Professional Documents

Culture Documents

Volkswagen Msrketing

Uploaded by

nk24091993Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Volkswagen Msrketing

Uploaded by

nk24091993Copyright:

Available Formats

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

The Investigation of Volkswagens Entry Strategy in Chinas Car Market

By

XiaoFeng Wen

2007

MA MANAGEMENT

17957 words

-0-

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Keywords

Volkswagen (VW); Market Entry Strategy; Foreign Direct investment (FDI); Chinas car industry; Shanghai Volkswagen; Joint Venture.

Abstract

China is one of the most attractive investment destinations for the world investors, now almost all the world car-manufacturing giants have launched their factories in this country, making huge efforts to explore their market share. And it has one of the worlds largest car markets, in the past few years sales have grown forty to sixty percent annually. The favorable macro-environment and policy environment has enabled Chinas car industry grew fast and steadily.

Volkswagen (hereafter VW) is one of the earliest investors and the biggest foreign car maker in China, its entry and development strategy is very successful, now it controls over 30% of the Chinas car market. This piece of study analyses the international strategy of VW, and focuses on its investment strategy in China, particular attention was paid on its selection of entry modes when it entered Chinese market, the objective was to find out which particular modes did VW use to enter Chinese market and what are the rationales behind such choice.

It was found that it is the macro environment (political, economic, social and technological) and micro environment (threat from five forces) of China lends itself to a particular entry mode: joint venture. It also presented the challenges and directions of the company in its future development in China

-1-

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Acknowledgements

In the course of writing this dissertation, I am indebted to my supervisor Richards John. He led me and continuously pushed me to finish my dissertation, immolate his time, and gave advice cannily through out the dissertation writing progress.

I am also very grateful to my friend, David Wu, who provided me much useful information, and my girl friend Yang Gao, who heartened me with her love.

XiaoFeng Wen Business school University of Nottingham September 2007

-2-

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

TABLE OF CONTENTS

1.0 INTRODUCTION

1.1 Introduction 1.2 Introduction of Topic 1.3 Research Objective and Research Questions 1.4 Available Research Method 1.5 Limitation of Research 1.6 The Structure of Dissertation 1.7 Summary

8

8 8 9 10 10 11 12

2.0 LITERATURE REVIEW

2.1 Introduction 2.2 Key Entry Modes and Influential Factors 2.3 The Review of Foreign Direct Investment

2.31 Definition of Foreign Direct Investment 2.32 Knowledge about FDI and Key Factors Affecting the FDI Decision 2.33 Types of FDI and Their Advantages & Disadvantages 2.34 Wholly Owned Subsidiary or Joint Venture? 2.35 Greenfield or Acquisition? 2.36 Key Theories and Models Affecting FDI Decision

13

13 13 16 16 17 22 26 27 27 36

-3-

2.4 Summary

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

3.0 RESEARCH METHODLOGY

3.1 Introduction 3.2 Research Purpose 3.3 Philosophical Perspectives 3.4 Research Strategy 3.5 Data Type, Source and Collection 3.6 Summary

37 37 37 38 40 40 42

4.0 VW International Strategy and Its Enter China Strategy

4.1 Introduction 4.2 VWs International Strategy

4.21 The Overview of VW 4.22 VWs International Strategy 4.23 VWs Competitive Advantage 4.24 VWS International Enter Strategy

44 44 44 44 46 49 51 54 54 54 55

4.3 VWs Strategy in China

4.31 VW in China 4.32 The Two Joint Ventures in China

4.4 Summary

5.0 The Investment Environment of Chinas Car Industry

5.1 Introduction

57 57

-4-

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

5.2 The Macro Environment of Chinas Car Industry 5.21 Political Environment 5.22 Economic Environment 5.23 Social Cultural Environment 5.24 Technological Environment 5.3 The Micro Environment of Chinas Car Industry 5.31 Five Forces Analysis 5.32 The Current Status of Chinas Car Industry 5.4 Summary

57 58 60 62 64 65 65 67 69

6.0 VWs Future Challenges and Directions

6.1 Introduction 6.2 SWOT analysis on VW in China 6.3 The Future Directions of VW in Chinas Group 6.4 Summary

70 70 70 73 74

7.0 Discussion and Conclusion

7.1 Discussion 7.2 Conclusion

75 75 75 77

REFERENCE

APPENDIX

-5-

82

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

List of tables and figures

Figure 1.7 The structure of the dissertation Figure2.2 Modes of entering foreign markets Table 2.32 Factors affecting the FDI decision Figure 2.33 Types of FDI 12 15 19 22

Figure 2.36-1 Porters five force

28

Figure 2.36-2 SWOT Analysis Frameworks

33

Table2.36-3 Factors in PEST Figure 3.3: Underlying Philosophical Assumptions Table 3.5 The structure of interview questions

34 38 41

Table 4.21-1 The brief introduction of VW

44

Figure 4.21-2 The VW group structure

45

Table 4.21-3 The brands of VW

45

Figure 4.21-4 VW Production Facilities Worldwide

46

Chart 4.22-1 The Global Geography of VW

47

Table 4.22-2 Three phases of VWs International Profile

48

-6-

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

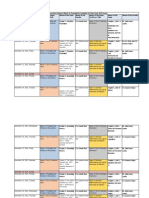

Table 4.4 Volkswagen in China

56

Figure 5.22-1 Growth of Real GDP of China 1978-2005

60

Figure 5.22-2 Chinas Real GDP 1992-2004

61

Figure 5.22-3 China FDI Growth 1984-2004 Figure 5.3 Major Players and their relationship in Chinas Car Industry

61

68

Table 6.2 SWOT analysis on VW in China

70

-7-

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

1.0 Introduction

1.1 Introduction

The introduction chapter will briefly introduce the topic, the research objective, and the structure of the project, it seeks to make clear that why to choose this topic, what the project will do, and how to do.

1.2 Introduction of topic

Car industry has been one of the fastest growing industries in the world for the last two decades, averagely a 2% annual growth (Eurosif, 2007), and it is still showing a upward trend, the growth rate is forecasted to be 27% from 2004 to 2009 (Datamonitor, 2007). While it is growing rapidly, the industry environment keeps continuously changing, and now the industry is highly competitive and consolidated, and the globalization of the industry has been accelerating dramatically. Nowadays, a few major players dominate the industry, mergers and alliances happen very frequently among them. With the saturation of the European market and the North American market, which have been the most competitive area in the last years, the new emerging economies in Latin America and East Asia have become the new battlefield for the giant global car makers.

As well known, Chinas car industry has a history of just 50 years since 1953, and it has become one of the pillar industries of China today. China has shifted from a nation of bikes to a mobile population in just one generation. Peng (2006) pointed out after Chinas reformation in its foreign direct investment policy since 1981, more and more car makers in the world are racing into this market that also brings big change to this industry. For example, car sales in China are doubling almost every year, and it has been the worlds most revved-up car market. Nowadays, Chinas car industry is growing from an infant industry to a mature industry. Most important,

-8-

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Chinese government has a series of new policies on national car companies, on one hand reforming the national car companies, on the other hand attracting more foreign investors invest into Chinese car market, which brings the Chinese car industry a dramatic development. Owing to the widespread public policy issues surrounding the car industry, from labor to environment concerns, car industry has become more and more attractive to foreign investors.

