Professional Documents

Culture Documents

College Savings

Uploaded by

vietrossCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

College Savings

Uploaded by

vietrossCopyright:

Available Formats

9 Things You Probably Don't Know About College Savings Plans For the 2013-2014 school year, the

College Board reports that the average cost of college tops $40,000 at a private school and over $18,000 for pu lic! "t#s no $onder that parents start to feel the pressure efore a $ould- e student can even read! %hat#s $hy &any parents turn to the '2( savings plan, $hich is a state-sponsored, ta)advantaged invest&ent account open to anyone! *hile &ost of us have heard the $ords +'2( plan,+ these accounts co&e $ith a ton of advantages you &ay not ,no$ a out! -ichael .gan, CF/ and founding partner of 0irginiaased financial planning fir& .gan, Berger 1 *einer, sheds light on ho$ to &a,e the &ost of a '2(2 529s aren't just for tra itional !ollege " or li#ite to tuition$ +3ne of the est things a out a '2( is that it#s so fle)i le,+ says .gan! +4ou can use it for undergraduate or grad school, or even for technical school or trade school, to pay for tuition, fees, and oo,s!+ Anyone !an o%en an !ontribute$ 5 parent, grandparent, godparent, particularly generous neigh or, or anyone else can open a '2(! 6i,e$ise, anyone can contri ute to one and ta,e the appropriate ta) deduction! Another fa#ily #e#ber !an use the #oney$ *hile the adult $ho opens the plan is the plan#s o$ner, the eneficiary is the person $ho receives the &oney 7 and it can e changed! "f one child decides not to go to school, goes to a cheaper school than e)pected, gets a full scholarship 8&ore on that in a &inute9, or for so&e other reason doesn#t use all of the &oney, you can si&ply change the eneficiary on the account and give those funds to another child : or even to yourself, if you#d li,e to go ac, to school! &f your 'i gets a full ri e( you !an have the #oney ba!'$ "f you saved &ore than you needed in your '2( and try to pull that &oney out to use for costs other than education, you#ll pay a fee! ;o$ever, there#s one &a<or e)ception2 +"f you#re not using the &oney ecause the ,id gets a full scholarship, the penalty is $aived,+ says .gan! +"t#s a federal rule, so it applies to all plans!+ You !an !hoose whi!h 529 you want to use$ =ince the plans are state-sponsored, each state runs one or &ore of their o$n, and savers are allo$ed to choose $hich they prefer! 5t savingforcollege!co&, there are 114 options, and each one has a slightly different invest&ent structure! ;o$ever, +if you don#t use your o$n state#s plan, and you live in a state $ith inco&e ta)es, you &ay &iss out on a ta) deduction,+ $arns .gan! +%here $ould have to e a really co&pelling reason to go outside your o$n state, li,e if the other plan had significantly lo$er e)penses and, in net of the ta) deduction, you#d still save &oney!+

