Professional Documents

Culture Documents

Companies Act - CSR

Uploaded by

Abhishek S AatreyaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Companies Act - CSR

Uploaded by

Abhishek S AatreyaCopyright:

Available Formats

K.

VAITHEESWARAN

ADVOCATE & TAX CONSULTANT

Mobile: 98400-96876 E-mail : askvaithi@yahoo.co.uk, vaithilegal@yahoo.co.in

Flat No.3, First Floor, No.9, Thanikachalam Road, T. Nagar, Chennai - 600 017, India Tel.: 044 + 2433 1029 / 4048 402, Front Wing, House of Lords, 15/16, St. Marks Road, Bangalore 560 001, India Tel : 080 22244854/ 41120804

A number of corporates spend significant amounts of money on social and charitable projects. Many companies have contributed to the development of the area in which they are located through non-mandated CSR spending. Under Article 38(2) of the Constitution dealing with Directive Principles of State Policy, the State has to strive to minimize inequalities of income and eliminate inequalities in status, facilities, opportunities amongst individuals as well as groups of people.

Section 135 is yet to be officially notified even though there is a unnumbered scanned notification dated 27.02.2014 in the website specifying 01.04.2014 as the date on which Section 135 and Schedule VII shall come into force. Section 467 enables the Government to alter any Schedules, Regulations through Notification and Section 467 has come into force vide SO No.2754(E) dated 12.09.2013. An un-numbered Notification dated 27.02.2014 is available in the website which has substituted Schedule VII. The Companies (Corporate Social Responsibility Policy) Rules, 2014 have been notified vide Notification dated 27.02.2014, in exercise of powers conferred under Section 135(1) and Section 469 (un-numbered). The Rules are effected from 01.04.2014.

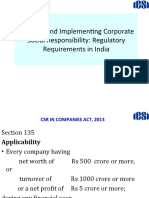

Every company having :

Net worth of Rs. 500 crores or more, or Turnover of Rs. 1000 crores or more; or Net profit of Rs. 5 crores or more during any financial year, shall constitute a

Corporate Social Responsibility (CSR) Committee of the Board consisting of 3 or more directors, out of which at least one director shall be an independent director.

Board report to disclose composition of CSR Committee.

The CSR Committee shall have the following functions: (a) Formulate and recommend to the Board, a CSR Policy indicating the activities to be undertaken by the company as specified in Schedule VII; (b) Recommend expenditure to be incurred on the activities referred to in clause (a); and (c) Monitor CSR Policy of the company from time to time.

The Board has to consider recommendations of the CSR Committee; approve the CSR Policy; The Board has to disclose the contents of the Policy in its report and also place it in the Companys website if any, in such manner as may be prescribed. Rule 8 of the CSR Rules, 2014 provides that the Boards report of a Company covered under the Rule pertaining to the financial year on or after 01.04.2014 shall include an annual report on CSR containing the particulars specified in the annexure. In respect of foreign companies, the balance sheet filed under Section 381(1)(d) should contain the annexure. Board has to ensure that the activities are undertaken by the Company

Board has to ensure that the company spends, in every financial year, at least 2% of the average net profits of the company made during the 3 immediately preceding financial years, in pursuance of its CSR Policy. The company can give preference to the local area and areas around it where it operates, for spending the amount earmarked for CSR activities. In case of failure to spend such amount, the Board shall in its report made under Section 134(3)(o) specify the reasons for not spending the amount.

Activities relating to:i. Eradicating hunger, poverty and malnutrition, promoting preventive health care and sanitation and making available drinking water; ii. Promoting education, including special education and employment and enhancing vocation skills especially among children, women, elderly and the differently abled and livelihood enhancement projects; iii. Promoting gender equality, empowering women, setting up homes and hostels for women and orphans; setting up old age homes, day care centres and such other facilities for senior citizens and measures for reducing inequalities faced by socially and economically backward groups;

iv.

v.

vi.

vii.

