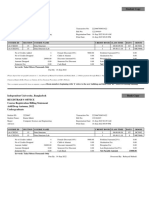

DISCLOSURE ON RISK BASED CAPITAL (BASEL II)

Scope of application Qualitative Disclosures (a) The name of the top corporate entity in the group to which this guidelines applies. (b) Rajshahi Krishi Unnayan Bank (RAKUB).

An outline of differences in the basis of consolidation for accounting and regulatory purposes, with a brief description of the entities within the group (a) that are fully consolidated; (b) that are given a deduction treatment; and (c) that are neither consolidated nor deducted (e.g. where the investment is risk-weighted). It is a Solo financial statement of the Bank. Rajshahi Krishi Unnayan Bank (the Bank) is a scheduled specialized state owned Bank. Rajshahi Krishi Unnayan Bank (RAKUB) was established by the President's Ordinance No.58 of 1986 with the aim of providing agricultural credit for optimum utilization of agricultural potentials of Rajshahi Division (Rajshahi & Rangpur Division). Taking over all the 253 branches and other offices along with assets and liabilities of the Bangladesh Krishi Bank within Rajshahi Division, RAKUB started functioning on 15 March 1987. The Head Office of the bank is stationed at Rajshahi. The branch network comprises 374 branches including one in Dhaka at present. As the largest development partner in the northwest region Rajshahi Krishi Unnayan Bank aims at overall development of the farmers and all the sectors and sub-sectors of agriculture in this region. Besides providing agricultural credit, financing agribusiness and agro-based industries, activities related to socioeconomic development and poverty alleviation programs, the bank also performs most of the commercial banking functions.

(c)

Any restrictions, or other major impediments, on transfer of funds or regulatory capital within the group. Not Applicable

(d)

The aggregate amount of capital deficiencies in all subsidiaries not included in the consolidation that are deducted and the name(s) of such subsidiaries.

b) Capital structure Quantitative Disclosures (a) Summary information on the terms and conditions of the main features of all capital instruments, especially in the case of capital instruments eligible for inclusion in Tier 1 or in Tier 2. The terms and conditions of the main features of all capital instruments have been segregated in line with the eligibility criteria set forth vide BRPD Circular No. 35 dated 29 December, 2010 and other relevant instructions given by Bangladesh Bank from time to time. The main features of the capital instruments are as follows: Tier 1 capital instruments Paid-up share capital: Rajshahi Krishi Unnayan Bank is a scheduled specialized state owned Bank. Its authorized capital is approved by government and Paid up Capital is being paid by government time to time. General Reserve: All types of reserve (general & special) are created through Profit and Loss Account for fulfilling the specific purpose. Retained Earnings: Amount of Loss is retained with the banking company after meeting up all expenses and provisions. Tier 2 capital instruments General provision maintained against unclassified loans: As per BB directive, amount of provision maintained against unclassified loans as of the reporting date has been considered. Quantitative Disclosures (b) The amount of Tier 1 capital, with separate disclosure In crore of: (As on 30-06-2012) Taka Paid up capital 570.00 Non-repayable share premium account Statutory reserve General reserve 20.85 Retained earnings -503.84 Minority interest in subsidiaries Non-cumulative irredeemable preference shares Dividend equalization account Total of Tier 1 Capital 87.01 (c) The total amount of Tier 2 and Tier 3 capital. 68.61 (d) Shortfall in provisions required against classified assets 209.06 (e) Total eligible capital. -53.44

c) Capital Adequacy Qualitative Disclosures (a) A summary discussion of the banks approach to assessing the adequacy of its capital to support current and future activities. Capital Adequacy is the cushion required to be maintained for covering the Credit risk, Market risk and Operational risk so as protecting the depositors and general creditors interest against such losses. In line with BRPD Circular No. 35 dated 29 December, 2010 [Guidelines on Risk Based Capital Adequacy (Revised regulatory Capital Framework for banks in line with Basel II)]. The Bank has adopted Standardized Approach for Credit Risk, Standardized (Rule Based) Approach for Market Risk and Basic Indicator Approach for Operational Risk for computing Capital Adequacy. Capital requirement for Credit Risk 324.02 Capital requirement for Market Risk 0.65 Capital requirement for Operational Risk 18.85 Total required Capital 343.52 Total Minimum Capital Required (MCR) as per BB Ins. 400.00 Total and Tier 1 capital ratio: For the consolidated group; and Not Applicable For stand alone Total -1.66 % Tier 1 -3.79 %

