Professional Documents

Culture Documents

Registration of Small Scale Industries

Uploaded by

Mohitraheja007Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Registration of Small Scale Industries

Uploaded by

Mohitraheja007Copyright:

Available Formats

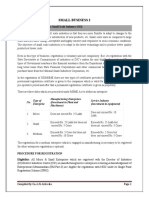

Registration of Small Scale Industries(SSIs)

Registration of an existing or proposed small scale enterprise is voluntary and not compulsory. It has no statutory basis. But, registration is beneficial for the enterprise itself because it makes the unit eligible for availing the benefits given by the Central or State Governments for the promotion of SSIs. Some of the incentives so obtained by them relate to credit guarantee scheme; priority sector lending; capital subsidy; reduced customs duty; ISO-9000 certification reimbursement; power tariff subsidies; exemptions under tax laws; etc. The State Directorate or Commissioner of Industries or District Industries Centres (DIC's) are the concerned authorities for registration of small scale units. This registration is both location specific and product specific. Like in certain State capitals and metropolitan cities, it is granted to only those units which are located in the designated industrial areas/estates. A small scale unit is generally subjected to two types of registration. Initially, a provisional registration is granted for the proposed enterprise. It is termed provisional because the enterprise is yet to come into existence. It is granted for a specified period of time during which the unit is expected to be setup. A 'Provisional Registration Certificate (PRC)' enables the unit to obtain :- (i) term loans and working capital from financial institutions, banks under priority sector lending; (ii) facilities for accommodation, land and other approvals; (iii) no objection certificates (NOCs) and clearances from regulatory bodies such as pollution control board, labour regulations, etc. Once the unit has commenced commercial production, it is granted permanent registration. It is a life time registration given after physical inspection of the enterprise and scrutiny of certain documents. Some of the formalities required to be completed for seeking permanent registration are :

Clearance from the municipal corporation

State pollution control board clearance

Sanction from the electricity board

Ownership/tenancy rights of the premises where unit is located

Copy of partnership deed/Memorandum of articles of association in case of a private limited company

Sale bill of product manufactured

Sale bill of each end product

Purchase bill of each raw material

Purchase bill of machinery installed

BIS/QC certificate if applicable

An affidavit giving status of the unit, machinery installed, power requirement, etc.

The registration certificate so issued by the concerned authority is seen as a proof of the unit being a small scale unit. It enables the unit to get several concessions like :

Income tax exemption and Sales tax exemption as per the State Government policy.

Incentives and concessions in power tariff, etc.

Price and purchase preference for goods produced.

Availability of raw material depending on existing policy.

Though, provisional registration is not compulsory for getting a permanent registration. But, a provisional certificate enables the unit to apply to the various departments and agencies for assistance in setting up of the enterprise. Such a registration procedures is generally uniform across the States. However, there may be some modifications done by individual States. For example, certain States may have a 'SIDO registration scheme' and a 'State registration scheme'. But, whatever be the registration scheme, the main purpose is to maintain statistics and a roll of such units for providing incentives as well as to create nodal centres at the Centre, State and District levels to promote SSIs. It gives recognition to the industrial unit and helps in generating a database for policy planning. A small scale unit may also become liable for de-registration, if it crosses the investment limits; starts manufacturing any new item or items that require an industrial license or other kind of statutory license; or does not satisfy the condition of being owned, controlled or being a subsidiary of any other industrial undertaking.

SSI Registration

Small Scale and ancillary units (i.e. undertaking with investment in plant and machinery of less than Rs. 10 million) should seek registration with the Director of Industries of the concerned State Government.

Registering your SSI Unit

The main purpose of Registration is to maintain statistics and maintain a roll of such units for the purposes of providing incentives and support services. States have generally adopted the uniform registration procedures as per the guidelines. However, there may be some modifications done by States. It must be noted that small industries is basically a state subject. States use the same registration scheme for implementing their own policies. It is possible that some states may have a 'SIDO registration scheme' and a 'State registration scheme'.

