Professional Documents

Culture Documents

Is Islamic Banking Really Islamic

Uploaded by

Kamran AbdullahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Is Islamic Banking Really Islamic

Uploaded by

Kamran AbdullahCopyright:

Available Formats

ISLAMIC BANKING: IS IT REALLY ISLAMIC? By: Omar Mustafa Ansari & ai!

an A"m#$ M#m%n

Is it really Islamic? . In this era of development and growth in Islamic finance and banking, this is a question being raised at every forum by various quarters. All those who raise this question, are undoubtedly well-wishers of Islam, Islamic economic system and uslim !mmah. Accordingly, while we celebrate the achievements of Islamic banking on one hand, we should not be ignoring the issues and ob"ections being raised by such quarters in order to ensure that we lay the foundations of this industry on strong, straight and acceptable-to-all footings. O&'#(ti)#s Of Is*ami( Ban+in, #efore discussing various ob"ections raised on the present day Islamic banking, we should first try to understand the ob"ectives of Islamic banking, which are as follows$ %. &o provide 'hariah compliant and prudent banking opportunities( hence providing an opportunity to uslims to do their banking transactions ) a *alal way$ In other words, this is "ust an effort to avoid +iba and other prohibited elements from commercial and banking transactions, in order to ensure that we do ,-othing-*aram.( and Achieving the goals and ob"ectives of an Islamic economic system.

/.

0e all can agree that, given the circumstances, the Islamic banking industry is making all efforts to ensure the first ob"ective, while the second ob"ective, although no-less important, is not the prime ob"ective of current-day Islamic banking. -ist%ry Of Is*ami( Ban+in, odern banking system was introduced in uslim countries at a time when they were politically and economically slave to the western world. &he main banks of the western world established their branches and subsidiaries in the uslim countries and territories to fulfill requirements of foreign business. &he uslim community generally avoided the foreign banks for religious reasons but with the passage of time, it became more and more difficult to engage in trade and other activities without making use of commercial banks. 1ven then, a large number of uslims, confined their involvement to transaction activities such as current account or hundred percent cash margin letter of credits. #orrowings from commercial banks or placement the access funds and saving accounts were strictly avoided by practicing uslims in order to keep away from dealing in interest which is prohibited by Islam. 0ith the passage of time, however, due to increase in cross-border transactions and other socio-economic forces demanding more involvement in national economic and financial activities, avoiding the interaction with the banks became impossible. 2ocal banks were established in uslim countries 3including the names like uslim 4ommercial #ank5 on the same lines as the interest-based foreign banks and they began to e6pand within the country bringing the banking system to more and more people. 7overnments, businesses and individuals began to transact business with the banks, with or without liking it. &his state of affairs drew the attention and concern of uslim intellectuals which gave emergence to the contemporary Islamic banking. #y the midst of the last century, many uslim countries started their efforts to adopt the Islamic economic and banking systems. any scholars, economist and e6perienced bankers came with different solutions to initiate the Islamic banking. &hose e6periences paved the route for modern Islamic banking. -owadays Islamic financial institutions 3I8Is5 are spread all over the world including 1uropean countries and the !nited 'tates. In particular these have their significant presence in 9akistan, 'audi Arabia, #ahrain, !nited Arab 1mirates, other 744 countries, alaysia, 'udan and Iran. ."% Rais# T"# /u#sti%ns? Islamic banking is a weak industry. In respect of resources, in respect of knowledge-bases, in respect of trainedknowledgeable-sincere human resources, in respect of availability of commercial options, in respect of state support, as well as, society support, in respect of sincerity of stake-holders and 0*A& -:&. 0ith such adverse footings, unfortunately, it really has certain weaknesses which are not only targeted by the enemies, but, are more severally and forcefully attacked by the 8+I1-;'.