Quantitative Disclosures (As on 30-06-2012)

(b) (c) (d)

(e)

d) Credit Risk Qualitative Disclosures (a) The general qualitative disclosure requirement with respect to credit risk, including: Definitions of past due and impaired (for accounting purposes); Bank classifies loans and advances into performing and non-performing loans (NPL) in accordance with the Bangladesh Bank guidelines in this respect. An NPA (impaired is defined as a loan or an advance where interest and/ or installment of principal remain overdue for more than 90 days in respect of a Continuous credit, Demand loan or a Term Loan etc. Classified loan is categorized under following 03 (three) categories: > Sub- standard > Doubtful > Bad & Loss Any continuous loan will be classified as:

> Sub-standard' if it is past due/overdue for 6 months or beyond but less than 9 months. > "Doubtful' if it is past due/overdue for 9 months or beyond but less

than 12 months. > Bad/Loss' if it is past due/overdue for 12 months or beyond. Any Demand Loan will be classified as: > Sub-standard' if it remains past due/overdue for 6 months or beyond but not over 9 months from the date of claim by the bank or from the date of creation of forced loan. > Doubtful' if it remains past due/overdue for 9 months or beyond but not over 12 months from the date of claim by the bank or from the date of creation of forced loan. > Bad/Loss' if it remains past due/overdue for 12 months or beyond from the date of claim by the bank or from the date of creation of forced loan. In case of any installment(s) or part of installment(s) of a Fixed Term Loan is not repaid within the due date, the amount of unpaid installment(s) will be termed as `defaulted installment'. In case of Fixed Term Loans, which are repayable within maximum five years of time: > If the amount of 'defaulted installment' is equal to or more than the amount of installment(s) due within 6 (six) months, the entire loan will be classified as ''Sub-standard''. > If the amount of 'defaulted installment' is equal to or more than the amount of installment(s) due within 12 (twelve) months, the entire loan will be classified as ''Doubtful". > If the amount of 'defaulted installment' is equal to or more than the amount of installment(s) due within 18 (eighteen) months, the entire loan will be classified as ''Bad/Loss''. In case of Fixed Term Loans, which are repayable in more than five years of time: > If the amount of 'defaulted installment' is equal to or more than the amount of installment(s) due within 12 (twelve) months, the entire loan will be classified as ''Sub-standard''. > If the amount of 'defaulted installment' is equal to or more than the amount of installment(s) due within 18 (eighteen) months, the entire loan will be classified as ''Doubtful". > If the amount of 'defaulted installment' is equal to or more than the amount of installment(s) due within 24 (twenty four) months, the entire loan will be classified as ''Bad/Loss''.

Description of approaches followed for specific and general allowances and statistical methods;

Short Term Agri. Credit Other than HF & LP HF LP SMEF Loans to BHs/MBs/ SDs against Shares All other Credit

Particulars

UC

Standard SMA SS DF B/L

5% 0% 5% 5% 100%

5% 5% 20% 50% 100%

2% 5% 20% 50% 100%

2% 5% 20% 50% 100%

1% 5% 20% 50% 100%

2% 5% 20% 50% 100%

1% 5% 20% 50% 100%

Classified

Discussion of the banks credit risk management policy; The Board approves the credit policy keeping in view relevant Bangladesh Bank guidelines to ensure best practice in credit risk management and maintain quality of assets. Authorities are properly delegated ensuring check and balance in credit operation at every stage i.e. screening, assessing risk, identification, management and mitigation of credit risk as well as monitoring, supervision and recovery of loans with provision for early warning system. There is a separate Loan and Advance Department-1 & 2 for dedicated credit risk management and ensuring perfection of securities, separate Loan Recovery Department-1 & 2 for monitoring and recovery of irregular loans. Internal control & compliance Department independently assess Quality of loans & Advances compliance status of loans. Adequate provision is maintained against classified loans as per Bangladesh Bank guidelines. Statuses of loans are regularly reported to the Bank Management and Board.