Benefits of Registering Objectives and Features Provisional Registration Permanent Registration Procedure De-registration Download Registration Forms & Related Documents (Proformas)

Application for Provisional Registration Provisional Registration Certificate Application for Permanent Registration Certificate of Registration Additional Sheet-1 (for Additions/Deletions) Appendix "A" (Production Details Appendix "B" (Details of Plant and Machinery Affidavit

Benefits of Registering

The registration scheme has no statutory basis. Units would normally get registered to avail some benefits, incentives or support given either by the Central or State Govt. The regime of incentives offered by the Centre generally contains the following: - Credit prescription (Priority sector lending), differential rates of interest etc. - Excise Exemption Scheme - Exemption under Direct Tax Laws. - Statutory support such as reservation and the Interest on Delayed Payments Act. (It is to be noted that the Banking Laws, Excise Law and the Direct Taxes Law have incorporated the word SSI in their exemption notifications. Though in many cases they may define it differently. However, generally the registration certificate issued by the registering authority is seen as proof of being SSI). States/UTs have their own package of facilities and incentives for small scale. They relate to development of industrial estates, tax subsidies, power tariff subsidies, capital investment subsidies and other support. Both the Centre and the State, whether under law or otherwise, target their incentives and support packages generally to units registered with them.

Objectives of the Registration Scheme

They are summarised as follows: To enumerate and maintain a roll of small industries to which the package of incentives and support are targeted. To provide a certificate enabling the units to avail statutory benefits mainly in terms of protection. To serve the purpose of collection of statistics. To create nodal centres at the Centre, State and District levels to promote SSI.

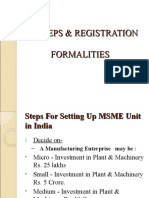

Features of the Scheme

Features of the scheme are as follows: DIC is the primary registering centre

Registration is voluntary and not compulsory. Two types of registration is done in all States. First a provisional registration certificate is given. And after commencement of production, a permanent registration certificate is given. PRC is normally valid for 5 years and permanent registration is given in perpetuity.

Provisional Registration Certificate (PRC)

This is given for the pre-operative period and enables the units to obtain the term loans and working capital from financial institutions/banks under priority sector lending. Obtain facilities for accommodation, land, other approvals etc. Obtain various necessary NOCs and clearances from regulatory bodies such as Pollution Control Board, Labour Regulations etc.

Permanent Registration Certificate

Enables the unit to get the following incentives/concessions: Income-Tax exemption and Sales Tax exemption as per State Govt. Policy. Incentives and concessions in power tariff etc. Price and purchase preference for goods produced. Availability of raw material depending on existing policy. Permanent registration of tiny units should be renewed after 5 years.

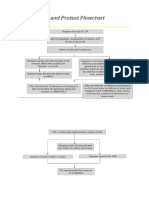

Procedure for Registration

Features of the present procedures are as follows: A unit can apply for PRC for any item that does not require industrial license which means items listed in Schedule-III and items not listed in Schedule-I or Schedule-II of the licencing Exemption Notification. Units employing less than 50/100 workers with/without power can apply for registration even for those items included in Schedule-II. Unit applies for PRC in prescribed application form. No field enquiry is done and PRC is issued. PRC is valid for five years. If the entrepreneur is unable to set up the unit in this period, he can apply afresh at the end of five years period. Once the unit commences production, it has to apply for permanent registration on the prescribed form. The following form basis of evaluation: The unit has obtained all necessary clearances whether statutory or administrative. e.g. drug license under drug control order, NOC from Pollution Control Board, if required etc. Unit does not violate any locational restrictions in force, at the time of evaluation. Value of plant and machinery is within prescribed limits.

Unit is not owned, controlled or subsidiary of any other industrial undertaking as per notification.

De-Registration

A Small Scale Unit can violate the regulations in the following ways which will make it liable for deregistration: It crosses the investment limits. It starts manufacturing any new item or items that require an industrial license or other kind of statutory license. It does not satisfy the condition of being owned, controlled or being a subsidiary of any other industrial undertaking.

