Professional Documents

Culture Documents

Iob Neft Form

Uploaded by

mn_sundaraamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Iob Neft Form

Uploaded by

mn_sundaraamCopyright:

Available Formats

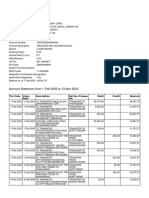

INDIAN OVERSEAS BANK Branch Name & Code Cash Remittance permissible upto Rs.

50,000/- only Quote PAN for amount of Rs.50,000/ Where Applicable To be filled by the Applicant in BLOCK LETTERS

APPLICATION FORM FOR NATIONAL ELECTRONIC FUNDS TRANSFER PAN

Please remit through NEFT a sum of Rs._____________ Rs.(in words)___________________________________ only against Cash Cheque Debit to my/our account with you/your_________________________________ Branch. DETAILS OF APPLICANT(REMITTER) Amount to be Remitted Charges/Commission Services Tax Rs. Rs. Rs. Centre : Bank : Branch : IFSC : Beneficiarys Name : Type of Account SB CA CC Address : Type of A/C : CARD Account No. Telephone/Mobile No. Sender to Receiver Message (Brief): SB CD CC LOANS CREDIT DETAILS OF BENEFICIARY

Total Amount to be debited Rs.

Account No.(15 digit)____________________________ Cheque Number_________________________________ Cheque Date _________________________________

Remitters Name ________________________________ Address : Mobile No.___________________________ (or) E-Mail ID :

I/We agree and abide by the Rules, that under the normal circumstances, the Beneficiary account would be credited by Destination Bank/Branch on the same day at the Destination Centre subject to Terms & Conditions mentioned below & NEFT Rules/Regulations enumerated by RBI. (Applicants Signature) FOR BANKS USE ONLY Transactions entered as per details of Beneficiary as given Applicants Signature Verified. Transaction Authorized & above. Funds Remitted through RTGS as per the details of UTR No. Beneficiary given above. Txn No. IFSC Code: Time : _________________________________ ___________________ __________ ________ Authorised Official (Maker) Authorized Official Date Time TERMS & CONDITIONS FOR ACCEPTING THE REQUEST FOR FUNDS TRANSFER(FT)THROUGH NEFT Funds Transfer shall be effected only when the Destination Bank/Branch is participating in NEFT. Sufficient clear funds in the remitters account must be available. The NEFT Customer/Applicant should verify the statement of account and confirm the correctness of remittance made. In case of any discrepancy the customer/Applicant should intimate the bank immediately. In Case of holidays at the destination branch the credit will be afforded on next working day. Once the Account is debited and funds are remitted/NEFT transfer effected, the remitter cannot revoke the given mandate. The Remitting Branch/Bank shall not be liable for delay/non-payments to the beneficiary if :a) Incorrect and insufficient details of beneficiary are provided by the Applicant/Remitter. b) Dislocation of work due to the circumstances beyond the control of Remitting/Destination Banks like nonfunctioning of Computer system, disruption of work due to natural calamities, strike,riot declared/undeclared holidays, etc. or internal problems or other causes beyond the control of the Branch/Bank resulting in disruption of communication. c) All payment instructions should be checked carefully by the remitter. Bank shall not be liable for crediting remittance amount to wrong beneficiary on account of incorrect information furnished by the customer in the application form. Date :

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- CUT HERE - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

INDIAN OVERSEAS BANK ______________________________ Branch

CUSTOMERS RECORD SLIP

Received from _________________________________________ by Cash/ Cheque (No.____________)/ debit authority SB/CA/CC Account No_______________________________ for Rs.________________Rs.(in words)_____________ _____________________ only on Date___________ at Time__________Hours for Fund Transfer under NEFT as detailed below: Remittance Amount Beneficiary Name Commission IFSC Service Tax Bank Type of Account Branch & City Account Number Banks Seal Authorised Signatory : ______________________________

You might also like

- Gst-Challan Creation FormatDocument2 pagesGst-Challan Creation FormatMANAS KUMAR SAHU100% (1)