Ensuring environmental sustainability, ecological balance, protection of flora and fauna, animal welfare, agroforestry, conservation of natural resources and maintaining quality of soil, air and water. Protection of national heritage, art and culture including restoration of buildings and sites of historical importance and works of art; setting up public libraries; promotion and development of traditional arts and handicrafts; Measures for the benefit of armed forces veterans, war widows and their dependents; Training to promote rural sports, nationally recognized sports, paralympic sports and Olympic sports;

viii.

ix.

x.

Contribution to the Prime Ministers National Relief Fund or any other fund set up by the Central Government for socio-economic development and relief and welfare of the Scheduled Castes, the Scheduled Tribes, other backward classes, minorities and women; Contributions or funds provided to technology incubators located within academic institutions which are approved by the Central Government; Rural development projects.

Rule 2(c) of the CSR Rules, 2014 defines CSR as under:CSR means and includes but is not limited to (i) Projects and programmes relating to activities specified in Schedule-VII; or (ii) Projects or programmes relating to activities undertaken by the Board as per recommendations of CSR Committee as per CSR Policy subject to the condition that such policy will cover the subjects enumerated in Schedule-VII.

The Supreme Court in the case of P.Kasilingam & Others Vs. PSG College of Technology has held that the words means and includes indicate an exhaustive explanation of the meaning which for the purpose of this act must invariably be attached to those words or expressions. The Rule has not expanded the ambit of activities and is in fact not specified any other activity.

Drinking water, eradication of poverty, education, vocational education, libraries, cultural activities, sanitation, etc. are all activities which fall in Schedule-XI of the Constitution of India Article 243G provides that the State may endow the Panchayat by law, the power and authority for implementation of schemes for economic development and social justice including those specified in Schedule-XI. Water supply, public health, urban poverty alleviation, cultural aspects, public amenities find place in Schedule-XII of the Constitution of India. Article 243W provides that the State may endow the Municipality by law, the power and authority for implementation of schemes for economic development and social justice including those specified in Schedule-XII.

Is the corporate sector being compelled to do what the State has to do? Can there be a law made by the Parliament mandating CSR activities in these segments when these activities are referred to in Article 243G and 243W?

Section 135 refers to net worth of Rs.500 crores Section 2(57) defines net worth to mean aggregate of paid up share capital; reserves out of profits and share premium account after deducting accumulated losses, deferred expenditure not written off as per audited balance sheet but does not include reserves created out of revaluation of assets write back of depreciation and amalgamation.

Section 135 refers to turnover of Rs.1000 crores Section 2(91) defines turnover to mean the aggregate value of the realisation of amount made from sale, supply or distribution of goods or on account of services rendered or both by a company during a financial year.

Section 135 refers to net profit of Rs.5 crores Section 135(5) provides that the Board shall ensure that every company spends in every financial year at least 2% of the average net profits of the company made during the 3 immediately preceding financial years.

Credits shall be given to

bounties

and subsidies received from any Government, or any public authority constituted or authorized in this behalf, by any Government

Credits shall not be given to

Profits by way of premium on shares or debentures of the

company, which are issued or sold by the company; Profits on sales of forfeited shares; Capital Profits including profits from sale of undertaking(s) of the company or of any part thereof;

Credits shall not be given to (Cont)

Profits from sale of any immovable property or fixed assets of a capital

nature comprised in the undertaking (s) of the company, unless the business of the company consists, whether wholly or partly, of buying and selling any such property or assets: Provided that where the amount for which any fixed asset is sold exceeds the WDV thereof, credit shall be given for so much of the excess as is not higher than the difference between the original cost of that fixed asset and its WDV ; Any change in carrying amount of an asset or of a liability recognized in equity reserves including surplus in P&L account on measurement of the asset or the liability at fair value

The following sums shall be deducted, namely:

