Professional Documents

Culture Documents

Solicitors Offer Advice Following Legal Aid Cuts: Teens Reach Bank Challenge Final

Uploaded by

api-120443862Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solicitors Offer Advice Following Legal Aid Cuts: Teens Reach Bank Challenge Final

Uploaded by

api-120443862Copyright:

Available Formats

6

Business Argus

Tuesday, April 8, 2014

In brief...

UKs rate of recovery slows

THE pace of the UK recovery slowed to its lowest level in nine months in March as the services sector completed a hat-trick of narrowing growth across the economy, according to new figures. Data from the Markit/ CIPS purchasing managers index (PMI) showed the sector recorded a reading of 57.6 in March, where the 50 mark separates growth from contraction. It marked a fall from the 58.2 recorded in February and its lowest reading since June last year.

Building boost

BRITAINS housebuilders saw a return to buoyant conditions last month after a weather-hit February, while confidence among construction firms rose to its highest level since before the recession.

Blind spot

UK FIRMS are putting their growth at risk due to a technology blind spot, according to a new report. The UK Business Digital Index showed only half of UK businesses and charities have a website, and more than one in tn do not have access to or use the internet.

Work together

BUSINESS and government must work together to win back public trust as part of efforts boost the economy and improve living standards, according to the shadow chancellor. Ed Balls told business leaders that action should be taken when markets fail and competition does not operate, such as in banking and energy . He set out a range of policies at the British Chambers of Commerce conference, including banking reforms, cutting business rates, more apprenticeships and Britain staying in a reformed Europe.

FAMILY courts are at risk of collapse with children caught up in legal battles as warring parents turn up at Court without legal representation, warns Gill Partington, an experienced family lawyer and mediator at Everett Tomlin Lloyd and Pratt. Gill says following cuts to the Legal Aid budget in April 2013, she witnessed a significant drop in the number of parties seeking legal advice for family matters such as divorce, contact and residence. Gill says not being able to access legal aid has meant vulnerable women and children being left unprotected, fathers being unable to see their children following the breakdown of their relationship, and parties being left to struggle financially where their spouse has refused to sell the family home after breakup. She says despite the expectation the majority of family disputes would be resolved through mediation, the take up has been virtually non existent with a 47 per cent drop nationally in the usual percentage of attendees. The founder of lawyersupportedmediation.com, Marc Lopatin, previously commented there had been a col-

Solicitors offer advice following legal aid cuts

lapse in mediation and that the government is trying to sever the link between mediators and lawyers which is worrying because clients need advice. Gill Partington said: Every day we meet people who are no longer eligible for legal aid who desperately need advice. When a relationship breaks down it is a very difficult time and people worry

that they will not be able to afford the advice they need to resolve contact difficulties with their children, for divorce proceedings or to resolve financial matters. Many solicitors firms are taking proactive action to assist people accessing legal advice. Experienced family lawyer Gill said: In an effort to allow people access to advice

we have set up a free family legal clinic at our Pontypool office on Tuesday and at our Newport office on Thursday afternoons each week each week. The clinic is open to all persons seeking advice on all manner of family matters, from divorce to financial matters and issues relating to their children. Since the cuts came into force, many family solicitors have been

working hard to encourage people to seek the help that they need. Myself and others have qualified as mediators to help promote our services. Attendance at mediation prior to proceedings being issued is not yet compulsory but the government proposes that this requirement be made compulsory as of this month.

