Professional Documents

Culture Documents

Marico Industries

Uploaded by

shankysmartestOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marico Industries

Uploaded by

shankysmartestCopyright:

Available Formats

Marico - An Information Update July 2005

Q1FY06 (Quarter ended June 30, 2005)

Group Turnover Rs. 273 Cr. Up 12 %

International Turnover Rs. 26 Cr. Up 19%

Net Profit Rs. 21 Cr. Up 22 %

First Interim dividend 12% on Equity of Rs. 58 Crore

This update covers the following:

• Financial results and other developments during Q1FY 06 for the Marico Group – Marico Limited and its subsidiaries / joint ventures - Marico

Bangladesh Limited (MBL), MBL Industries Ltd. (MBLIL), Kaya Skin Care Limited and Sundari LLC. (The Marico Group is referred to as

“Marico” or “Group” or “Marico group” in this update, while “the Company” denotes a reference to Marico Limited.)

• A Profile containing basic/historical information on Marico.

We recommend that readers refer to the Marico Group financials to get a better appreciation of the business performance. A copy of the latest

quarterly Unaudited Financial Results of Marico Limited as also that of the Group are available on Marico’s website –

http://www.maricoindia.com/latest.asp

GROWTH IN TURNOVER AND PROFITS SUSTAINED

Marico continued on its path of delivering sustainable profitable growth during the quarter. During Q1 FY06, the

Marico Group turned in a topline of Rs 273 crore, a growth of 12% over Q1 FY 05. Profit after tax increased by 22% from

Rs. 17 crore in Q1FY05 to Rs. 20.8 crore in Q1FY06.

During the quarter, Marico earned an extraordinary income of Rs 1.5 crore by way of sale of property. This was more

than offset by the impairment of clinic assets at Kaya Clinics in Dubai to the tune of Rs 2.4 crore. The profit after tax,

before both these extraordinary items is therefore Rs 21.6 crore, a growth of 27% over the previous year.

Q1 FY 06 is in Y-o-Y growth terms, the:

• 19th consecutive Quarter of growth in Turnover and

• 23rd consecutive Quarter of growth in Profits

The Board of Marico Limited, at its meeting held on July 26, 2005, declared a first interim dividend of 12% on its equity

share capital of Rs. 58 Crore. Q1 FY 06 is now the 18th consecutive quarter of dividend distribution.

CONSUMER PRODUCTS BUSINESS

Sustained Volume Growth across categories

During Q1FY 06, volumes for Marico’s Consumer Products business grew by 6% with the High Margin Portfolio growing by 9%. The

high margin portfolio now comprises 71% as against 70% in Q1FY05.

Domestic FMCG Business

In the Domestic market, Parachute Coconut Oil, the flagship brand continued to show healthy growth. The brand grew by 9% in

volume terms and maintained its market share above 50%. The high margin slice of the Hair Care range (Parachute Jasmine,

Marico Information Update July 26, 2005 Page 1 of 10

Shanti Amla, and Hair & Care being the key elements) grew by 7% in volume and 18% in value terms. Mediker, Marico’s offering in

the Anti-lice market, grew its franchise by 26% in volume terms. In the Premium Refined Oils market Saffola, the company’s second

flagship, grew its franchise by 6% in volumes.

During the quarter, volumes in some brands were adversely impacted. Sweekar, which was any way consciously defocused,

declined in volume by 9%, partly owing to temporary suspension of Canteen Stores Department (CSD) orders after VAT

implementation. There has been some negative fallout in the CSD business, wherein some of the CSD depots did not place orders.

CSD comprises about 7% of Marico’s turnover.

The impact of VAT is yet to evolve, but it is likely to be neutralized by market dynamics, hence addition to the bottom line may be

limited.

International FMCG Business

During Q1FY06 Marico’s International FMCG business grew by 13% over the corresponding quarter in the previous year.

In Bangladesh, Parachute Coconut Oil has established itself as a strong market leader with over 50% market share. Marico

Bangladesh has acquired two soap brands Camelia and Magnolia. These brands can now ride on Parachute’s distribution network

in Bangladesh.

In the Gulf countries, Marico had earlier tapped into the oiling habit of the Indian expat population. In more recent times, Marico

has begun to offer products suited to the local Arab population as well. The launch of Parachute Hair Cream has been well received

by consumers. During April 2005, the brand had increased its market share in the UAE to over 20%.

The aggregate International business of Marico, comprising the FMCG business, Kaya in UAE and Sundari in the US for the quarter

was Rs. 26 Crore.

Growing portfolio of New Products and Prototypes

In the recent past Marico has launched a clutch of new products after successfully prototyping them. These include - Silk-n-Shine,

Parachute Sampoorna, Parachute Advansed, and Saffola Gold in Domestic and Parachute Cream, Parachute Gold and Beliphool in

International. Two more products are currently being prototyped – Parachute After Shower Hair Cream for men and Saffola meal

mixes. The company has plans to prototype more products during the course of the year.

A few Brand Stories:

Parachute:

In the recent past, Marico has launched packs at low price points in order to facilitate the conversion of loose oil users of coconut

oil to Parachute and grow the market. Thus the blister pack, the 20 ml pack and the 50 ml pack are available at Re1, Rs 5 and Rs 9

respectively. In addition, the brand has targeted share growth in specific markets through micro-marketing initiatives. During

Q1FY06 Parachute volumes in rigid packs (the higher margin segment) grew by about 7% over Q1FY05. This comes on the back of

an 8% growth achieved during the year FY05. The overall volume market share remained above 50% during the 12 months ended

May 2005 (Source: AC Nielsen).

