Professional Documents

Culture Documents

CH 16

Uploaded by

Đào Duy TúOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 16

Uploaded by

Đào Duy TúCopyright:

Available Formats

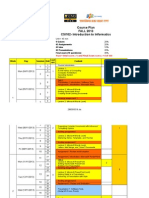

Chapter 16 (29) Practice Test: The Monetary System

This practice test is by no means comprehensive and should not be the only source of studying for the test. Furthermore, the level of difficulty of the actual test could be different from this practice test. The idea here is to give you more practice on the topics discussed in class.

Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 1. Consider five individuals with different occupations. Mary Clark Nathan Polly Paul provides legal advice grows tomatoes styles hair brews beer sharpens knives wants knives sharpened wants legal advice wants tomatoes wants knives sharpened wants beer

Which of the following pairs of individuals has a double coincidence of wants? a. Mary and Clark b. Clark and Nathan c. Nathan and Polly d. Polly and Paul ____ 2. The ease with which an asset can be a. traded for another asset determines whether or not that asset is a unit of account. b. transported from one place to another determines whether or not that asset could serve as fiat money. c. converted into a store of value determines the liquidity of that asset. d. converted into the economys medium of exchange determines the liquidity of that asset. 3. Which list ranks assets from most to least liquid? a. currency, fine art, stocks b. currency, stocks, fine art c. fine art, currency, stocks d. fine art, stocks, currency 4. Money is a. the most liquid asset and a perfect store of value. b. the most liquid asset but an imperfect store of value. c. the least liquid asset but a perfect store of value. d. the least liquid asset and an imperfect store of value. 5. Which of the following is not included in M1? a. a $5 bill in your wallet b. $100 in your checking account c. $500 in your savings account d. All of the above are included in M1. 6. The yardstick people use to post prices and record debts is called 1

____

____

____

____

a. b. c. d. ____

a medium of exchange. a unit of account. a store of value. liquidity.

7. You receive money as payment for babysitting your neighbors' children. This best illustrates which function of money? a. medium of exchange b. unit of account c. store of value d. liquidity 8. Commodity money is a. backed by gold. b. the principal type of money in use today. c. money with intrinsic value. d. receipts created in international trade that are used as a medium of exchange. 9. Money market mutual funds are included in a. M1 but not M2. b. M1 and M2. c. M2 but not M1. d. neither M1 nor M2.

____

____

____ 10. Which of the following statements is correct? a. Credit cards are important for our system of payments, but they are not important for analyzing the monetary system. b. Account balances that lie behind debit cards are included in neither M1 nor M2. c. People who have credit cards probably hold less money on average than people who do not have credit cards. d. A debit card allows its user to postpone payment for a purchase. ____ 11. Given the following information, what are the values of M1 and M2? Small time deposits Demand deposits and other checkable deposits Savings deposits Money market mutual funds Travelers' checks Large time deposits Currency Miscellaneous categories in M2 a. b. c. d. M1 = $400 billion, M2 = $2,475 billion. M1 = $125 billion, M2 = $3,025 billion. M1 = $425 billion, M2 = $2, 450 billion. M1 = $425 billion, M2 = $1,875 billion. $650 billion $300 billion $750 billion $600 billion $25 billion $600 billion $100 billion $25 billion

____ 12. In the U.S., the average adult holds about $3,300 in a. currency. b. wealth. 2

c. M1. d. M2. ____ 13. At any given time, the voting members of the Federal Open Market Committee include a. five of the 12 presidents of the regional Federal Reserve banks. b. the president of the Federal Reserve Bank of New York. c. the seven members of the Board of Governors. d. All of the above are correct. ____ 14. All Fed purchases and sales of a. corporate stocks and bonds are conducted at the New York Feds trading desk. b. government bonds are conducted at the New York Feds trading desk. c. real estate and other real assets are conducted by the Federal Open Market Committee. d. All of the above are correct. ____ 15. The president of each regional Federal Reserve Bank is appointed by a. the U.S. president with the approval of the Senate. b. the Board of Governors. c. the voting members of the Federal Open Market Committee. d. the board of directors of that regional Federal Reserve Bank. ____ 16. At any meeting of the Federal Open Market Committee, that committees voting members consist of a. 5 Federal Reserve Regional Bank Presidents and all the members of the Board of Governors. b. 5 Federal Reserve Regional Bank Presidents and 5 members of the Board of Governors. c. 12 Federal Reserve Regional Bank Presidents and all the members of the Board of Governors. d. 12 Federal Reserve Regional Bank Presidents and 5 members of the Board of Governors. ____ 17. Monetary policy affects employment a. only in the long run. b. only in the short run. c. in both the long run and the short run. d. in neither the long run nor the short run. ____ 18. There is a a. short-run tradeoff between inflation and unemployment. b. short-run tradeoff between an increase in the money supply and inflation. c. long-run tradeoff between inflation and unemployment. d. long-run tradeoff between an increase in the money supply and inflation. ____ 19. In a system of 100-percent-reserve banking, a. banks do not accept deposits. b. banks do not influence the supply of money. c. loans are the only asset item for banks. d. All of the above are correct. ____ 20. Suppose that banks desire to hold no excess reserves, the reserve requirement is 5 percent, and a bank receives a new deposit of $1,000. This bank a. will increase its required reserves by $50. b. will initially see its total reserves increase by $1,000. c. will be able to make a new loan of $950. 3

