Professional Documents

Culture Documents

Introduction

Uploaded by

AvniMalikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction

Uploaded by

AvniMalikCopyright:

Available Formats

. Introduction India is the fastest growing paint market in Asia Pacific. Indias paint industry size is estimated to be 3.5bn.

The following paints are available in the market Acoustic Paints Resin Paints (Alkyd) Dripless Paints Latex Paints Single Coated Paints PrimeryRubber based Paints Texture oriented Paints The decorative paints to industrial paints ratio is 70:30 both in value and volumeterms. Almost half of the revenues earned by the Indian paint industry are throughenamels. The demand in the paint industry is seasonal to some extent. While the demanddips in the monsoon season, it is the maximum in the festive season. 3. Growth Market has been growing on average 15 % annually during thelast five years and thus it is growing 1.5-2.0 times faster thanGDP. The expected CAGR is 13-15 % for the period FY11-13. 30 % of the paint business is comprised of new constructionprojects. The paint industry growth drivers are: Repainting demand fuelled by the real estate boom over the past fewyears Changing consumer preferences, from pure aesthetics to value addedfeatures Raising demand for industrial paints The organized section of the industry is growing faster thanthe unorganized sector. 4. Decorative Paints The key drivers of decorative paints are Robust economic growth leading to higher disposable income Continued growth in real estate Change in perception towards painting Launch of affordable houses Shift in demographic profile resulting in increase in number ofhouseholds Various innovations by market players 5. Industrial Paints The Industrial Paint Segment isdominated by organized sector. Automotive paint form approx. 45 %of industrial paints. Performance coating forms approx.25 % of industrial paints. Consumer durables and auto ancillaryproducts use power coating. Coil coating are used in industrialconstructions, electric equipment andinteriors of trains & buses.45%25%15%15%Industrial Paint SegmentAuto paintsProtectiveCoatingsPowerCoatingsOtherIndustrialCoatings 6. Major Players The unorganised sector with about2,000 units having small and mediumsized manufacturing plants controlsaround 35 % of the paint market. Out of the rest, most is controlled by thetop 5 companies and they are: Asian Paints (Overall market leader due toleadership in decorative segment) Kansai Nerolac (Market leader in automobileindustrial paint segment, also into decorativesegment) Berger Paints (Major revenue from decorativesegment, also into industrial paints) AkzoNobel (Major revenue from decorativesegment, also into automotive paints) Shalimar Paints (Mainly into decorative andnon-automobile industrial coatings)33%11%11%6%3%36%Market ShareAsian PaintsBerger PaintsKansaniNerolacICI (AkzoNobel)ShalimarPaintsUnorganisedSector &others 7. Opportunities Indian GDP is expected to grow 8.5-9.0 % annually thenext few years. Because of the high correlation betweenGDP and paint volume growth, decorative paints areexpected to grow on the back of strong economicmomentum. Real estate boom in the past few years will lead to strongdemand for repainting. At the moment the per capita consumption of paint inIndia is merely around 1 kg (20 kg in the developedcountries, global average 15 kg) so the absoluteconsumption of paint in India is expected to rise. The paint demand in tier II and tier III cities is growing ata faster rate than the tier I cities. Expected decrease in the use of distemper in future. 8. Key challenges All the manufacturers have their own manufacturing unitsto maintain the quality. Paints have high volume-to-value ratio and requiremanufacturing near the market. Entry barrier is very high because the top five playershave maintained market share despite of entry of

newforeign players. Outsourcing is limited and only for the low-end paints. The competition in the paint industry is becoming moreintense with the entry of new foreign players like Jotun,Nippon & Sherwin Williams. Crude prices have been in an upswing and this is raisingthe cost burden of the industry players.