Saffola:

Saffola is Marico’s refined edible oil brand operating in the premium ROCP (Refined Oil in Consumer Packs) category. The

franchise aims to grow without sacrificing premiums. Saffola enjoys a strong positioning on the good for heart and health platform.

An advertising campaign that helps people become more aware about heart risks and encourages them to take preventive action is

being run. Radio and outdoor advertising are supporting the television media campaign. Apart from advertising, the brand invests

in surround activities like heart check-up camps, health runs etc. Last year, Marico launched a new Saffola variant, Saffola Gold, a

blend of refined safflower oil and refined rice bran oil, making Saffola available in three variants. During the quarter Q1FY06, the

Saffola volume franchise grew by 6% over Q1FY05.

Marico Information Update July 26, 2005 Page 2 of 10

Hair Oils

Last year Marico re-launched Hair & Care with a claim of “Upto 50% less sticky than other oils”. During Q1FY06, it rolled out a

campaign targeted at youth in the North to coincide with the “lagan” season. The re-launch has strengthened Marico’s position in

the Non-Sticky Hair Oils segment with Hair & Care showing healthy volume growth. Parachute Jasmine has been positioned as a

light coconut based oil with a distinctive jasmine perfume. The company has focused on growing its rigid packs, which earn a

higher margin as opposed to pouch packs. A new advertising campaign was launched in Q4FY05 to support the brand. Parachute

Sampoorna, a value added coconut hair oil leverages Parachute’s equity and is positioned on the nourishment platform with the

addition of extracts of almond & hibiscus. The brand was launched nationally in the previous year. In order to differentiate itself

from other Amla oils in the market, Shanti Badam Amla re-launched itself last year with an improved formulation – Shanti Amla

reinforced with “badam”. After being prototyped in Punjab, it was launched nationally in April 2005.

Marico’s high margin hair oils franchise grew by about 7% in volume and about 18% in value during Q1FY06 over Q1FY05. Marico’s

share in the hair oils segment during the period June 04 to May 05 stands at about 18% (Source: AC Nielsen)

Silk-n-Shine:

With Silk-n-Shine, Marico had entered yet another new segment in Hair Care - Hair Potion. Having met prototype action standards

in Kolkata it was rolled out nationally in Q2 FY 05. The brand continued with experimentation in advertising and promotion. Last

year Silk-n-Shine adopted an innovative strategy for branding with its association with the popular programme 'Indian Idol' on Sony

Entertainment Television. Recently, it experimented with in-film brand placement in the movie “Kya Kool Hai Hum” to connect with

college going audiences. The movie has met with reasonable success giving the brand mileage with the target audience. The brand

has now notched up a market share of 33% of the conditioning market. In February 2005, Marico introduced a small pack at a Rs. 25

price point. As one of the early brands in the category, Silk-n-Shine must play its role in market expansion by making the category

accessible to the mass market.

Mediker Plus Anti Lice Oil

Mediker remains the only significant player in the anti-lice shampoo and oil treatment market. The brand has been exploring

options for providing greater value to the consumer. In Q4 FY05, Marico expanded the Mediker product range with the introduction

of Mediker Plus Anti-Lice Oil in the Southern Market. Mediker Plus has been launched with a strong benefit of 1 Hour - Lice Out,

providing a perceptibly efficacious solution to the consumer. In July 05, it has commenced prototyping a completely natural variant

of Mediker in Maharashtra. Media campaigns on the brand are being complemented by on-ground support activity of visiting

homes, schools and centers with “urban-poor” populations. During Q1FY06 the Mediker franchise grew by 26% in volumes terms

over Q1FY05.

Kaya Skin Clinic

The base clientele at Kaya has now gone beyond 50,000. Customer ratings of the services at Kaya remain very high and the

company gets a large number of repeat clients to whom it has been able to cross-sell services. During the quarter April – June

2005 two additional Kaya clinics were opened, one each in Delhi and Bangalore. During July 3 more clinics have been opened

in Amritsar, Coimbatore and Mumbai. The chain of Kaya clinics now number 37 in India. The company is on track to add 10

clinics in India during the course of the year. About 100 dermatologists now offer personalized consultations to clients at Kaya

Skin clinics. During Q1FY06, the Kaya business recorded a turnover of Rs 10 crore. As the company continued to be in the

investment phase, the loss during the quarter was Rs 1.83 crore. Kaya is expected to break even at the PBIT level during FY06.

Sundari:

In the global ayurvedics business, Sundari has been focussing on Tier 1 spas in the United States and Asia Pacific countries. While

entry into some prestigious accounts such as Marriott, Four Seasons and Canyon Ranch gives confidence on the approach being

adopted, lead times are long (about 6-9 months from the time the first approach is made to bagging the first order). It may be a

while therefore before critical mass is built. The company expects the business to remain in the investment phase over this year

and the next.