Teens reach bank challenge nal

young people be more aware A TEAM of seven young peoof money issues. Our event ple from Newport is celebratwas very successful and I ing after impressing a panel of have learnt a lot too. judges to reach the Wales final Money Monkeys will join of Lloyds Banks Money for four other Wales teams Life Challenge. whose projects have shown This national competition the Money for Life Challenge aims to inspire better money judges they have what it management skills in local takes to improve not just communities across the UK. their own money manageThe team of 17- to 18-year-old ment skills, but those of learners from ITEC, a training friends, families and local provider in Newport, fought communities. off competition from all over The Wales final is taking Wales with their exciting proplace at The Royal College of ject called Money Monkeys. Music and Drama today The group set up their prowhen each team will present ject in January, when they Zac Nekkhavi, Josh Foley and Amy-Lee Poole, members of the their projects to a panel of were awarded a 500 grant Money Monkeys team, preparing for the Wales nal of Lloyds high-profile judges. from Money for Life to put Banks Money for Life Challenge The winner will win 1,000 their ideas into action. Since to donate to the charity of then, it has set up a financial advice, and ran engaging activities their choice and each memawareness project aimed at gaining support from MPs and financial ber of the team will receive 50 shopgiving young people the knowledge and charities along the way . ping vouchers. The team will also represkills they need as they progress to Chloe Liddle, 18, from Money sent Wales in the UK final at the 02 adulthood. Monkeys, said: I really enjoyed taking Arena in London on May 15. They targeted secondary schools and part in the Money for Life Challenge The four other Wales finalists are all training centres across South Wales and think we have helped teenagers and based in Cardiff. with resource packs on where to get

Business morale is increasing

Interest risks

FINANCIAL markets are at risk of becoming too complacent about possible higher interest rates despite the degree of disruption they could cause, the Bank of England has warned. The Banks Financial Policy Committee (FPC) said the transition from the current low rates that helped support recovery could pose challenges.

OVER half of manufacturers (58%) invested more in machinery in the last financial year than the previous year, according to the latest Annual Manufacturing Report (AMR). Only 5% of people in the report, which is made by The Manufacturer magazine in association with Barclays, said they were investing less in machinery with 37% at the same as last year. The high number of investing in this area further underlines growing confidence. More than two-fifths (42%)of manufacturers are investing more in new products than 12 months ago, with 42% investing the same and only 5% investing less than last year.

Follow us on Twitter: @SWABusiness

You might also like

- JRF Information Bulletin - W/E 19/09/2014Document2 pagesJRF Information Bulletin - W/E 19/09/2014JRHT_FacebookNo ratings yet

- JRF Activity: Information BulletinDocument4 pagesJRF Activity: Information BulletinKaren WilsonNo ratings yet

- JRF/JRHT Information Bulletin 29/11Document5 pagesJRF/JRHT Information Bulletin 29/11JRHT_FacebookNo ratings yet

- JRF Activity: Information BulletinDocument4 pagesJRF Activity: Information BulletinJRHT_FacebookNo ratings yet

- JRF/JRHT Information Bulletin 13/12/2013Document4 pagesJRF/JRHT Information Bulletin 13/12/2013JRHT_FacebookNo ratings yet

- Information Bulletin 04/10Document3 pagesInformation Bulletin 04/10JRHT_FacebookNo ratings yet

- Information Bulletin - 11 January 2013Document3 pagesInformation Bulletin - 11 January 2013JRHT_FacebookNo ratings yet

- Information Bulletin 25 January 2013Document4 pagesInformation Bulletin 25 January 2013JRHT_FacebookNo ratings yet

- Information Bulletin 01/02/2013Document3 pagesInformation Bulletin 01/02/2013JRHT_FacebookNo ratings yet

- Information Bulletin 01/03/2013Document3 pagesInformation Bulletin 01/03/2013JRHT_FacebookNo ratings yet

- JRF Activity: Information BulletinDocument4 pagesJRF Activity: Information BulletinJRHT_FacebookNo ratings yet

- JRF Information Bulletin - 28 February 2014Document3 pagesJRF Information Bulletin - 28 February 2014Karen WilsonNo ratings yet

- JRF Information Bulletin - W/E 25 July 2014Document4 pagesJRF Information Bulletin - W/E 25 July 2014JRHT_FacebookNo ratings yet

- JRF Activity: Information BulletinDocument3 pagesJRF Activity: Information BulletinJRHT_FacebookNo ratings yet

- JRF Activity: Information BulletinDocument3 pagesJRF Activity: Information BulletinKaren WilsonNo ratings yet

- Parlamentarni RivjuDocument68 pagesParlamentarni RivjuRadoslav ZdravkovicNo ratings yet