Page - 1 of 7

As a consequence, the Islamic banking and finance is facing disagreements from various quarters including certain ,revolutionary. Islamic movements, certain ,rigid. and ,hard-core. religious scholars, and ,idealistic. and ,utopian. Islamic economists 3without any disrespect to them all5. Can Ban+in, E)#r B# R#a**y Is*ami(? &he first question is raised mostly by those who either do not have any knowledge about banking, or those who have the courage to evaluate the banking systems from its evolution to its ob"ectives. &hey feel that the banking per-se is against the very basic concepts of Islam. &hey feel that "ust like the fact that there can not be any ,*alal pork. or ,Islamic prostitution., there can be no ,*alal banking.. &his viewpoint is supported by the fact that, particularly in 9akistan, we have already faced a complete disaster in the name of interest-free banking and so-called I8Is particularly including odarabas. &he argument, as to whether Islamic banking is really Islamic, has two different facets. &he first one is that whatever is being performed in the name of Islamic banking is apparently quite similar to the operations of a conventional financial institution hence creates doubts in people<s mind, as to on what grounds we can call it Islamic? 'o they feel that it is merely a change in name and documents and in fact, it is nothing different from conventional banking. &he second facet of this question is more important and deals with the socio-economic factors associated with the overall Islamic financial system. ;ue to significance of these ob"ections, we will discuss these two issues before looking for other arguments. M#r#*y A C"an,# In Nam# An$ 0%(um#nts &he most common and most discussed argument against contemporary Islamic banking is that there is ,-: ;I881+1-41 A& A22. between the conventional banking and Islamic banking and this is merely a change of name and documents. &he second argument, which is in-fact a derivative of the first argument, is that even in Islamic banking, the most common products being used e.g. urabaha, usawwama, 'alam, Istisna, diminishing usharaka and I"ara untahia #ittamleek are on fi6ed return basis. 1ven the usharaka and odaraba based products are engineered in a way that the profits are ,virtually-fi6ed.. :ne should reali=e the fact that unless we can distinguish an Islamic bank from a conventional bank, it would be difficult for any of us to rely on the same. 9articularly, it is observed that they try to make sure that their product is similar to the conventional products in all respects, even if for that purpose they have to incorporate a few provisions in these products which are not considered to be good or a few of them are considered akrooh. In addition, their endeavors are focused towards minimi=ation of their risk through every possible option and accordingly, the essence of Islamic finance which is based on risk taking is killed. 0e can note that most I8Is market their products on the models very much similar to those used by the conventional banks. As an e6ample, an I"ara untahia #ittamleek transaction introduced by an I8I might be very similar to a finance lease transaction offered by a conventional leasing company, e6cept for a difference of &akaful > insurance cost which in Islamic mode is to be borne by the lessee and accordingly, the same is built-in the rentals. &he basic reason behind this similarity is to ensure three ob"ectives. &he first one, which is more important one, is to provide an ,even playing ground. to the I8Is in order to ensure their survival in the overall banking system. &he second one, is that even by I8Is, it has to be ensured that their shareholders and depositors get some return and preferably a return equivalent to those of conventional banks. And the third reason is to avoid arbitrage amongst Islamic and conventional financial systems which may be e6ploited by a few big-guns to get the benefit of the pricing difference between the two parallel financial systems. 8or such reason, time value of money concept is used for performance measurement and pricing of financial products. ost importantly, it should be kept in mind that in some areas *aram and *alal have a very small difference. 8or an e6ample, only saying the name of Allah Almighty on an animal at the time of slaughter makes it *alal and permissible while by not saying that name we make it *aram or by "ust a few words of acceptance in -ikah, in presence of a few persons, a man and woman become *alal for each other. 'imilarly, if a transaction can be engineered in a way that the same becomes 'hariah compliant, then we should not conclude that the same is *aram only due to its resemblance with the interest based financing. It is also pertinent to note that since the Islamic financial services sector is in its infancy phase, as compared to the conventional banking, we unfortunately have to follow the conventional system in the pattern of financial products and are still not in a position to invent absolutely new financial services. ;uring the last few centuries, the conventional banking system has well read the human needs and psychology and has invented a considerable number of financial products and accordingly, it is not simple to "ust invent a new financial tool "ust for the purpose of inventing one. 8or e6ample, if they have running finance and overdraft as a financing tool, we have invented an alternate to the same in form of Isti"rar with urabaha or usharaka based running finance model. 'imilarly, if they use finance leases as a financing tool, we have converted the same in a 'hariah