Marico Information Update July 26, 2005 Page 3 of 10

ADDITIONS TO THE BOARD OF DIRECTORS

With a view to drawing value from the experience and insights of management practitioners, Marico has inducted additional

members on to its Board of Directors over the last few years. Recently, Rajen Mariwala joined the board of Marico limited. He came

on board after Mr. K V Mariwala stepped down from the Board upon completing 70 years of age. The Board of Directors has now

inducted two more members to join them.

Hema Ravichandar, 44, is a Bachelor of Arts (Economics) from the University of Chennai and holds a Post Graduate Diploma in

Management from the Indian Institute of Management, Ahmedabad. Hema’s has 22 years of corporate experience, including in

Motor Industries Co. Ltd., as head of HR in Infosys Technologies Ltd and an entrepreneurial stint in an HR consulting venture

she set up independently to service clients across industries. Her experience spans across Change Management, Leadership

Development and Human Resource Development.

Hema is a part of the Executive Committee of the National Human Resources Development Network and the Chairperson of

Conference Board’s HR Council for India. She has co-chaired the Confederation of Indian Industry’s (CII) HR & IR (Southern

Region) Sub-committee as also CII’s National Conference on Leveraging Diversity and Managing Inclusion. Hema has also

been a part of the Industry Advisory Board for Executive Education of the prestigious Indian School of Business, Hyderabad,

set up in close collaboration with Wharton and Kellogg. Hema has received several Outstanding HR Professional awards and

has featured in Business Today’s and Dataquest’s lists of the Most Powerful Women in Indian Business and IT.

We believe Hema’s analytical skills and understanding of the HR arena in context to the business objectives will enable her to

add significant value to Board level deliberations and strategies.

Jacob Kurian, 49, is a Bachelor of Engineering (Electrical & Electronics) from the Regional Engineering College, University of

Chennai and holds a Post Graduate Diploma in Management from the Xavier Labour Relations Institute. His corporate

experience of 26 years includes over 21 years as a Tata Administrative Service Officer in the Tata Group. His last assignment

with the Tata’s was Chief Operating Officer & Senior Vice President - Jewellery Division, Titan Industries. Since 2003, he has

been President, Sylvan Learning India, a part of the world's leading education services company focused on post-secondary

education.

Jacob has a record of accomplishments- of turning around and scaling consumer and technology businesses, both in

international and domestic markets. Jacob has managed the worldwide marketing responsibilities while at Titan. He also led a

dramatic turnaround to profitability in the jewellery business (Tanishq) and it’s strategic transformation into one of India’s

most successful retailers.

Jacob has been a member of the CII National Committee on Retailing and Marketing and the Tata Group Strategy Forum.

Jacob has been behind one of the largest fund raising projects with CRY (Child Relief and You) where he conceptualized and

established new benchmarks for corporate-NGO partnerships.

We believe Jacob’s expertise in devising entry strategies as well as revamping business strategies to achieve business

transformation will enable him to add significant value to the deliberations at the Marico Board.

Marico Information Update July 26, 2005 Page 4 of 10

COST STRUCTURE FOR THE CONSUMER PRODUCTS BUSINESS

% to Sales & Services (net of excise) Q1 FY 06 Q1 FY 05

Material Cost (Raw + Packaging) 58.3 62.2

Advertising & Sales Promotion (ASP) 10.3 9.9

Personnel Costs 5.8 4.4

Depreciation 1.0 1.0

Other Expenses 13.8 13.8

Operating Costs 89.2 91.3

Net Operating Margin ( PBIT) 10.8 8.7

PBDIT margins 11.9 9.8

Gross Margins ( PBDIT before ASP) 22.1 19.7

Operating ROCE (%) 45 45

Notes:

1. Margins have been computed without including “Other Income”, major components of which are profit on sale of assets Rs.

1.46 Cr. (previous year – Nil), lease rental Rs. 0.10 Cr. (previous year Rs. 0.11 Cr.), profit on sale of investment Rs. 0.06 Cr.

(previous year no loss no gain) and dividend income – Rs. 0.14 Cr. (previous year Rs. 0.17 Cr.)

2. Material cost to sales has shown a decline as compared to Q1FY05 mainly on account of Parachute opting to retain retail prices

despite lower raw material prices in Q1FY06.

3. The increase in Personnel Costs to Sales is on account of the annual increase in employee salaries in April 2005 and a

provision for the company’s performance based incentive scheme for its employees.

4. Marico prices its products having regard to the value it provides to the consumer, targeting a certain margin per unit of volume.

Therefore, Marico’s operating margins are reasonably insulated from commodity price fluctuations, although commodity

prices can influence Turnover value for Marico. Therefore, instead of analyzing operating margins as a percentage of Sales, it

may be more logical to analyze operating ROCE.

5. The Consumer Products business comprises operations in India (Marico Ltd.) and Bangladesh (Marico Bangladesh Ltd, along

with its subsidiary – MBL Industries Limited). Skin Care Services and Global Ayurvedics are still evolving; hence their cost

structures have not been discussed here, as these may not yet be capable of meaningful analysis and projection.