You !an have #ore than one a!!ount$ %hat said, the fact that you can open &ore than one '2( &eans that if you have an open account and &ove out of the state, you can ,eep your &oney in your original '2( and open a ne$ one in your ne$ state! *hile you can choose to consolidate the&, .gan &entions that so&e states $ill re>uest the &oney fro& your ta) deduction ac, if you $ithdra$ the funds 7 in $hich case you &ight as $ell leave it! "n fact, any fa&ily $ith &ore than one ,id ound for higher education should have an account per child! +For the average person, it#s easier to thin, of an account per child instead of one collective pot to e divvied up,+ e)plains .gan! +%hen you ,no$ that =u?y has her o$n savings, ut you could ta,e &oney for =u?y out of @ohnny#s pot if you needed to! "t also gives the a ility to get &ore deductions 7 three plans for three ,ids allo$s three ti&es the deduction!+ You !an store a lot of #oney$ *hile the &ost generous a&ong us have to loo, out for incurring a gift ta), $hich is a ta) designed to discourage sheltering inco&e in +gifts,+ you can contri ute up to $14,000 per year, per child, and per donor! +5 hus and and $ife could put in $28,000 a year, per child, $ithout the gift ta) eing an issue,+ says .gan! 5nd in states li,e 0irginia, he adds, there is no cap on the ta) deduction you can ta,e! You !an front)loa the a!!ount$ "f you need it, there is a $ay around the donation li&it2 4ou can give up to five years# $orth of contri utions at once 7 that#s $A0,000 per person! +"n year one of the plan, you &ight see a grandparent $ho has done really $ell for the&selves and $on#t need the &oney &a,e this ,ind of contri ution,+ .gan e)plains! +"t &eans they $on#t e a le to contri ute for the ne)t five years, ut y putting the &oney in early, they#re giving it &ore ti&e to co£, and they#re getting it out of their estates!+ A 529 !an last for generations$ %here is no e)piration date on a '2(! +"f you front-load your grandchild#s '2( t$ice, odds are they &ay not spend $140,000 $hen they go to college,+ says .gan! +%hat &oney could stay in the account and go to their ,ids! 4ou could ,eep it as a &ultigenerational fa&ily trust!+ The botto# line* *hether or not you choose to use a '2( 7 although for al&ost everyone, it#s the est choice 7 get started as soon as possi le! Bote that you do have to $ait until the a y arrives, since eneficiaries &ust have a =ocial =ecurity nu& er! =oon after$ard, start &anaging your child#s e)pectations! .gan reco&&ends having discussions $ell efore college a out ho$ &uch &oney you#ll e providing and ho$ &uch your child is e)pected to chip in! +%he iggest &ista,e " see is parents $ho try and pay 100C of a child#s college costs and scre$ up their o$n retire&ent ecause of it,+ says .gan! +%hey run out of &oney efore they run out of life and have to live $ith their ,ids for 1' years!+

You might also like

- Personal FinanceDocument2 pagesPersonal FinanceSteck SS100% (2)

- 10 Things I Wish I Knew in High SchoolDocument12 pages10 Things I Wish I Knew in High SchoolSarah GalimoreNo ratings yet

- Sight Word SentencesDocument52 pagesSight Word Sentencesvietross75% (4)

- Consumers Guide To Home InsuranceDocument20 pagesConsumers Guide To Home InsurancevietrossNo ratings yet

- Dorks List For Sql2019 PDFDocument50 pagesDorks List For Sql2019 PDFVittorio De RosaNo ratings yet

- Children and Money MiniDocument34 pagesChildren and Money Minirhoda363No ratings yet

- Freelance Contract TemplateDocument7 pagesFreelance Contract TemplateAkhil PCNo ratings yet

- Iso 8062Document1 pageIso 8062Asrar Ahmed100% (2)

- Surefire Ways To Get Taken by Identity ThievesDocument3 pagesSurefire Ways To Get Taken by Identity ThievesvietrossNo ratings yet

- Pre-Departure Orientation 2013: Banking in The UsDocument2 pagesPre-Departure Orientation 2013: Banking in The UsKyiv EducationUSA Advising CenterNo ratings yet

- AMCA 210-07 PreDocument10 pagesAMCA 210-07 PretiagocieloNo ratings yet

- Safal Niveshak InvestmentDocument70 pagesSafal Niveshak InvestmentTrilok Chand Gupta100% (1)

- Li Ka ShingDocument6 pagesLi Ka ShingMarc Edwards100% (1)

- Carbozinc 11 HS PDSDocument2 pagesCarbozinc 11 HS PDSvietrossNo ratings yet

- Carbozinc 11 HS PDSDocument2 pagesCarbozinc 11 HS PDSvietrossNo ratings yet

- 15.910 Draft SyllabusDocument10 pages15.910 Draft SyllabusSaharNo ratings yet

- DCF ModelDocument14 pagesDCF ModelTera ByteNo ratings yet

- Bob Proctor - It's Easy To Earn MoneyDocument3 pagesBob Proctor - It's Easy To Earn Moneyturuitus232323100% (3)

- Specification Sheet: Alloy 310/310S/310H: (UNS S31000, S31008, S31009) W. Nr. 1.4845Document2 pagesSpecification Sheet: Alloy 310/310S/310H: (UNS S31000, S31008, S31009) W. Nr. 1.4845Manoj PaneriNo ratings yet

- CALM Summer School Final Exam Bonus QuestionDocument8 pagesCALM Summer School Final Exam Bonus QuestionMelanie HinesNo ratings yet

- Michael Nolan A5 No Track ChangesDocument6 pagesMichael Nolan A5 No Track Changesapi-240150212No ratings yet