Page - 2 of 7

compliant form in form of I"ara untahia #ittamleek or in form of ;iminishing usharaka. &hese are only two e6amples, but the tally is practically very high and for each interest based financial product e6cept for those e6plicitly *aram, more than one alternates have been engineered. &he ob"ective of this discussion was "ust to emphasi=e that merely an amorti=ation schedule similar to the one offered by a conventional bank, is not a basis for declaring a *alal product to be *aram. If "ust a pricing model or "ust the similarity of a cashflow model makes the transaction *aram, what you will say regarding a conventional loan offered at a price much higher or much lower than the market prevailing rates for which the pricing model and the cash-flow model are not similar to those generally applied in the industry. ;oes anybody think that such dissimilarity will make it *alal? Accordingly, from 'hariah principles it is rightly concluded that it is the substance of a transaction what makes it *alal or *aram and not a pricing model used to price the transaction or the cash-flow model used for the payments and repayments in monetary terms. S%(i%1E(%n%mi( Eff#(ts Of Is*ami( Ban+in, An$ inan(# 'econd most significant argument from such group, predominantly by certain Islamic economists and certain Islamic revolutionary movements, is about the socio-economic factors of Islamic banking. &hey feel that since Islamic banking is also based on profit motive and in present form, it generally works on ,virtually-fi6ed. return basis( hence the same cannot attribute anything-positive towards the socio-economic changes that Islam desires. &his is a crucial question and, we believe that, every conscious uslim will concur with the concerns of those who raise the same, although the conclusions derived by different people might vary. -obody can argue that virtually-fi6ed return based banking, although being 'hariah compliant, is not what has been desired by Islam as a complete way of living. In addition, the current-day Islamic banking is emphasi=ing more on consumer finance as compared to financing to ' 1 sector, agricultural sector, and more importantly, on the micro-finance( hence, it is not contributing enough towards the ,"ust and equitable monetary system. that Islam needs. *aving due regard for these arguments, may we remind you that that the Islamic economic system is not something that can work in isolation of the geo-political and legislative system, as well as, and more importantly the society<s behavior towards the in"unctions of Islamic 'hariah in personal and collective matters. Accordingly, one can easily imagine that in an economy whereby most of the businessmen are not honest in fairly presenting the financial statements of their businesses, how difficult it is to introduce a profit and loss sharing based financial solution. 'imilarly, in most of the cases payment of ?akat and 'adaqat depends on the individual and particularly, in view of the gigantic volume of the black economy in the country, what can be e6pected even if a good system for ?akat and !shr is introduced? It needs to be emphasi=ed that only the change in banking system is not a solution to the overall revolution of economic system unless other facets of Islamic economic system, as well as, Islamic social system are not implemented simultaneously. Accordingly, the complete transition of economy to an Islamic economic system can be performed, when and only when, the overall consensus of the society is developed towards practical application of 'hariah in all the facets of human life, particularly including the governmental, political and legislative structures. ;espite such an unsatisfactory and rather discouraging attitude of the society towards application of Islamic 'hariah, it should be noted that such a situation do not relieve a uslim from the applicability of 'hariah principles, but rather increases his responsibilities in the way that it becomes his duty not only to try to abide by all applicable 'hariah requirements in his personal capacity but also to put his endeavors towards improvement in such system. 4onsequently, in case the Islamic banking, in your opinion, is not contributing enough towards betterment of society, you cannot blame the same alone. &he responsibilities of the uslim !mmah as a whole 3or of the 'tate5 can not be e6pected to be borne by a single sector only, which, at this point of time is in its infancy stages. Is It -##*a Ban+in,? &his is a general discussion at various forums that contemporary Islamic banking is based on *eelas. 8rom 'hariah perspective, a *eela is an option utili=ed to disobey the divine guidance through engineering the circumstances and playing with the facts and intentions. *aving an insight into the industry, one can not disagree with this argument to certain e6tent, as it has been observed in a number of cases that in-fact, certain transactions are practically applied on this basis. *aving said that( this argument should, however, not be used to blame the entire industry. 0e should acknowledge that the foundations of the industry have been built using the pillars which are directly derived from the *oly @uran, 'unnah and 8iqh. It is worth-noting that mostly, a *eela is applied in the ,e6ecution of a transaction. rather than ,designing of a transaction.. In other words, we can safely conclude that application of *eelas in Islamic banking is not a weakness in the theories of Islamic banking, but actually is a matter of misuse > misinterpretation of basic 'hariah guidance in respect of various 'hariah compliant financial transactions.