Registration of Small Scale Industrial Units

The Scheme of voluntary registration of Small Scale, Village and Cottage Industries with the State Directorate of Industries was introduced in 1960 and such registered industrial units were made eligible for different types of assistances by the Governmental Agencies. Initially a uniform norm for registration were not laid down with the result that some of the States had granted different registration numbers to different lines of manufacturing processes to the same unit thereby resulting in multiple registration. Therefore to avoid such anomalies a uniform set of Application Forms for both Provisional as well as Permanent Registration were evolved out at the time of introduction of the revised procedure of registration of these sectors of industrial undertakings in 1975. With the passage of time, the Government of India, Ministry of Commerce and Industries further simplified the procedures by simplification of the forms for registration and also introduced the coded system to indicate the State, Districts and the unit's serial number so as to facilitate computerisation of the whole system of SSI registration, in 1989. Registration of Small Scale, Village and Cottage industries are done under two stages, viz-

i. ii.

Provisional and Permanent Registration

Provisional Registration : Provisional registration is granted to a unit at its preinvestment period to enable it to take necessary steps to apply for financial credit, land or an industrial set, water, power or telephone connections, etc. Permanent / Final Registration : A provisionally registered industrial unit when it is about to go into production is to apply for grant of Permanent / Final Registration. An existing and functioning industrial unit is eligible to apply for Permanent / Final Registration without going into provisional registration processes.

The District wise SSI Registration of the State is given in Table below:Districts Wise Yearly Registration of SSI Units. East Khasi Hills 76 77 78 79 80 81 82 83 50 33 72 54 95 137 62 61 74 112 67 63 75 80 72 69 76 43 88 81 115 1809 85 86 87 88 89 90 91 92 93 95 96 97 98 99 00 01 02 03 04 2 13 14 11 9 72 45 64 West Khasi Hills 1 13 5 2 7 17 27 62 34 72 40 41 39 40 76 41 49 49 58 160 50 49 21 953 Jaintia Hills 5 5 18 10 12 19 17 24 22 29 22 22 15 19 23 35 31 33 39 37 41 38 33 37 35 621 West Garo Hills 28 7 25 18 13 24 15 20 14 16 21 17 11 17 8 18 29 32 26 7 25 23 14 428 East Garo Hills 6 11 10 8 21 12 9 12 2 22 25 19 13 19 29 25 22 32 24 5 44 35 32 437 South Garo Hills -

Sl. No. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29.

Year 1975 1976 1977 1978 1979 1980 1981 1982 1984 1985 1986 1987 1988 1989 1990 1991 1992 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Total

Ri Bhoi 10 12 19 23 27 24 18 26 23 27 209

Total 2 18 14 11 9 112 76 97 99 78 130 131 260 260 134 193 175 208 153

1983 84

1993 94

16 200 8 239 16 232 9 243 19 265 9 258 2 273 266 20 268 8 323 107 4564

Year Wise SSI Registration With Employment Details. Sl. No. 1. 2. 3. 4. Year 1975 1976 1977 1978 76 77 78 79 Nos. of UnitsRegistered 2 18 14 11 Investment in plant / Machinery Employment (Rs. in lakhs) Generation 0.77 21 8.27 141 6.69 204 11.08 100

5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29.

1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Total

80 81 82 83 84 85 86 87 88 89 91 92 93 94 95 96 97 98 99 00 01 02 03 04

9 112 76 97 99 78 130 131 260 260 134 193 175 208 153 200 239 232 243 265 258 273 266 268 323 4564

5.11 74.43 23.63 51.36 25.42 22.11 48.11 71.11 126.70 133.85 91.75 149.88 82.28 205.79 146.40 229.04 217.00 260.65 258.05 218.39 484.60 297.00 667.18 668.00 702.00 5286.65

91 878 554 656 573 376 679 709 1048 1428 723 1067 921 1043 830 1441 1308 1313 1155 1334 1499 1330 1638 1416 1805 26281