VW was one of the earliest foreign carmakers in China, which made direct investment and succeed in entering Chinese market with its preliminary strategy. VW set up joint ventures with the only two passenger carmakers in China - Shanghai Auto Works and First Auto Works. In 1978, it firstly negotiated with Shanghai Auto Works in China. And the reformation & open door policy that launched in the next year in China increase the speed of negotiation process. In 1984, Shanghai-VW was set up and started local production of the Santana in the next year. In 1988, FAW started its licensed production of Audi and set up FAW-VW brand. Two years later, it introduced a new model named Jetta to the market. Today, VW has been the most successful foreign car maker, which controls almost 50% car market in China. (Datamonitor, 2007)

Through the introduction background, both Chinas car industry and VWs entry strategy in China are very significant to be studied in. Hence, this piece of project will analyze the market entry and expansion strategies adopted by VW. In other words, the focus of the study is reviewing the main entry strategies adopted by VW when entered the Chinese market and why these strategies were appropriate during that period.

1.3 Research objective and research questions

The objective of this project can be summarized as the following three aspects:

-9-

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

The first objective is to identify the major factors that influence VWs selection of entry strategies, it will through the investigation of VWs international strategy to achieve this objective.

Then, the second objective is to analyze VWs investment activity in China, to find out the companys entry strategy.

The third objective is to find out why VW used joint venture entry strategy when it entered Chinas car market. It will compare the VWs international strategy and the strategy in China, and analyze the Chinese investment environment.

Finally, it will briefly analyze the companys future direction and development.

Hence, the research questions are: What entry modes have Volkswagen used when it entered the Chinas car market? What are the rationales behind such choices? What makes it so successful?

1.4 Available research methods

The deductive approach is applicable research method. The strategy of this research will include the following three stages: first, exploratory studies; second, descriptive studies; third, explanatory studies. Furthermore, secondary data of this topic is available for this study.

1.5 Limitation of research

Naturally, with the available time period, the research will not be able to study all of the investment activities of VW, as well as collecting primary data from activities can not be able to do. Thus, this research will briefly introduce that part.

- 10 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

1.6 The structure of dissertation

This research is structured in nine main sections with the reference and appendix sections allocated at the end.

The first chapter presents the introduction, background of global car industry, Chinas car industry and VW in Chinas car market. It also outlines the objectives of this study, which lead this researcher to the selected topic and addresses relevant aspects underlying this dissertation.

The second chapter is literature review, it mainly introduce the foreign direct investment, and factor about that.

The third chapter presents and describes the methodology employed in this research, which will mainly use the qualitative research . The chapter four focuses on analyzing the VWs international strategy and its investment activity in China, it seeks to find which entry strategy is VWs most favorable strategy and what entry strategy did VW use when it enter Chinas market.

The chapter five analyses the Chinas investment environment on car industry, it will use PEST and five force mode in order to know why VW use that entry strategy when it enter Chinas car market.

The chapter six briefly analyses the future direction and challenges of VW in China. The chapter seven is the concluding chapter, which draws conclusions and implication of this dissertation.

- 11 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

1.7 Summary

This chapter briefly introduced the global car industry, Chinas car industry, and VWs investment activity in China, all of that are also seen as the motivations to choose this project

The objective of this project is to find out what influence VW select the entry strategy when it entered Chinas car market, in order to achieve this objective, some key research questions were set, they are what entry modes have Volkswagen used when it entered the Chinas car market? What are the rationales behind such choices? What makes it so successful?

Finally, it showed the structure of the dissertation, and summarized in figure 1.7.

Figure 1.7 the structure of the dissertation

Introduction

Literature review

Research methodology

VW international strategy and enter China strategy

The investment environment of Chinas car industry

Future direction and challenges

Discussion and Conclusion

- 12 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

2.0 Literature review

2.1 Introduction

Literature review provides a background of the existing research on the topic and those theoretical frameworks that can be used to achieve the purpose of the investigation. In order to construct frameworks for further research, this chapter briefly introduces the literatures on international business entry modes, and then mainly introduces literatures on Foreign Direct Investment (FDI), factors affecting the FDI decision, types of FDI, the advantages and disadvantages of each type. Also, it will introduce some key theories and models, which may influence the FDI activities.

2.2 Key entry modes and Influential Factors

International business is all commercial transactions, private and governmental, between two or more countries (Dniels, Radebaugh and Sullivan, 2004). Domestic firms engage in international business very many reasons, marketing objectives, strategic reasons, behaviour motives or economic rationales (Peng, 2006), most importantly, to expand sales, to acquire resources and to minimize risk (Dniels, Radebaugh and Sullivan, 2004).

However, for domestic firms, foreign market is much different from their own countries market, hence, choose a mode to enter foreign market is very important.

Hill (2005) stated that normally a firm could choose six modes to enter foreign markets: exporting, turnkey projects, and licensing, franchising, establishing joint ventures with a Host-country firm, or setting up a new wholly owned subsidiary in the host country (Figure 2.2), and next will gives a brief introduction of these modes:

- 13 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Exporting: It can be defined as shipping goods to another country for sale or exchange. This is still the most popular entry mode now, and many manufacturing firms begin their global expansion as exporters and switch to another mode later. For example: Diebold (Hill 2005).

Turnkey Projects: According to Peng (2006), Turnkey projects refer to projects in which clients pay contractors to design and construct new facilities and train personnel. At their completion, contractors hand clients and proverbial key to the facilities ready for operations-hence the term turnkey.

Licensing: A licensing agreement is an arrangement whereby a licensor grants the rights to intangible property to another entity for a specified period, and in return, the licensor receives a royalty fee from the licensee (Hill, 2005). The intangible property includes patent, inventions, formulas, process, designs, copyrights and trademarks.

Franchising: It is a specialized form of licensing in which the franchiser not only sells intangible property to the franchisee, but also sells the template of doing business (Hill, 2005). The franchiser will often assist the franchisee to run the business on an ongoing basis. It is primarily employed by services companies.

Joint Venture: It is a corporate child that is a new entity given birth and jointly owned by two or more parent companies (Peng, 2006). Operational responsibilities and financial risks and rewards are shared while preserving their separate identity. It could be in three forms, minority JV, which means less than 50 percent equity, 50/50 JV, and majority JV, which means more than 50 percent equity (Peng, 2006).

Wholly Owned Subsidiary: In a wholly owned subsidiary, the firm owns one hundred percent of the stock. Establishing a wholly owned subsidiary in a foreign market can be down in two ways: (1) Greenfield venture, which means setting up a new operation in a foreign country;

- 14 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

(2) Acquisition, which means acquiring an established firm in the host country.