d. All of the above are correct. ____ 21. Suppose the Fed requires banks to hold 10 percent of their deposits as reserves. A bank has $20,000 of excess reserves and then sells the Fed a Treasury bill for $9,000. How much does this bank now have to lend out if it decides to hold only required reserves? a. $29,000 b. $28,100 c. $19,100 d. $11,000 Table 29-2. An economy starts with $10,000 in currency. All of this currency is deposited into a single bank, and the bank then makes loans totaling $9,250. The T-account of the bank is shown below. Assets Reserves Loans $750 9,250 Liabilities Deposits $10,000

____ 22. Refer to Table 29-2. This bank operates in a a. system of 0-percent-reserve banking. b. system of 100-percent-reserve banking. c. system of Federal-Reserve banking. d. fractional-reserve banking system. ____ 23. Refer to Table 29-2. The banks reserve ratio is a. 7.50 percent. b. 8.12 percent. c. 92.50 percent. d. 100 percent. ____ 24. Refer to Table 29-2. If all banks in the economy have the same reserve ratio as this bank, then the value of the economys money multiplier is a. 1.33. b. 10.00. c. 10.81. d. 13.33. ____ 25. Refer to Table 29-2. If all banks in the economy have the same reserve ratio as this bank, then an increase in reserves of $150 for this bank has the potential to increase deposits for all banks by a. $866.67. b. $1,666.67. c. $2,000.00. d. an infinite amount. ____ 26. Which of the following statements is correct? a. In the special case of 100-percent-reserve banking, the reserve ratio is 1, the money multiplier is 2, and banks create money. b. In the special case of 100-percent-reserve banking, the reserve ratio is 1, the money multiplier is 1, and banks do not create money. c. When the reserve ratio is 0.5, then the money multiplier is 1 and banks do not create money. d. When the reserve ratio is 0.125, then the money multiplier is 8, and each bank loans $8 for 4

every $1 that it accept in deposits. ____ 27. If the reserve ratio is 12.5 percent, then $5,600 of money can be generated by a. $64 of new reserves. b. $448 of new reserves. c. $700 of new reserves. d. $800 of new reserves. ____ 28. A sale of government bonds by the Fed a. increases the money supply and increases the federal funds rate. b. increases the money supply and decreases the federal funds rate. c. decreases the money supply and increases the federal funds rate. d. decreases the money supply and decreases the federal funds rate. ____ 29. A bank loans Kellie's Print Shop $350,000 to remodel a building near campus to use as a new store. On their respective balance sheets, this loan is a. an asset for the bank and a liability for Kellie's Print Shop. The loan increases the money supply. b. an asset for the bank and a liability for Kellie's Print Shop. The loan does not increase the money supply. c. a liability for the bank and an asset for Kellie's Print Shop. The loan increases the money supply. d. a liability for the bank and an asset for Kellie's Print Shop. The loan does not increase the money supply. ____ 30. Suppose a bank has $10,000 in deposits and $8,000 in loans. It has loaned out all it can given the reserve requirement. It follows that the required reserve ratio is a. 2 percent. b. 12.5 percent. c. 20 percent. d. 80 percent. ____ 31. If the reserve ratio is 12.5 percent, the money multiplier is a. 6.25. b. 8. c. 12.5. d. 25. ____ 32. If the reserve ratio for all banks is 9 percent, then a decrease in reserves of $6,000 can cause the money supply to fall by as much as a. $60,000.00. b. $66,666.67. c. $90,900.00. d. $100,555.56. Scenario 29-2. The Monetary Policy of Tazi is controlled by the countrys central bank known as the Bank of Tazi. The local unit of currency is the Taz. Aggregate banking statistics show that collectively the banks of Tazi hold 300 million Tazes of required reserves, 75 million Tazes of excess reserves, have issued 7,500 million Tazes of deposits, and hold 225 million Tazes of Tazian Treasury bonds. Tazians prefer to use only demand deposits and so all money is on deposit at the bank. 5

