Professional Documents

Culture Documents

Voyage Soleil

Uploaded by

jacksonfegfefefsfOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Voyage Soleil

Uploaded by

jacksonfegfefefsfCopyright:

Available Formats

MGT 4070: International Finance Course Instructor: Professor Nishant Dass Midterm Exam 1 17 February 2014

Name: Lee Yao Xin GTID: 903042270

Case Study: Voyages Soleil: The Hedging Decision

Jacques Dupuis, president and owner of Voyages Soleil (VS), faces an important financial decision in determining how he should manage his companys upcoming foreign exchange obligations. This situation arises due to the fact that VS clients paid in Canadian dollars while the hotels in the United States would only accept payment in U.S. dollars. Furthermore, reservations at these hotels had to be booked in April but payment had to be made in October. There were three options being considered: wait and exchange in October; contract forward contracts now; or to borrow Canadian dollars to buy U.S. dollars now and invest them for six months, using the proceeds to pay in October. This case analysis aims to evaluate the options and to present a recommendation with regards to the knowledge and situation at that point in time. Firstly, a brief overview of the economic situation in Canada will be discussed. As a result of the events of 9/11 on the United States, the travel industry, especially air travel, was adversely affected. This can be seen numerically from the statistics that the total number of trips Canadians made to the United States dropped by almost 25 per cent. Specifically, trips by Canadians to Florida and Mexico dropped by 15 and 12 per cent respectively. Part of the decline can also be attributed to the falling value of the Canadian dollar even before 9/11. This downward trend can be observed from Exhibit 2 with the Canadian dollar steadily depreciating against the U.S dollar. A weak Canadian dollar would translate into higher average cost for Canadian tourists and decrease overall consumption in the tour operating industry. Shifting the focus to Quebec, the total volume of the tourism sector declined between 30 to 50 per cent. Consequently, two of Quebecs seven tour operators declared bankruptcy, and the surviving few were competing to attract customers. Minimisation of risk became a huge factor in these uncertain times as companies were unsure of the future demand for tour packages. In deciding which option is best for VS as a whole, two main criteria are employed in the decision making process. Firstly, minimisation of cost is used as this determines the revenue of VS. Secondly, minimisation of risk is used and is especially pertinent in these unpredictable times.

The first alternative available to Dupuis is to wait it out and only exchange for the U.S. dollars at the prevailing spot exchange rate in October. There are three possible scenarios for this option. Firstly, if the spot exchange rate remains at the current value of 0.6298 US$/Cdn$, the total amount in Canadian dollars will be Cdn$ 95,268,339.16 Secondly, if the Canadian dollars were to depreciate below 0.6298 US$/Cdn$, the total amount will be greater than in the first case and vice versa for the opposite case. As seen in exhibits 2 and 5, the general trend for the US$/Cdn$ is to decrease over time. Although these trends are observed in the long term, they can be used somewhat as an indicator of the future short term trend. This notion is also supported in exhibit 7 which clearly shows a downward trend in the PPP exchange rates from the middle of 2001 to the first quarter of 2002. Furthermore, the six-month forward rate is 0.6271 US$/Cdn$, showing that the market expects the Canadian dollar to depreciate. Based on the current outlook for the spot exchange rate in October, it is likely that VS will pay more than Cdn$ 95,268,339.16 The next alternative is to utilise forward contracts to lock in the amount payable to the suppliers. Based on the April 1, 2002 rate of 0.6271 US$/Cdn$, the total amount in Canadian dollars will be Cdn$ 95,678,520.17 This option does not minimise cost but in return has zero foreign exchange risk. The last alternative is to borrow Canadian dollars to exchange for U.S. dollars on April 1, 2002, which are to be invested for six months. Based on the calculations in appendix 1, this will result in Cdn$ 96,252,419.39 payable in October. This option ensures that there is no foreign exchange risk but increases the expenditure of the company. Having discussed all three alternatives, I feel that option 2 presents the best choice given the circumstances. Options 2 and 3 are very similar in that they both eliminate foreign exchange risk. However option 2 is the clear winner as the net amount payable is Cdn$ 573899.2 less, appreciably lower compared to option 3. In comparison, the decision between options 1 and 2 is not as straightforward. On one hand, option 1 minimises cost at the expense of a certain amount of foreign exchange risk. On the other hand, option 2 has zero foreign exchange risk at the expense of (possibly) minimising cost. To resolve this issue, we need to evaluate the potential gains of using option 1. Assuming the spot exchange rate does not change, and assuming all profits go to lowering the prices of tour packages, customers can expect to have a 1.85 per cent decrease in overall price of tour packages. From the perspective of a consumer, this is not a significant enough change in price. The insignificant price reduction combined with the high probability of the Canadian dollar depreciating makes option 2 the better of the two alternatives. Overall, option 2 is the best amongst the three alternatives due to the probable depreciation of the Canadian dollar and the minimising of foreign exchange risk.