1989 90

You might also like

- Small and Medium Scale EnterprisesDocument5 pagesSmall and Medium Scale EnterprisesRao JeetuNo ratings yet

- Projects Management: Komal GangiDocument3 pagesProjects Management: Komal GangiHimanshu PaliwalNo ratings yet

- Be Sem 1 Unit 2 SsiDocument17 pagesBe Sem 1 Unit 2 SsiYash KeshkamatNo ratings yet

- Constitution of BusinessDocument18 pagesConstitution of BusinessGangadhar MamadapurNo ratings yet

- Registration Formalities For A New FirmDocument9 pagesRegistration Formalities For A New FirmmrkktheroboNo ratings yet

- On REGISTRATION NOC FROM POLLUTION BOARDDocument14 pagesOn REGISTRATION NOC FROM POLLUTION BOARDankitabhardwaj3750% (1)

- Steps To Start A Small Scale IndustryDocument3 pagesSteps To Start A Small Scale Industrysajanmarian80% (5)

- Advantages of Incentives and SubsidiesDocument38 pagesAdvantages of Incentives and SubsidiesShashank Jain67% (3)

- Unit 6 Small Business-2-1Document13 pagesUnit 6 Small Business-2-1AkasaNo ratings yet

- Small Sclae IndustriesDocument22 pagesSmall Sclae IndustriesDev kartik AgarwalNo ratings yet

- Preferential TaxationDocument9 pagesPreferential TaxationMNo ratings yet

- 1.) Who Are Eligible To Register As Bmbes?: AnswerDocument6 pages1.) Who Are Eligible To Register As Bmbes?: AnswerHazel Seguerra BicadaNo ratings yet

- Iv Sem Tax ProjDocument9 pagesIv Sem Tax ProjVagisha SharmaNo ratings yet

- Steps To Register Small Scale IndustiresDocument2 pagesSteps To Register Small Scale IndustiresSara BradleyNo ratings yet

- Startup BenefitsDocument3 pagesStartup BenefitsSSNo ratings yet

- Week 16 and 17 Tax Incentives and BMBEDocument28 pagesWeek 16 and 17 Tax Incentives and BMBEwatanabe200412No ratings yet

- Excise Law PDFDocument54 pagesExcise Law PDFJay BudhdhabhattiNo ratings yet

- Formalities For Setting Up Small BusinessDocument37 pagesFormalities For Setting Up Small BusinessNitya GuptaNo ratings yet

- IndustryDocument14 pagesIndustryMohd ShahidNo ratings yet

- Ssi Steps & Registration FormalitiesDocument26 pagesSsi Steps & Registration Formalitieskartheek_aldiNo ratings yet

- Information About: Entrepreneurs Memorandum (EM) - I RegistrationDocument2 pagesInformation About: Entrepreneurs Memorandum (EM) - I RegistrationGanesh SantoshNo ratings yet

- WWW - Bnrs.dti - Gov.ph Business Name Registration Application FormDocument7 pagesWWW - Bnrs.dti - Gov.ph Business Name Registration Application FormLouie BruanNo ratings yet

- MSMEDocument1 pageMSMENagarNo ratings yet

- Preferential Taxation - Magumpara, AliahDocument8 pagesPreferential Taxation - Magumpara, AliahAliah MagumparaNo ratings yet

- CIR v. SeagateDocument4 pagesCIR v. SeagateGain DeeNo ratings yet

- Companies Registered Under The Section 8 of Companies ActDocument7 pagesCompanies Registered Under The Section 8 of Companies ActGriffith Biju John (GBJ)No ratings yet

- Corporate Taxation in BangladeshDocument8 pagesCorporate Taxation in Bangladeshskn092No ratings yet

- Business Law and Regulations Rhin FrancineDocument207 pagesBusiness Law and Regulations Rhin FrancineShiela MarieNo ratings yet

- Module 3 - Preferential Taxation P1Document5 pagesModule 3 - Preferential Taxation P1Bella RonahNo ratings yet