- KidsandcashDocument7 pagesKidsandcashapi-239373469No ratings yet

- Word of WisdomDocument8 pagesWord of WisdomRyan AndrianNo ratings yet

- Map Your Financial FutureDocument8 pagesMap Your Financial FutureThanhphuong1511No ratings yet

- Life Cycle and Wealth Cycle in Financial PlanningDocument4 pagesLife Cycle and Wealth Cycle in Financial Planningaman27jaiswalNo ratings yet

- It's Super EasyDocument3 pagesIt's Super Easyapi-462894542No ratings yet

- National Publishing Company: Marketing of Childrens Fortnightly MagazineDocument3 pagesNational Publishing Company: Marketing of Childrens Fortnightly MagazineSumitAggarwalNo ratings yet

- Edited Instrument HFJJDocument9 pagesEdited Instrument HFJJKrystel Joy AuroNo ratings yet

- Recession, Lighter Side and PunctualityDocument8 pagesRecession, Lighter Side and Punctualitygokuboy1derNo ratings yet

- Salida InglesDocument2 pagesSalida InglesSergio RodriguezNo ratings yet

- They Save Regularly: Open A Top-Rated Savings AccounDocument3 pagesThey Save Regularly: Open A Top-Rated Savings AccounRaga MalikaNo ratings yet

- Working in The United StatesDocument13 pagesWorking in The United StatesNathalie LucasNo ratings yet

- SOC 101 Poverty1Document7 pagesSOC 101 Poverty1britthens16No ratings yet

- Education Savings Accounts (Esas) : Reyna GobelDocument8 pagesEducation Savings Accounts (Esas) : Reyna GobelAbhishek SinghNo ratings yet

- 406save Money Ebook (1) .HTMDocument7 pages406save Money Ebook (1) .HTMntobzaNo ratings yet

- MyfinancialplanDocument4 pagesMyfinancialplanapi-337932889No ratings yet

- Septnl 1Document2 pagesSeptnl 1api-265596527No ratings yet

- Family PlanningDocument9 pagesFamily PlanningMaimai DuranoNo ratings yet

- A To Z Learning Tree Parent Handbook Updated 9-11-14Document12 pagesA To Z Learning Tree Parent Handbook Updated 9-11-14api-230985728No ratings yet

- Year 7 Newbies Intro Letter Please Host1Document4 pagesYear 7 Newbies Intro Letter Please Host1api-235103566No ratings yet

- The Bigger The Family The BetterDocument3 pagesThe Bigger The Family The BetterSachvinder GillNo ratings yet

- Pocket MoneyDocument3 pagesPocket MoneyAtef StiliNo ratings yet

- How to get the Scholarship of Your Dreams: The Step by Step Guide to Securing and Maximizing a ScholarshipFrom EverandHow to get the Scholarship of Your Dreams: The Step by Step Guide to Securing and Maximizing a ScholarshipNo ratings yet

- Akhs Knightly NewsDocument5 pagesAkhs Knightly Newsapi-198044962No ratings yet

- Business Etiquettes - OldDocument63 pagesBusiness Etiquettes - OldNikita SangalNo ratings yet

- Bright Ideas: The Ins & Outs of Financing a College EducationFrom EverandBright Ideas: The Ins & Outs of Financing a College EducationRating: 5 out of 5 stars5/5 (1)

- Chingford Hall Information: Week Ending: Friday 23 May 2014Document2 pagesChingford Hall Information: Week Ending: Friday 23 May 2014chingfordhallschoolNo ratings yet

- Sponsoring TipDocument17 pagesSponsoring Tipapi-250348842No ratings yet

- CUESTIONARI0 AUPAIR para Países de Habla InglesaDocument7 pagesCUESTIONARI0 AUPAIR para Países de Habla InglesaMaggie Sarah ShelleyNo ratings yet

- Blown Away by Science: Dates To RememberDocument7 pagesBlown Away by Science: Dates To Remembermbockstruck30No ratings yet

- Essay Outline 8Document21 pagesEssay Outline 8gnp1986No ratings yet

- 2013 2014minigrantapplicationDocument11 pages2013 2014minigrantapplicationapi-232628807No ratings yet

- Absent - Divorced FatherDocument3 pagesAbsent - Divorced FatherNO,NO,NO 2 status QUONo ratings yet