All the usual working charges; Directors remuneration; Bonus or commission paid or payable to any member of the companys staff, or to any engineer, technician or person employed or engaged by the company, whether on a whole-time or on a part-time basis; Any tax notified by the Central Government as being in the nature of a tax on excess or abnormal profits; Any tax on business profits imposed for special reasons or in special circumstances and notified by the Central Government in this behalf; Interest on debentures issued by the company; mortgages executed by the company and on loans and advances secured by a charge on its fixed or floating assets; on unsecured loans and advances; Expenses on repairs, whether to immovable or to movable property, provided the repairs are not of a capital nature; Outgoings inclusive of contributions made under section 181; Depreciation to the extent specified in section 123;

The following sums shall be deducted, namely (Cont):

Excess of expenditure over income, which had arisen in computing the

net profits in accordance with this section in any year which begins at or after the commencement of this Act, in so far as such excess has not been deducted in any subsequent year preceding the year in respect of which the net profits have to be ascertained; Compensation or damages to be paid in virtue of any legal liability including a liability arising from a breach of contract; Sum paid by way of insurance against the risk of meeting any liability such as is referred to above; Debts considered bad and written off or adjusted during the year of account.

The following sums shall not be deducted:

Income-tax and super-tax payable by the company under the

Income-tax Act, 1961, or any other tax on the income of the company; any compensation, damages or payments made voluntarily; Capital loss including loss on sale of the undertaking (s) of the company or of any part thereof not including any excess of the WDV of any asset which is sold, discarded, demolished or destroyed over its sale proceeds or its scrap value; any change in carrying amount of an asset or of a liability recognised in equity reserves including surplus in P&L account on measurement of the asset or the liability at fair value.

Sec. 198 refers to the calculation of net profit in any financial year. Company falling under CSR mandate is required to spent at least 2% of the average net profit of the company made during the three immediately preceding years in pursuance of its CSR Policy.

While Sec. 198 refers to calculation of net profit, Rule 2(f) also refers to net profit. Net profit means the profit of a company as per its financial statements prepared in accordance with applicable provisions of the Act but shall not include (i) Profit from any overseas branch or branches of the company whether operated as a separate company or otherwise; (ii) Any dividend received from other companies in India which are covered under and complying with the provisions of Sec. 135. If net profit for a financial year has been prepared as per 1956 Act the same is not required to be recalculated under the 2013 Act.

Every company including its holding company or subsidiary and a foreign company having its branch office or project office in India which fulfills the criteria specified in Sec. 135(1) shall company with the provisions of Section 135 and these Rules. If a company ceases to be covered under Sec.135(1) for three consecutive financial years, it shall not be required to constitute the CSR Committee or company with Sec.135 till it meets the criteria set out in Sec.135(1).

CSR Activities should be undertaken as per the CSR Policy as projects or programs or activities (either new or ongoing) excluding activities undertaken in pursuance of its normal course of business. Board can decide to undertake the approved CSR activities through a registered trust or registered society or a company established by the Company or its holding or subsidiary or associate company under Sec.8 (Sec. 8 deals with companies formed with charitable objects) If Trust, etc. is not established by the Company, etc. it must have an established track record of three years in undertaking similar projects or programmes.

CSR projects or programs or activities undertaken in India alone shall amount to CSR expenditure. Activities that benefit only the employees of the company and their families shall not be considered as CSR activities. Contribution of amount directly or indirectly to any political party under Section 182 shall not be considered as CSR. Contribution through a political party pursuant to 293A of the 1956 Act was considered as an outgoing in computation of net profit under Section 349 of the 1956 Act vide Circular dated 08.01.1962. Section 198 refers to outgoings inclusive of contributions made under Section 181 and does not refer to 182.

An unlisted public company or a private company not required to appoint an independent director under Sec. 149(4) can have a CSR Committee without independent director. A private company having only two directors can constitute CSR Committee with two such directors. In respect of a foreign company, CSR Committee shall comprise of at least 2 persons of which one person shall be specified under Section 380(1)(d) and another nominated by the foreign company.