Quantitative Disclosures

(b)

Total gross credit risk exposures broken down by major types of credit exposure. Major types of credit exposure as per In disclosure in the audited financial statements as crore on 30 June 2012. Taka 1. Crop 1731.58 2. Fisheries 58.74 3. Live stock 342.65 4. Irrigation Equipment & Farm Machinery 125.08 5. Agro-based Industries 316.35 6. SME 91.69 7. Cash Credit Loan 582.30 8. Poverty alleviation 125.00 9. Other Loan 194.49 10. Staff Loan 268.12 Total: 3836.00 Geographica1 distribution of exposures, broken down in significant areas by major types of credit exposure. Division & District wise Loans and Advances as per disclosure in the audited financial statements as on 30 June 2012. Rajshahi Division: 1. Rajshahi In crore Taka 1719.23 330.43

(c)

(d)

2. Naogaon 301.29 3. Chapai Nawabgonj 115.13 4. Natore 112.08 5. Pabna 190.27 6. Sirajgonj 168.87 7. Bogra 306.38 8. Joypurhat 194.78 Rangpur Division: 1848.51 1. Rangpur 366.52 2. Gaibandha 220.01 3. Dinajpur 252.70 4. Kurigram 241.64 5. Nilphamari 309.11 6. Lalmonirhat 229.89 7. Thakurgaon 111.57 8. Panchagarh 117.07 Dhaka Branch 0.13 Industry or counterparty type distribution of exposures, broken down by major types of credit exposure. Industry or counterparty type distribution of In crore exposures, as per disclosure in the audited Taka financial statements as on 30 June 2012. 1. Cold Storage Loan 194.66 2. Rice Mills 5.05 3. Flower Mills 5.36 4. Edible Oil Mills 2.50 5. Mini Sugar Mills 0.07 6. Spice Mills 0.20 7. Bread & Biscuit Factory 0.66 8. Saw Mills 0.17 9. Biri Factory 0.01 10. Silk Factory 0.01 11. Handloom/Weavers Scheme 6.54 12. Engineering and metal Industries 0.95 13. Ice Factory 0.87 14. Other 99.30 Residual contractual maturity breakdown of the whole portfolio, broken down by major types of credit exposure. Residual contractual maturity breakdown of the whole portfolio, as per disclosure in the audited financial statements as on 30 June 2012. 1. On demand 2. Within one to three month In crore Taka 0.00 0.00

(e)

(f)

(g)

3. Within three to twelve month 4. Within one to five years 5. More than five years By major industry or counterparty type: Amount of impaired loans and if available, past due loans, provided separately; 1. Standard 2. Special Mention Accounts 3. Sub- Standard 4. Doubtful 5. Bad/Loss 6. Staff loan Specific and general provisions; and Provision Maintained against Loans Gross Non Performing Assets (NPAs) Non Performing Assets (NPAs) to Outstanding Loans & advances Movement of Non Performing Assets (NPAs) Opening balance Additions Reductions Closing balance Movement of specific provisions for NPAs Opening balance Provisions made during the period Write-off & Interest remission Write-back of excess provisions Closing balance

2936.28 533.85 365.87 In crore Taka 2154.87 32.94 274.99 204.97 900.11 268.12 278.23 1307.71 34.09%

1118.65 602.69 413.63 1307.71 228.23 33.59 3.59 0 278.23

e) Equities: Disclosures for Banking Book Positions Qualitative Disclosures (a) The general qualitative disclosure requirement with respect to equity risk, including: Differentiation between holdings on which capital gains are expected and those taken under other objectives including for relationship and strategic reasons; and

Not Applicable.