____ 33. Refer to Scenario 29-2. Assume that banks desire to continue holding the same ratio of excess reserves to deposits. What is the reserve requirement and the reserve ratio for Tazian Banks? a. 5 percent, 8 percent b. 4 percent, 8 percent c. 4 percent, 5 percent d. None of the above is correct. ____ 34. Refer to Scenario 29-2. Assuming the only other thing Tazian banks have on their balance sheets is loans, what is the value of existing loans made by Tazian banks? a. 6,900 million Tazes b. 7,125 million Tazes c. 7,350 million Tazes d. None of the above is correct. ____ 35. Refer to Scenario 29-2. Suppose the Bank of Tazi loaned the banks of Tazi 10 million Tazes. Suppose also that both the reserve requirement and the percentage of deposits held as excess reserves stay the same. By how much would the money supply change? a. 250 million Tazes b. 200 million Tazes c. 125 million Tazes d. None of the above is correct. ____ 36. Refer to Scenario 29-2. Suppose the Bank of Tazi purchased 50 million Tazes of Tazian Treasury Bonds from the banks. Suppose also that both the reserve requirement and the percentage of deposits held as excess reserves stay the same. By how much does the money supply change? a. 625 million Tazes b. 1,000 million Tazes c. 1,250 million Tazes d. None of the above is correct. ____ 37. To increase the money supply, the Fed could a. sell government bonds. b. increase the discount rate. c. decrease the reserve requirement. d. None of the above is correct. ____ 38. When the Fed conducts open market purchases, reserves a. increase and banks can increase lending. b. increase and banks must decrease lending. c. decrease and banks can increase lending. d. decrease and banks must decrease lending. ____ 39. In a fractional-reserve banking system with no excess reserves and no currency holdings, if the central bank buys $100 million of bonds, a. reserves and the money supply increase by less than $100 million. b. reserves increase by $100 million and the money supply increases by $100 million. c. reserves increase by $100 million and the money supply increases by more than $100 million. d. both reserves and the money supply increase by more than $100 million. 6

____ 40. The banking system currently has $10 billion of reserves, none of which are excess. People hold only deposits and no currency, and the reserve requirement is 10 percent. If the Fed raises the reserve requirement to 20 percent and at the same time buys $1 billion of bonds, then by how much does the money supply change? a. It falls by $45 billion. b. It falls by $52 billion. c. It falls by $55 billion. d. None of the above is correct. ____ 41. Suppose banks decide to hold fewer excess reserves relative to deposits. Other things the same, this action will cause the a. money supply to fall. To reduce the impact of this the Fed could sell Treasury bonds. b. money supply to fall. To reduce the impact of this the Fed could buy Treasury bonds. c. money supply to rise. To reduce the impact of this the Fed could sell Treasury bonds. d. money supply to rise. To reduce the impact of this the Fed could buy Treasury bonds. ____ 42. If people decide to hold more currency relative to deposits, the money supply a. falls. The larger the reserve ratio is, the more the money supply falls. b. falls. The larger the reserve ratio is, the less the money supply falls. c. rises. The larger the reserve ratio is, the more the money supply rises. d. rises. The larger the reserve ratio is, the less the money supply rises. ____ 43. In December 1999 people feared that there might be computer problems at banks as the century changed. Consequently, people wanted to hold relatively more in currency and relatively less in deposits. In anticipation banks raised their reserve ratios to have enough cash on hand to meet depositors' demands. These actions by the public a. would increase the multiplier. If the Fed wanted to offset the effect of this on the size of the money supply, it could have sold bonds. b. would increase the multiplier. If the Fed wanted to offset the effect of this on the size of the money supply, it could have bought bonds. c. would reduce the multiplier. If the Fed wanted to offset the effect of this on the size of the money supply, it could have sold bonds. d. would reduce the multiplier. If the Fed wanted to offset the effect of this on the size of the money supply, it could have bought bonds. ____ 44. The Fed can directly protect a bank during a bank run by a. increasing reserve requirements. b. selling government bonds to the bank. c. lending reserves to the bank. d. doing any of the above. ____ 45. Imagine that the federal funds rate was above the level the Federal Reserve had targeted. To move the rate back towards its target the Federal Reserve could a. buy bonds. This buying would reduce reserves. b. buy bonds. This buying would increase reserves. c. sell bonds. This selling would reduce reserves. d. sell bonds. This selling would increase reserves.