All the entry modes have advantages and disadvantages, hence trade-offs are inevitable when selecting an entry mode. Peng (2006) and Hill (2005) states that the factors influenced entry modes selection are: Resources and capabilities: The amount of resources required by each entry mode is very different. For example, wholly owned subsidiary is the most expensive mode, if a firm cannot afford it; it has to go with other cheaper modes, such as licensing and franchising. Amount of control: Different modes of entry give different degree of control over the subsidiaries. For example, in franchising and licensing, quality control is difficult, and amount of control in joint venture depends on the level of ownership, wholly owned subsidiaries give the most control in decision-making. Risk of losing technology: Managers are afraid to lost technology to their local partners when some high risk of losing technology modes is selected. For examples, in licensing, the licensees very often reproduce technology; joint venture partners may also learn technology from the firm; technology risk is probably lowest in wholly owned subsidiary. Familiarity with the host country: if the firm is not familiar with the host country, it is probably better to choose joint venture, in that way the firm can benefit from the local partners local knowledge. Figure2.2 Modes of entering foreign markets

- 15 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

2.3 The review of Foreign Direct Investment

2.31 Definition of Foreign Direct Investment There has been a great deal of literature on FDI, such as World Trade Organization defined FDI as occurring when an investor in one country (the home country) acquires an asset in another country (the host country) with the intent to management that asset (WTO, 1999). Daniels (2004) stated foreign investment means ownership of foreign property in exchange for a financial return, such as interest and dividends. And Hill (1999) indicated foreign direct investment occurs when a firm invests directly in facilities to produce and/or market a product in a foreign country.

In the recent years the most common definition of FDI is related to the compilation Balance on Payment accounts. It was originally provided by International Monetary Fund (IMF) in 1993 and then endorsed by the OECD in 1996, and revised by the OECD in 2005. Foreign direct investment reflects the objective of obtaining a lasting interest by a resident entity in one economy (Direct investor) in an entity resident in an economy other than that of the investor (Direct investment enterprise). The lasting interest implies the existence of a long-term relationship between the direct investor and the enterprise and a significant degree of influence on the management of the enterprise. Direct investment involves both the initial transaction between the two entities and all subsequent capital transactions between them and among affiliated enterprises, both incorporated and unincorporated.

According to the Balance of Payments Manual: Fifth Edition (BPM5) of United Kingdom (2007), FDI refers to an investment made to acquire lasting interest in enterprises operating outside of the economy of the investor. Further, in cases of FDI, the investors purpose is to gain an effective voice in the management of the enterprise.

The United Nations provides a definition that focus more on the control issues,

- 16 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

according to the UN system of National Accounts, Foreign Controlled enterprises include subsidiaries with more than 50% owned by a foreign parent. Associates of whom foreign ownership is 10-50% ... may be included or excluded by individual countries according to their qualitative assessment of foreign control. Hill (2001) said that with the phenomenon of foreign direct investment. Such as foreign direct investment occurs when a firm invests directly in facilities to produce and/or market a product in a foreign country.

2.32 Knowledge about FDI and Key factors affecting the FDI decision Foreign direct investment is a company controlled through ownership by a foreign company or foreign individuals. FDI is important because production facilities abroad comprise a large and increasingly important part of international companies activities and strategies.

FDI plays an extraordinary and growing role in global business. It can provide a firm with new markets and marketing channels, cheaper production facilities, access to new technology, products, skills and financing. For a host country or the foreign firm which receives the investment, it can provide a source of new technologies, capital, processes, products, organizational technologies and management skills, and as such can provide a strong impetus to economic development.

The direct investment in buildings, machinery and equipment is in contrast with making a portfolio investment, which is considered an indirect investment. In recent years, given rapid growth and change in global investment patterns, the definition has been broadened to include the acquisition of a lasting management interest in a company or enterprise outside the investing firms home country. Thus, it may take many forms, such as a direct acquisition of a foreign firm, construction of a facility, or investment in a joint venture or strategic alliance with a local firm with attendant input of technology, licensing of intellectual property and so on.

- 17 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

In the past decade, FDI has come to play a major role in the internationalization of business. Reacting to changes in technology, growing liberalization of the national regulatory framework governing investment in enterprises, and changes in capital markets profound changes have occurred in the size, scope and methods of FDI. New information technology systems, decline in global communication costs have made management of foreign investments far easier than in the past. The sea change in trade and investment policies and the regulatory environment globally in the past decade, including trade policy and tariff liberalization, easing of restrictions on foreign investment and acquisition in many nations, and the deregulation and privatization of many industries, has probably been the most significant catalyst for FDIs expanded role. The most profound effect has been seen in developing countries, where yearly foreign direct investment flows have increased from an average of less than $10 billion in the 1970s to a yearly average of less than $20 billion in the 1980s, to explode in the 1990s from $26.7billion in 1990 to $179 billion in 1998 and $208 billion in 1999 and now comprise a large portion of global FDI. Driven by mergers and acquisitions and internationalization of production in a range of industries, FDI into developed countries last year rose to $636 billion, from $481 billion in 1998. (Fung and Tong, 2004)

Proponents of foreign investment point out that the exchange of investment flows benefits both the home country (the country from which the investment originates) and the host country (the destination of the investment). Opponents of FDI note that multinational conglomerates are able to wield great power over smaller and weaker economies and can drive out much local competition.

In the past 15 years, the content of FDI has changed that because the advent of the Internet, the increasing role of technology, loosening of direct investment restrictions in many markets and decreasing communication costs means that newer,

- 18 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

non-traditional forms of investment will play an important role in the future.

Many governments, especially in industrialized and developed nations, pay very close attention to foreign direct investment because the investment flows into and out of their economies can and does have a significant impact. In the United States, the Bureau of Economic Analysis, a section of the U.S. Department of Commerce, is responsible for collecting economic data about the economy including information about foreign direct investment flows. Monitoring this data is very helpful in trying to determine the impact of such investments on the overall economy, but is especially helpful in evaluating industry segments. State and local governments watch closely because they want to track their foreign investment attraction programs for successful outcomes.

What are factors influencing the firms decision to undertake FDI? Griffin and Pustay (2005) summarized that into 3 factors, there are supply factors, demand factors, and political factors (Table 2.32), they are well explained why firms choose to undertake FDI to enter into foreign market. Dunnings eclectic theory also shows three conditions of FDI, there are ownership advantage, location advantage and internalization advantage (Brouther et al, 1996). It is a very popular framework too. Table 2.32 factors affecting the FDI decision Supply factors Production cost demand factors Customer access political factors Avoidance of trade barriers Logistics Marketing advantages Economic development incentives Resource availability Competitive advantages

Access to technology

Customer mobility

Source: Rick W. Griffin, Michael W. Pustay (2005)

- 19 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

1. Supply factors Supply factors include production cost, Logistics, Resource availability and Access to technology, and these factors are influence decision when the firm undertakes FDI.

Production costs: the foreign locations may have lower land prices, tax rates, commercial real estate, or lower cost of labor, it made the production cost lower, and the firm will gain more profit. For example, China is famous for its low-cost workers, the salary rates it much lower than developed countries (e.g. one- third to western countries), and a lot of firms have flocked to China to benefit from its low cost workforce.

Logistics: firms may produce their produce in the foreign countries when transportation costs are high. In other word, FDI may save the large transportation costs rather than exporting.

Availability of natural resources: because of the limitation of natural resources or raw material in home country, firms may choose to undertake FDI.

Access to key technology: technology may share between domestic factories and foreign factories when the firms undertake FDI.

2. Demand factors Demand factors include customer access, marketing advantages, exploitation of competitive advantages and customer mobility. These factors are influence decision when the firm undertakes FDI.

Customer access: a lot of international businesses require firms to have a physical presence in the market, so in the foreign countries they have to undertake FDI. For example, KFC has to locate outlets in foreign countries in order to provide its freshly prepared fired chicken to foreign customers.

