Professional Documents

Culture Documents

An Empirical Model of Capital Structure: Some New Evidence

Uploaded by

Бекзат АсановOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Empirical Model of Capital Structure: Some New Evidence

Uploaded by

Бекзат АсановCopyright:

Available Formats

Journal of Business Finance & Accounting, 21(1), January 1994, 0306 686 X

AN EMPIRICAL MODEL OF CAPITAL STRUCTURE: SOME NEW EVIDENCE

GHASSEM HOMAIFAR, JOACHIM ZIETZ AND O M A R BENKATO*

INTRODUCTION

According to the traditional viewpoint, the vsilue ofthe firm can be increased by the use of debt, even though stockholders may incur increasing risks of bankruptcy. Miller (1977) has pointed out in this context that the advantage of debt financing at the corporate level is counter-bcilanced by the personal tax disadvantage of debt at the personal level, thereby leaving a zero gain from leverage in steady state equilibrium. Along the dynamic adjustment path toward this equilibrium, however, the bEilancing of bankruptcy costs against the tax gains of debt financing may give rise to an optimal capital structure. In a previous article, DeAngelo and Masulis (DM) (1980) question the validity of Miller's leverage irrelevancy proposition under more realistic assumptions about the corporate tax code and in the presence of bankruptcy, agency, or other leverage-related costs. In particular, DM prove that a unique optimal capital structure exists in the steady state if one introduces into the model non-debt corporate tax shields, such as depreciation deductions or investment tax credit. DM's model yields a number of testable hypotheses. For example, the authors' investment tcix shield hypothesis predicts an inverse relationship between the firm's financial leverage and investment tax shield. Their tax rate hypothesis suggests a direct relationship between the firm's debt level and the corporate tax rate. The validity of these hypotheses have far reaching implications for corporate policy makers and have therefore been explored by a number of researchers. Dotan and Ravid (1985), Dammon and Senbet (DS) (1988), and Green and Talmor (1985) have analyzed the theoretical interdependence between a firm's investment and financing decisions.^ While Dotan and Ravid's analysis supports DM's tax shield and tax rate hypotheses for a given output level, DS as well as Green and Talmor find that the effect on the firm's optimal debt level of an increase in investment tax shields is not determined. Empirical evidence by Kim and Wu (1988) as well as Mandelker and Rhee (1984) point to a tradeoff between investment and debt tax shields. Bradley, Jarrell and Kim (BJK) (1984), Boquist and Moore (1984), and Titman and Wessels (TW) (1988) reach opposite conclusions.

The authors are respectively, Professor of Finance and Professor of Economics, at Middle Tennessee State University, and Associate Professor of Finance at Ball State University. (Paper received August 1991, accepted October 1991) Basil Blackwell Ltd. 1994, 108 Cowley Road, Oxford OX4 IJF, UK and 238 Main Street, Cambridge, MA 02142, USA.

HOMAIFAR, ZIETZ AND BENKATO

The purpose of this paper is to extend the empirical work of BJK and TW in two significant ways.^ First, we present a more comprehensive model of capital structure, by including a proxy for the corporate tax rate which has been omitted from the models of both BJK and TW, Second, we provide longrun steady state equilibrium estimates of the determinants of capital structure rather than presenting only short-run contemporaneous relationships as in earlier studies. Our results reveal that proper dynamic specification of the estimating equations is crucial for testing hypotheses that pertain to long-run steady state equilibria,^ In particular, we find that, in the long run, the corporate tax rate is positively related to the leverage ratio. By contrast, there appears to be no significant short-run contemporaneous relationship between leverage and tax rate. Our results also reveal that the short-run and long-run relation between non-debt tax shields and leverage is randomly distributed around zero, inconsistent with DM non-debt tax shield hypothesis. The paper is organized as follows: in the following section we discuss the theoretical determinants of the firm's capital structure; data and empirical methodology are presented in the third section; estimation results follow in the fourth section and the final section summarizes the findings.

THEORETICAL DETERMINANTS OF CAPITAL STRUCTURE

The model identifies seven attributes that determine the firm's leverage ratio (/), These are the corporate tax rate (r), the non-debt tax shelter ratio (r), firm size (s), future growth opportunities (v), capital market conditions (m), the inflation rate (p), and earnings volatility (a). Accordingly, the theoretical model can be written in its general form as / = f(T, r, s, V, m, p, a). (1)

The rationale for each of the variables and their expected signs are discussed next, DM hypothesize a positive relationship between the corporate tax rate and the amount of debt employed by corporations, Davis (1987) finds some weak evidence for this hypothesis for 115 Canadian firms over the period 19631982, He also makes the important point that the unlevered tax rate is the proper variable to be included in equation (1) for T. Davis (p, 23) argues that 'DM recognize that, cdthough a firm faces an exogenous tax schedule, its effective tax rate is lowered by the use of both debt and investment related tax shields (as long as they are not superfiuous). To be consistent with theory, the direct relationships between the size of a firm's effective tax rate and the amount of debt used should be tested using a tax rate that is calculated before debt effects,' We follow Davis's suggestion for variable definitions,*