The report of the Board of Directors to be placed in the General Meeting to include the details about the policy developed and implemented by the company on CSR initiatives taken during the year. While preparing the Statement of Profit and Loss, A Company shall disclose by way of notes additional information amount of expenditure incurred on CSR activities

The new Schedule-VII is much wider and general compared to old Schedule-VII. Education, environmental sustainability, technology incubators, employment enhancing vocational skills are all good activities. Companies can focus on skill related activities and develop talent pool in their area. Poverty alleviation initiatives creates goodwill Current spends can also fit into CSR subject to meeting the requirements.

Impact on profit Calculation pains Additional compliance costs Bonafides of organizations receiving the money End-use misappropriations Vs. Increase in cost due to constant monitoring of end-use.

CSR has remained a controversial subject across the world Countries like Sweden, Norway, Netherlands, France and Australia mandated CSR reporting India has walked the extra mile and legislated mandatory CSR activities as well as reporting Looks like India is the first country to mandate CSR through legislation. This is the first step and it is likely that the law will develop further when CSR spend does not happen

Hard earned money goes for community development which is the responsibility of the State. Companies are already paying huge taxes by way of Income Tax, Excise, CST, VAT, Service Tax, Customs Duty, Entry Tax apart from various fees and levies.

What sort of explanations can be given in case the Company does not spend on CSR? What happens if there is a social cause which does not fit into Schedule-VII? Is training promotion of education?

Can the mandatory requirement of CSR expenditure be considered as a tax? Justice Holmes of the US Supreme Court said that tax is the price which we pay for a civilized society. Article 265 provides that no tax shall be levied or collected except by authority of law. Mandatory 2% to be spent on social welfare activities through law Can it be seen as a tax on profits and if so can it be through the Companies Act? Will this not amount to an increase in corporate tax rate indirectly? The profits of the Company suffer income tax; dividend distribution attracts DDT and these taxes are available to the Government for carrying out these activities. By making the companies incur CSR through law, can it be perceived as an indirect levy?

Corporates are already engaged in CSR. Mandated CSR creates issues of perfunctory compliance as against dedicated CSR. Controls and costs Judgmental errors Misuse by local groups Local politics Misuse by corporate sector

K.VAITHEESWARAN

ADVOCATE & TAX CONSULTANT

Mobile: 98400-96876 E-mail : askvaithi@yahoo.co.uk vaithilegal@yahoo.co.in

Flat No.3, First Floor, No.9, Thanikachalam Road, T. Nagar, Chennai - 600 017, India Tel.: 044 + 2433 1029 / 4048 402, Front Wing, House of Lords, 15/16, St. Marks Road, Bangalore 560 001, India Tel : 080 22244854/ 41120804

You might also like

- Report 03Document36 pagesReport 03Akhil Berad ABNo ratings yet

- Twinings CSR PolicyDocument5 pagesTwinings CSR PolicyPyramid BalerNo ratings yet

- CSR Policy PDFDocument7 pagesCSR Policy PDFRAJAT SINGHNo ratings yet

- Report On CSRDocument9 pagesReport On CSRVinay VimalNo ratings yet

- Corporate Social ResponsibilityDocument3 pagesCorporate Social Responsibilitysakshi chauhanNo ratings yet

- Corporate Social Responsibility (Section-135) : by Akhil Kodam 20464Document24 pagesCorporate Social Responsibility (Section-135) : by Akhil Kodam 20464Kodam AkhilNo ratings yet

- Corporate Social Responsibility PolicyDocument5 pagesCorporate Social Responsibility PolicyRaaj SinghNo ratings yet

- Franklin India CSR PolicyDocument7 pagesFranklin India CSR PolicyBhomik J ShahNo ratings yet

- Corporate Social Responsibility Policy: Exide Industries LimitedDocument7 pagesCorporate Social Responsibility Policy: Exide Industries LimitedMuskan ManchandaNo ratings yet

- Corporate Social ResponsibilityDocument33 pagesCorporate Social ResponsibilitySharma VishnuNo ratings yet

- Corporate Social Responsibility - FiinovationDocument2 pagesCorporate Social Responsibility - FiinovationInnovative Financial Advisors Pvt.ltdNo ratings yet