- Rom2010augm27 893098023 602445287Document79 pagesRom2010augm27 893098023 602445287Mandar KubalNo ratings yet

- Section 74 Reply Narachi IndustriesDocument9 pagesSection 74 Reply Narachi Industriesbirpal singhNo ratings yet

- MSMEDocument1 pageMSMESikandar AlamNo ratings yet

- Canara Bank ChargesDocument8 pagesCanara Bank Chargesaca_trader100% (1)

- Dobbala Raghu Nandan: Account StatementDocument10 pagesDobbala Raghu Nandan: Account Statementraghu INo ratings yet

- Sale Bill43220541Document1 pageSale Bill43220541Rajeev KejriwalNo ratings yet

- 1678691785571rH0b3Hgl23zPj4gz PDFDocument6 pages1678691785571rH0b3Hgl23zPj4gz PDFAmit Kumar gargNo ratings yet

- Bill FormatDocument7 pagesBill FormatZuberNo ratings yet

- Tata AIA Life MahaLife Gold DadDocument1 pageTata AIA Life MahaLife Gold DadMirzaNo ratings yet

- KotakDocument2 pagesKotakHarsh wadhwaNo ratings yet

- Tata AIA Life Diamond Savings PlanDocument4 pagesTata AIA Life Diamond Savings Plansree db2No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961AshishNo ratings yet

- Subject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Document4 pagesSubject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Rimpa SenapatiNo ratings yet

- Income Tax Department: Challan ReceiptDocument1 pageIncome Tax Department: Challan ReceiptJugal K MundadaNo ratings yet

- One 97 Communications LTD RHPDocument539 pagesOne 97 Communications LTD RHPTIANo ratings yet

- Amc 2 Times Tvs Service Bike MinakshiDocument1 pageAmc 2 Times Tvs Service Bike MinakshiprathamNo ratings yet

- Tendernotice 1Document236 pagesTendernotice 1Shweta JoshiNo ratings yet

- 30X40 Feet South Face at Harihar - Ffirst Floor Bank FormatDocument6 pages30X40 Feet South Face at Harihar - Ffirst Floor Bank FormatKS CONSTRUCTIONSNo ratings yet

- 2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMDocument1 page2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMMohammad MAAZNo ratings yet

- Notes On Initiations of Apars For New Manual Online Apar FormatsDocument21 pagesNotes On Initiations of Apars For New Manual Online Apar FormatsSoham MukherjeeNo ratings yet

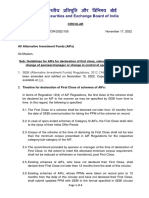

- CircularDocument4 pagesCircularyashNo ratings yet

- Tax Liability of A Firm and PartnersDocument28 pagesTax Liability of A Firm and PartnersRohitNo ratings yet

- 1 MPB-501 - Application For Pension 2 MPC - 60Document10 pages1 MPB-501 - Application For Pension 2 MPC - 60Anitha Mary DambaleNo ratings yet

- Fund Transfer Form: (Applicable For Existing Customers)Document1 pageFund Transfer Form: (Applicable For Existing Customers)raj rajNo ratings yet

- AVVNL List For RUVN For Component-ADocument41 pagesAVVNL List For RUVN For Component-ASuresh KumarNo ratings yet

- Shyama Health Care &fitness Solution: Ret No.018 13636203Document1 pageShyama Health Care &fitness Solution: Ret No.018 13636203Wjajshs UshdNo ratings yet

- Dokumen - Tips Reliance Industries LTD Head Office PayslipDocument1 pageDokumen - Tips Reliance Industries LTD Head Office PayslipVijay BhargavuNo ratings yet

- Skybag Lifestyle BillDocument3 pagesSkybag Lifestyle Billyugant shahNo ratings yet

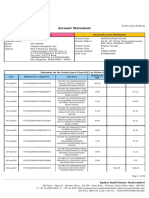

- Account Statement For Account:0114002101107545: Branch DetailsDocument4 pagesAccount Statement For Account:0114002101107545: Branch DetailsHappy JainNo ratings yet