CAPITAL UTILIZATION

Over the years, Marico has been maintaining its Return on Capital Employed (ROCE) at levels above 30%. Given below is a snapshot

of various capital efficiency ratios for Marico:

Ratio Q1FY06 Q1FY05

Return on Capital Employed

- Marico Group 36% 36%

- Consumer Products 42% 39%

Return on Net Worth – (Group) 37% 35%

Working Capital Ratios (Consumer Products)

- Debtors Turnover (Days) 13 13

- Inventory Turnover (Days) 40 37

- Net Working Capital Turnover (Days) 38 33

Economic Value Added (Group)

- Rs. Crore 14 12

- % to Capital employed 21% 22%

Debt : Equity (Group) 0.17 0.08

Finance Costs to Turnover (%) (Group) 0.3% 0.2%

Marico Information Update July 26, 2005 Page 5 of 10

BALANCE SHEET FOR THE CONSUMER PRODUCTS BUSINESS RS. CRORE

June 30, 2005 June 30, 2004

SOURCE OF FUNDS

Shareholders’ Funds 252.85 201.52

Borrowings 30.99 20.27

Deferred Income Tax Provision 5.04 7.31

TOTALA 288.88 229.10

APPLICATION OF FUNDS

Deployed in Business

Net Fixed Assets 91.36 94.90

Investments 23.63 23.55

Current Assets 274.75 205.87

Less: Current Liabilities 131.33 115.69

Net Working Capital 143.42 90.18

OPERATING CAPITAL EMPLOYED 258.41 208.63

Financial Assets 30.47 20.47

TOTALA 288.88 229.10

COMMENCEMENT OF OPERATIONS AT GOA PLANT

The strike at Marico’s Goa plant (manufacturing coconut oil), which had commenced in January 2005, ended in the first week of

July 2005. The Government of Goa, prohibited the continuance of the strike and directed the workers to commence work whilst the

dispute is pending for adjudication before the Goa Industrial Tribunal. The Company has managed to handle the impact of the

strike without difficulty and continued to service the markets from its other plants, which were hitherto operated at 65 %-70% of

their installed capacity

SHAREHOLDER VALUE RELATED POLICIES & PRACTICES

Payout - Distribution of profits to shareholders

Marico’s Distribution policy, which aims at sharing Marico’s prosperity with its shareholders, through a formal earmarking /

disbursement of profits to shareholders, has, in the recent past, been characterized by the following:

1. Payout increasing from year to year and, to the extent feasible, also from quarter to quarter in a year.

2. Relentless regular dividend – every quarter reflecting the confidence to sustain Continuous Distribution

3. Innovation through use of special instruments as and when feasible

4. Use of distribution to Increase Liquidity on the Stock Exchanges

Marico’s cash profits have continued to grow and provide a logical support to its practice of declaring a dividend every quarter.

Marico will continue with its policy of declaring multiple dividends every year, while continuously identifying innovative means of

rewarding its shareholders. The endeavor will be to keep a high payout- about 50 %, subject to financial requirements of its core

business.

Dividend declared, Record Dates etc.

The Board of Directors of Marico Limited, at its meeting held on July 26, 2005 declared a first interim equity dividend of 12% on the

equity base of Rs. 58 crore, the Record Date being 8 August, 2005.

Marico Information Update July 26, 2005 Page 6 of 10

SHAREHOLDING PATTERN

The shareholding pattern as on June 30, 2005 is as given in the graph

below.

The shareholding of FIIs and Mutual Funds now stands at 18.2%.

SHARE PERFORMANCE ON STOCK EXCHANGES

Marico’s performance on the exchange vis-à-vis its peer group is depicted in the graph below.

M arico v /s. BSE F M CG

220

200

180

Price In d e xe d to 100

160

140

120

100

80

60

Jul-04

Aug-04

Sep-04

Dec-04

F eb-05

Apr-04

May-04

Jun-04

Oct-04

Nov-04

Jan-05

Mar-05

Apr-05

May-05

Jun-05

M aric o B S E FM CG

Marico's market capitalization improved from Rs. 754 crore as on March 31, 2004 to Rs. 1439 crore as on June 30, 2005, a rise of 90%.

The average daily volume on BSE and NSE during Q1FY06 has risen to about 83450 up from about 55000 during FY05.

Marico Information Update July 26, 2005 Page 7 of 10

OUTLOOK

Sustainable profitable growth has been the pivot around which Marico’s strategies have evolved of late. FY05 saw Marico reach two

important milestones in this journey

• Group Turnover reaching Rs. 1000 Crore mark and

• International Business turnover reaching Rs. 100 Crore mark

During FY 06, we have moved ahead in this journey.

The Domestic Business has displayed a healthy growth in bottom line in Q1FY06. This has been led by sustained profitable growth

in the focus brands, mainly Parachute. To pave way for sustained profitable growth even in future, we believe that as market

leaders in most categories, it is our primary responsibility is to grow the market, through pricing strategies or otherwise. Also, in

line with our prototyping approach, we will continue to plough back gross profits into prototypes in the existing and contiguous

categories in Beauty and Wellness. Except for the impact such strategies would have on profitability, we plan to hold the growth

momentum for the rest of the year. It may not however be sound to extrapolate to the whole year the margin that has been obtained

during Q1FY06.

The international business too has continued to grow in all the territories where Marico is present. Exploratory work on new

geographies is underway but we are unlikely to reap the benefits of such exploration in the immediate future.

In the new category of skin care that we entered recently, Kaya continues to hold its growth trajectory. During the rest of FY06, we

plan to maintain the tempo by opening more new clinics. We will also invest behind the extension of the Kaya brand into products.