- Module 03Document15 pagesModule 03Deepika SoniNo ratings yet

- Company Law CIA III CSRDocument6 pagesCompany Law CIA III CSRVedant GoswamiNo ratings yet

- Planning and Implementing Corporate Social Responsibility: Regulatory Requirements in IndiaDocument23 pagesPlanning and Implementing Corporate Social Responsibility: Regulatory Requirements in IndiaMuskan ManchandaNo ratings yet

- Legal Aspects of Business Corporate Social Responsibility: Management Development Institute, GurgaonDocument10 pagesLegal Aspects of Business Corporate Social Responsibility: Management Development Institute, GurgaonGautam BindlishNo ratings yet

- Corporate Social ResponsibilityDocument3 pagesCorporate Social ResponsibilityabcNo ratings yet

- Bda CSRDocument12 pagesBda CSRtejanshbirthday1No ratings yet

- LGPI CSR Policy PDFDocument6 pagesLGPI CSR Policy PDFnswain76No ratings yet

- Markem Imaje India CSR PolicyDocument6 pagesMarkem Imaje India CSR PolicyAzim KhanNo ratings yet

- CSR Policy New JBMLDocument7 pagesCSR Policy New JBMLKimmi KatariaNo ratings yet

- Corporate Social Responsibility. - (1) Every Company Having Net Worth of Rupees FiveDocument2 pagesCorporate Social Responsibility. - (1) Every Company Having Net Worth of Rupees FiveAmit NandanNo ratings yet

- Preamble: Corporate Social Responsibility (CSR) Policy of Anik Industries LimitedDocument4 pagesPreamble: Corporate Social Responsibility (CSR) Policy of Anik Industries LimitedSeshangNo ratings yet

- UTIITSL - CSR Policy - Revised 9th January 2021Document8 pagesUTIITSL - CSR Policy - Revised 9th January 2021Mukesh CinnaNo ratings yet

- SMEL Policy Doc CSR PolicyDocument7 pagesSMEL Policy Doc CSR Policyrounak sahuNo ratings yet

- Company CSR Policy As Per Section 135 (4) - 24072018Document6 pagesCompany CSR Policy As Per Section 135 (4) - 24072018rajesh uluwatuNo ratings yet

- CSR Policy Web Site VersionDocument6 pagesCSR Policy Web Site VersionsooricivilNo ratings yet

- Delivery Crs PolicyDocument7 pagesDelivery Crs Policyasif_rahman06No ratings yet

- CSR Policy FinalDocument4 pagesCSR Policy FinalNaresh khandelwalNo ratings yet

- CSR Orient FashionDocument3 pagesCSR Orient FashionmyloveispureNo ratings yet

- Corporate Social Responsibility 2013Document8 pagesCorporate Social Responsibility 2013sanjeevseshannaNo ratings yet

- CSR Unit ViDocument6 pagesCSR Unit Vilabani.gh01No ratings yet

- ApplicabilityDocument4 pagesApplicabilityvasantharaoNo ratings yet

- CSR - A Panoramic View - DR Bhasker ChatterjiDocument39 pagesCSR - A Panoramic View - DR Bhasker ChatterjicodemakitNo ratings yet

- DBS Bank CSR Policy PDFDocument10 pagesDBS Bank CSR Policy PDFArun KumarNo ratings yet

- Corporate Social Responsibility in India Amity ProjectDocument4 pagesCorporate Social Responsibility in India Amity ProjectSanjay GroverNo ratings yet

- R K Marble CSR PolicyDocument9 pagesR K Marble CSR PolicyAbhimanyu Singh BhatiNo ratings yet

- Corporate Social Responsibility PolicyDocument4 pagesCorporate Social Responsibility PolicyAbhishek MauryaNo ratings yet

- Public Sector Accounting II Lecture NoteDocument65 pagesPublic Sector Accounting II Lecture NoteAtunbi AgnesNo ratings yet

