Professional Documents

Culture Documents

Submission Bir

Uploaded by

332156879554Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Submission Bir

Uploaded by

332156879554Copyright:

Available Formats

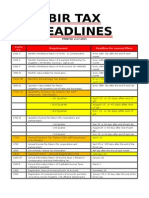

JANUARY 2014 1 Wednesday SUBMISSION Consolidated Return of All Transactions based on the Reconciled Data of Stockbrokers Engagement Letters

and Renewals or Subsequent Agreements for Financial Audit by Independent CPAs 5 Sunday SUBMISSION Summary Report of Certification Issued by the President of the National Home Mortgage Finance Corporation (RA 7279) e-FILING/FILING & e-PAYMENT/PAYMENT 2000 - Documentary Stamp Tax Declaration/Return 2000-OT- Documentary Stamp Tax Declaration/Return (One-Time Transactions) 8 Wednesday SUBMISSION Transcript sheets of the following: 2.08-ORB (A-1) 2.43-ORB 31.18-ORB 2.08-ORB 2.11-ORB 2.14-ORB 2.61-ORB 31.27-ORB 2.68-ORB 31.46-ORB 31.46Auxiliary 2.69-ORB Register Book (L71/2) 2.69A-1938.01-ORB ORB 2.70-ORB 398 ORB 2.83-ORB 398-1 ORB 31.01(L7) Month of Dec. 2013 Month of Dec. 2013 Month of December 2013 Month of December 2013 Month of December 2013 Dec. 16 31, 2013 FY beginning Mar. 01, 2014

2.17-ORB 2.17a-ORB 2.20-ORB 2.36-ORB

Transcript sheets of ORB used by manufacturers/assemblers, importers and dealers of automobiles

Monthly e-Sales Report for all Taxpayers using CRM/POS with TIN ending in even Month of Dec. 2013 number

10 Friday SUBMISSION Transcript Sheets of 2222-ORB Month of Dec. 2013

List of Buyers of Sugar Together with a Copy of Certificate of Advance Payment of VAT Made by Each Buyer Month of Dec. 2013 appearing in the List by a Sugar Cooperative Information Return on Releases of Refined Sugar by the Proprietor or Operator of a Sugar Refinery or Mill Monthly Report of DST Collection and Remitted by the Government Agency Month of Dec. 2013 Month of Dec. 2013

Monthly e-Sales Report for all Taxpayers using CRM/POS Month of Dec. 2013 with TIN ending in odd number Importer's Notarized Liquidation Statement together with Month of Dec. 2013 the required attachments e-FILING/FILING & e-PAYMENT/PAYMENT 1600 together w/ the Monthly Alphalist of Payees (MAP)Month of Dec. 2013 EFPS & Manual Filers 1606 - EFPS & Manual Filers Month of Dec. 2013

Withholding Tax Remittance Return/s for BIR Form 1600 with the Corresponding Tax Remittance Advice/s (TRAs)/Electronic Tax Remittance Advice/s (eTRAs) by Month of Dec. 2013 National Government Agencies (NGAs) - EFPS & Manual filers FILING & PAYMENT/REMITTANCE 1603 - Manual Filers 2200M - Excise Tax return for sale of gold & other mettalic mineral products by small-scale miners to the BSP DISTRIBUTION 2307- Certificate of Creditable Tax Withheld at Source (VAT/Percentage Tax) 2306 Certificate of Final Tax Withheld at Source (VAT/Percentage Tax) 11 Saturday e-FILING 1601C & 1602 EFPS filers under Group E 1601E & 1601F together w/ the Monthly Alphalist of Payees (MAP) - EFPS filers under Group E Month of December 2013 Month of December 2013 Month of Dec. 2013 Month of Dec. 2013 CQ ending Dec. 31, 2013 Month of Dec. 2013