- SA Withdrawal New - Settlement FormDocument6 pagesSA Withdrawal New - Settlement Formimran zaidiNo ratings yet

- Dealer FeedbackDocument3 pagesDealer FeedbackTarun BhatiNo ratings yet

- RANCON Developments Ltd.Document32 pagesRANCON Developments Ltd.Ehteshamul Haque SunnyNo ratings yet

- HDFC Bank LTDDocument5 pagesHDFC Bank LTDAditya Adi SinghNo ratings yet

- 4330467076170342677Document1 page4330467076170342677vamsi patnalaNo ratings yet

- DPO No. 4600065994Document7 pagesDPO No. 4600065994Abhinn KothariNo ratings yet

- Postpaid Monthly Statement: This Month's SummaryDocument9 pagesPostpaid Monthly Statement: This Month's SummaryMY WAY IELTSNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAman DosaniNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document3 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)9828472925No ratings yet

- NiyoX-Statement-Jayavani M-01Sep22 - To - 30nov22 - 3cwp9zqDocument26 pagesNiyoX-Statement-Jayavani M-01Sep22 - To - 30nov22 - 3cwp9zqRicha BehraNo ratings yet

- Selvam: 47480: 320: AddressDocument1 pageSelvam: 47480: 320: AddressmagicpalNo ratings yet

- DigitalApproval Letter PDFDocument1 pageDigitalApproval Letter PDFreddynagiNo ratings yet

- B MadhuDocument6 pagesB MadhuRahul ReddyNo ratings yet

- Barcode Item HSN Code GST (%) Brand Size ColourDocument155 pagesBarcode Item HSN Code GST (%) Brand Size ColourKapil KantNo ratings yet

- NTPC Challan FormDocument1 pageNTPC Challan FormGaurang Grover100% (1)

- Admixture MTC, InvoiceDocument3 pagesAdmixture MTC, InvoiceAbhik GhoshNo ratings yet

- Non Initiation of ACRDocument19 pagesNon Initiation of ACRRajkumar MathurNo ratings yet

- Max Bupa Health Insurance Company LimitedDocument1 pageMax Bupa Health Insurance Company LimitedTarunNo ratings yet

- Misc Fee ReceiptDocument1 pageMisc Fee ReceiptTULIP DAHIYANo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBK Venture Capital PVT LTDNo ratings yet

- Apollo Medicine InvoiceOct 14 2022 23 25Document2 pagesApollo Medicine InvoiceOct 14 2022 23 25mani kandanNo ratings yet

- Documents Required For MSMELoans - Limits-MODIFIEDDocument6 pagesDocuments Required For MSMELoans - Limits-MODIFIEDSumit KumarNo ratings yet

- Government of Telangana Irrigation & Cad DepartmentDocument95 pagesGovernment of Telangana Irrigation & Cad Departmentsantosh yevvariNo ratings yet

- Wa0001.Document41 pagesWa0001.Mohamed IsmailNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemozo dingdongNo ratings yet

- IOB419201761616PM - Iob Rtgs Form PDFDocument2 pagesIOB419201761616PM - Iob Rtgs Form PDFpsgnanaprakash8686No ratings yet

- Iob Rtgs FormDocument2 pagesIob Rtgs FormApuri Rammohan Reddy100% (1)

- All NeftDocument3 pagesAll NeftSaravana Kumar AnandanNo ratings yet

- Indian Overseas Bank Application Form For Funds Transfer Under Rtgs Where ApplicableDocument2 pagesIndian Overseas Bank Application Form For Funds Transfer Under Rtgs Where ApplicableNagamuthu.SNo ratings yet

- RTGS Indian Overseas BankDocument2 pagesRTGS Indian Overseas Bankanaga1982No ratings yet

- Philips Industry Lighting BrochureDocument39 pagesPhilips Industry Lighting Brochureuriquil006No ratings yet

- Water Hammer: Cause and EffectDocument8 pagesWater Hammer: Cause and Effectmn_sundaraamNo ratings yet