- Start-Up: ObjectiveDocument10 pagesStart-Up: ObjectiveAventhikaNo ratings yet

- Startup - Bareilly - Zari-BambooDocument6 pagesStartup - Bareilly - Zari-Bamboosaakshiis295No ratings yet

- Notice & DRDocument25 pagesNotice & DRvermasanjay69No ratings yet

- 1 Create RA 11534 FullDocument10 pages1 Create RA 11534 FullTreb LemNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Guidelines On Applying For BOI RegistrationDocument12 pagesGuidelines On Applying For BOI RegistrationCarol DonsolNo ratings yet

- 4.final ReportDocument121 pages4.final ReportAmardeep SinghNo ratings yet

- The Pioneer Legislation and Its Tax Implications AwokeDocument12 pagesThe Pioneer Legislation and Its Tax Implications Awokeawokede100% (2)

- Preferential Taxation - Magumpara, AliahDocument8 pagesPreferential Taxation - Magumpara, AliahAliah MagumparaNo ratings yet

- Individual - Sole Proprietorship - Corporation/PartnershipDocument3 pagesIndividual - Sole Proprietorship - Corporation/PartnershipAliyaaaahNo ratings yet

- How To Register A Business in The PhilippinesDocument7 pagesHow To Register A Business in The PhilippinesStewart Paul TorreNo ratings yet

- Prepared By: Leyla B. Malijan J19-65663Document31 pagesPrepared By: Leyla B. Malijan J19-65663leyla malijanNo ratings yet

- How To Register A Business in The Philippines: Requirements and PermitsDocument2 pagesHow To Register A Business in The Philippines: Requirements and PermitsBelle MadrigalNo ratings yet

- BOI Incentive and Application GuidelinesDocument7 pagesBOI Incentive and Application GuidelinesAnonymous 7qv2ubCTd9No ratings yet

- Doing Business in China - 1Document7 pagesDoing Business in China - 1ashu1403No ratings yet

- Small Scale Exemption SchemeDocument8 pagesSmall Scale Exemption SchemebakulhariaNo ratings yet

- Missive Volume IV - July 2011: Transaction AdvisorsDocument11 pagesMissive Volume IV - July 2011: Transaction AdvisorsAkhil BansalNo ratings yet

- Foreign Tax CreditDocument6 pagesForeign Tax CreditJanna Grace Dela CruzNo ratings yet

- Vietnam Political AnalysisDocument2 pagesVietnam Political AnalysisMina YulzNo ratings yet

- BDO Budget Snapshot - 2012-13Document9 pagesBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarNo ratings yet

- Tax Alert BIR Ruling 142-2011Document3 pagesTax Alert BIR Ruling 142-2011Ia Bolos0% (1)

- Msme NotesDocument4 pagesMsme NotesAbhishek Rai0% (1)

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- Thai Insurance Research (Ef)Document2 pagesThai Insurance Research (Ef)gia fardilaNo ratings yet

- Business License in CameroonDocument20 pagesBusiness License in Cameroonjemblem66No ratings yet

- Preferential TaxationDocument10 pagesPreferential TaxationAlex OngNo ratings yet

- Handout PDFDocument23 pagesHandout PDFElla CayNo ratings yet

- Note On Ssi RegistrationDocument9 pagesNote On Ssi RegistrationJayanthi BalasubramaniamNo ratings yet

- Happy Veggie Req and Qua, Legal Req BSDocument4 pagesHappy Veggie Req and Qua, Legal Req BSKyle's ChannelNo ratings yet

- Procedure For Starting Small Scale Industries in IndiaDocument4 pagesProcedure For Starting Small Scale Industries in IndiaViswan Thrissur100% (1)

- Revised Verification of Marks - Class X 2019Document4 pagesRevised Verification of Marks - Class X 2019Mohitraheja007No ratings yet

- Brochure 2021 B.ED. USOLDocument9 pagesBrochure 2021 B.ED. USOLMohitraheja007No ratings yet