12 Sunday e-FILING 1601C & 1602 EFPS filers under Group D 1601E & 1601F together w/ the Monthly Alphalist of Payees (MAP)- EFPS filers under Group D 13 Monday e-FILING 1601C & 1602 EFPS filers under Group C 1601E & 1601F together w/ the Monthly Alphalist of Payees (MAP) - EFPS filers under Group C 14 Tuesday e-FILING 1601C & 1602 EFPS filers under Group B 1601E & 1601F together w/ the Monthly Alphalist of Payees (MAP) - EFPS filers under Group B 15 Wednesday REGISTRATION Permanently Bound Computer Generated/Loose Leaf Books of Accounts & other Accounting Records such as CY ending but not limited to Receipts & Invoices together w/ the Dec. 31, 2013 affidavit/certificate under oath as to the type of books,no. of pages/leaves used & volume number during the TY SUBMISSION List of Medical Practitioners Quarterly List of (with monthly breakdown) of contractors of government contracts entered into by the provinces/municipalities/barangays Month of Dec. 2013 CQ ending Dec. 31, 2013 Month of December 2013 Month of December 2013 Month of December 2013 Month of December 2013 Month of December 2013 Month of December 2013

Monthly Summary Report/Schedule of Transfers of Titled and Untitled Properties by City or Municipal Assessors, Month of Dec. 2013 RDS and LRAs Summary List of blank OCTs/TCTs/CCTs issued to all RDs Month of Dec. 2013 Copy of Quarterly Updates of Assessment Roll (list of existing Tax Declaration of Real Properties)from LGUs thru its Local Treasurer CQ ending Dec. 31, 2013

e-SUBMISSION Quarterly Summary List of Machines (CRM-POS) Sold by TQ ending all machine distributor/dealer/vendor/supplier Dec. 31, 2013 e-FILING/FILING & e-PAYMENT/PAYMENT/REMITTANCE Withholding Tax Remittance Return/s with the Corresponding Tax Remittance Advice/s (TRAs)/Electronic Month of Dec. 2013 Tax Remittance Advice/s (eTRAs) by National Government Agencies (NGAs) - EFPS & Manual filers FILING & PAYMENT 1702 by corporation,partnership and other non-individual FY ending taxpayer together with the applicable attachments-EFPS & Sept. 30,2013 Manual filers Audited Financial Statements together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT) Photocopy of the Certificate of Entitlement (CE) for Income Tax holiday (ITH) issued by the BOI/BOI-ARMM Photocopy of the Certificate issued by the PEZA 1704 together with the applicable attachments 2200M- Excise Tax Return for Mineral Products e-FILING & e-PAYMENT/REMITTANCE 1603 - EFPS Filers e-FILING 1601C & 1602 EFPS filers under Group A 1601E & 1601F together w/ the Monthly Alphalist of Payees (MAP) EFPS filers under Group A FILING & REMITTANCE Month of Dec. 2013 Month of Dec. 2013 Month of Dec. 2013 CQ ending Dec. 31, 2013 CY ending Dec. 31,2012 CQ ending Dec. 31, 2013

1601C (and attachment, if applicable)-Manual Filers Month of Dec. 2013 Copy of the Certified Alphalist submitted to the nearest DOLE Regional/Provincial Office Operations Division/Unit for MWEs receiving hazard pay -for the Private Sector Justification for such payment of hazard pay as certified by DOLE -for the Private Sector

Copy of the Department of Budget and Management (DBM) circular/s or its equivalent as to who are allowed to receive hazard pay - for the Public Sector 1602 - Manual Filers 1601E & 1601F together w/ the Monthly Alphalist of Payees (MAP) - Manual Filers 1707A together with the applicable attachments by corporate taxpayers 16 Thursday SUBMISSION Consolidated Return of all Transactions based on the Reconciled Data of Stockbrokers 20 Monday SUBMISSION Quarterly Information on OCWs or OFWs Remittances which are Exempt from DST to be furnished by the local banks and non-bank money transfer agents e-SUBMISSION Monthly Report of Printers e-FILING/FILING & e-PAYMENT/PAYMENT 2551Q For transactions involving overseas TQ ending dispatch,message or conversation originating from the Dec. 31, 2013 Philippines and Amusement Taxes - EFPS & Manual filers FILING & PAYMENT 2550M & 2551M together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT) if applicable- Manual Filers e-PAYMENT 1601C, 1601E, 1601F & 1602 - EFPS filers DISTRIBUTION 2307 Certificate of Creditable Tax Withheld at Source (Income Tax) 21 Tuesday e-FILING TQ ending Dec. 31, 2013 Month of December 2013 Month of December 2013 Month of December 2013 CQ ending Dec. 31, 2013 Jan. 01-15, 2014 Month of Dec. 2013 Month of Dec. 2013 FY ending Sept. 30, 2013