- ReadmeDocument1 pageReadmeBala KathirveluNo ratings yet

- Design of Rec FootingDocument20 pagesDesign of Rec FootingBhanu VadlamaniNo ratings yet

- Foundations Theory & DesignDocument35 pagesFoundations Theory & Designbhavik91100% (2)

- Tamilnadu Hill Area (PT) Act 1955Document11 pagesTamilnadu Hill Area (PT) Act 1955Charles SamuelNo ratings yet

- Philips Industrial LightingsDocument13 pagesPhilips Industrial Lightingsmn_sundaraamNo ratings yet

- GST Invoice Upload Offline Tool User Manual - V1.0Document51 pagesGST Invoice Upload Offline Tool User Manual - V1.0www.TdsTaxIndia.comNo ratings yet

- Asme B16.5Document11 pagesAsme B16.5jacquesmayol100% (1)

- 58banks PDFDocument1 page58banks PDFmn_sundaraamNo ratings yet

- GSTR1 Excel Workbook Template-V1.1Document41 pagesGSTR1 Excel Workbook Template-V1.1vaishaliak2008No ratings yet

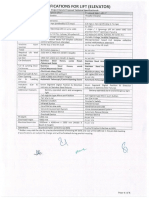

- Specification Lift Elevators PDFDocument5 pagesSpecification Lift Elevators PDFKUMARJITNo ratings yet

- NPT SizingDocument1 pageNPT SizingpetroNo ratings yet

- Asme B16.5Document11 pagesAsme B16.5jacquesmayol100% (1)

- SAC Codes & GST Rates For Services - Chapter 99Document26 pagesSAC Codes & GST Rates For Services - Chapter 99mn_sundaraam67% (3)

- Indonesia Code PDFDocument21 pagesIndonesia Code PDFkiplingkipNo ratings yet

- Earthing TransformersDocument12 pagesEarthing Transformersjitendrakmr593No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 01 - Fluid FlowDocument76 pages01 - Fluid FlowMubarak AhmadNo ratings yet

- VSAT HandbookDocument203 pagesVSAT Handbookwalelwi100% (6)

- Type 994 - 0001 Water Bath Desuperheater: For Desuperheating Superheated Steam To Saturated Steam TemperatureDocument4 pagesType 994 - 0001 Water Bath Desuperheater: For Desuperheating Superheated Steam To Saturated Steam Temperaturemn_sundaraamNo ratings yet

- Ansi b36.10 Pipe SizeDocument9 pagesAnsi b36.10 Pipe SizeSpoonful BurnsideNo ratings yet

- CGST Rules, 2017 As Amended Upto 01/07/2017 - CGST Rules 01july2017Document392 pagesCGST Rules, 2017 As Amended Upto 01/07/2017 - CGST Rules 01july2017Vaishnavi JayakumarNo ratings yet

- 210 0100 MicroChem2 - Sept15Document12 pages210 0100 MicroChem2 - Sept15mn_sundaraamNo ratings yet

- Flow Measurement PDFDocument32 pagesFlow Measurement PDFmn_sundaraam100% (1)

- What Is Meant by Solidity Ratio in Structural Engineering - QuoraDocument3 pagesWhat Is Meant by Solidity Ratio in Structural Engineering - Quoramn_sundaraamNo ratings yet

- Bs848 Fan Performance TestingDocument12 pagesBs848 Fan Performance TestingKumaran GopalNo ratings yet

- Gis Form 403 M. UploadDocument3 pagesGis Form 403 M. Uploadmn_sundaraamNo ratings yet

- Useful Formulas & Fan LawsDocument2 pagesUseful Formulas & Fan LawsEngr_WRQNo ratings yet

- Earthing TransformersDocument12 pagesEarthing Transformersjitendrakmr593No ratings yet

- The Great South African Land ScandalDocument158 pagesThe Great South African Land ScandalTinyiko S. MalulekeNo ratings yet

- Sinar Mas: Introduction To and Overview ofDocument26 pagesSinar Mas: Introduction To and Overview ofBayuNo ratings yet