- Online Submission of Forms by Private Candidates Comptt. Class X-Xii July 2019Document8 pagesOnline Submission of Forms by Private Candidates Comptt. Class X-Xii July 2019Mohitraheja007No ratings yet

- Indirect Taxes: (K.M V Olrqfu"B Á'UDocument41 pagesIndirect Taxes: (K.M V Olrqfu"B Á'UMohitraheja007No ratings yet

- Indirect Taxes: (K.M V Olrqfu"B Á'UDocument41 pagesIndirect Taxes: (K.M V Olrqfu"B Á'UMohitraheja007No ratings yet

- Verification of Marks Class XiiDocument3 pagesVerification of Marks Class XiiKunaal GoswamiNo ratings yet

- 1984Document55 pages1984Mohitraheja007No ratings yet

- Workload ManegmentDocument27 pagesWorkload ManegmentMohitraheja007100% (1)

- The Social Responsibility of BusinessDocument36 pagesThe Social Responsibility of BusinessMohitraheja007No ratings yet

- Changing Social Values and Political Culture in PunjabDocument23 pagesChanging Social Values and Political Culture in PunjabMohitraheja007No ratings yet

- Broadband ServicesDocument43 pagesBroadband ServicesMohitraheja007No ratings yet

- Waste Management1Document25 pagesWaste Management1Mohitraheja007No ratings yet

- Overview of MNPDocument40 pagesOverview of MNPShweta BerryNo ratings yet

- The Companies Act 1956Document19 pagesThe Companies Act 1956Mohitraheja007No ratings yet

- Prime Minister'S Employment Generation Programme (Pmegp)Document6 pagesPrime Minister'S Employment Generation Programme (Pmegp)Mohitraheja007No ratings yet

- Industrel Relation ABCDocument76 pagesIndustrel Relation ABCMohitraheja007No ratings yet

- Final Report MainDocument100 pagesFinal Report MainNoorpreet SinghNo ratings yet

- Introduction of Industrial RelationDocument27 pagesIntroduction of Industrial RelationMohitraheja007No ratings yet

- The Social Responsibility of BusinessDocument36 pagesThe Social Responsibility of BusinessMohitraheja007No ratings yet

- Ethics in MarketingDocument15 pagesEthics in Marketinganon_632611927No ratings yet

- Industrel Relation ABCDocument76 pagesIndustrel Relation ABCMohitraheja007No ratings yet

- According To Crowther, "Inflation Is A State in Which The Value of Money Is Falling I.E. Prices Are Rising."Document8 pagesAccording To Crowther, "Inflation Is A State in Which The Value of Money Is Falling I.E. Prices Are Rising."Mohitraheja007100% (2)

- The Companies Act 1956Document19 pagesThe Companies Act 1956Mohitraheja007No ratings yet

- Synopsis No 3 - Poonam 22 PDFDocument12 pagesSynopsis No 3 - Poonam 22 PDFMohitraheja007No ratings yet

- Definition of EntrepreneurshipDocument26 pagesDefinition of EntrepreneurshipAfsanaKhanNo ratings yet

- Employee Motivation ProjectDocument82 pagesEmployee Motivation ProjectMohitraheja007100% (1)

- Ethics in MarketingDocument15 pagesEthics in Marketinganon_632611927No ratings yet

- Companies ActDocument60 pagesCompanies ActMohitraheja007No ratings yet

- SavitaDocument26 pagesSavitaMohitraheja007No ratings yet

- 1627 - 2001 - QD-NHNN Bank BorrowDocument11 pages1627 - 2001 - QD-NHNN Bank Borrowjetnguyenulis93No ratings yet

- Managing An Effective and Profitable Microfinance BankDocument23 pagesManaging An Effective and Profitable Microfinance BankToyin OlufolahanNo ratings yet

- Variety Show - Score SheetDocument3 pagesVariety Show - Score SheetApril Joy LascuñaNo ratings yet

- Full Compilation Qawaid FiqhiyyahDocument215 pagesFull Compilation Qawaid Fiqhiyyahanis suraya mohamed said95% (20)