Chapter 29 Practice Test Answer Section

MULTIPLE CHOICE 1. ANS: NAT: TOP: 2. ANS: NAT: MSC: 3. ANS: NAT: MSC: 4. ANS: NAT: MSC: 5. ANS: NAT: TOP: 6. ANS: NAT: MSC: 7. ANS: NAT: MSC: 8. ANS: NAT: MSC: 9. ANS: NAT: MSC: 10. ANS: NAT: MSC: 11. ANS: NAT: MSC: 12. ANS: NAT: MSC: 13. ANS: NAT: MSC: 14. ANS: NAT: MSC: D PTS: Analytic LOC: Barter MSC: D PTS: Analytic LOC: Interpretive B PTS: Analytic LOC: Definitional B PTS: Analytic LOC: Interpretive C PTS: Analytic LOC: Money supply B PTS: Analytic LOC: Definitional A PTS: Analytic LOC: Definitional C PTS: Analytic LOC: Definitional C PTS: Analytic LOC: Definitional C PTS: Analytic LOC: Definitional C PTS: Analytic LOC: Definitional A PTS: Analytic LOC: Definitional D PTS: Analytic LOC: Definitional B PTS: Analytic LOC: Interpretive 1 DIF: 1 REF: 29-0 The study of economics and definitions in economics Applicative 1 DIF: 1 REF: 29-1 The role of money TOP: Liquidity 1 DIF: 1 The role of money 1 DIF: 2 The role of money REF: 29-1 TOP: Liquidity REF: 29-1 TOP: Money | Liquidity | Store of value

1 DIF: 2 REF: 29-1 The study of economics and definitions in economics MSC: Interpretive 1 DIF: 1 REF: 29-1 The role of money TOP: Unit of account 1 DIF: 1 The role of money 1 DIF: 1 The role of money 1 DIF: 1 The role of money 1 DIF: 1 The role of money 1 DIF: 2 Monetary and fiscal policy 1 DIF: 1 The role of money 1 DIF: 2 Monetary and fiscal policy 1 DIF: 2 Monetary and fiscal policy 8 REF: 29-1 TOP: Medium of exchange REF: 29-1 TOP: Commodity money REF: 29-1 TOP: Money supply | Money supply REF: 29-1 TOP: Money supply REF: 29-1 TOP: Money supply REF: 29-1 TOP: Currency REF: 29-2 TOP: Federal Open Market Committee REF: 29-2 TOP: Open-market operations

15. ANS: NAT: MSC: 16. ANS: NAT: MSC: 17. ANS: NAT: MSC: 18. ANS: NAT: MSC: 19. ANS: NAT: MSC: 20. ANS: NAT: MSC: 21. ANS: NAT: MSC: 22. ANS: NAT: MSC: 23. ANS: NAT: MSC: 24. ANS: NAT: MSC: 25. ANS: NAT: MSC: 26. ANS: NAT: MSC: 27. ANS: NAT: TOP: 28. ANS: NAT: MSC: 29. ANS: NAT: MSC: 30. ANS: NAT: MSC:

D PTS: Analytic LOC: Definitional A PTS: Analytic LOC: Definitional B PTS: Analytic LOC: Applicative A PTS: Analytic LOC: Definitional B PTS: Analytic LOC: Interpretive D PTS: Analytic LOC: Applicative A PTS: Analytic LOC: Applicative D PTS: Analytic LOC: Applicative A PTS: Analytic LOC: Applicative D PTS: Analytic LOC: Applicative C PTS: Analytic LOC: Applicative B PTS: Analytic LOC: Applicative C PTS: Analytic LOC: Money multiplier C PTS: Analytic LOC: Interpretive A PTS: Analytic LOC: Interpretive C PTS: Analytic LOC: Applicative

1 DIF: 2 Monetary and fiscal policy 1 DIF: 2 Monetary and fiscal policy 1 DIF: 2 Monetary and fiscal policy 1 DIF: 1 Monetary and fiscal policy 1 DIF: 2 The role of money 1 DIF: 2 Monetary and fiscal policy 1 DIF: 3 Monetary and fiscal policy 1 DIF: 1 The role of money 1 DIF: 2 The role of money 1 DIF: 2 The role of money 1 DIF: 3 The role of money 1 DIF: 2 The role of money