- Fintech Vision For The UKDocument27 pagesFintech Vision For The UKammersaleemi1No ratings yet

- Information Bulletin 25/10Document3 pagesInformation Bulletin 25/10JRHT_FacebookNo ratings yet

- What Are The Millennium Development Goals?Document5 pagesWhat Are The Millennium Development Goals?Cheryl TayNo ratings yet

- JRF Information Bulletin - 21 February 2013Document3 pagesJRF Information Bulletin - 21 February 2013Karen WilsonNo ratings yet

- JRF Activity: Information BulletinDocument3 pagesJRF Activity: Information BulletinJRHT_FacebookNo ratings yet

- Northern Democrat 61 Feb 12Document7 pagesNorthern Democrat 61 Feb 12Jonathan WallaceNo ratings yet

- JRF Activity: Information BulletinDocument2 pagesJRF Activity: Information BulletinJRHT_FacebookNo ratings yet

- JRF Information Bulletin - 24 January 2014Document3 pagesJRF Information Bulletin - 24 January 2014Karen WilsonNo ratings yet

- Bulletin 22 February 2013Document3 pagesBulletin 22 February 2013JRHT_FacebookNo ratings yet

- JRF Information Bulletin W/e 13/06/2014Document3 pagesJRF Information Bulletin W/e 13/06/2014JRHT_FacebookNo ratings yet

- UKTI Social Investment Trade Mission BrochureDocument12 pagesUKTI Social Investment Trade Mission BrochurellewellyndrcNo ratings yet

- JRF Information Bulletin - 14 April 2014Document4 pagesJRF Information Bulletin - 14 April 2014Karen WilsonNo ratings yet

- JRF Activity: Information BulletinDocument3 pagesJRF Activity: Information BulletinJRHT_FacebookNo ratings yet

- NPF Annual Report 2013Document164 pagesNPF Annual Report 2013geoffreyawalkerNo ratings yet

- JRF Activity: Information BulletinDocument3 pagesJRF Activity: Information BulletinJRHT_FacebookNo ratings yet

- JRF Activity: Information BulletinDocument4 pagesJRF Activity: Information BulletinJRHT_FacebookNo ratings yet

- Front June 12Document1 pageFront June 12Rebecca BlackNo ratings yet

- JRF Information Bulletin We 20 March 2015Document3 pagesJRF Information Bulletin We 20 March 2015JRHT_FacebookNo ratings yet

- Front Sept 6Document1 pageFront Sept 6rebecca_black2No ratings yet

- Information Bulletin 20/09Document3 pagesInformation Bulletin 20/09JRHT_FacebookNo ratings yet

- Corruption Worsens Under Populist Leaders of Irish Politicians in Ireland and Their Lies and BetrayalDocument993 pagesCorruption Worsens Under Populist Leaders of Irish Politicians in Ireland and Their Lies and BetrayalRita CahillNo ratings yet

- Information Bulletin 16/08Document3 pagesInformation Bulletin 16/08JRHT_FacebookNo ratings yet

- Mat Q3 2012 Final Eh PDFDocument12 pagesMat Q3 2012 Final Eh PDFKezia Dugdale MSPNo ratings yet

- IFA39 LoresDocument68 pagesIFA39 LoresMarkus MilliganNo ratings yet

- NewsletterDocument4 pagesNewsletterMRSN1No ratings yet

- Current Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16From EverandCurrent Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- JRF Information Bulletin - 21/03/2014Document3 pagesJRF Information Bulletin - 21/03/2014Karen WilsonNo ratings yet

- Email Bulletin Issue 2 SummerDocument9 pagesEmail Bulletin Issue 2 SummerHarrow MencapNo ratings yet

- Information Bulletin 01/11Document3 pagesInformation Bulletin 01/11JRHT_FacebookNo ratings yet

- The Rise of Future Finance UK 2013Document14 pagesThe Rise of Future Finance UK 2013Catalina AmihaiesiNo ratings yet