- 20 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Marketing advantages: by adopt FDI, the foreign firm may gain from buy local attitudes of host country consumers and improve their customer service. For example, Taiwans Delta products shifted some of its production to a Mexican factory just across the border from Nogales, Arizona, not only get the local customer, but also provide better service to US customers.(Wall street , 1996)

Exploitation of competitive advantages: a firm which has big trade mark, brand name, or technology may not just export its products to foreign countries, normally it will decide to undertake FDI to exploit competitive.

Customer mobility: if customers or clients are in or will move to the foreign country, firm will decide to undertake FDI. For example, after Samsung decided to construct and operate an electronics factory in northeast England, six of its Korean part suppliers also established factories in the vicinity. (Financial Times, 1996)

3. Political factors Political factors include avoidance of trade barriers and economic development incentives. These factors are influence decision when the firm undertakes FDI.

Avoidance of trade barriers: FDI may help firms to avoid trade barriers.

Economic development incentives: Government offer incentive to firms to induce them locates new factories in the government jurisdictions. Government may offer lower tax rate in a certain period, reduce the utility rate and so on.

4. Dunnings eclectic theory John Dunning in his theory stated that FDI will occur when three conditions are satisfied: Ownership advantage: firms must own some specific competitive advantages compete with foreign firm; these advantages may include brand name, experience,

- 21 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

product differentiation, and so on.

Location advantage: firms must gain more profit than just export products to the foreign countries. For example, VW produces its products in China to enjoy lower labor cost.

Internalization advantage: firms must gain more benifit from controlling the foreign business activty than hiring a local company to provide the service.

2.33 Types of FDI and Their Advantages & Disadvantages When a firm decides to enter a new market in another country through foreign direct investment, the next step is to choose between the different types of FDI (Figure 2.4), wholly owned subsidiary or joint venture (Definitions in the chapter 2.2), and next will introduce the advantages and disadvantages of them. Figure 2.33 Types of FDI

FDI

Wholly owned subsidiary

Joint venture

Greenfield

Acquisition

1. Joint Venture Advantages Firms can gain the benefits from a local partners knowledge of the host countries, competitive conditions, political systems, business systems, culture and language; the costs and risks can be shared by the local partners, especially when the development costs and risks of opening a foreign market are high. Finally, joint venture reduces

- 22 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

political risk as it involves a local firm. In many countries, political consideration makes joint ventures the only feasible entry mode. This is the reason that joint venture is so popular when firms enter the Chinese market.

Disadvantages Firstly, firms have to face the risk of giving control of technology to the local partner. Majority ownership in the venture can help exercise greater control over the technology, but it is difficult to find a local partner who is willing to settle for minority ownership (Wang, 2003).

Secondly, a joint venture does not give a firm the tight control over subsidiaries that it might need to realize experience curve or location economies. Thus, it is difficult to make strategic change to coordinate global attacks against rivals, as the partner may not will to cooperate.

Thirdly, shared ownership leads to conflicts and battles for control between investing firms if their goals and objectives change or if they take different views as to what the strategy should be, this is especially serious when the firms are from different nations, culture differences also can cause problems.

2. Wholly Owned Subsidiary Advantages Wholly Owned Subsidiary reduces the risk of losing technical competence to a competitor, particularly when a firms competitive advantage is based on technological competence. This is why many high-tech companies prefer this entry mode for overseas expansion. And it gives tight control over operations in different countries; this is necessary for engaging in global strategic coordination, as the firm could use the profit from one country to support competitive attacks in another. in order to realize learning curve and location economies, a global production system needs to be established and centrally determined decisions are needed, this requires

- 23 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

high control over the subsidiaries, wholly owned subsidiary gives such tight control (Hill, 2005).

Disadvantage Establishing a wholly owned subsidiary is the most costly method of serving a foreign market in terms of capital investment. Firms must bear full capital costs and the risks. When acquisition is adopted, other problems such as culture issues also raise. As it said before, there are two ways to establishing a wholly owned subsidiary, Greenfield and Acquisition

1). Greenfield Advantages By establishing a Greenfield venture in a foreign country, a firm can build the kind of subsidiary company that it wants, thus it is easy to establish operating routines and organization culture in a new subsidiary than it is to concert the operating routines of an acquired unit. This is an important advantage international business for transferring products, core competencies, skills and know-how from the head office to the new established subsidiary. A good example would be Lincoln Electric, which proved that it is almost not possible to transfer its organization culture to an acquired firm by its experience (Hill, 2005).

Disadvantages The first disadvantage of Greenfield venture is it needs very long time to establish the building from the ground up.

It is also risky, as it is associated with uncertainty with future profit prospects, there is a possibility that the future profit cannot cover the costs of the venture, the loss of VW recently in the Chinese market is an example (Wang, 2003).

- 24 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Finally, since it is slow to establish a Greenfield venture, there is the possibility of being preempted by aggressive competitors who enter the same market via acquisition.

2). Acquisition Advantages Acquisitions are quick to execute. Unlike Greenfield venture, acquisitions save the time of building the subsidiary; therefore a firm can quickly build its presence in the target market. For example, Daimler-Benz rapidly showed its presence in the US market by acquiring and merging a few big US automobile companies (Wild 2006).

Second, it is easy to preempt the competitors because it is quick; many firms make acquisitions for this purpose. This is particularly effective in the industries that are rapidly globalizing, such as the telecommunication market. It is possible that acquisitions are less risky than Greenfield ventures, as firms buy assets that are already making profits, so less uncertainty, and also, except for the tangible assets, firms also buy intangible assets such as local brand name and experienced managers, these all reduce the risk.

Disadvantages Firstly, acquired firms are often overpaid, especially when more than one firm is interested in it, and top managers tend to overestimate their ability to create value from an acquisition.

Secondly, culture clash is another important reason for the fails of acquisitions. Culture difference between the established firm and acquired subsidiary cause high management turnover, which harms the performance of the acquired firm, especially when the managers have valuable local knowledge. For example, in the first year after Daimler acquired Chrysler, many senior managers left because of culture clash (Hill, 2005).

- 25 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Finally, many acquisitions fail because attempts to realize synergies by integrating the operations of the acquired and acquiring entities are slowed by the differences in management philosophy and company culture.

2.34 Wholly owned or joint venture Company resources: the most basic factor that a firm needs to consider is its resources and capabilities. The amount of resources required by the two methods is different. For example, wholly owned subsidiary is the most expensive mode, however, joint venture may require less resources.

Second, the issue of control, how much control the firm wants over the subsidiary should be considered, in joint venture, the amount of control depends on the level of ownership and conflicts over control issues happen frequently in joint venture, WOS gives the most control.

Thirdly, Joint venture has risk of losing technology to local partners; technology risk is probably lowest in wholly owned subsidiary.

Fourth, familiarity with the host country, if the firm is not familiar with the host country, it is probably better to choose joint venture, in that way the firm can benefit from the local partners local knowledge. If the host country government prohibits foreign ownership, joint venture would be the easier way to enter the market than WOS.

Moreover, the companys core competency also has impact on the choice of entry modes. If the companies core competency is its technology knows how, it would be better to choose WOS, as it has the lowest possibility of losing technology to partners.

Finally, where the pressure for cost reduction is great, a firm is likely to prefer WOS.

- 26 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

By manufacturing in the optimal locations firm may be able to realize substantial location and experience curve economies, but in joint venture, the firm does not have such tight control to achieve that.

