Professional Documents

Culture Documents

Hemarus Industries Income Tax Declaration Form Summary

Uploaded by

Shashi NaganurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hemarus Industries Income Tax Declaration Form Summary

Uploaded by

Shashi NaganurCopyright:

Available Formats

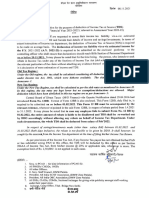

HEMARUS INDUSTRIES LTD.

INCOME TAX DECLARATION FORM - F.Y. 2014-15

(To be used to declare investment that will be made during the period from 01/04/2014 to 31/03/2015 for Income Tax purpose)

Company Name Employee Name

Hemarus Industries Limited SHASHIDHAR NAGANUR

Emp ID PAN of Employee (compulsory)

45 AJFPN9446F

As per section 206AA, in case PAN is not submitted, TDS will be deducted at flat rate of 20% ITEMS DEDUCTION U/S 10 I am staying in a rented house and I agree to submit Leave & Licence A'ment when required.The Rent Paid is (Rs. 5000 X 12 months) & the house is located in a METRO / NON METRO (Tick whichever is applicable) Sec 80D - Medical Insurance Premium (If the policy covers a senior citizen then exemption is Rs.20,000/-) Sec 80DD - Handicapped Dependent Sec 80E - Repayment of Loan for higher education (only Interest) Sec 80GG - Rent Paid DEDUCTION UNDER CHAPTER - VI A Sec 80U - Handicapped Sec 80CCG - Rajeev Gandhi Equity Saving Scheme (Investment max upto Rs.50,000, would get a deduction of 50% on the amount invested) Sec 80TTA - Interest on saving a/c Sec 80EE - additional deduction of Rs. 1Lac on home loan interest (applicable only for FY2013-14) Any other Deduction (Please specify) Contribution to Pension Fund (Jeevan Suraksha) Life Insurance Premium on life of self/spouse/child only Deferred Annuity Public Provident Fund in own name/spouse/child only ULIP of UTI/LIC in own name or spouse and child only Repayment of Housing Loan (Only principal) DEDUCTION U/S 80C Contribution to Pension Fund or UTI or Notified Mutual Fund Investment in ELSS made in units of Notified Mutual Fund Children Tuition Fee: Restricted to a max of 2 Children Deposit in home loan account scheme of NHB/HDFC 5 yrs. Term deposit in a Sch.Bank Others (please specify) Others (please specify) DEDUCTION U/S 80CCC Annuity/Pension Plan DEDUCTION U/S 80CCD Notified Pension Scheme 1,00,000.00 1,00,000.00 1,00,000.00 Max Limit DEDUCTION U/S 24 Interest on Housing Loan on fully constructed accomodation only Interest if the loan is taken before 01/04/99 on fully constructed accomodation only 150,000.00 30,000.00 Declared Amount PARTICULARS MAXIMUM LIMIT DECLARED AMOUNT

HOUSE RENT

NON METRO

60,000.00

Max Limit -

Declared Amount

25,000.00 10,000.00 100,000.00 Max Limit 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 Declared Amount 46,676.00

Aggregate Deduction U/S 80C, 80CCC & 80CCD cannot exceed Rs. 100000/-

DECLARATIONS:

1. I hereby declare that the information given above is correct and true in all respects. I am also aware that the company will be considering the above details in utmost good faith based on the details provided by me and that I am personally liable for any consequences arising out of errors, if any, in the above information. 2. I am also aware that any person making a false statement / declaration in the above form shall be liable to be fined and prosecution u/s 277 of the Income Tax Act, 1961 3. The proof of payment / Supportings for claim, will be provided latest by -------15 March 2015

Note -

Date : Place:

19.04.2014 Rajgoli, Kolhapur

SHASHIDHAR NAGANUR SIGNATURE OF THE EMPLOYEE

Investment details: 1) LIC JEEVAN ANAND - 636137269 2) MAX LIFE INSURANCE - 816441695 3) PNB METLIFE - 20333587 TOTAL

