Professional Documents

Culture Documents

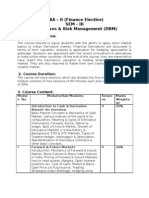

07 Banking, Insurance and Disaster Management Concerns For Indian Real Estate

Uploaded by

donaldshahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07 Banking, Insurance and Disaster Management Concerns For Indian Real Estate

Uploaded by

donaldshahCopyright:

Available Formats

Banking, insurance and disaster management concerns for Indian real estate By - Sandeep Donald Shah

Banking, insurance and real estate are considered the three siblings intervened with one another with more than one strings. Not to offend or undermine the importance of other sectors but these three can be termed as the corner stones essential to any great economy (the forth spot left open for competition). All developing and developed nations have long realized their importance and hence these are closely monitored and regulated by respective overnments and independent regulatory authorities, with of course one e!ception, the real estate markets of "ndia. #ately banking and real estate are stealing the limelight. All business news channels and tabloids are concentrating their efforts on how the $eserve Bank of "ndia ($B") and the %inance &inistry are tightening the reins on the "ndian real estate. &ost articles cover the sub'ect with a sense of criticism( however fall short of blatantly opposing the moves. None until now have dealt with the rationale behind $B")s actions. "ts not that the overnment has suddenly become the sworn enemy of the once blue eyed sector, in addition to controlling inflation $B" is most concerned about speculators having penetrated the sector in a huge way. *he typical modus operandi being to undertake bulk bookings by paying a small token amount during pre+launch , launch of a pro'ect, holding stock for few months and then selling at a smart profit. -o how do the figures work out, let us assume an apartment of size ./// s0uare foot priced a $s. 1/// a s0uare foot. 2ost of the apartment works out a modest one 2rore, typical price levels e!isting in all metropolitan cities with the e!ception of &umbai where it can be multiplied by a factor of three. *he apartment is booked by paying a token amount of 1 or 3/ percent when opting for installment payment option, 1 lakhs in this case. "n the coming months hype is created and the prices escalate by anything close to 3/+./4, speculator then sells at the inflated prices. "n this case the sale price works out to $s.5/// a s0uare foot, a profit of $s. ./ lakhs on an investment of $s. 1 lakhs in appro!imately 6+7 months, 3.//4 return annualized. *oday the real estate sector once considered safe is being talked of as high risk. "n addition to the fear of speculation giving a bad name to the entire industry there is one another uncertainty i.e. risk of a natural calamity like earth0uake. .3st 2entury %inance (formerly ./th 2entury %inance) went bankrupt after the Northridge earth0uake of 3887, suffering a loss of 3.3 Billion 9- :. *he memory is still fresh amongst many bankers and insurance companies. Not to forget that many other companies also with investments in real estate sector suffered similar losses in Billions. Banks also face the dilemma as to what happens to the property loans disbursed by them in case the very property mortgaged gets destroyed in an earth0uake (all buildings being designed in "ndia are aimed with protecting lives of occupants and not the building per se implying that they would have to be demolished and re+built as there would be considerable structural damage). -imilarly the insurance companies are worried as to how would they pay up the hundreds of thousands of claims especially in densely populated areas like &umbai. %rom lessons learnt from Northridge earth0uake in 9- (3887) and ;obe earth0uake in <apan (3881) there does e!ist an innovative solution. 2onsiderable research has been put into seismic response of structures and means to protect them without structural damage. *o start with =arth0uake $esistant is now classified into three separate categories depending on the anticipated structural response and the capacity of the building to absorb, accept structural damage.

=arth0uake $esistant #ife -afety > minimum level of earth0uake protection, aims at preventing total building collapse, however there will be structural damage and the building may warrant demolition and reconstruction. *he building codes are based on this minimum protection, however leave the window open incase the user wants to opt for higher level of protection. =arth0uake $esistant "mmediate ?ccupancy > ne!t higher level of earth0uake protection, in addition to collapse prevention, aims at keeping the structural damage to a minimum thereby ensuring safe occupancy even immediately after a ma'or earth0uake. "deally suited for highrise buildings. =arth0uake $esistant %ully ?perational > highest level of earth0uake protection ensures safety and operation ability of non+structural components in addition to the "mmediate ?ccupancy standard of the building structure. 2riteria used in important buildings like hospitals and command @ control centers.