2.35 Greenfield or Acquisition If a firm is seeking to enter a market where there are well-established incumbent enterprises and other global competitors are also interested in establishing a presence in the market, acquisition may be preferred as Greenfield venture is too slow, it gives the competitors chance to preempt. If the firm is considering to enter a market where there are no incumbent competitors to be acquired, it may have to choose Greenfield venture.

Moreover, if the competitive advantage of the firm is based on the transfer of organizationally embedded competencies, skills, routines and culture, Greenfield may be the better choice, as it is much easier to build a set of routines and organization cultures in a new subsidiary than transferring them to acquired firm.

2.36 Key theories and models affecting FDI decision This dissertation will use PEST mode and Porters five forces mode to analyze the macro and micro environment of Chinas car industry, through the investigation, it seeks to answer the question: what entry modes are appropriate to be used when a carmaker enter the Chinas car market, and why.

1. The Five Forces Model The Five Forces Model is an important model for analyzing an organization industry structure in strategic processes, which is introduced by Michael E. Porter in his book Competitive Strategy: Techniques for Analyzing Industries and Competitors in the year of 1980.

- 27 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

The five force model is applied to analyze opportunities and threats by 5 major forces in the organizations micro-environment, as the bargaining power of suppliers; the bargaining power of buyers; the threat of potential new entrants; the threat of substitutes; and the extent of competitive rivalry. (See Figure 2.36-1)

These forces determine the intensity of competition and hence the profitability and attractiveness of an industry. Based on the information derived from the Five Forces Analysis, companies are able to decide how to create their strategy in order to develop their opportunities and protect themselves against the threats in their industries. (Richard Lynch, 2006)

Figure 2.36-1: Porters five force

Source: Johnson, G. and Scholes, K. (2002)

Bargaining Power of Suppliers: Suppliers provide all of the raw materials and components for final goods production. (David Jobber, 2004; Richard Lynch, 2006) The cost of these resources determines the profitability of the firm. The bargaining power of suppliers is likely to be high when: The market is dominated by a few large suppliers rather than a fragmented source of supply. Thus, it is difficult for the firm to switch from one supplier to another.

- 28 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

There are no substitutes for the particular input, such as for the input which requires high technology support. The switching costs from one supplier to another are high, unless the firm as power to rise its own price as compensation. (Richard Lynch, 2006) There are many buyers in the market, and they do not threaten to integrate backward into supply (David Jobber, 2004)

Furthermore, the suppliers may integrate forwards in order to obtain higher prices and margins, e.g. Brewers buying bars. This threat is especially high when: The buying industry has a higher profitability than the supplying industry. Forward integration provides economies of scale for the supplier. The buying industry hinders the supplying industry in their development (e.g. reluctance to accept new releases of products). The buying industry has low barriers to entry. In such situations, the buyers often face a high pressure on margins from their suppliers with limited strategic options. And a stable and friendly relationship with powerful suppliers is considered as a potential competitive advantage in buying industry.

Bargaining Power of buyers: Under a strong bargaining power of buyers, the firms are difficult to determine the price in the market, and get small profit margins from their products.

Buyers bargaining power is likely to be high when: There are only a few buyers in the demand side, or there is a concentration of buyers, the firm has little option to switch to an alternative buyer. The buyers clear the cost of products, and they are price-sensitive. The product is undifferentiated and can be replaces by substitutes. That switching to an alternative product may be relatively simple and cheap. Or the customers could even produce the product by themselves.

- 29 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

The supplying industry comprises a large number of small operators, the buyers can free choose among different firms. The supplying industry operates with high fixed costs, thus, it desires high speed of turnover. The product is not of strategically importance for the customer.

Threat of New Entrants: The competition in an industry will be higher when it is easier for a potential entrant to enter this industry. The threat of new entrants brings to the existing firms is the potentially change on market environment and market structure, such as market shares, prices, and customer loyalty etc.

The threat of new entries will depend on the extent to which there are barriers to entry. Under a low entry barrier, potential entrants will enter the industry easily, that is always a latent pressure for reaction and adjustment for existing players in the industry.

Porter argued there is seven key barriers for a potential entrant enter the industry. (Richard Lynch, 2006), they are Economies of scale (minimum size requirements for profitable operations). Product differentiation. Capital requirements: when high initial investments and fixed costs are required in this industry, the entry barrier is high. Switch costs: the entry barrier is high when switching cost is high for customers to switch from the one firm to the other. That means it is difficult to obtain the customers from the existing players. Access to distribution channels and access to raw materials. For example, when the distribution channels and raw materials are controlled by existing players, the entry barrier is high. Cost advantages of existing players due to experience curve effects of

- 30 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

operation with fully depreciated assets. Government policy, such as the protection of intellectual property, which requires patents and licenses in the industry. In this situation, the entry barrier is high.

Furthermore, the entry barrier is also high when The brand loyalty of customers is very high, or the existing players have close customer relations, e.g. from long-term service contracts.

Threat of Substitutes: Substitute exists as an alternative choice for customer in the market, with lower prices or better performance parameters for the same purpose of the existing products. It means a threat for the existing firms as taking their customers, reducing their potential sales volume.

Similarly to the threat of new entrants, the treat of substitutes is determined by factors like: Brand loyalty of customers. Close customer relationships. Switching costs for customers. The relative price for performance of substitutes. Current trends.

Competitive Rivalry between Existing Players: This force describes the intensity of competition between existing firms in an industry. High competitive rivalry may due to the competition on prices, products and service, promotions, margins, technology R&D etc. Competition between existing players is likely to be high when: There are many players in the industry of about the same size, which means no firm dominates the market over others.

- 31 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Players have similar strategies. There is not much differentiation between players and their products; hence, there is much price competition. Low market growth rates (growth of a particular company is possible only at the expense of a competitor). Barriers for exit are high (e.g. expensive and highly specialized equipment).

Generic Competitive Strategies: In order to coping with the five competitive forces, Porter (1985) identified three main potentially successful generic strategic approaches to outperforming other firms in an industry, which include cost leadership, differentiation and focus (Barney 2007). Firms either can focus on:

Cost leadership: the attainment of the lowest unit cost base in the industry Differentiation: the ability to charge a premium price for offering some perceived added value to the customer e.g., improved quality. Note that it's the customer's perception that differentiates the product, not the product itself (Taylor, 2005). Focus: firms should consider the degree of focus they wish to apply to their cost leadership or differentiation strategy.

Porter (1980) suggests that an organization should concentrate on one type of generic strategy and should not mix each of the strategy together, as each generic strategy demands different and dedicated, resource base. If a firm intends to combine different generic strategies, the organization will end up being being stuck in the middle and not have the capabilities to compete effectively (Wickham, 2002).

As a summary, the five forces collectively determine the profitability of the industry, which helps companies understand the opportunity and threat of an industry, and

- 32 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

figure out how to mitigate the pressure of threat and obtain the opportunity. Under the analysis of five forces model, companies can start to see how this relates to the generic strategies (see appendix 1: the Five Forces Model and Generic Strategies). In order to develop effective strategies, a company must understand the implication of the forces and how each of them affects the company in its strategy formulation. However, porter also stated that forces that take on prominence in shaping competition could be different in different industries. (Besanko et al, 2000)

2. SWOT analysis SWOT analysis provides information that is helpful in matching the firms resources and capabilities to the competitive environment in which it operates, and helps to know the position of the firm in the existing market, then firm can decide if they can use FDI as entry strategy. The Figure 2.36-2 shows how a SWOT analysis fits into an environmental scan:

Figure 2.36-2 SWOT Analysis Frameworks

Strengths: A firms strengths are its resources and capabilities that can be used as a basis for developing a competitive advantage, so it is a firms internal analysis, and normally a firms strengths may include: patents, strong brand names, good reputation among customers, cost advantages from proprietary know-how, exclusive access to high grade natural resources and favorable access to distribution networks, etc.