Basil Blackwell Ltd. 1994

AN EMPIRICAL MODEL OF CAPITAL STRUCTURE

In the DM model, non-debt tax shields serve as a substitute for tax deductible interest payments in reducing before-tax cash flows for taxation purposes. By separating investment decisions from financing decisions, the DM model leads to an inverse relationship between non-debt tix shields and the firm's level of leverage.^ The first direct empirical evidence on DM's tax shelter hypothesis by Bowen, Daley, and Huber (BDH) (1982) confirms this hypothesis at the industry level. By contrast, more recent evidence by Boquist and Moore reveals a significant positive association between investment and debt tax shields.^ Most recently, DS have presented a theory of capital structure that substantially modifies and even reverses the implications of DM's tax shield hypothesis. According to DS, the effect of an increase in investment tax shields on a firm's leverage depends on the trade-off between the 'income effect' and the 'substitution effect' that are associated with an increase in optimal investment.' Several studies have investigated the relationship between firm size and the leverage ratio. Warner (1977) and Ang, Chua and McConnell (1982) theorize that large corporations' cash flows are diversified, thus making them less vulnerable to bankruptcy. Based on the above argument, large firms are expected to employ more debt in their capital structure. Using three different indicators of size TW do not confirm this hypothesis. Myers (1977) argues that a significant part of any firm's market value is accounted for by the present value of future growth opportunities. According to Myers, firms financed with risky debt may pass up value-creating investment opportunities in the future. In this context, Myers contends that the amount of debt supported by the present value of future growth opportunities will be less than is supported by tangible assets already in place. A finding of a negative and significant relationship between leverage and the present value of future growth opportunities is likely to be consistent with Myers' hypothesis. Similar to Jcililvand and Harris (1984), we hypothesize that capital market conditions, in particular the return on stocks, influence a firm's capital structure decisions. We use individual stock returns rather than the return on an aggregate stock index because capital structure decisions are made at the individual firm level. Whether corporations are actually able to time the issuance of equity (debt) to coincide with rising stock prices is an empirical issue. It would not be consistent with the spirit of the efficient market hypothesis. A likely scenario is that firms favor equity financing over debt financing during a period of stock price run-up. Studies by Jaffe (1978), Modigliani and Cohn (1979), Modigliani (1982), and Gordon and Malkiel (1981), reveal that, during an inflationary period, firms employ more debt in their capital structure as the real cost of debt falls. Several studies have investigated the relationship between a firm's earnings volatility and leverage. Chaplinsky (1983), BJK, and TW hypothesize that the firm's optimal debt ratio is a decreasing function of earnings volatility. However,

Basil Blackwell Ltd. 1994

HOMAIFAR, ZIETZ AND BENKATO

Castanias and DeAngelo (1983) have provided examples that suggest earnings volatility and leverage are positively related. TW use the standard deviation of the percentage changes in operating income as an indicator of volatility and find no significant relationship between debt and volatility. By contrast, Chaplinsky and BJK uncover a strong negative association.^

DATA AND ECONOMETRIC TECHNIQUE The model presented in the previous section is analyzed with annual company level data for the period 1978-88. The data are taken from the annual Compustat four-digit (SIC code) industrial files. A firm is included in our sample only if observations are available on all the variables for the period of analysis. The resulting sample includes 370 companies. The definitions of our model variables are provided in the Appendix Table Al. The model's empirical implementation requires some choice about both functional form and dynamic specification. The decision on functional form is constrained by the fact that, for some years and some companies, /, T, and r assume zero values. This clearly excludes a log transformation on those variables. For the remaining variables a log transformation is chosen because the standard error of the regression clearly reaches a minimum for this specification. The choice of dynamic specification is a bit more complex. In general, this topic receives little if any attention in pooled cross-section studies. As a result, an equation like (1) is estimated either without any lags at all in the equation, or the estimating equation is restricted to a few lags, possibly constrained to allow for a partial adjustment mechanism as in Jalilvand and Harris. In neither case is it clear to what extent the estimated parameters capture the long-run steady state characteristics of the data generating process. Yet the underlying theoretical model provides predictions only for the steady state or long-run equilibrium. Hence, theory and data have to be matched appropriately. This clearly requires a more elaborate dynamic structure because firms cannot be expected to be in steady state equilibrium at every point in time. For this reason, we proceed from a very general dynamic model superimposed on a pooled data set. A short description of our methodology follows next. Written more compactly and in more general terms, equation (1), which represents our theoretical long-run or steady state relationship, condenses into

/ = irz

(2)

where TT is a 1 X n vector of long-run steady state coefficients and z an n X 1 vector of regressor variables as defined in some detail in Table Al. The stochastic static equivalent of (2) can be written as /, = TTz, + u, (3)

Basil Blackwell Ltd. 1994

AN EMPIRICAL MODEL OF CAPITAL STRUCTURE

where fr is a 1 X n vector of short-run contemporaneous coefficients and u, a stochastic error term. Following the lead of Hendry, Pagan, and Sargan (1984) we postulate that the data generating process is of the form of a general autoregressive distributed lag model (ADL). Hence, (3) is transformed to A{L)l, = B{L)Trz, + e, (4)

where A{L) and B(L) are polynomials of unspecified order in the lag operator L and where e is a white noise error process. Some experimentation with the lag length verified that a second-order polynomial L is sufficient to generate white noise errors for the annual data. This decision on the lag length requires omitting from the data set the years 1978 through 1980 for each cross-section unit, leaving therefore eight observations per cross-section unit.' In estimating the components of 7r in (2) we proceed by first fitting a general unrestricted second-order ADL to the pooled data. We then employ a standard testing-down procedure starting from this general lag model, eliminating contemporaneous or lagged variables wherever possible. The parameter restrictions are checked against the most general ADL by a likelihood ratio test (x^)- From the restricted version of (4), the components of the vector of long-run coefficients (TT) are retrieved by the transformation T T = [B'{L)/A'{L)]7t where the prime identifies zero restrictions compared to (4). (5)

ESTIMATION RESULTS

Table 1 provides a summary of the estimation results on the pooled cross-section time series data. The table contains point estimates of the long-run steady state model parameters (TT), their associated t- values,'" and a number of regression statistics for the underlying short-run dynamic regressions. Among the latter statistics are the Schwarz-Bayes Information Criterion (SBIC)," the value of the log-likelihood function and the likelihood ratio test for the parameter restrictions versus the general second-order ADL model that corresponds to the first line of Table 1. The lags in the underlying regressions required omitting from the sample all observations for 1978, 1979, and 1980. This left a sample of 2960 observations per equation in Table 1. To provide a better understanding for the results of Table 1, in particular, how they correspond to equations (1) through (5) of the previous section, we present the underlying short-run dynamic regression equations for the first two sets of estimates in Table 1. The first regression (equation (6)), which corresponds to the first line of long-run paraimeters in Table 1, is an unrestricted ADL of second order (equation (4) in the last section).'