An important event in the Kaya business history would be breaking even at the PBT level. As we plan opening of new clinics with

the coming of age of the established clinics, we will experience a trade off. Our approach is to let such a trade off be settled in

favour of growth as we believe that the key driver of sustained growth in the Kaya business is the acquisition of new customers for

both services and products. Based on this, our current estimate is that the Kaya business would reach a breakeven at the PBIT level

in this year although it would be some time before the business breaks even at all levels and recovers its accumulated losses.

The growth rate of the Sundari operations has lagged behind our expectations. This is because of longer than expected lead-time

between prospecting for new accounts and realizing first orders. We have, however, continued to support this nascent business,

especially because we now have a clear focus on ‘Spas’. The Sundari business is thus, not expected to break even in the immediate

future.

Thus, the next phase of Marico’s growth journey will be centered on the following:

• Continued Investment in new products, creating a pipeline of new product ideas through prototypes in India and abroad

• Realigning the portfolio towards higher Value add

• Accelerating, judiciously, the entrepreneurial foray into services through Kaya Skin Care clinics & in Sundari.

•

DISCLOSURE OF INFORMATION, COMMUNICATION WITH INVESTORS / ANALYSTS / FINANCIAL COMMUNITY

Marico issues a fresh information Update, like the one you are reading now; on the day it declares its Quarterly Financial Results. Some forward

looking statements on projections, estimates, expectations, outlook etc. are included in such updates to help investors / analysts get a better

comprehension of the Company's prospects and make informed investment decisions. Actual results may, however, differ materially from those

stated on account of factors such as changes in government regulations, tax regimes, economic developments within India and the countries within

which the Company conducts its business, exchange rate and interest rate movements, impact of competing products and their pricing, product

demand and supply constraints. All the aforesaid information is also available on Marico’s Website: www.maricoindia.com. In view of this,

information contained in such updates is made public and does not therefore constitute unpublished price sensitive information under the SEBI

(Prohibition of Insider Trading) Regulations, 1992.

Marico typically holds a general meeting with investors, analysts and other members of the financial community once a year, in April, apart from

periodic meetings/ conference calls, from time to time, with individual members of the financial community. Marico’s Investor Relations Efforts are

co-ordinated by Milind Sarwate, Chief Financial Officer and Chaitanya Deshpande, Head, Corporate Finance. For further information / clarification,

Marico may be contacted on Tel: (91-22) 5648 0480 Fax no.: (91-22) 5649 0112; E-mail: milinvrel@maricoindia.net

Marico Information Update July 26, 2005 Page 8 of 10

A Profile giving Basic / Historical Information

Marico is a leading Indian Group in Consumer Products and Services in the Beauty and Wellness space. Marico’s products and

Services in Hair care, Skin Care and Healthy Foods during 2004-05 generated a Turnover was about Rs.10 billion (USD 230 Million)

from 12 brands - Parachute, Saffola, Sweekar, Hair & Care, Shanti, Mediker, Oil of Malabar, Mealmaker, Sil, Revive, Kaya and

Sundari. Marico’s brands and their extensions occupy leadership positions with significant market shares in all categories- Coconut

Oil, Hair Oils, Anti-lice Treatment, Premium Refined Edible Oils, Fabric Care etc. Marico is present in the Skin Care Services

segment through Kaya Skin Clinics (39 clinics) in India and UAE, and also through the Sundari range of Ayurvedic skin care spa

products in the US & other Countries. Marico's branded products are also present in Bangladesh, other SAARC countries and the

Middle East. The Overseas Sales franchise of Marico’s Consumer Products (whether as exports from India or as local operations in

a foreign country) is one of the largest amongst Indian Companies and is entirely in branded products and services.

Marico has leveraged its core sources of competitive advantage viz. Branding, Distribution, Cost Management, Innovation and

Technology to set up a fast growing franchise of new products and services – their share in turnover has moved up from 3% in FY00

to 20% in FY05.

Marico's own manufacturing facilities are located at Goa, Kanjikode, Jalgaon, Saswad, Pondicherry, Dehradun and Daman and

supported by subcontracting units. Marico’s wholly owned subsidiary, Marico Bangladesh Limited, has its manufacturing facility at

Mouchak, near Gazipur in Bangladesh.

Marico was incorporated in 1988 and during 1990 took over the then 40-year old consumer products business of The Bombay Oil

Industries Limited. It made its initial public offer for equity shares in March 1996. Given below is an overview of Marico's market

standing.

Brands Category Indicative Market Rank

Share range %

Parachute, Oil of Malabar Coconut Oil 59 - 60 1

Revive Fabric Starch ~100 1

Mediker Anti Lice Treatment 96 - 100 1

Saffola & Sweekar High Margin Refined Oils 13 - 14 3

in Consumer packs

Hair Oil (Hair & Care, Parachute Jasmin Hair Oils 17 - 19 2

Shanti, Parachute Sampoorna)

Sil Jams 7-8 2

Source: A.C.Neilsen Urban Retail Market Research and Company Sources.

Marico's frontline brands have shown remarkable resilience against competition - refer the market share statistics given below:

Brand Category 1992 (%) Now

Parachute & Oil of Malaba Coconut Oils 48 - 49 59 - 60

Saffola & Sweekar High Margin Refined Oils in Consum 5 - 6 13-14

Packs

Parachute Jasmine, Shant Hair Oils - 17- 19

Hair & Care

Marico’s Parachute and Saffola are among India’s top 100 most trusted brands as per the survey carried out by Brand Equity (The

Economic Times) - Parachute ranks 46th while Saffola ranks 92nd. Parachute continues to be the world’s largest packaged Coconut

Oil Brand.