Amount 11,574.00 10,102.00 25,000.00 46,676.00

Provident Fund House Rent -5000 X 12months

As per Deduction 60,000.00

Form 12c PARTICULARS OF INCOME U/S 192 (2B) FORM NO. 12C [See rule 26B] Form for sending particulars of income under section 192 (2B) for the year ending 31st March, 2015 1 2 3 4 Name and address of the employee Permanent Account Number Residential Status Particulars of income under any head of income other than "salaries" (not being a loss under any such head other than the loss under the head "Income from house property") received in the financial year. (I) Income from house property (in case of loss, enclose computation thereof) (ii) Profits and gains of business or profession (iii) Capital gains (iv) Income from other sources Rs. (a) Dividends _____________ (b) Interest _____________ (c) Other incomes (specify) _____________ Total Aggregate of sub-items (I) to [(iv)] of item 4 Tax deducted at source [enclose certificate(s) issued under section 203] Place _____________ Date _____________ Rs. _____________ _____________ _____________ FORM 12-C

_____________

5 6

_______________________ Signature of the employee

1 2

______________________________ Inserted by the IT (Eighth Amdt.) Rules, 1987. Substituted by the IT (Fourteenth Amdt.) Rules, 1998, w.e.f. 14-9-1998. Prior to its substitution, item 4, as inserted by the IT(Eighth Amdt.) Rules, 1987, read as under: "4. Particulars of income (not being loss) under any head other than "Salaries" received in the financial year (I) "Interest on securities" Rs. _____________ (ii) Income from house property Rs. _____________ (iii) Profits and gains of business or profession Rs. _____________ (iv) Capital gains Rs. _____________ (v) Income from other sources Rs. _____________ (a) Dividends Rs. _____________ (b) Interest Rs. _____________ (c) Other incomes Rs. _____________ (specify) Total Rs. _____________ Substituted for "(v)" by the IT (Fourteenth Amdt.) Rules, 1998. w.e.f. 14-9-1998

Page 3

Form 12c Form 12C INCOME-TAX RULES, 1962 Verification I,_________________________,do hereby declare that what is stated above is true to the best of my knowledger and belief. Verified today, the ____________________day of ___________________20. Place _____________ Date _____________ _______________________ Signature of the employee _____________________ ACTION POINTS 1 This form is to be used by an assesse-employee when he desires that his income from sources other than "salaries" may also be taken into account by the employer for purposes of deduction of tax of source. This form may be submitted by the assessee employee to his employer. Once the Form is submitted by the assessee employees, the employer has to take into account the other income disclosed by the assesse and the tax deducted at source thereon while computing the tax deductible at source from the assessee's salary. From the assessment year 1999-2000, the assessee is permitted to furnish particulars in respect of any loss under the head 'Income from house property' to his employer. The Form has consequently been enlarged, so as to enable the assessee-employee to furnish particulars of such loss. Employees having loss under the head 'Income from house property' will find it to their advantage to furnish such loss (if any) to the employer, since the tax deductible at source will get corresponsdingly reduced. This apart, such employees will also be saved from the botheration of filing a return of income just for the purpose of obtaining tax refund. 4 The assessee-employee cannot however furnish particulars of loss (if any) under any head of income other than 'Income from house property'. _____________________ 1.428

Page 4

You might also like

- 1040 Tax Return SummaryDocument4 pages1040 Tax Return SummaryTrish Hit50% (2)

- Some Secret Tantra SadhanaDocument7 pagesSome Secret Tantra Sadhanasumit girdharwal100% (6)

- Webull Tax DocumentDocument10 pagesWebull Tax DocumentHimer VerdeNo ratings yet