Discussion of important policies covering the valuation and accounting of equity holdings in the banking book. This includes the accounting techniques and valuation methodologies used, including key assumptions and practices affecting valuation as well as significant changes in these practices.

Not Applicable.

Quantitative Disclosures

(b)

Value disclosed in the balance sheet of investments, as well as the fair value of those investments; for quoted securities, a comparison to publicly quoted share values where the share price is materially different from fair value.

Not Applicable.

(c)

The cumulative realized gains (losses) arising from sales and liquidations in the reporting period.

Not Applicable.

(d)

Total unrealized gains (losses) Total latent revaluation gains (losses) Any amounts of the above included in Tier 2 capital.

(e)

Capital requirements broken down by appropriate equity groupings, consistent with the banks methodology, as well as the aggregate amounts and the type of equity investments subject to any supervisory provisions regarding regulatory capital requirements.

Not Applicable.

f) Interest rate risk in the banking book (IRRBB) Qualitative Disclosures (a) The general qualitative disclosure requirement including the nature of IRRBB and key assumptions, including assumptions regarding loan prepayments and behavior of non-maturity deposits, and frequency of IRRBB measurement. Not Applicable Quantitative Disclosures (b) The increase (decline) in earnings or economic value (or relevant measure used by management) for upward and downward rate shocks according to managements method for measuring IRRBB, broken down by currency (as relevant). Not Applicable

g) Market risk Qualitative Disclosures (a) Views of BOD on trading/investment activities

The BOD of the Bank views the ' Market Risk' as the risk to the banks earnings and Capital due to change in the market level of interest rates of securities, foreign exchange and equities as well as the volatilities of those changes.

Methods used to measure Market risk

The Bank uses the standardized (Rule Based) approach to calculate market risk for trading book exposures.

Market Risk Management system

ALCO is the key tool for managing market risk. An ALCO is in place in the bank to administer of the system.

Quantitative Disclosures

(b)

The capital requirements for: Interest rate risk; Equity position risk; Foreign exchange risk; and Commodity risk. 0.00 0.64 0.01 0.00

h) Operational risk Qualitative Disclosures (a) Views of BOD on system to reduce Operational Risk The policy for operational risks including internal control & compliance risk is approved by the board taking into account relevant guidelines of Bangladesh bank. Audit committee of the Board oversees the activities of Internal Control & Compliance Department (ICCD) to protect against all operational risk. Performance gap of executives and staffs There is no material performance gap among the Executives and Staff. Potential external events Rajshahi Krishi Unnayan Bank as a state owned Bank is exposed to directed loans as the major external event. Bank has internal manuals on Internal Control and Compliance

where details of operational policies & Procedures have been stated. Bank regularly monitors and reviews the performance of employees both quantitatively and qualitatively through analysis of achievement of business target in various parameters and behavioral, tactical and leadership aspects through confidential evaluation process.

Policies and processes for mitigating operational risk The policy for operational risks including internal control & compliance risk is approved by the Board taking into account relevant guidelines of Bangladesh bank. Policy guidelines on Internal Audit system is in operation. Branches are audited regularly by Zonal Audit Office under supervision of Internal Control & Compliance Department (ICCD). It is the policy of the bank to put all the branches of the bank under any form of audit at least once in a year. ICCD directly report to Audit Committee of the Board. Bank's Anti- Money laundering activities are headed by CAMELCO and their activities are devoted to protect against all money laundering and terrorist finance related activities. There is no record of any money laundering and terrorist finance related activities of the bank. Apart from that, there is adequate check & balance at every stage of operation, authorities are properly segregated and there is at least dual control on every transaction to protect against operational risk. Approach for calculating capital charge for operational risk Basic Indicator Approach was used for calculating capital charge for operational risk as of the reporting date. In crore Taka 18.85

Quantitative Disclosures

(b)

The capital requirements for operational risk The capital requirements for operational risk ******

(Md. Mizanur Rahman)

Senior Officer

(Md. Ataur Rahaman)