REF: 29-2 TOP: Federal Reserve System REF: 29-2 TOP: Federal Open Market Committee REF: 29-2 TOP: Monetary policy REF: 29-2 TOP: Inflation | Unemployment REF: 29-3 TOP: Reserves | Money supply REF: 29-3 TOP: Reserves REF: 29-3 TOP: Reserves REF: 29-3 TOP: Fractional-reserve banking REF: 29-3 TOP: Reserve ratio REF: 29-3 TOP: Money multiplier REF: 29-3 TOP: Money multiplier REF: 29-3 TOP: Money multiplier

1 DIF: 2 REF: 29-3 The study of economics and definitions in economics MSC: Applicative 1 DIF: 2 REF: 29-3 Monetary and fiscal policy TOP: Open-market operations 1 DIF: 2 Monetary and fiscal policy 1 DIF: 1 Monetary and fiscal policy 9 REF: 29-3 TOP: Banks | T-accounts REF: 29-3 TOP: Reserves

31. ANS: NAT: MSC: 32. ANS: NAT: MSC: 33. ANS: NAT: MSC: 34. ANS: NAT: MSC: 35. ANS: NAT: MSC: 36. ANS: NAT: MSC: 37. ANS: NAT: TOP: 38. ANS: NAT: MSC: 39. ANS: NAT: TOP: 40. ANS: NAT: TOP: 41. ANS: NAT: MSC: 42. ANS: NAT: MSC: 43. ANS: NAT: TOP: 44. ANS: NAT: MSC: 45. ANS: NAT: TOP:

B PTS: 1 DIF: 1 Analytic LOC: Monetary and fiscal policy Applicative B PTS: 1 DIF: 1 Analytic LOC: Monetary and fiscal policy Applicative C PTS: 1 DIF: 2 Analytic LOC: Monetary and fiscal policy Applicative A PTS: 1 DIF: 2 Analytic LOC: Monetary and fiscal policy Applicative B PTS: 1 DIF: 2 Analytic LOC: Monetary and fiscal policy Applicative B PTS: 1 DIF: 2 Analytic LOC: Monetary and fiscal policy Applicative C PTS: 1 DIF: 1 Analytic LOC: Monetary and fiscal policy Money supply | Reserve requirements A PTS: 1 DIF: 2 Analytic LOC: Monetary and fiscal policy Interpretive C PTS: 1 DIF: 2 Analytic LOC: Monetary and fiscal policy Fractional-reserve banking | Open-market operations A PTS: 1 DIF: 3 Analytic LOC: Monetary and fiscal policy Money multiplier | Open-market operations C PTS: 1 DIF: 3 Analytic LOC: Monetary and fiscal policy Applicative B PTS: 1 DIF: 3 Analytic LOC: Monetary and fiscal policy Applicative D PTS: 1 DIF: 3 Analytic LOC: Monetary and fiscal policy Money multiplier | Open-market operations C PTS: 1 DIF: 1 Analytic LOC: Monetary and fiscal policy Definitional B PTS: 1 DIF: 3 Analytic LOC: Monetary and fiscal policy Federal funds rate | Open-market operations

REF: 29-3 TOP: Money multiplier REF: 29-3 TOP: Money multiplier REF: 29-3 TOP: Reserve ratio REF: 29-3 TOP: Reserve ratio REF: 29-3 TOP: Reserve ratio REF: 29-3 TOP: Reserve ratio REF: 29-3 MSC: Definitional REF: 29-3 TOP: Open-market operations | Reserves REF: 29-3 MSC: Applicative REF: 29-3 MSC: Analytical REF: 29-3 TOP: Reserves | Money multiplier REF: 29-3 TOP: Currency | Money multiplier REF: 29-3 MSC: Analytical REF: 29-3 TOP: Banks | Federal Reserve System REF: 29-3 MSC: Analytical

10

You might also like

- Janette Utility BillDocument2 pagesJanette Utility BillSharon JonesNo ratings yet

- The Cost of Living: The Consumer Price Index andDocument21 pagesThe Cost of Living: The Consumer Price Index andWan Nursyafiqah Wan RusliNo ratings yet

- CH17Document7 pagesCH17mnbzxcpoiqweNo ratings yet

- Test Business English Banking VocabularyDocument10 pagesTest Business English Banking VocabularyTijana Doberšek Ex Živković100% (2)

- International Financial Market InstrumentsDocument21 pagesInternational Financial Market InstrumentsJASVEER S86% (21)

- Pre-Test Chapter 18 Ed17Document7 pagesPre-Test Chapter 18 Ed17dware2kNo ratings yet