Basil Blackwell Ltd. 1994

6 / = -

HOMAIFAR, ZIETZ AND BENKATO 0,028 + 0,076 T + 0,851 r + 0,162 v - 0,291 m + 0,311 s (-3,7) (0,6) (5,8) (21) (-37) (48) 0,661 r ( - l ) (-3,7) 0,176 />(-l) (-2,0) 0,040 (-4,2) v{-2) (6)

+ 0,368/)+ 0 , 8 7 9 / ( - I ) + 0,425 T ( - 1 ) (3.7) (45) (2,9) 0,134 v{-l) (-12) -

0,043 m ( - l ) - 0,304 s{-l) (-3,9) (-27)

+ 0,022 / ( - 2 ) - 0,250 7-(-2) - 0,096 r ( - 2 ) (1,2) (-1,8) (-0,6) + 0,004 m ( - 2 ) - 0,005 ^ ( - 2 ) (1,1) (-0,5) 0,160 p{-T) (-3,2)

Lagged variables are indicated in this equation (6) by parenthesis behind the variable. For example, m( 2) identifies a two year lag of m. T-values are provided in parenthesis. The second line of long-run model parameters in Table 1 (equation (7)) is based on a short-run regression that is restricted compared to equation (6), Six coefficients are set to zero. These restrictions lower the value of the log likelihood function, but by a sufficiendy small amount. The low value of the log-likelihod ratio test (5,92) indicates that the data support these six zero restrictions at any reasonable level of statistical significance. By contrast, the eight and eleven zero restrictions implied, respectively, by the third and fourth model version in Table 1 are clearly rejected by the data.

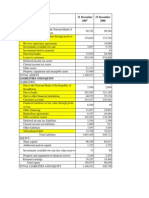

Table 1 Long-run Parameters Estimated from Pooled Regressions, 1981 1988 R' adj. R' SBIC DW Log Likel. x^ (DF)

__r

I)

2,551 0,950 0,319 -0,122 -3,353 0,028 0,9133 -6,0101 (2,1) (1,1) (0,6) (-5,3) (-12,0) (4,7) 0,9127 1,73 3,102 1,090 0,484 -0,121 -3,315 0,028 0,9132 -6,0243 (3,0) (1,3) (0,9) (-5,5) (-12,9) (4,7) 0,9127 1,73 3,324 (3,3) 3,082 (3.0)

Note:

4778,76

4775,80 5,92 (6) 0,127 -0,128 -3,337 0,030 0,9121 -6,0182 4758,83 (0,2) (-6,1) (-12,9) (5,4) 0,9118 1,73 39,86 (8) -0,101 -3,530 0,032 0,9107 -6,0102 4734,93 (-4,8) (-12,8) (5,7) 0,9104 1,71 87,66 (11)

/ ? ' is the coeflicient of multiple determination; adj, R'^ is its adjusted equivalent, SBIC is the Schwarz-Bayes Information Criterion, DW stands for the Durbin-Watson statistic corrected for gaps in the seimple, Log-Likel, provides the value of the maximized log-likelihood function, x^ gives the value of the log-likelihood ratio test described in the text (it is based on the log-likelihood values given above); DF is the corresponding number of degrees of freedom. The dependent variable is / in all cases. Variables are defined in Table AI, T-values are given in parenthesis below the coefficient estimates. Constants are not reported, Basil Blackwell Ltd, 1994

AN EMPIRICAL MODEL OF CAPITAL STRUCTURE I = 0,030 -I- 0,830 r + 0,161 v (-4,2) (5,8) (21) 0,290 m + 0,312 s + 0.407 p (-37) (48) (4,3) 0,137 ( - l ) (-13)

-I- 0,901 / ( - I ) -I- 0,306 T ( - 1 ) - 0,722 r ( - l ) (135) (3,0) (-4,9) 0,036 m ( - l ) - 0,309 ^ ( - 1 ) - _ 0 . 2 1 5 p{-l) (-4,5) (-47) (-2,5) 0,036 v(-2) (-4,7) 0,144 / ) ( - 2 ) (-2,9)

(7)

We note that the SBIC value is less for the second model version of Table 1 (equation (7)) than that for the unrestricted ADL, In fact, for equation (7), SBIC is smaller than for any of the four model versions reported in Table 1, Hence, by the Schwarz-Bayes Information Criteria, the second model version is to be preferred. However, we note in this context that the choice of model version has no significant influence on any of the estimated long-run parameters reproduced in Table 1, Thus, the statistical choice among model versions based on the SBIC value does not matter in terms of economic significance. It is also reassuring that the long-run parameter estimates of Table 1 are very resilient to modifications of the basic model,'^ Even leaving out more than half the model coefficients compared to the general second-order ADL (11 out of 21) does not materially affect the economic results. This would be a rather unlikely event for a model, with a defect in the design matrix resulting from either data problems such as multicollinearity or model problems such as non-orthogonal errors. The absence of multicollinearity is also suggested by the very low correlation coefficients among the independent variables (Table A2), Except for the coefficient of the non-debt tax shield ratio (r), the long-run estimates of Table 1 are consistent with a priori expectations. The unlevered effective tax rate (T) has a positive and statistically significant impact on the leverage ratio. The results of Table 1 are clearly consistent with DM's tax rate hypothesis. Our finding of a positive and significant association between leverage and T parallels that of Davis's result. The estimates show no statistically significant relationship between leverage and non-debt tax shelters. Thus, the DM tax shelter hypothesis is not substantiated. This is in line with earlier evidence by BJK, Boquist and Moore, and TW, Based on the sign of r, the non-debt tax shelter appears to be a compliment rather than a substitute for debt tax shields. This finding agrees with DS's theoretical model. The coefficient of the inflation rate is positive but insignificant. This result contradicts the theoreticEil finding of a strong positive relationship between inflation and leverage by Jaffe, Modigliani and Cohn, Modigliani, Gordon and Malkiel, and Gordon (1982), The coefficients of the remaining variables carry expected signs and are significant at the one percent level or better. Table 1 reveals, for example, that firms with greater future growth opportunities (firms with a high market to book vcdue ratio) employ