- Amma Mobile InsuranceDocument1 pageAmma Mobile InsuranceANANTH JNo ratings yet

- Woodward Life Cycle CostingDocument10 pagesWoodward Life Cycle CostingmelatorNo ratings yet

- Suarez, Francis - FORM 1 - 2009 PDFDocument3 pagesSuarez, Francis - FORM 1 - 2009 PDFal_crespoNo ratings yet

- 18 043Document3 pages18 043cah7rf9099No ratings yet

- TB Chapter 05 Risk and Risk of ReturnsDocument80 pagesTB Chapter 05 Risk and Risk of Returnsabed kayaliNo ratings yet

- Europe VATContactsDocument2 pagesEurope VATContactsEriwaNo ratings yet

- Chap 3 MCDocument29 pagesChap 3 MCIlyas SadvokassovNo ratings yet

- Vehicle Advance FormatDocument8 pagesVehicle Advance Formatmuralitharan100% (1)

- IB Business and Management Example CommentaryDocument24 pagesIB Business and Management Example CommentaryIB Screwed94% (33)

- International Management+QuestionsDocument4 pagesInternational Management+QuestionsAli Arnaouti100% (1)

- Luis Rodrigo Ubeda: Mission, Values and Culture of POTCDocument6 pagesLuis Rodrigo Ubeda: Mission, Values and Culture of POTCLuis Rodrigo ÚbedaNo ratings yet

- CSR 2Document7 pagesCSR 2Shravan RamsurrunNo ratings yet

- Rise of Hitler Inquiry Sources-3CDocument15 pagesRise of Hitler Inquiry Sources-3CClaudia ChangNo ratings yet

- A Study On Customer Satisfaction of Honda Activa Among Customers in Changanacherry TalukDocument55 pagesA Study On Customer Satisfaction of Honda Activa Among Customers in Changanacherry TalukgunNo ratings yet

- Update 14Document82 pagesUpdate 14suvromallickNo ratings yet

- Forklift Driving Training MalaysiaDocument2 pagesForklift Driving Training MalaysiaIsogroupNo ratings yet

- Seedling Trays Developed by Kal-KarDocument2 pagesSeedling Trays Developed by Kal-KarIsrael ExporterNo ratings yet

- Portfolio Management ASSIGN..Document23 pagesPortfolio Management ASSIGN..Farah Farah Essam Abbas HamisaNo ratings yet

- New Microsoft Word DocumentDocument6 pagesNew Microsoft Word DocumentmanojjoshipalanpurNo ratings yet

- CV Siti Nur Najihah BT Nasir 1Document1 pageCV Siti Nur Najihah BT Nasir 1sitinurnajihah458No ratings yet

- 25-JUNE-2021: The Hindu News Analysis - 25 June 2021 - Shankar IAS AcademyDocument22 pages25-JUNE-2021: The Hindu News Analysis - 25 June 2021 - Shankar IAS AcademyHema and syedNo ratings yet

- Solution Manual For Macroeconomics For Today 10th Edition Irvin B TuckerDocument6 pagesSolution Manual For Macroeconomics For Today 10th Edition Irvin B TuckerKelly Pena100% (31)

- 2023 Nigerian Capital Market UpdateDocument13 pages2023 Nigerian Capital Market Updatemay izinyonNo ratings yet

- Galvor CaseDocument10 pagesGalvor CaseLawi AnupamNo ratings yet

- Balancing Natural Gas Policy Vol-1 Summary (NPC, 2003)Document118 pagesBalancing Natural Gas Policy Vol-1 Summary (NPC, 2003)Nak-Gyun KimNo ratings yet

- Abu Dhabi EstidamaDocument63 pagesAbu Dhabi Estidamagolashdi100% (3)

- Why Poverty Has Declined - Inquirer OpinionDocument6 pagesWhy Poverty Has Declined - Inquirer OpinionRamon T. Conducto IINo ratings yet

- MSC Chain of Custody StandardDocument10 pagesMSC Chain of Custody StandardIMMASNo ratings yet