Senior Officer

(Md. Sk. Ashek Ullah)

Assistant General Manager

(Md. Abdul Latif)

Deputy General Manager

10

11

You might also like

- Revision Rate Allowance 2017 PDFDocument2 pagesRevision Rate Allowance 2017 PDFMehedi HasanNo ratings yet

- New Vision Eco City BrochureDocument4 pagesNew Vision Eco City BrochureMehedi HasanNo ratings yet

- W' Bbw÷Wudu Ae E VSKVM©, Evsjv 'K (Avbwewe)Document13 pagesW' Bbw÷Wudu Ae E VSKVM©, Evsjv 'K (Avbwewe)Mehedi HasanNo ratings yet

- Job Analysis FormDocument3 pagesJob Analysis FormLisan AhmedNo ratings yet

- New Vision City PDFDocument4 pagesNew Vision City PDFMehedi HasanNo ratings yet

- Bank Governance Effectiveness Anwar Deepty BDDocument16 pagesBank Governance Effectiveness Anwar Deepty BDMehedi HasanNo ratings yet

- Uw eMBA Wikibook-Managerial-Accounting PDFDocument103 pagesUw eMBA Wikibook-Managerial-Accounting PDFEswari Gk100% (1)

- Guideline On ICT Security by BBDocument56 pagesGuideline On ICT Security by BBMehedi Hasan100% (1)

- New Vision City PDFDocument4 pagesNew Vision City PDFMehedi HasanNo ratings yet

- Specimen Question For Driving License in BangladeshDocument4 pagesSpecimen Question For Driving License in BangladeshMehedi HasanNo ratings yet

- Credit Risk ManualDocument39 pagesCredit Risk ManualMehedi HasanNo ratings yet

- Amendment Result 82nd BD Examination December 2015 JAIBBDocument1 pageAmendment Result 82nd BD Examination December 2015 JAIBBMehedi HasanNo ratings yet

- Bkash Frequently Asked QuestionsDocument1 pageBkash Frequently Asked QuestionsMehedi HasanNo ratings yet

- Bkash Frequently Asked QuestionsDocument1 pageBkash Frequently Asked QuestionsMehedi HasanNo ratings yet

- Emcee Script Revised 1Document9 pagesEmcee Script Revised 1Mehedi Hasan100% (2)

- List of ConjunctionsDocument3 pagesList of ConjunctionsMehedi HasanNo ratings yet

- Sample Emcee ScriptDocument7 pagesSample Emcee ScriptMehedi Hasan83% (6)

- Types of Sentences.Document2 pagesTypes of Sentences.Mehedi HasanNo ratings yet

- Wedding Emcee Script GuideDocument7 pagesWedding Emcee Script Guideiammiguelsalac100% (6)

- How Do You Write A Formal Emcee ScriptDocument1 pageHow Do You Write A Formal Emcee ScriptMehedi HasanNo ratings yet

- Commencement SpeechDocument4 pagesCommencement SpeechMehedi HasanNo ratings yet

- Special Event Script.Document14 pagesSpecial Event Script.Mehedi HasanNo ratings yet

- Conference Keynote SpeechDocument5 pagesConference Keynote SpeechMehedi HasanNo ratings yet

- Arts Council Silicon ValleyDocument14 pagesArts Council Silicon ValleyMehedi HasanNo ratings yet

- Acknowledgement RemarksDocument1 pageAcknowledgement RemarksMehedi HasanNo ratings yet

- Money LaunderingDocument95 pagesMoney LaunderingKuhu RNo ratings yet

- Memorial Tribute: "Though Much Is Taken, Much Abides."Document2 pagesMemorial Tribute: "Though Much Is Taken, Much Abides."Mehedi HasanNo ratings yet

- Air Practices GuideDocument6 pagesAir Practices GuideMehedi HasanNo ratings yet

- How To Make Your Meetings FunDocument3 pagesHow To Make Your Meetings FunMehedi HasanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- New Education Policy 2019Document55 pagesNew Education Policy 2019Aakarshanam VenturesNo ratings yet