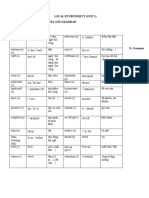

Appendix 1 Option 1: Wait and exchange in October

Scenario 1: Spot rate is unchanged in October at 0.6298 US$/Cdn$ Amount paid: (US$ 60,000,000)/(0.6298 US$/Cdn$) = Cdn$ 95,268,339.16

Option 2: Hedge using forward rate Amount paid: (US$ 60,000,000)/(0.6271 US$/Cdn$) = Cdn$ 95,678,520.17

Option 3: Borrow Canadian dollars, exchange for U.S. dollars and invest them Using the Euro-U.S. rate of depositing at 1.65 per cent, USD 60,000,000 = (1+0.0165)(X) X = USD 59,026,069.85 Using the spot exchange rate of 0.6298 US$/Cdn$. Need to borrow => (USD 59,026,069.85)/(0.6298 US$/Cdn$) = Cdn$ 93,721,927.35 Using the Euro-Canadian rate of borrowing at 2.7 per cent, Amount paid: (Cdn$ 93,721,927.35)(1+0.027) = Cdn$ 96,252,419.39

Option 1 vs Option 2 Possible benefit to customers =>

Option 2 vs Option 3 Net difference in amount paid = 96,252,419.39 - 95,678,520.17 = 573899.22

You might also like

- English Step by StepDocument145 pagesEnglish Step by StepandreeaNo ratings yet

- M&M Pizza Assignment - Group 6Document4 pagesM&M Pizza Assignment - Group 6Arnnava SharmaNo ratings yet

- Travel & Tourism: Unit 4 Product & ServicesDocument6 pagesTravel & Tourism: Unit 4 Product & ServicesElyana100% (2)

- AmeriTrade Case StudyDocument3 pagesAmeriTrade Case StudyTracy PhanNo ratings yet

- WrigleyDocument28 pagesWrigleyKaran Rana100% (1)

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- Leisure Leisure TheoriesDocument943 pagesLeisure Leisure TheoriesKhoo Beng Kiat75% (4)

- Wk8 Laura Martin REPORTDocument18 pagesWk8 Laura Martin REPORTNino Chen100% (2)

- Case Study Debt Policy Ust IncDocument10 pagesCase Study Debt Policy Ust IncWill Tan80% (5)

- Case Analysis 2012 Fuel Hedging at JetBlDocument3 pagesCase Analysis 2012 Fuel Hedging at JetBlPritam Karmakar0% (1)

- American Chemical Corporation: Financial Analysis: June 2010Document9 pagesAmerican Chemical Corporation: Financial Analysis: June 2010BenNo ratings yet

- MaldivesDocument10 pagesMaldivesJohn Carlo AdranedaNo ratings yet

- HBS Ameritrade Corporate Finance Case Study SolutionDocument6 pagesHBS Ameritrade Corporate Finance Case Study SolutionEugene Nikolaychuk100% (5)

- Midland Case CalculationsDocument13 pagesMidland Case CalculationsGurupreet MathaduNo ratings yet

- Loewen Group Inc.Document18 pagesLoewen Group Inc.Muntasir Bin MostafaNo ratings yet

- Midland CaseDocument8 pagesMidland CaseDevansh RaiNo ratings yet

- Voyages Soleil The Hedging Decision - AnswersDocument3 pagesVoyages Soleil The Hedging Decision - AnswersEdNo ratings yet

- 0320 US Fixed Income Markets WeeklyDocument96 pages0320 US Fixed Income Markets WeeklycwuuuuNo ratings yet

- Snap IPODocument16 pagesSnap IPOKaran NainNo ratings yet

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- Case 20 Target Corporation 1Document37 pagesCase 20 Target Corporation 1hnooy100% (1)

- Ameritrade Case SolutionDocument34 pagesAmeritrade Case SolutionBhawna Khosla0% (1)

- Daktronics Analysis 1Document27 pagesDaktronics Analysis 1Shannan Richards100% (3)