Basil Blackwell Ltd. 1994

HOMAIFAR, ZIETZ AND BENKATO

less debt, a finding in agreement with that of Myers. Furthermore, size, as proxied by total assets, appears to be an important determinant of firm capital structure. All variables except the inflation rate are company specific. As a consequence, the latter variable is eliminated for the pure cross-section regressions that we discuss now. Similar to Davis's (1987) study of 115 Canadian firms, separate annual cross-section regressions are presented for each year from 1979 to 1988. The purpose of these regressions is to show that simple cross-sections without regard to lags and dynamics do not capture the long-run characteristics of the data generating process and are, therefore, of little use for testing hypotheses about long-run steady state behavior. The results of the pure cross-sections are reported in Tables 2 and 3. There is no statistically significant relationship between leverage and the unlevered tax rate (T) in any of the annual cross-section regressions for the years 1979-88 (Table 2). A similar result holds for the tax shelter ratio (r). Its coefficient is negative and insignificant in four often years. The cross-section behavior ofthe coefficient associated with stock returns (m) is highly unstable over time. Its positive sign in nine out often periods is also inconsistent with theoretical expectation. This contrasts sharply with the strongly negative coefficient of m in the long-run equilibrium results of Table 1. The coefficients ofthe other two variables in Table 2 (v and s) have the expected sign and are statistically significant at the one percent level or better for most years. Their values are rather close to those reported in Table 1. Two regressions are run on data that are averaged over time (197888) for each company. Averaging is effectively equivalent to taking the mean of the estimates from the annual cross-sections provided in Table 2. The results of these regressions are presented in Table 3. In contrast to Table 2, the two regressions in Table 3 make use ofthe volatility variable (CT) described earlier. The first regression uses the data for all companies. The second regression excludes regulated industries such as trucking, airlines, telephone and financial intermediaries. The results of these two regressions are similar to those reported in Table 2. In particular, the coefficient ofthe unlevered tax rate and the tax shelter ratio are negative but insignificant for the sample of all firms. For unregulated firms, however, the coefficient ofthe unlevered tax rate is negative and statistically significant. We also find a strong negative association between volatility and leverage. Once regulated firms are excluded, however, volatility's coefficient turns insignificant. This is counter-intuitive because regulated firms are expected to have lower earnings volatility than non-regulated companies. The regression result suggests that regulated firms' volatility dominates that of nonregulated firms. Because the volatility measure appears to be sample sensitive, we can concur with TW's finding of an insignificant association between volatility and leverage. Overall, the results of Table 2 have to be discounted as they relate to short-term contemporaneous relationships between leverage and its determinants. They do not capture the long-run equilibrium behavior of firms that has been provided in Table 1.

Basil Blackwell Ltd. 1994

AN EMPIRICAL MODEL OF CAPITAL STRUCTURE

Table 2 Annual Cross-sections for Each Year, 197988

Year 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 Constant -0.27 (-3.1) -0.20 (-2.8) -0.24 (-3.3) -0.24 (-4.6) -0.20 (-3.9) -0.27 (-5.2) -0.29 (-5.9) -0.31 (-5.8) -0.22 (-3.8) -0.27 (-4.2) r -0.14 (-0.1) 0.96 (0.8) 1.50 (1.2) 0.88 (1.0) -0.51 (-0.7) 0.32 (0.3) 0.06 (0.1) -0.25 (-0.3) -0.41 (-0.5) 0.17 (0.2) m 0.11 (3.2) 0.09 (2.8) 0.05 (1.8) 0.04 (1.5) 0.10 (3.7) 0.09 (2.2) 0.01 (0.2) 0.07 (1.9) -0.12 (-3.3) 0.04 (0.8) s 0.02 (2.9) 0.01 (2.6) 0.01 (2.7) 0.02 (3.4) 0.02 (4.3) 0.02 (3.7) 0.03 (6.2) 0.03 (6.2) 0.03 (6.4) 0.04 (7.4) R'/ adj. R' 0.405 0.397 0.401 0.393 0.365 0.356 0.344 0.335 0.316 0.306 0.322 0.312 0.329 0.320 0.301 0.292 0.340 0.331 0.299 0.289

-2.10 (-1.2) -2.13 (-1.4) -0.35 (-0.2) 0.07 (0.1) -1.07 (-1.3) -0.17 (-0.2) 0.35 (0.5) 0.53 (0.7) -0.59 (-0.6) -1.56 (-1.7)

-0.23 (-11.0) -0.20 (-9.7) -0.18 (-8.8) -0.17 (-8.0) -0.16 (-7.7) -0.19 (-8.4) -0.17 (-7.2) -0.16 (-7.8) -0.14 (-7.1) -0.16 (-6.5)

Note:

R^ is the coefficient of multiple determination; adj. R^ is its adjusted equivalent. The dependent variable is / in all cases. All variables are defined in Table A l . T-values are given in parenthesis below the coefficient estimates.

Table 3 Cross-sections for Averaged Data Series (AVG)

Year AVG Constant -0.42 T -4.64 r -1.22 v -0.30 m 0.56 s 0.03 a -0.05 adj. R^ 0.287

all AVG nonreg.

NoU:

(-2.6) -0.32 (-2.3)

(-1.6) (-0.5) (-7.8) (3.0) (3.6) (-2.1) -4.69 2.84 -0.24- 0.68 0.03 -0.02 (-2.0) (1.4) (-7.3) (3.8) (3.3) (-1.0)

0.276 0.336 0.324

R^ is the coefficient of multiple determination; adj. R'^ is its adjusted equivalent. The dependent variable is / in all cases. All variables are defined in Table A l . 7"-values are given in parenthesis below the coefficient estimates. AVG all refers to all 370 companies, AVG nonreg. to 336 nonregulated companies. Basil Blackwell Ltd. 1994

10

HOMAIFAR, ZIETZ AND BENKATO SUMMARY AND CONCLUSIONS

Using a general autoregressive distributed lag model (ADL), we estimate the long-run steady state determinants of the firm's capital structure. The ADL approach allows us to clearly identify the long-run equilibrium parameters of interest. We find that, in the long run, the leverage ratio is indeed positively related to corporate tax rates. To our knowledge, this is the first direct evidence of DM's tax hypothesis for US data in a comprehensive model of corporate capital structure. The relationship between leverage and the non-debt tax shelter ratio is also positive but statistically insignificant. This contradicts DM's tax shelter hypothesis. We find that, on a short-run contemporaneous year by year basis, there is no statistically significant relationship between leverage and corporate tax rates or between leverage and non-debt tax shields. This distinct difference in the results between the long-run equilibrium model (Table 1) and the simple annual cross-sections (Tables 2 and 3) suggests that, at any given point in time, firms cannot be assumed to have reached their desired long-run equilibrium leverage ratio that is consistent with their long-term corporate objectives. Most firms will rather find themselves on an adjustment path toward their desired long-run equilibrium state. Our regression results also reveal that firm size and future growth opportunities appear to be important determinants of the capital structure. The positive association between leverage and firm size is remarkably robust and consistent with evidence of Warner as well as Ang, Chua and McConnell. We also find a strong negative relationship between future growth opportunities and leverage, as well as between leverage and stock returns. The negative relation between leverage and future growth opportunities is consistent with Myers' hypothesis that firms with greater future growth opportunities employ less debt. The negative relation between stock returns and leverage substantiates our earlier argument that firms tend to substitute equity for debt when stock returns are high.