Page - 3 of 7

Accordingly, it needs to be emphasi=ed that in order to support the growth of Islamic banking and finance on right footings, we need to strengthen the 'hariah compliance mechanism for the industry. In addition, in the longer run, we need to eliminate the Islamic financial products which have the potential of misuse. 2s# Of Int#r#st1Rat# As B#n("mar+3 Is It -a*a*? 4ritics, including scholars, as well as, economists, strongly condemn that most of I8Is while providing financing by way of any of the ,*alal. transactions, determine their profit rate on the basis of the current interest-rate benchmarks prevailing in the conventional money market. 'cholars are of the view that by applying these benchmarks, the Islamic banking industry makes their transactions ,similar. to interest-based transactions and as a consequence, these transactions become doubtful from 'hariah point-of-view. 1conomists feel further issues and that and are of the view that this thing makes these financial institutions a part of the prevailing capitalistic economic systems, hence this sort of transactions are absolutely not desirable by Islam. *ere it would be worthwhile to have a look on the arguments by the Islamic banking for better understanding of the pricing issue. &hey generally give e6amples like( suppose you enter into a supermarket in !A and see that the pork, the beef and the *alal beef are all being sold for 7#9 / per kg. ;o you think that this similarity of price or the fact that these products are being sold under the same roof renders the *alal beef as *aram? :r for e6ample( in the same superstore you note that they are using the same balance for weighing these three types of meat. ;o you think that using the same balance will render the *alal beef, as *aram? If not, then we should better understand the principle that it is the substance and legal form of the transaction that makes it *alal or *aram and not its pricing, rate or the cash-flow model or the institution, or even the environment that offers such transaction. &his issue, however, needs to be addressed by the government, as well as, the market players. A strong Islamic interbank market will InshaAllah provide us opportunities to develop our own benchmarks for Islamic banking operations. 0#a*in, %f Is*ami( Ban+s 4it" C%n)#nti%na* Ban+s Another strong argument against Islamic banking is against dealing with conventional banks. &hese dealings are of two types i.e. sharing of services and commercial transactions. As far as services are concerned, where the Islamic #anks are facilitating the foreign businesses of their customer or helping out their customers to transfer the money from safe channels. 8or these services, the remuneration or e6pense of Islamic banks is service charges which are allowed by 'hariah "urists, although they recommend that such interaction should be avoided wherever I8Is are available. &he second argument which is much strong is regarding the commercial transactions with conventional financial institutions. &hese transactions generally relate to the treasury side of the #ank whereby either the I8Is place their e6cess liquidity with the conventional banks or obtain financings from them to meet their own liquidity requirements. 8or placement of funds with conventional banks most of Islamic banks in 9akistan are using the product of 4ommodity urabaha or they invest in certain ,*alal assets. of the conventional financial institutions. :n the other hand, they normally obtain financings from the conventional banks on the basis of profit and loss sharing, although the profit rates are once again ,virtually-fi6ed.. Although, most of the 'hariah scholars have allowed these transactions duly considering the 'hariah requirements, however, nobody can argue that it is a must to avoid all such transactions. 8or this purpose, however, we need to strengthen the Islamic inter-bank market and to provide further liquidity management options to the I8Is particularly, in form of strong 'hariahcompliant government securities and a stable capital market with plenty of *alal investment options available. All dealings with conventional financial institutions should remain limited to the necessities which reach the e6tremes of compulsion. C%st Of B#in, A Mus*im &hose who have bad memories of dealing with Islamic banks are in front-line of critics with this remark. 9eople feel that there are serious doubts on the honesty and integrity of I8Is. &hey feel that these #anks are using the name of Islam to earn a few bucks more as compared to the conventional banks or rather they are e6ploiting the faith of uslims by charging them, the ,cost of being a uslim.. :n the financing side, they charge higher than conventional banks. In other words, internal rate of return on Islamic financial products is higher than the conventional products. :n the contrary, it is observed that on the deposit sides they pay less as compared to the conventional banks. In addition, it is generally observed that the e6pected rates, as well as, the actual rates of return offered by these financial institutions are fairly equivalent to 3generally slightly less than5 the rates being offered by conventional financial institutions. A "ustification against the first argument is that since I8Is are sub"ect to the commodity risk, asset destruction and holding risks and the price risk, as well as their relevant costs e.g. &akaful e6penses, in addition to the risks and costs that a bank