CHAPTER-I INTRODUCTION Industry origin and growth:The earliest paint factory in India dates back to 1902, when Shalimar Paints, Colour & VarnishCompany, A Pinchin Johnson unit, was established at Calcutta. Growing industrialization,expansion of the railways and introduction of electric power a couple of years earlier had all kept business confidence soaring high. However, this did not provide a ready and expanding market for the nascent paint industry then. Imports from Britain continued to swarm the market and rawmaterials were not easy to come by. The industry still consisting of one lone unit went through arather prolonged period of infancy, till the World War II brought in dramatic opportunities. Withthe stoppage of imports owing to war conditions, the domestic market at last became almost theexclusive reserve of the domestic industry. European manufacturers, hitherto exporting to India,readily saw the advantages of setting up manufacturing facilities here. The period between thewars thus saw the greatest ever influx of foreign paint companies into India- Goodlass Wall(1918), Elphant Oil Mills (1917) in Bombay, and British Paints, Jenson & Nicholson andMacfarlances in Calcutta. Macfarlanes was brought over by the Poddars and became a completelyIndian company, while the other three: Shalimar Paints (Pinchin Johnson), British Paints andJenson Nicholson continued as British operated units.While talking about the post independent development of the Paint industry in India,mention must be made of Asian Paints, a completely Indian unit which started on a very smallscale, grew so big and so beyond recognition over the years that it is today not only the largest unitin India but way ahead of the second largest, Kansai (Goodlass) Nerolac Paints Ltd., formerly aunit of Goodlass Wall (UK).Besides Asian Paints, numerous factories, wholly Indian in ownership and with rare exceptions intechnology as well were set up in Calcutta, Kanpur and Bombay. The British units, though a few innumber, were technically strong and financially sound and, with the active support and patronageof the Government, controlled a vastly higher share of the market. The post independence periodwitnessed a steady growth in the paint industry. From a mere Rs.200 million turnover in 1950, the paint industry crossed the Rs.14000 million mark in 1990-91.

But even in this period, paints were considered a luxury item. Only people with high incomes wereexpected to decorate their houses with the use of paints. Paints, as a protective element, weretotally unheard of. The industrial segment, which was traditionally a low user of paints, vis-visi t s c o u n t e r p a r t s i n t h e d e c o r a t i v e s e g m e n t , t o o c o n t r i b u t e d t o t h i s n o t i o n . I n l i n e w i t h t h i s misconceived notion, the government drastically increased duties on paints in the early ninetieswith an aim to bolster exchequer

revenues. The result was obvious. This inevitably brought about ad o w n t u r n i n t h e f o r t u n e s o f t h e i n d u s t r y. T h e p r o d u c t s , w h i c h a r e h i g h l y p r i c e e l a s t i c , s a w a negative growth rate of 20 % in 1991-92. The next year was also not good, registering a growth of only 2%, bringing it back to the 1990-91 level, thus corroborating the fact that the industry neededlower excise levels to grow. The industrial slowdown during that periodalso did not help matters.In line with the liberalized policies and the realization that paints are not necessarily a luxury item,duties were progressively reduced from 1993-94.This squared growth as most companies passed on duty reductions. Further, the entry of worldmajors in the automobile and white goods market in India since 1993 helped the market to expand.D e m a n d f o r a u t o p a i n t s s h o t u p s u d d e n l y. F o r m a m o d e s t 8 % g r o w t h r a t e i n 1 9 9 3 - 9 4 , p a i n t demand touched 12% in 199596.R a p i d i n d u s t r i a l i z a t i o n a n d i m p r o v e m e n t s i n t h e i n f r a s t r u c t u r e s u c h a s t r a n s p o r t , e n e r g y a n d communication during the last decade gave a further fillip to the growth of the paint industry.Aided by Governments liberal policy of technology import, the automotive and consumer durablesegments expanded phenomenally, with a flurry of foreign collaboration. Increased demand for decorative, protective and functional coatings was a natural fall out, which brought, in its stride, ahost of indigenous developments as well as the injection of new technology.

History :- Paint has been used by mankind since its origin. The evidence can be found in the cave paintings. The Chinese are considered to be the pioneers of manufacturing paints thousands of years ago. In modern times paint is made artificially and is used in many different ways. There arethree basic things required to make paint. You need a Pigment to get the exact color you wantBinder to hold the paint together Thinner so that it can be applied easily.Types of PaintsThere are different types of paints available today. Till the 19th century the word paint was used to describe oil-bound types only. The paints bound with glue were called distemper.For farmhouses and cottages an alternative was found and was called lime wash or color wash.Different things need different paints. The interior of the house is painted by different type of paintthan the exterior of the house. Automobiles use different type of paint. The industrial paint isd i f f e r e n t t h a n m a r i n e p a i n t . N o w c o l o r s a r e m a d e b y u s i n g d i f f e r e n t i n g r e d i e n t s f o r s p e c i f i c surfaces.For example enamel paint, when dries it becomes especially hard and usually has glossy finish.The term enamel paint today means hard surfaced paint and usually it is used in reference to paintfloor coatings of a gloss finish or spray paints. It can be used for concrete, stairs, porches and patios. Fast dry enamel is ideal for refrigerators, counters and other industrial finishes. High-tempenamel may be used for engines, brakes and exhaust. Enamel is also used on wood to make itwater resistant.The Indian Paint IndustryIn India, Indian Paint industrys total market size is US$1400 million.The organized sector of the industry is 55%. The 45% unorganized sector has about 2500 units.The big players and their market share-

value of the organized sector are Asian Paints 37% Goodlass Nerolac 15.9% Berger Paints 13.8% ICI 11% Jenson & Nicholso n 5.7% Shalimar 4% Others 12%The market segment is divided into two sectors. Architec tural70% Industrial 30%The total volume of the market is 600,000 MT.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Permit Receiver - Issuer Competency ExamDocument2 pagesPermit Receiver - Issuer Competency ExamSubzone ThreeNo ratings yet