- ESG NotesDocument16 pagesESG Notesdhairya.h22No ratings yet

- Wingify Corporate Social Responsibility PolicyDocument7 pagesWingify Corporate Social Responsibility PolicyHRISHIKESH DASNo ratings yet

- CSR Policy: HCL Technologies Limited Corporate Social Responsibility PolicyDocument3 pagesCSR Policy: HCL Technologies Limited Corporate Social Responsibility PolicyMittal Kirti MukeshNo ratings yet

- Corporate Social Responsibility (CSR) Policy 1. PreambleDocument6 pagesCorporate Social Responsibility (CSR) Policy 1. PreambleRitika sharmaNo ratings yet

- Omnibus Investment CodeDocument31 pagesOmnibus Investment CodeAllen PonceNo ratings yet

- Policy For Corporate Social Responsibility (CSR) : PreambleDocument3 pagesPolicy For Corporate Social Responsibility (CSR) : PreambleHarshit GoyalNo ratings yet

- SpendingDocument269 pagesSpendingTommyNo ratings yet

- Financial Technologies (India) Limited CSR PolicyDocument8 pagesFinancial Technologies (India) Limited CSR PolicyBhomik J ShahNo ratings yet

- CorpDocument3 pagesCorpMuskan KhatriNo ratings yet

- Scheme For Startup Policy 2016 21Document29 pagesScheme For Startup Policy 2016 21raman00119168No ratings yet

- CSR PolicyDocument6 pagesCSR PolicyAmish GangarNo ratings yet

- How To Register Your CooperativeDocument10 pagesHow To Register Your CooperativeGINA OCHONo ratings yet

- CSR PolicyDocument3 pagesCSR PolicyAshok GNo ratings yet

- Decoding Section 135, The CSR Clause in The Companies Act 2013Document18 pagesDecoding Section 135, The CSR Clause in The Companies Act 2013Chhavi KhuranaNo ratings yet

- What Is CSR? Whats Are Its Features? Describe The Provisions of CSR in Companies Act 2013. Explain The Composition of CSR CommitteeDocument5 pagesWhat Is CSR? Whats Are Its Features? Describe The Provisions of CSR in Companies Act 2013. Explain The Composition of CSR CommitteeNevidita BhengraNo ratings yet

- OPaL CSR & Sustainability Report - Engaging in A Larger RoleDocument10 pagesOPaL CSR & Sustainability Report - Engaging in A Larger Roleanupma.26novNo ratings yet

- Wage Order No. ROVII-18Document12 pagesWage Order No. ROVII-18nia0323No ratings yet

- 0205 - Pragati - Verma - Assignment - 2 - Pragati VermaDocument6 pages0205 - Pragati - Verma - Assignment - 2 - Pragati VermaAKSHAT SINGHNo ratings yet

- Scheme of Grant-VNSDocument33 pagesScheme of Grant-VNSVeeresh SavadiNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- Loan ApplicationDocument5 pagesLoan ApplicationAbhishek S AatreyaNo ratings yet

- Prakriya Hospitals Investor Brochure - 2019Document19 pagesPrakriya Hospitals Investor Brochure - 2019Abhishek S AatreyaNo ratings yet

- Prakriya Hospitals Investor Brochure - 2019Document19 pagesPrakriya Hospitals Investor Brochure - 2019Abhishek S AatreyaNo ratings yet

- IKS Calendar2021 PDFDocument14 pagesIKS Calendar2021 PDFMahesh Daxini Thakker100% (1)

- Greement HIS Greement Made AND Executed AT ON This DAY OF Y AND EtweenDocument16 pagesGreement HIS Greement Made AND Executed AT ON This DAY OF Y AND EtweenAbhishek S AatreyaNo ratings yet

- Fresh Vegetables Poster-WPS OfficeDocument1 pageFresh Vegetables Poster-WPS OfficeAbhishek S AatreyaNo ratings yet

- Mijoss Price List PDFDocument1 pageMijoss Price List PDFAbhishek S AatreyaNo ratings yet