- EBE Seminar2Document12 pagesEBE Seminar2Xandra ElenaNo ratings yet

- November 2014Document9 pagesNovember 2014api-257559837No ratings yet

- Financial Eportfolio2Document3 pagesFinancial Eportfolio2api-242533380No ratings yet

- Children Should Earn Their Pocket MoneyDocument6 pagesChildren Should Earn Their Pocket MoneyGabiNo ratings yet

- Re: Request or Donations: (Project ChairpersonDocument4 pagesRe: Request or Donations: (Project ChairpersonJulius Juju KenangoNo ratings yet

- Advice For ParentsDocument1 pageAdvice For Parentsdkay3kscribdmoonshineNo ratings yet

- All 25 Guides PsDocument74 pagesAll 25 Guides Pscheeseem100% (1)

- Children Should Earn Their Pocket MoneyDocument5 pagesChildren Should Earn Their Pocket MoneyGabiNo ratings yet

- Malaysian Alumni ApplDocument4 pagesMalaysian Alumni ApplEmolover SriNo ratings yet

- Effective Ways To Use Authentic Materials With ESLDocument6 pagesEffective Ways To Use Authentic Materials With ESLBang VutheNo ratings yet

- 11111111111111111111Document4 pages11111111111111111111Harshita SrivastavaNo ratings yet

- Lesson 15 2Document8 pagesLesson 15 2alfredolawyerNo ratings yet

- September:: Dates at A GlanceDocument3 pagesSeptember:: Dates at A Glancemelissadavis8180No ratings yet

- Money Matters For All AgesDocument42 pagesMoney Matters For All AgesBenjamin WilliamsNo ratings yet

- Ready, Set, Go!: Dates To RememberDocument7 pagesReady, Set, Go!: Dates To Remembermbockstruck30No ratings yet

- Lesson 4 10 Tips For Managing Your Money As A College StudentDocument9 pagesLesson 4 10 Tips For Managing Your Money As A College StudentAndrew BantiloNo ratings yet

- Identify Desired Results (Stage 1) Content Standards: Title of Unit Grade Level Time Frame Developed byDocument8 pagesIdentify Desired Results (Stage 1) Content Standards: Title of Unit Grade Level Time Frame Developed bywestpoint1522No ratings yet

- 316 316L 317L Spec Sheet PDFDocument3 pages316 316L 317L Spec Sheet PDFSaúl L Hdez TNo ratings yet

- Flat Socket Head Cap ScrewsDocument8 pagesFlat Socket Head Cap Screwsvietross100% (1)

- Flat Socket Head Cap ScrewsDocument8 pagesFlat Socket Head Cap Screwsvietross100% (1)

- 08 Attachment 8Document11 pages08 Attachment 8vietrossNo ratings yet

- IRS - Comparison of Form 8938 and FBAR RequirementsDocument8 pagesIRS - Comparison of Form 8938 and FBAR RequirementsvietrossNo ratings yet

- CFDDocument9 pagesCFDvietrossNo ratings yet

- Slug FlowDocument7 pagesSlug FlowharishtokiNo ratings yet

- Ways To Minimize Income Tax in RetirementDocument2 pagesWays To Minimize Income Tax in RetirementvietrossNo ratings yet

- Cotter Pin, Stainless Steel: Page 1 of 1 REV-03 Date: August 4, 2015 Pin - Cot.SsDocument1 pageCotter Pin, Stainless Steel: Page 1 of 1 REV-03 Date: August 4, 2015 Pin - Cot.SsD_D_76No ratings yet

- 5 14 906kt1000Document2 pages5 14 906kt1000vietrossNo ratings yet

- An Introduction To Air Density and Density Altitude CalculationsDocument22 pagesAn Introduction To Air Density and Density Altitude CalculationsvietrossNo ratings yet

- Correlations For Heat Transfer CoefficientsDocument4 pagesCorrelations For Heat Transfer CoefficientsvietrossNo ratings yet

- Minimize Your Investment Losses Using Decision TreesDocument2 pagesMinimize Your Investment Losses Using Decision TreesvietrossNo ratings yet

- 10 Fluid Power LessonsDocument5 pages10 Fluid Power LessonsvietrossNo ratings yet

- HydrogenDocument6 pagesHydrogenvietrossNo ratings yet

- Slide Plate ApplicationsDocument2 pagesSlide Plate ApplicationsvietrossNo ratings yet