2550M & 2551M together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT) if applicable - EFPS filers under Group E 22 Wednesday e-FILING 2550M & 2551M together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT) if applicable - EFPS filers under Group D 23 Thursday e-FILING 2550M & 2551M together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT) if applicable - EFPS filers under Group C 24 Friday e-FILING 2550M & 2551M together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT) if applicable - EFPS filers under Group B 25 Saturday SUBMISSION Quarterly Summary List of Sales/Purchases by a VATRegistered Taxpayers - Manual Filers Sworn Statements of the Manufacturers & Importer's Volume of Sales of each particular brand of alcohol and tobacco products e-FILING/FILING & e-PAYMENT/PAYMENT 2550Q together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT)if applicable - EFPS & Manual Filers e-FILING

Month of December 2013

Month of December 2013

Month of December 2013

Month of December 2013

TQ ending Dec. 31, 2013 TQ ending Dec. 31, 2013

TQ ending Dec. 31, 2013

2550M & 2551M together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT) if applicable- EFPS filers under Group A e-PAYMENT 2550M & 2551M - EFPS Filers REFUND Excess Taxes Withheld on Compensation by Employer, whether private or Government as a result of the YearEnd Adjustment 29 Wednesday e-FILING/FILING & e-PAYMENT/PAYMENT 1702Q together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT) if applicable - EFPS & Manual filers 30 Thursday REGISTRATION

Month of December 2013

Month of December 2013

CY ending Dec. 31, 2013

FQ ending Nov. 30, 2013

Computerized Books of Accounts & Other Accounting Records in CD-R, DVD R or other optical media properly labeled with the information required under existing CY ending revenue issuances together with affidavit attesting to the Dec. 31, 2013 completeness, accuracy and appropriateness of the computerized accounting books/records SUBMISSION Inventory List of finished goods,work in process,raw materials,supplies and stock-in trade of taxpayers e-SUBMISSION/e-ATTACHMENTS Quarterly Summary List of Sales/Purchases (SLSP) by EFPS filers Attachment to e-Filed 1702 (if Applicable) - EFPS filers Audited Financial Statements together w/ the Summary Alphalist of W/holding Agents of Income Payments Subjected to W/holding Tax (SAWT) Photocopy of the Certificate of Entitlement (CE) for Income Tax holiday (ITH) issued by the BOI/BOI-ARMM Photocopy of the Certificate issued by the PEZA TQ ending Dec. 31, 2013 FY ending Sept. 30, 2013 CY ending Dec. 31, 2013

31 Friday SUBMISSION Sworn Statement by every lessee, concessionaire, owner or operator of mines or quarry, processor of minerals, 2nd Semester of 2013 producers or manufacturer of mineral products Sworn Declaration of motel and other similar establishments TY 2013