Marico has consistently sought to broadbase its brand basket. The new products introduced by the Company during last 3-4 years

have now assumed a critical mass and contribute around 19% to the consumer products business. In the process, Marico's

dependence on Parachute has consistently been reducing. From a share in the range of 70% - 75% in early 90's, Parachute today

contributes about 40% - 45% to the top line of Marico. Its share in profits too has come down.

Marico Information Update July 26, 2005 Page 9 of 10

Reach

Marico procures one out of every twenty coconuts produced in India and 3 nuts per coconut tree in India. Marico sells over 6.3 Crore

(63 Mio) packs to around 13 Crore (130 Mio) people every month. Marico’s products reach around 1.8 Crore (18 Mio) households

through over 17 Lac (1.7 Mio) retail outlets serviced by its nation-wide distribution network comprising 5 Regional offices, 30

carrying & forwarding agents (CFAs) and about 3500 distributors and stockists. Marico’s distribution network covers almost every

Indian town with population over 20,000. Marico has partially leveraged its network through a distribution alliance with Indo Nissin

Foods Ltd. (Top Ramen- Curry, Cup O' Noodles). The table below provides an indicative summary of Marico's Distribution Network

in India.

Urban Rural

Sales Territories 135 35

Towns Covered (‘000's) 3.2 11.0

Distributors 850 0

Super Distributors 0 115

Stockists 0 2,600

Retail Outlets – Reach (‘000’s) 1100 650

Skin Care Services and Global Ayurvedics:

In recent years, Marico entered the skin care solutions business through Kaya Skin Clinics offering a range of highly effective

and safe services based on cosmetic dermatological procedures and products. Services offered at Kaya use US FDA approved

technology and have been specifically customized for Indian skin. In-clinic dermatologists recommend a personalized series of

treatments. The chain of Kaya clinics (all company owned) is now 39 strong, spread across 14 cities in India and UAE. Its

customer base is now over 50,000.

In FY03, Marico acquired a controlling stake in Sundari LLC. The focus of Sundari is the spa market in the USA and other parts

of the world. The spa products market is estimated to be about US$ 2 billion. Sundari can find a niche in this market

positioning itself as an ayurvedic skin care brand.

Financial Highlights

Marico has maintained a steady top line and bottom line growth over past decade with a consistently healthy Return on Capital

Employed (ROCE) of over 30%.

Particulars (Rs. Crore) FY01 FY02 FY03 FY04 FY05 CAGR%

Sales & Services 671 696 775 888 1013 13

Profit before Tax 50 58 64 65 74 12

Net Profit ( PAT ) 46 50 56 59 70 13

Earning per share-Annualised (Rs.) * 8 9 10 10 12 13

Book value per share (Rs.) * 30 34 34 32 39 8

Net Worth 171 197 193 184 217 6

ROCE % 33 32 31 32 33

* For a meaningful comparison of EPS and Book Value, the numbers for the previous years have been re-computed based on the

enhanced equity share capital of Rs.58 Crore.

Business Model and Organization

Marico’s business model is based on focused growth across all its brands and territories driven by continuously improving value

propositions to consumers, market expansion and widening of retail reach. Marico aims to be the leader in each of the businesses;

by heightened sensitivity to consumer needs, setting new standards in the delivery and quality of products and services through

processes of continuous learning and improvement. The model ensures that Marico is present in unique / ethnic Indian Product or

Services categories where typical MNCs would not be strong. Therefore, Marico does not, unlike many other Indian FMCG

Companies, get caught in MNC cross fires.

Marico is a professionally managed Company that has built for itself a stimulating work culture that empowers people, promotes

team building and encourages new ideas. This has, over the years, enabled Marico to grow its stature as one of the few successful

Indian FMCG Companies. Marico was awarded the National Award for outstanding work in HRD by National HRD Network in 1994

as also the award for Top Performing Global Growth Company from India at the World Economic Forum in 1997.

Marico Information Update July 26, 2005 Page 10 of 10

You might also like

- Media Release Q3 FY10Document3 pagesMedia Release Q3 FY10Mohan KrishnanNo ratings yet

- Marketing Effectiveness of Marico BangladeshDocument17 pagesMarketing Effectiveness of Marico BangladeshMehedi Hasan ShakilNo ratings yet

- Report On Marketing Effectiveness of MaricoDocument48 pagesReport On Marketing Effectiveness of MaricoMehedi HassanNo ratings yet

- 11111MNC MericoDocument24 pages11111MNC MericoMehedi Hasan ShakilNo ratings yet

- Media Release Q1FY12Document3 pagesMedia Release Q1FY12guptaswati7No ratings yet

- The Game Changes For Marico - Business Standard NewsDocument3 pagesThe Game Changes For Marico - Business Standard NewsJulia BrewerNo ratings yet

- The Game Changes For MaricoDocument9 pagesThe Game Changes For MaricoShiv RanjanNo ratings yet

- Results Press Release (Company Update)Document17 pagesResults Press Release (Company Update)Shyam SunderNo ratings yet