- 33 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Weaknesses: The absence of certain strengths may be viewed as a weakness. Hence they are: Lack of patent protection, a weak brand name, poor reputation among customers, high cost structure, lack of access to the best natural resources and lack of access to key distribution channels, etc

Opportunities: The external environmental analysis may reveal certain new opportunities for profit and growth. So the opportunities of a firm are like: An unfulfilled customer need, arrival of new technologies, loosening of regulations, and removal of international trade barriers, etc.

Threats: Changes in the external environmental also may present threats to the firm. So the threats of a firm should include: Shifts in consumer tastes away from the firms products, emergence of substitute products, new regulations and increased trade barriers

3. PEST analysis PEST analysis is a very important mode, which is used to scan firms macro-environment before beginning the marketing process, for example, and firms can use it to test if they can enter the foreign market. The PEST analysis is known as: Political factors, Economic factors, Social cultural factors and technological factors. The table 2.36-3 gives an example of some factors that might be considered in a PEST analysis

- 34 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Table2.36-3 Factors in PEST Political Analysis

- Political stability - Risk of military invasion - Government - Legal framework for contract enforcement - Intellectual property protection - Trade regulations & tariffs - Favored trading partners - Anti-trust laws - Infrastructure quality - Pricing regulations - Skill level of workforce - Taxation-tax rates and incentives - Wage legislation-minimum wage and overtime - Work week - Mandatory employee benefits - Unemployment rate - Industry safety regulations -Product labeling requirements - Inflation rate - Interest rates - Labor costs - Business cycle stage (e.g. prosperity, recession, recovery) - Economic growth rate - Discretionary income - Efficiency of financial markets - Leisure interests intervention in the free market - Comparative advantages of host country - Exchange rates & stability of host country currency - Attitudes (health, environmental consciousness, etc.) - Rate of technological diffusion - Entrepreneurial spirit - Impact on value chain structure - Culture (gender roles, etc.) - Impact on cost structure - Education

Economic Analysis

- Type of economic system in countries of operation

Social Analysis

- Demographics - Class structure

Technological Analysis

- Recent technological developments - Technologys impact on product offering

Source: David Jobber, 2004

- 35 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

The number of macro-environmental factors is virtually unlimited. In practice, the firm must prioritize and monitor those factors that influence its industry. Even so, it may be difficult to forecast future trends with an acceptable level of accuracy. In this regard, the firm may turn to scenario planning techniques to deal with high levels of uncertainty in important macro-environmental variables.

2.4 Summary

The literature review chapter shows: The modes of international business, there are exporting, turnkey projects, licensing, franchising, joint ventures, and wholly owned subsidiary. The factors influenced managers decision is: resources and capabilities, amount of control, risk of losing technology and familiarity with the host country. After introduced these definitions of these modes, it helps to have a general understand of foreign market entry strategy.

And then mainly introduce literatures on Foreign Direct Investment because it is the main strategy of VW, which enter into Chinese car market. This part include: definition of FDI, reason of firms choose FDI (three factors, three conditions), the types of FDI, the advantages and disadvantages of each type, and the key theories and models affecting FDI (five-force, PEST, and SWOT).

In the next chapter, the methodology of this research will be presented. Also, it includes the selecting research method, adopting the appropriate research strategies as well as collecting of primary and secondary data.

- 36 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

3.0 Research methodology

3.1 Introduction

The previous chapter on literature review has set up the theoretical background for the present research, this chapter introduces the purpose of the research, explains the philosophy behind the research, approach, strategy and techniques adopted in the process of collecting, interpreting data and reaching conclusions.

3.2 Research purpose

As we all know, management research aims to discover a set of causal laws that can be used to predict general patterns of human behaviour (David Jobber, 2004), so the purpose of this paper is to move from the surface problem to the reasons behind, it aims to find out what particular entry mode did VW choose and why did it chose the mode when it entered the Chinese car market.

According to the purpose of this research, this paper will adopt three kinds of enquiries, there are: exploratory, descriptive, or explanatory (Yin 1994)

Exploratory studies aim at exploring something, and are appropriate when the research problem is difficult to delimit. The purpose is to gather as much information as possible concerning a specific problem. Exploratory research is often used when a problem is not well known, or the available knowledge is not absolute. The technique that is best suited for information gathering when performing an exploratory research is interview (Yin, 1994). So in this paper, the purpose of this study is to answer what is VWs international strategy (both in China and the other countries).

The descriptive research purpose is used when a problem is well structured and there is no intention to examine the casual relationships. The conclusion of the study is

- 37 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

derived from a conclusive description of the examined aspects or variables (Bryman and Bell, 2003). Hence, the purpose of research moved to gain further understanding of the issue in this study (for example, by reading relevant literature), and it is descriptive and aimed to portray a detailed profile of the contexts (Robson, 2002), researcher expects the study will answer the question how the VW entered the Chinese market.

Explanatory is to develop precise theory that can be used to explain the empirical generalizations. Based on this, the researcher tries to answer the research question, which is What are the rationales behind VW chose such entry mode and what makes it so successful? by collecting, analyzing and interpreting both primary and secondary data.

3.3 Philosophical perspectives

Research philosophy is a very important element of the business and management research, Saunders (2003) states that it (research philosophy) is the way that researcher think about the development of knowledge. Epistemology refers to the assumptions about knowledge and how it can be obtained. Thus, Chua (1986) suggest three categories, which based on the underlying research epistemology such as: positivist, interpretive and critical (see Figure 3.3)

Figure 3.3: Underlying Philosophical Assumptions

- 38 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Positivist: it is often adopted in the research philosophy, which reflects the principles of positivism (Saunders, Lewis & Thornhill, 2003). The results worked out by researchers are from observable social realities and can be law like generalizations similar to the ones obtained by scientists (Saunders, Lewis & Thornhill, 2003). The researchers focus on highly structured methodology to facilitate replicate previous data and quantifiable observations, results in statistical analysis (Saunders, Lewis & Thornhill, 2003).

Interpretive: the researchers need to recognize the subjective reality of their study so as to be able to understand the motives, actions and in intention of research participants. The philosophical base of interpretive research is hermeneutics and phenomenology (Boland, 1985). Interpretive research does not predefine dependent and independent variables, but focuses on the full complexity of human sense making as the situation emerges (Kaplan and Maxwell, 1994).

Critical: it requires the researchers to understand the peoples social constructed interpretations and behaviors which would affect by their broader social force, structures or process (Saunders, Lewis & Thornhill, 2003).

In order to analyze the current situation of China car market and VW, the philosophy behind this part of research will be positivist, moreover the PEST analysis (for China car market), Porters five force model and SWOT analysis (for VW) is employed to assist it. And reflects a critical stance when interpret social reality and prospect people in the society. However, this research is inclined to an interpretive philosophy, it because the objective of this research is answer the why and how question, it cannot answer clearly by quantifiable observation and statistical.