Page - 4 of 7

faces, they are "ustified in their demand i.e. higher internal rate of return. -evertheless, financial e6perts have generally felt that even if these factors are considered, the pricing by these #anks is on the higher side. :n the other side, in a profit and loss based model, it is agreeable that they assign weightage to different types of deposits in a manner that the total return on investment and financing pools is allocated amongst various depositors and the #ank 3working as a partner5. 1ven then, it is generally noted that I8Is are paying less than the market. 0e can only hope that in near future, with increasing competition in the Islamic banking industry, this effect will minimi=e because of market-forces e6cept to the e6tent of pricing against actual additional risk elements. Mar+#tin, A55r%a(" Of I Is Another valid argument is about the marketing approach being used by these financial institutions, which adversely effects the public reliance on this mode. 9eople raising ob"ections on the marketing approach of I8Is have two grounds for the same. &he first one is the general marketing approach being applied by the a few I8Is which include advertisement and other publicity materials including involvement of women and traditional marketing and advertisement styles for promotion of ,Islamic. banking business. 'econd ground is the marketing strategy in which sometimes it is felt that false statements are made for promotional purposes. An e6ample of the same is the claim by a leading Islamic bank that all its day to day activities are monitored by its 'hariah Advisor. Bust imagine, if it is humanly possible, that a part time 'hariah Advisor can look after all day to day activities of a full fledged bank with a number of branches even located at other cities. Another e6ample is the claim by an Islamic mutual fund that it is the first one of its kind in the country, whereas another fund was operating in the country for around one year earlier to subscription for such mutual fund. T"#y 0%n6t L%%+ Li+# Is*ami( :nce you enter into a glittering branch or office of an I8I, generally you do not feel any difference with a conventional bank. &his issue is raised particularly by the blend of people who feel that once they enter into such location, it should look like a sacred place instead of a commercial office. Cou generally feel that they have over-spent on the furniture, interior-decoration and publicity stuff, which apparently, is against the in"unctions of Islam. &his impression is further strengthened when you see the overall environment, the dealing style of personnel and most significantly, you feel 3in most of the cases5 that there are ladies working for the organi=ation without *i"ab or even ,appropriate attire. 3in line with the dress-code of a uslim woman as defined by 'hariah5. Although a few ,moderate-enlightened. uslims will not like this ob"ection at all, nevertheless, it should be kept in mind that a common uslim cannot digest ,Islamic. banking while he feels that other factors of business are not really Islamic. 0e can<t argue with these ob"ections as these have due weightage in them and the management of I8Is should take these ob"ections seriously. *owever, we should keep in mind that the prime ob"ective of Islamic finance, is to ensure that ,financial. matters are dealt with in line with Islamic 'hariah. In other words, environment does not make anything *aram. -eedless to mention, from 'hariah perspective, you can always buy a *alal product from a store where everything else is *aram although the same needs to be avoided if other options are available. Is*ami( Ban+#rs 7 0%n6t Kn%4 Is*ami( Ban+in, &his argument, once again, has key significance from the perspective of the overall control environment of these banks with regard to the applicability of 'hariah principles. 9articularly, it is astonishing when you deal with an Islamic banker, who knows very little about Islamic banking, but unfortunately, this is not very uncommon. &he prime cause behind this issue is the fact that most of the I8Is have hired the conventional bankers and generally no or very little consideration is awarded to ensure that they are well conversant with the 'hariah requirements with regard to the modes of finance being used by these #anks. 'imilarly, the I8Is do not spend enough on their resource-building for 'hariah compliance and training of their staff, in comparison to what they spend for marketing. *aving e6perience of training ,Islamic #ankers., as well as, performing 'hariah compliance reviews, we may safely conclude that, this ob"ection is not without substance. &his accordingly, is a strongest need that the I8Is should allocate more and more resources for staff training and 'hariah compliance.