- file ôn trắc nghiệm cuối kì 8 .vi.enDocument38 pagesfile ôn trắc nghiệm cuối kì 8 .vi.en2-Nguyễn Thị Lan Anh100% (2)

- Idiots Guide To BitcoinDocument105 pagesIdiots Guide To BitcoinOisin ConollyNo ratings yet

- Chapter 16 (29) Practice Test: The Monetary System: Multiple ChoiceDocument11 pagesChapter 16 (29) Practice Test: The Monetary System: Multiple ChoiceRaymund GatocNo ratings yet

- Two Exercises About The is-LM ModelDocument2 pagesTwo Exercises About The is-LM ModelMatheus AugustoNo ratings yet

- Relative ClauseDocument4 pagesRelative Clause3. Nguyễn Văn ĐượcNo ratings yet

- End of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83Document2 pagesEnd of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83opi ccxv100% (1)

- Chapter 02 - How To Calculate Present ValuesDocument18 pagesChapter 02 - How To Calculate Present ValuesTrinh VũNo ratings yet

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1lyellNo ratings yet

- Preston Department Store Has A New Promotional Program That Offers A Free GiftDocument3 pagesPreston Department Store Has A New Promotional Program That Offers A Free GiftElliot RichardNo ratings yet

- Stock SolutionDocument9 pagesStock Solution신동호No ratings yet

- Unit 15Document4 pagesUnit 15Oktawia TwardziakNo ratings yet

- ErrorChecking1 QuestionsDocument9 pagesErrorChecking1 QuestionsChrisNo ratings yet

- Design-Expert Software, Version 7.0: Optimize Your Product or Process With Design of Experiments (DOE)Document4 pagesDesign-Expert Software, Version 7.0: Optimize Your Product or Process With Design of Experiments (DOE)leninkathirNo ratings yet

- Chapter 13 Saving, Investment, and The Financial SystemDocument3 pagesChapter 13 Saving, Investment, and The Financial SystemPhuong Vy PhamNo ratings yet

- Financial Crisis PPT FMS 1Document48 pagesFinancial Crisis PPT FMS 1Vikas JaiswalNo ratings yet

- StilbenoidDocument107 pagesStilbenoidasri nurul ismiNo ratings yet

- Consumption Tax ExercisesDocument8 pagesConsumption Tax ExercisesMinh TuấnNo ratings yet

- Chapter4 (Money and Banking)Document2 pagesChapter4 (Money and Banking)ibraheemNo ratings yet

- Taxation - Ins 3010: Group 2Document10 pagesTaxation - Ins 3010: Group 2nguyễnthùy dươngNo ratings yet

- You Are Researching Time Manufacturing and Have Found The FollowingDocument1 pageYou Are Researching Time Manufacturing and Have Found The Followingtrilocksp SinghNo ratings yet

- Chapter 17 - Selected Quantitative Problems & SolutionsDocument2 pagesChapter 17 - Selected Quantitative Problems & Solutions分享区No ratings yet

- Bản sao của Câu hỏi trắc nghiệm (bản đánh sẵn đáp án)Document30 pagesBản sao của Câu hỏi trắc nghiệm (bản đánh sẵn đáp án)HẬU TRẦN TOÀN XUÂNNo ratings yet

- Unit 7:: Precious Stones Handmade Jewelry Luxury Clothing Luxury Clothing Precious MetalsDocument23 pagesUnit 7:: Precious Stones Handmade Jewelry Luxury Clothing Luxury Clothing Precious MetalsĐức Lương Nguyễn0% (1)

- Causes of Hypokalemia in AdultsDocument23 pagesCauses of Hypokalemia in AdultsOmar Armando Gutiérrez DuránNo ratings yet

- Topic 5 - CVPDocument15 pagesTopic 5 - CVPTân NguyênNo ratings yet

- MNC Nep PresentationDocument53 pagesMNC Nep PresentationSaajan RathodNo ratings yet

- Bai Tap InsuranceDocument12 pagesBai Tap InsuranceVũ HoàngNo ratings yet

- Speak B1.2Document5 pagesSpeak B1.2Xuân ThưNo ratings yet

- Exercises 270919Document3 pagesExercises 270919Kim AnhNo ratings yet

- 10a What Have We Learned?: Group: 3 MembersDocument2 pages10a What Have We Learned?: Group: 3 MembersYeferson Mayron Lozano ChallaNo ratings yet

- Ôn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Document48 pagesÔn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Thương TrầnNo ratings yet

- BNC Oval Gear Flowmeter-CmcDocument2 pagesBNC Oval Gear Flowmeter-CmcHữu Tấn NguyễnNo ratings yet