- CV Dourhri Anouar - English - April 2012Document2 pagesCV Dourhri Anouar - English - April 2012aanouar77No ratings yet

- E 10231Document1,024 pagesE 10231Gab AntNo ratings yet

- Step Back 5x5 PresentationDocument8 pagesStep Back 5x5 Presentationtim100% (1)

- Saep 125Document9 pagesSaep 125Demac SaudNo ratings yet

- Third Party Logistics Providers Typically Specialize in Integrated OperationDocument3 pagesThird Party Logistics Providers Typically Specialize in Integrated Operationjsofv5533No ratings yet

- 9d28939de23952ae026dc6a4a5584db6Document69 pages9d28939de23952ae026dc6a4a5584db6rathorsumit2006No ratings yet

- Well Testing BrochureDocument24 pagesWell Testing BrochureFabricetoussaint100% (1)

- FMEA Nasa SpacecraftDocument12 pagesFMEA Nasa SpacecraftsashassmNo ratings yet

- BV Service Sheet - in Shop - Steel InspectionDocument2 pagesBV Service Sheet - in Shop - Steel Inspectionsivagnanam sNo ratings yet

- BS 5656-1Document32 pagesBS 5656-1Atif NaveedNo ratings yet

- Airwork Helicopter Maintenance 3Document8 pagesAirwork Helicopter Maintenance 3subha_aeroNo ratings yet

- P3 Summary ModelsDocument4 pagesP3 Summary ModelsMahfuzah MjNo ratings yet

- Ovr Dossier.Document93 pagesOvr Dossier.suria qaqcNo ratings yet

- Section 334626 - Filter FabricsDocument3 pagesSection 334626 - Filter Fabricsabdullah sahibNo ratings yet

- Risk Assessment DAWRA001R4 Loading Unloading Vehicles 090621Document2 pagesRisk Assessment DAWRA001R4 Loading Unloading Vehicles 090621Danny100% (1)

- Input Rate (Unit/hr) Throughput Rate Output Rate (Unit/hr) Min (Demand, Capacity)Document3 pagesInput Rate (Unit/hr) Throughput Rate Output Rate (Unit/hr) Min (Demand, Capacity)Tanvi S PurohitNo ratings yet

- Fire Risk Assesment-Dave SibertDocument11 pagesFire Risk Assesment-Dave SibertSam OyelowoNo ratings yet

- Pmi-Acp: Agile Continuous ImprovementDocument49 pagesPmi-Acp: Agile Continuous Improvementswati jainNo ratings yet

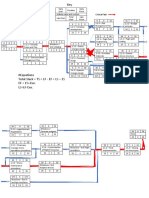

- CPM Method Wilmont's Drone Case PDFDocument2 pagesCPM Method Wilmont's Drone Case PDFRwa Gihuta100% (3)

- 1VAP420002-TG - OEM IT Ref Guide - April2014 PDFDocument110 pages1VAP420002-TG - OEM IT Ref Guide - April2014 PDFflyzalNo ratings yet

- Digi Schmidt 2000 ManualDocument22 pagesDigi Schmidt 2000 ManualBerkah SuprayogiNo ratings yet

- Excel FormulaDocument4 pagesExcel FormulaAmir RashidNo ratings yet

- CV Oil and GasDocument6 pagesCV Oil and Gaszameer malikNo ratings yet

- Mini Dual-Drive Bowden Extruder Installation Instructions: Check All The Components in The Package For IntactnessDocument12 pagesMini Dual-Drive Bowden Extruder Installation Instructions: Check All The Components in The Package For IntactnessPedro R.No ratings yet

- E Voting GanttDocument2 pagesE Voting Ganttpikes89No ratings yet

- Presentation On Airport Authority of India.Document35 pagesPresentation On Airport Authority of India.Aditi Parnami100% (1)

- WAE200 Pre-Course Review ActivitiesDocument36 pagesWAE200 Pre-Course Review ActivitiesJoel Kionisala50% (2)

- Woven Wire Test Sieve Cloth and Test Sieves: Standard Specification ForDocument9 pagesWoven Wire Test Sieve Cloth and Test Sieves: Standard Specification ForGraham StokesNo ratings yet

- MS 51 Previous Year Question Papers by IgnouassignmentguruDocument72 pagesMS 51 Previous Year Question Papers by IgnouassignmentguruAravind MoluguNo ratings yet