- Short CircuitDocument4 pagesShort CircuitShashi NaganurNo ratings yet

- 1a. IR8A (M) - YA 2012 - v1Document1 page1a. IR8A (M) - YA 2012 - v1freepublic9No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Compliance Under Labour Laws: Presented By: RSPH & Associates CA Hitesh Agrawal Baroda. (O) 02652342932/33 (M) 9998028737Document57 pagesCompliance Under Labour Laws: Presented By: RSPH & Associates CA Hitesh Agrawal Baroda. (O) 02652342932/33 (M) 9998028737Himanshu ShahNo ratings yet

- Chapter-Cooling TowersDocument17 pagesChapter-Cooling TowersSAGIS ETIENNENo ratings yet

- EO 98 - How To Apply TINDocument7 pagesEO 98 - How To Apply TINPeterSalas100% (1)

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Suppliers AddressDocument355 pagesSuppliers AddressShashi Naganur100% (1)

- 87549654Document3 pages87549654Joel Christian Mascariña100% (1)

- Olam HR PolicyDocument21 pagesOlam HR PolicyShashi NaganurNo ratings yet

- Bicolandia Drug Corporation allowed tax credit for senior citizen discountsDocument2 pagesBicolandia Drug Corporation allowed tax credit for senior citizen discountsAlyssa Alee Angeles JacintoNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Document5 pages1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiNo ratings yet

- IDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1Document3 pagesIDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1ragupathi.arumugaNo ratings yet

- Income Tax 2017 Edazdb1013Document50 pagesIncome Tax 2017 Edazdb1013Pradeep PatilNo ratings yet

- HRA, 80C, 80D, 80CCD deductions and landlord detailsDocument9 pagesHRA, 80C, 80D, 80CCD deductions and landlord detailsfaiyaz432No ratings yet

- 04 LectureDocument23 pages04 Lecturehsmalik777No ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- Circular / Office OrderDocument10 pagesCircular / Office OrderrockyrrNo ratings yet

- Withholding Tax Requirements and ProceduresDocument5 pagesWithholding Tax Requirements and ProceduresStevenkyNo ratings yet

- WT IT - Declarations - Guidelines - FY - 2019-20 PDFDocument11 pagesWT IT - Declarations - Guidelines - FY - 2019-20 PDFGautham ReddyNo ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- Investment Declaration Form11-12Document2 pagesInvestment Declaration Form11-12girijasankar11No ratings yet

- 1 Section 80CDocument2 pages1 Section 80CcssumanNo ratings yet

- TDS Provisions SummaryDocument54 pagesTDS Provisions SummaryFalak GoyalNo ratings yet

- 1829618-SAP NoteDocument1,463 pages1829618-SAP NoteRyan PittsNo ratings yet

- Deduction, Collection & Recovery of TaxesDocument143 pagesDeduction, Collection & Recovery of TaxesjyotiNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- Tax Deducted at Source ExplainedDocument31 pagesTax Deducted at Source ExplainedShaleenPatniNo ratings yet

- Income Tax Circular No. 17/2014 Dated 10.12.14Document70 pagesIncome Tax Circular No. 17/2014 Dated 10.12.14Elisabeth MuellerNo ratings yet

- A Guide To Your Personal Income TaxDocument7 pagesA Guide To Your Personal Income TaxRekha SinghNo ratings yet

- HRA, 80C, 80D, 80CCD Investment Declaration GuideDocument10 pagesHRA, 80C, 80D, 80CCD Investment Declaration GuidecutieedivyaNo ratings yet

- DHBVN Tax Statement DeadlineDocument13 pagesDHBVN Tax Statement DeadlineResearch AccountNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- TaxDocument46 pagesTaxAkashTokeNo ratings yet

- For Tds On SalaryDocument40 pagesFor Tds On SalarykshitijsaxenaNo ratings yet

- Section24-Prior Year Salary OverpaymentsDocument8 pagesSection24-Prior Year Salary OverpaymentsP45 TesterNo ratings yet

- INVESTMENT DECLARATIONDocument1 pageINVESTMENT DECLARATIONShishir RoyNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- Instructions For Filling Out FORM ITR-2Document8 pagesInstructions For Filling Out FORM ITR-2Ganesh KumarNo ratings yet