- Accounting Principles Manual Chapter 5 (Brief Exercises)Document5 pagesAccounting Principles Manual Chapter 5 (Brief Exercises)Dani SaputraNo ratings yet

- IB - Chap 003Document29 pagesIB - Chap 003TCNo ratings yet

- Corporate Finance (AOF)Document37 pagesCorporate Finance (AOF)Linh NguyenNo ratings yet

- Closeup2 - Final Test - Unit 1 - 5 - g9.2Document9 pagesCloseup2 - Final Test - Unit 1 - 5 - g9.2Thu Uyên NguyễnNo ratings yet

- Speaking Level 3 - Sample FinalsDocument8 pagesSpeaking Level 3 - Sample FinalsTú NguyễnNo ratings yet

- NCU3e BrE B1 Assessment EndofUnit Test Unit02Document6 pagesNCU3e BrE B1 Assessment EndofUnit Test Unit02Agustina Lobos MartinoNo ratings yet

- Gestion Des Risques-FinanceDocument58 pagesGestion Des Risques-FinancePiedmondNo ratings yet

- Ps 11Document31 pagesPs 11Anh Tran HoangNo ratings yet

- Testbank - Multinational Business Finance - Chapter 11Document14 pagesTestbank - Multinational Business Finance - Chapter 11Uyen Nhi NguyenNo ratings yet

- PAPDI DR Mardiah Suci Hardianti - Case Study ThrombocytopeniaDocument43 pagesPAPDI DR Mardiah Suci Hardianti - Case Study ThrombocytopeniaMarcelliaNo ratings yet

- Chapter 11: Forward and Futures Hedging, Spread, and Target StrategiesDocument9 pagesChapter 11: Forward and Futures Hedging, Spread, and Target StrategiesNam MaiNo ratings yet

- Tổng hợp bài mẫu task 2 Kiên LuyệnDocument48 pagesTổng hợp bài mẫu task 2 Kiên Luyệnenfa.work.confNo ratings yet

- Mock Test 2021 PMDocument5 pagesMock Test 2021 PMBao Thy PhoNo ratings yet

- CH 1Document16 pagesCH 1dragopyreNo ratings yet

- Report 4: Practical 4: EnzymesDocument8 pagesReport 4: Practical 4: EnzymesĐặng Thị Kim SangNo ratings yet

- ARBs (Angiotensin II Receptor Blockers) NCLEXDocument15 pagesARBs (Angiotensin II Receptor Blockers) NCLEXSameerQadumi100% (1)

- L4 LipidDocument57 pagesL4 LipidLe Thanh HaiNo ratings yet

- DTTC 2Document44 pagesDTTC 2ngochanhime0906No ratings yet

- Securities Market Exercise HVNHDocument8 pagesSecurities Market Exercise HVNHBánh Bèo KangNo ratings yet

- Exercise Exercise 3.1 Component Accounting - Engine: Costs of PurchaseDocument15 pagesExercise Exercise 3.1 Component Accounting - Engine: Costs of PurchaseVõ Kim loanNo ratings yet

- TỔNG HỢP CÂU HỎI PHỎNG VẤN THƯỜNG GẶP CHO SINH VIÊN HÀNG HẢI PART 2 - Tài liệu textDocument18 pagesTỔNG HỢP CÂU HỎI PHỎNG VẤN THƯỜNG GẶP CHO SINH VIÊN HÀNG HẢI PART 2 - Tài liệu textHoài ThanhNo ratings yet

- Tiền Tệ Ngân Hàng Cô TrâmDocument7 pagesTiền Tệ Ngân Hàng Cô Trâmhuy7n-35No ratings yet

- TA2-K61 Trở Đi - Final Sample Test 1 - OnlineDocument4 pagesTA2-K61 Trở Đi - Final Sample Test 1 - OnlineMinh TiếnNo ratings yet

- Macro Tut 5Document7 pagesMacro Tut 5TACN-2M-19ACN Luu Khanh LinhNo ratings yet

- Homework Moneytary Policy - AnnaDocument6 pagesHomework Moneytary Policy - AnnaAnna Nguyen100% (1)

- Macro Tut 5Document9 pagesMacro Tut 5trang snoopyNo ratings yet

- LawDocument5 pagesLawĐào Duy TúNo ratings yet

- Course Plan I2I Fall 2013 Block 3Document6 pagesCourse Plan I2I Fall 2013 Block 3Đào Duy TúNo ratings yet