Basil Blackwell Ltd. 1994

AN EMPIRICAL MODEL OF CAPITAL STRUCTURE APPENDIX Table Al Definitions of Variables /

11

Leverage: current portion of interest bearing long-term debt plus long-term debt, normalized by the sums of the market value of equity, the book value of debt, and the book value of preferred stock. This is consistent with the spirit of DM's model. It has been used empirically by Davis as well as Boquist and Moore, Unlevered effective tax rate:" [{T, Tj) + Ti]/CF, where T^ denotes reported tax payments, Tj tax deferral that occurred during the year, T the statutory tax rate, i interest expenses, and CFbefore-tax cash flow,'' The corresponding levered effective tax rate would be given as(T,-Tj)/CF. Non-debt tax shelter ratio: the sum of depreciation, investment tax credit, and tax loss carry forward over operating income before depreciation, depletion, and amortization, Firm size: the natural logarithm of total assets. Future growth opportunity: the natural logarithm of the ratio of the market to book value of equity. The ratio's numerator is composed of the sum of the present value of tangible and intangible assets. The ratio's denominator measures the net asset value of the firm already in place, Capital market conditions: first differences in natural logarithms of the stock price; closing stock prices for the calendar year are used. Inflation rate: first differences in natureil logarithms of the consumer price index; consumer price index is from the US Department of Labor, Bureau of Labor Statistics Publications. Earnings volatility: the natural logarithm of the standard deviation of the first difference of operating income before depreciation normalized by total assets.

r s V

m p a

Notes:

" This definition follows Davis's: interest tax shields (Ti) are imputed to the actual amount of tax paid to unlever the actual tax paid. ^ Before-tax cash flow is obtained using the definition of Fama (1981), Gonedes (1981), and Davis, i.e. as the sum of income before extraordinary items, total income tax imposed by federal, state and foreign governments, minority interest, interest expense, and depreciation.

Table A2 Contemporaneous Correlation Coefficients of Model Variables

T T

r

V

m s

P

Note:

1 . 0 -0.32290 0,15725 0.085843 -0.16458 0,084102

1 , 0 -0,28981 -0.089874 0,30560 -0,064533

1 . 0 0,27712 0,062856 -0.25656

1 , 0 -0,063830 -0.044137

1. 0 -0.10300

1 . 0

See Table Al for variable definitions. The matrix is based on 2960 observations, the same number as the regressions reported in Table 1.

Basil Blackwell Ltd. 1994

12

HOMAIFAR, ZIETZ AND BENKATO

Table A3 Calculation of Long-Run Parameters from Short-Run Coefficients

Variable as

defined in

Table Al

Derivation of long-run parameters (Table l)fiom the short-run dynamic ones of eq. (7)

Result based on rounded short-run coefficients (equation 7)

Result based on exact short-run coefficients

P

V

0.306/(1-0,901) (0.830-0.722)/(l-0,901) (0.407-0.215-0,144)/(l-0,901) (0,161 -0,137-0,036)/(1 -0.901)

(-0.290-0.036)/(l -0,901)

m s Note:

(0.312-0.309)/(l-0,901)

3.091 1,091 0,485 -0,121 -3.290 0.030

3.102 1.090 0.484 -0,121 -3.315 0,280

The calculations implement equation (5). They generate the long-run equilibrium parameters (x) of Table 1 (equation (2) or (3)) from the coefficients of equation (7), which, in turn, is an estimated version of equation (4).

NOTES 1 Dotan and Ravid analyze the simultaneity of investment and financing decisions pointing to a negative association between operating and financial leverage (cf. also Mzindelker and Rhee, 1984), According to their results, the firm's optimal leverage is an increasing function of the tax rate and a decreasing function of firm size, Numerous studies have provided theoretical and empirical evidence on optimum capital structure choices. These include, inter alia, Scott (1972), Kraus and Litzenberger (1973), Myers (1977) Brennan and Schwartz (1978), Kim (1978), Holland and Myers (1980), Myers and Majluf (1984) and Hochman and Palmon (1985), However, there is, as of now, no direct evidence, at least for US data, on the relationship between the firm's financial leverage and the corporate tax rate. The importance of this proposition has been demonstrated for an example drawn from financial economics in Zietz and Weichert (1988). Appendix Table Al contains complete variable definitions, Bowen, Daley, and Huber (1982), BJK, Boquist and Moore, and TW all analyze the association between the non-debt tax shelter ratio and leverage. They find conflicting evidence on the 'substitution effect' of the non-debt tax shield. Boquist and Moore relate the substantial variation between their findings and those of BDH to methodological differences. While BDH measure leverage as total debt over total assets, Boquist and Moore employ non-interest bearing debt in the numerator. Furthermore, the evidence presented by Boquist and Moore relates to the capital structure at the firm level, while BDH's analysis is conducted at the industry level, which is not consistent with the spirit of DM's model. Boquist and Moore also suggest that BDH's results are sensitive to the method of normalizing non-debt tax shields, DS (p. 367) show that, if the 'income effect' is greater than the 'substitution effect', firms with a greater non-debt tax shield will employ more debt. By contrast, the net effect of an increase in the rate of depreciation on the optimum amount of debt is ambiguous. It depends upon the relative magnitude of the income and substitution effects, Chaplinsky argues that volatility, as measured by the first difference of operating income before depreciation normalized by total asset, does not suffer from the statistical problem associated with the alternative measure of firms volatility, such as the standard deviation of earnings, Note we omit 1978 through 1980 for each cross section unit because the process of lagging in the stacked data set consisting of n cross-section units would otherwise associate the data of different cross-section units, Basil Blackwell Ltd. 1994

3 4 5 6

AN EMPIRICAL MODEL OF CAPITAL STRUCTURE

10 11 12 13

13

The standard errors entering the (-values are based on the variance-covariance matrix for the underlying short-run dynamic regression (equation (4)). Judge et al. (1980, chapter 9) provide an overview of information criteria in regression analysis. The optimal properties of SBIC for regressor selection are proven in Geweke and Meese (1981). The definition of the variables, including their transformation to natural logarithm, is given in the Appendix, Table Al. Table A3 in the Appendix provides the pertinent calculations for transforming the coefficients of short-run dynamic equation (7) into the long-run parameters of Table 1.