- Almost 8m People in UK Struggling To Pay BillsDocument2 pagesAlmost 8m People in UK Struggling To Pay BillsPatricia YeoNo ratings yet

- November Policy UpdateDocument5 pagesNovember Policy UpdateMelissa PeacockNo ratings yet

- The Alternative Finance Industry ReportDocument56 pagesThe Alternative Finance Industry ReportCrowdfundInsiderNo ratings yet

- NewsDocument9 pagesNewsJerome Christopher BaloteNo ratings yet

- JRF Information Bulletin - W/e 30/01/2015Document3 pagesJRF Information Bulletin - W/e 30/01/2015JRHT_FacebookNo ratings yet

- Statement by Nessa Childers: Labour Party MEP For Ireland East Wednesday, 25th April 2012Document35 pagesStatement by Nessa Childers: Labour Party MEP For Ireland East Wednesday, 25th April 2012Aidan OSullivanNo ratings yet

- Front 29 NovDocument1 pageFront 29 NovRebecca BlackNo ratings yet

- News Bulletin From Greg Hands M.P #312Document1 pageNews Bulletin From Greg Hands M.P #312Greg HandsNo ratings yet

- A4 Front 20120509Document1 pageA4 Front 20120509nahgoeNo ratings yet

- JRF Information Bulletin - W/e 30 MayDocument3 pagesJRF Information Bulletin - W/e 30 MayJRHT_FacebookNo ratings yet

- July Collaborate 2011Document12 pagesJuly Collaborate 2011Scottish Mediation NetworkNo ratings yet

- Feb Hit 36 BvilleDocument1 pageFeb Hit 36 BvillePrice LangNo ratings yet

- Private Client Practice: An Expert Guide, 2nd editionFrom EverandPrivate Client Practice: An Expert Guide, 2nd editionNo ratings yet

- Auctioneer Bids For Icy Aid To Conquer Yukon: Area To Get BoostDocument1 pageAuctioneer Bids For Icy Aid To Conquer Yukon: Area To Get Boostapi-120443862No ratings yet

- Business: ArgusDocument1 pageBusiness: Argusapi-120443862No ratings yet

- Imposing Commercial Property On Market: Support Strengthens For Small Welsh BusinessesDocument1 pageImposing Commercial Property On Market: Support Strengthens For Small Welsh Businessesapi-120443862No ratings yet

- Electrification Row Is Harming The Economy: Business ArgusDocument1 pageElectrification Row Is Harming The Economy: Business Argusapi-120443862No ratings yet

- Epic Trek Across Ice, Where - 10C Feels Warm: Advice Will Still Be On HandDocument1 pageEpic Trek Across Ice, Where - 10C Feels Warm: Advice Will Still Be On Handapi-120443862No ratings yet

- The Big Question: Business ArgusDocument1 pageThe Big Question: Business Argusapi-120443862No ratings yet

- The Big Question... : Business ArgusDocument1 pageThe Big Question... : Business Argusapi-120443862No ratings yet

- Nut-Free Cakes Prove A Real Recipe For Success: Superwoman Lowri Gives Audience A Taste of AdventuresDocument1 pageNut-Free Cakes Prove A Real Recipe For Success: Superwoman Lowri Gives Audience A Taste of Adventuresapi-120443862No ratings yet

- Six Driven To Aid Charity in 24-Hour Car Marathon: Ostler Family Expands Their Budgen Stores With Chepstow OpeningDocument1 pageSix Driven To Aid Charity in 24-Hour Car Marathon: Ostler Family Expands Their Budgen Stores With Chepstow Openingapi-120443862No ratings yet

- Essential Skills On The Menu For Food Workers: It's Party Time As Principality Branch Celebrates A Year OnDocument1 pageEssential Skills On The Menu For Food Workers: It's Party Time As Principality Branch Celebrates A Year Onapi-120443862No ratings yet

- 20 Questions... : Business ArgusDocument1 page20 Questions... : Business Argusapi-120443862No ratings yet

- Farming Is Different in Approach To Accounts: Business ArgusDocument1 pageFarming Is Different in Approach To Accounts: Business Argusapi-120443862No ratings yet