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekaleNo ratings yet

- Tax Savings Declarations GuidelinesDocument13 pagesTax Savings Declarations GuidelinesAditya DasNo ratings yet

- PPP Loan Forgiveness Application (Revised 6.16.2020)Document5 pagesPPP Loan Forgiveness Application (Revised 6.16.2020)LaurenNo ratings yet

- Instructions For Filling Out FORM ITR-2: Page 1 of 10Document10 pagesInstructions For Filling Out FORM ITR-2: Page 1 of 10mehtakvijayNo ratings yet

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- Taxation Notes 4.1.23 MidtermDocument11 pagesTaxation Notes 4.1.23 MidtermRaissa Anjela Carman-JardenicoNo ratings yet

- Taxation of Salaried Employees, Pensioners and Senior by IndiagovermentDocument88 pagesTaxation of Salaried Employees, Pensioners and Senior by IndiagovermentHarshala NileshNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- SET 23 24 Detail Guide EDocument20 pagesSET 23 24 Detail Guide ENishan MahanamaNo ratings yet

- Instruction For Submitting ProofsDocument3 pagesInstruction For Submitting Proofssastrylanka_1980No ratings yet

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Document4 pagesOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BNo ratings yet

- Tax Deduction at SourceDocument5 pagesTax Deduction at SourceSarayu BhardwajNo ratings yet

- Income Tax All Particulars 2013-14Document72 pagesIncome Tax All Particulars 2013-14kvsgssNo ratings yet

- Individual Paper Income Tax Return 2015Document23 pagesIndividual Paper Income Tax Return 2015marrukhjNo ratings yet

- Guide ITProof SubmissionDocument9 pagesGuide ITProof SubmissionSrikanthNo ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- Rayat Educational Trust Income Tax FormDocument2 pagesRayat Educational Trust Income Tax Formvijay_2594No ratings yet

- Taxs Note 2015Document17 pagesTaxs Note 2015Anonymous FQaTclTNNo ratings yet

- TDS ElaboratedDocument80 pagesTDS ElaboratedAncyNo ratings yet

- Income Tax FAQ - Everything You Need to KnowDocument4 pagesIncome Tax FAQ - Everything You Need to KnowRanjan SatapathyNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- Tax ReturnDocument18 pagesTax ReturnJoachim NosikNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- PresidentMessage PDFDocument1 pagePresidentMessage PDFShashi NaganurNo ratings yet

- New Enrolment ListsDocument57 pagesNew Enrolment ListsShashi NaganurNo ratings yet

- Steam TurbinesDocument6 pagesSteam TurbinesmuksinNo ratings yet

- PowerPlantTechnologybyM M EIWakil-1 PDFDocument878 pagesPowerPlantTechnologybyM M EIWakil-1 PDFShashi NaganurNo ratings yet

- Flyash Prospects PDFDocument4 pagesFlyash Prospects PDFShashi NaganurNo ratings yet

- Control FeedbackDocument7 pagesControl FeedbackShashi NaganurNo ratings yet

- CompressorDocument29 pagesCompressorShashi Naganur100% (1)

- Remove Boiler SludgeDocument2 pagesRemove Boiler SludgeShashi Naganur100% (1)

- Basic of Process ControlDocument42 pagesBasic of Process Controlghass815100% (6)

- 2.2 BoilersDocument9 pages2.2 BoilersSalihibnuali KpNo ratings yet

- PowerCable SpecDocument1 pagePowerCable SpecShashi NaganurNo ratings yet

- Limits of Variations of Inlet Steam ConditionsDocument1 pageLimits of Variations of Inlet Steam ConditionsShashi NaganurNo ratings yet

- IndentDocument1 pageIndentShashi NaganurNo ratings yet

- Energy Managers & Auditors Question Bank ChapterDocument8 pagesEnergy Managers & Auditors Question Bank ChapterSuseel Jai KrishnanNo ratings yet