- Yellow Hand-Painted Creative Hiring Poster-WPS Office PDFDocument1 pageYellow Hand-Painted Creative Hiring Poster-WPS Office PDFAbhishek S AatreyaNo ratings yet

- ARIS WholesaleDocument2 pagesARIS WholesaleAbhishek S AatreyaNo ratings yet

- Ar Infinite SolutionDocument2 pagesAr Infinite SolutionAbhishek S AatreyaNo ratings yet

- AR Infinite SolutionDocument16 pagesAR Infinite SolutionAbhishek S AatreyaNo ratings yet

- Fresh Vegetables Poster-WPS Office PDFDocument1 pageFresh Vegetables Poster-WPS Office PDFAbhishek S AatreyaNo ratings yet

- Customer:: Item Name Unit QuantityDocument2 pagesCustomer:: Item Name Unit QuantityAbhishek S AatreyaNo ratings yet

- Mijoss Price List PDFDocument1 pageMijoss Price List PDFAbhishek S AatreyaNo ratings yet

- Vedanth Vayun Quotation PDFDocument1 pageVedanth Vayun Quotation PDFAbhishek S AatreyaNo ratings yet

- 2011 Blossom 15 Petal 1 PDFDocument18 pages2011 Blossom 15 Petal 1 PDFSai Ranganath BNo ratings yet

- Online Business Banner-WPS Office PDFDocument1 pageOnline Business Banner-WPS Office PDFAbhishek S AatreyaNo ratings yet

- Date of Mahabharata War-Vedveer AryaDocument9 pagesDate of Mahabharata War-Vedveer AryaAbhishek S AatreyaNo ratings yet

- Propaganda Photo Poster-WPS Office PDFDocument1 pagePropaganda Photo Poster-WPS Office PDFAbhishek S AatreyaNo ratings yet

- Ar Infinite Solution: QuotationDocument2 pagesAr Infinite Solution: QuotationAbhishek S AatreyaNo ratings yet

- Sandeep Proforma of 15th Sep 2020 PDFDocument2 pagesSandeep Proforma of 15th Sep 2020 PDFAbhishek S AatreyaNo ratings yet

- Yaksha PrashnaDocument41 pagesYaksha Prashnawriterhari100% (2)

- Bridge Course TestDocument4 pagesBridge Course TestAbhishek S AatreyaNo ratings yet

- 17 - Chapter 8 PDFDocument108 pages17 - Chapter 8 PDFAbhishek S AatreyaNo ratings yet

- 17 - Chapter 8 PDFDocument108 pages17 - Chapter 8 PDFAbhishek S AatreyaNo ratings yet

- Chandi Inner MeaningDocument49 pagesChandi Inner MeaningIngerasul_Iubirii100% (1)

- Provisional Selection List of Civil Police Constables of Bangalore DistrictDocument5 pagesProvisional Selection List of Civil Police Constables of Bangalore DistrictAbhishek S AatreyaNo ratings yet

- Pan Card Scan826Document1 pagePan Card Scan826Abhishek S AatreyaNo ratings yet

- QuotationDocument2 pagesQuotationAbhishek S AatreyaNo ratings yet

- Provisional Selection List of Civil Police Constables of Bangalore DistrictDocument5 pagesProvisional Selection List of Civil Police Constables of Bangalore DistrictAbhishek S AatreyaNo ratings yet

- Julius Evola - The Meaning and Function of MonarchyDocument13 pagesJulius Evola - The Meaning and Function of Monarchympbh91No ratings yet

- Aggressive Personalities IIDocument2 pagesAggressive Personalities IISeb SaabNo ratings yet

- Footwear InternationalDocument5 pagesFootwear InternationalNeil CalvinNo ratings yet

- Administration of HarhsaDocument6 pagesAdministration of HarhsaGahininath ShelkeNo ratings yet

- Ramon Magsaysay StoryDocument6 pagesRamon Magsaysay StoryRomeo Javier Jr.No ratings yet

- DOLE Organizational Structure (AO 10 Feb 2017)Document1 pageDOLE Organizational Structure (AO 10 Feb 2017)razamora81_325924543100% (1)