REFERENCES Ang,J.,J. Chua, a n d j . McConnell (1982), 'The Administrative Costs of Corporate Bankruptcy: A Note.' Journal of Finance, Vol. 37 (March 1982), pp. 219-26. Boquist, J.A. and W.T. Moore (1984), 'Inter-Industry Leverage Differences and the De AngeloMasulis Tax Shield Hypothesis', Financial Management (Spring 1984), pp. 59. Bowen, R.M., L.A. Daley and C.C. Huber, Jr. (1982), 'Evidence on the Existence of Determinants of Inter-Industry Differences in Leverage', Financial Management (Winter 1982), pp. 1020. Bradley, M., G. Jarrell and E.H. Kim (1984), 'On the Existence of an Optimal Capital Structure: Theory and Evidence,' Journal of Finance, Vol. 39 (July 1984), pp. 857-78. Brennan, M. and E. Schwartz (1978), 'Corporate Income Taxes, Valuation, and the Problem of Optimal Capital Structure,' Journal of Business, Vol. 51 January 1978), pp. 10314. Castanias, R. and H. DeAngelo (1983) 'Bankruptcy Risk and Optimal Capital Structure,'yourna/ of Finance, Vol. 38 (December 1983), pp. 1617-37. Chaplinsky, S. (1983), 'The Economic Determinant of Leverage Theories and Evidence', Unpublished Ph.D. Dissertation, University of Chicago (September 1983). Dammon, R.M. and L.W. Senbet (1988), 'The Effect of Taxes and Depreciation on Corporate Investment and Financial heverage', Journal of Finance, Vol. 43 (June 1988), pp. 35773. Davis, A. (1987), 'Effective Tax Rates as Determinants of Canadian Capital Structure', Financial Management, Vol. 16 (Autumn 1987), pp. 22-28. De Angelo, H. and R.W. Masulis (1980), 'Optimal Capital Structure Under Corporate and Personal Taxes', Journal of Financial Economics, Vol. 8 (March 1980), pp. 329. Dotan, A. and S.A. Ravid (1985), 'On the Interaction of Real and Financial Decisions of the Firm Under Uncertainty', yourna/ of Finance, Vol. 40 (June 1985), pp. 50117. Fama, E.F. (1981), 'Stock Returns Real Activity, Inflation, and Money', American Economic Review (September 1981), pp. 545-565. Geweke, J.F. and R. Meese (1981), 'Estimating Regression Models of Finite but Unknown Order', International Economic Review, Vol. 22 (February 1981), pp. 5570. Gonedes, N.J. (1981), 'Evidence on the Tax Effects of Inflation Under Historical Cost Accounting Methods',/ourna/o/Bu.ri>!Mj (April 1981), pp. 227-270. Gordon, M.J. (1982), 'Leverage and the Value of a Firm Under a Progressive Personal Income Tax', Journal of Banking and Finance, Vol. 6 (December 1982), pp. 483-93. Gordon, R.H., and B.G. Malkiel (1981), 'Corporation Finance', in How Taxes Affect Economic Behavior, H.J. Aaron and J.A. Pechman (eds), (Washington, DC: The Brookings Institution, 1981). Green, R. and E. Talmor (1985), 'The Structure and Incentive Effects of Corporate Tax Liability', Journal of Finance, Vol. 40 (September 1985), pp. 1095-1114. Hendry, D.F., A.R. Pagan and J.D. Sargan (1984), 'Dynamic Specification', Chapter 18 in Handbook of Econometrics, Vol. II, Z. GHliches and M.D. Intriligator (eds.), (Amsterdam: NorthHolland, 1984). Hochman, S. and O. Palmon (1985), 'The Impact of Inflation on the Aggregate Debt-Asset Ratio', Journal of Finance, Vol. 40 (September 1985), pp. 1115-1125. Holland, D.M. and S.C. Myers (1980), 'Profitability and Capital Cost for Manufacturing Corporations and All Nonfinancial Corporations', American Economic Review (May 1980), pp. 320-325. Jaffe, J.F. (1978), 'A Note on Taxation and Investment', Journal of Finance, Vol. 33 (December 1978), pp. 1439-45. Basil Blackwell Ltd. 1994

14

HOMAIFAR, ZIETZ AND BENKATO

Jalilvand, A, and R,S. Harris (1984), 'Corporate Behavior in Adjusting to Capital Structure md Dividend Targets: An Econometric Study', youmo/ of Finance, Vol, 39. (March 1984), pp, 127-146, Judge, G.G., R.C, Hill, W. Griffiths and T,S. Lee (1980), The Theory and Practice of Econometrics (New York: Wiley, 1980). Kim, E.H. (1978), 'A Mean Variance Theory of Optimal Capital Structure and Corporate Debt Ceipacity', Journal of Finance, Vol, 33 (March 1978), pp, 45-64, Kim, M.K, and C. Wu (1988), 'Effects of Inflation on Capital Structure', Financial Review, Vol. 23 (May 1988), pp, 183-200, Kraus, A, and R, Litzenberger (1973), 'A State Preference Model of Optimal Financial Leverage', Journal of Finance, Vol. 28 (September 1973), pp. 911-21, Mandelker, G, and S,G, Rhee (1984), 'The Impact of the Degrees of Operating and Financial Leverage on Systematic Risk of Common Stock', Journal of Financial and (Quantitative Analysis, Vol, 19 (March 1984), pp. 45-57, Miller, M, (1977), 'Debt and Taxes', Journal of Finance, Vol, 32 (May 1977), pp, 261-75, Modigliani, F. (1982), 'Debt, Dividend Policy, Taxes, Inflation and Market Valuation',youma/ of Finance, Vol, 37 (May 1982), pp, 255-73, and R. Cohn (1979), 'Inflation, Rationed Valuation and the Market', Financial Analysis Journal (March/April 1979), pp, 24-44. Myers, S. (1977), 'Determinants of Corporate Borrowing', Journal of Financial Economics, Vol. 5 (November 1977), pp, 147-175, and N. Majluf (1984), 'Corporate Financing and Investment Decisions When Firms Have Information Investors Do Not Have', Journal of Financial Economics, Vol, 13 Qune 1984), pp, 187-221. Scott, D. (1972), 'Evidence on the Importzuice of Financial Structure', Financial Management, Vol. 1 (Summer 1972), pp. 45-50, Titman, S, and R, Wessels (1988), 'The Determinants of Capital Structure Choice', Journal of Finance, Vol, 43 (March 1988), pp. 1-20. Warner, J. (1977), 'Bankruptcy Costs: Some Evidence', Journal of Finance, Vol. 32 (May 1977), pp. 337-47. Zietz, J, and R, Weichert (1988), 'A Dynamic Singular Equation System of Asset Demand', European Economic Review, Vol, 32 Quly 1988), pp. 1349-57.