A key advantage of adopting higher levels of earth0uake protection is that a much lower interest rate can be negotiated with the banks for the particular pro'ect. Banks would gladly oblige as higher safety also reduces their risk levels. "nsurance companies will also follow suit in reducing the premiums. *he direct implication for the buyer would be that this twin advantage will offset the cost of higher protection. *ypically =arth0uake $esistant > "mmediate ?ccupancy would cost $s. 31/ to .// per s0uare foot implying a 31// s0uare foot will cost $s. . to 6 lakh more. *he Aonourable -upreme 2ourt is presently hearing a B"# on safeguarding the interests of general public who are being e!ploited by some unscrupulous builders and developers. *he B"# has been filed by a N ? called -anrakshak (*he Brotector). Aopefully the court ruling would serve as a guideline and e!pedite the formulation of concrete laws by the overnment. ?n the issue of earth0uake protection, the builders, developers should clearly mention on the buyer,seller agreement that the building is protected against what magnitude earth0uake on the $ichter scale and what will be the building performance if that scale of earth0uake strikes. Cill the building sustain structural damage and to what e!tent. *aking advantage of lack of awareness of the masses most builders are selling Dseismically deficientE buildings. Felhi which falls in Gone 7 can be e!pected to witness a magnitude H earth0uake on the $ichter scale whereas &umbai in Gone 6 can e!perience a magnitude 5.1 0uake. Aowever recent studies conducted at ""* &umbai by Brof. $avi -inha have concluded that the risk that &umbai faces is far greater than what was envisaged earlier. *he threat perception of &umbai should be upgraded to Gone 7,1. Are "ndian citizens not entitled to know what the different levels of earth0uake protection are and their building has been designed to withstand what magnitude earth0uakeI "s it not the responsibility of the overnment to increase public awareness and promote earth0uake risk mitigationI "s this problem not serious enough to warrant a concerted media campaignI *he present situation is not as bleak as it sounds, National Fisaster &anagement Authority has commenced an advertisement campaign and hopefully the same will spread actionable awareness such as what are different kinds of earth0uake resistance and how the respective buildings will perform so that people can then go in for seismic upgrade and retrofitting. www.taylordevicesindia.com

www.taylordesign.in

You might also like

- HT 23jan2007 - Stress On Making Bridges Quake-ResistantDocument1 pageHT 23jan2007 - Stress On Making Bridges Quake-ResistantdonaldshahNo ratings yet

- FE - Mandatory Home Insurance 14july2007Document1 pageFE - Mandatory Home Insurance 14july2007donaldshahNo ratings yet

- Times Property Delhi 07apr2007Document1 pageTimes Property Delhi 07apr2007donaldshahNo ratings yet

- FE 14july2007 Mandatory Home InsuranceDocument2 pagesFE 14july2007 Mandatory Home InsurancedonaldshahNo ratings yet

- ET Delhi 16may2007Document1 pageET Delhi 16may2007donaldshahNo ratings yet

- Earthquakes Fast FactsDocument3 pagesEarthquakes Fast FactsdonaldshahNo ratings yet

- ET 25mar2007Document2 pagesET 25mar2007donaldshahNo ratings yet

- 20140125-HT ArticleDocument2 pages20140125-HT ArticledonaldshahNo ratings yet

- Dna 07 - 05 - 2007Document1 pageDna 07 - 05 - 2007donaldshahNo ratings yet

- Archieve Outlook 16oct2005Document3 pagesArchieve Outlook 16oct2005donaldshahNo ratings yet

- Archieve 16oct2005 Deccan Herald - Major Earthquake Could Occur in Delhi-Meteorological DepartmentDocument3 pagesArchieve 16oct2005 Deccan Herald - Major Earthquake Could Occur in Delhi-Meteorological DepartmentdonaldshahNo ratings yet

- 10 Frequently Asked QuestionsDocument4 pages10 Frequently Asked QuestionsdonaldshahNo ratings yet

- 10 Frequently Asked QuestionsDocument5 pages10 Frequently Asked QuestionsdonaldshahNo ratings yet

- 20131006-India Today - 8 Lakh May DieDocument2 pages20131006-India Today - 8 Lakh May DiedonaldshahNo ratings yet