Sworn Statement by Senior Citizens whose annual taxable income for the previous year does not exceed the poverty TY 2013 level as determined by the NEDA thru the NSCB Sworn Certification from the International Carrier stating that there is no change in the Domestic laws of its Home Country granting Income Tax Exemption to Philippine CY 2014 Carriers (RA 10378), and its required applicable For Exemptions issued in 2013 attachment - to be filed in International Tax Affairs Division (ITAD) Annual Information by all accredited Tax Agents/Practitioners to be submitted to RNAB/RRAB Annual Alphabetical List of Professionals/Persons who were issued Professional/Occupational Tax Receipt (PTR/OTR) by LGUs Tenants profile including the following documents: a) Building/space layout of the entire area being leased with proper unit/space address or reference; b) Certified True Copy of Contract of Lease per Tenant; and c) The Lessee Information Statement e-SUBMISSION List of Regular Suppliers of Goods and Services by the Top 5,000/20,000 Individual/Private Corporations including Large Taxpayers e-FILING/FILING 1604CF together with the Alphabetical List of Employees/Payees by EFPS & Manual filers e-PAYMENT/PAYMENT 0605 Annual Registration Fee DISTRIBUTION 2304 to all income receipients of payment not subject to CY 2013 withholding tax excluding compensation income TY 2014 CY 2013 2nd Semester of 2013 TY 2013 CY ending Dec. 31, 2013 As of Dec. 31, 2013

2306 to all income recipients including qualified employees whose purely compensation income & fringe benefits were subjected to Final Withholding Tax 2316 to all compensation income earners

CY 2013

CY 2013

You might also like

- Submission March 2014Document7 pagesSubmission March 2014332156879554No ratings yet

- Witholding TaxDocument68 pagesWitholding TaxReynante GungonNo ratings yet

- Submission February 2014Document6 pagesSubmission February 2014332156879554No ratings yet

- Reminders - Due DatesDocument7 pagesReminders - Due Datesdhuno teeNo ratings yet

- BIR - Invoicing RequirementsDocument17 pagesBIR - Invoicing RequirementsCkey ArNo ratings yet

- Bir Updates - GacpaDocument38 pagesBir Updates - GacpaAngelo GasatanNo ratings yet

- CV Gumarang Jaya LestariDocument44 pagesCV Gumarang Jaya LestariMaulynda Arifah RNo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- JUNE 2013 Tax ReminderDocument1 pageJUNE 2013 Tax ReminderArtjerjes Comendador PorrasNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- Axxa Car Rental Annual Report FY2013Document15 pagesAxxa Car Rental Annual Report FY2013Monde IdeaNo ratings yet

- New Tax Campaign 2024 DumagueteDocument14 pagesNew Tax Campaign 2024 DumaguetebugsparNo ratings yet

- THE Ministry of FinanceDocument19 pagesTHE Ministry of FinancePhương Trần Đỗ NgọcNo ratings yet

- Presentation in Dept of Agri RevisedDocument28 pagesPresentation in Dept of Agri RevisedLeo CasaclangNo ratings yet

- Withholding TaxesDocument29 pagesWithholding TaxesJoshua NotaNo ratings yet

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNo ratings yet

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCNo ratings yet

- 2014 BIR-RMC ContentsDocument13 pages2014 BIR-RMC ContentsMary Grace Caguioa AgasNo ratings yet

- TAX PAYER GUIDE: BIR Compliance for BusinessesDocument7 pagesTAX PAYER GUIDE: BIR Compliance for BusinessesLevi Lazareno EugenioNo ratings yet

- SubjectDocument2 pagesSubjectapi-247793055No ratings yet

- Dec 2023 Compliance DeadlinesDocument2 pagesDec 2023 Compliance DeadlinesGab Ocoma Dela CruzNo ratings yet

- Submission of Monthly/Quarterly Statement by Local Agents of Foreign Courier Service CompaniesDocument8 pagesSubmission of Monthly/Quarterly Statement by Local Agents of Foreign Courier Service CompaniesBijiNo ratings yet

- BIR Registration RequirementsDocument27 pagesBIR Registration RequirementsCrizziaNo ratings yet

- BIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsDocument107 pagesBIR Webinar on Primary Registration and Bookkeeping for New Business RegistrantsEdward Gan100% (1)

- Bureau of Internal RevenueDocument5 pagesBureau of Internal RevenuegelskNo ratings yet

- Value-Added Tax Description: BIR Form 2550MDocument15 pagesValue-Added Tax Description: BIR Form 2550MJAYAR MENDZNo ratings yet

- Bir Vat QueriesDocument8 pagesBir Vat QueriesMinerva Bautista RoseteNo ratings yet