- Focus Area: Energy Manager & Energy AuditorsDocument8 pagesFocus Area: Energy Manager & Energy AuditorsShashi NaganurNo ratings yet

- Lub Oil Consumer SystemDocument1 pageLub Oil Consumer SystemShashi NaganurNo ratings yet

- DocumentDocument1 pageDocumentShashi NaganurNo ratings yet

- Drawing PDFDocument1 pageDrawing PDFShashi NaganurNo ratings yet

- Create PDFs easily with pdfFactoryDocument1 pageCreate PDFs easily with pdfFactoryShashi NaganurNo ratings yet

- Slip Gaji No 14Document3 pagesSlip Gaji No 14sahabatproperti8No ratings yet

- RMC No. 117-2021Document1 pageRMC No. 117-2021Em SantosNo ratings yet

- Club Tax Invoice JULY 2021: Rotary International South Asia OfficeDocument1 pageClub Tax Invoice JULY 2021: Rotary International South Asia OfficeAnnopNo ratings yet

- LESCO4Document1 pageLESCO4Dr. Tanvir ZaverNo ratings yet

- Form 15H DeclarationDocument2 pagesForm 15H Declarationyraju88No ratings yet

- Discussion 001Document2 pagesDiscussion 001TRIXIE KIM BADILLOSNo ratings yet

- Manasa Resume - 1Document3 pagesManasa Resume - 1ManasaNo ratings yet

- RR 10-76Document4 pagesRR 10-76Althea Angela GarciaNo ratings yet

- DLA Piper Guide To Going Global Global Equity Full HandbookDocument298 pagesDLA Piper Guide To Going Global Global Equity Full HandbookOlegNo ratings yet

- Notes - ACCTG 114 - 04 26 - 04 28 2022Document13 pagesNotes - ACCTG 114 - 04 26 - 04 28 2022Janna Mari FriasNo ratings yet

- Revenue Memorandum Circular No. 35-06: June 21, 2006Document17 pagesRevenue Memorandum Circular No. 35-06: June 21, 2006Kitty ReyesNo ratings yet

- 1 2Document3 pages1 2Anuj Singh RaghuvanshiNo ratings yet

- Notes From PT 365 2022Document1 pageNotes From PT 365 2022Atul KumarNo ratings yet

- Tax Guide For Texas Home BuyersDocument2 pagesTax Guide For Texas Home BuyersVishal NaikNo ratings yet

- KPMG - Indonesian TaxDocument13 pagesKPMG - Indonesian Taxbang bebetNo ratings yet

- Revised Tax Position Paper ENGDocument8 pagesRevised Tax Position Paper ENGPedro Dias da SilvaNo ratings yet

- Tax Remedies and AdministrationDocument21 pagesTax Remedies and AdministrationexquisiteNo ratings yet

- TAX Cir V YmcaDocument1 pageTAX Cir V Ymcacindy mateoNo ratings yet

- Tax Exempt de Minimis Benefits Under TRAIN RA 10963 Philippines - Tax and Accounting Center, Inc.Document7 pagesTax Exempt de Minimis Benefits Under TRAIN RA 10963 Philippines - Tax and Accounting Center, Inc.Nicale JeenNo ratings yet

- Mithila Farjana - FinalDocument49 pagesMithila Farjana - FinalSelim KhanNo ratings yet

- Soal Siklus AkuntansiDocument6 pagesSoal Siklus Akuntansidery dulitaNo ratings yet

- Taxation Syllabus ACCADocument4 pagesTaxation Syllabus ACCAMadina NugmetNo ratings yet

- Holly Tree 2015 990taxDocument21 pagesHolly Tree 2015 990taxstan rawlNo ratings yet

- Suppose Holt Renfrew The Specialty Retailer Had These Records ForDocument1 pageSuppose Holt Renfrew The Specialty Retailer Had These Records ForMuhammad ShahidNo ratings yet