- Form For Filing FDCPA Law SuitDocument18 pagesForm For Filing FDCPA Law Suitnutech18100% (2)

- Elizabeth Del Carmen Vs Spouses Restituto Sabordo and Mima Mahilim-SabordoDocument6 pagesElizabeth Del Carmen Vs Spouses Restituto Sabordo and Mima Mahilim-SabordoChoi ChoiNo ratings yet

- Materiality Matrix BCADocument1 pageMateriality Matrix BCAGalla GirlNo ratings yet

- Amaecombrochure - V0.1Document25 pagesAmaecombrochure - V0.1Afolayan ToluwalopeNo ratings yet

- YFC Projects - R-28062017Document5 pagesYFC Projects - R-28062017vinay durgapalNo ratings yet

- 5 - Allied Thread v. City of Manila G.R. No. L-40296 November 21, 1984Document1 page5 - Allied Thread v. City of Manila G.R. No. L-40296 November 21, 1984Pam Otic-ReyesNo ratings yet

- Ar 20 Nissan GandharaDocument152 pagesAr 20 Nissan GandharaGravel coNo ratings yet

- Aml Case StdyDocument5 pagesAml Case Stdyammi25100% (2)

- Invoice: Charge DetailsDocument3 pagesInvoice: Charge DetailsAli HabibieNo ratings yet

- DeKalb FreePress: 06-14-19Document24 pagesDeKalb FreePress: 06-14-19Donna S. SeayNo ratings yet

- Transfer Pricing: Acc 7 - Management Consultancy Test BankDocument14 pagesTransfer Pricing: Acc 7 - Management Consultancy Test BankHiraya ManawariNo ratings yet

- Chapter 11 Quiz - SolutionsDocument15 pagesChapter 11 Quiz - Solutionszak robertsNo ratings yet

- Log ValidasiDocument6 pagesLog ValidasiHermanNo ratings yet

- Edelweiss Securities Ltd. 01/121: DdmmyyyyDocument2 pagesEdelweiss Securities Ltd. 01/121: DdmmyyyySarah DeanNo ratings yet

- Bookkeeping FinalDocument67 pagesBookkeeping FinalKatlene JoyNo ratings yet

- Bernanke - 1983 - Non-Monetary Effects of The Financial Crisis in The Propagation of The Great DepressionDocument21 pagesBernanke - 1983 - Non-Monetary Effects of The Financial Crisis in The Propagation of The Great Depressionyezuh077No ratings yet

- Exeter Delinquent Property Tax ListDocument3 pagesExeter Delinquent Property Tax ListseacoastonlineNo ratings yet

- Proyecto de Modificaciones A La Niif para Las PymesDocument60 pagesProyecto de Modificaciones A La Niif para Las PymesKevin JimenezNo ratings yet

- Rusa Presentation PDFDocument87 pagesRusa Presentation PDFRakeshNo ratings yet

- Burden of LaborDocument4 pagesBurden of Laborhamiltjw2No ratings yet

- Week 12: Chapter 17-Banking and Management of Financial InstitutionsDocument4 pagesWeek 12: Chapter 17-Banking and Management of Financial InstitutionsJay Ann DomeNo ratings yet

- Chapter 4 Branch AccountingDocument17 pagesChapter 4 Branch Accountingkefyalew TNo ratings yet

- Final Exam Cfas WoDocument11 pagesFinal Exam Cfas WoAndrei GoNo ratings yet

- Duty Drawback, Refund and Abatement, and Return of Cash Deposits Held in TrustDocument14 pagesDuty Drawback, Refund and Abatement, and Return of Cash Deposits Held in TrustPortCalls100% (2)

- Reading Gaps in Charts PDFDocument11 pagesReading Gaps in Charts PDFkalelenikhlNo ratings yet

- Main Report - Study of Risk Perception of Equity Investors and Potrfolio ManagementDocument22 pagesMain Report - Study of Risk Perception of Equity Investors and Potrfolio ManagementSnehaVohra100% (1)