Page - 5 of 7

M%n%5%*y Of S"aria" A$)is%rs Another ob"ection is regarding the appointment of 'hariah #oards and 'hariah Advisors. 9eople have largely noted and discussed at various forums that the ma"or contribution in this field in 9akistan is limited to a very small group of "urists most of whom relate to a single family and their pupils 3a single religious university5. #esides this, another question is also being raised that generally the honorariums, consultancy fee and other benefits being offered to such "urists by the I8Is in 9akistan, as well as, abroad are quite high and this may "eopardi=e their independence. In addition, it is felt that they are the only ones who are whole and sole responsible for 'hariah compliance. &hey approve the products, they review the transactions and in the end( they perform 'hariah audit themselves, which is, however, an indicative of a conflict of interest 3without any doubt on their personal independence and integrity5. ost of the people conversant with the business and operations of Islamic finance do not agree with this observation, because the contribution of these people to the industry as a whole is remarkable and they deserve even more than that based on their contribution and efforts in the promotion of this industry. &he general concept that a , oulvi. should be paid the minimum for his life, is not "ustifiable. If you are getting benefits from their efforts, their knowledge and skills, then they should be "ustifiably rewarded. *aving said that, it is always agreeable that it is the right time that contributions from "urist from other schools of thought should also be sought and they should necessarily be provided opportunities to enter into the field. 8or this purpose, it is a good proposition from the 'tate #ank that a "urist should not be allowed to hold more than one remunerative position as a 'hariah Advisor or member of a 'hariah #oard. &his will ensure that fresh blood gets an option to enter into the field which will eventually improve the overall 'hariah compliance in the field, as well as, will help these institutions to innovate fresh products. I Is 2s# C%n)#nti%na* Insuran(# A valid ob"ection( can<t argue with that. It was a real issue that according to the legal requirements, as well as, derived from real ,compulsion., the banks were required to obtain insurance coverage from conventional insurance companies and this practice was allowed by the 'hariah Advisors to the e6tent of compulsion only. &his situation, Alhamdolillah has changed after introduction of Islamic mode of insurance 3&akaful5 in 9akistani market. !nfortunately, there are a still I8Is who have not yet switched to &akaful while to-date three &akaful companies and a family &akaful company have commenced operations in 9akistan and now this lame e6cuse of compulsion can not be e6ercised anymore. -ow it<s high time that the 'tate #ank and the 'hariah Advisors should take strong steps to ensure that no business is given by the I8Is to any conventional insurance company either in respect of owned assets, or against assets held under security. S"%u*$ .# Sti** 8r#f#r Is*ami( Ban+in,? As a conclusion to this debate, we may say that we are required by our religion to implement a complete Islamic way of living in our individual and collective lives and the society and the government as well. &he Islamic banking and financial system is a part of such system and is not construed to be applicable in isolation while other laws and customs repugnant to the 'hariah requirements are still in force. *owever, for the sake of our own benefits, in order to avoid interest by ourselves and providing interest-free opportunities to our brothers and sisters in Islam, we should promote and support the Islamic banking and finance in the country with all our possible efforts and endeavors. 0e should not try to pull legs of an infant who is "ust trying to take his first step towards a long "ourney to go. *owever, we should try to ensure that he commences his "ourney on the right way, with strong footings. 'uch Islamic banking, may not be termed as perfect, but can provide us with a shelter from interest based transactions for the time being, and might support us in augmenting a truly Islamic financial system, and more appropriately said, will serve as an e6periment for the time when we will really be in a position to the implement the complete Islamic way of living in our beloved country. ay Allah Almighty bestow us his blessings and enable us to evolve a complete system of life in accordance with the principles of life provided by the *oly @uran and the *oly 9rophet 3'AA0'5. ay Allah accept our efforts and forgive us for our mistakes in this field in our individual capacities, as well as, as a society. A&%ut Omar & ai!an: :mar is a 4hartered Accountant by profession, and is presently working as 9artner ) Islamic 8inancial 'ervices 7roup with 8ord +hodes 'idat *yder D 4o. 3A member firm of 1rnst D Coung 7lobal 2imited5. :mar en"oys vast e6perience in audit,