- Premium Broadband Critical' For Newport: Network Forecasts Boom For BuildersDocument1 pagePremium Broadband Critical' For Newport: Network Forecasts Boom For Buildersapi-120443862No ratings yet

- The Big Question... : Business ArgusDocument1 pageThe Big Question... : Business Argusapi-120443862No ratings yet

- Rotary Raft Race Raises 25,454 For Charities: Singers Set To Perform at Business ClubDocument1 pageRotary Raft Race Raises 25,454 For Charities: Singers Set To Perform at Business Clubapi-120443862No ratings yet

- Business: ArgusDocument1 pageBusiness: Argusapi-120443862No ratings yet

- The Big Debate Over: Loan Would Help Ensure Timely Completion So Anchor Store Stays'Document1 pageThe Big Debate Over: Loan Would Help Ensure Timely Completion So Anchor Store Stays'api-120443862No ratings yet

- Business: ArgusDocument1 pageBusiness: Argusapi-120443862No ratings yet

- Cheers To Joanna On Achieving Her Dream: New Store Venture in Town Launched by BusinessmanDocument1 pageCheers To Joanna On Achieving Her Dream: New Store Venture in Town Launched by Businessmanapi-120443862No ratings yet

- Apprentices Win Gold in National Skills Contest: New Car Vinyl Company Moves To Industrial UnitDocument1 pageApprentices Win Gold in National Skills Contest: New Car Vinyl Company Moves To Industrial Unitapi-120443862No ratings yet

- The Big Question: Business ArgusDocument1 pageThe Big Question: Business Argusapi-120443862No ratings yet

- Friars Walk Funding: Why Back Scheme When No-One Else Will Take Risk?Document1 pageFriars Walk Funding: Why Back Scheme When No-One Else Will Take Risk?api-120443862No ratings yet

- Five Top Restaurants On Their Way To City Centre: Man Who Drowned Probably Tripped'Document1 pageFive Top Restaurants On Their Way To City Centre: Man Who Drowned Probably Tripped'api-120443862No ratings yet

- Business: ArgusDocument1 pageBusiness: Argusapi-120443862No ratings yet

- Job Interviews - What Is Acceptable To Ask?: Business ArgusDocument1 pageJob Interviews - What Is Acceptable To Ask?: Business Argusapi-120443862No ratings yet

- Work Gear Doesn't Have To Be Unfashionable: Finance Advice Specialist in UK's Top 200Document1 pageWork Gear Doesn't Have To Be Unfashionable: Finance Advice Specialist in UK's Top 200api-120443862No ratings yet

- Paul Fosh Auctions May Be The Biggest and Best But We Know That We Can Do Even Bett Er..Document1 pagePaul Fosh Auctions May Be The Biggest and Best But We Know That We Can Do Even Bett Er..api-120443862No ratings yet

- Business: ArgusDocument1 pageBusiness: Argusapi-120443862No ratings yet

- The Big Question... : Business ArgusDocument1 pageThe Big Question... : Business Argusapi-120443862No ratings yet

- Christmas in The Valley: Experience: Retreat - Escape - PassionDocument1 pageChristmas in The Valley: Experience: Retreat - Escape - Passionapi-120443862No ratings yet

- Romulo Cantimbuhan V Judge CruzDocument2 pagesRomulo Cantimbuhan V Judge CruzCamille BugtasNo ratings yet

- Coclin Tobacco Co., Inc. v. Brown & Williamson Tobacco Corporation, 353 F.2d 727, 2d Cir. (1965)Document2 pagesCoclin Tobacco Co., Inc. v. Brown & Williamson Tobacco Corporation, 353 F.2d 727, 2d Cir. (1965)Scribd Government DocsNo ratings yet

- Stevens Vs NorddeuscherDocument1 pageStevens Vs NorddeuscherLouise Bolivar DadivasNo ratings yet

- Model Report For ExpertsDocument12 pagesModel Report For Expertspeter_davies_7100% (1)