- Ocean Carriers IncDocument5 pagesOcean Carriers IncflwgearNo ratings yet

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDocument19 pagesThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalMai Pham100% (1)

- Chasecase PaperDocument10 pagesChasecase PaperadtyshkhrNo ratings yet

- CARREFOUR S.A. Case SolutionDocument3 pagesCARREFOUR S.A. Case SolutionShubham PalNo ratings yet

- FIN RealOptionsDocument3 pagesFIN RealOptionsveda20No ratings yet

- AES Capital BudgetingDocument3 pagesAES Capital BudgetingShubham KesarkarNo ratings yet

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 pagesCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNo ratings yet

- Ameritrade Case SolutionDocument31 pagesAmeritrade Case Solutionsanz0840% (5)

- SNAP Pivotal ResearchDocument18 pagesSNAP Pivotal ResearchZerohedge100% (2)

- Swedish MatchDocument6 pagesSwedish MatchMechanical DepartmentNo ratings yet

- FM 2 Real Project 2Document12 pagesFM 2 Real Project 2Shannan Richards100% (1)

- Noble GroupDocument3 pagesNoble GroupromanaNo ratings yet

- M&M Pizza With 20% TaxDocument5 pagesM&M Pizza With 20% TaxAnkitNo ratings yet

- USTDocument4 pagesUSTJames JeffersonNo ratings yet

- International Financial Management 13th Edition Madura Test Bank 1Document36 pagesInternational Financial Management 13th Edition Madura Test Bank 1keithreynoldsrciaejxmqf100% (24)

- Final AssignmentDocument15 pagesFinal AssignmentUttam DwaNo ratings yet

- Applications For Financial FuturesDocument12 pagesApplications For Financial FuturesNikki JainNo ratings yet

- Winfieldpresentationfinal 130212133845 Phpapp02Document26 pagesWinfieldpresentationfinal 130212133845 Phpapp02Sukanta JanaNo ratings yet

- M&M PizzaDocument1 pageM&M Pizzasusana3gamito0% (4)

- M&A Valuation Expanded BV SSDocument4 pagesM&A Valuation Expanded BV SSvardhan73% (11)

- Introduction To Tourism and HospitalityDocument14 pagesIntroduction To Tourism and HospitalityATUL SHARMA100% (1)

- Óscar Lima Silva (Editor) - Digital Marketing Strategies For Tourism, Hospitality, and Airline Industries (Advances in Marketing, Customer Relationship Management, and E-Services) - IGI GLDocument284 pagesÓscar Lima Silva (Editor) - Digital Marketing Strategies For Tourism, Hospitality, and Airline Industries (Advances in Marketing, Customer Relationship Management, and E-Services) - IGI GLNgọc Nguyễn Thị BíchNo ratings yet

- Snap Inc FinalDocument35 pagesSnap Inc Finalapi-461693941No ratings yet

- Strategy, Castle in TransylvaniaDocument152 pagesStrategy, Castle in TransylvaniaRoberta BaxhoNo ratings yet

- Snapchat Going IpoDocument14 pagesSnapchat Going Ipoapi-431589978No ratings yet

- Yell Part IDocument5 pagesYell Part IAdithi RajuNo ratings yet

- Midland Energy Resources FinalDocument5 pagesMidland Energy Resources FinalpradeepNo ratings yet

- Chapter 5 - Group DisposalsDocument4 pagesChapter 5 - Group DisposalsSheikh Mass JahNo ratings yet

- Coursehero 40252829Document2 pagesCoursehero 40252829Janice JingNo ratings yet

- Pine Street CapitalDocument5 pagesPine Street CapitalAnket Gupta0% (1)

- Dividend Policy at PFL GroupDocument5 pagesDividend Policy at PFL GroupWthn2kNo ratings yet

- Capital Structure MSCIDocument10 pagesCapital Structure MSCIinam ullahNo ratings yet

- FM - INT7 - P&G Case - Group4Document6 pagesFM - INT7 - P&G Case - Group4Ramarayo MotorNo ratings yet

- R CF E NPV CF E: Historic RF On LTBDocument2 pagesR CF E NPV CF E: Historic RF On LTBBhawna Khosla100% (2)

- Case 13 Royal Mail F1774XDocument12 pagesCase 13 Royal Mail F1774XAndy NamNo ratings yet

- Royal Mail CaseDocument5 pagesRoyal Mail Casedf0% (1)