- Investing WiselyDocument1 pageInvesting WiselyvietrossNo ratings yet

- Health InsurersDocument2 pagesHealth InsurersvietrossNo ratings yet

- College SavingsDocument2 pagesCollege SavingsvietrossNo ratings yet

- FAGIX Fidelity IncomeDocument8 pagesFAGIX Fidelity IncomevietrossNo ratings yet

- Four High Yielding StocksDocument2 pagesFour High Yielding StocksvietrossNo ratings yet

- Simple Way To Save On EverythingDocument2 pagesSimple Way To Save On EverythingvietrossNo ratings yet

- DenmarkDocument4 pagesDenmarkFalcon KingdomNo ratings yet

- Hex Bucket InspectionDocument1 pageHex Bucket InspectionSixto Guarniz AnticonaNo ratings yet

- 032017Document107 pages032017Aditya MakwanaNo ratings yet

- HyderabadDocument3 pagesHyderabadChristoNo ratings yet

- 14 DETEMINANTS & MATRICES PART 3 of 6 PDFDocument10 pages14 DETEMINANTS & MATRICES PART 3 of 6 PDFsabhari_ramNo ratings yet

- Application Form New - Erik WitiandikaDocument6 pagesApplication Form New - Erik Witiandikatimmy lauNo ratings yet

- 1634 - Gondola Head Super - Structure and Side Wall - ENDocument8 pages1634 - Gondola Head Super - Structure and Side Wall - ENmohammadNo ratings yet

- Maverick Research: World Order 2.0: The Birth of Virtual NationsDocument9 pagesMaverick Research: World Order 2.0: The Birth of Virtual NationsСергей КолосовNo ratings yet

- Transportation Problem VAMDocument16 pagesTransportation Problem VAMLia AmmuNo ratings yet

- Current Matching Control System For Multi-Terminal DC Transmission To Integrate Offshore Wind FarmsDocument6 pagesCurrent Matching Control System For Multi-Terminal DC Transmission To Integrate Offshore Wind FarmsJackie ChuNo ratings yet

- Enabling Trade Report 2013, World Trade ForumDocument52 pagesEnabling Trade Report 2013, World Trade ForumNancy Islam100% (1)

- DBR KochiDocument22 pagesDBR Kochipmali2No ratings yet

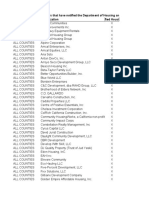

- Ab 1486 Developer Interest ListDocument84 pagesAb 1486 Developer Interest ListPrajwal DSNo ratings yet

- PT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaDocument16 pagesPT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaihsanlaidiNo ratings yet

- Stryker Endoscopy SDC Pro 2 DVDDocument2 pagesStryker Endoscopy SDC Pro 2 DVDWillemNo ratings yet

- User Manual OptiPoint 500 For HiPath 1220Document104 pagesUser Manual OptiPoint 500 For HiPath 1220Luis LongoNo ratings yet

- DTDC Rate Quotation-4Document3 pagesDTDC Rate Quotation-4Ujjwal Sen100% (1)

- An Analytical Study On Impact of Credit Rating Agencies in India 'S DevelopmentDocument14 pagesAn Analytical Study On Impact of Credit Rating Agencies in India 'S DevelopmentRamneet kaur (Rizzy)No ratings yet

- MC 33199Document12 pagesMC 33199Abbode HoraniNo ratings yet

- 3D Archicad Training - Module 1Document3 pages3D Archicad Training - Module 1Brahmantia Iskandar MudaNo ratings yet

- PraxiarDocument8 pagesPraxiara_roy003No ratings yet

- GGSB MibDocument4 pagesGGSB MibShrey BudhirajaNo ratings yet

- 4 FAR EAST BANK & TRUST COMPANY V DIAZ REALTY INCDocument3 pages4 FAR EAST BANK & TRUST COMPANY V DIAZ REALTY INCDanielleNo ratings yet

- What Is EBSD ? Why Use EBSD ? Why Measure Microstructure ? What Does EBSD Do That Cannot Already Be Done ?Document5 pagesWhat Is EBSD ? Why Use EBSD ? Why Measure Microstructure ? What Does EBSD Do That Cannot Already Be Done ?Zahir Rayhan JhonNo ratings yet

- Remote SensingDocument30 pagesRemote SensingVijay RajNo ratings yet