Basil Blackwell Ltd. 1994

You might also like

- EIB Working Papers 2018/08 - Debt overhang and investment efficiencyFrom EverandEIB Working Papers 2018/08 - Debt overhang and investment efficiencyNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Business MGMT - IJBMR - A Study On Capital Structure - Shrabanti BalDocument10 pagesBusiness MGMT - IJBMR - A Study On Capital Structure - Shrabanti BalTJPRC PublicationsNo ratings yet

- Determinants of The Capital Structure: Empirical Study From The Korean MarketDocument10 pagesDeterminants of The Capital Structure: Empirical Study From The Korean MarketSigit Anaklostime Stenby SellaluNo ratings yet

- Determinants of Capital Structure: Evidence From Pakistani Firm'sDocument13 pagesDeterminants of Capital Structure: Evidence From Pakistani Firm'sSyed Ali Danish BukhariNo ratings yet

- 08 Bradley M., Jarrell G.A. and Kim E., (1984)Document23 pages08 Bradley M., Jarrell G.A. and Kim E., (1984)Zoogys GarcíaNo ratings yet

- How Capital Structure Affects Firm PerformanceDocument10 pagesHow Capital Structure Affects Firm PerformanceIsabel HoNo ratings yet

- How Inflation Impacts Corporate Capital StructureDocument15 pagesHow Inflation Impacts Corporate Capital StructurequockhanhnguyenNo ratings yet

- The Effect of Leverage On Firm Value and How The Firm Financial Quality Influence On This EffectDocument25 pagesThe Effect of Leverage On Firm Value and How The Firm Financial Quality Influence On This EffectadtyshkhrNo ratings yet

- Onexistence Jof1983 PDFDocument23 pagesOnexistence Jof1983 PDFIchsan FeriansyahNo ratings yet

- Fama 1998Document25 pagesFama 1998Rizqi NadhirohNo ratings yet

- Do Personal Taxes Affect Corporate Financing Decision GrahamDocument55 pagesDo Personal Taxes Affect Corporate Financing Decision GrahamAshiv MungurNo ratings yet

- Benkato - CS of Firms in An Emerging MarketDocument16 pagesBenkato - CS of Firms in An Emerging MarketIvana JovanovskaNo ratings yet

- Adjusted Present Value - Michael C. EhrhardtDocument28 pagesAdjusted Present Value - Michael C. EhrhardtXiao YangNo ratings yet

- Capial Sructure and The Firm Characteristics: Evidence From An Emerging MarketDocument19 pagesCapial Sructure and The Firm Characteristics: Evidence From An Emerging MarketSunil B.S.No ratings yet

- The Research On The Effects of Capital Structure On Firm PerformanceDocument9 pagesThe Research On The Effects of Capital Structure On Firm PerformanceIsabel HoNo ratings yet

- Panel Threshold Effect Analysis Between Capital Structure and Operating Efficiency of Chinese Listed CompaniesDocument17 pagesPanel Threshold Effect Analysis Between Capital Structure and Operating Efficiency of Chinese Listed Companiesakita_1610No ratings yet

- What Determines The Capital Structure of Ghanaian FirmsDocument12 pagesWhat Determines The Capital Structure of Ghanaian FirmsHughesNo ratings yet

- Determinants of Capital Structure Evidence From Ghanaian FirmsDocument10 pagesDeterminants of Capital Structure Evidence From Ghanaian FirmsAlexander DeckerNo ratings yet

- Do Nonfinancial Firms Use Interest Rate Derivatives To HedgeDocument28 pagesDo Nonfinancial Firms Use Interest Rate Derivatives To Hedgevidovdan9852No ratings yet

- Managerial Finance: Leverage Determinants in Saudi ArabiaDocument29 pagesManagerial Finance: Leverage Determinants in Saudi ArabiaMahmood KhanNo ratings yet

- Variable Measurement in Light of Empirical LiteratureDocument13 pagesVariable Measurement in Light of Empirical LiteratureAbhishek SinghNo ratings yet

- Capital Structure and Firm ValueDocument9 pagesCapital Structure and Firm ValueAbid HussainNo ratings yet

- Tax Position, Investment Opportunity Set (IOS), and Signaling Effect As A Determinant of LeverageDocument14 pagesTax Position, Investment Opportunity Set (IOS), and Signaling Effect As A Determinant of LeverageRasi BantingNo ratings yet

- Financial ContractingDocument41 pagesFinancial ContractingAjazzMushtaqNo ratings yet

- Net Benefits of Leverage for FirmsDocument56 pagesNet Benefits of Leverage for FirmsSajid KhanNo ratings yet

- Capital StructureDocument29 pagesCapital StructureBenardMbithiNo ratings yet

- Article1380789599 - Cheng Et AlDocument8 pagesArticle1380789599 - Cheng Et Alakita_1610No ratings yet

- Tests of Pecking Order and Static Tradeoff Theories of Capital StructureDocument33 pagesTests of Pecking Order and Static Tradeoff Theories of Capital StructureRohit BaliyanNo ratings yet

- Chapter 2Document4 pagesChapter 2ganstNo ratings yet

- The Capital Structure Through The Trade-Off Theory: Evidence From Tunisian FirmDocument12 pagesThe Capital Structure Through The Trade-Off Theory: Evidence From Tunisian FirmAhanaf JawadNo ratings yet

- Firm Size and Capital StructureDocument42 pagesFirm Size and Capital Structure陈辰No ratings yet

- Capital Structure Management in Nepalese Enterprises: Dinesh Prasad GajurelDocument73 pagesCapital Structure Management in Nepalese Enterprises: Dinesh Prasad GajurelRussell PeterNo ratings yet

- Firm Size and Capital StructureDocument41 pagesFirm Size and Capital StructureVectorNo ratings yet

- Effects of Financial Crisis on Capital Structure of Listed Firms in VietnamDocument9 pagesEffects of Financial Crisis on Capital Structure of Listed Firms in VietnamAnonymous ed8Y8fCxkSNo ratings yet