- 39 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

3.4 Research strategy

Quantitative research classifies features, count them, and even construct more complex statistical models in an attempt to explain what is observed (David 2003). Thus, in this paper, quantitative analysis can helps researcher to analyze the phenomena of VW enters Chinas car market, but it cannot clearly identify what rationales behind this. According to the research objective is to identify the key entry strategy that adopted by VW when it entered the Chinas car market, and find out what behind this phenomena, hence, quantitative research is not main strategy in this paper. According to the limitation of quantitative research, the researcher of this paper will mainly adopt the qualitative research strategy.

The qualitative research is aim to discover the responders attitudes, values, behaviors and beliefs (David 2003). It can be used to discover the cause of phenomenon that is represented in the finding of a quantitative research, and it seek to answer how and why of phenomena occur as its objective which in order to understand the world from participants frames of reference. Hence, it can answer research question very well.

3.5 Data type, source and collection

According to Saunders et al. (2003), to be able to understand the research area more in detail, empirical data must be collected. There are two different types of empirical data that can be collected: primary and secondary. The primary data is collected from specific problems, while the secondary data is collected from a more general purpose.

In this paper, the primary and secondary data have been collected and mainly qualitative, the quantitative data will be used as well, but not in statistical way, it is only used to support the qualitative data.

- 40 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Interview is the most common method of data gathering in qualitative research (King, 2004), and is adopted as the primary method to collect primary information in the present research. The goal of a qualitative interview is to see the research topic from the perspective of the interviewee, and to understand how and why they come to have this particular perspective (Kvale, 1983), it meet the requirements of the research objective. Hence, the primary data has been conducted through a personal interview and the interviewee is Mr Cai Qian, Sculpt Project Manager of Shanghai Volkswagen, the purpose of the interview is to find out the information about VWs entry strategy in Chinas car market, what are they consider about, the structure of the interview questions are shown in table 3.5

Table 3.5 the structure of interview questions

What kind of entry mode did VW choose when it enter Chinas car market and why

Government policy, both encouraging and restricting

Competitive advantage of VW

Any other things affect the entry strategy

The limitation of primary data is the collection process is very difficult, because the data can only collected from very top managers or decision-makers, but make appointment with these people is nearly improbable, even though the researcher arranged an interview with a manager of VW.

Due to the limitation of primary data, this paper will mainly use the secondary data. Hence it is a library-based project, which means this topic will be addressed by using published information for the construction; thus, this research will conduct with the

- 41 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

secondary research, using relative secondary data. These data are mainly obtained by accessing to journal articles, school library database, academic books, documentaries, survey reports as well as Internet sources. These secondary data is used for investigate Chinas investment environment, Chinas car industry environment, the VWs international investment strategy, and its enter Chinas car market strategy. The literatures also come from secondary data.

However, use the secondary data also has limitations. Firstly, the data could quickly run out of time, because the publishers could easily to update the information on the daily basis, and in the car market, the figure is changing occasionally, for instance, at the time the researcher is organizing the data, that data might be changed after the researcher organized, thus, it is a problem for researchers to develop a updated analysis or argument. Thus, the researchers need to collect the data as new as possible, to keep update, to minimize this effect. Secondly, the data may not reliable, because the data published by other organizations might also secondary; the researcher is unknown about the original source of data, and various data has been published by different organization, it could confuse the researchers, they may wander which source of data is the most accurate one. By considering on this, the researchers could more focus on the data, which issued by the government sectors, it cannot be guaranteed as 100 per cent reliable, but at least, these data are more authoritative.

3.6 Summary

The purpose of this paper it aims to find out what particular entry mode did VW choose and why did it chose the mode when it entered the Chinese car market. It will goes through three kinds of studies, there are exploratory, descriptive, and explanatory. The research philosophy of this paper is inclined to an interpretive philosophy, but in order to analyse the current situation of China car market and VW, it is also include positivist philosophy and reflects a critical stance. This paper

- 42 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

will mainly use qualitative research, collecting secondary data, although they have several limitations, it is more appropriate to be used in this paper.

The next chapter will briefly introduce the international strategy of VW and its operation in China. It will focuses on the international strategy of Volkswagen and find out if there are some particular reasons that company choose a particular entry mode when it entered Chinese market.

- 43 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

4.0 VW international strategy and its enter China strategy

4.1 Introduction

In Chapter two, it reviewed the existing literature in the field relate to this project, this chapter and the following chapter aim to find out (1) what entry modes are frequently adopted by VW in its international expansion process; (2) What entry mode did VW applied when it entered into the Chinas car market. After understanding this differentiation, this study will identify whether there are any particular reasons that VW chose such a particular entry mode in China different from its international strategies.

4.2 VWs international strategy

In order to understand the investment activity of VW, this part will focus on the international strategy of VW. It will give a brief introduction of VW at the beginning; secondly, finding out the most favorable entry modes that VW has been used in the past; finally, analyzing the companys international strategy and competitive advantage etc.

4.21 The overview of VW VW is a world-wide Car maker, it headquarters is in Wolfsburg of Germany. The Group been founded in 1937, and now, it is incontrovertible that VW is one of the most successful car makers all over the world. (See Table 4.21-1) Table 4.21-1 the brief introduction of VW

- 44 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

The Groups car producing business can be divided into two brand groups, the Audi and Volkswagen brand group. The Audi brand of group is mainly made up of the Audi, Lamborghini and SEAT brands. The Volkswagen brand group includes the Volkswagen, Skoda, Bugatti and Bentley brands (see Figure 4.21-2 and table 4.21-3). The product ranges is very wide, it covered nearly all classes of cars, which extend from low-consumption small cars to luxury class vehicles. (Volkswagen AG, 2007). The financial service part of the group includes financial services for retail and insurance purposes, EuropCar and Leaseplan (Global Insight, 2007). Figure 4.21-2 the VW group structure

Table 4.21-3 the brands of VW

- 45 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

The Group has already operated 44 production plants in eleven countries of European, and other seven countries out of European, which have America, Asia and Africa (see Figure 4.2-4). Now, VW has nearly 345,000 employees, in every working day it can produce over 21,500 vehicles, and sells its vehicles in more than 150 countries. (Volkswagen AG, 2007)

Figure 4.21-4: VW Production Facilities Worldwide

Source: www. Volkswagen-ag.de

4.22 VWs international strategy Dicken (2005) said, Outside Europe, VW is a major producer in Brazil and in Mexico. Within Europe, prior to the opening up of Eastern Europe, VW concentrated its production in two countries in a clear strategy of spatial segmentation. Highly value, technologically advanced cars was produced in the former West Germany; low-cost, small cars were produced in Spain where VW undertook a massive investment programmed in Seat. During 1990s, after the collapse of the Soviet-dominated system, VW moved rapidly to establish production of small cars in eastern Germany and to take a 70 per cent stake in the Czech firm, Skoda. (See Chart 4.22-1). Hence, the product of VW is thoroughly transnational.

- 46 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Chart 4.22-1: The Global Geography of VW

Source: SMMT (2001) World Automotive Statistics

However, look through the development history of VW, it has passed three phases in its international strategy, they are Distribution oriented multinational company, Production-oriented multinational company, and globally operating transitional company. (See Table 4.22-2) The following part will briefly introduce the organizational changes happened during the three phases under three dimensions, namely, corporate governance and profit strategies, product structure and market strategies, and production systems.