- FPT University Subject: Introduction To Informatics Assignment 1Document3 pagesFPT University Subject: Introduction To Informatics Assignment 1Đào Duy TúNo ratings yet

- Gap (The Difference Between What The Economy Could Produce and What It Actually Produced) Widened ToDocument7 pagesGap (The Difference Between What The Economy Could Produce and What It Actually Produced) Widened ToĐào Duy TúNo ratings yet

- Qizz 1,2,4Document60 pagesQizz 1,2,4Đào Duy TúNo ratings yet

- Chapter 5-Problem Solving and Decision Making: Multiple ChoiceDocument11 pagesChapter 5-Problem Solving and Decision Making: Multiple ChoiceĐào Duy TúNo ratings yet

- Assignment 2: Distinguish Implicit and Explicit Cost. Give Examples of These CostsDocument3 pagesAssignment 2: Distinguish Implicit and Explicit Cost. Give Examples of These CostsĐào Duy TúNo ratings yet

- OTS FormDocument2 pagesOTS FormMirza AdnanNo ratings yet

- Bank of Mongolia - PDFDocument7 pagesBank of Mongolia - PDFGustavo MazaNo ratings yet

- Master Tile Internship UOGDocument54 pagesMaster Tile Internship UOGAhsanNo ratings yet

- Bank - Its Origin, Meaning, Objectives & FunctionDocument5 pagesBank - Its Origin, Meaning, Objectives & FunctionKarar HussainNo ratings yet

- Functions of RbiDocument4 pagesFunctions of RbiMunish PathaniaNo ratings yet

- FXD Depst CalDocument2 pagesFXD Depst CalKhalid DarNo ratings yet

- Conventional Bank Vs Islamic BankDocument2 pagesConventional Bank Vs Islamic BankSyaii Mohamed100% (2)

- BibliographyDocument14 pagesBibliographyshrikrushna javanjalNo ratings yet

- Latest Banking PDFDocument20 pagesLatest Banking PDFvarunNo ratings yet

- DhruboDocument28 pagesDhruboMd.Yousuf AkashNo ratings yet

- CHPT 8 IFM - 2Document29 pagesCHPT 8 IFM - 2Hamdan HassinNo ratings yet

- Master Circular - Single Borrower Exposure Limit 09.04.2005Document3 pagesMaster Circular - Single Borrower Exposure Limit 09.04.2005tazim07No ratings yet

- What Is Square, IncDocument7 pagesWhat Is Square, IncTSEDEKENo ratings yet

- General Mathematics Quarter 2-Module 2: Week 6 - Week 9: Department of Education - Republic of The PhilippinesDocument34 pagesGeneral Mathematics Quarter 2-Module 2: Week 6 - Week 9: Department of Education - Republic of The PhilippinesElaiza GaytaNo ratings yet

- Quarterly Bulletin of Cocoa Statistics: Publications Order FormDocument1 pageQuarterly Bulletin of Cocoa Statistics: Publications Order FormCamilo Ernesto Araujo BarabasNo ratings yet

- BANK OF ENGLAND: Working Paper No 529Document61 pagesBANK OF ENGLAND: Working Paper No 529Dr. KIRIAKOS TOBRAS - ΤΟΜΠΡΑΣNo ratings yet

- Chapter 3 Proof of CashDocument6 pagesChapter 3 Proof of CashJomallene MartinezNo ratings yet

- Instrument Is Incomplete and Revocable Until Delivery ofDocument5 pagesInstrument Is Incomplete and Revocable Until Delivery ofAnonymous fnlSh4KHIgNo ratings yet

- Syllabus: Institute of Business and Public Affairs Second Semester AY 2021 - 2022 College VisionDocument13 pagesSyllabus: Institute of Business and Public Affairs Second Semester AY 2021 - 2022 College VisionMichelle PeralesNo ratings yet

- Copia de TOEFL Team 4Document3 pagesCopia de TOEFL Team 4Andrés DueñasNo ratings yet

- LC NotesDocument2 pagesLC NotesAnnie KhowajaNo ratings yet

- IFM 03 FE MarketsDocument22 pagesIFM 03 FE MarketsTanu GuptaNo ratings yet

- Current AccountDocument1 pageCurrent AccountLegal DivisionNo ratings yet

- Sabeetha Final ProjectDocument52 pagesSabeetha Final ProjectPriyesh KumarNo ratings yet

- Strategic Risk Management Paper 2014Document11 pagesStrategic Risk Management Paper 2014Ale BessNo ratings yet

- Https Iiprd - MetavanteDocument5 pagesHttps Iiprd - MetavanteShahab HussainNo ratings yet