Page - 6 of 7

'hariah compliance and providing related services to Islamic finance industry in 9akistan. *e is author of a #ook on Islamic finance namely , anaging 8inances ) A 'hariah 4ompliant 0ay.. 8ai=an holds e6perience in the field of 'hariah audits and product development. In past, he has worked with a leading Islamic bank as 'hariah 4oordinator and 'hariah Auditor. 9resently, he is working with 8ord +hodes 'idat *yder D 4o. as anager ) Islamic 8inancial 'ervices.

Page - 7 of 7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chap 017Document27 pagesChap 017Xeniya Morozova Kurmayeva100% (4)

- MODULE 2 - Partnership AccountingDocument14 pagesMODULE 2 - Partnership AccountingEdison Salgado CastigadorNo ratings yet

- 01 SAP OverviewDocument41 pages01 SAP OverviewKushal Varshney50% (2)

- BSC Di Book PDFDocument278 pagesBSC Di Book PDFpiccasa100% (1)

- 01-Incentive Scheme 2014-15 - BdoDocument9 pages01-Incentive Scheme 2014-15 - BdoKamran AbdullahNo ratings yet

- Period SPI CPI WPI: Inflation Rates For The Year 2001-02 Till To Date Are Based On 2000-01 100Document2 pagesPeriod SPI CPI WPI: Inflation Rates For The Year 2001-02 Till To Date Are Based On 2000-01 100Kamran AbdullahNo ratings yet

- Analyzing The OrganizationDocument1 pageAnalyzing The OrganizationKamran Abdullah0% (1)

- Bootstrapped Technical Efficiency Scores: A Comparative Analysis ofDocument20 pagesBootstrapped Technical Efficiency Scores: A Comparative Analysis ofKamran AbdullahNo ratings yet

- 03Document17 pages03Kamran AbdullahNo ratings yet

- 1-Introduction To OSHADocument10 pages1-Introduction To OSHAKamran AbdullahNo ratings yet

- 01 With DEADocument54 pages01 With DEAKamran AbdullahNo ratings yet

- Survey Methods & Design in Psychology: Reliabilities, Composite Scores & Review of Lectures 1 To 6 Lecturer: James NeillDocument54 pagesSurvey Methods & Design in Psychology: Reliabilities, Composite Scores & Review of Lectures 1 To 6 Lecturer: James NeillKamran AbdullahNo ratings yet

- Accounting SpeachohiocouncilDocument134 pagesAccounting SpeachohiocouncilKamran AbdullahNo ratings yet