- Valuation of The Debt Tax ShildDocument30 pagesValuation of The Debt Tax ShildFame SupawongwandeeNo ratings yet

- 29Document10 pages29Бекзат АсановNo ratings yet

- Does Corporate Performance Determine Capital Structure and Dividend Policy?Document57 pagesDoes Corporate Performance Determine Capital Structure and Dividend Policy?DevikaNo ratings yet

- Corporate Hedging Impacts Financing and InvestmentDocument33 pagesCorporate Hedging Impacts Financing and InvestmentcolinbolinNo ratings yet

- Capital Structure: Features of Optimal Capital StructureDocument7 pagesCapital Structure: Features of Optimal Capital StructureSana MahmoodNo ratings yet

- The Impact of Financing Decision On The Shareholder Value CreationDocument20 pagesThe Impact of Financing Decision On The Shareholder Value CreationChâu VũNo ratings yet

- Capital Structure Impact on Profitability of Listed Manufacturing CompaniesDocument10 pagesCapital Structure Impact on Profitability of Listed Manufacturing CompaniessomiyaNo ratings yet

- By Suleiman, Hamisu Kargi Phd/Admin/11934/2008-2009Document26 pagesBy Suleiman, Hamisu Kargi Phd/Admin/11934/2008-2009Lareb ShaikhNo ratings yet

- Reading SummaryDocument89 pagesReading SummaryTrang TranNo ratings yet

- Mackie Mason1990Document23 pagesMackie Mason1990Adam JohnosonNo ratings yet

- Hedging ChannelsDocument33 pagesHedging ChannelsTanushree RoyNo ratings yet

- The Effect of Capital Structure On Profitability - Evidence From United States Article PublishedDocument15 pagesThe Effect of Capital Structure On Profitability - Evidence From United States Article PublishedErlin PramesthiiNo ratings yet

- FRBSF E L: Conomic EtterDocument4 pagesFRBSF E L: Conomic Ettertariq74739No ratings yet

- International Evidence on Financial Distress CostsDocument8 pagesInternational Evidence on Financial Distress CostsShafqat BukhariNo ratings yet

- Capital Structure Decisions and Determinants: An Empirical Study in IranDocument6 pagesCapital Structure Decisions and Determinants: An Empirical Study in IranyebegashetNo ratings yet

- Fainancial Management AssignmentDocument13 pagesFainancial Management AssignmentSamuel AbebawNo ratings yet

- Bangladesh Capital Structure DeterminantsDocument16 pagesBangladesh Capital Structure Determinantshaider_shah882267No ratings yet

- Mac A.B CiaranDocument20 pagesMac A.B Ciarannira_110No ratings yet

- Determinants of Capital Structure Master ThesisDocument6 pagesDeterminants of Capital Structure Master Thesisjacquelinedonovanevansville100% (2)

- Tax Incentives Boost Small Business Investment More than Large FirmsDocument32 pagesTax Incentives Boost Small Business Investment More than Large FirmszarigueiaNo ratings yet

- Dynamic Capital Structure ModelDocument30 pagesDynamic Capital Structure ModelShan KumarNo ratings yet

- The Costs of Financial Distress Across Industries: Arthur Korteweg September 20, 2007Document59 pagesThe Costs of Financial Distress Across Industries: Arthur Korteweg September 20, 2007Fathimah Azzahra JafrilNo ratings yet

- Milena 2012Document47 pagesMilena 2012rehan44No ratings yet

- Christie 1990Document31 pagesChristie 1990HO TOUNo ratings yet

- Fries, Miller, and Perraudin RoFE (1997)Document30 pagesFries, Miller, and Perraudin RoFE (1997)Ricardo RNo ratings yet

- The Cost of Capital, Corporate Finance and The Theory of Investment-Modigliani MillerDocument38 pagesThe Cost of Capital, Corporate Finance and The Theory of Investment-Modigliani MillerArdi GunardiNo ratings yet

- Miller and Modigliani Theory ArticleDocument7 pagesMiller and Modigliani Theory ArticleRenato WilsonNo ratings yet

- Jensen and Meckling (1976)Document22 pagesJensen and Meckling (1976)Taufik IsmailNo ratings yet

- Master's Thesis Guidelines 2014Document19 pagesMaster's Thesis Guidelines 2014bekza_159No ratings yet

- Corporate Tax Planning and Debt Endogeneity: Case of American FirmsDocument12 pagesCorporate Tax Planning and Debt Endogeneity: Case of American Firmsbekza_159No ratings yet

- Kazakhstan Institute of ManagementDocument8 pagesKazakhstan Institute of Managementbekza_159No ratings yet

- Capital Structure, Equity Ownership and Firm Performance PDFDocument34 pagesCapital Structure, Equity Ownership and Firm Performance PDFHop LuuNo ratings yet

- Jensen MecklingDocument71 pagesJensen MecklingAllouisius Tanamera NarasetyaNo ratings yet

- IntroductionDocument1 pageIntroductionbekza_159No ratings yet

- They Discussed Discounted Cash Flow (DCF) Methods. What Was One We Used in Class?Document5 pagesThey Discussed Discounted Cash Flow (DCF) Methods. What Was One We Used in Class?bekza_159No ratings yet

- Kazakhstan Institute of Management, Economics and Strategic Research FIN5206 Investment ManagementDocument23 pagesKazakhstan Institute of Management, Economics and Strategic Research FIN5206 Investment Managementbekza_159No ratings yet

- Joint Stock CompanyDocument2 pagesJoint Stock Companybekza_159No ratings yet

- Financial Derivatives FinalDocument26 pagesFinancial Derivatives Finalbekza_159No ratings yet

- Financial StatementDocument20 pagesFinancial Statementbekza_159No ratings yet

- Financial Derivatives FinalDocument37 pagesFinancial Derivatives Finalbekza_159No ratings yet

- Executive Summary Adv CorpDocument2 pagesExecutive Summary Adv Corpbekza_159No ratings yet

- Adv Corporate Finance Paper FinalDocument3 pagesAdv Corporate Finance Paper Finalbekza_159No ratings yet

- Of Difference To The Brand in Order To Have A Competitive Advantage and That ConsumersDocument3 pagesOf Difference To The Brand in Order To Have A Competitive Advantage and That Consumersbekza_159No ratings yet

- Alliance BankDocument5 pagesAlliance Bankbekza_159No ratings yet