- Annual Investment Plan 2012Document39 pagesAnnual Investment Plan 2012Nicole Andrea Ricafranca100% (1)

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- Due Date Wise Tax AlertDocument1 pageDue Date Wise Tax AlertCA Arpit YadavNo ratings yet

- RR No. 02-2006Document10 pagesRR No. 02-2006odessaNo ratings yet

- COMMISSION ON AUDIT CIRCULAR NO. 94-005 February 14, 1994 TODocument3 pagesCOMMISSION ON AUDIT CIRCULAR NO. 94-005 February 14, 1994 TOPasig City Accounting DepartmentNo ratings yet

- Mc2023051 (Application for ESD Clearance)Document7 pagesMc2023051 (Application for ESD Clearance)jgagarinNo ratings yet

- State Board of Equalization Proposed Fy-2015 Revenue CertificationDocument13 pagesState Board of Equalization Proposed Fy-2015 Revenue CertificationFortySix NewsNo ratings yet

- RMO No 19-2015Document10 pagesRMO No 19-2015gelskNo ratings yet

- Coa 2016-006Document8 pagesCoa 2016-006Genesis Caesar ManaliliNo ratings yet

- Submission of Scanned Copies of Form 2307 and 2316Document1 pageSubmission of Scanned Copies of Form 2307 and 2316RB BalanayNo ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- MRD 2015Document191 pagesMRD 2015Russel SarachoNo ratings yet

- Bir Tax Deadlines 2015Document2 pagesBir Tax Deadlines 2015Mary Grace BanezNo ratings yet

- CL2013 16A ExmdpsDocument3 pagesCL2013 16A ExmdpsDadoy AlugrivNo ratings yet

- Vat TDocument29 pagesVat TJean Cristel De ClaroNo ratings yet

- Bir Form 0605Document2 pagesBir Form 0605alona_245883% (6)

- Description: (Return To Index)Document7 pagesDescription: (Return To Index)Min JeeNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pump & Pumping Equipment World Summary: Market Values & Financials by CountryFrom EverandPump & Pumping Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Air & Gas Compressors World Summary: Market Values & Financials by CountryFrom EverandAir & Gas Compressors World Summary: Market Values & Financials by CountryNo ratings yet

- Freight Forwarding Revenues World Summary: Market Values & Financials by CountryFrom EverandFreight Forwarding Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Broadcasting Radio & Television Revenues World Summary: Market Values & Financials by CountryFrom EverandBroadcasting Radio & Television Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Transportation Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandTransportation Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Air Brakes (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandAir Brakes (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Hardware, Plumbing & Heating Equipment Agents & Brokers Revenues World Summary: Market Values & Financials by CountryFrom EverandHardware, Plumbing & Heating Equipment Agents & Brokers Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wholesalers Electronic Markets & Agents & Brokers Revenues World Summary: Market Values & Financials by CountryFrom EverandWholesalers Electronic Markets & Agents & Brokers Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Hydraulic & Pneumatic Pumps & Motors Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandHydraulic & Pneumatic Pumps & Motors Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Packing & Crating Revenues World Summary: Market Values & Financials by CountryFrom EverandPacking & Crating Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pollution Monitoring World Summary: Market Values & Financials by CountryFrom EverandPollution Monitoring World Summary: Market Values & Financials by CountryNo ratings yet

- Loose Coarse Pitch Worms & Worm Gearing World Summary: Market Sector Values & Financials by CountryFrom EverandLoose Coarse Pitch Worms & Worm Gearing World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Shut Up and Marry MeDocument1,186 pagesShut Up and Marry Me332156879554100% (1)

- Sample Board ResolutionDocument4 pagesSample Board Resolution33215687955486% (37)

- Submission BirDocument9 pagesSubmission Bir332156879554No ratings yet

- HR412Document8 pagesHR412332156879554No ratings yet

- CFO Director Finance Controller in Chicago IL Resume Louis ColellaDocument3 pagesCFO Director Finance Controller in Chicago IL Resume Louis ColellaLouisColellaNo ratings yet