- Summary of SM Case Study AVNI PUROHITDocument5 pagesSummary of SM Case Study AVNI PUROHITavni purohitNo ratings yet

- Information Update (Company Update)Document17 pagesInformation Update (Company Update)Shyam SunderNo ratings yet

- Project Report012145421445442Document10 pagesProject Report012145421445442Mijanur ShuvoNo ratings yet

- Marico AssignmentDocument46 pagesMarico AssignmentRafiqul Awal0% (2)

- MaricoDocument23 pagesMaricopompresntNo ratings yet

- Q4 ABFRL FY23 Results PR - VFDocument4 pagesQ4 ABFRL FY23 Results PR - VFmNo ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- Scrip Symbol: MARICO: Hemangi Ghag Company Secretary & Compliance OfficerDocument28 pagesScrip Symbol: MARICO: Hemangi Ghag Company Secretary & Compliance OfficerParthibanNo ratings yet

- Marico Ltd.Document16 pagesMarico Ltd.Mitali ParekhNo ratings yet

- 2fd8d5dd-7c95-48d8-8abc-1a26cdd6c7ffDocument6 pages2fd8d5dd-7c95-48d8-8abc-1a26cdd6c7ffkrishna_buntyNo ratings yet

- Marico Industries: Healthy Sales GrowthDocument3 pagesMarico Industries: Healthy Sales GrowthJeet DuttaNo ratings yet

- Pidilite CompanyDocument6 pagesPidilite Companykhalsa.taranjitNo ratings yet

- A C Choksi: Marico LimitedDocument40 pagesA C Choksi: Marico LimitedArvind SainathNo ratings yet

- Marketing Strategy and SWOT Analysis of MaricoDocument5 pagesMarketing Strategy and SWOT Analysis of MaricoApoorva JainNo ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- Analyst PresentationDocument20 pagesAnalyst PresentationroselilygirlNo ratings yet

- Radico Khaitan - ICDocument21 pagesRadico Khaitan - ICMaulik ChhedaNo ratings yet

- Dabur India maintains margins despite sales declineDocument9 pagesDabur India maintains margins despite sales declineHitendra PanchalNo ratings yet

- Managerial Economics ProjectDocument11 pagesManagerial Economics Projectruch51286No ratings yet

- Marico LTD: A Safe Parachute!: Recommendation: BUYDocument14 pagesMarico LTD: A Safe Parachute!: Recommendation: BUYAnandNo ratings yet

- Mission, Vision and Values of Marico LTD.: Link For ReferenceDocument9 pagesMission, Vision and Values of Marico LTD.: Link For ReferenceYash TiwariNo ratings yet

- Marico Limited 4decDocument3 pagesMarico Limited 4decAarti SounNo ratings yet

- Term Paper Topic:: Course Name: Course CodeDocument25 pagesTerm Paper Topic:: Course Name: Course CodeMehedi Hasan ShakilNo ratings yet

- Jyothy Labs Q1FY21: Financial Results & HighlightsDocument3 pagesJyothy Labs Q1FY21: Financial Results & HighlightsSam vermNo ratings yet

- A Industrial Tour - Marico ProductsDocument60 pagesA Industrial Tour - Marico Productsabin tijo100% (3)

- Jyothy Labs Q4FY20 Results AnalysisDocument3 pagesJyothy Labs Q4FY20 Results AnalysisSumit ChaudharyNo ratings yet

- Presentation 372 Marico Ltd.Document15 pagesPresentation 372 Marico Ltd.UpomaAhmedNo ratings yet

- Report Om Sectoral Analysids On Capitalisation, Leverage and Dividend PolicyDocument23 pagesReport Om Sectoral Analysids On Capitalisation, Leverage and Dividend PolicyShambhavi SinhaNo ratings yet

- Marico PresentationDocument36 pagesMarico Presentationsandeep0975No ratings yet

- Annual Report 2001-2002Document2 pagesAnnual Report 2001-2002Raakze MoviNo ratings yet

- Key Highlights of Q4 and FY20 Performance: in Rs. CRDocument5 pagesKey Highlights of Q4 and FY20 Performance: in Rs. CRSuman SarkarNo ratings yet

- Marico Valuation Report - Aryan KuhadDocument8 pagesMarico Valuation Report - Aryan KuhadAryan KuhadNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Marico's Strategies, Products, and International OperationsDocument27 pagesMarico's Strategies, Products, and International Operationsakhileshkumar prajapatiNo ratings yet

- Marico Case StudyDocument13 pagesMarico Case StudyAshiq R Niloy100% (1)

- Project Report at Market ReserchDocument179 pagesProject Report at Market ReserchGagan preetNo ratings yet

- Project Report ON Marico Submitted in Indira School of Business Studies BY Shruti Kumari Roll Number: F-46 PGDMDocument46 pagesProject Report ON Marico Submitted in Indira School of Business Studies BY Shruti Kumari Roll Number: F-46 PGDMShruti KumariNo ratings yet

- Godrej Consumer Products Limited 1225432389188096 8Document28 pagesGodrej Consumer Products Limited 1225432389188096 8elizabeth_jeenaNo ratings yet

- Investment TDocument4 pagesInvestment TRohit GuptaNo ratings yet

- Camlin Fine Sciences: PCG ResearchDocument12 pagesCamlin Fine Sciences: PCG ResearchumaganNo ratings yet