- AFNOR IPTDS BrochureDocument1 pageAFNOR IPTDS Brochurebdiaconu20048672No ratings yet

- M8-2 - Train The Estimation ModelDocument10 pagesM8-2 - Train The Estimation ModelJuan MolinaNo ratings yet

- August 03 2017 Recalls Mls (Ascpi)Document6 pagesAugust 03 2017 Recalls Mls (Ascpi)Joanna Carel Lopez100% (3)

- Service and Maintenance Manual: Models 600A 600AJDocument342 pagesService and Maintenance Manual: Models 600A 600AJHari Hara SuthanNo ratings yet

- Books of AccountsDocument18 pagesBooks of AccountsFrances Marie TemporalNo ratings yet

- Evolution of Bluetooth PDFDocument2 pagesEvolution of Bluetooth PDFJuzerNo ratings yet

- Electronics Project Automatic Bike Controller Using Infrared RaysDocument16 pagesElectronics Project Automatic Bike Controller Using Infrared RaysragajeevaNo ratings yet

- Complete Guide To Sports Training PDFDocument105 pagesComplete Guide To Sports Training PDFShahana ShahNo ratings yet

- Yellowstone Food WebDocument4 pagesYellowstone Food WebAmsyidi AsmidaNo ratings yet

- PLC Networking with Profibus and TCP/IP for Industrial ControlDocument12 pagesPLC Networking with Profibus and TCP/IP for Industrial Controltolasa lamessaNo ratings yet

- Kami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Document3 pagesKami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Anna HattenNo ratings yet

- Brick TiesDocument15 pagesBrick TiesengrfarhanAAANo ratings yet

- AZ-900T00 Microsoft Azure Fundamentals-01Document21 pagesAZ-900T00 Microsoft Azure Fundamentals-01MgminLukaLayNo ratings yet

- Sewage Pumping StationDocument35 pagesSewage Pumping StationOrchie DavidNo ratings yet

- Trading As A BusinessDocument169 pagesTrading As A Businesspetefader100% (1)

- Marine Engineering 1921Document908 pagesMarine Engineering 1921Samuel Sneddon-Nelmes0% (1)

- Reg FeeDocument1 pageReg FeeSikder MizanNo ratings yet

- Intro To Gas DynamicsDocument8 pagesIntro To Gas DynamicsMSK65No ratings yet

- Rtsa 2012Document7 pagesRtsa 2012Justin RobinsonNo ratings yet

- Java development user guide eclipse tutorialDocument322 pagesJava development user guide eclipse tutorialVivek ParmarNo ratings yet

- Onan Service Manual MDJA MDJB MDJC MDJE MDJF Marine Diesel Genset Engines 974-0750Document92 pagesOnan Service Manual MDJA MDJB MDJC MDJE MDJF Marine Diesel Genset Engines 974-0750GreenMountainGenerators80% (10)

- Case 5Document1 pageCase 5Czan ShakyaNo ratings yet

- 17BCE0552 Java DA1 PDFDocument10 pages17BCE0552 Java DA1 PDFABHIMAYU JENANo ratings yet

- Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural CitizensDocument2 pagesPradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural Citizenssairam namakkalNo ratings yet

- Book Networks An Introduction by Mark NewmanDocument394 pagesBook Networks An Introduction by Mark NewmanKhondokar Al MominNo ratings yet

- KPMG Inpection ReportDocument11 pagesKPMG Inpection ReportMacharia NgunjiriNo ratings yet

- Assignment 2 - Weather DerivativeDocument8 pagesAssignment 2 - Weather DerivativeBrow SimonNo ratings yet

- Radio Frequency Transmitter Type 1: System OperationDocument2 pagesRadio Frequency Transmitter Type 1: System OperationAnonymous qjoKrp0oNo ratings yet

- Exercises 6 Workshops 9001 - WBP1Document1 pageExercises 6 Workshops 9001 - WBP1rameshqcNo ratings yet