- In Re JuradoDocument3 pagesIn Re JuradoCamille Britanico100% (2)

- REVIEWERDocument51 pagesREVIEWERChristian Daryll CatacutanNo ratings yet

- 39 Calero vs. CarrionDocument13 pages39 Calero vs. CarrionJanine RegaladoNo ratings yet

- DR - Professionalism & EthicsDocument167 pagesDR - Professionalism & EthicsOmarNo ratings yet

- Nicoleta Learning ActvityDocument2 pagesNicoleta Learning ActvityAnonymous Pilots100% (1)

- Action Research FormatDocument7 pagesAction Research FormatRainier G. de JesusNo ratings yet

- Types of Domestic ViolenceDocument6 pagesTypes of Domestic ViolenceNaveedNo ratings yet

- Aliviado vs. Procter - Gamble Phils., Inc., 650 SCRA 400, G.R. No. 160506 June 6, 2011Document23 pagesAliviado vs. Procter - Gamble Phils., Inc., 650 SCRA 400, G.R. No. 160506 June 6, 2011Trea CheryNo ratings yet

- Madurai High Court Judgement 2020Document11 pagesMadurai High Court Judgement 2020Samidurai MNo ratings yet

- Tiny Beautiful Things: Advice On Love and Life From Dear Sugar (Excerpt) by Cheryl StrayedDocument9 pagesTiny Beautiful Things: Advice On Love and Life From Dear Sugar (Excerpt) by Cheryl StrayedVintageAnchor4% (25)

- Bad GeniusDocument3 pagesBad GeniusHaziqah Izam100% (3)

- The Dos Hermanos, 15 U.S. 76 (1817)Document13 pagesThe Dos Hermanos, 15 U.S. 76 (1817)Scribd Government DocsNo ratings yet

- Understanding The FilipinoDocument5 pagesUnderstanding The Filipinoapi-2657097990% (10)

- Desh Apnayen Citizenship Club GuidelinesDocument32 pagesDesh Apnayen Citizenship Club GuidelinesDesh ApnayenNo ratings yet

- The Nature and Scope of Sexual Abuse of Minors by Catholic Priests and Deacons in The United States 1950 2002Document291 pagesThe Nature and Scope of Sexual Abuse of Minors by Catholic Priests and Deacons in The United States 1950 2002John K. Y. ChoiNo ratings yet

- Womenandlaw Wills and Trusts SpitkoDocument67 pagesWomenandlaw Wills and Trusts Spitkoproveitwasme100% (1)

- Mengenal Filsafat Antara Metode Praktik Dan Pemikiran Socrates, Plato Dan AristotelesDocument22 pagesMengenal Filsafat Antara Metode Praktik Dan Pemikiran Socrates, Plato Dan AristotelesAbhimana NegaraNo ratings yet

- Caste, Clas and Politics in IndiaDocument14 pagesCaste, Clas and Politics in IndiaMohammad Azam Alig0% (1)

- Update To SIA 2016Document6 pagesUpdate To SIA 2016limegreensNo ratings yet

- Buenaventura vs. RepublicDocument11 pagesBuenaventura vs. RepublicCarty MarianoNo ratings yet

- Emotional Quotient: The Ability To Understand and Manage Your Own Emotions As Well As Other People's Emotions Around YouDocument8 pagesEmotional Quotient: The Ability To Understand and Manage Your Own Emotions As Well As Other People's Emotions Around YouRachel UttangiNo ratings yet

- 4) What Advantages and Disadvantages Are Associated With The Organization's Culture? How Could The Culture Be Improved?Document4 pages4) What Advantages and Disadvantages Are Associated With The Organization's Culture? How Could The Culture Be Improved?Syed OsamaNo ratings yet

- Understanding of Education According To ExpertsDocument8 pagesUnderstanding of Education According To ExpertsMa'am Ja Nheez RGNo ratings yet

- Torts and DamagesDocument17 pagesTorts and DamagesCons Baraguir100% (1)