- Project On Dabur India LTD.: By: K. Sai PrasadDocument3 pagesProject On Dabur India LTD.: By: K. Sai Prasadapi-3805289No ratings yet

- Dabur MRD 00 01Document16 pagesDabur MRD 00 01Vinita PathakNo ratings yet

- Investor-Presentation-Q2-FY-23-24Document18 pagesInvestor-Presentation-Q2-FY-23-24arnabdeb83No ratings yet

- Definition of The Business & Marico CompanyDocument21 pagesDefinition of The Business & Marico CompanyMahantesh mamadapurNo ratings yet

- Marico Investor Presentation - Feb14Document27 pagesMarico Investor Presentation - Feb14Tushar PatilNo ratings yet

- Marico StrategyDocument15 pagesMarico StrategyNgoc Linh Phan100% (1)

- Nykaa RevisedDocument5 pagesNykaa RevisedVidit JainNo ratings yet

- Marico SlipDocument30 pagesMarico SlipRushikesh DixitNo ratings yet

- November 2013Document36 pagesNovember 2013mpariksheetNo ratings yet

- Industrial and Organizational PsychologyDocument21 pagesIndustrial and Organizational PsychologyCris Ben Bardoquillo100% (1)

- Total Product Marketing Procedures: A Case Study On "BSRM Xtreme 500W"Document75 pagesTotal Product Marketing Procedures: A Case Study On "BSRM Xtreme 500W"Yasir Alam100% (1)

- 2020052336Document4 pages2020052336Kapil GurunathNo ratings yet

- BAFINAR - Midterm Draft (R) PDFDocument11 pagesBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)

- Food and ReligionDocument8 pagesFood and ReligionAniket ChatterjeeNo ratings yet

- Adjusted School Reading Program of Buneg EsDocument7 pagesAdjusted School Reading Program of Buneg EsGener Taña AntonioNo ratings yet

- Dhikr or Zikr or Remembrance of AllahDocument27 pagesDhikr or Zikr or Remembrance of AllahMd. Naim KhanNo ratings yet

- Costco Case StudyDocument3 pagesCostco Case StudyMaong LakiNo ratings yet

- Rock Art and Metal TradeDocument22 pagesRock Art and Metal TradeKavu RI100% (1)

- Underground Rock Music and Democratization in IndonesiaDocument6 pagesUnderground Rock Music and Democratization in IndonesiaAnonymous LyxcVoNo ratings yet

- Inferences Worksheet 6Document2 pagesInferences Worksheet 6Alyssa L0% (1)

- Álvaro García Linera A Marxist Seduced BookDocument47 pagesÁlvaro García Linera A Marxist Seduced BookTomás TorresNo ratings yet

- Alluring 60 Dome MosqueDocument6 pagesAlluring 60 Dome Mosqueself sayidNo ratings yet

- Lab Report FormatDocument2 pagesLab Report Formatapi-276658659No ratings yet

- Annexure 2 Form 72 (Scope) Annexure IDocument4 pagesAnnexure 2 Form 72 (Scope) Annexure IVaghasiyaBipinNo ratings yet

- 6.variable V Variable F Control - Braking, Closed Loop ControlDocument25 pages6.variable V Variable F Control - Braking, Closed Loop ControlJanani RangarajanNo ratings yet

- Torts and DamagesDocument63 pagesTorts and DamagesStevensonYuNo ratings yet

- Feminism in Lucia SartoriDocument41 pagesFeminism in Lucia SartoriRaraNo ratings yet

- Marchetti-How The CIA Views The UFO PhenomenonDocument7 pagesMarchetti-How The CIA Views The UFO PhenomenonAntonio De ComiteNo ratings yet

- Invoice Inv0006: Er. Mohamed Irshadh P MDocument1 pageInvoice Inv0006: Er. Mohamed Irshadh P Mmanoj100% (1)

- Soil Mechanics: Principle of Effective Stress, Capillarity and Permeability On SoilDocument54 pagesSoil Mechanics: Principle of Effective Stress, Capillarity and Permeability On SoilAwadhiNo ratings yet

- Miriam Garcia Resume 2 1Document2 pagesMiriam Garcia Resume 2 1api-548501562No ratings yet

- Political Science Assignment PDFDocument6 pagesPolitical Science Assignment PDFkalari chandanaNo ratings yet

- ESG Module 2 1 32Document33 pagesESG Module 2 1 32salamat lang akinNo ratings yet

- Statement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FDocument2 pagesStatement. Cash.: M.B.A. Semester-Ill Exadinatioh Working Capital Management Paper-Mba/3103/FPavan BasundeNo ratings yet

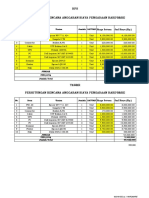

- HPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANDocument2 pagesHPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANYanto AstriNo ratings yet

- Pot PPTDocument35 pagesPot PPTRandom PersonNo ratings yet

- Here Late?", She Asked Me.: TrangDocument3 pagesHere Late?", She Asked Me.: TrangNguyễn Đình TrọngNo ratings yet

- PORT DEVELOPMENT in MALAYSIADocument25 pagesPORT DEVELOPMENT in MALAYSIAShhkyn MnNo ratings yet

- Sale Agreement SampleDocument4 pagesSale Agreement SampleAbdul Malik67% (3)