- Fraud at Waste Management: © 2003, 2005 by The AICPADocument25 pagesFraud at Waste Management: © 2003, 2005 by The AICPAKamran AbdullahNo ratings yet

- Merrill Lynch ProjectsDocument4 pagesMerrill Lynch ProjectsSwatiThaparNo ratings yet

- Vitamin Shoppe, Inc.: Management Discussion SectionDocument13 pagesVitamin Shoppe, Inc.: Management Discussion Sectionaeroport999No ratings yet

- 2011 03 14 Palm Oil Sector ReportDocument72 pages2011 03 14 Palm Oil Sector ReportSrujitha Reddy LingaNo ratings yet

- Far450 Fac450Document9 pagesFar450 Fac450aielNo ratings yet

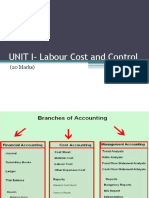

- Labour Cost and ControlDocument65 pagesLabour Cost and Controlaishwarya raikarNo ratings yet

- Auditing - MasterDocument11 pagesAuditing - MasterJohn Paulo SamonteNo ratings yet

- Key Data StructureDocument38 pagesKey Data StructureroseNo ratings yet

- A Project Report On Ratio AnalysisDocument21 pagesA Project Report On Ratio AnalysisKaviya KaviNo ratings yet

- Fin304 1midterm2Document5 pagesFin304 1midterm2darkhuman343No ratings yet

- ATP Oil First Day Declaration Company CFODocument38 pagesATP Oil First Day Declaration Company CFOChapter 11 DocketsNo ratings yet

- Topic TwoDocument67 pagesTopic TwoMerediths KrisKringleNo ratings yet

- High School Franchise Rs. 8.02 Million Sep-2020Document19 pagesHigh School Franchise Rs. 8.02 Million Sep-2020Zeeshan NazirNo ratings yet

- 1.1 Origin of The Report: Prime Bank LimitedDocument93 pages1.1 Origin of The Report: Prime Bank LimitedAami TanimNo ratings yet

- Garry Halper Menswear Limited A Loan Request For An Export OrderDocument17 pagesGarry Halper Menswear Limited A Loan Request For An Export OrderRahul KashyapNo ratings yet

- Questions For HerbalifeDocument40 pagesQuestions For HerbalifeTom GaraNo ratings yet

- Case Digest Incomplete TaxDocument135 pagesCase Digest Incomplete TaxHencel GumabayNo ratings yet

- Shareholders' Equity SectionDocument30 pagesShareholders' Equity SectionAlly DeanNo ratings yet

- Inventory Costing MethodsDocument4 pagesInventory Costing MethodsjosiahNo ratings yet

- Simple and Compound InterestDocument26 pagesSimple and Compound InterestCarlos Cary Colon100% (7)

- Financial Statement AnalysisDocument34 pagesFinancial Statement AnalysisbillyNo ratings yet

- Investor Presentation (Company Update)Document28 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Capital Adequacy Asset Quality Management Soundness Earnings & Profitability Liquidity Sensitivity To Market RiskDocument23 pagesCapital Adequacy Asset Quality Management Soundness Earnings & Profitability Liquidity Sensitivity To Market RiskCharming AshishNo ratings yet

- E-Filing Home Page, Income Tax Department, Government of IndiaDocument2 pagesE-Filing Home Page, Income Tax Department, Government of IndiassNo ratings yet

- MercedesDocument138 pagesMercedesMihaela DavidoaiaNo ratings yet

- Income Taxation (Principles of Taxation) : Fritz A. Perez, Cpa, CTT, Mritax, Mba (O.G)Document40 pagesIncome Taxation (Principles of Taxation) : Fritz A. Perez, Cpa, CTT, Mritax, Mba (O.G)JessaNo ratings yet

- M&M 2006-2007Document160 pagesM&M 2006-2007Ramajit BhartiNo ratings yet

- Lecture 1Document42 pagesLecture 1Megha JainNo ratings yet