- United States District Court. Dismissal Fagan vs. The Czech Republic and National Gallery in Praga.Document6 pagesUnited States District Court. Dismissal Fagan vs. The Czech Republic and National Gallery in Praga.eliahmeyerNo ratings yet

- Case Digests On VATDocument46 pagesCase Digests On VATDeb Bie100% (1)

- Respondent. Re: Petition (For Extraordinary Mercy) of Edmundo L. Macarubbo Adm. Case No. 6148 January 22, 2013Document4 pagesRespondent. Re: Petition (For Extraordinary Mercy) of Edmundo L. Macarubbo Adm. Case No. 6148 January 22, 2013Mae Jansen DoroneoNo ratings yet

- HistoryDocument12 pagesHistoryAnand YadavNo ratings yet

- Sales Parties To A Contract of SaleDocument7 pagesSales Parties To A Contract of SaleCharles Roger RayaNo ratings yet

- WWL Construction 2022 v3Document178 pagesWWL Construction 2022 v3Ryan Denver MendesNo ratings yet

- Rural Bank of Makati vs. MakatiDocument7 pagesRural Bank of Makati vs. Makaticmv mendozaNo ratings yet

- Chapter 5 PuglieseDocument11 pagesChapter 5 PuglieseKhalid Hussein SharifNo ratings yet

- Domingo Vs RubioDocument2 pagesDomingo Vs RubioClaudine GolangcoNo ratings yet

- (All) Roman Institutes OCR HLDocument622 pages(All) Roman Institutes OCR HLCheeseman3749No ratings yet

- Crim Pro CasesDocument71 pagesCrim Pro CasesAngelGempNo ratings yet

- Resume of Marvin Krislov, Finalist For University of Iowa PresidentDocument5 pagesResume of Marvin Krislov, Finalist For University of Iowa PresidentdmronlineNo ratings yet

- Armovit vs. CADocument3 pagesArmovit vs. CAMj BrionesNo ratings yet

- Abatement of NuisanceDocument4 pagesAbatement of NuisanceXhain Psypudin67% (6)

- Advertising Agreement Template - Download Free SampleDocument19 pagesAdvertising Agreement Template - Download Free SampleEng Simon Peter NsoziNo ratings yet

- Supplemental Complaint Affidavit - Tongpalen.2018Document6 pagesSupplemental Complaint Affidavit - Tongpalen.2018black stalkerNo ratings yet

- STRONGHOLD INSURANCE CO. INC. vs. CADocument2 pagesSTRONGHOLD INSURANCE CO. INC. vs. CAJoan Eunise FernandezNo ratings yet

- Sundesa v. Tabletops Unlimited - ComplaintDocument9 pagesSundesa v. Tabletops Unlimited - ComplaintSarah BursteinNo ratings yet

- Sanicovs PeopleDocument3 pagesSanicovs PeopleZaira Gem GonzalesNo ratings yet

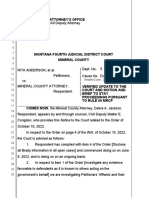

- Update To The Court - County Attorney's OfficeDocument5 pagesUpdate To The Court - County Attorney's OfficeNBC MontanaNo ratings yet

- Agustin Vs CADocument3 pagesAgustin Vs CAbebebaaNo ratings yet

- Govino v. Goverre - ComplaintDocument121 pagesGovino v. Goverre - ComplaintSarah BursteinNo ratings yet

- 19 AMJUR TRIALS On Suing A Decedants EstateDocument93 pages19 AMJUR TRIALS On Suing A Decedants EstateDUTCH551400No ratings yet

- Azuela V CA and CastilloDocument2 pagesAzuela V CA and CastilloGillian Calpito100% (2)

- Rule 118: Pre - Trial: Criminal Procedure Notes (2013 - 2014) Atty. Tranquil SalvadorDocument3 pagesRule 118: Pre - Trial: Criminal Procedure Notes (2013 - 2014) Atty. Tranquil SalvadorRache GutierrezNo ratings yet

- Credit OwnDocument1 pageCredit OwnLuis Miguel PedemonteNo ratings yet