- 47 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

Table 4.22-2: Three phases of VWs International Profile

Source: Pries, L (2001). Accelerating from a Multinational to a Transnational Carmaker

1. Distribution oriented multinational company: It can be started from the 1940s to the 1967, the VW Company tried to open a few production facilities out of Germany, which include Canada, the USA and France, the prime strategy was enter these big markets to get the market share and acquire cheaper labor. However, due to the lack link between foreign companies and the headquarters, the foreign factories were still using older methods and producing older models cars compared with the center plant for the national markets and they have relatively high autonomy from the headquarters. 2. Production-oriented multinational company: During the period from 1967 to 1990, the VW group changed their production network, it is a heart-stirring changing in VWs history, because the company plants were redefined in a transnational division of labor, the periphery plants were increasingly integrated into a global division of production, not only produces the older models than the center plants.

Although the product structure and market strategies was still in center-periphery figure, the peripheral plants sill produced and sold older models, the gap of models closed slowly, and they gained an important role in the overall transnational division

- 48 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

of labor in the organization.

3. Globally operating transitional company: This period is between the 1980s and 1990s, Volkswagen began to shift more and more from a simple multinational company to a globally operating transitional company (Pries, 2001).

The changes happened in this phase relate to three dimensions, which are the product structure & market strategies, corporate governance & profit strategies, and production systems at both the headquarters and the periphery plants level. They integrated new foreign companies and reorganized the overall corporate governance structures. There is no longer a big fixed hierarchy between the centers and the peripheries; the company searched for best production places and best practices. They diffused knowledge among the periphery plants and the headquarters, although the headquarters still owned the core strategic competencies such as R & D and design, knowledge diffusion is much greater than before. They recently have opened new plants as technical and organizational laboratories in the development of new production systems and best practice principles. The strategic function of each plant is to maximize the exploitation of all local idiosyncrasies and to optimize intra consortium competition and learning processes (Pries, 2001).

Nowadays, Volkswagen has become a transnational car maker in real sense, and has succeed with the most extensive and systematic transnational strategies in the world. (Dicken, 2005).

4.23 VWs Competitive Advantage 1. Leveraging international resources, assets and competences VW has been trying to obtain access to cheap international resources through its global production network; the group has 41 manufacturing plants in the entire world. (Global Insight, 2006) The group has also built a brand portfolio that covers most

- 49 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

segments of the automobile market. These advantages help the group achieves economies of scale and economies of scope simultaneously.

2. Knowledge creation and innovation Normally, knowledge creation and innovation happen either in the center and transferred to local branches, or in the local branches and primarily used in local markets. There have been some new trends recently, knowledge creation can happen in subsidiaries and transferred worldwide; or globally linked, which means recourses and capabilities of many operations pooled to joint create and manage new activity.

VW Groups knowledge leverage used to be in center-periphery model as it used to be a multinational company during the second half of the past country. However, now, as a transnational organization, its knowledge creation and innovation are globally linked, its new Beetle product and production in Mexico is a good example. VWs Mexican plant used to produce completely out-fashioned models, which were sold mainly in Mexico. The Mexican factory assigned a subordinated position to the Puebla plant. The Groups distribution of resources, functions, competencies and power between headquarters and plants followed a center-periphery configuration. The situation changed dramatically since the 1990s, when the Group made a qualitative shift of the organization structure. In 1993, when VW was having a difficult time in the US market, they realized that they need a competitive car for the small car market, and they need to be innovative in order to compete with the major competitors, therefore they made the decision to produce the New Beetle in Puebla.

In 1995, the Mexican plant was defined as keystone in VWs market strategy to recuperate presence in USA reviving the image and nostalgia of the old buggy and combining it with a high tech fun car for a market niche (Pries, 2001). 30 managers and technicians mostly from Mexico came to Wolfsbury to develop the project and prepare production in Puebla, and 200 technicians were prepared in Puebla, the new Beetle was produced in 1997 and the production of the new Beetle accounts for 40%

- 50 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

of the Mexican production. (VW website, 2007) This is the signal of the changes in VWs product structure, production system, market strategy and knowledge learning and leverage configuration. An inter-hierarchical team working and management system was developed.

4.24 VWs international entry strategies 1. Acquisition & Greenfield It is well known that VW is one of the most successful car makers in the world, it is not only because the quality of its car but also the successful entry strategies it used. The Group now consists of seven major brands, which include Volkswagen Passenger Cars, Audi, Bentley, Seat, Skoda, Bugatti and Lamborghini. Except Volkswagen Passenger Cars brand, rest of them were all bought in the form of acquisition. Audi was bought from Daimler-Benze in 1964; Bentley, was bought in 1998 from Vickers along with Rolls-Royce, but the company cannot produce cars using the brand of Rolls-Royces because this trademark is belonged to BMW; majority of Seat was acquired in 1987, Bugatti and Lamborghini were both acquired in 1998. The Audi division also bought NUS in 1969, but the brand was never used since 1977 (Wikipedia Contributors, 2007).

Hence, it is clear that acquisition is the most favorable entry mode for VW in the past. But because the available targets have been gradually reduced in recent years, and the adverse global market conditions together with the rapid erosion of the profit, VW Group has been more cautious with its investment and its acquisition activities were reduced. Nonetheless, the Group is still investing widely in some new models and new plants, for examples, it constructed a new plant in Dresden and restructured its operations in Brazil. Because of it huge potential market, and the experiences from the maturity North American and European market, it has also continued to expand its production capacity in China , Mexico and many other emerging markets. The Group also built a manufacturing plant in India for the Skoda brand, and hopefully it would become the export base to the around regions. Furthermore , it has

- 51 -

MA MANAGEMENT DISSERTATION

XIAOFENG WEN

increased the assembly volume in Ukraine through Skoda subsidiary. The Group has recently made an acquisition of LeasePlan, a fleet management business formerly owned by ABN Amro, with two partners, which is valued at two billion Euros. It is also considering to invest in a new assembly plant in Russia recently, and it aims to produce three models in 2007 (Global Insights, 2007).

2. Joint Ventures & Strategic Alliances There are two joint ventures companies formed by VW in China, and the partners are the largest car makers in China, therefore VW has an opportunity to gain low-cost plant and get a competitive position in the Asian market, this will be discussed in details later in this paper.

Besides that, VW also formed joint ventures and strategic alliances with other manufacturers in order to enter foreign markets and co-operate on the development of cars and production of key components. Take common SUV architecture for the VW Touareg and Porsche Cayenne for example, VWs plant in Slovakia produce the vehicle bodies, then VWs vehicles are finished and assembled in Slovakia, Porsches are finished in the plant of Leipzig (Global Insights, 2007).

The Group also considered a co-operation with Maserati, which is a sports car brand of Fiat, aiming to develop several technical and commercial co-operation projects. It was reported that VW was planning to use QuattroPorte, which is Maseratis four-door sports saloon platform, as the plant for its C1 concept new luxury model. However, the C1 project was suspended indefinitely; the Group did not enter into the alliance with Maserati (Global Insights, 2007).

There are also many other joint ventures and alliances that the VW participated, for examples: