Professional Documents

Culture Documents

99ebook CA Om RFP ATM Recon

Uploaded by

faemozOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

99ebook CA Om RFP ATM Recon

Uploaded by

faemozCopyright:

Available Formats

REQUEST FOR PROPOSAL

FOR

ATM CARDS/ DEBIT CARDS/ POINT OF SALE PAYMENT GATEWAY TRANSACTIONS RECONCILIATION SERVICES

TRANSACTION BANKING DIVISION ATM RECONCILIATION CELL HO WING: 9TH FLOOR, ANTRIKSH BHAWAN 22, K G MARG, NEW DELHI 110 001 Tel No. 011-43532212 E-Mail: ijarora@pnb.co.in

BID DETAILS

1.

Date of commencement of Tender download on PNB site at http://pnbindia.com Last date of acceptance of queries from the prospective bidders Last date and time for submission of Technical and Commercial Bids Date and Time of Technical Bid Opening Opening of Commercial Bids

19th February 2010 26th February 2010 Up to 5 P.M. 15th March 2010 Up to 5 P.M.

2. 3 4. 5.

16th March 2010 at 11 A.M.

After Evaluation of Technical Bids and shortlisting of bidders, Date, Time and Venue for opening of commercial bids would be conveyed

Rs. 10,000/- (non refundable) in the form of Demand Draft in favour of Transaction Banking Division, Punjab National Bank payable at New Delhi. The DD/ Banker cheque should be submitted in person along with the bids. Rs.25,00,000/- (Rs. T w e n t y F i v e Lakh Only) in the form of Demand Draft in favour of Transaction Banking Division, Punjab National Bank payable at New Delhi, The DD/ Banker cheque should be submitted in person along with bids. Punjab National Bank, Transaction Banking Division

6.

Cost of RFP

7.

Earnest Money Deposit Amount

8.

Place of opening of Bids

ATM Reconciliation Cell Ho wing: 9th floor, Antriksh Bhawan 22, K G Marg, New Delhi 110 001

9. Contact Us Details Interested Bidders may contact us if they require any clarification in RFP by sending Email to ijarora@pnb.co.in mentioning following details: Name of party, Contact Person, Mailing Address with PIN Code, Telephone No., FAX No., email Address, Mobile Number etc. giving their clear request for specific clarification. Clarifications requested after 26th February, 2010 would not be entertained.

Bank will follow the e-procurement process for Reverse Auction. The complete details of t h e requirements for participation in the e-procurement process of the bank are given in the website h t t p : / / www.pnb.org.in, which may be referred for details & clarifications. Note: - Technical bids will be opened in the presence of b i d d e r s who choose to attend as above

1.

INTRODUCTION AND PURPOSE

1.1 INTRODUCTION Punjab National Bank is one of the largest public sector bank in India providing state of the art products and services viz. Any Time Any Where Banking, ATMs, Telebanking, Internet Banking, RTGS, NEFT, established Payment Gateway, etc. PNB has recently entered into (point of sale) POS acquiring business. Bank implemented a Centralized Core banking Solution (CBS) and in the process established primary data centre at New Delhi and DR site at Mumbai. Bank has a Centralized ATM Transaction Switch at New Delhi and more than 3000 online connected ATMs ( Offsite and lobby ATMs) , which are operational across the country with a Card Base of more than ten million having more than 8 lakh transactions per day. The Bank has ATM Sharing Arrangements (Bilateral and Multilateral) with different Banks / Networks viz., NFS, SBI (Bilateral), MasterCard, Everest Bank Ltd. of Nepal etc. allowing inter bank ATM transactions and Point of Sale (POS) transactions worldwide. The card base as well as transaction hits have been growing at a phenomenal rate. 1.2 PURPOSE Punjab National Bank (hereinafter referred to as the Bank) with Head Office at Bhikhaiji Cama Place, New Delhi is interested in implementing a Centralized ATM Reconciliation Activity, which should be accessible from any office of the Bank. We invite Technical and commercial bids from qualified service providers to implement Centralized ATM Debit Card and Point of Sale (POS) Reconciliation Activity for the Bank as per the terms and conditions mentioned hereunder. 2. SYSTEM DESCRIPTION The System of the bidder for implementation of ATM/Debit Card and Point of Sale (POS) Recon Activity should be c apable of being integrated with existing Core Banking Solution (Finacle), Switch & EJ through flat files or also through API. The system should also be capable of being integrated with Banks Corporate Data Ware House project and Middleware Solution. However, bidder would be responsible for finalizing requirements for integration directly with the vendor for successful integration and any f i n a n c i a l implication a r i s i n g o u t of such integrations s h a l l b e the responsibility of the solution provider. The bidder will be required to implement the A T M R e c o n c i l i a t i o n A c t i v i t y at a n a l t e r n a t e l o c a t i o n , t o b e d e c i d e d b y t h e b a n k , f o r c o n t i n u i t y o f s e r v i c e . No separate amount would be payable for the DR implementation.

3.

SCOPE OF WORK

This RFP document has been prepared by Bank to convey the broad requirement of ATM/Debit Card /POS/ e-Payment Gateway Transactions Reconciliation activity as per the specifications / activities and terms & conditions elaborated in this document. 3.1 Reconciliation Manage all ATM Transactions reconciliation work with the appropriate software and experienced/skilled man-power for the related job. The software should be efficient enough to handle huge volumes of transactions, which can complete the reconciliation process within time-bound schedule, as per established rules and mandate of various interchange networks with which the bank has ATM sharing arrangements , with tracking capabilities of each event for each transaction to avoid duplication of the same activity at any level up to the closure of the transaction. 3.1.1 ATM & POS Transactions Upload data files obtained from Banks Central Server / Base24 Switch / EJ Data / Transaction Log Files (TLF) / Data Files as received from ATM Sharing Networks, in the Reconciliation Server and carry out the process of reconciliation of all entries by generating Reports of Matched, Unmatched, failed, Reversal, Partial Reversal, Suspected, manual entries; ATM-wise etc. of : i) Reconciliation of ATM transactions such as On Us, Acquirer and Issuer Transactions with tie-up Banks / networks like MASTER/ EBL / NFS / SBI etc. on daily basis based on Host, Switch and EJ/JP Log; ii) Reconciliation for all POS transactions made through our PIN based and Signature/biometric etc. based Debit Cards; iii) Reconciliation for Inter Account Transfer of Funds through ATMs; iv) Reconciliation of Sundry and Suspense account entries; v) Handling queries from branches on the reconciled and pending entries, etc.;

vi) Quantifying the funds to be provided to sharing banks and facilitating transfer of such funds to them; vii) Reconciliation of our Banks Settlement A/cs with the settlement A/cs maintained with different banks for different ATM Sharing Arrangements. viii) Raising all chargebacks for resolution of disputes, raising & settling debit/credit adjustments, making represent-ments, as per Rules and Mandates of different ATM Sharing arrangement. 4

ix) Making 1st presentments, 2nd presentments etc, making, receiving and presenting arbitration cases etc as per Rules and Mandates of different ATM Sharing arrangement. x) future. Reconciliation for all existing and new products and tie-ups present and

xi) Process Electronic Journal pulled from ATMs as integral component of reconciliation. 3.2 Accounting, Reconciliation & Reports i) Creation of Interface / Reports for Cardholders account through uploadable data files; ii) Fees Management Interchange for debit to cardholders A/cs; Fee Auto-Debiting / Crediting

as well

as

other

charges

iii) Charge-back Management. iv) Generating Uploadable files of Credit vouchers in favour of Branches for the credits received from different ATM Sharing Arrangements on daily basis; v) Receiving and recording of Claim applications from cardholders / branches / other banks/Call Centre and disposing them off as per procedure. vi) Facilitating reply to cardholder queries on pending claims, placing periodical MIS Reports on claims settled as per format defined by the Bank; vii) The software used must be compatible to the Electronic journal pulled from ATMs of NCR Corporation India Ltd. / Diebold / Wincore or of any other make installed / to be installed by the Bank; viii) MIS Reports must meet both specified and need based present and/or future requirements of the bank; ix) The bidder shall deploy adequate resources to meet the Banks reconciliation requirement within the turnaround period stipulated by Bank/RBI/Any other Regulatory authority. x) Bank has approved procedure of reconciliation of ATM transactions by matching EJ Data with Finacle Data. Base 24 files will be used for the purpose of reference for determining cases for customers claims. xi) Vendor will segregate ATM transactions done by Shared Network Member Banks cardholders from TLF (Switch) and prepare batch files for debiting the consolidated amount to the various Suspense A/cs viz. NFS Suspense A/c, MASTER Suspense A/c, SBI Suspense A/c and EBL Suspense A/c and crediting these transactions individually in each ATM on the next day so that such transactions may be uploaded in the Finacle in each ATM. 5

xii) Vendor will also maintain record of entries debited to Suspense A/c and adjustment thereof and provide outstanding suspense entries and issue reminders periodically as desired by the Bank. xiii) Vendor will reconcile on daily basis reports of ATMs where there is difference in cash Dr. / Cr as per ATM A/c (using Finacle Data) vis--vis bills appearing in ATM Counters as per EJ. Automated letters/e-mails/SMS alerts be generated to the branches showing cash differences with instructions to pass rectification (adjustment) vouchers. Report showing compliance by the branch will also be provided with dates of cause of action and adjustment. xiv) Vendor to provide position of reconciliation as per pre-determined format provided by the Bank from one stage of cash replenishment in ATM to the next one. Mismatch ATM transactions (EJ and ATM A/c) to be exhibited with proper remarks as per EJ and Switch Reports. xv) Vendor will generate automated letters and send through e-mails, SMS etc to the customers and branches as per format provided by the bank from time to time. xvi) Providing files for uploading in Finacle relating to excess / short receipt of ATM transactions amounts. xvii) The Vendor to present Reconciliation Report in consonance with days transactions, amount, interchange fee, remittances sent, balance in respective Settlement A/cs, all other A/cs maintained for reconciliation purposes etc. The bidder should be using RDBMS based software for all the services and should either own the software or hold license, with the right to customize. Software interfaces wherever required for CBS, BASE 24 Switch and other accounting systems will have to be provided by the bidder. The list of technical activities to be supported is also detailed in the Technical Specification as per Annexure A. 4. ELIGIBLE BIDDER CRITERIA i) The bidder/service provider should have undertaken the activity as defined in the scope of work for at least 5 scheduled commercial banks in India. In support of this, the bidder is to submit certificate from the concerned banks. ii) The bidder should have experience of processing and reconciling more than 2 lakh transactions per day in at least three banks individually. In support of this, the bidder is to submit certificate from the concerned banks. iii) The Bidder should be a profit making registered Company/Firm and should have minimum turnover of Rs.5 crores (Rupees Five Crores) per year in the preceding two years. The Business figures/turnover of bidder should not include the turnover of its Subsidiary or Parent Company/Firm or group of companies. In support of this, the bidder is to submit audited copy of the Balance Sheet of the 6

Company/Firm for the preceding two years. iv) The bidder should be well conversant with the rules and mandates of Master Card, Visa and other ATM sharing networks, with which the bank has ATM sharing arrangements and should have implemented ATM transaction Reconciliation, Settlement, Charge-back, Adjustments Solutions for the International and Domestic Payment Clearance Houses such as VISA, Master Cards, NFS (NPCI) and bilateral arrangement etc. The bidder to provide declaration to this effect on Company/Firms letter head. v) In case of disruption of services at the Primary Site, the bidder should be capable of providing continuous services at an alternate location within a period of 2 days. The bidder to provide undertaking to this effect on Company/Firms letter head. vi) The bidder should not have been blacklisted or its services should not have been terminated by any Bank / Financial Institution in India during the preceding 3 years. The bidder to provide declaration to this effect on Company/Firms letter head.

5. OPERATIONAL GUIDELINES The selected vendor will have to carry out all the operations from the ATM Reconciliation Cell, HO: TBD Wing, New Delhi and / or from any other location as decided by the bank. The Bank will provide the necessary space, networking and telephones for operations. The vendor is expected to provide: -Hardware including Computers and Servers for processing; -Stand by servers and fall back arrangements in case of disasters; - Maintain backup as per data back policy of the bank , All operating system, software and utility backups and daily activity of the following for a period as decided by the bank:. Full database back up on weekly basis Incremental backup on daily basis.

- Adequate HR and other resources - The Required Software The bidder should be using RDBMS based software for all the services and should either own the software or hold license, with the right to customize. The vendor should specify the total number of man power required to handle the work. 7

5.1 QUALITY ASSURANCE The bidder shall include in his proposal the quality assurance programme containing the overall quality management procedures that the bidder proposes to follow in the performance of the work during various phases of implementation. At the time of award of contract, the detailed quality assurance programme to be followed for the execution of the contract will be mutually discussed and agreed to, and such agreed programme should form a part of the contract. 5.2 ASSIGNMENT The Service Provider shall not assign to anyone, in whole or in part, its obligations to perform under the contract, except with the Banks prior written consent. 5.3 PAYMENT TERMS The Bank shall make the payments on a monthly basis based on the bill submitted by the vendor for the actual work undertaken under this contract. 5.4 PRICE VALIDITY The Prices shall be valid for three years. However, successful bidder shall pass any benefit due to downward recourse in the prices of activities to the bank. Bank at its discretion may extend the validity of the price for further period up to one to three years or less. 6. PERFORMANCE BANK GUARANTEE The successful bidder shall at his own expense deposit with PNB, an unconditional and irrevocable Performance Bank Guarantee (PBG) from any scheduled Bank acceptable to PNB. The following points must be noted with respect to the PBG: PBG must be furnished in the format provided by the Bank. The successful bidder must submit the PBG within 15 (Fifteen) days from the date of award of contract. The PBG will be for an amount of Rs.25 lakh denominated in Indian Rupees. All charges whatsoever such as premium, commission etc. with respect to the PBG shall be borne by the successful bidder. Each page of the PBG must bear the signature and seal of the Bank and PBG number.

The PBG shall be valid for three years from the date of the order. The PBG will be payable on demand for the due performance and fulfillment of the contract by the successful bidder. The PBG may be discharged/ returned by PNB upon being satisfied that there has been due performance of the obligations of the successful bidder under the contract. However, no interest shall be payable on the PBG. In the event of the successful bidder being unable to service the contract for whatever reason, PNB would invoke the PBG. Notwithstanding and without prejudice to any rights whatsoever of PNB under the contract in the matter, the proceeds of the PBG shall be payable to PNB as compensation for any loss resulting from the successful bidders failure to complete its obligations under the contract. PNB shall notify the successful bidder in writing of the exercise of its right to receive such compensation within 14 days, indicating the contractual obligation(s) for which the successful bidder is in default. PNB shall also be entitled to make recoveries from the successful bidders bills, performance Bank guarantee, or from any other amount due to him, the equivalent value of any payment made to him due to in-advertence, error, collusion, misconstruction or misstatement. 7 PENALTY CLAUSE 7.1 The vendor is to reconcile the transactions and resolve the complaints of the customers within T+5 days. The Sharing Settlement Accounts are to be reconciled within T+7 days. In any case, the period of reconciling of ATM Accounts and Sharing Settlement Accounts should not go beyond T+10 days. 7.2 In case of delay in reconciliation beyond 10 days for the accounts mentioned at 7.1 above, penalty would be imposed on the vendor for the un-reconciled accounts due to the reasons attributable to the vendor, as decided by the Bank, as under: ATM Accounts: Period of 10 days from date of transaction : Nil

Beyond 10 days penalty would be chargeable, on proportionate basis, from the date of transaction as under:

Period of delay 11 days to one month

Amount of Penalty chargeable from date of transaction Number of ATMs un-reconciled*Number of days since unreconciled*Rs.20/Number of ATMs un-reconciled*Number of days since unreconciled*Rs.25/Number of ATMs un-reconciled*Number of days since unreconciled*Rs.30/Number of ATMs un-reconciled*Number of days since unreconciled*Rs.50/-

Between one month To two months Between two months To three months Beyond three months

Sharing Settlement Accounts: Period of delay 11 days to one month Amount of Penalty chargeable from date of transaction Number of Sharing Settlement Accounts un-reconciled* Rs.5,000/Number of Sharing Settlement Accounts un-reconciled* Rs.10,000/-

Beyond one month

The penalty would be calculated as on the 1st day of every month and would be subject to the cap of 10% of the billing amount for the Recon Activity for that particular month. The penalty on account of 7.2 above would be over and above the penalty/compensation on account of 7.3 and 7.4 below. 7.3 RBI has presently prescribed that the complaint of the customers for wrongful debit of account (non/partial disbursement of cash from ATMs) be resolved maximum within 12 working days from the date of complaint of the customer/Bank. In case the complaint is not resolved within the time prescribed by RBI, compensation of Rs.100/- per day of delay is to be paid to the customer without any claim from the customer. The vendor is to comply with the instructions/guidelines of RBI and any penalty/compensation levied by RBI or any other regulatory authority from time to time in this regard will be borne by the vendor due to the reasons attributable to the vendor, as decided by the Bank. The vendor has to comply with all regulations, present and future, as prescribed by the Regulatory authorities. 7.4 The vendor will also be liable to bear the actual loss on account of wrongful/excess credits or wrong/delayed reporting in reconciliation activities undertaken by the vendor due to the reasons attributable to the vendor, as decided by the Bank. 7.5 In case the vendor is able to reconcile 90% or more ATM Accounts and related Settlement accounts within T+5 days throughout a month, incentive @Rs.20/- for each 10

ATM tallied would be payable to the vendor for that month. On 1st day of every month, the recon position of ATMs and Settlement accounts would be taken into account and incentive, if any, would be calculated accordingly. 8. ORDER CANCELLATION The Bank reserves its right to cancel the entire / unexecuted part of the order at any time by assigning appropriate reasons in the event of one or more of the following conditions: 1. Delay in operationalising/customizing the service beyond the specified period; or 2. Serious Discrepancy in the reconciliation work; or 3. Any other reason. In addition to the cancellation of purchase order, the Bank reserves the right to foreclose the Performance Bank Guarantee given by the successful bidder and / or recover from the payment to appropriate the damages. 9. TENURE OF THE CONTRACT The contract shall be for a period of THREE years (unless terminated by the Bank before that date). However, after completion of initial contract, Bank reserves its right to extend the contract on the terms and conditions mutually agreed between the Bank and the Bidder, for further period of one to three years or less, at the option of the bank at the same terms and conditions after negotiating the rates. During shifting of the services to new agency, the Bidder shall provide necessary help for smooth switch over, and necessary training to Banks staff. 10 SERVICE LEVEL AGREEMENT (SLA) The successful bidder shall enter into a SLA with the Bank for a period of three years. The SLA shall enumerate the timeliness, confidentiality, financials and also other terms and conditions for the efficient service to be rendered to the Bank. The performance of the successful bidder shall be reviewed after every 6 months and the bank reserves the right to terminate the contract at any point of time after giving 1 month notice without assigning any reason. 11 INSPECTION & AUDIT The Bank or its nominated agency and/or other statutory authority may conduct an end to end audit or inspection of the reconciliation system / activity of the successful bidder at any time. The successful bidder shall allow the same and extend necessary cooperation. The information / details required for the audit shall be provided by the successful bidder without fail. The recommendation of the auditor shall be implemented by the successful bidder. 12 MIS REPORTS 11

MIS reports must be provided to the Bank by the successful bidder in softcopy as well as printed hardcopy, on the formats provided by the Bank on daily basis covering Reconciliation and Settlement areas. Any other details which may be required by the Bank shall also be provided by the successful bidder in the desired format. 12.1 Other Reports & Statements Preparation and Submission of monthly / quarterly Statements / Reports at regular intervals to National / International Interchange Service Providers such as IDRBT / VISA / MasterCard etc. or any such Regulatory Agency / Authority as asked by the Bank. 13. COST OF BIDDING The bidder shall bear all the costs associated with the preparation and submission of bid and Bank will in no case be responsible or liable for these costs regardless of the conduct or outcome of the bidding process. 14. BIDDING DOCUMENT The bidder is expected to examine all instructions, forms, terms in the Bidding and conditions and technical specifications Document. Submission of a bid not responsive to the Bidding Document in every respect will be at the bidders risk and may result in the rejection of its bid without any further reference to the bidder. 15. AMENDMENTS TO BIDDING DOCUMENTS At any time prior to the last Date and Time for submission of bids, the Bank may, for any reason, modify the Bidding Document by amendments at the sole discretion of the Bank. All amendments shall be delivered by hand / post / courier or through e-mail or faxed to all bidders, who have received the bidding document and will be binding on them. For this purpose bidders must provide name of the contact person, mailing address, telephone number and FAX numbers on the covering letter sent along with the bids. In order to provide, prospective bidders, reasonable time to take the amendment if any, into account in preparing their bid, the Bank may, at its discretion, extend the deadline for submission of bids. 16. PERIOD OF VALIDITY Bids shall remain valid for one year from the date of bid opening prescribed by the Bank. A bid valid for shorter period shall be rejected by the Bank as non-responsive. 17. BID CURRENCY 12

Prices shall be expressed in Indian Rupees only.

18. BIDDING PROCESS (TWO STAGES) For the purpose of the present job, a two-stage bidding process will be followed. The response to the RFP will be submitted in two parts: Technical bid Commercial bid Part I Part II

The bidder will have to submit the Technical bid and Commercial portion of the bid separately in two separate red lac-sealed envelopes (wax seal), duly super scribing ATM RECON ACTIVITY TECHNICAL BID a n d ATM RECON ACTIVITY-COMMERCIAL BID . TECHNICAL BID will not contain any pricing or commercial information. The bid shall be typed or written in indelible ink and shall be signed by the Bidder or a person duly authorized by him. The authorization shall be indicated by a written power of attorney accompanying the Bid. All pages of the Bid shall be initialed by the person(s) signing the Bid. The Bid shall contain no interlineations, erasures or overwriting except as necessary to correct errors made by the Bidder, in which case corrections shall be initialed by the person(s) signing the Bid. 19. SUBMISSION OF BIDS The bidders shall s u b m i t duly seale d envelopes of Technical & Commercial Bids in the required formats. Bids submitted in any other format would be summarily rejected. The bid should be addressed to Bank at the following address up to the time and date mentioned on page 2 of this document. The Assistant General Manager Transaction Banking Division Atm Reconciliation Cell Ho wing: 9th floor, Antriksh Bhawan 22, K G Marg, New Delhi 110 001 20. LAST DATE AND TIME FOR SUBMISSION OF BIDS Bids must be received by the Bank at the address specified in the Bid Document not later than the specified date and time as specified in the Bid Document or as extended by the Bank. In the event of the specified date of submission of bids being declared a holiday for the 13

Bank, the bids will be received up to the appointed time on next working day. 21. BID EARNEST MONEY Bidder has to submit the Bid Earnest Money of Rs.25,00,000/(Rs. Twenty Five lakh only) in the form of Pay Order/Demand Draft favoring PUNJAB NATIONAL BANK, Transaction Banking Division payable at Delhi In case of unsuccessful bidder, EMD will be returned w i t h i n 3 0 d a y s o f completion of Reverse Auction. . 22. LATE BIDS Any bid received by the Bank after the deadline for submission of bids will be rejected and/or returned unopened to the Bidder, if so desired by him. 23. MODIFICATIONS AND/OR WITHDRAWAL OF BIDS Bids once submitted will be treated, as final and no further correspondence will be entertained on this. No bid will be modified after the deadline for submission of bids. No bidder shall be allowed to withdraw the bid, if the bidder happens to be a successful bidder. 24. CONTENT OF DOCUMENTS TO BE SUBMITTED 24.1 Documents required in Technical Bid Envelope (Sealed Cover): All functionalities /capabilities available with the bidder for implementation of ATM/Debit Card Recon Activity as outlined in Annexture A ii. Bidders information as per part I of Annexure-B. iii. Letter to the Bank as per pat II of Annexure B iv. Technical Features & Architecture of the Reconciliation Activity v. Documents required in support of the Eligibility Criteria indicating the Eligibility Criteria on the documents. 24.2 Documents required in Commercial Bid Envelope (Sealed Cover): Commercial offer: The offer should be as per commercial bid format in Annexure C and should be exclusive of all taxes and statutory levies. 14 i.

25. BID OPENING AND T E C H N I C A L EVALUATION BID OPENING: The Bank will open the technical bids, in the presence of Bidders representative who choose to attend, at the time and date mentioned in Bid document at the address mentioned at p a g e 2 u n d e r B i d Details. The bidders or their representatives who are present shall sign register evidencing their attendance. In the event of the specified date of bid opening being declared a holiday for Bank, the bids shall be opened at the same time and place on next working day. T E C H N I C A L EVALUATION In the first stage, only TECHNICAL B I D will be opened and evaluated. The following would form part of Technical Evaluation: I. Eligibility Criteria: Based on the documents submitted b y t h e Bidders in support of Eligibility Criteria along with Technical Bid documents, Bank will ascertain if the bidder fulfils the Eligibility Criteria or not. Technical/Functional Capability of the Bidder: The bidder is required to indicate compliance of technical capability in regard to the activities illustrated at Annexure A. Compliance Statement : The bidder is to provide declaration of compliance statement as at Annexure D Presentation/Demonstration & Proof of Implementation: The bidders shall be required to g i v e p r e s e n t a t i o n / D e m o n s t r a t i o n a n d provide proof of implementation.

II.

III.

IV.

The Bank shall shortlist the bidders based on Technical Evaluation as above. In the second stage, the COMMERCIAL BID of short-listed bidders after Technical Evaluation a s o u t l i n e d a b o v e w i l l b e o p e n e d . 26. CLARIFICATIONS OF BIDS 15

To assist in the examination, evaluation and comparison of bids the Bank may, at its discretion, ask the bidder for clarification and response shall be in writing and no change in the price or substance of the bid shall be sought, offered or permitted. 27. PRELIMINARY EXAMINATION The Bank will examine the bids to determine whether they are complete, whether any computational errors have been made, whether required information has been provided as underlined in the bid document, whether the documents have been properly signed, and whether bids are in order. The bid determined as not in order as per the specifications will be rejected by the Bank without assigning and informing any reason to the bidder. 28. CONTACTING THE BANK Any effort by b i d d e r to influence the Bank in the Banks bid evaluation, bid comparison or contract award decision may result in the rejection of the Bidders bid. Banks decision will be final and without prejudice and will be binding on all parties. 29. BANKS RIGHT TO ACCEPT OR REJECT ANY BID OR ALL BIDS The Bank reserves the right to accept or reject any bid and annul the bidding process and reject all bids at any time prior to award of contract, without thereby incurring any liability to the affected bidder or bidders or any obligation to inform the affected bidder or bidders of the ground for the Banks action. 30. SIGNING OF CONTRACT. The successful bidder(s) to be called as vendor, shall be required to enter into a Service level Agreement (SLA) with the Bank, within 7 days of the award of the tender or within such extended period as may be specified by the Bank. 31. REVERSE AUCTION The Bank will be adopting the reverse auction process through eprocurement in case there are 2 or more technically qualified bidders. --------

16

ANNEXURE - A

Activities Sr. No I I.1 I.2 I.3 1.4 I.5 Debit / ATM Card Reconciliation and Accounting Reconciliation Collect TLF Files from Base24 Switch as per prevailing format To identify mismatches and duplicate transactions. Reconciliation of the transactions based on Host, Switch & EJ. Compliance Remarks (Yes/No)

The capability to process Electronic Journal pulled from ATMs as integral component of reconciliation.

Upload and Reconcile third party files such as MASTER, NFS (NPCI), EBL Tie-up banks etc. with Base24 files. Segregate ATM transactions of CBS/NonCBS/Shared Networks from TLF and prepare batch files for debiting to respective Suspense A/cs. Second Level forced reconciliation system by relaxation of some parameters. Generation of exception reports like: entries unreconciled Sharing Arrangement-wise / Utility wise outstanding etc. Standard queries, Ad hoc queries, Standard reports, Ad hoc reports on reconciliation data to be provided Use Electronic Journal from ATMs for Reconciliation of ATMs and settling outstanding/mismatch/disputed entries Generating uploadable files for debiting or crediting Branches accounts. Verification of correctness of Interchange Fee and other charges levied by Sharing Networks. Reconciling Banks A/cs with other Settlement Banks for different Sharing Arrangements. Cash in ATM Reconciliation Account Computation of load / unload amount and cross tallying with EJ files and generate letters of difference to Branches. Marking date of adjustment thereof. Verification of overages / shortages at the time of load / unload. Upload Electronic / Manual Cash position of each ATM / ATM A/c wise Provide reconciliation position of ATMs from one stage of Cash Replenishment to next one. Compliance Remarks (Yes/No)

I.6

I.7 I.8

I.9 I.10

I.11 I.12 I.13

II II.1

II.2 II.3 II.4

17

III III.1 Reconciliation & Accounting Reconciliation of transactions of various network to which bank is associated with like MASTERCARD,VISA, EBL, NFS (NPCI), SBI, and in any other network to be joined in future. Capability to handle all types of settlements and reconciliation works related to payments and receipts to these Networks / banks, including but not limited to chargebacks, dispute resolution as per the mechanisms set out by these Networks / Banks etc. Capable to modify and incorporate changes in procedures and policies, accounting and settlements in line with PNB / MASTER / EBL / NFS (NPCI) / Future Tie up banks / Networks etc. requirements. Reconciliation and generation of mismatches. Reconciliation of incoming and outgoing transaction batch files with regard to MASTER / EBL / NFS (NPCI)/ Tie up banks / Networks etc. Creation of outgoing files for chargeback for MASTER / EBL / NFS (NPCI)/ Tie up banks / Networks etc as in the specified format of BASE 24 or any other. Automated voucher posting system for transactions files from MASTER / EBL / NFS (NPCI)/ Tie up banks / Networks etc. Computations of Issuer fees, acquirer fees, balance enquiry fees uploaded in the branches. Tracking of inflated POS transactions such as: Petrol / Railways / Others etc. Generating the files for the ATM Reconciliation Cell / Branches to debit/ credit the cardholders as the case may be. Cross tallying of Settlement Bank A/c foreign and local for MASTER transactions with Nodal Branch advice. Cross tallying of Settlement Bank A/c for MASTER / EBL / NFS (NPCI)/ Tie up banks / Networks etc. transactions with Nodal Branch advice. Compliance Remarks (Yes/No)

III.2

III.3

III.4 III.5

III.6

III.7

III.8 III.9 III.10

III.11

III.12

18

IV IV.1 Charge Back management Automated processing & generation of chargeback / Representment/ makings and presenting arbitration case received ,requests and related MIS. Compliance of the chargeback rules & mandates / request procedures. Chargeback details Query History of chargebacks and remedy Dates and other particulars of 1st chargeback, second presentment received, document received, arbitration chargeback, credit processed to cardholders arbitration received, accepted /referred to MASTER/ EBL / NFS (NPCI) / Tie up banks / Networks etc. Creation of chargeback/ arbitration chargeback for onward transmission to MASTER / EBL / NFS (NPCI) / Tie up banks / Networks etc. Generation of files for debiting or crediting the Card holder for the amount of Chargeback or Representment Chargeback charges to be levied to cardholder, if any. E-mailing cardholder / Branches details of having initiated chargeback and procedures for releasing credits. Register for forwarding to cardholder / Branch documents received in 2nd presentment. Menu for accepting chargeback received and for making 2nd presentment. Acceptance of arbitration chargeback and generation of Pre arbitration / Pre compliance/Arbitration/ Compliance letters wherever necessary. Good Faith request Acceptance / Forwarding of our request as per various ATM sharing Networks . Facility to attach scanned document in the system for Retrieval Request. Generating and Submission of Monthly / Quarterly / Half yearly / Yearly reports as per rules and mandates of various networks with which, the bank is associated with or specified by the Bank. Compliance (Yes/No) Remarks

IV.2 IV.3

IV.4

IV.5

IV.6 IV.7

IV.8 IV.9 IV.10

IV.11 IV.12 IV.13

19

V V.1

Dispute & Claim Management Electronic claim register to record complaints received for: Nonreceipt of cash. Multiple debits in account for a single transaction. Allow entry from various sources such as Cardholders, call centre, branches, head office etc. Check for duplicate entry for single claim. Validate the transaction from database. Verify the EJ available. Tracking of dispensed amount and claimed amount; Cardholder wise / Branch wise / ATM wise Tracking of turnaround time of dispute resolution and variance with standard time. MIS reports: ATM wise Date wise Branch wise / Tie-up bank wise / Charge back and dispute pending / Others (As required by bank) Accounting Transaction based accounting of all the transactions in: Switch, Branch, Tie-up Bank, Third Party Network & Others Generating uploadable files for debiting or crediting cardholders accounts. Generation of tallied report and difference statement

Compliance (Yes/No)

Remarks

V.2 V.3 V.4 V.5 V.6 V.7

VI VI.1

Compliance (Yes/No)

Remarks

VI.2

VI.3 VI.4 VII VII.1 VII.2 VII.3

Generating letters to Branches for claiming amount in respect of its Cardholders transactions. Other Services Interface with Banks Software of Complaint Management. Reconciliation of Inter branch funds transfer through ATM. Any other mode of payment from the debit card reflected in Switch. (Mobile Recharging, Transfer of Funds, Any other similar service etc.) Facilitating resolving Cardholders queries / claims. Facilitating resolving Cardholders / Branches queries / claims. Capability of processing non-card transactions like Internet Banking Services, Bills Payment, RTGS, NEFT etc. Capability to successfully operationalize / customize the reconciliation services within a period of 30 days from the date of award of contract. Capability to provide solution having Inter-face with Debit Card Management System Compliance (Yes/No) Remarks

VII.4 VII.5 VII.6 VII.7

VII.8

20

VIII VIII.1 MIS Reports / Queries and Decision Making Compliance (Yes/No) Support System Generation of daily MIS statement. Status of reconciliation Branch-wise, Date-wise, transaction-wise / Sharing Network-wise etc. Summary reports like outstanding /pending reconciliation branch-wise /transaction-wise Branches and ATMs pending for reconciliation Monthly Statements: List of heavy cash drawing cardholders; List of cardholders using the ATM heavily for drawing low amounts; List of Cards frequently used abroad Should be able to generate periodical as well as ad-hoc reports as per the requirements of the Bank / Sharing Network. Should provide Decision Making tools for and Trend analysis for Top Management as well as access to information to branches. Decision Making Tools should be able to provide all combination of information at Master and Detailed level with geographic, demographic etc distribution analysis. Should be capable of generating Statement / Report, as required under the national / international laws/ RBI instructions governing AntiMoney Laundering transactions/activities. Preparation and submission of various reports / information to Sharing Networks / Service Providers about Cards Transactions / ATMs etc, as required at Monthly / Quarterly or other such intervals.(QMR /SAFE etc.) Remarks

VIII.2

VIII.3

VIII.4

VIII.5

VIII.6

VIII.7

21

Annexure B PART I: Bidder Information Please provide following information about the Company (Attach separate sheet if required): S. No. 1. 2. 3. Information Company /Firm Name Date of Incorporation/Registration Company Head Office / Registered Office and Addresses Contact Person(s) Phone Fax E-mail Website Provide the range of services /options offered by you covering service description and different schemes available for: Customization Implementation Support Post-implementation Ongoing Support for: o Helpdesk o Training o Others (specify) 5. Any pending or past litigation (within three years)? If yes please give details Also mention the details of claims and complaints received in the last three years (About the Company / Services provided by the Company/Firm). 6. Please mention turnover and Profit & Loss for last two years. Year Turnover Profit/Loss(-) Yes/No/Comments (if option is Yes) Particulars / Response

4.

Yes / No / Comments (if option is No)

7.

Experience of handling ATM & POS transactions Recon Activity : Name of the Banks served with years of service: The name of banks currently serving with years of service: Monthly average number of transactions currently being handled for difference scheduled commercial banks in detail.

22

The details of implementing Reconciliation, Settlement, Charge-back, Adjustments Solutions for International and Domestic Payment Clearance Houses such as VISA, Master Cards, NFS (NPCI) and bilateral arrangement etc. The details of capability of the bidder in processing non-card transactions like Internet Banking Services, Bills Payment, RTGS, NEFT etc. The details of capability of the bidder to continue providing the services at alternate location in case of disruption of services at Primary Site.

10

Signature & Seal of Bidder

23

Annexure B Part -II Letter to be submitted by bidder along with bid documents To The Asstt. General Manager ATM Reconciliation Cell Transaction Banking Divsion Punjab National Bank Head Office, 22 K G Marg, New Delhi 110 001 Sir Reg: Our bid for A T M /Debit Card Reconciliation Activity We submit our Bid Document herewith. If our Bid for the above job is accepted, we undertake to enter into and execute at our cost, when called upon by the Bank to do so, a contract in the prescribed form. Unless and until a formal contract is prepared and executed, this bid together with your written acceptance thereof shall constitute a binding contract between us. We understand that if our Bid is accepted, we are to be jointly and severally responsible for the due performance of the contract. We understand that you are not bound to accept the lowest or any bid received by you, and you may reject all or any bid; you may accept or entrust the entire work to one vendor or divide the work to more than one vendor without assigning any reason or giving any explanation whatsoever. We understand that the names of short listed bidders after the completion of first stage (Technical Bid) and the name of the successful bidder to whom the contract is finally awarded after the completion of the second stage (Commercial Bid), shall be communicated to the bidders either over phone/e-mail/letter. Dated at / day of 2010. Yours faithfully, For

Signature Name Address

(Authorised Signatory)

(Authorised Signatory)

24

Annexure C Format for Commercial Bid: S.No. Service Offered Rate per transaction (Excluding enquiry and system reversal transactions ) in Paisa (exclusive of all taxes and statutory levies etc.) In figures In words No extra cost payable

ATM/Debit Card Reconciliation Activity (upto the Logical closure of the Transaction including Resolution of the Complaint, if any) Integration with all relevant software applications for our bank.

Note: 1. The bidder has to submit the commercial bid only in the above format. Any other format would be summarily rejected at the time of opening the bid. 2. In case there is any difference in Rate quoted given in words and figures, the rate written in words shall be considered final & binding. Price Comparison and criteria for L-1 bidder The cost of reconciliation of one transaction shall be considered for the purpose of price comparisons to arrive at the lowest offer. The per transaction rate quoted should be exclusive of all i.e. Taxes, statutory levies etc. The Bank will be adopting the reverse auction process through eprocurement in case there are 2 or more technically qualified bidders.

Signature & Seal of Bidder

25

ANNEXURE D COMPLIANCE STATEMENT

DECLARATION

We hereby undertake and agree to abide by all the terms and conditions stipulated by the Bank in the RFP document including all annexure(s), addendum(s) and corrigendum(s)

Signature and Seal of Bidder

We certify that the systems/services offered by us for tender conforms to the specifications stipulated by you with the following deviations List of deviations 1) 2) 3) 4) (If left blank it will be construed that there is no deviation from the specifications given above)

Signature and Seal of Bidder

26

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Google WalletDocument6 pagesGoogle WalletfaemozNo ratings yet

- Micro ATMDocument42 pagesMicro ATMfaemozNo ratings yet

- Being Five Star in ProductivityDocument48 pagesBeing Five Star in ProductivityfaemozNo ratings yet

- Understanding The ATM BusinessDocument6 pagesUnderstanding The ATM BusinessfaemozNo ratings yet

- XLRIDocument145 pagesXLRIVijay GautamNo ratings yet

- Sample Process 1Document11 pagesSample Process 1faemozNo ratings yet

- Sales Training Workshop - MelbourneDocument7 pagesSales Training Workshop - MelbournefaemozNo ratings yet

- How Well Do You Think On Your Feet - or Seat (Nov 07)Document4 pagesHow Well Do You Think On Your Feet - or Seat (Nov 07)faemozNo ratings yet

- Gatefold Brochure FinalDocument8 pagesGatefold Brochure FinalfaemozNo ratings yet

- Gatefold Brochure FinalDocument8 pagesGatefold Brochure FinalfaemozNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PTV ReportDocument80 pagesPTV ReportSaleh JanjuaNo ratings yet

- UNIT 8 SpoilageDocument16 pagesUNIT 8 SpoilageKale MessayNo ratings yet

- ch1 AdditionalandMissingValueQuestionsDocument9 pagesch1 AdditionalandMissingValueQuestionsneervaan.dagar1No ratings yet

- Lesson 1 Home Office and Branch AccountingDocument4 pagesLesson 1 Home Office and Branch AccountingAndy Lalu100% (3)

- Fabm1 Quarter1 Module 6.2 Week 6Document22 pagesFabm1 Quarter1 Module 6.2 Week 6Danny BulacsoNo ratings yet

- Format of Profit and Loss AccountDocument8 pagesFormat of Profit and Loss AccountJayachandran Malayidappadath100% (1)

- Error Message No f5702 Balance in Trassanction CurrencyDocument66 pagesError Message No f5702 Balance in Trassanction CurrencybiswajitNo ratings yet

- Revenue Memorandum Circular No. 62-05: SubjectDocument12 pagesRevenue Memorandum Circular No. 62-05: Subject김비앙카No ratings yet

- Anjanadri Granite Stone Project ReportDocument35 pagesAnjanadri Granite Stone Project ReportKanaka Raja CNo ratings yet

- Chap 004Document84 pagesChap 004MubasherAkramNo ratings yet

- Principles of Business Revision NotesDocument31 pagesPrinciples of Business Revision Notesgabrielle100% (9)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Auditing McqsDocument27 pagesAuditing McqsGhulam Abbas100% (5)

- AFAR QuizDocument7 pagesAFAR QuizCerise SNo ratings yet

- Balance of PaymentDocument26 pagesBalance of Paymentnitan4zaara100% (3)

- 2 DoneDocument3 pages2 Donesophia100% (2)

- Standard Operating Procedure: SOP 94-01 / July 25, 1994Document4 pagesStandard Operating Procedure: SOP 94-01 / July 25, 1994Irwan WijayaNo ratings yet

- PROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)Document2 pagesPROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)zsaw zsawNo ratings yet

- Coduri Mesaje SWIFTDocument18 pagesCoduri Mesaje SWIFTgsgheneaNo ratings yet

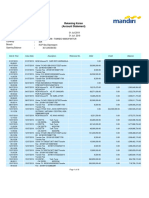

- RK MANDIRI Timindo-DikonversiDocument18 pagesRK MANDIRI Timindo-DikonversiJake Santoso100% (3)

- Handout 1Document13 pagesHandout 1Krisha ErikaNo ratings yet

- Corporate AccountingDocument16 pagesCorporate AccountingshakuttiNo ratings yet

- 2 Chapter 2 Partnership LiquidationDocument11 pages2 Chapter 2 Partnership LiquidationKate NuevaNo ratings yet

- Accounting For Non-Profit OrganizationsDocument39 pagesAccounting For Non-Profit Organizationsrevel_13193% (29)

- Moniepoint Document 2023-10-21T08 04Document2 pagesMoniepoint Document 2023-10-21T08 04James LightonNo ratings yet

- PayPal User AgreementDocument42 pagesPayPal User AgreementJason TiongcoNo ratings yet

- College Accounting A Practical Approach Canadian 12th Edition Slater Test Bank 1Document48 pagesCollege Accounting A Practical Approach Canadian 12th Edition Slater Test Bank 1ellen100% (37)

- Receivables AuditDocument32 pagesReceivables AuditCertified PANo ratings yet

- The Monetary System in The International ArenaDocument2 pagesThe Monetary System in The International Arenagian reyesNo ratings yet

- EBMS Serialized ItemsDocument51 pagesEBMS Serialized ItemsabuzarifNo ratings yet