- 18 Torre Mayor - Seismic Dampers For The High Rise BuildingsDocument7 pages18 Torre Mayor - Seismic Dampers For The High Rise Buildingsdonaldshah100% (1)

- 17 INVESTING in REAL ESTATE Is Your Checklist CompleteDocument2 pages17 INVESTING in REAL ESTATE Is Your Checklist CompletedonaldshahNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Study of Financial Derivatives (Futures and Options)Document128 pagesA Study of Financial Derivatives (Futures and Options)tanvirNo ratings yet

- Summer Internship Project ReportDocument73 pagesSummer Internship Project ReportVishal Patel100% (1)

- HDFCDocument51 pagesHDFCnikitapatil420No ratings yet

- Money Management MethodsDocument18 pagesMoney Management MethodsEduardo PáezNo ratings yet

- SAPM All Chapters (Mid Sem)Document97 pagesSAPM All Chapters (Mid Sem)deekshithaNo ratings yet

- MK 5BDocument3 pagesMK 5BFaqih NuriandaNo ratings yet

- Introduction To DerivativesDocument430 pagesIntroduction To DerivativesKunal MehtaNo ratings yet

- PGP 2021-23 Term 3 Financial Derivatives: An Assignment OnDocument12 pagesPGP 2021-23 Term 3 Financial Derivatives: An Assignment Onnischal mathurNo ratings yet

- Security Analysis IntroductionDocument18 pagesSecurity Analysis IntroductionAshish KumarNo ratings yet

- Oil & Gas Hedging Mitigates Price Risk ExposureDocument3 pagesOil & Gas Hedging Mitigates Price Risk ExposureMercatus Energy Advisors100% (2)

- Investment Options in IndiaDocument25 pagesInvestment Options in IndiaamiNo ratings yet

- Indian EthosDocument32 pagesIndian EthosSantosh MaheshwariNo ratings yet

- Trading FX Like Jesse Livermore Traded StocksDocument5 pagesTrading FX Like Jesse Livermore Traded StocksMishu Aqua0% (1)

- Swing Trading The Speculator Way 124Document10 pagesSwing Trading The Speculator Way 124KL RoyNo ratings yet

- 231 1004Document16 pages231 1004api-27548664No ratings yet

- Kondratieff CycleDocument31 pagesKondratieff CyclepaganrongsNo ratings yet

- Synopsis On Financial DerivativesDocument13 pagesSynopsis On Financial Derivativesgursharan4march67% (3)

- Annamalai University: Directorate of Distance EducationDocument148 pagesAnnamalai University: Directorate of Distance EducationMALU_BOBBYNo ratings yet

- Investment Analysis and Portfolio Management 2010Document166 pagesInvestment Analysis and Portfolio Management 2010johnsm2010No ratings yet

- Swot Analysis of Asset ClassesDocument5 pagesSwot Analysis of Asset ClassesRakkuyil Sarath33% (3)

- ) AeonsDocument346 pages) AeonsAmol AdsulNo ratings yet

- Tape Reading and Market Tactics NeillDocument129 pagesTape Reading and Market Tactics NeillSameer MishraNo ratings yet

- Forex FlashcardsDocument63 pagesForex Flashcardssting74100% (2)

- International Finance B.M.S.Document15 pagesInternational Finance B.M.S.mukesh sahooNo ratings yet

- KarvyDocument66 pagesKarvyveeresh_patil39_100% (1)

- Overview of Capital MarketsDocument31 pagesOverview of Capital MarketsDiwakar BhargavaNo ratings yet

- Black Book Internship Traning ProjectDocument41 pagesBlack Book Internship Traning ProjectRahul Pujare67% (9)

- Derivatives & Risk ManagementDocument4 pagesDerivatives & Risk Managementadil1787No ratings yet

- 4 Pillars of InvestingDocument32 pages4 Pillars of InvestingVaradharajan RagunathanNo ratings yet

- A Minsky-Kindleberger Perspective On The Financial Crisis: J. Barkley Rosser, JR., Marina V. Rosser and Mauro GallegatiDocument11 pagesA Minsky-Kindleberger Perspective On The Financial Crisis: J. Barkley Rosser, JR., Marina V. Rosser and Mauro Gallegatilcr89No ratings yet