- Questions For The HMC Case StudyDocument1 pageQuestions For The HMC Case StudyMinhNo ratings yet

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- MCQS 4Document23 pagesMCQS 4humna khanNo ratings yet

- 2nd Assignment IfmDocument2 pages2nd Assignment IfmAgdum BagdumNo ratings yet

- IRS - Notional Principal Is Never Exchanged 2. CS - Notional Principal Is Always ExchangedDocument2 pagesIRS - Notional Principal Is Never Exchanged 2. CS - Notional Principal Is Always ExchangedqwertyuiopNo ratings yet

- Summer 2021 FIN 6055 New Test 2Document2 pagesSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- IceCap February 2011 Global Market OutlookDocument8 pagesIceCap February 2011 Global Market OutlookIceCap Asset ManagementNo ratings yet

- 1 FrameworkDocument26 pages1 FrameworkIrenataNo ratings yet

- Bai Tap Tieng Anh Sach Thi Diem Theo Tung Unit Lop 9 (Co Dap An Chi Tiet)Document268 pagesBai Tap Tieng Anh Sach Thi Diem Theo Tung Unit Lop 9 (Co Dap An Chi Tiet)Hương LêNo ratings yet

- Inspiring A Tourism Revolution in Morocco: SearchDocument7 pagesInspiring A Tourism Revolution in Morocco: SearchMoratuoa MaitseNo ratings yet

- 10 de Thi Tieng Anh Hướng Dẫn Giải Chi TiếtDocument145 pages10 de Thi Tieng Anh Hướng Dẫn Giải Chi TiếtVuong DiepNo ratings yet

- Assessor Eligibility Criteria 18 01 2021 FinalDocument342 pagesAssessor Eligibility Criteria 18 01 2021 FinalDheeraj SinghNo ratings yet

- Unit 9Document19 pagesUnit 9elizabethsliusarenkiNo ratings yet

- The Hospitality Management NotesDocument86 pagesThe Hospitality Management NotesagnesmutugaNo ratings yet

- Land Use Policy 96 (2020) 104697Document20 pagesLand Use Policy 96 (2020) 104697henryNo ratings yet

- Travel Agent in GuwahatiDocument10 pagesTravel Agent in GuwahatiMitali TravelsNo ratings yet

- Jelena MiljkovicDocument18 pagesJelena MiljkovicAleksandar JovicNo ratings yet

- Sample Paper-) : PART-A - Multiple Choice Questions (40 Marks)Document19 pagesSample Paper-) : PART-A - Multiple Choice Questions (40 Marks)Sapna MishraNo ratings yet

- Guest Editor, Chandana Jayawardena.-Tourism and Hospitality Management in The Caribbean PDFDocument68 pagesGuest Editor, Chandana Jayawardena.-Tourism and Hospitality Management in The Caribbean PDFSiddheshNo ratings yet

- Summer Tourist Season in Bosnia and Herzegovina (Issue #3)Document124 pagesSummer Tourist Season in Bosnia and Herzegovina (Issue #3)bosniaandherzegovina100% (1)

- Macro 1Document4 pagesMacro 1Mei Abalos100% (1)

- An Assessment of The Impacts of Tourism in SrilankaDocument65 pagesAn Assessment of The Impacts of Tourism in SrilankaJohn Wilbert R. AretanoNo ratings yet

- Final CasestudyDocument31 pagesFinal CasestudyHimkala ShahNo ratings yet

- Handbook For Tour Guides: Research GateDocument15 pagesHandbook For Tour Guides: Research Gateimrul khanNo ratings yet

- Limerick City Development Plan 2010-2016Document398 pagesLimerick City Development Plan 2010-2016richard_tobin_4No ratings yet

- International Tourism Management Dissertation TopicsDocument8 pagesInternational Tourism Management Dissertation TopicsPapersHelpUKNo ratings yet

- July 25 2014Document48 pagesJuly 25 2014fijitimescanadaNo ratings yet

- Ptaa Travel Tour Expo - ReflectionDocument7 pagesPtaa Travel Tour Expo - ReflectionRoje BangalandoNo ratings yet

- Agriculture 12 01586 v2Document15 pagesAgriculture 12 01586 v2Ying SunNo ratings yet

- Government of India Ministry of Tourism Guidelines For Market Development Assistance (MDA) Scheme - Active Members of ICPBDocument7 pagesGovernment of India Ministry of Tourism Guidelines For Market Development Assistance (MDA) Scheme - Active Members of ICPBsudeepshauryaNo ratings yet