- AIS Chapter 11 CasesDocument6 pagesAIS Chapter 11 CasesHarold Dela FuenteNo ratings yet

- Revenue Regulation 2-99Document5 pagesRevenue Regulation 2-99Joanna MandapNo ratings yet

- 0 Asset Protection BasicsDocument43 pages0 Asset Protection Basicspwilkers36100% (1)

- RETURNS Under GST - Types, Applicability, Annual Returns, Matching, Final Returns With Rules CA. V.Vijay AnandDocument8 pagesRETURNS Under GST - Types, Applicability, Annual Returns, Matching, Final Returns With Rules CA. V.Vijay Anandshahista786No ratings yet

- 11 CIR V JavierDocument11 pages11 CIR V JavierNeil BorjaNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- Additions To TaxDocument22 pagesAdditions To Taxstannis69420No ratings yet

- Determining Tax Literacy of Salaried Individuals - An Empirical AnalysisDocument5 pagesDetermining Tax Literacy of Salaried Individuals - An Empirical AnalysisRacerAkashNo ratings yet

- Submit VAT Return Mushak-9.1Document107 pagesSubmit VAT Return Mushak-9.1Tapu BassNo ratings yet

- TAX - LEAD BATCH 3 - Preweek 1 PDFDocument28 pagesTAX - LEAD BATCH 3 - Preweek 1 PDFMay Litt0% (1)

- SK-PST FormDocument1 pageSK-PST FormOsama JavaidNo ratings yet

- Chapter 2 Tax AdministrationDocument12 pagesChapter 2 Tax AdministrationGlomarie GonayonNo ratings yet

- Documents Preparation Guide for ILPDocument3 pagesDocuments Preparation Guide for ILPjenishaNo ratings yet

- Assignment Taxation 2Document6 pagesAssignment Taxation 2Alexander Steven ThemasNo ratings yet

- GAT General Analytical Questions and Answers Part1Document12 pagesGAT General Analytical Questions and Answers Part1HAFIZ IMRAN AKHTER67% (3)

- 202 Scra 450 (GR 60714) Cir vs. Japan Airlines Inc.Document7 pages202 Scra 450 (GR 60714) Cir vs. Japan Airlines Inc.Ruel FernandezNo ratings yet

- Senior Tax Accountant in Philadelphia PA Resume Joseph McLaughlinDocument2 pagesSenior Tax Accountant in Philadelphia PA Resume Joseph McLaughlinJosephMcLaughlinNo ratings yet

- Lousianna Tax InstructionDocument17 pagesLousianna Tax Instructionchuckhsu1248No ratings yet

- Revenue Memorandum CircularsDocument90 pagesRevenue Memorandum CircularsJess Esmena100% (1)

- USA vs. James Timothy TurnerDocument11 pagesUSA vs. James Timothy TurnerJay GatsbyNo ratings yet

- Remedies Tax Recovery Letters PDFDocument92 pagesRemedies Tax Recovery Letters PDFmo100% (9)

- PTP OneClick v. AvalaraDocument25 pagesPTP OneClick v. AvalaraNat LevyNo ratings yet

- Prulife UK Application FormDocument9 pagesPrulife UK Application FormjayarcyNo ratings yet

- Tax - RemediesDocument14 pagesTax - RemediesMergilyn OngcoyNo ratings yet

- Tax Guidance On Red Hill ReimbursementsDocument5 pagesTax Guidance On Red Hill ReimbursementsHNNNo ratings yet

- Bar Exam Questions To ChubiboDocument33 pagesBar Exam Questions To ChubiboLester BalagotNo ratings yet

- ESCP Bachelor Scholarship Application Form 2021Document3 pagesESCP Bachelor Scholarship Application Form 2021Med Elyes GharsallahNo ratings yet

- Research - Tax Evasion 2Document27 pagesResearch - Tax Evasion 2Jade ViguillaNo ratings yet

- US Internal Revenue Service: f8878 - 2002Document2 pagesUS Internal Revenue Service: f8878 - 2002IRSNo ratings yet